Key Insights

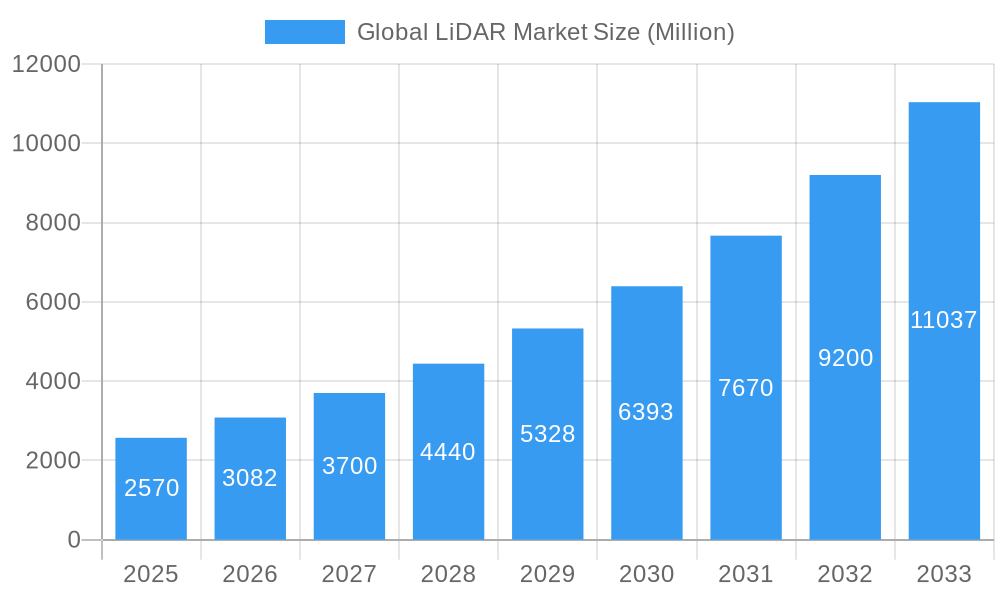

The Global LiDAR Market is poised for significant expansion, projected to reach $2.57 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 19.93% over the forecast period of 2025-2033. This impressive growth is fueled by the increasing adoption of LiDAR in autonomous vehicles (AVs) and Advanced Driver-Assistance Systems (ADAS), where it provides critical real-time environmental perception for enhanced safety and navigation. The burgeoning demand for precise 3D mapping and surveying in various industrial applications, including construction, infrastructure development, and environmental monitoring, further propels market growth. Advancements in sensor technology, leading to smaller, more affordable, and higher-resolution LiDAR systems, are democratizing access and accelerating their integration across a wider spectrum of use cases.

Global LiDAR Market Market Size (In Billion)

Key trends shaping the LiDAR market include the development of solid-state LiDAR for improved durability and cost-effectiveness, alongside the integration of AI and machine learning for sophisticated data processing and interpretation. The growing focus on smart city initiatives, precision agriculture, and forestry management also presents substantial opportunities. While the market is experiencing strong tailwinds, challenges such as high initial costs for some advanced systems and the need for standardized data formats and regulations may pose moderate restraints. The market is segmented into Aerial and Terrestrial types, with applications spanning robotic vehicles, ADAS, industrial uses, and environmental monitoring, encompassing topography, wind, agriculture, and forestry. Leading companies such as Velodyne LiDAR Inc., RoboSense LiDAR, and Waymo are at the forefront of innovation, driving the competitive landscape.

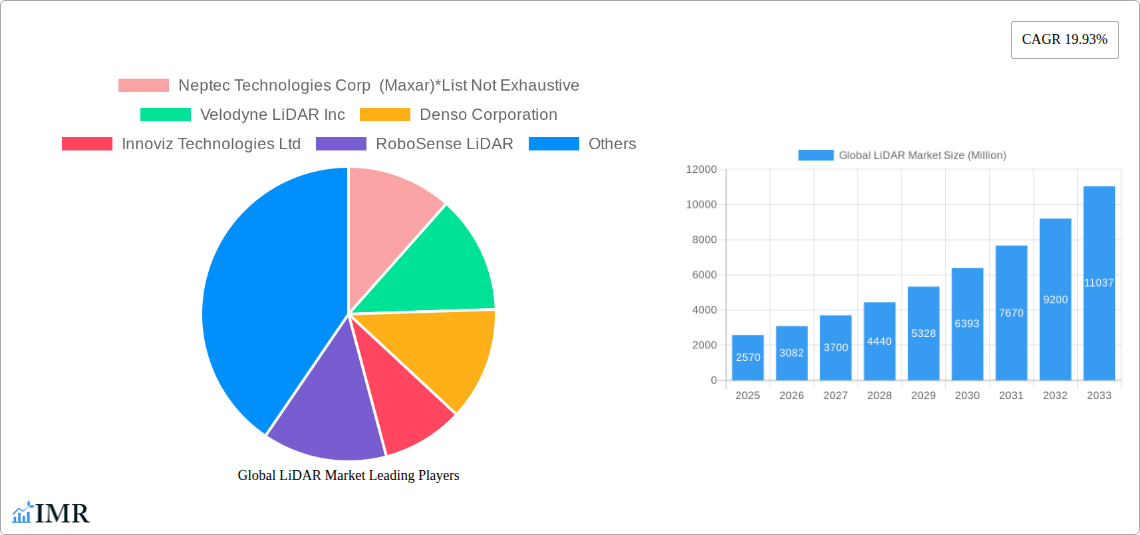

Global LiDAR Market Company Market Share

Here is a compelling, SEO-optimized report description for the Global LiDAR Market, incorporating your specified details and adhering to all formatting and content requirements.

Global LiDAR Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth LiDAR market report provides a thorough analysis of the global Light Detection and Ranging (LiDAR) market, a pivotal technology driving advancements across autonomous vehicles, robotics, environmental monitoring, and industrial automation. With a comprehensive LiDAR market size estimation, the report covers the historical period from 2019 to 2024, the base and estimated year of 2025, and an extensive LiDAR market forecast period extending to 2033. We delve into intricate LiDAR market dynamics, exploring key growth drivers such as the surging demand for autonomous vehicle LiDAR and ADAS LiDAR systems, coupled with the burgeoning adoption of LiDAR for robotics. The report meticulously segments the market by application, including robotic vehicles, ADAS, environmental applications (topography, wind, agriculture, and forestry), and industrial LiDAR, as well as by type, encompassing aerial LiDAR (topographic and bathymetric) and terrestrial LiDAR (mobile and static). Discover how emerging trends in 3D mapping technology and geospatial solutions are reshaping industries and creating new opportunities.

Key Report Features:

- Comprehensive Market Coverage: Detailed analysis of the global LiDAR market from 2019 to 2033.

- Segmented Insights: In-depth examination of applications (Robotic Vehicles, ADAS, Environment, Industrial) and types (Aerial, Terrestrial).

- High-Traffic Keyword Integration: Optimized for searches related to LiDAR market analysis, LiDAR sensor market, LiDAR technology trends, and automotive LiDAR.

- Quantitative & Qualitative Data: Market size, CAGR, market share, growth rates, and qualitative factors influencing market dynamics.

- Industry Developments: Latest news and milestones from key players like Inertial Labs, RoboSense, and others.

- Competitive Landscape: Detailed profiles of leading companies shaping the LiDAR industry.

- Future Outlook: Identification of emerging opportunities, growth accelerators, and strategic imperatives.

Global LiDAR Market Market Dynamics & Structure

The global LiDAR market is characterized by intense technological innovation and a rapidly evolving competitive landscape, projected to reach significant revenue in the coming years. Market concentration is moderate, with a mix of established players and emerging startups vying for market share. Key drivers of technological innovation include the relentless pursuit of higher resolution, increased range, reduced cost, and miniaturization of LiDAR sensors, crucial for the widespread adoption of autonomous driving LiDAR and advanced ADAS LiDAR systems. Regulatory frameworks, particularly concerning autonomous vehicle safety standards and drone usage, are increasingly influencing market development and product deployment. Competitive product substitutes, such as radar and advanced camera systems, exist but often complement LiDAR rather than replace its unique capabilities for precise 3D environmental mapping. End-user demographics are broadening, extending from the automotive and robotics sectors to surveying, construction, environmental science, and smart city initiatives. Mergers and acquisitions (M&A) trends are active as larger companies seek to acquire cutting-edge LiDAR technology or gain access to new markets and customer bases. For instance, strategic partnerships like the one between Inertial Labs and Stitch3D highlight the ongoing consolidation and collaborative efforts to enhance 3D data processing and distribution capabilities. The LiDAR market share is constantly being redefined by these dynamic forces.

- Market Concentration: Moderate, with increasing consolidation expected.

- Technological Innovation Drivers: Cost reduction, improved resolution, miniaturization, weather resilience.

- Regulatory Frameworks: Influence on autonomous vehicle safety, drone operation, and data privacy.

- Competitive Product Substitutes: Radar, ultrasonic sensors, advanced cameras.

- End-User Demographics: Automotive, robotics, surveying, construction, agriculture, environmental monitoring.

- M&A Trends: Strategic acquisitions and partnerships to enhance technological capabilities and market reach.

Global LiDAR Market Growth Trends & Insights

The global LiDAR market is experiencing robust growth, fueled by an escalating demand for advanced sensing solutions across a multitude of applications. The market size is projected to witness a substantial Compound Annual Growth Rate (CAGR) during the forecast period, driven by increased investments in autonomous vehicle development, smart infrastructure, and precision agriculture. Adoption rates for LiDAR technology are rapidly accelerating, particularly within the automotive sector where LiDAR for ADAS and fully autonomous systems is becoming indispensable for enhanced safety and navigation. Technological disruptions, including the transition from mechanical to solid-state LiDAR, are further pushing the boundaries of performance and affordability, making LiDAR sensors more accessible for a wider range of applications. Consumer behavior shifts towards greater acceptance of autonomous technologies and data-driven decision-making in various industries are also contributing to market expansion. The penetration of LiDAR in industrial automation and its application in environmental monitoring LiDAR for detailed topographic and atmospheric studies are opening up new revenue streams. The continuous refinement of LiDAR mapping technology is enabling higher precision and efficiency in surveying and construction, further solidifying its market position. Market players are actively focusing on integrating LiDAR with other sensor technologies and artificial intelligence for more comprehensive environmental perception.

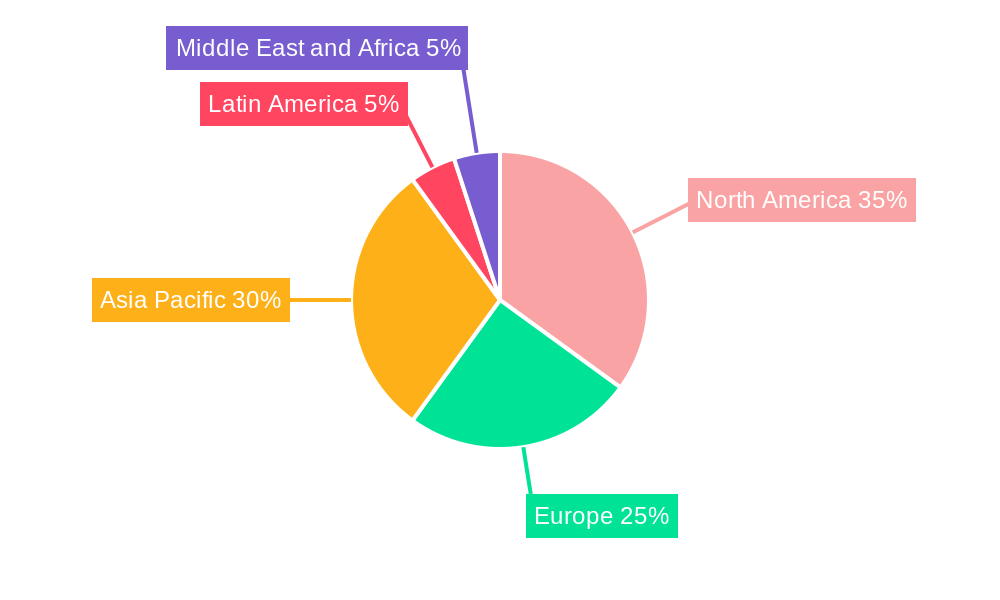

Dominant Regions, Countries, or Segments in Global LiDAR Market

The Automotive sector, particularly the sub-segments of Robotic Vehicles and ADAS, is a dominant driver of growth within the global LiDAR market. This dominance is propelled by significant investments in autonomous driving technology by major automakers and tech giants, aiming to achieve higher levels of vehicle autonomy. The stringent safety regulations being implemented globally are also pushing for the mandatory integration of advanced sensing technologies like LiDAR. North America, with its leading position in autonomous vehicle research and development and a strong presence of key LiDAR manufacturers, stands out as a leading region. The United States, in particular, benefits from supportive government initiatives and a robust venture capital ecosystem that fuels innovation in LiDAR for autonomous vehicles.

Dominant Application Segment:

- Robotic Vehicles & ADAS: These applications are at the forefront due to the critical need for precise 3D perception for navigation, obstacle detection, and safety.

- Market Share: Expected to hold a significant majority of the global LiDAR market revenue.

- Key Drivers: Autonomous driving mandates, enhanced safety features, advancements in AI for sensor fusion.

Leading Region:

- North America: Spearheaded by the United States, it hosts numerous R&D centers and deployment initiatives for autonomous vehicles and advanced robotics.

- Economic Policies: Government funding for smart city projects and autonomous vehicle testing zones.

- Infrastructure: Development of supportive infrastructure for autonomous systems.

Emerging Dominance in Other Segments:

- Environment (Topography, Wind, Agriculture and Forestry): Growing adoption for high-precision mapping, resource management, and climate change research.

- Industrial: Increasing use in logistics, mining, and smart factory environments for automation and safety.

The integration of LiDAR for surveying and mapping in environmental applications is also gaining substantial traction, driven by the need for accurate geospatial data for urban planning, disaster management, and natural resource monitoring. This broad applicability across critical sectors underscores the pervasive influence of LiDAR technology on shaping future industries.

Global LiDAR Market Product Landscape

The global LiDAR market product landscape is characterized by a continuous stream of innovations focused on enhancing performance, reducing size and weight, and lowering costs. Key product innovations include the development of solid-state LiDAR, which replaces moving parts with fixed components, leading to greater reliability and scalability for mass production. Advancements in wavelength technologies, such as short-wave infrared (SWIR) LiDAR, are enabling better performance in adverse weather conditions like fog and rain, crucial for reliable autonomous driving LiDAR. Applications range from high-resolution mapping for autonomous vehicles and drones to precision surveying for construction and infrastructure projects, and detailed environmental monitoring for agriculture and forestry. Performance metrics such as range, resolution, field of view, and data acquisition rate are continuously being improved. Unique selling propositions often lie in proprietary detection methods, advanced signal processing algorithms for noise reduction, and seamless integration capabilities with other sensors and software platforms, such as the RESEPI LiDAR products from Inertial Labs. Technological advancements are also enabling the development of lower-cost LiDAR solutions, paving the way for broader market penetration beyond niche high-end applications.

Key Drivers, Barriers & Challenges in Global LiDAR Market

Key Drivers:

The global LiDAR market is propelled by several critical factors. The burgeoning demand for autonomous vehicles and advanced driver-assistance systems (ADAS) is a primary driver, necessitating precise 3D perception for safe navigation and obstacle avoidance. The increasing adoption of robotics in manufacturing, logistics, and warehousing further fuels demand for LiDAR for environment mapping and object recognition. Furthermore, advancements in LiDAR technology itself, including miniaturization, improved resolution, and reduced costs, are making it more accessible for a wider array of applications, such as LiDAR for surveying and environmental monitoring. Government initiatives promoting smart cities and smart infrastructure projects also contribute significantly.

- Technological advancements (solid-state LiDAR, SWIR sensors).

- Escalating demand for autonomous driving and ADAS.

- Growth in industrial automation and robotics.

- Supportive government policies and smart city initiatives.

Barriers & Challenges:

Despite its immense potential, the LiDAR market faces several challenges and barriers. The cost of LiDAR sensors, particularly for high-performance systems, remains a significant barrier to widespread adoption, especially in cost-sensitive consumer markets. Integration complexities with existing systems and the need for specialized expertise in data processing and interpretation can also hinder deployment. Intense competition and the constant need for innovation to stay ahead of technological obsolescence put pressure on manufacturers. Supply chain disruptions and the availability of key components can also impact production volumes and pricing. Regulatory hurdles, particularly in the evolving landscape of autonomous vehicle certification, can slow down market entry.

- High cost of LiDAR sensors.

- Integration complexities and data processing challenges.

- Rapid technological evolution and the need for continuous innovation.

- Supply chain vulnerabilities and component availability.

- Evolving regulatory frameworks.

Emerging Opportunities in Global LiDAR Market

Emerging opportunities in the global LiDAR market are diverse and expanding rapidly. The growing demand for 3D mapping and surveying in infrastructure development, urban planning, and disaster management presents a significant avenue for growth. The agriculture sector is increasingly leveraging LiDAR for precision farming, crop monitoring, and yield optimization, creating new markets for specialized LiDAR solutions. In the environmental domain, the use of LiDAR for detailed forest inventory, wildlife habitat assessment, and atmospheric studies is gaining momentum. Furthermore, the integration of LiDAR with augmented reality (AR) and virtual reality (VR) technologies is opening up new applications in entertainment, design, and training. The expansion of LiDAR for drones technology, enabling more efficient aerial data acquisition, is also a key growth area, particularly for mapping vast or inaccessible terrains.

- Expansion of LiDAR in precision agriculture and forestry.

- Increased use in smart city infrastructure and urban planning.

- Integration with AR/VR for immersive experiences.

- Growth of drone-based LiDAR for aerial surveying.

- Development of lower-cost LiDAR for consumer applications.

Growth Accelerators in the Global LiDAR Market Industry

Several key growth accelerators are propelling the global LiDAR market forward. The relentless pace of technological breakthroughs, particularly in solid-state LiDAR technology, is significantly reducing manufacturing costs and improving sensor performance, making it more viable for mass-market applications like automotive LiDAR. Strategic partnerships and collaborations between LiDAR manufacturers, automotive companies, and software providers are accelerating product development and market penetration. For example, collaborations focusing on sensor fusion and advanced AI algorithms for data interpretation are enhancing the value proposition of LiDAR systems. Market expansion strategies, including the development of specialized LiDAR solutions tailored for specific industry needs, such as industrial LiDAR or environmental LiDAR, are creating new revenue streams and broadening the market base. The increasing global focus on safety and efficiency across various sectors, from transportation to industrial automation, directly translates into higher demand for the precise perception capabilities offered by LiDAR.

Key Players Shaping the Global LiDAR Market Market

- Neptec Technologies Corp (Maxar)

- Velodyne LiDAR Inc

- Denso Corporation

- Innoviz Technologies Ltd

- RoboSense LiDAR

- Faro Technologies Inc

- RIEGL Laser Measurement Systems GmbH

- Waymo

- Quanergy Systems Inc

- Topcon Corp

- Teledyne Optech

- Leosphere (Vaisala)

- Leica Geosystems AG (Hexagon AB)

- Sick AG

- Trimble Inc

Notable Milestones in Global LiDAR Market Sector

- February 2024: Inertial Labs announced a strategic partnership with Stitch3D, a cloud-optimized software startup, to enhance the distribution of Inertial Labs' RESEPI LiDAR products and expand innovative LiDAR technology applications.

- December 2023: RoboSense unveiled the M Platform line of sensors at CES 2024, showcasing advancements in LiDAR technology for various applications.

In-Depth Global LiDAR Market Market Outlook

The future outlook for the global LiDAR market is exceptionally bright, driven by ongoing technological innovation and expanding application horizons. Growth accelerators such as the maturation of solid-state LiDAR technology promise to significantly reduce costs, thereby democratizing access to advanced 3D sensing for a wider range of industries, including consumer electronics and affordable autonomous vehicles. Strategic partnerships will continue to play a pivotal role, fostering ecosystem development and accelerating the integration of LiDAR into complex systems, particularly in the automotive LiDAR and robotics sectors. The increasing global emphasis on safety, efficiency, and data-driven decision-making across transportation, industrial automation, and environmental management will act as a persistent demand driver. Emerging opportunities in sectors like smart cities, precision agriculture, and AR/VR applications are poised to unlock substantial new market potential, ensuring sustained and robust growth for the LiDAR industry in the coming years.

Global LiDAR Market Segmentation

-

1. Application

- 1.1. Robotic Vehicles

- 1.2. ADAS

-

1.3. Environment

- 1.3.1. Topography

- 1.3.2. Wind

- 1.3.3. Agriculture and Forestry

- 1.4. Industrial

-

2. Type

- 2.1. Aerial (Topographic and Bathymetric)

- 2.2. Terrestrial (Mobile and Static)

Global LiDAR Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Global LiDAR Market Regional Market Share

Geographic Coverage of Global LiDAR Market

Global LiDAR Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Paced Developments and Increasing Application of Drone; Increasing Adoption in the Automotive Industry

- 3.3. Market Restrains

- 3.3.1. ; High Cost of The LiDAR Systems

- 3.4. Market Trends

- 3.4.1. Robotic Vehicles are among the Factors Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LiDAR Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Robotic Vehicles

- 5.1.2. ADAS

- 5.1.3. Environment

- 5.1.3.1. Topography

- 5.1.3.2. Wind

- 5.1.3.3. Agriculture and Forestry

- 5.1.4. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Aerial (Topographic and Bathymetric)

- 5.2.2. Terrestrial (Mobile and Static)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Global LiDAR Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Robotic Vehicles

- 6.1.2. ADAS

- 6.1.3. Environment

- 6.1.3.1. Topography

- 6.1.3.2. Wind

- 6.1.3.3. Agriculture and Forestry

- 6.1.4. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Aerial (Topographic and Bathymetric)

- 6.2.2. Terrestrial (Mobile and Static)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Global LiDAR Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Robotic Vehicles

- 7.1.2. ADAS

- 7.1.3. Environment

- 7.1.3.1. Topography

- 7.1.3.2. Wind

- 7.1.3.3. Agriculture and Forestry

- 7.1.4. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Aerial (Topographic and Bathymetric)

- 7.2.2. Terrestrial (Mobile and Static)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Global LiDAR Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Robotic Vehicles

- 8.1.2. ADAS

- 8.1.3. Environment

- 8.1.3.1. Topography

- 8.1.3.2. Wind

- 8.1.3.3. Agriculture and Forestry

- 8.1.4. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Aerial (Topographic and Bathymetric)

- 8.2.2. Terrestrial (Mobile and Static)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Global LiDAR Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Robotic Vehicles

- 9.1.2. ADAS

- 9.1.3. Environment

- 9.1.3.1. Topography

- 9.1.3.2. Wind

- 9.1.3.3. Agriculture and Forestry

- 9.1.4. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Aerial (Topographic and Bathymetric)

- 9.2.2. Terrestrial (Mobile and Static)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Global LiDAR Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Robotic Vehicles

- 10.1.2. ADAS

- 10.1.3. Environment

- 10.1.3.1. Topography

- 10.1.3.2. Wind

- 10.1.3.3. Agriculture and Forestry

- 10.1.4. Industrial

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Aerial (Topographic and Bathymetric)

- 10.2.2. Terrestrial (Mobile and Static)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Neptec Technologies Corp (Maxar)*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Velodyne LiDAR Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denso Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Innoviz Technologies Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RoboSense LiDAR

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Faro Technologies Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RIEGL Laser Measurement Systems GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Waymo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Quanergy Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Topcon Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teledyne Optech

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Leosphere (Vaisala)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Leica Geosystems AG (Hexagon AB)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sick AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Trimble Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Neptec Technologies Corp (Maxar)*List Not Exhaustive

List of Figures

- Figure 1: Global Global LiDAR Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Global LiDAR Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Global LiDAR Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Global LiDAR Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Global LiDAR Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Global LiDAR Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Global LiDAR Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global LiDAR Market Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Global LiDAR Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Global LiDAR Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Global LiDAR Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global LiDAR Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Global LiDAR Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global LiDAR Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Global LiDAR Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Global LiDAR Market Revenue (Million), by Type 2025 & 2033

- Figure 17: Asia Pacific Global LiDAR Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Global LiDAR Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Global LiDAR Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Global LiDAR Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America Global LiDAR Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Global LiDAR Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Latin America Global LiDAR Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Global LiDAR Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Global LiDAR Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global LiDAR Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Global LiDAR Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Global LiDAR Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East and Africa Global LiDAR Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Global LiDAR Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Global LiDAR Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LiDAR Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global LiDAR Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global LiDAR Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global LiDAR Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global LiDAR Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global LiDAR Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global LiDAR Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global LiDAR Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global LiDAR Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global LiDAR Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global LiDAR Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global LiDAR Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global LiDAR Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global LiDAR Market Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global LiDAR Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global LiDAR Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global LiDAR Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global LiDAR Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global LiDAR Market?

The projected CAGR is approximately 19.93%.

2. Which companies are prominent players in the Global LiDAR Market?

Key companies in the market include Neptec Technologies Corp (Maxar)*List Not Exhaustive, Velodyne LiDAR Inc, Denso Corporation, Innoviz Technologies Ltd, RoboSense LiDAR, Faro Technologies Inc, RIEGL Laser Measurement Systems GmbH, Waymo, Quanergy Systems Inc, Topcon Corp, Teledyne Optech, Leosphere (Vaisala), Leica Geosystems AG (Hexagon AB), Sick AG, Trimble Inc.

3. What are the main segments of the Global LiDAR Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Fast Paced Developments and Increasing Application of Drone; Increasing Adoption in the Automotive Industry.

6. What are the notable trends driving market growth?

Robotic Vehicles are among the Factors Driving the Market.

7. Are there any restraints impacting market growth?

; High Cost of The LiDAR Systems.

8. Can you provide examples of recent developments in the market?

February 2024 - Inertial Labs, one of the leading advanced navigation and positioning technology providers, announced a strategic partnership with Stitch3D, a renowned cloud-optimized software startup specializing in advanced 3D data hosting and sharing solutions. This collaboration marks a significant milestone in expanding innovative LiDAR technology by distributing Inertial Labs' RESEPI LiDAR products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global LiDAR Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global LiDAR Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global LiDAR Market?

To stay informed about further developments, trends, and reports in the Global LiDAR Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence