Key Insights

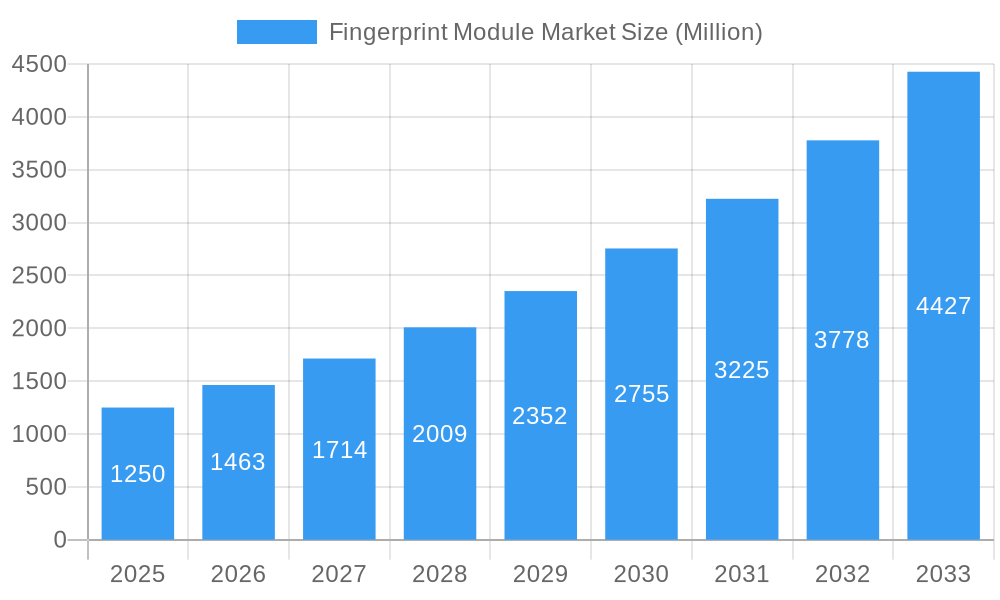

The global fingerprint module market is experiencing robust expansion, projected to reach a significant market size by 2033. Fueled by a compelling Compound Annual Growth Rate (CAGR) of 17.08%, this growth is primarily driven by the escalating demand for enhanced security and authentication solutions across diverse industries. The consumer electronics sector, in particular, is a major contributor, with fingerprint sensors becoming a standard feature in smartphones, laptops, and wearable devices. Furthermore, the increasing adoption of biometrics in government and law enforcement for identity verification and surveillance, as well as in the BFSI sector for secure transactions and access control, are pivotal growth accelerators. The aviation industry's focus on streamlined passenger processing and enhanced security also plays a significant role. Advancements in technology, such as the development of more sophisticated optical and capacitive-based fingerprint readers, along with emerging multispectral imaging sensors offering improved accuracy and liveness detection, are continuously pushing the market forward.

Fingerprint Module Market Market Size (In Billion)

The market's trajectory is characterized by several key trends, including the integration of fingerprint modules into an ever-wider array of devices and applications, moving beyond traditional security systems. The increasing emphasis on contactless and hygienic authentication methods is also bolstering the demand for advanced fingerprint scanning technologies. While the market presents significant opportunities, certain restraints may influence its pace. These could include the initial cost of implementing advanced biometric systems in some industries, concerns regarding data privacy and security, and the potential for spoofing or false rejections in certain environmental conditions. However, ongoing research and development efforts aimed at improving accuracy, reducing costs, and enhancing security are expected to mitigate these challenges, ensuring sustained and dynamic growth for the fingerprint module market throughout the forecast period. The competitive landscape features prominent players like NITGEN Co Ltd, Suprema Inc, and Idemia France SAS, who are instrumental in driving innovation and market penetration.

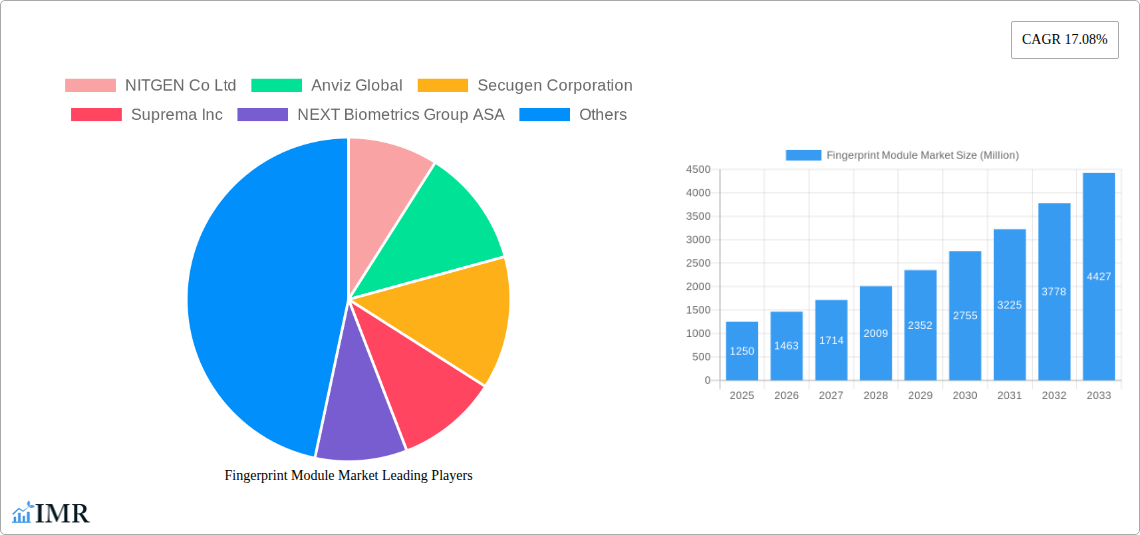

Fingerprint Module Market Company Market Share

Fingerprint Module Market: Comprehensive Analysis and Future Outlook (2019–2033)

Unlock the future of biometric security with our in-depth Fingerprint Module Market report. This meticulously researched analysis delves into the intricate dynamics, growth trajectories, and competitive landscape of the global fingerprint module market, providing critical insights for stakeholders across various industries. From foundational technologies to emerging applications, this report equips you with the knowledge to navigate this rapidly evolving sector.

Fingerprint Module Market Dynamics & Structure

The global fingerprint module market is characterized by a moderate to high concentration, driven by significant technological advancements and increasing adoption across diverse end-user industries. Key innovation drivers include the relentless pursuit of enhanced security, miniaturization for seamless integration into portable devices, and improved accuracy and speed. Regulatory frameworks, particularly in sectors like BFSI and government, are increasingly mandating robust biometric authentication, further fueling market growth. While competitive product substitutes like facial recognition and iris scanning exist, fingerprint modules maintain a strong foothold due to their established trust, cost-effectiveness, and ease of use. End-user demographics are broadening, encompassing not just enterprise and government applications but also a significant surge in consumer electronics. Mergers and acquisitions (M&A) are a notable trend, with larger players acquiring innovative startups to bolster their technology portfolios and market reach. The market has witnessed approximately 25 M&A deals in the historical period, indicating consolidation and strategic expansion. Innovation barriers primarily revolve around the high cost of research and development for advanced sensor technologies and the need to overcome spoofing vulnerabilities.

- Market Concentration: Moderate to High

- Key Innovation Drivers: Enhanced security, miniaturization, improved accuracy/speed.

- Regulatory Influence: Mandates in BFSI, Government & Law Enforcement.

- Competitive Substitutes: Facial recognition, iris scanning.

- End-User Demographics: Expanding from enterprise/government to consumer electronics.

- M&A Trends: Active consolidation and strategic acquisitions.

- Innovation Barriers: R&D costs, spoofing vulnerabilities.

Fingerprint Module Market Growth Trends & Insights

The global fingerprint module market is poised for substantial growth, projected to expand from USD 5,200 Million in the Base Year 2025 to USD 10,500 Million by the Estimated Year 2025, and further reaching USD 22,750 Million by the end of the Forecast Period 2033. This impressive CAGR of approximately 8.5% between 2025 and 2033 underscores the robust demand for secure and convenient authentication solutions. The market's evolution is intrinsically linked to the widespread adoption of smartphones, laptops, and tablets, where fingerprint sensors have become a standard feature, driving a significant portion of market penetration. Beyond consumer electronics, the surge in digital transactions, the growing need for identity verification in secure access control systems, and the implementation of national ID programs are compelling growth catalysts. Technological disruptions are continuously refining sensor capabilities, leading to smaller, faster, and more accurate modules. Capacitive-based fingerprint readers, for instance, have seen a significant increase in adoption due to their balance of performance and cost. Optical fingerprint scanners continue to hold a substantial market share, particularly in applications requiring larger sensing areas. Multispectral imaging sensors are emerging as a premium technology, offering enhanced performance in challenging conditions, such as wet or dry fingers. Consumer behavior has shifted demonstrably towards prioritizing security and ease of use, making fingerprint authentication a preferred method over passwords or PINs for many. This shift is particularly evident in the BFSI sector, where mobile banking and payment applications heavily rely on biometrics for user authentication. The market penetration of fingerprint modules in the consumer electronics segment alone is estimated to exceed 70% by 2025. The increasing emphasis on data privacy and security regulations globally is also acting as a powerful tailwind, pushing organizations to invest in advanced biometric solutions. The integration of fingerprint modules into the Internet of Things (IoT) devices, smart homes, and wearable technology further expands the addressable market. The historical data from 2019–2024 shows a consistent upward trend, with a CAGR of approximately 7.9%, setting a strong foundation for future growth. The growing preference for contactless authentication methods, accelerated by global health concerns, also favors fingerprint-based solutions. The expanding use cases in healthcare for patient identification and secure access to medical records, alongside the critical need for secure identification in aviation and government services, will continue to drive demand. The market is expected to witness a diversification in form factors and integration methods, catering to a wider array of device designs and user needs.

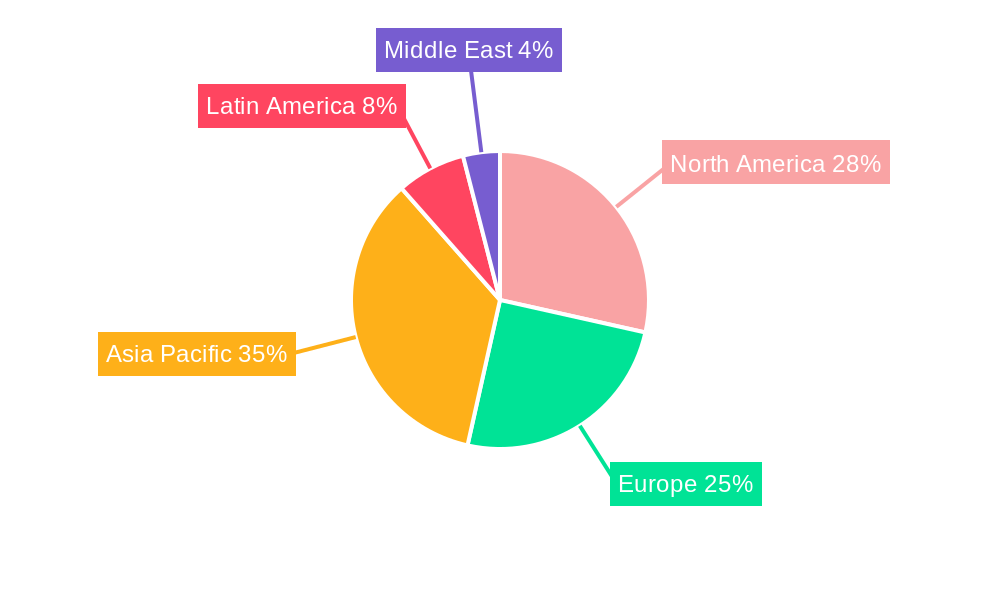

Dominant Regions, Countries, or Segments in Fingerprint Module Market

The Asia Pacific region stands as the dominant force in the global fingerprint module market, driven by a confluence of factors including a massive consumer electronics manufacturing base, rapidly growing economies, and widespread government initiatives promoting digital identity and security. Within this region, countries like China, South Korea, and India are at the forefront. China, being a global hub for smartphone and electronics production, dictates a significant portion of the demand for fingerprint modules. South Korea’s technological prowess and its leading electronics manufacturers further solidify its position. India's immense population and its ambitious digital transformation agenda, including the Aadhaar program, have created an unparalleled demand for biometric identification solutions, with fingerprint technology being a cornerstone.

In terms of technology segments, Capacitive-based Fingerprint Readers are currently leading the market. Their widespread adoption in smartphones and tablets is attributed to their excellent balance of cost, performance, and size, making them ideal for mass-produced consumer devices. The market share for capacitive sensors is estimated to be around 45% in 2025.

The Consumer Electronics end-user industry is the primary growth driver, accounting for an estimated 55% of the market revenue in 2025. The ubiquitous presence of fingerprint sensors in smartphones, laptops, and wearable devices has cemented its dominance.

However, the Government & Law Enforcement sector exhibits a high growth potential and significant market share, driven by national ID programs, border control, and criminal identification systems. The need for robust and reliable identification solutions in these critical areas ensures sustained demand. The market share for government applications is projected to reach 20% by 2025.

The BFSI sector is another crucial segment, with increasing reliance on fingerprint authentication for secure mobile banking, online transactions, and ATM access, contributing approximately 15% to the market. While Optical FingerPrint Scanners represent a mature technology, they continue to be relevant in applications requiring larger sensing areas and higher resolution, such as access control systems and specialized government applications. Multispectral Imaging Sensors, though a smaller segment currently, is experiencing rapid growth due to its superior performance in challenging conditions and is projected to capture a growing market share as costs decrease and applications diversify. The economic policies promoting digital infrastructure and security in the Asia Pacific region, coupled with the rapid urbanization and increasing disposable income, further fuel the demand for fingerprint modules.

Fingerprint Module Market Product Landscape

The fingerprint module market is characterized by continuous product innovation focused on enhancing user experience and security. Key advancements include the development of under-display fingerprint sensors, enabling seamless integration into smartphone screens and offering a sleeker aesthetic. Under-display optical sensors and ultrasonic sensors are gaining traction, providing faster and more accurate authentication. Furthermore, improvements in sensor resolution, speed, and spoof detection capabilities are ongoing. Companies are also focusing on miniaturization and power efficiency to support integration into an ever-wider array of devices, from wearables to smart home appliances.

Key Drivers, Barriers & Challenges in Fingerprint Module Market

Key Drivers:

- Rising Demand for Enhanced Security: Increasing concerns over data breaches and identity theft are driving the adoption of robust biometric authentication.

- Growth of Consumer Electronics: The widespread integration of fingerprint sensors in smartphones, laptops, and wearables fuels significant market growth.

- Government Initiatives: National ID programs and digital identity projects globally necessitate secure authentication solutions.

- Technological Advancements: Continuous innovation in sensor technology, leading to improved accuracy, speed, and miniaturization.

- BFSI Sector Adoption: The increasing use of mobile banking and digital payment platforms relies heavily on secure biometric authentication.

Barriers & Challenges:

- High R&D Costs: Developing next-generation biometric technologies requires substantial investment.

- Spoofing Vulnerabilities: Overcoming sophisticated spoofing techniques remains an ongoing challenge.

- Privacy Concerns: User privacy concerns and data protection regulations can impact adoption rates.

- Interoperability Issues: Ensuring seamless integration and compatibility across different devices and platforms can be complex.

- Supply Chain Disruptions: Geopolitical factors and manufacturing complexities can lead to supply chain challenges.

Emerging Opportunities in Fingerprint Module Market

Emerging opportunities lie in the expanding applications of fingerprint technology within the Internet of Things (IoT) ecosystem, including smart homes, connected vehicles, and industrial automation, where secure, keyless access is paramount. The healthcare sector presents a significant untapped market for patient identification and secure access to sensitive medical records, enhancing patient safety and data integrity. Furthermore, the development of more advanced, multi-modal biometric systems that integrate fingerprint with other authentication methods offers a pathway to even greater security and user convenience. The growing demand for contactless authentication solutions continues to open new avenues, particularly in public spaces and high-traffic environments.

Growth Accelerators in the Fingerprint Module Market Industry

Technological breakthroughs in sensor materials and algorithms are key growth accelerators, enabling more accurate, faster, and energy-efficient fingerprint modules. Strategic partnerships between sensor manufacturers and device OEMs are crucial for driving integration and market penetration. The increasing global focus on digital transformation and cybersecurity mandates is a significant accelerator, compelling industries to invest in advanced security solutions. Furthermore, the expansion of fingerprint technology into new verticals like access control for smart buildings and secure payment terminals will further propel market growth.

Key Players Shaping the Fingerprint Module Market Market

- NITGEN Co Ltd

- Anviz Global

- Secugen Corporation

- Suprema Inc

- NEXT Biometrics Group ASA

- Integrated Biometrics LLC

- Idemia France SAS

- Thales Group (Gemalto NV)

- HID Global Corporation

- NEC Corporation

Notable Milestones in Fingerprint Module Market Sector

- 2019: Widespread integration of under-display optical fingerprint sensors in flagship smartphones.

- 2020: Advancements in ultrasonic fingerprint sensors offering improved accuracy and 3D sensing capabilities.

- 2021: Increased adoption of fingerprint modules in laptops and personal computers for enhanced security.

- 2022: Growth in demand for fingerprint solutions in the healthcare sector for patient identification and record access.

- 2023: Development of smaller and more power-efficient fingerprint sensors for wearable devices.

- 2024: Exploration of advanced multi-spectral imaging sensors for superior performance in diverse environmental conditions.

In-Depth Fingerprint Module Market Market Outlook

The future outlook for the fingerprint module market is exceptionally promising, driven by an unwavering demand for secure and user-friendly authentication solutions. Growth accelerators like cutting-edge technological innovations, strategic collaborations with leading device manufacturers, and the global push towards digitalization and robust cybersecurity frameworks will continue to propel the market forward. The expanding application scope across various industries, coupled with evolving consumer preferences for seamless and secure identification, presents significant strategic opportunities for market players to innovate and capture new market share. The market is expected to witness continuous evolution in sensor technology, leading to more integrated and powerful biometric solutions.

Fingerprint Module Market Segmentation

-

1. Technology

- 1.1. Optical FingerPrint Scanner

- 1.2. Capacitive-based Fingerprint Reader

- 1.3. Multispectral Imaging Sensor

-

2. End-user Industry

- 2.1. Government & Law Enforcement

- 2.2. Consumer Electronics

- 2.3. Aviation

- 2.4. BFSI

- 2.5. Healthcare

- 2.6. Others

Fingerprint Module Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Fingerprint Module Market Regional Market Share

Geographic Coverage of Fingerprint Module Market

Fingerprint Module Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Government Investment for Creating Citizen Repositories & Improving Security; Expanding Smartphone Integration for Biometric Authentication

- 3.3. Market Restrains

- 3.3.1. ; Threat to Security of Fingerprint Data Within the System; Limitations of the Technology Leading to Breaches

- 3.4. Market Trends

- 3.4.1. Aviation Sector will Increasingly Use Bio-metric Solutions to Enhance Security for Air Travellers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fingerprint Module Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Optical FingerPrint Scanner

- 5.1.2. Capacitive-based Fingerprint Reader

- 5.1.3. Multispectral Imaging Sensor

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government & Law Enforcement

- 5.2.2. Consumer Electronics

- 5.2.3. Aviation

- 5.2.4. BFSI

- 5.2.5. Healthcare

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Fingerprint Module Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Optical FingerPrint Scanner

- 6.1.2. Capacitive-based Fingerprint Reader

- 6.1.3. Multispectral Imaging Sensor

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Government & Law Enforcement

- 6.2.2. Consumer Electronics

- 6.2.3. Aviation

- 6.2.4. BFSI

- 6.2.5. Healthcare

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Fingerprint Module Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Optical FingerPrint Scanner

- 7.1.2. Capacitive-based Fingerprint Reader

- 7.1.3. Multispectral Imaging Sensor

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Government & Law Enforcement

- 7.2.2. Consumer Electronics

- 7.2.3. Aviation

- 7.2.4. BFSI

- 7.2.5. Healthcare

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Fingerprint Module Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Optical FingerPrint Scanner

- 8.1.2. Capacitive-based Fingerprint Reader

- 8.1.3. Multispectral Imaging Sensor

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Government & Law Enforcement

- 8.2.2. Consumer Electronics

- 8.2.3. Aviation

- 8.2.4. BFSI

- 8.2.5. Healthcare

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Fingerprint Module Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Optical FingerPrint Scanner

- 9.1.2. Capacitive-based Fingerprint Reader

- 9.1.3. Multispectral Imaging Sensor

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Government & Law Enforcement

- 9.2.2. Consumer Electronics

- 9.2.3. Aviation

- 9.2.4. BFSI

- 9.2.5. Healthcare

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East Fingerprint Module Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Optical FingerPrint Scanner

- 10.1.2. Capacitive-based Fingerprint Reader

- 10.1.3. Multispectral Imaging Sensor

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Government & Law Enforcement

- 10.2.2. Consumer Electronics

- 10.2.3. Aviation

- 10.2.4. BFSI

- 10.2.5. Healthcare

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NITGEN Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Anviz Global

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Secugen Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Suprema Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NEXT Biometrics Group ASA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Integrated Biometrics LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Idemia France SAS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thales Group (Gemalto NV)*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HID Global Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NEC Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NITGEN Co Ltd

List of Figures

- Figure 1: Global Fingerprint Module Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Fingerprint Module Market Revenue (undefined), by Technology 2025 & 2033

- Figure 3: North America Fingerprint Module Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Fingerprint Module Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Fingerprint Module Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Fingerprint Module Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Fingerprint Module Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fingerprint Module Market Revenue (undefined), by Technology 2025 & 2033

- Figure 9: Europe Fingerprint Module Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Fingerprint Module Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Fingerprint Module Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Fingerprint Module Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Fingerprint Module Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fingerprint Module Market Revenue (undefined), by Technology 2025 & 2033

- Figure 15: Asia Pacific Fingerprint Module Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Fingerprint Module Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Fingerprint Module Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Fingerprint Module Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Fingerprint Module Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Fingerprint Module Market Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Latin America Fingerprint Module Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Fingerprint Module Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Latin America Fingerprint Module Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Fingerprint Module Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Fingerprint Module Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Fingerprint Module Market Revenue (undefined), by Technology 2025 & 2033

- Figure 27: Middle East Fingerprint Module Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East Fingerprint Module Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East Fingerprint Module Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Fingerprint Module Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Fingerprint Module Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fingerprint Module Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Global Fingerprint Module Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Fingerprint Module Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Fingerprint Module Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: Global Fingerprint Module Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Fingerprint Module Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Fingerprint Module Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: Global Fingerprint Module Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Fingerprint Module Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Fingerprint Module Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 11: Global Fingerprint Module Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Fingerprint Module Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Fingerprint Module Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Global Fingerprint Module Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Fingerprint Module Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Fingerprint Module Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 17: Global Fingerprint Module Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Fingerprint Module Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fingerprint Module Market?

The projected CAGR is approximately 20.24%.

2. Which companies are prominent players in the Fingerprint Module Market?

Key companies in the market include NITGEN Co Ltd, Anviz Global, Secugen Corporation, Suprema Inc, NEXT Biometrics Group ASA, Integrated Biometrics LLC, Idemia France SAS, Thales Group (Gemalto NV)*List Not Exhaustive, HID Global Corporation, NEC Corporation.

3. What are the main segments of the Fingerprint Module Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Government Investment for Creating Citizen Repositories & Improving Security; Expanding Smartphone Integration for Biometric Authentication.

6. What are the notable trends driving market growth?

Aviation Sector will Increasingly Use Bio-metric Solutions to Enhance Security for Air Travellers.

7. Are there any restraints impacting market growth?

; Threat to Security of Fingerprint Data Within the System; Limitations of the Technology Leading to Breaches.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fingerprint Module Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fingerprint Module Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fingerprint Module Market?

To stay informed about further developments, trends, and reports in the Fingerprint Module Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence