Key Insights

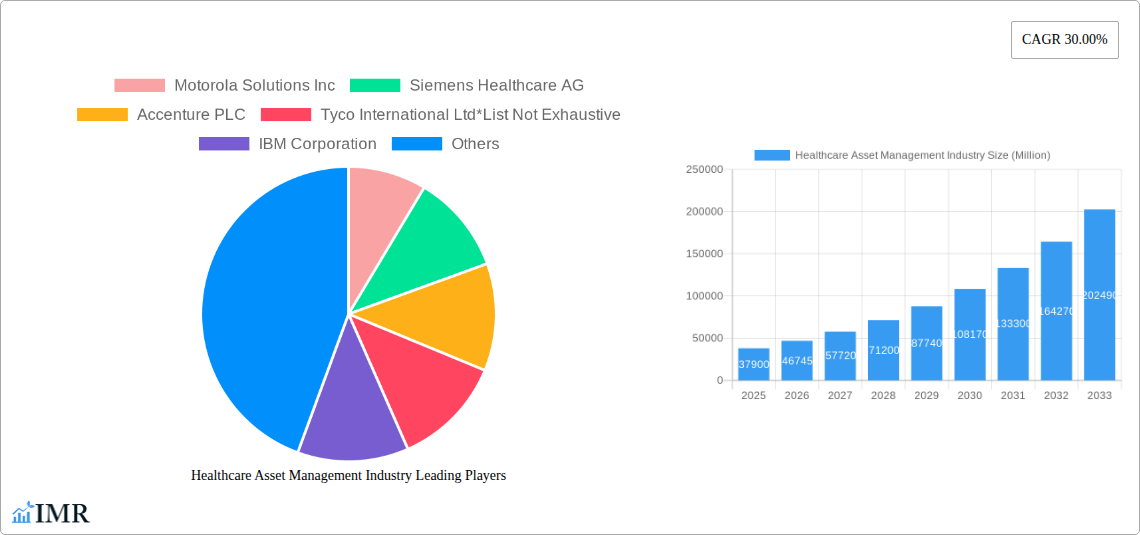

The Healthcare Asset Management market is poised for substantial growth, projected to reach $37.9 billion by 2025, demonstrating a robust CAGR of 23.42% through 2033. This expansion is largely fueled by the increasing demand for operational efficiency, enhanced patient care, and regulatory compliance within healthcare facilities. Key drivers include the burgeoning adoption of Internet of Things (IoT) and Radio-Frequency Identification (RFID) technologies, which enable real-time tracking and management of valuable assets like medical equipment and pharmaceuticals. Furthermore, the growing complexity of healthcare supply chains necessitates advanced solutions to prevent stockouts, minimize waste, and ensure the timely availability of critical supplies. The rising adoption of digital health initiatives and the need for improved inventory control and utilization of expensive medical devices are also significant contributors to market expansion. This dynamic growth is creating a fertile ground for innovation and investment in sophisticated asset management solutions.

Healthcare Asset Management Industry Market Size (In Billion)

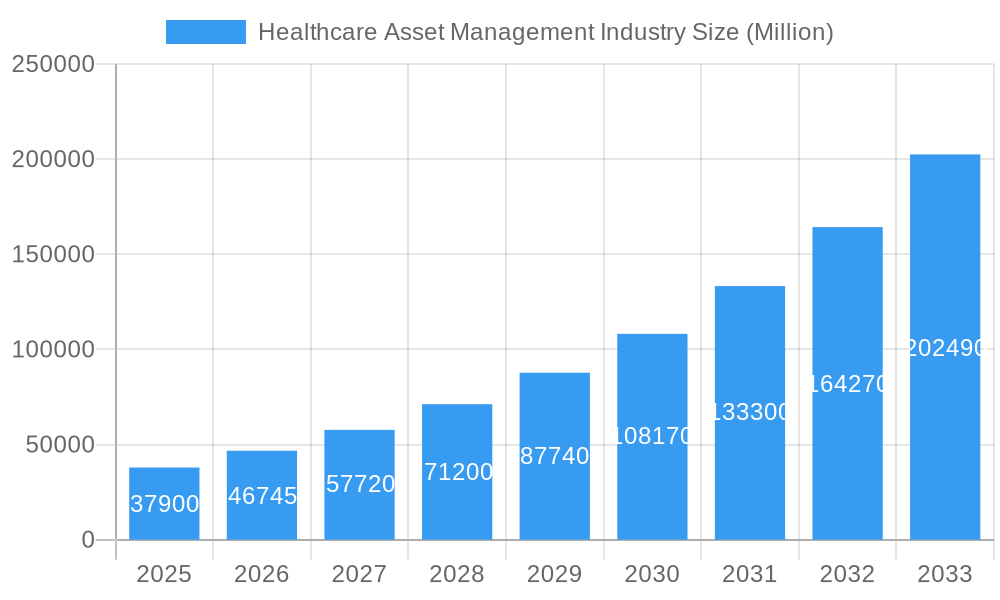

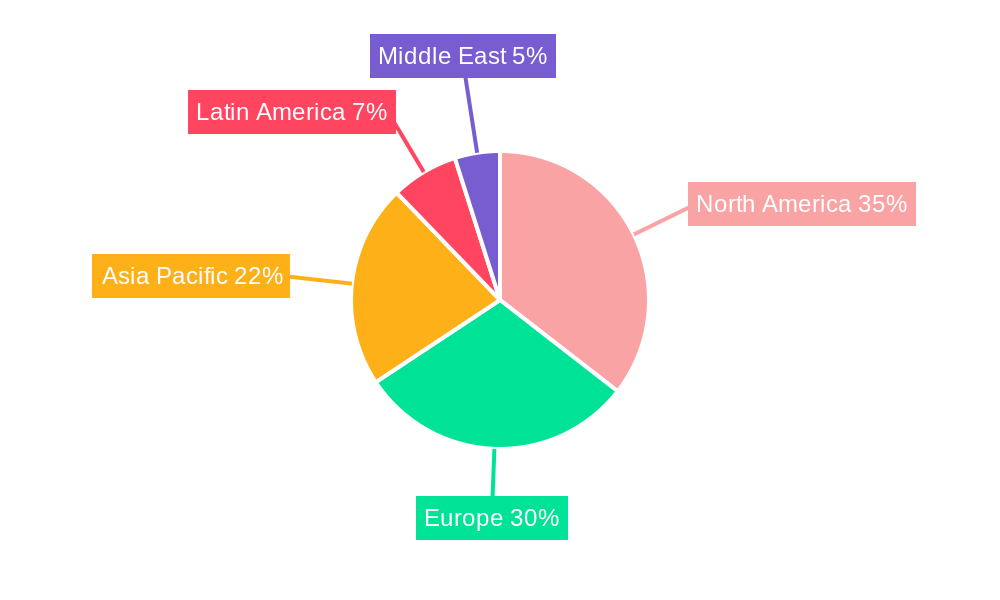

The market is segmented across critical applications such as Staff Management, Equipment Tracking, Patient Tracking, and Supply Chain Management, with hospitals and clinics representing the primary end-users, followed by laboratories and pharmaceutical companies. Geographically, North America and Europe are leading the market, driven by early adoption of advanced technologies and substantial healthcare expenditure. However, the Asia Pacific region is expected to witness the most rapid growth due to its expanding healthcare infrastructure, increasing medical tourism, and a growing focus on improving healthcare delivery standards. While the market presents immense opportunities, potential restraints such as high initial investment costs for implementing advanced asset management systems and concerns regarding data security and privacy need to be addressed to ensure widespread adoption and sustained growth. Leading companies like Motorola Solutions Inc, Siemens Healthcare AG, and IBM Corporation are at the forefront, offering innovative solutions to meet these evolving market demands.

Healthcare Asset Management Industry Company Market Share

Unlocking Efficiency: Healthcare Asset Management Industry Market Report 2019–2033

This comprehensive report provides an in-depth analysis of the global Healthcare Asset Management market, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and the influential players shaping its future. With a detailed study period from 2019 to 2033 and a base year of 2025, this report offers actionable insights for stakeholders looking to capitalize on the evolving healthcare technology sector. Our analysis incorporates high-traffic keywords such as "healthcare asset tracking," "medical equipment management," "patient flow optimization," and "supply chain visibility" to ensure maximum search engine visibility and engagement with industry professionals. We also explore the parent and child market segments to provide a holistic view of market interdependencies and growth potential.

Healthcare Asset Management Industry Market Dynamics & Structure

The global Healthcare Asset Management market is characterized by a moderately concentrated structure, with leading players investing heavily in research and development to drive technological innovation. Key drivers include the increasing need for operational efficiency, cost reduction in healthcare facilities, and the growing adoption of IoT and AI in asset tracking and management solutions. Regulatory frameworks, such as those promoting patient safety and data privacy, also significantly influence market strategies. Competitive product substitutes, though present in basic tracking mechanisms, are increasingly being outpaced by advanced, integrated healthcare asset management systems. End-user demographics are shifting towards larger hospital networks and integrated healthcare systems seeking comprehensive solutions. Mergers and acquisitions (M&A) are a significant trend, facilitating market consolidation and the expansion of service offerings. For instance, the March 2022 acquisition of ABM's clinical engineering by Crothall Healthcare's HTS division signifies a move towards deeper integration of medical device lifecycle management. The total M&A deal volume is projected to reach XX billion units by 2025, with a further XX billion units expected by 2033.

- Market Concentration: Moderately concentrated with key players dominating specific niches.

- Technological Innovation Drivers: IoT, AI, RFID, RTLS for real-time tracking and predictive maintenance.

- Regulatory Frameworks: Emphasis on patient safety, data security (HIPAA, GDPR), and compliance.

- Competitive Product Substitutes: Basic manual tracking vs. advanced digital solutions.

- End-User Demographics: Growing demand from large hospital chains and integrated health systems.

- M&A Trends: Strategic acquisitions for market expansion and service portfolio enhancement.

- Innovation Barriers: High implementation costs, integration challenges with legacy systems, and workforce training needs.

Healthcare Asset Management Industry Growth Trends & Insights

The Healthcare Asset Management market is poised for robust growth, driven by the escalating demand for improved patient care, operational efficiencies, and cost containment within healthcare institutions worldwide. The market size is projected to expand significantly from an estimated $XX billion in 2025 to $XX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This surge is fueled by increasing adoption rates of advanced technologies like Real-Time Location Systems (RTLS), RFID, and IoT sensors, enabling real-time tracking of medical equipment, staff, and patients. Technological disruptions, including the integration of artificial intelligence for predictive maintenance and optimized resource allocation, are revolutionizing how healthcare assets are managed. Consumer behavior shifts, with a greater emphasis on patient-centric care and reduced wait times, further propel the demand for solutions that enhance patient flow and operational visibility. The penetration of sophisticated healthcare asset management systems is expected to move from XX% in 2025 to XX% by 2033, indicating a substantial market opportunity.

Dominant Regions, Countries, or Segments in Healthcare Asset Management Industry

North America currently stands as the dominant region in the Healthcare Asset Management market, driven by its advanced healthcare infrastructure, high adoption rates of cutting-edge technologies, and robust government initiatives promoting digital health solutions. The United States, in particular, accounts for a substantial market share, estimated at XX% in 2025, due to its large patient population, significant healthcare spending, and the presence of major technology providers and healthcare organizations.

From an application perspective, Equipment Tracking and Patient Tracking are emerging as the leading segments, collectively capturing an estimated XX% of the market share in 2025. This dominance is attributed to the critical need for efficient management of expensive medical devices to prevent loss, theft, and downtime, and the increasing focus on improving patient safety and care coordination.

Among end-users, Hospitals/Clinics represent the largest and fastest-growing segment, accounting for approximately XX% of the market in 2025. The sheer volume of assets and patient traffic within these facilities necessitates sophisticated management solutions.

Key drivers for this regional and segmental dominance include:

- Economic Policies: Favorable reimbursement policies and government funding for healthcare technology adoption.

- Infrastructure: Well-established digital infrastructure and connectivity supporting advanced tracking systems.

- Market Penetration: High awareness and early adoption of asset management solutions.

- Technological Advancement: Proximity to leading technology developers and research institutions.

- Regulatory Support: Stringent regulations promoting patient safety and operational accountability.

- Growth Potential: Emerging economies in Asia-Pacific are showing rapid growth, presenting significant future potential as they upgrade their healthcare infrastructure.

Healthcare Asset Management Industry Product Landscape

The Healthcare Asset Management product landscape is characterized by a convergence of hardware and software solutions designed to optimize the utilization and management of healthcare resources. Innovations focus on real-time visibility, predictive analytics, and enhanced security for medical equipment, staff, and patients. Key product categories include RFID tags, RTLS sensors, mobile asset tracking applications, and integrated asset management software platforms. Performance metrics are centered on improved asset utilization rates (projected to increase by XX% by 2030), reduced equipment downtime (by XX%), and enhanced patient safety and workflow efficiency. Unique selling propositions often lie in the seamless integration of these technologies with existing hospital information systems and the ability to provide actionable insights through advanced data analytics. Technological advancements are rapidly moving towards AI-powered predictive maintenance and automated inventory management.

Key Drivers, Barriers & Challenges in Healthcare Asset Management Industry

Key Drivers: The Healthcare Asset Management market is propelled by the relentless drive for operational efficiency and cost reduction within healthcare systems. The increasing complexity of medical equipment and the need to ensure patient safety are significant motivators. Furthermore, the proliferation of IoT devices and advancements in AI are creating new possibilities for real-time tracking, inventory optimization, and predictive maintenance. Government mandates for improved healthcare delivery and resource management also act as strong catalysts.

Barriers & Challenges: Despite the growth potential, several barriers hinder widespread adoption. High initial implementation costs and the complexity of integrating new systems with legacy IT infrastructure remain significant challenges. Data security and privacy concerns, coupled with the need for robust cybersecurity measures, add to the complexity. Regulatory hurdles, though often drivers, can also present challenges in terms of compliance and validation. Furthermore, a shortage of skilled personnel to manage and operate these advanced systems poses a restraint. Supply chain disruptions, as experienced in recent global events, can impact the availability of critical hardware components. Competitive pressures from established players and emerging niche providers also shape the market.

Emerging Opportunities in Healthcare Asset Management Industry

Emerging opportunities in the Healthcare Asset Management industry are abundant, particularly in the realm of specialized applications and untapped markets. The growing demand for remote patient monitoring solutions presents a significant opportunity for asset tracking technologies that can ensure the secure and efficient management of home-use medical devices. Furthermore, the expansion of telehealth services requires robust systems for managing and distributing portable diagnostic equipment. The integration of blockchain technology for enhanced data security and traceability of high-value assets is another promising avenue. Developing countries with rapidly expanding healthcare infrastructure offer a vast untapped market for scalable and cost-effective asset management solutions. The increasing focus on personalized medicine also opens doors for asset management systems that can support the intricate logistics of specialized treatments and drug delivery.

Growth Accelerators in the Healthcare Asset Management Industry Industry

Several catalysts are accelerating the long-term growth of the Healthcare Asset Management industry. Technological breakthroughs, such as the development of more accurate and cost-effective RTLS solutions and the widespread adoption of AI for predictive analytics, are significantly enhancing the value proposition. Strategic partnerships between technology providers, healthcare systems, and medical device manufacturers are fostering innovation and market penetration. For example, collaborations that integrate asset management seamlessly into the clinical workflow are becoming increasingly common. Market expansion strategies, including the development of tailored solutions for specific healthcare segments like ambulatory surgery centers and long-term care facilities, are broadening the industry's reach. The continuous drive for value-based healthcare reimbursement models also incentivizes healthcare providers to invest in technologies that demonstrate improved patient outcomes and cost efficiencies.

Key Players Shaping the Healthcare Asset Management Industry Market

- Motorola Solutions Inc

- Siemens Healthcare AG

- Accenture PLC

- Tyco International Ltd

- IBM Corporation

- AiRISTa Flow Inc

- CenTrak Inc

- Sonitor Technologies Inc

- INFOR INC

- GE Healthcare Inc

- Stanley Security Solutions Inc

- Zebra Technologies Corporation

Notable Milestones in Healthcare Asset Management Industry Sector

- March 2022: Crothall Healthcare's Healthcare Technology Solutions (HTS) division acquired ABM's clinical engineering organization. This strategic move integrates ABM's clinical engineering expertise under Crothall's HTS business, aiming to enhance the management of the entire lifecycle of medical devices within hospitals.

- March 2022: Sodexo teamed up with University Hospitals to offer comprehensive primary care and community-based services. This partnership extends Sodexo's service offerings to include resource and construction management, technical control over healthcare operations, patient diet, retail food, and overall resource management.

In-Depth Healthcare Asset Management Industry Market Outlook

The Healthcare Asset Management industry is on a trajectory of sustained growth, fueled by an ever-increasing demand for operational efficiency and enhanced patient care. Future market potential is anchored in the continued integration of advanced technologies like AI and IoT, which will unlock new levels of predictive capabilities and automation in asset management. Strategic opportunities lie in developing scalable, cloud-based solutions that cater to the diverse needs of healthcare providers, from small clinics to large hospital networks. The growing emphasis on data-driven decision-making within healthcare will further propel the adoption of sophisticated analytics platforms offered by asset management providers. Embracing interoperability and seamless integration with existing health IT infrastructure will be crucial for market leaders looking to capitalize on these evolving trends and secure a dominant position in the future healthcare ecosystem.

Healthcare Asset Management Industry Segmentation

-

1. Application

- 1.1. Staff Management

- 1.2. Equipment Tracking

- 1.3. Patient Tracking

- 1.4. Supply Chain Management

-

2. End User

- 2.1. Hospital/Clinic

- 2.2. Laboratory

- 2.3. Pharmaceutical

Healthcare Asset Management Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

- 5. Middle East

-

6. UAE

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Healthcare Asset Management Industry Regional Market Share

Geographic Coverage of Healthcare Asset Management Industry

Healthcare Asset Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand with Increasing Concerns of Drug Counterfeiting; Need to Increase Efficiency in Healthcare Institutions; Growing Concerns for Patient Safety

- 3.3. Market Restrains

- 3.3.1. Data Privacy Concerns; Organizational and Infrastructural Facility of Healthcare Institutions Affecting Implementation

- 3.4. Market Trends

- 3.4.1. Demand with Increasing Concerns of Drug Counterfeiting

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Staff Management

- 5.1.2. Equipment Tracking

- 5.1.3. Patient Tracking

- 5.1.4. Supply Chain Management

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital/Clinic

- 5.2.2. Laboratory

- 5.2.3. Pharmaceutical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. UAE

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Staff Management

- 6.1.2. Equipment Tracking

- 6.1.3. Patient Tracking

- 6.1.4. Supply Chain Management

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital/Clinic

- 6.2.2. Laboratory

- 6.2.3. Pharmaceutical

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Staff Management

- 7.1.2. Equipment Tracking

- 7.1.3. Patient Tracking

- 7.1.4. Supply Chain Management

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital/Clinic

- 7.2.2. Laboratory

- 7.2.3. Pharmaceutical

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Staff Management

- 8.1.2. Equipment Tracking

- 8.1.3. Patient Tracking

- 8.1.4. Supply Chain Management

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital/Clinic

- 8.2.2. Laboratory

- 8.2.3. Pharmaceutical

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Staff Management

- 9.1.2. Equipment Tracking

- 9.1.3. Patient Tracking

- 9.1.4. Supply Chain Management

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospital/Clinic

- 9.2.2. Laboratory

- 9.2.3. Pharmaceutical

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Staff Management

- 10.1.2. Equipment Tracking

- 10.1.3. Patient Tracking

- 10.1.4. Supply Chain Management

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospital/Clinic

- 10.2.2. Laboratory

- 10.2.3. Pharmaceutical

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. UAE Healthcare Asset Management Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Staff Management

- 11.1.2. Equipment Tracking

- 11.1.3. Patient Tracking

- 11.1.4. Supply Chain Management

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Hospital/Clinic

- 11.2.2. Laboratory

- 11.2.3. Pharmaceutical

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Motorola Solutions Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Siemens Healthcare AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Accenture PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tyco International Ltd*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 IBM Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AiRISTA Flow Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CenTrak Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sonitor Technologies Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 INFOR INC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 GE Healthcare Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Stanley Security Solutions Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Zebra Technologies Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Global Healthcare Asset Management Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 9: Europe Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: Asia Pacific Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 21: Latin America Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Latin America Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: Middle East Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: UAE Healthcare Asset Management Industry Revenue (undefined), by Application 2025 & 2033

- Figure 33: UAE Healthcare Asset Management Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: UAE Healthcare Asset Management Industry Revenue (undefined), by End User 2025 & 2033

- Figure 35: UAE Healthcare Asset Management Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: UAE Healthcare Asset Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: UAE Healthcare Asset Management Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: India Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Brazil Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Argentina Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 31: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 33: Global Healthcare Asset Management Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Healthcare Asset Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East Healthcare Asset Management Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare Asset Management Industry?

The projected CAGR is approximately 23.42%.

2. Which companies are prominent players in the Healthcare Asset Management Industry?

Key companies in the market include Motorola Solutions Inc, Siemens Healthcare AG, Accenture PLC, Tyco International Ltd*List Not Exhaustive, IBM Corporation, AiRISTA Flow Inc, CenTrak Inc, Sonitor Technologies Inc, INFOR INC, GE Healthcare Inc, Stanley Security Solutions Inc, Zebra Technologies Corporation.

3. What are the main segments of the Healthcare Asset Management Industry?

The market segments include Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand with Increasing Concerns of Drug Counterfeiting; Need to Increase Efficiency in Healthcare Institutions; Growing Concerns for Patient Safety.

6. What are the notable trends driving market growth?

Demand with Increasing Concerns of Drug Counterfeiting.

7. Are there any restraints impacting market growth?

Data Privacy Concerns; Organizational and Infrastructural Facility of Healthcare Institutions Affecting Implementation.

8. Can you provide examples of recent developments in the market?

March 2022 - Crothall Healthcare's Healthcare Technology Solutions (HTS) division acquired ABM's clinical engineering organization. Whereas The Clinical Engineering group of ABM will be under the control of Crothall's Healthcare Technology Solution business, which will use its knowledge and expertise to enhance operations, as the entire lifecycle of medical devices in a hospital is managed and overseen by Crothall Healthcare.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthcare Asset Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthcare Asset Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthcare Asset Management Industry?

To stay informed about further developments, trends, and reports in the Healthcare Asset Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence