Key Insights

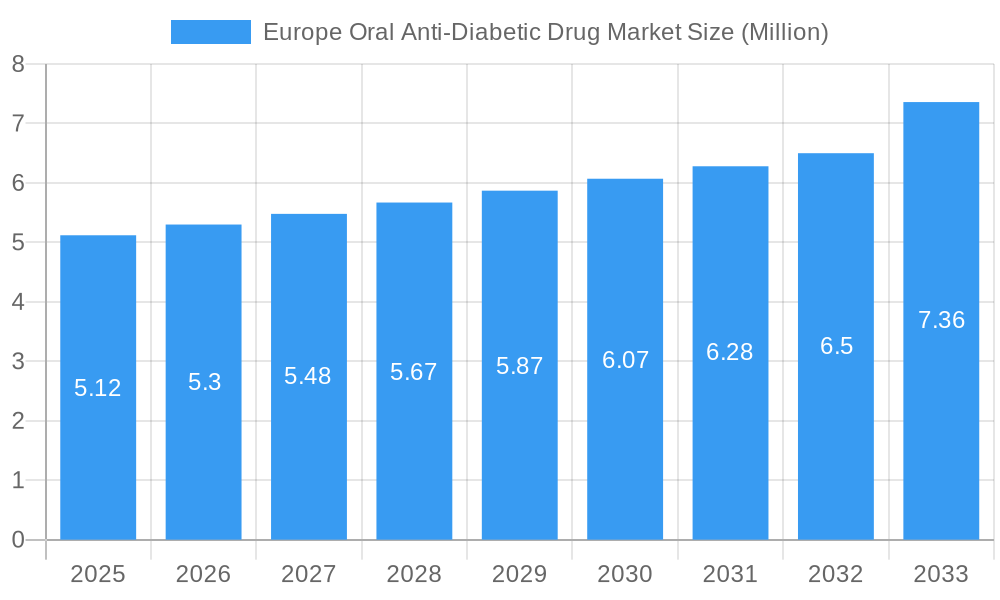

The European Oral Anti-Diabetic Drug Market is poised for significant growth, projected to reach a market size of 7.36 Million by the end of the study period in 2033. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 3.40%, indicating a steady and robust upward trajectory for the market. The increasing prevalence of diabetes across Europe, particularly Type 2 diabetes, is a primary catalyst, coupled with a growing emphasis on lifestyle modifications and early intervention strategies. Furthermore, advancements in drug development, leading to the introduction of more effective and patient-friendly oral formulations, are contributing substantially to market expansion. The market is segmented by drug type, including Biguanides, Sulfonylureas, Meglitinides, Thiazolidinediones, DPP-4 inhibitors, GLP-1 agonists, and SGLT2 inhibitors. The growing demand for SGLT2 inhibitors and GLP-1 agonists, known for their cardiovascular and renal benefits beyond glycemic control, is a notable trend. Oral administration remains the dominant route, though advancements in injectable formulations are also influencing the market.

Europe Oral Anti-Diabetic Drug Market Market Size (In Million)

Key drivers fueling this market growth include the aging European population, a sedentary lifestyle leading to increased obesity rates, and a heightened awareness among both patients and healthcare providers regarding the long-term complications of poorly managed diabetes. However, certain restraints, such as the high cost of newer generation drugs and the potential for side effects, could temper the growth in specific segments. The market also faces challenges related to stringent regulatory approvals for new drug entities. Despite these challenges, the focus on proactive diabetes management and the continuous innovation in the oral anti-diabetic drug landscape in Europe are expected to propel the market forward, offering substantial opportunities for pharmaceutical companies and improved therapeutic outcomes for patients.

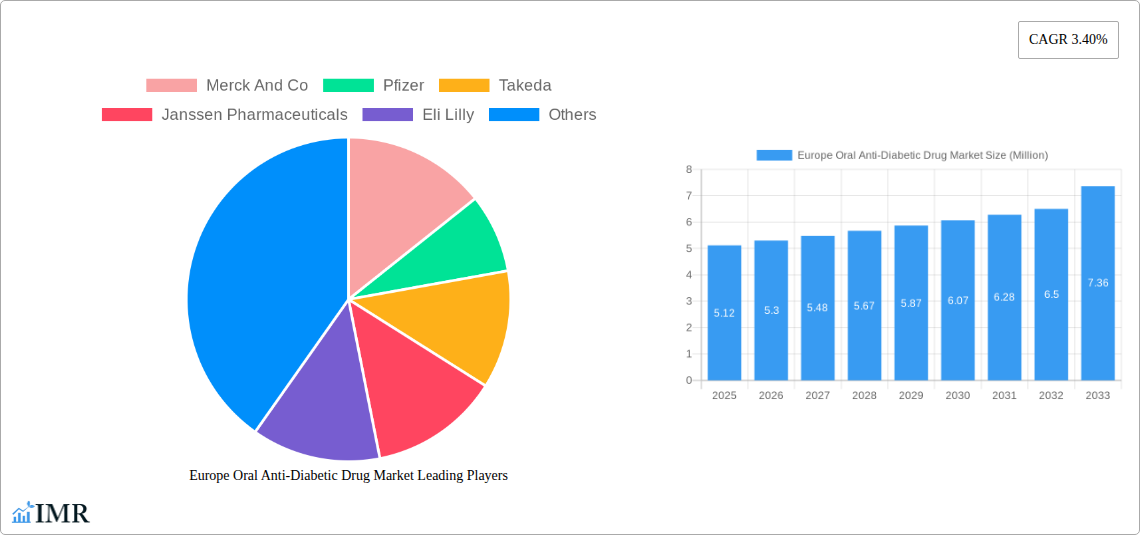

Europe Oral Anti-Diabetic Drug Market Company Market Share

This report offers an in-depth analysis of the Europe oral anti-diabetic drug market, providing critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. With a comprehensive study period from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving European diabetes treatment landscape. We cover key segments including Biguanides, DPP-4 inhibitors, GLP-1 agonists, SGLT2 inhibitors, and explore routes of administration and indications like Type 2 diabetes.

Europe Oral Anti-Diabetic Drug Market Market Dynamics & Structure

The Europe oral anti-diabetic drug market exhibits a moderately concentrated structure, with key players like Merck And Co, Pfizer, Takeda, and Eli Lilly holding significant market share. Technological innovation is a primary driver, fueled by ongoing research and development into novel drug formulations and improved delivery mechanisms for oral anti-diabetic medications. Regulatory frameworks, while stringent, are evolving to accommodate new therapeutic advancements, influencing drug approvals and market access. Competitive product substitutes, including injectable therapies and lifestyle interventions, continually challenge the market, necessitating a focus on efficacy, safety, and patient convenience. End-user demographics, characterized by an aging population and rising prevalence of Type 2 diabetes, present a growing demand base. Mergers and acquisitions (M&A) activity, though not at peak levels, remains a strategy for market consolidation and portfolio expansion. For instance, an estimated 5-8 M&A deals annually are observed in the broader European pharmaceutical sector, with a subset impacting oral anti-diabetic drugs. Innovation barriers include the high cost of R&D, complex clinical trial requirements, and the need for robust post-market surveillance.

- Market Concentration: Moderate, with a few key players dominating.

- Technological Innovation: Driven by R&D in novel formulations and delivery systems.

- Regulatory Frameworks: Evolving to support new therapeutic advancements.

- Competitive Landscape: Influenced by injectable therapies and lifestyle interventions.

- End-User Demographics: Aging population and rising Type 2 diabetes prevalence.

- M&A Trends: Strategic tool for consolidation and portfolio expansion.

- Innovation Barriers: High R&D costs, complex trials, and post-market surveillance.

Europe Oral Anti-Diabetic Drug Market Growth Trends & Insights

The Europe oral anti-diabetic drug market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% between 2025 and 2033. This expansion is underpinned by the increasing prevalence of diabetes across Europe, a direct consequence of lifestyle changes, sedentary habits, and an aging population. The market size, valued at an estimated $12,500 million units in 2025, is expected to reach approximately $18,000 million units by 2033. Adoption rates for newer classes of oral anti-diabetic drugs, such as SGLT2 inhibitors and DPP-4 inhibitors, are steadily rising due to their improved efficacy profiles, reduced side effects, and potential cardiovascular and renal benefits. Technological disruptions, including advancements in drug discovery and formulation, are leading to the development of more targeted and personalized treatment options. Patient behavior shifts are also playing a crucial role, with an increasing preference for oral medications over injectables due to convenience and perceived ease of use. This demand for oral therapies is driving innovation in drug delivery systems and combination therapies. The market penetration of oral anti-diabetic drugs currently stands at around 70% for Type 2 diabetes management, with considerable scope for growth in addressing associated comorbidities. Furthermore, the ongoing development of innovative molecules and improved understanding of diabetes pathophysiology are fostering the introduction of next-generation oral anti-diabetic agents, further stimulating market growth and offering enhanced therapeutic outcomes for patients. The continuous push towards managing diabetes effectively and preventing complications is a key overarching theme influencing market evolution.

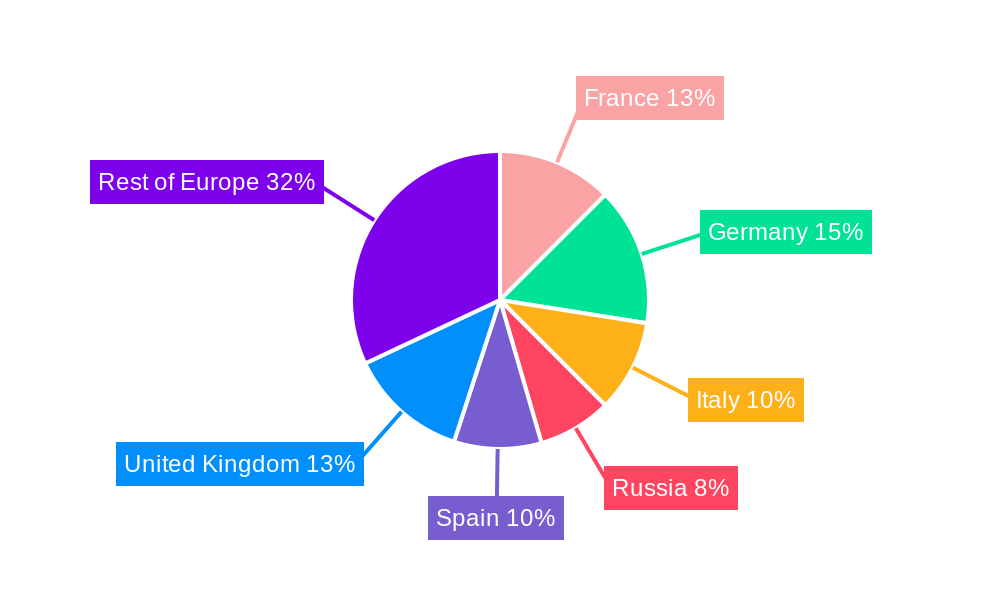

Dominant Regions, Countries, or Segments in Europe Oral Anti-Diabetic Drug Market

Within the Europe oral anti-diabetic drug market, Germany consistently emerges as a dominant country, driven by a high prevalence of diabetes, robust healthcare infrastructure, and a strong emphasis on advanced medical treatments. The Type 2 diabetes indication segment is the largest and fastest-growing, accounting for an estimated 85% of the total market in 2025, due to its widespread occurrence across all European nations. Among the drug types, DPP-4 inhibitors and SGLT2 inhibitors are exhibiting substantial growth, collectively holding an estimated 35% of the market share in 2025. Their appeal stems from favorable efficacy, safety profiles, and emerging evidence of cardiovascular and renal protective benefits, making them preferred choices for physicians and patients. The oral route of administration remains the most dominant, representing approximately 90% of the market, reflecting patient preference for convenience. In Germany, factors such as a well-established reimbursement system, high disposable income, and an aging population contribute to its leading position. The country’s proactive stance on public health initiatives and early diagnosis of diabetes further fuels demand for oral anti-diabetic drugs. The market share of Type 2 diabetes treatments in Germany is estimated to be around 15% of the total European market. Economic policies favoring pharmaceutical innovation and a strong research base contribute to the country’s dominance. Furthermore, the increasing adoption of combination therapies, often involving oral anti-diabetic drugs, and the rising awareness of diabetes management underscore the significant growth potential within Germany and the broader European region. The continuous introduction of novel oral anti-diabetic drugs with improved patient outcomes is a key driver of dominance for these segments and regions.

- Dominant Country: Germany

- High diabetes prevalence.

- Robust healthcare infrastructure.

- Emphasis on advanced medical treatments.

- Dominant Indication: Type 2 diabetes (85% of market in 2025)

- Widespread occurrence across Europe.

- Dominant Drug Segments: DPP-4 inhibitors and SGLT2 inhibitors (35% of market in 2025)

- Favorable efficacy and safety profiles.

- Cardiovascular and renal protective benefits.

- Dominant Route of Administration: Oral (90% of market)

- Patient preference for convenience.

Europe Oral Anti-Diabetic Drug Market Product Landscape

The Europe oral anti-diabetic drug market is characterized by a dynamic product landscape featuring continuous innovation aimed at enhancing therapeutic efficacy, improving patient safety, and simplifying administration. Key advancements include the development of novel molecules with improved pharmacokinetic profiles, offering better glycemic control with reduced side effects. Combination therapies, integrating two or more active ingredients in a single pill, are gaining traction, providing a convenient and effective approach to managing complex diabetes cases. Furthermore, research is focused on developing drugs with disease-modifying potential, aiming to not only control blood glucose but also mitigate long-term complications associated with diabetes. The performance metrics for these drugs are rigorously assessed through extensive clinical trials, focusing on HbA1c reduction, cardiovascular outcome benefits, and renal protection. Unique selling propositions include patient-friendly dosing regimens, reduced risk of hypoglycemia, and positive impacts on weight management. Technological advancements in drug delivery, such as extended-release formulations, further contribute to the product landscape by offering improved adherence and convenience.

Key Drivers, Barriers & Challenges in Europe Oral Anti-Diabetic Drug Market

Key Drivers:

- Rising Diabetes Prevalence: The escalating incidence of Type 2 diabetes across Europe, driven by lifestyle factors and an aging population, is the primary growth accelerator.

- Technological Advancements: Ongoing research and development in novel drug discovery, improved formulations, and advanced delivery systems are introducing more effective and patient-friendly oral anti-diabetic options.

- Growing Patient Preference for Oral Medications: The convenience and ease of use associated with oral anti-diabetic drugs compared to injectables significantly boost their adoption.

- Increasing Healthcare Expenditure: Growing investments in diabetes management and healthcare infrastructure across European nations support market expansion.

Key Barriers & Challenges:

- Competition from Injectable Therapies: While oral drugs are preferred, advanced injectable therapies, particularly GLP-1 receptor agonists and insulin, offer competitive efficacy and specific benefits.

- Stringent Regulatory Approvals: Navigating the complex and time-consuming regulatory pathways for new drug approvals in Europe presents a significant hurdle.

- Pricing Pressures and Reimbursement Policies: Healthcare systems face budgetary constraints, leading to price negotiations and influencing reimbursement levels for oral anti-diabetic drugs.

- Adherence Challenges: Despite preference for oral drugs, achieving consistent adherence to medication regimens remains a challenge for some patient populations.

Emerging Opportunities in Europe Oral Anti-Diabetic Drug Market

Emerging opportunities in the Europe oral anti-diabetic drug market lie in the development of personalized medicine approaches, tailoring treatments based on individual patient genetic profiles and disease subtypes. The growing focus on preventative care and early intervention presents a significant market for novel oral agents that can delay or prevent the onset of Type 2 diabetes. Untapped markets within specific European regions with lower diagnosis rates and access to advanced treatments also offer considerable growth potential. Furthermore, the development of oral anti-diabetic drugs with dual or triple mechanisms of action, addressing multiple aspects of diabetes pathophysiology simultaneously, represents a key area for innovation and market differentiation. The increasing demand for combination therapies, offering improved convenience and efficacy, will continue to drive market expansion.

Growth Accelerators in the Europe Oral Anti-Diabetic Drug Market Industry

Long-term growth in the Europe oral anti-diabetic drug market will be significantly propelled by continued technological breakthroughs in drug discovery and development. Strategic partnerships between pharmaceutical companies, research institutions, and technology providers will foster innovation and accelerate the pipeline of novel oral anti-diabetic agents. Market expansion strategies focusing on emerging European economies with growing healthcare needs and increasing diabetes prevalence will unlock new revenue streams. The development of oral formulations for existing effective injectable drugs, along with advancements in patient support programs and digital health solutions for diabetes management, will further enhance market growth and patient outcomes.

Key Players Shaping the Europe Oral Anti-Diabetic Drug Market Market

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- Sanofi

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk

- Boehringer Ingelheim

- Astellas

Notable Milestones in Europe Oral Anti-Diabetic Drug Market Sector

- March 2022: Oramed announced that ORMD-0801 (a new molecule) is being evaluated in two pivotal Phase 3 trials and can be the first oral insulin capsule that has the most convenient and safest way to deliver insulin therapy. This drug is expected to be a game-changer in the insulin and oral anti-diabetes drugs markets. Oramed is also developing an oral GLP-1 (Glucagon-like peptide-1) analog capsule (ORMD-0901).

- May 2021: The Committee for Medicinal Products for Human Use (CHMP) recommended a change to the terms of the marketing authorization for the medicinal product Jalra by Novartis Europharm Limited. Detailed recommendations for the use of this product will be described in the updated summary of product characteristics (SmPC).

In-Depth Europe Oral Anti-Diabetic Drug Market Market Outlook

The future outlook for the Europe oral anti-diabetic drug market is exceptionally promising, driven by sustained demand and continuous innovation. Growth accelerators such as the introduction of next-generation oral therapies with enhanced efficacy and safety profiles, particularly in managing comorbidities like cardiovascular and renal diseases, will define the market trajectory. Strategic opportunities lie in expanding access to these advanced treatments in underserved European regions and developing personalized treatment regimens that cater to diverse patient needs. The ongoing research into novel drug targets and improved delivery mechanisms, exemplified by the potential of oral insulin, promises to revolutionize diabetes management and further solidify the market's growth potential. The focus will remain on providing convenient, effective, and safe treatment options that improve the quality of life for millions living with diabetes.

Europe Oral Anti-Diabetic Drug Market Segmentation

-

1. Type of drug

- 1.1. Biguanides

- 1.2. Sulfonylureas

- 1.3. Meglitinides

- 1.4. Thiazolidinediones

- 1.5. DPP-4 inhibitors

- 1.6. GLP-1 agonists

- 1.7. SGLT2 inhibitors

-

2. Route of administration

- 2.1. Oral

- 2.2. Injectable

- 2.3. Transdermal

-

3. Indication

- 3.1. Type 1 diabetes

- 3.2. Type 2 diabetes

- 3.3. Gestational diabetes

Europe Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Russia

- 5. Spain

- 6. United Kingdom

- 7. Rest of Europe

Europe Oral Anti-Diabetic Drug Market Regional Market Share

Geographic Coverage of Europe Oral Anti-Diabetic Drug Market

Europe Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Biguanide Segment Occupied the Highest Market Share in the Europe Oral Anti-Diabetic Drugs Market in 2022

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of drug

- 5.1.1. Biguanides

- 5.1.2. Sulfonylureas

- 5.1.3. Meglitinides

- 5.1.4. Thiazolidinediones

- 5.1.5. DPP-4 inhibitors

- 5.1.6. GLP-1 agonists

- 5.1.7. SGLT2 inhibitors

- 5.2. Market Analysis, Insights and Forecast - by Route of administration

- 5.2.1. Oral

- 5.2.2. Injectable

- 5.2.3. Transdermal

- 5.3. Market Analysis, Insights and Forecast - by Indication

- 5.3.1. Type 1 diabetes

- 5.3.2. Type 2 diabetes

- 5.3.3. Gestational diabetes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.4.2. Germany

- 5.4.3. Italy

- 5.4.4. Russia

- 5.4.5. Spain

- 5.4.6. United Kingdom

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of drug

- 6. France Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of drug

- 6.1.1. Biguanides

- 6.1.2. Sulfonylureas

- 6.1.3. Meglitinides

- 6.1.4. Thiazolidinediones

- 6.1.5. DPP-4 inhibitors

- 6.1.6. GLP-1 agonists

- 6.1.7. SGLT2 inhibitors

- 6.2. Market Analysis, Insights and Forecast - by Route of administration

- 6.2.1. Oral

- 6.2.2. Injectable

- 6.2.3. Transdermal

- 6.3. Market Analysis, Insights and Forecast - by Indication

- 6.3.1. Type 1 diabetes

- 6.3.2. Type 2 diabetes

- 6.3.3. Gestational diabetes

- 6.1. Market Analysis, Insights and Forecast - by Type of drug

- 7. Germany Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of drug

- 7.1.1. Biguanides

- 7.1.2. Sulfonylureas

- 7.1.3. Meglitinides

- 7.1.4. Thiazolidinediones

- 7.1.5. DPP-4 inhibitors

- 7.1.6. GLP-1 agonists

- 7.1.7. SGLT2 inhibitors

- 7.2. Market Analysis, Insights and Forecast - by Route of administration

- 7.2.1. Oral

- 7.2.2. Injectable

- 7.2.3. Transdermal

- 7.3. Market Analysis, Insights and Forecast - by Indication

- 7.3.1. Type 1 diabetes

- 7.3.2. Type 2 diabetes

- 7.3.3. Gestational diabetes

- 7.1. Market Analysis, Insights and Forecast - by Type of drug

- 8. Italy Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of drug

- 8.1.1. Biguanides

- 8.1.2. Sulfonylureas

- 8.1.3. Meglitinides

- 8.1.4. Thiazolidinediones

- 8.1.5. DPP-4 inhibitors

- 8.1.6. GLP-1 agonists

- 8.1.7. SGLT2 inhibitors

- 8.2. Market Analysis, Insights and Forecast - by Route of administration

- 8.2.1. Oral

- 8.2.2. Injectable

- 8.2.3. Transdermal

- 8.3. Market Analysis, Insights and Forecast - by Indication

- 8.3.1. Type 1 diabetes

- 8.3.2. Type 2 diabetes

- 8.3.3. Gestational diabetes

- 8.1. Market Analysis, Insights and Forecast - by Type of drug

- 9. Russia Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of drug

- 9.1.1. Biguanides

- 9.1.2. Sulfonylureas

- 9.1.3. Meglitinides

- 9.1.4. Thiazolidinediones

- 9.1.5. DPP-4 inhibitors

- 9.1.6. GLP-1 agonists

- 9.1.7. SGLT2 inhibitors

- 9.2. Market Analysis, Insights and Forecast - by Route of administration

- 9.2.1. Oral

- 9.2.2. Injectable

- 9.2.3. Transdermal

- 9.3. Market Analysis, Insights and Forecast - by Indication

- 9.3.1. Type 1 diabetes

- 9.3.2. Type 2 diabetes

- 9.3.3. Gestational diabetes

- 9.1. Market Analysis, Insights and Forecast - by Type of drug

- 10. Spain Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of drug

- 10.1.1. Biguanides

- 10.1.2. Sulfonylureas

- 10.1.3. Meglitinides

- 10.1.4. Thiazolidinediones

- 10.1.5. DPP-4 inhibitors

- 10.1.6. GLP-1 agonists

- 10.1.7. SGLT2 inhibitors

- 10.2. Market Analysis, Insights and Forecast - by Route of administration

- 10.2.1. Oral

- 10.2.2. Injectable

- 10.2.3. Transdermal

- 10.3. Market Analysis, Insights and Forecast - by Indication

- 10.3.1. Type 1 diabetes

- 10.3.2. Type 2 diabetes

- 10.3.3. Gestational diabetes

- 10.1. Market Analysis, Insights and Forecast - by Type of drug

- 11. United Kingdom Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type of drug

- 11.1.1. Biguanides

- 11.1.2. Sulfonylureas

- 11.1.3. Meglitinides

- 11.1.4. Thiazolidinediones

- 11.1.5. DPP-4 inhibitors

- 11.1.6. GLP-1 agonists

- 11.1.7. SGLT2 inhibitors

- 11.2. Market Analysis, Insights and Forecast - by Route of administration

- 11.2.1. Oral

- 11.2.2. Injectable

- 11.2.3. Transdermal

- 11.3. Market Analysis, Insights and Forecast - by Indication

- 11.3.1. Type 1 diabetes

- 11.3.2. Type 2 diabetes

- 11.3.3. Gestational diabetes

- 11.1. Market Analysis, Insights and Forecast - by Type of drug

- 12. Rest of Europe Europe Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type of drug

- 12.1.1. Biguanides

- 12.1.2. Sulfonylureas

- 12.1.3. Meglitinides

- 12.1.4. Thiazolidinediones

- 12.1.5. DPP-4 inhibitors

- 12.1.6. GLP-1 agonists

- 12.1.7. SGLT2 inhibitors

- 12.2. Market Analysis, Insights and Forecast - by Route of administration

- 12.2.1. Oral

- 12.2.2. Injectable

- 12.2.3. Transdermal

- 12.3. Market Analysis, Insights and Forecast - by Indication

- 12.3.1. Type 1 diabetes

- 12.3.2. Type 2 diabetes

- 12.3.3. Gestational diabetes

- 12.1. Market Analysis, Insights and Forecast - by Type of drug

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Merck And Co

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Pfizer

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Takeda

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Janssen Pharmaceuticals

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Eli Lilly

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Novartis

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sanofi

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 AstraZeneca

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bristol Myers Squibb

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Novo Nordisk

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Boehringer Ingelheim

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Astellas

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Merck And Co

List of Figures

- Figure 1: Europe Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Oral Anti-Diabetic Drug Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 2: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 3: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 4: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 5: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 6: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 7: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 10: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 11: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 12: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 13: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 14: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 15: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 18: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 19: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 20: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 21: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 22: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 23: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 26: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 27: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 28: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 29: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 30: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 31: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 34: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 35: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 36: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 37: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 38: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 39: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 42: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 43: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 44: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 45: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 46: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 47: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 50: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 51: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 52: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 53: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 54: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 55: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 57: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Type of drug 2020 & 2033

- Table 58: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Type of drug 2020 & 2033

- Table 59: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Route of administration 2020 & 2033

- Table 60: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Route of administration 2020 & 2033

- Table 61: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2020 & 2033

- Table 62: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2020 & 2033

- Table 63: Europe Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Europe Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Europe Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the Europe Oral Anti-Diabetic Drug Market?

The market segments include Type of drug, Route of administration, Indication.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Biguanide Segment Occupied the Highest Market Share in the Europe Oral Anti-Diabetic Drugs Market in 2022.

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

March 2022: Oramed announced that ORMD-0801 (a new molecule) is being evaluated in two pivotal Phase 3 trials and can be the first oral insulin capsule that has the most convenient and safest way to deliver insulin therapy. This drug is expected to be a game-changer in the insulin and oral anti-diabetes drugs markets. Oramed is also developing an oral GLP-1 (Glucagon-like peptide-1) analog capsule (ORMD-0901).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the Europe Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence