Key Insights

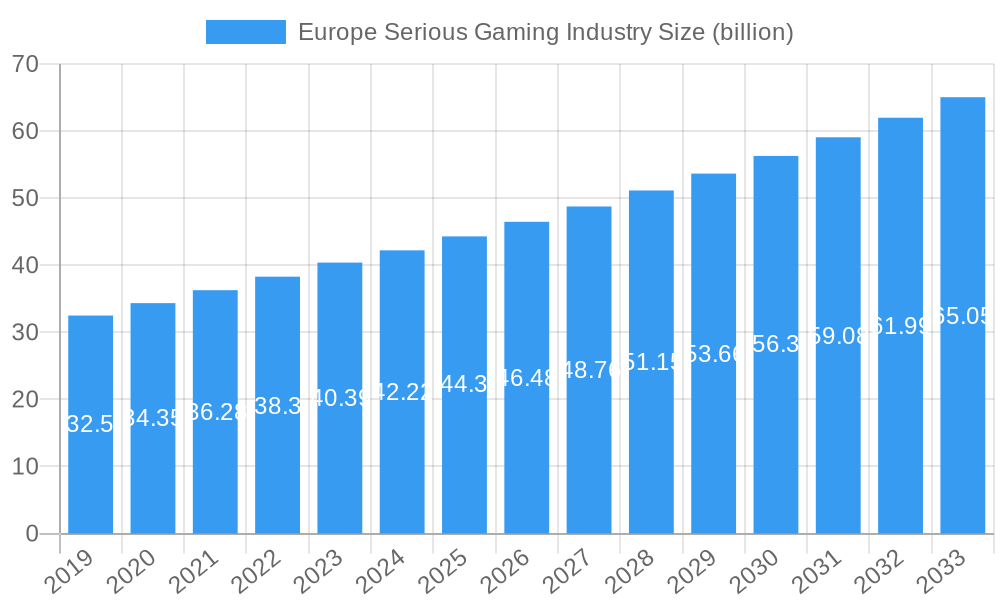

The European Serious Gaming industry is poised for significant expansion, projected to reach an estimated USD 42.22 billion in 2024, demonstrating a robust compound annual growth rate (CAGR) of 5.32% through 2033. This substantial growth is fueled by the increasing adoption of serious games across diverse sectors, primarily driven by their effectiveness in enhancing learning outcomes, improving operational efficiency, and fostering engagement. Key applications like Advertising and Marketing, Simulation Training, and Learning and Education are at the forefront, with industries such as Healthcare, Education, and Automotive actively investing in these immersive solutions. The demand for skilled professionals proficient in serious game development and implementation continues to rise, further bolstering market expansion.

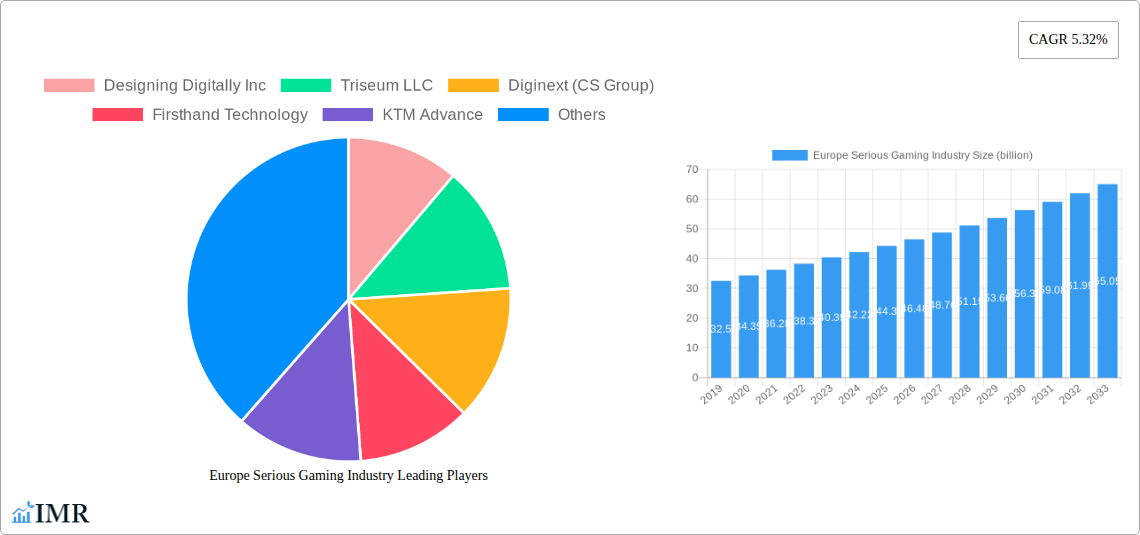

Europe Serious Gaming Industry Market Size (In Million)

The European market benefits from a strong digital infrastructure and a proactive approach to adopting innovative technologies. Countries like the United Kingdom, Germany, and France are leading the charge, with significant investments in developing and deploying serious gaming solutions for critical sectors. While the market benefits from a clear upward trajectory, certain factors could influence its pace. High development costs for sophisticated serious games and the need for extensive user training to maximize adoption represent potential hurdles. However, the inherent value proposition of serious games in delivering measurable results, from improved patient care in healthcare to enhanced safety in automotive training, continues to drive demand and innovation, paving the way for sustained growth throughout the forecast period.

Europe Serious Gaming Industry Company Market Share

Europe Serious Gaming Industry Market Analysis: Forecast to 2033

This comprehensive report offers an in-depth analysis of the Europe Serious Gaming Industry, providing critical insights into market dynamics, growth trends, and future opportunities from 2019 to 2033. Leveraging extensive data and expert analysis, this study delivers actionable intelligence for stakeholders seeking to navigate and capitalize on this rapidly evolving sector.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Europe Serious Gaming Industry Market Dynamics & Structure

The European serious gaming industry is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and diverse end-user demands. Market concentration varies across different segments, with key players like Designing Digitally Inc, Triseum LLC, Diginext (CS Group), Firsthand Technology, KTM Advance, Serious Games Solutions, MPS Interactive Systems, BreakAway Games, Bedaux Serious Games, and Tygron BV actively shaping the competitive landscape. Technological innovation, particularly in areas like AI, VR, and AR, serves as a primary growth driver, enabling more immersive and effective training and educational experiences. Regulatory frameworks, while still developing, are increasingly supporting the adoption of serious games, especially in sectors like healthcare and defense. Competitive product substitutes, such as traditional training methods and e-learning platforms, pose a challenge, but the unique engagement and efficacy of serious games are carving out significant market share. End-user demographics are broad, spanning from healthcare professionals and students to automotive engineers and government personnel, each with specific needs and adoption patterns. Mergers and acquisitions (M&A) trends are on the rise as larger companies recognize the strategic value of serious gaming solutions for employee development and public engagement. The market is projected to reach an estimated USD 15.XX billion by 2025, with a substantial CAGR expected throughout the forecast period.

- Market Concentration: Moderate, with leading players dominating specific niches.

- Technological Innovation Drivers: AI, VR, AR, gamification techniques, cloud-based platforms.

- Regulatory Frameworks: Growing government and industry support, with increasing data privacy and security considerations.

- Competitive Product Substitutes: Traditional training, e-learning modules, simulations.

- End-User Demographics: Diverse, with strong penetration in Education, Healthcare, and Government sectors.

- M&A Trends: Increasing consolidation and strategic partnerships.

Europe Serious Gaming Industry Growth Trends & Insights

The European serious gaming industry is poised for robust expansion, driven by an increasing understanding of its pedagogical and practical benefits across a multitude of sectors. The market size is projected to witness significant evolution, transitioning from an estimated USD 8.XX billion in 2019 to an estimated USD 15.XX billion by 2025, and further to an estimated USD 35.XX billion by 2033, showcasing a remarkable Compound Annual Growth Rate (CAGR) of approximately 12.XX% during the forecast period. Adoption rates are accelerating, fueled by the demonstrably higher engagement and retention levels offered by serious games compared to conventional learning and training methodologies. Technological disruptions, including advancements in immersive technologies like virtual and augmented reality, are not only enhancing the realism and effectiveness of serious games but also expanding their applicability to complex, high-stakes scenarios within industries such as healthcare, defense, and automotive. Consumer behavior shifts are also playing a crucial role, with a growing preference for interactive, personalized, and experiential learning and skill development. This trend is particularly evident in the younger demographics entering the workforce and the increasing demand for continuous professional development across all age groups. The integration of gamified elements into everyday work and learning environments is becoming a mainstream expectation, further solidifying the growth trajectory of the serious gaming market in Europe.

Dominant Regions, Countries, or Segments in Europe Serious Gaming Industry

The Learning and Education segment within the Europe Serious Gaming Industry stands as a dominant force, driving significant market growth. This dominance is underpinned by several key factors, including substantial government investment in educational technology, a growing recognition of the efficacy of gamified learning for improved student engagement and knowledge retention, and the continuous push for digital transformation within educational institutions across the continent. Countries like the United Kingdom, Germany, and France are at the forefront of this adoption, benefiting from strong educational infrastructure, proactive policy initiatives, and a thriving ecosystem of EdTech companies.

Dominant Application Segment: Learning and Education.

- Key Drivers: Increased adoption in K-12 and higher education, corporate training initiatives, government funding for educational technology.

- Market Share: Estimated to account for over 35% of the total market by 2025.

- Growth Potential: High, driven by the need for personalized and engaging learning experiences.

Dominant End-User Industry: Education.

- Key Drivers: Demand for immersive learning tools, development of critical thinking skills, remote learning solutions.

- Market Share: Significant contribution to the overall serious gaming market.

- Growth Potential: Continues to expand as educational institutions embrace digital solutions.

Leading Countries:

- United Kingdom: Strong R&D in serious games, substantial investment from educational institutions and government bodies.

- Germany: Growing demand for simulation training in industrial sectors and automotive, coupled with robust educational initiatives.

- France: Increasing government support for digital learning and innovative training solutions, particularly in defense and healthcare.

The Simulation Training application also exhibits significant growth, particularly within the Automotive and Government sectors, driven by the need for safe, cost-effective, and repeatable training environments for complex procedures and hazardous operations. The Healthcare sector, while a significant adopter, is increasingly leveraging serious games for patient education and rehabilitation, presenting another avenue for substantial market expansion. The Media and Entertainment sector, though not as prominent as education, contributes to the market through gamified advertising and marketing campaigns, demonstrating the versatility of serious gaming principles.

Europe Serious Gaming Industry Product Landscape

The Europe Serious Gaming Industry is distinguished by a continuous stream of innovative products designed to meet diverse application needs. Companies are actively developing immersive experiences that leverage cutting-edge technologies such as virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) to enhance user engagement and learning outcomes. For instance, simulation training applications are offering hyper-realistic environments for sectors like automotive and defense, enabling risk-free practice of complex tasks. In healthcare, serious games are being utilized for patient rehabilitation, pain management, and medical training, providing personalized and interactive therapeutic solutions. The learning and education segment sees a proliferation of gamified platforms that adapt to individual learning paces and styles, making education more accessible and effective. The advertising and marketing segment is also benefiting from unique engagement strategies through interactive brand experiences and educational campaigns. The performance metrics of these products are increasingly measured by their impact on user proficiency, knowledge retention, behavioral change, and overall return on investment for organizations.

Key Drivers, Barriers & Challenges in Europe Serious Gaming Industry

Key Drivers:

- Technological Advancements: The rapid evolution of VR, AR, AI, and cloud computing is enabling more sophisticated and immersive serious game experiences.

- Demand for Skill Development: Increasing need for effective and engaging training solutions across all industries to upskill the workforce.

- Cost-Effectiveness: Serious games can offer a more economical and scalable alternative to traditional training methods, especially for repetitive tasks or hazardous environments.

- Government Initiatives & Funding: Supportive policies and public funding in sectors like education, healthcare, and defense are accelerating adoption.

- Proven Efficacy: Growing body of research demonstrating the effectiveness of serious games in improving learning outcomes, engagement, and retention.

Barriers & Challenges:

- High Development Costs: Creating high-quality, specialized serious games can be expensive, requiring significant investment in design, development, and testing.

- Lack of Standardization: The absence of universal standards for development, deployment, and evaluation can hinder interoperability and wider adoption.

- Resistance to Change: Traditional mindsets and resistance to adopting new learning methodologies can slow down market penetration in some sectors.

- Measuring ROI: Quantifying the return on investment (ROI) of serious games can be challenging, requiring robust metrics and analytics.

- Intellectual Property Concerns: Ensuring the security and protection of intellectual property within complex serious game environments.

Emerging Opportunities in Europe Serious Gaming Industry

Emerging opportunities within the Europe Serious Gaming Industry are abundant, driven by evolving technological capabilities and expanding market needs. The healthcare sector presents significant potential, particularly in areas of mental health, chronic disease management, and rehabilitation, where personalized and engaging therapeutic interventions are in high demand. The automotive industry is increasingly exploring serious games for driver training, autonomous vehicle simulation, and customer engagement through interactive brand experiences. Furthermore, the growing focus on sustainability and climate change offers avenues for serious games aimed at public awareness and behavioral change initiatives. The rise of remote work and distributed teams also creates a demand for collaborative serious gaming solutions that can foster team cohesion and skill development in virtual environments. Untapped markets within small and medium-sized enterprises (SMEs) seeking cost-effective training solutions also represent a considerable growth area.

Growth Accelerators in the Europe Serious Gaming Industry Industry

Several key factors are accelerating the growth of the Europe Serious Gaming Industry. The continuous integration of advanced technologies such as AI-powered adaptive learning, photorealistic VR environments, and real-time AR overlays is significantly enhancing the immersive and educational value of serious games. Strategic partnerships between technology providers, content creators, and industry-specific organizations are fostering innovation and expanding market reach. For instance, collaborations between universities and game development studios are driving research and development of more effective learning games. Market expansion strategies, including the localization of serious game content for diverse European languages and cultural contexts, are crucial for broader adoption. The increasing demand for data analytics and performance tracking within serious games is also a significant accelerator, enabling organizations to measure the impact and optimize training outcomes, thereby justifying further investment.

Key Players Shaping the Europe Serious Gaming Industry Market

- Designing Digitally Inc

- Triseum LLC

- Diginext (CS Group)

- Firsthand Technology

- KTM Advance

- Serious Games Solutions

- MPS Interactive Systems

- BreakAway Games

- Bedaux Serious Games

- Tygron BV

Notable Milestones in Europe Serious Gaming Industry Sector

- May 2022: Virtual Heroes announced the release of Applied Research Associates Inc. (ARA). The US Army's medics will receive new training using the BurnCare Virtual Trainer to treat severe burn injuries. Soldiers may train whenever they want, anywhere, as the cutting-edge application is made to run on portable devices. BurnCARE Virtual Trainer is accessible to everyone for free on Google Play, and an iOS release is soon to come.

- Jan 2022: MITRE announced a serious innovative game to promote positive personal communications that could save relationships and maybe lives among people in high-stress jobs, such as veterans, the military, and the police. In contrast, Users can track scores, like relationship trust level or partner's emotional stamina. One of the main features is a virtual therapist, a section of the screen dedicated to providing feedback on the impact and consequences of a player's choices.

In-Depth Europe Serious Gaming Industry Market Outlook

The Europe Serious Gaming Industry is on an upward trajectory, fueled by the persistent need for innovative and engaging solutions in learning, training, and simulation. Growth accelerators such as the increasing integration of AI for personalized learning experiences, the development of more accessible VR/AR technologies, and strategic collaborations between industry leaders are setting the stage for sustained expansion. The market's future potential lies in its adaptability to emerging challenges, including the demand for reskilling and upskilling workforces in response to rapid technological shifts and economic transformations. Strategic opportunities will arise from the continued penetration of serious games into niche sectors like mental wellness and sustainable development, alongside the ongoing digitalization of education and corporate training. The industry is well-positioned to address complex societal needs through engaging and effective digital solutions, promising significant returns for stakeholders who can leverage these evolving trends.

Europe Serious Gaming Industry Segmentation

-

1. Application

- 1.1. Advertising and Marketing

- 1.2. Simulation Training

- 1.3. Learning and Education

- 1.4. Other Applications

-

2. End-user Industry

- 2.1. Healthcare

- 2.2. Education

- 2.3. Retail

- 2.4. Media and Entertainment

- 2.5. Automotive

- 2.6. Government

- 2.7. Other End-user Industries

Europe Serious Gaming Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

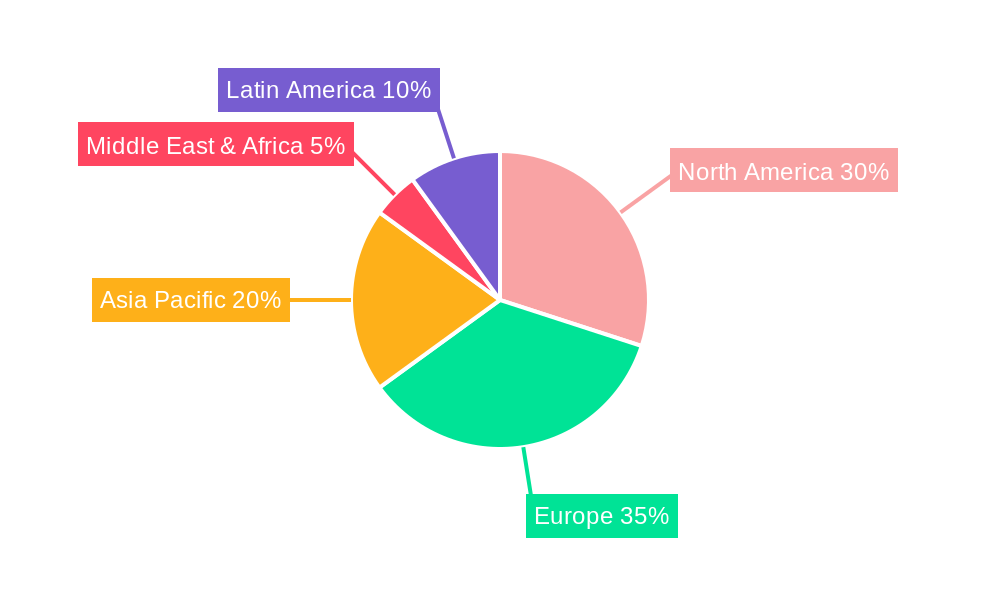

Europe Serious Gaming Industry Regional Market Share

Geographic Coverage of Europe Serious Gaming Industry

Europe Serious Gaming Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Usage of Mobile-based Educational Games; Improved Learning Outcomes Expected to Increase the Adoption of Serious Games among End Users

- 3.3. Market Restrains

- 3.3.1. Lack of Assessment Tools to Measure Serious Game Effectiveness

- 3.4. Market Trends

- 3.4.1. Improved Learning Outcomes Expected to Increase the Adoption of Serious Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Serious Gaming Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Advertising and Marketing

- 5.1.2. Simulation Training

- 5.1.3. Learning and Education

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare

- 5.2.2. Education

- 5.2.3. Retail

- 5.2.4. Media and Entertainment

- 5.2.5. Automotive

- 5.2.6. Government

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Designing Digitally Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Triseum LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Diginext (CS Group)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Firsthand Technology

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KTM Advance

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Serious Games Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MPS Interactive Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BreakAway Games

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bedaux Serious Games

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tygron BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Designing Digitally Inc

List of Figures

- Figure 1: Europe Serious Gaming Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Serious Gaming Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Serious Gaming Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Serious Gaming Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Europe Serious Gaming Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Serious Gaming Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Serious Gaming Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Serious Gaming Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Serious Gaming Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Serious Gaming Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Europe Serious Gaming Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Serious Gaming Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Serious Gaming Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Serious Gaming Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: France Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Serious Gaming Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Serious Gaming Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Serious Gaming Industry?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the Europe Serious Gaming Industry?

Key companies in the market include Designing Digitally Inc, Triseum LLC, Diginext (CS Group), Firsthand Technology, KTM Advance, Serious Games Solutions, MPS Interactive Systems, BreakAway Games, Bedaux Serious Games, Tygron BV.

3. What are the main segments of the Europe Serious Gaming Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.22 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Usage of Mobile-based Educational Games; Improved Learning Outcomes Expected to Increase the Adoption of Serious Games among End Users.

6. What are the notable trends driving market growth?

Improved Learning Outcomes Expected to Increase the Adoption of Serious Games.

7. Are there any restraints impacting market growth?

Lack of Assessment Tools to Measure Serious Game Effectiveness.

8. Can you provide examples of recent developments in the market?

May 2022: Virtual heroes announced the release of Applied Research Associates Inc. (ARA). The US Army's medics will receive new training using the BurnCare Virtual Trainer to treat severe burn injuries. Soldiers may train whenever they want, anywhere, as the cutting-edge application is made to run on portable devices. BurnCARE Virtual Trainer is accessible to everyone for free on Google Play, and an iOS release is soon to come.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Serious Gaming Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Serious Gaming Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Serious Gaming Industry?

To stay informed about further developments, trends, and reports in the Europe Serious Gaming Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence