Key Insights

The European Testing, Inspection, and Certification (TIC) market is poised for significant expansion, propelled by heightened regulatory oversight, a steadfast commitment to product quality and safety, and the pervasive integration of cutting-edge technologies. Valued at approximately 119057.8 million in 2025, the market is projected to achieve a compound annual growth rate (CAGR) of 3% from 2025 to 2033. Key growth drivers include escalating demand for safety and quality assurance in sectors such as automotive, food and agriculture, and consumer goods. The increasing intricacy of products and supply chains further amplifies the need for comprehensive testing and certification solutions. Additionally, evolving environmental regulations and growing consumer emphasis on sustainability are instrumental in shaping market dynamics.

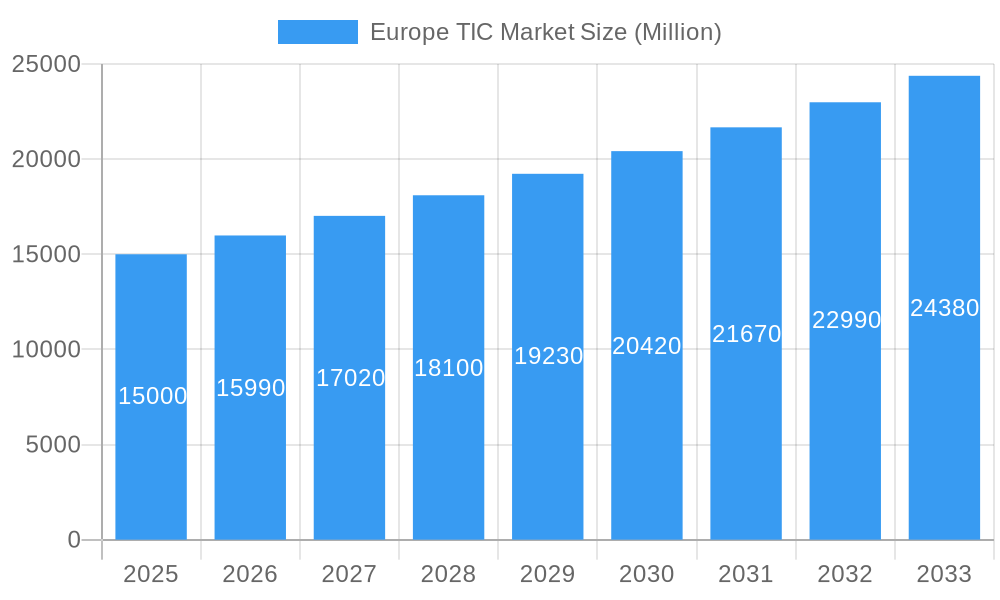

Europe TIC Market Market Size (In Billion)

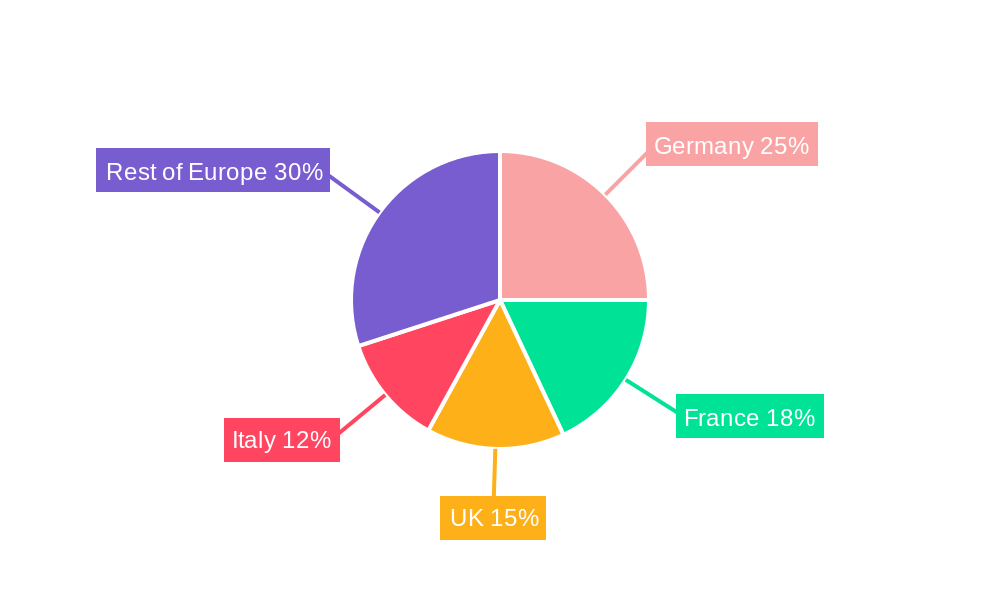

Anticipated growth spans across various market segments. Outsourced TIC services are expected to lead, owing to their economic viability and specialized expertise. Regarding service types, testing and inspection are projected to command a larger market share than certification, reflecting the perpetual requirement for quality assurance throughout the product lifecycle. Geographically, Germany, France, the United Kingdom, and Italy are anticipated to remain dominant markets, supported by strong industrial output and stringent regulatory frameworks. Nevertheless, other European nations are also forecasted to experience considerable growth, aligning with the industry's overall upward trajectory. The competitive arena is robust, featuring prominent players like Intertek, SGS, and Bureau Veritas, alongside regional and niche providers. Strategic acquisitions, technological advancements, and service portfolio expansion are central to navigating this competitive landscape and addressing evolving client requirements.

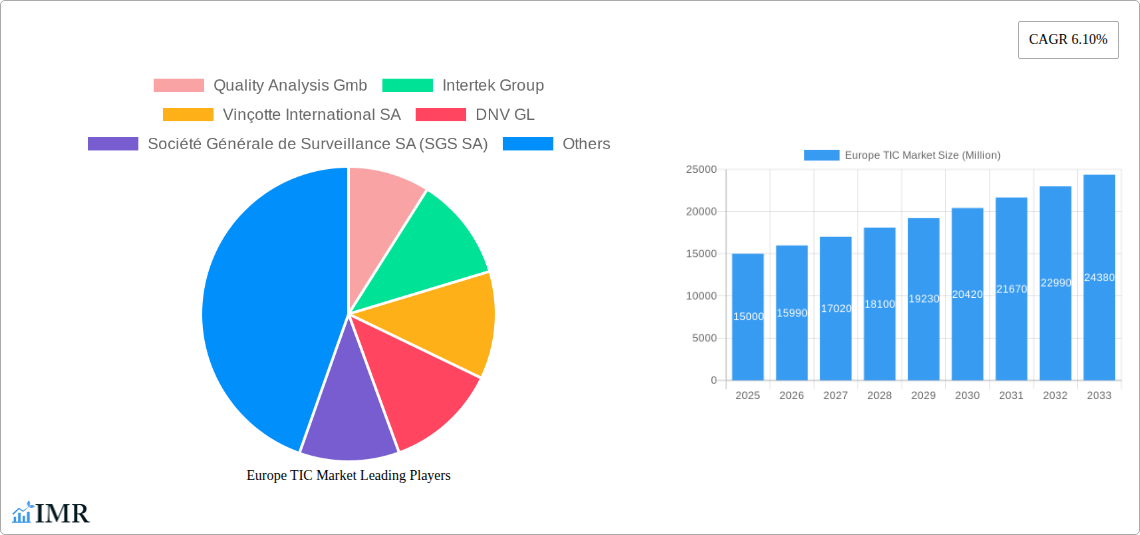

Europe TIC Market Company Market Share

Europe TIC Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe TIC (Testing, Inspection, and Certification) market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The total market size in 2025 is estimated at xx Million units, projected to reach xx Million units by 2033.

Europe TIC Market Dynamics & Structure

The European TIC market is characterized by a moderately concentrated landscape with several major players holding significant market share. Quality Analysis Gmb, Intertek Group, and Bureau Veritas SA are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. Technological innovation, particularly in areas like AI and digitalization, is a major driver, impacting efficiency and expanding service offerings. Stringent regulatory frameworks across various sectors (e.g., automotive, food safety) significantly influence market demand, pushing for enhanced quality control and compliance. The market faces competition from in-house testing capabilities and government-led inspections, representing a notable challenge to external TIC providers. End-user demographics are diverse, encompassing various sectors, with the manufacturing and industrial goods sector being a significant contributor. M&A activity remains significant, with several deals recorded in recent years; xx major M&A deals occurred between 2021-2024, with an average deal value of xx Million units.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: AI-powered inspection systems and digitalization of processes are driving efficiency gains and new service offerings.

- Regulatory Framework: Stringent regulations across sectors drive demand for TIC services.

- Competitive Substitutes: In-house testing and government inspections pose a challenge to external providers.

- M&A Activity: A significant number of mergers and acquisitions contribute to market consolidation and expansion.

- Innovation Barriers: High initial investment costs for advanced technologies and a lack of skilled workforce in specific niche areas.

Europe TIC Market Growth Trends & Insights

The European TIC market has witnessed substantial growth in recent years, driven by factors such as increasing global trade, stricter regulatory compliance mandates, and growing consumer awareness of product quality and safety. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration for outsourced TIC services remains high in sectors like automotive and aerospace due to stringent quality standards. Technological disruptions, particularly the adoption of AI and automation in inspection processes, are transforming the industry's efficiency and service offerings, leading to increased adoption rates amongst both large and SME clients. Consumer behavior shifts toward greater demand for sustainable and ethically sourced products are also influencing the demand for TIC services associated with environmental, social, and governance (ESG) compliance.

Dominant Regions, Countries, or Segments in Europe TIC Market

Germany, the UK, and France represent the dominant markets in Europe, accounting for a combined xx% of the total market share in 2025. Germany benefits from its strong manufacturing base and stringent regulatory environment, while the UK and France possess extensive networks of TIC providers. Within the segmentation:

By Sourcing Type: Outsourced services dominate the market, representing xx% of the market in 2025, driven by cost efficiency and specialized expertise.

By Type of Service: Testing and inspection constitute the largest segment, followed closely by certification services.

By End-User Vertical: Manufacturing and industrial goods remain the largest end-user segment due to high volume and complex supply chains, accounting for xx% of the market in 2025. Automotive, food & agriculture and Oil & Gas and Chemicals also represent significant market segments, driving growth in specialized TIC services.

By Country: Germany holds the largest market share, followed by the UK and France, reflecting their robust industrial sectors and regulatory frameworks.

Key Drivers (Germany): Strong industrial base, stringent regulatory environment, and a highly skilled workforce.

Key Drivers (UK): Large and diversified economy, established TIC infrastructure, and strong focus on regulatory compliance.

Key Drivers (France): Significant manufacturing sector, a growing emphasis on quality assurance, and a commitment to upholding strict standards.

Europe TIC Market Product Landscape

The TIC market offers a broad range of services, with advancements focusing on digitalization, automation, and specialized testing capabilities for emerging technologies. The shift is toward remote inspection tools, AI-powered analytics for improved efficiency, and specialized testing methods for advanced materials and sustainable products. Key selling propositions include speed, accuracy, reduced costs, and enhanced risk mitigation through advanced technologies and expert analysis.

Key Drivers, Barriers & Challenges in Europe TIC Market

Key Drivers:

- Increasing global trade and stringent regulatory compliance requirements.

- Growing consumer demand for quality and safety assurance.

- Technological advancements, including AI and automation.

Key Challenges:

- Intense competition among numerous providers.

- Supply chain disruptions impacting service delivery.

- Regulatory complexities across different countries and sectors.

- Skilled labor shortages in specialized testing areas.

Emerging Opportunities in Europe TIC Market

- Growing demand for ESG compliance-related testing and certification.

- Increased focus on cybersecurity within TIC infrastructure.

- Expansion of TIC services into new emerging technologies such as sustainable materials and renewable energy.

- Development of customized TIC solutions for specific industries.

Growth Accelerators in the Europe TIC Market Industry

The long-term growth trajectory of the Europe TIC market is strongly influenced by ongoing technological innovation, strategic partnerships that enhance service offerings and market reach, and government policies promoting product safety and quality. The increasing integration of AI and digital technologies will continue to optimize efficiency and expand the range of services offered. Strategic partnerships are vital for extending market reach and providing comprehensive solutions to clients. Supportive government policies that stress quality, safety, and compliance will further accelerate industry growth.

Key Players Shaping the Europe TIC Market Market

- Quality Analysis Gmb

- Intertek Group

- Vinçotte International SA

- DNV GL

- Société Générale de Surveillance SA (SGS SA)

- Applus Services SA

- TÜV NORD Group

- A/S Baltic Control Ltd Aarhus

- RTM BREDA SRL

- TÜV SÜD Limited

- LabAnalysis SRL

- CIS Commodity Inspection Services BV

- TÜV Rheinland Group

- VIC Inspection Services Holding Ltd

- DEKRA SA

- UL LLC

- Kiwa NV

- ALS Limited

- AQM SRL

- Bureau Veritas SA

- Element Materials Technology

- Eurofins Scientific SE

- ATG Technology Group

Notable Milestones in Europe TIC Market Sector

- June 2023: NMi and CCIC Europe partner to offer testing, inspection, and certification services to PRC manufacturers.

- October 2022: TÜV NORD invests in Global Surface Intelligence, integrating AI-based image analysis with certification.

- January 2022: SGS collaborates with Microsoft to develop innovative TIC solutions.

In-Depth Europe TIC Market Market Outlook

The future of the Europe TIC market appears bright, with sustained growth driven by several factors. Technological advancements, particularly in AI and automation, will further optimize efficiency and expand the range of services. Strategic partnerships and increased demand for ESG compliance-related services will continue to drive expansion. The market's growth will depend on the effective management of regulatory hurdles and supply chain disruptions. The focus on specialized solutions for emerging technologies and niche markets presents substantial opportunities for growth and market expansion.

Europe TIC Market Segmentation

-

1. Sourcing Type

-

1.1. Outsourced

-

1.1.1. Type of Service

- 1.1.1.1. Testing and Inspection

- 1.1.1.2. Certification

-

1.1.1. Type of Service

- 1.2. In-house/Government

-

1.1. Outsourced

-

2. End User Vertical

- 2.1. Consumer Good and Retail

- 2.2. Automotive

- 2.3. Food and Agriculture

- 2.4. Manufacturing and Industrial Goods

- 2.5. Energy and Utilities

- 2.6. Oil & Gas and Chemicals

- 2.7. Construction

- 2.8. Transport, Aerospace, and Rail

- 2.9. Life Sciences

- 2.10. Marine & Mining

- 2.11. Other End User Verticals

Europe TIC Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe TIC Market Regional Market Share

Geographic Coverage of Europe TIC Market

Europe TIC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trading Across Borders and Stringent Regulations; Technological Evolution; Mass Customization and Shorter Product Life Cycles

- 3.3. Market Restrains

- 3.3.1. Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain

- 3.4. Market Trends

- 3.4.1. Consumer Goods and Retail Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe TIC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. Outsourced

- 5.1.1.1. Type of Service

- 5.1.1.1.1. Testing and Inspection

- 5.1.1.1.2. Certification

- 5.1.1.1. Type of Service

- 5.1.2. In-house/Government

- 5.1.1. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Consumer Good and Retail

- 5.2.2. Automotive

- 5.2.3. Food and Agriculture

- 5.2.4. Manufacturing and Industrial Goods

- 5.2.5. Energy and Utilities

- 5.2.6. Oil & Gas and Chemicals

- 5.2.7. Construction

- 5.2.8. Transport, Aerospace, and Rail

- 5.2.9. Life Sciences

- 5.2.10. Marine & Mining

- 5.2.11. Other End User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Quality Analysis Gmb

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intertek Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vinçotte International SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DNV GL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Société Générale de Surveillance SA (SGS SA)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Applus Services SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TÜV NORD Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 A/S Baltic Control Ltd Aarhus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 RTM BREDA SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TÜV SÜD Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LabAnalysis SRL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CIS Commodity Inspection Services BV

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TÜV Rheinland Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 VIC Inspection Services Holding Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 DEKRA SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 UL LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Kiwa NV

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 ALS Limited

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 AQM SRL

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Bureau Veritas SA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Element Materials Technology

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Eurofins Scientific SE

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 ATG Technology Group

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.1 Quality Analysis Gmb

List of Figures

- Figure 1: Europe TIC Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe TIC Market Share (%) by Company 2025

List of Tables

- Table 1: Europe TIC Market Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Europe TIC Market Revenue million Forecast, by End User Vertical 2020 & 2033

- Table 3: Europe TIC Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe TIC Market Revenue million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Europe TIC Market Revenue million Forecast, by End User Vertical 2020 & 2033

- Table 6: Europe TIC Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe TIC Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe TIC Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Europe TIC Market?

Key companies in the market include Quality Analysis Gmb, Intertek Group, Vinçotte International SA, DNV GL, Société Générale de Surveillance SA (SGS SA), Applus Services SA, TÜV NORD Group, A/S Baltic Control Ltd Aarhus, RTM BREDA SRL, TÜV SÜD Limited, LabAnalysis SRL, CIS Commodity Inspection Services BV, TÜV Rheinland Group, VIC Inspection Services Holding Ltd, DEKRA SA, UL LLC, Kiwa NV, ALS Limited, AQM SRL, Bureau Veritas SA, Element Materials Technology, Eurofins Scientific SE, ATG Technology Group.

3. What are the main segments of the Europe TIC Market?

The market segments include Sourcing Type, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 119057.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trading Across Borders and Stringent Regulations; Technological Evolution; Mass Customization and Shorter Product Life Cycles.

6. What are the notable trends driving market growth?

Consumer Goods and Retail Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023 - NMi, one of the market leaders in the certification of measuring and metering technologies, and CCIC Europe (CCIC EU), the regional company of the China Inspection & Certification Group, have announced a partnership to provide testing, inspection, and certification services to manufacturers in the People’s Republic of China (PRC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe TIC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe TIC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe TIC Market?

To stay informed about further developments, trends, and reports in the Europe TIC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence