Key Insights

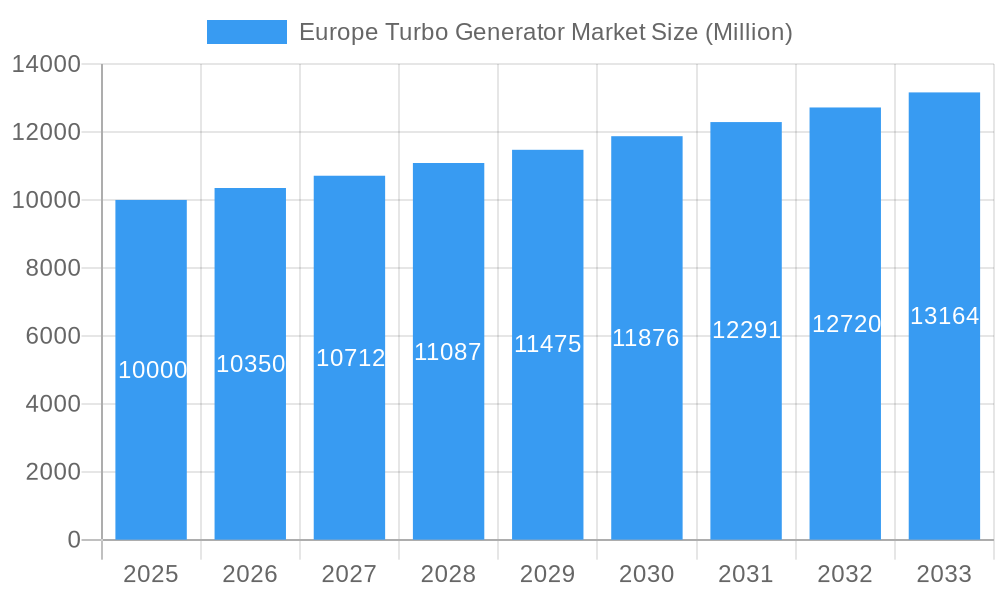

The European turbo generator market, valued at approximately €[Estimate based on market size XX and value unit Million; let's assume €10 Billion in 2025 for example purposes] in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 3.5% through 2033. This expansion is driven by several key factors. Firstly, the increasing demand for electricity across various sectors, particularly in the power generation industry, fuels the need for efficient and reliable turbo generators. The shift towards cleaner energy sources, while impacting the coal-fired power plant segment, simultaneously creates opportunities in gas-fired and potentially nuclear power plants, alongside a rise in renewable energy integration requiring advanced grid management solutions often involving turbo generators. Furthermore, technological advancements in turbo generator design, including improvements in efficiency, reliability, and lifespan, are contributing significantly to market growth. Stringent environmental regulations aimed at reducing greenhouse gas emissions are also driving the adoption of more efficient and environmentally friendly turbo generators, fostering innovation in the sector.

Europe Turbo Generator Market Market Size (In Billion)

However, the market faces certain restraints. The high initial investment costs associated with purchasing and installing turbo generators can be a barrier for smaller companies and developing regions within Europe. Furthermore, fluctuating energy prices and economic downturns can impact investment decisions in the power generation sector, potentially slowing down market growth. Nevertheless, the long-term outlook for the European turbo generator market remains positive, driven by consistent energy demand growth and the ongoing transition towards a cleaner and more efficient energy infrastructure. Market segmentation reveals that steam turbo generators currently hold a significant market share, but gas turbo generators are expected to witness substantial growth, driven by increasing gas-fired power plant installations and the need for flexible generation capacity to integrate intermittent renewable sources. Key players such as MAN Energy Solutions, Siemens AG, and General Electric are shaping market competition through continuous innovation and strategic partnerships, further contributing to overall market dynamism.

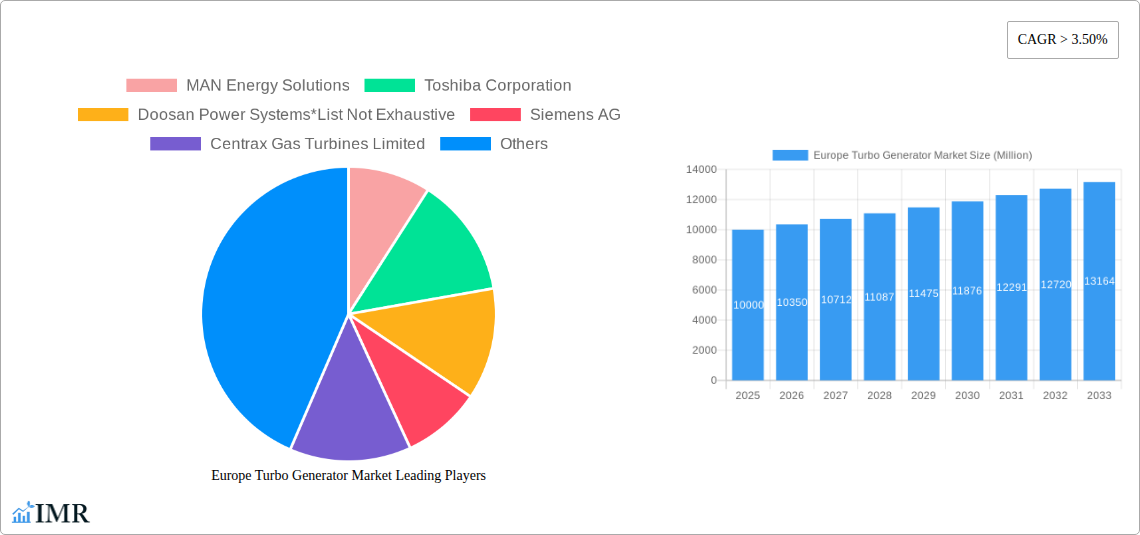

Europe Turbo Generator Market Company Market Share

Europe Turbo Generator Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Turbo Generator Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period 2019-2033, with 2025 as the base year and forecast period from 2025-2033. The parent market is the European Power Generation Market, and the child market is the Europe Turbo Generator Market, segmented by type and end-user. Market values are presented in million units.

Europe Turbo Generator Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends shaping the European turbo generator market. The market is characterized by a moderate level of concentration, with several major players holding significant market share. Technological innovation, driven by the need for greater efficiency and sustainability, is a key driver. Stringent environmental regulations are also influencing market dynamics, pushing adoption of cleaner technologies. The increasing demand for reliable power generation, particularly from renewable sources, is fueling market growth.

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on improving efficiency (xx% improvement projected by 2033), reducing emissions (xx% reduction target), and incorporating digital technologies (e.g., predictive maintenance).

- Regulatory Framework: Compliance with EU emissions standards (e.g., EU ETS) is driving demand for more efficient and cleaner turbo generators.

- Competitive Product Substitutes: Growth of renewable energy sources (solar, wind) presents a competitive challenge.

- End-User Demographics: Growth in industrial and commercial sectors driving demand, particularly in Germany, France, and the UK.

- M&A Trends: xx M&A deals recorded in the last 5 years, primarily focused on expanding geographic reach and technological capabilities.

Europe Turbo Generator Market Growth Trends & Insights

The Europe Turbo Generator Market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is projected to accelerate during the forecast period (2025-2033), reaching a CAGR of xx%, driven by factors such as increasing electricity demand, investments in new power generation capacity, and the ongoing energy transition. Technological advancements, including the integration of digital technologies and improvements in efficiency, are further contributing to market growth. The market is witnessing a shift towards gas turbo generators, driven by their relatively lower emissions compared to steam turbo generators. Adoption rates are expected to increase significantly, driven by government incentives and supportive policies focused on decarbonization. Consumer behavior is shifting towards reliable, efficient, and environmentally friendly power generation solutions.

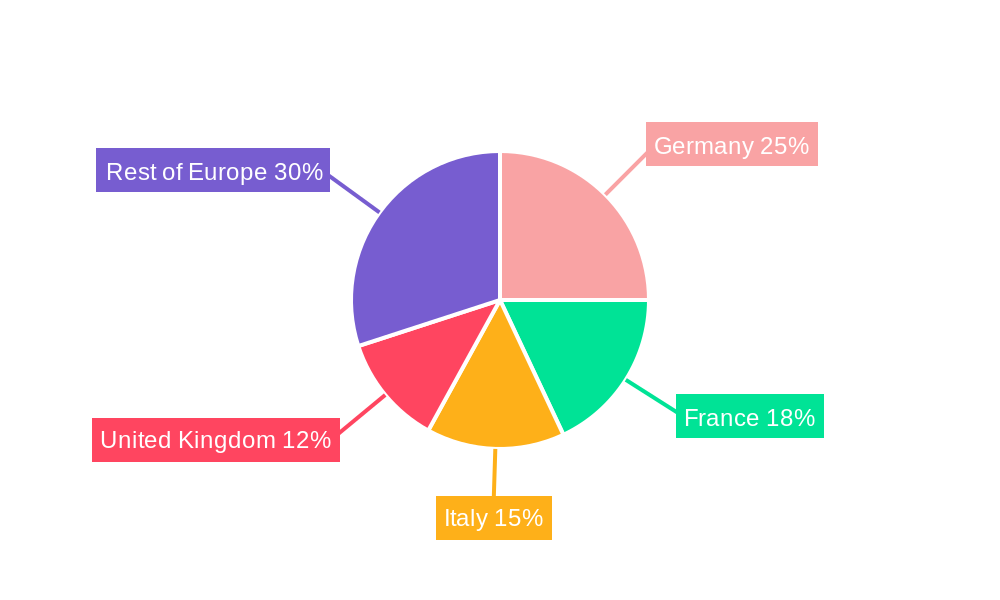

Dominant Regions, Countries, or Segments in Europe Turbo Generator Market

Germany, France, and the United Kingdom are the dominant markets in Europe for turbo generators, driven by their substantial installed power generation capacity and robust economies. The Gas-fired Power Plant segment holds the largest market share due to its versatility and relatively lower emissions compared to coal-fired plants. The Steam Turbo Generator segment is also substantial, though its growth is anticipated to be slower than Gas Turbo Generators. Nuclear power plants contribute significantly, particularly in France and the UK. However, future growth in this sector depends on new plant construction plans and regulatory approvals.

Key Drivers:

- Strong economic growth in key European nations driving industrial and commercial power demand.

- Government support for renewable energy integration.

- Modernization of existing power plants.

- Investment in new power generation infrastructure.

Dominance Factors:

- High energy consumption in key economies.

- Existing infrastructure.

- Supportive government policies.

Europe Turbo Generator Market Product Landscape

The European turbo generator market offers a diverse range of products, including steam and gas turbo generators, varying in capacity and technological features. Recent innovations focus on enhanced efficiency, reduced emissions, and improved reliability. Manufacturers are increasingly integrating digital technologies, such as advanced control systems and predictive maintenance capabilities, to optimize performance and reduce operational costs. Unique selling propositions include high efficiency ratings, extended operational lifespan, and reduced maintenance needs.

Key Drivers, Barriers & Challenges in Europe Turbo Generator Market

Key Drivers: Increased electricity demand fueled by economic growth and industrialization. Government support for renewable energy integration. Stringent environmental regulations driving adoption of cleaner technologies. Technological advancements increasing efficiency and reducing emissions.

Key Barriers & Challenges: High initial investment costs for new generation capacity. Competition from renewable energy sources. Supply chain disruptions impacting component availability and pricing. Regulatory hurdles and permitting processes delaying new project implementation. xx% increase in raw material costs in 2024 added significant pressure on the market.

Emerging Opportunities in Europe Turbo Generator Market

Emerging opportunities lie in the growing demand for distributed generation, particularly microgrids and combined heat and power (CHP) systems. Technological advancements, such as the development of more efficient and sustainable turbo generator designs, present significant opportunities for market expansion. Focus on service contracts and long-term maintenance agreements is a growing revenue stream.

Growth Accelerators in the Europe Turbo Generator Market Industry

Technological breakthroughs in materials science, digital technologies, and advanced control systems are accelerating market growth. Strategic partnerships between manufacturers and power generation companies are facilitating the adoption of innovative technologies. Government policies aimed at promoting energy efficiency and decarbonization are driving investment in new generation capacity.

Key Players Shaping the Europe Turbo Generator Market Market

- MAN Energy Solutions

- Toshiba Corporation

- Doosan Power Systems

- Siemens AG

- Centrax Gas Turbines Limited

- Ansaldo Energia SpA

- General Electric Company

- Kawasaki Heavy Industries Ltd

- Andritz AG

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Europe Turbo Generator Market Sector

- December 2022: The Netherlands announced plans to build two new nuclear power plants in Borssele by 2035.

- July 2022: The UK approved a new nuclear power plant (Sizewell C) with a capacity of 3,200 MW.

In-Depth Europe Turbo Generator Market Market Outlook

The Europe Turbo Generator Market is poised for significant growth over the forecast period, driven by sustained electricity demand, government support for renewable energy, and technological advancements. Strategic partnerships, investments in research and development, and expansion into new markets will be crucial for long-term success. The market will continue to be shaped by environmental regulations, pushing manufacturers towards more sustainable and efficient designs. The focus on digitalization and predictive maintenance will also be pivotal for improving operational efficiency and reducing costs.

Europe Turbo Generator Market Segmentation

-

1. End User

- 1.1. Coal-fired Power Plant

- 1.2. Gas-fired Power Plant

- 1.3. Nuclear Power Plant

- 1.4. Other End Users

Europe Turbo Generator Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Rest of Europe

Europe Turbo Generator Market Regional Market Share

Geographic Coverage of Europe Turbo Generator Market

Europe Turbo Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Gas-fired Power Plants to Dominate the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Coal-fired Power Plant

- 5.1.2. Gas-fired Power Plant

- 5.1.3. Nuclear Power Plant

- 5.1.4. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Germany Europe Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Coal-fired Power Plant

- 6.1.2. Gas-fired Power Plant

- 6.1.3. Nuclear Power Plant

- 6.1.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. United Kingdom Europe Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Coal-fired Power Plant

- 7.1.2. Gas-fired Power Plant

- 7.1.3. Nuclear Power Plant

- 7.1.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. France Europe Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Coal-fired Power Plant

- 8.1.2. Gas-fired Power Plant

- 8.1.3. Nuclear Power Plant

- 8.1.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest of Europe Europe Turbo Generator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Coal-fired Power Plant

- 9.1.2. Gas-fired Power Plant

- 9.1.3. Nuclear Power Plant

- 9.1.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 MAN Energy Solutions

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toshiba Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Doosan Power Systems*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Centrax Gas Turbines Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ansaldo Energia SpA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 General Electric Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kawasaki Heavy Industries Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Andritz AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mitsubishi Heavy Industries Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 MAN Energy Solutions

List of Figures

- Figure 1: Europe Turbo Generator Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Turbo Generator Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 2: Europe Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 3: Europe Turbo Generator Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Turbo Generator Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Europe Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Europe Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 7: Europe Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Europe Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

- Table 9: Europe Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Europe Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 11: Europe Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Europe Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Europe Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 15: Europe Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Turbo Generator Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Europe Turbo Generator Market Volume K Units Forecast, by End User 2020 & 2033

- Table 19: Europe Turbo Generator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Europe Turbo Generator Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Turbo Generator Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Europe Turbo Generator Market?

Key companies in the market include MAN Energy Solutions, Toshiba Corporation, Doosan Power Systems*List Not Exhaustive, Siemens AG, Centrax Gas Turbines Limited, Ansaldo Energia SpA, General Electric Company, Kawasaki Heavy Industries Ltd, Andritz AG, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Europe Turbo Generator Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Gas-fired Power Plants to Dominate the Market Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

In December 2022, the Government of the Netherlands announced its plans to build two new nuclear power plants in Borssele by 2035. The construction of the power plants is expected to start in 2028.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Turbo Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Turbo Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Turbo Generator Market?

To stay informed about further developments, trends, and reports in the Europe Turbo Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence