Key Insights

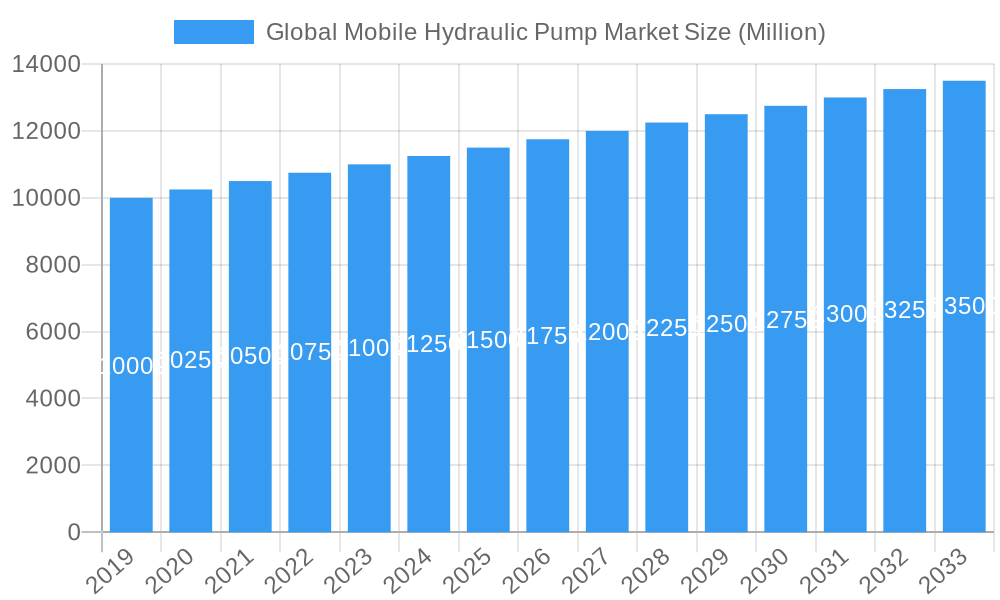

The Global Mobile Hydraulic Pump Market is poised for significant growth, projected to reach approximately $12.50 billion by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.1% from 2025 to 2033. This expansion is driven by the increasing demand for efficient and reliable hydraulic systems in diverse mobile applications. Key growth catalysts include ongoing technological advancements in pump performance, energy efficiency, and durability, alongside rising mechanization and automation in essential end-user sectors. Industries such as construction, agriculture, material handling, mining, and defense are heavily investing in advanced mobile machinery, thus elevating the demand for sophisticated hydraulic pumps. Furthermore, the development of more compact, lightweight, and eco-friendly pump solutions to meet evolving regulatory standards and consumer preferences is shaping market dynamics.

Global Mobile Hydraulic Pump Market Market Size (In Billion)

The market's evolution is also characterized by trends like the integration of smart technologies and IoT for enhanced monitoring and predictive maintenance, alongside the increasing adoption of variable displacement pumps for optimized power delivery and fuel efficiency. While significant growth opportunities exist, market players must strategically address challenges such as the initial high cost of advanced hydraulic systems and rising competition from alternative technologies like electric and electro-hydraulic systems. Nevertheless, the inherent advantages of hydraulic power, including high power density, precise control, and robustness, will ensure its sustained relevance and market growth. Leading players such as Parker Hannifin Corporation, Eaton Corporation, Bosch Rexroth, and Danfoss Power Solutions are actively pursuing R&D, strategic partnerships, and market expansion to leverage these opportunities and maintain a competitive advantage. Regional differences in adoption rates and regulatory frameworks will also be critical in defining future market trajectories.

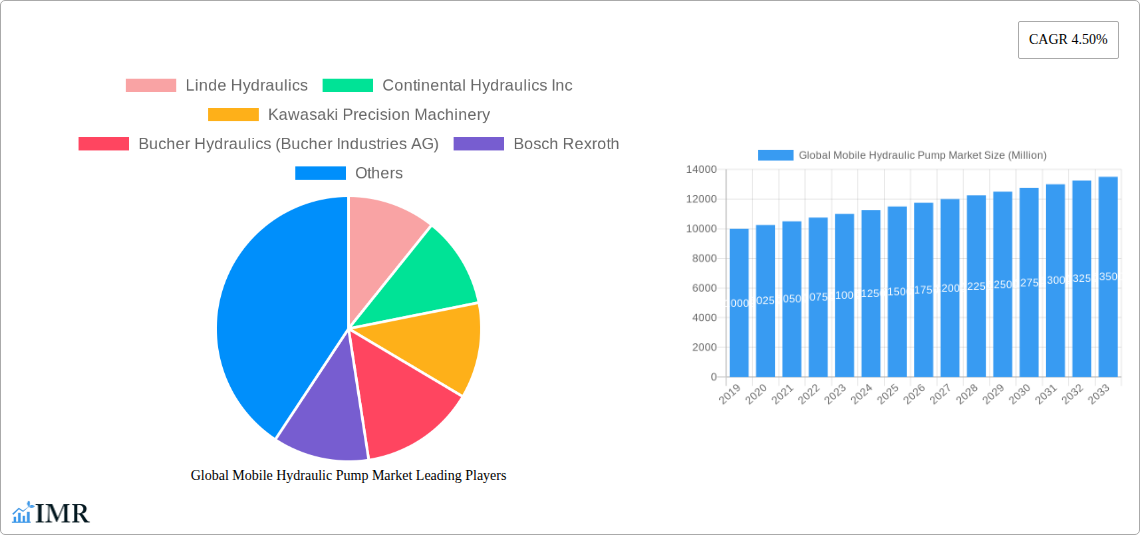

Global Mobile Hydraulic Pump Market Company Market Share

Report Description: Global Mobile Hydraulic Pump Market Insights 2025-2033

This comprehensive report delves into the intricate dynamics and future trajectory of the Global Mobile Hydraulic Pump Market. Examining the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this analysis provides critical insights for stakeholders seeking to understand market evolution, growth drivers, and competitive landscapes. The report focuses on key segments including Vane, Piston, and Gear pumps, catering to diverse end-user industries such as Construction, Agriculture, Material Handling, Mining & Extraction, Aerospace and Defense, and Others. Values are presented in Million Units.

Global Mobile Hydraulic Pump Market Market Dynamics & Structure

The Global Mobile Hydraulic Pump Market exhibits a moderately concentrated structure, characterized by a blend of established multinational corporations and emerging regional players. Technological innovation is a significant driver, with continuous advancements in efficiency, durability, and miniaturization shaping product development. Linde Hydraulics, Bosch Rexroth, and Eaton Corporation are at the forefront of these innovations, introducing solutions that cater to evolving industry demands. Regulatory frameworks, particularly concerning emissions and safety standards in sectors like Construction and Agriculture, are increasingly influencing pump design and material selection.

- Market Concentration: Dominated by a few key players, but with significant presence of mid-sized and specialized manufacturers.

- Technological Innovation Drivers: Demand for energy efficiency, reduced noise levels, enhanced power density, and integration with digital control systems.

- Regulatory Frameworks: Stricter emission standards (e.g., Tier 4 for off-highway vehicles), safety certifications, and environmental impact assessments.

- Competitive Product Substitutes: While hydraulic systems remain dominant in heavy-duty applications, advancements in electric and electro-hydraulic systems pose a growing, albeit nascent, challenge.

- End-User Demographics: Shifting towards automation, precision control, and greater sustainability in operational practices across all key industries.

- M&A Trends: Driven by a desire for market consolidation, technology acquisition, and expanded geographical reach. Recent years have seen strategic acquisitions aimed at strengthening portfolios in specialized segments like high-pressure piston pumps.

Global Mobile Hydraulic Pump Market Growth Trends & Insights

The Global Mobile Hydraulic Pump Market is poised for robust growth, propelled by a confluence of factors including escalating demand from infrastructure development, increasing mechanization in agriculture, and the persistent need for efficient material handling solutions. The market size is projected to witness a compound annual growth rate (CAGR) of xx% from 2025 to 2033, reaching an estimated value of XXX Million Units by the end of the forecast period. Adoption rates of advanced hydraulic pump technologies, such as variable displacement piston pumps and energy-efficient vane pumps, are on an upward trajectory across all major end-user industries.

Technological disruptions are primarily focused on enhancing the performance and sustainability of hydraulic systems. This includes the development of lighter, more compact pumps with improved thermal management capabilities, and the integration of smart sensor technology for predictive maintenance and real-time performance monitoring. The shift towards electro-hydraulic systems, where electronic controls augment traditional hydraulic power, is also gaining momentum, offering greater precision and energy savings.

Consumer behavior is evolving with a greater emphasis on total cost of ownership, operational efficiency, and environmental responsibility. End-users are increasingly seeking hydraulic solutions that not only deliver superior performance but also contribute to reduced fuel consumption and lower emissions. This preference is driving innovation in variable speed drives and intelligent pump control systems. The increasing demand for customized hydraulic solutions tailored to specific application requirements is also a significant trend, fostering closer collaboration between pump manufacturers and equipment OEMs.

- Market Size Evolution: Projected to grow from an estimated XXX Million Units in 2025 to XXX Million Units by 2033.

- CAGR: Anticipated to be xx% during the forecast period (2025-2033).

- Adoption Rates: Rising for energy-efficient and smart hydraulic pump technologies.

- Technological Disruptions: Focus on miniaturization, increased power density, improved thermal management, and integration of IoT for predictive maintenance.

- Consumer Behavior Shifts: Emphasis on sustainability, total cost of ownership, operational efficiency, and demand for customized solutions.

- Market Penetration: Significant penetration in core sectors like Construction and Agriculture, with growing opportunities in specialized niches.

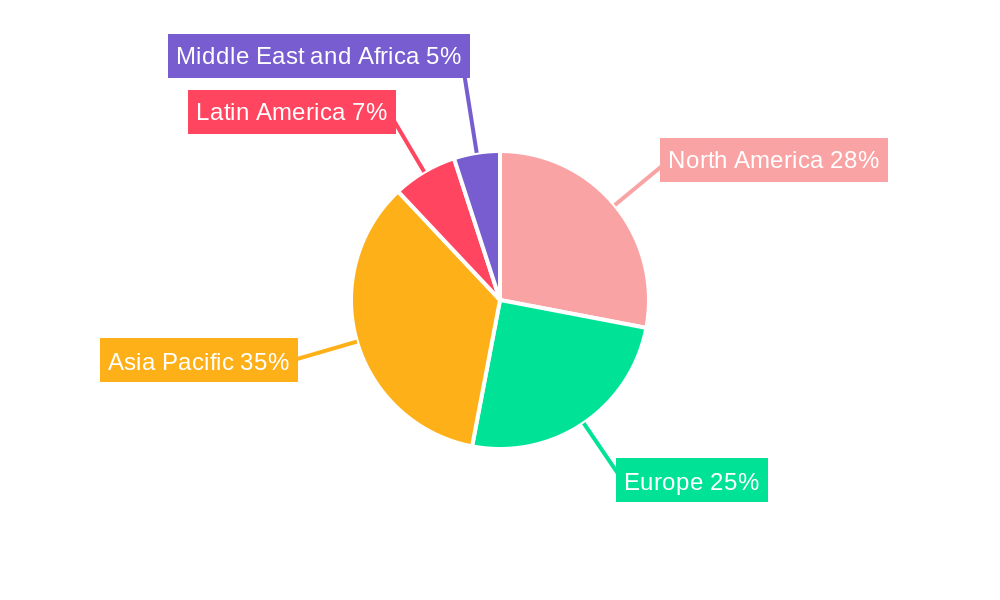

Dominant Regions, Countries, or Segments in Global Mobile Hydraulic Pump Market

The Global Mobile Hydraulic Pump Market is experiencing significant growth acceleration, with the Construction industry emerging as the dominant end-user segment driving overall market expansion. This dominance is fueled by substantial global investments in infrastructure development, urbanization, and the need for robust and reliable heavy machinery. Countries within Asia Pacific, particularly China, India, and Southeast Asian nations, are leading this surge due to large-scale construction projects and a rapidly growing manufacturing base.

Within the product type segment, Piston pumps are witnessing substantial demand owing to their high efficiency, durability, and ability to operate under extreme pressures, making them ideal for heavy-duty construction equipment such as excavators, loaders, and dozers. The forecast period is expected to see a continued preference for piston pumps, with an estimated market share of xx% in 2025.

- Dominant End-User Industry: Construction, accounting for an estimated xx% of the market share in 2025.

- Key Drivers: Massive infrastructure projects, urbanization trends, and the demand for heavy construction machinery.

- Regional Dominance: Asia Pacific, North America, and Europe are major contributors due to extensive construction activities.

- Growth Potential: Continued infrastructure spending in developing economies will sustain this dominance.

- Dominant Product Type: Piston Pumps, expected to hold xx% of the market share in 2025.

- Key Drivers: High efficiency, durability, precise control, and suitability for high-pressure applications.

- Applications: Excavators, bulldozers, wheel loaders, cranes, and other heavy construction equipment.

- Technological Advancements: Innovations in axial piston pumps for enhanced performance and efficiency.

- Key Countries: China, United States, Germany, India, and Japan are significant markets due to their strong industrial and construction sectors.

- Economic Policies: Government initiatives promoting infrastructure development and manufacturing.

- Technological Adoption: High uptake of advanced hydraulic systems in construction equipment.

- Agriculture Sector's Role: Remains a strong secondary market, with increasing adoption of hydraulic systems in tractors, harvesters, and other farm machinery for improved efficiency and automation.

- Material Handling Segment: Steady growth driven by e-commerce expansion and the need for efficient logistics and warehousing solutions.

Global Mobile Hydraulic Pump Market Product Landscape

The Global Mobile Hydraulic Pump Market product landscape is defined by continuous innovation aimed at enhancing performance, efficiency, and durability. Manufacturers are increasingly focusing on developing compact, lightweight, and energy-efficient pump designs. Variable displacement piston pumps continue to lead in terms of technological advancement, offering precise flow control and reduced energy consumption. Daikin-Sauer-Danfoss Ltd and Parker Hannifin Corporation are actively introducing new product lines that integrate smart features and advanced materials. Applications span a wide array of mobile machinery, from agricultural tractors requiring precise hydraulic power for implements to heavy-duty mining equipment demanding high-pressure, robust pump solutions. Unique selling propositions often lie in extended service life, reduced maintenance requirements, and improved operational reliability under challenging environmental conditions.

Key Drivers, Barriers & Challenges in Global Mobile Hydraulic Pump Market

Key Drivers: The Global Mobile Hydraulic Pump Market is propelled by the sustained growth in global infrastructure development, particularly in emerging economies, driving demand for heavy construction machinery. Increased mechanization in agriculture, aimed at boosting productivity and efficiency, also fuels the need for reliable hydraulic systems. Furthermore, the growing adoption of sophisticated material handling equipment in logistics and warehousing sectors, alongside advancements in hydraulic technology leading to improved energy efficiency and performance, are significant growth catalysts.

Key Barriers & Challenges: Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, pose a significant challenge, impacting production timelines and costs. Stringent environmental regulations regarding emissions and noise pollution necessitate continuous R&D investment for compliance, potentially increasing manufacturing costs. Intense competition among a large number of global and regional players can lead to price pressures and affect profit margins. The growing interest in alternative technologies, such as electric and electro-hydraulic systems, presents a long-term challenge that manufacturers must address through continued innovation and strategic adaptation.

Emerging Opportunities in Global Mobile Hydraulic Pump Market

Emerging opportunities within the Global Mobile Hydraulic Pump Market are largely centered around the increasing demand for "smart" hydraulic systems. The integration of IoT sensors and advanced control electronics allows for real-time monitoring, predictive maintenance, and optimized operational performance, appealing to end-users focused on efficiency and reduced downtime. Untapped markets in developing nations, with their burgeoning infrastructure projects and growing agricultural sectors, represent significant growth potential. Furthermore, the development of more compact and energy-efficient pumps for specialized applications, such as advanced robotics and compact construction equipment, presents niche opportunities for innovative manufacturers. The growing emphasis on sustainable hydraulics, including the use of biodegradable hydraulic fluids and more energy-efficient designs, will also shape future market developments.

Growth Accelerators in the Global Mobile Hydraulic Pump Market Industry

Several key factors are accelerating growth in the Global Mobile Hydraulic Pump Market. Technological breakthroughs in material science are leading to the development of more durable and lighter hydraulic components, enhancing overall system efficiency and longevity. Strategic partnerships between hydraulic pump manufacturers and original equipment manufacturers (OEMs) are crucial for co-developing tailored solutions that meet specific application needs, fostering deeper market penetration. Expansion into new geographical markets, particularly in regions with developing economies and significant infrastructure investment, is a major growth accelerator. The increasing trend towards electrification of certain mobile machinery functions, while potentially impacting solely hydraulic systems, is also spurring innovation in hybrid hydraulic-electric systems, creating new avenues for growth.

Key Players Shaping the Global Mobile Hydraulic Pump Market Market

- Linde Hydraulics

- Continental Hydraulics Inc

- Kawasaki Precision Machinery

- Bucher Hydraulics (Bucher Industries AG)

- Bosch Rexroth

- Dana Inc

- HAWE Hydraulik SE

- Liebherr Group

- Hydro Leduc

- HANSA-TMP S r l

- Fluidyne Fluid Power

- Daikin-Sauer-Danfoss Ltd

- Danfoss Power Solutions

- KYB Americas Corporation

- Mottrol Co Ltd

- Jiangsu Hengli Hydraulic Co Ltd

- Poclain Hydraulics Inc

- Bondioli & Pavesi Inc

- Parker Hannifin Corporation

- Eaton Corporation

Notable Milestones in Global Mobile Hydraulic Pump Market Sector

- 2023: Bosch Rexroth launched its new generation of compact axial piston pumps, offering enhanced energy efficiency and reduced noise levels for construction machinery.

- 2023: Danfoss Power Solutions announced strategic collaborations to integrate their advanced hydraulic control systems with emerging electric powertrain technologies in agricultural machinery.

- 2022: Eaton Corporation acquired a significant stake in a leading electro-hydraulic system developer, signaling a move towards hybrid solutions.

- 2022: Linde Hydraulics introduced a new series of high-pressure gear pumps designed for demanding mining and extraction applications.

- 2021: Poclain Hydraulics Inc expanded its manufacturing capabilities in Asia to cater to the growing demand from the construction and agriculture sectors in the region.

- 2020: Parker Hannifin Corporation unveiled a new range of smart hydraulic valves featuring advanced diagnostic capabilities for the material handling industry.

- 2019: Kawasaki Precision Machinery introduced innovative technologies for variable speed drives in mobile hydraulic applications, focusing on fuel savings.

In-Depth Global Mobile Hydraulic Pump Market Market Outlook

The Global Mobile Hydraulic Pump Market is set for a dynamic future, with growth accelerators pointing towards continued expansion and innovation. The ongoing push for greater sustainability and energy efficiency will drive the adoption of advanced hydraulic technologies. Strategic partnerships and mergers will likely continue to consolidate market share and foster technological advancements. Emerging markets in infrastructure development and a strong focus on agricultural mechanization will sustain demand. The industry's ability to adapt to evolving technological landscapes, including the integration of digital solutions and potentially hybrid systems, will be crucial for long-term success. The outlook suggests a market that is not only resilient but also poised for significant evolution, driven by both established needs and emerging technological frontiers.

Global Mobile Hydraulic Pump Market Segmentation

-

1. Product Type

- 1.1. Vane

- 1.2. Piston

- 1.3. Gear

-

2. End-user Industry

- 2.1. Construction

- 2.2. Agriculture

- 2.3. Material Handling

- 2.4. Mining & Extraction

- 2.5. Aerospace and Defense

- 2.6. Others

Global Mobile Hydraulic Pump Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Global Mobile Hydraulic Pump Market Regional Market Share

Geographic Coverage of Global Mobile Hydraulic Pump Market

Global Mobile Hydraulic Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing use of IoT and digitization leading to smart hydraulic pump products; Demand for miniaturization of mobile hydraulic equipment

- 3.3. Market Restrains

- 3.3.1. Increasing presence of aftermarket suppliers and refurbished/used products in some end-users

- 3.4. Market Trends

- 3.4.1. Construction Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Hydraulic Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Vane

- 5.1.2. Piston

- 5.1.3. Gear

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction

- 5.2.2. Agriculture

- 5.2.3. Material Handling

- 5.2.4. Mining & Extraction

- 5.2.5. Aerospace and Defense

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Global Mobile Hydraulic Pump Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Vane

- 6.1.2. Piston

- 6.1.3. Gear

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Construction

- 6.2.2. Agriculture

- 6.2.3. Material Handling

- 6.2.4. Mining & Extraction

- 6.2.5. Aerospace and Defense

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Global Mobile Hydraulic Pump Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Vane

- 7.1.2. Piston

- 7.1.3. Gear

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Construction

- 7.2.2. Agriculture

- 7.2.3. Material Handling

- 7.2.4. Mining & Extraction

- 7.2.5. Aerospace and Defense

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Global Mobile Hydraulic Pump Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Vane

- 8.1.2. Piston

- 8.1.3. Gear

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Construction

- 8.2.2. Agriculture

- 8.2.3. Material Handling

- 8.2.4. Mining & Extraction

- 8.2.5. Aerospace and Defense

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Global Mobile Hydraulic Pump Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Vane

- 9.1.2. Piston

- 9.1.3. Gear

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Construction

- 9.2.2. Agriculture

- 9.2.3. Material Handling

- 9.2.4. Mining & Extraction

- 9.2.5. Aerospace and Defense

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Global Mobile Hydraulic Pump Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Vane

- 10.1.2. Piston

- 10.1.3. Gear

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Construction

- 10.2.2. Agriculture

- 10.2.3. Material Handling

- 10.2.4. Mining & Extraction

- 10.2.5. Aerospace and Defense

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Linde Hydraulics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Continental Hydraulics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kawasaki Precision Machinery

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bucher Hydraulics (Bucher Industries AG)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bosch Rexroth

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dana Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HAWE Hydraulik SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Liebherr Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hydro Leduc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HANSA-TMP S r l

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fluidyne Fluid Power

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Daikin-Sauer-Danfoss Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Danfoss Power Solutions

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 KYB Americas Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mottrol Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Jiangsu Hengli Hydraulic Co Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Poclain Hydraulics Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Bondioli & Pavesi Inc

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Parker Hannifin Corporation

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Eaton Corporation

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Linde Hydraulics

List of Figures

- Figure 1: Global Global Mobile Hydraulic Pump Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Global Mobile Hydraulic Pump Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Global Mobile Hydraulic Pump Market Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Global Mobile Hydraulic Pump Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Global Mobile Hydraulic Pump Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Global Mobile Hydraulic Pump Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Global Mobile Hydraulic Pump Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 8: North America Global Mobile Hydraulic Pump Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: North America Global Mobile Hydraulic Pump Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Global Mobile Hydraulic Pump Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Global Mobile Hydraulic Pump Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Global Mobile Hydraulic Pump Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Global Mobile Hydraulic Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Global Mobile Hydraulic Pump Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Global Mobile Hydraulic Pump Market Revenue (billion), by Product Type 2025 & 2033

- Figure 16: Europe Global Mobile Hydraulic Pump Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 17: Europe Global Mobile Hydraulic Pump Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Global Mobile Hydraulic Pump Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Global Mobile Hydraulic Pump Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 20: Europe Global Mobile Hydraulic Pump Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Global Mobile Hydraulic Pump Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Global Mobile Hydraulic Pump Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Global Mobile Hydraulic Pump Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Global Mobile Hydraulic Pump Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Global Mobile Hydraulic Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Global Mobile Hydraulic Pump Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Global Mobile Hydraulic Pump Market Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Global Mobile Hydraulic Pump Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Global Mobile Hydraulic Pump Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Global Mobile Hydraulic Pump Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Global Mobile Hydraulic Pump Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 32: Asia Pacific Global Mobile Hydraulic Pump Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: Asia Pacific Global Mobile Hydraulic Pump Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Pacific Global Mobile Hydraulic Pump Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Pacific Global Mobile Hydraulic Pump Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Global Mobile Hydraulic Pump Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Global Mobile Hydraulic Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Global Mobile Hydraulic Pump Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Global Mobile Hydraulic Pump Market Revenue (billion), by Product Type 2025 & 2033

- Figure 40: Latin America Global Mobile Hydraulic Pump Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 41: Latin America Global Mobile Hydraulic Pump Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Latin America Global Mobile Hydraulic Pump Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Latin America Global Mobile Hydraulic Pump Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 44: Latin America Global Mobile Hydraulic Pump Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Latin America Global Mobile Hydraulic Pump Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Latin America Global Mobile Hydraulic Pump Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Latin America Global Mobile Hydraulic Pump Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Latin America Global Mobile Hydraulic Pump Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Global Mobile Hydraulic Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Global Mobile Hydraulic Pump Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Global Mobile Hydraulic Pump Market Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Global Mobile Hydraulic Pump Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Global Mobile Hydraulic Pump Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Global Mobile Hydraulic Pump Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Global Mobile Hydraulic Pump Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 56: Middle East and Africa Global Mobile Hydraulic Pump Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Middle East and Africa Global Mobile Hydraulic Pump Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Middle East and Africa Global Mobile Hydraulic Pump Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Global Mobile Hydraulic Pump Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Global Mobile Hydraulic Pump Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Global Mobile Hydraulic Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Global Mobile Hydraulic Pump Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 15: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 21: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 33: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Mobile Hydraulic Pump Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Mobile Hydraulic Pump Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Mobile Hydraulic Pump Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Global Mobile Hydraulic Pump Market?

Key companies in the market include Linde Hydraulics, Continental Hydraulics Inc, Kawasaki Precision Machinery, Bucher Hydraulics (Bucher Industries AG), Bosch Rexroth, Dana Inc, HAWE Hydraulik SE, Liebherr Group, Hydro Leduc, HANSA-TMP S r l, Fluidyne Fluid Power, Daikin-Sauer-Danfoss Ltd, Danfoss Power Solutions, KYB Americas Corporation, Mottrol Co Ltd, Jiangsu Hengli Hydraulic Co Ltd, Poclain Hydraulics Inc, Bondioli & Pavesi Inc, Parker Hannifin Corporation, Eaton Corporation.

3. What are the main segments of the Global Mobile Hydraulic Pump Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing use of IoT and digitization leading to smart hydraulic pump products; Demand for miniaturization of mobile hydraulic equipment.

6. What are the notable trends driving market growth?

Construction Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing presence of aftermarket suppliers and refurbished/used products in some end-users.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Mobile Hydraulic Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Mobile Hydraulic Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Mobile Hydraulic Pump Market?

To stay informed about further developments, trends, and reports in the Global Mobile Hydraulic Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence