Key Insights

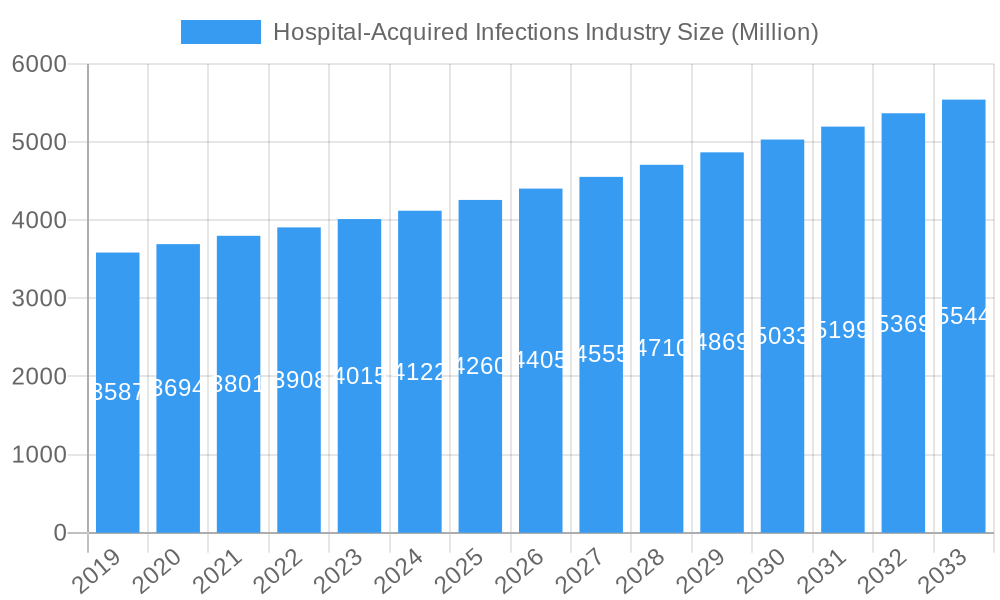

The global market for combating Hospital-Acquired Infections (HAIs) is poised for significant expansion, projected to reach a substantial USD 4.26 billion by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 3.97% during the forecast period of 2025-2033. A primary driver of this market's expansion is the escalating global incidence of HAIs, which places a considerable burden on healthcare systems and patient well-being. Advances in sterilization technologies, including heat, low-temperature, radiation, and steam sterilization, are crucial in mitigating infection risks, alongside the growing adoption of potent disinfectants. Furthermore, the increasing number of surgical procedures and the rising prevalence of chronic diseases contribute to a larger patient population susceptible to infections, thus fueling demand for effective HAI prevention and control solutions. The expanding healthcare infrastructure in emerging economies, coupled with heightened awareness among healthcare professionals and regulatory bodies regarding infection control protocols, further propels market growth.

Hospital-Acquired Infections Industry Market Size (In Billion)

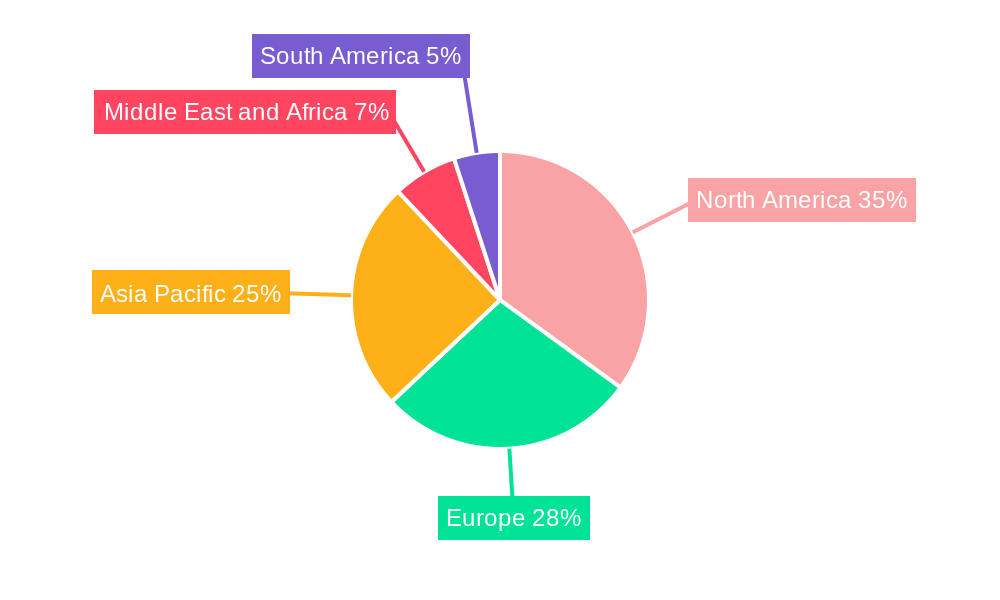

The market segmentation reveals a dynamic landscape with diverse applications and end-user bases. Sterilants, encompassing a range of advanced equipment and methods, represent a core segment, vital for ensuring the safety of medical instruments and environments. Disinfectants also play a critical role in maintaining hygienic conditions across healthcare facilities. The indication-wise segmentation highlights key areas of concern, with Hospital-Acquired Pneumonia, Bloodstream Infections, and Surgical Site Infections being major focal points for intervention and prevention strategies. Geographically, North America is expected to maintain a leading position, driven by its advanced healthcare infrastructure and stringent regulatory standards. However, the Asia Pacific region is anticipated to witness the fastest growth, fueled by rapid healthcare expenditure, increasing medical tourism, and a rising awareness of infection control practices. Key industry players, including Becton Dickinson and Company, STERIS PLC, and 3M Company, are actively investing in research and development to introduce innovative solutions and expand their market reach, further shaping the competitive dynamics of this essential market.

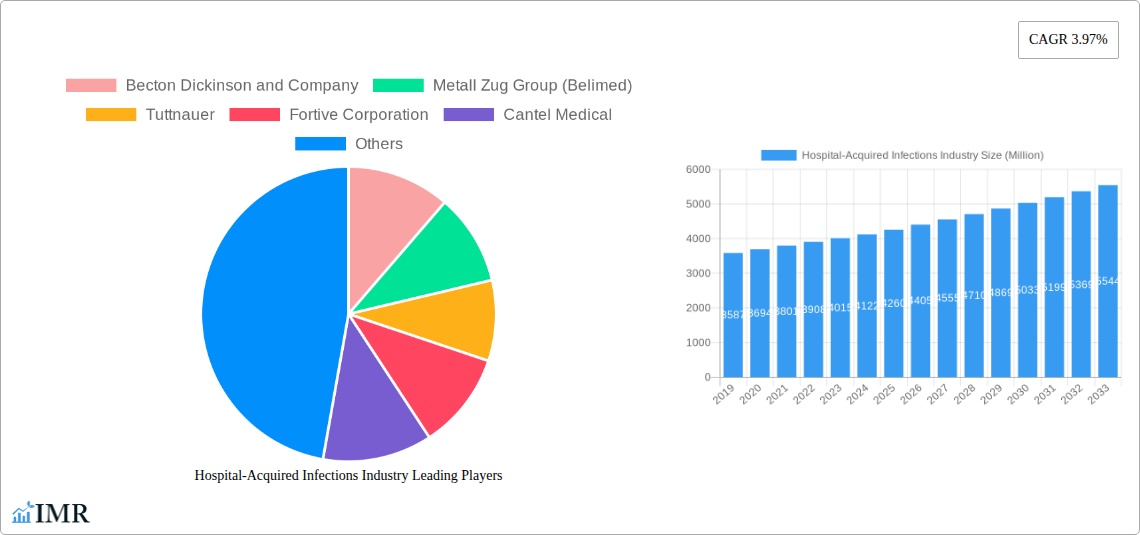

Hospital-Acquired Infections Industry Company Market Share

Hospital-Acquired Infections Industry Market Dynamics & Structure

The Hospital-Acquired Infections (HAIs) market is characterized by a moderately concentrated structure, driven by a blend of established players and emerging innovators. Key companies like Becton Dickinson and Company, STERIS PLC, and Getinge AB hold significant market share through their comprehensive portfolios of sterilization and disinfection solutions. Technological innovation is a primary driver, with continuous advancements in sterilization equipment, novel disinfectant formulations, and infection surveillance systems. The regulatory framework, particularly stringent guidelines from bodies like the FDA and EMA, dictates product development and market entry, fostering a demand for scientifically validated and efficacious solutions. Competitive product substitutes, such as advanced antimicrobial coatings and non-chemical sterilization methods, are beginning to challenge traditional approaches, albeit with varying adoption rates. End-user demographics, primarily driven by an aging global population and increasing prevalence of chronic diseases, are expanding the demand for HAI prevention. Mergers and acquisitions (M&A) are a notable trend, with companies strategically consolidating to expand their product offerings, geographical reach, and technological capabilities. For instance, recent M&A activities have focused on acquiring innovative disinfection technologies and expanding presence in rapidly growing emerging markets. The market’s growth is further fueled by increasing awareness and the high cost associated with treating HAIs, incentivizing healthcare providers to invest in robust infection prevention strategies.

- Market Concentration: Moderately concentrated with key players like Becton Dickinson and Company, STERIS PLC, and Getinge AB.

- Technological Innovation Drivers: Advancements in sterilization equipment, novel disinfectant chemistries, and digital infection surveillance.

- Regulatory Frameworks: Stringent guidelines from FDA, EMA, and other national health authorities.

- Competitive Product Substitutes: Antimicrobial coatings, UV-C disinfection, and advanced air filtration systems.

- End-User Demographics: Aging population, rise in chronic diseases, and increased surgical procedures.

- M&A Trends: Consolidation for portfolio expansion, technology acquisition, and market penetration.

Hospital-Acquired Infections Industry Growth Trends & Insights

The global Hospital-Acquired Infections (HAIs) industry is poised for robust expansion, driven by an escalating awareness of infection control and a growing burden of healthcare-associated infections. The market size is projected to witness a significant CAGR of approximately 7.5% from 2019 to 2033, indicating a sustained upward trajectory. This growth is underpinned by the increasing adoption of advanced sterilization technologies and potent disinfectants aimed at combating a spectrum of HAIs, including Hospital Acquired Pneumonia, Bloodstream Infections, Surgical Site Infections, Gastrointestinal Infections, and Urinary Tract Infections. Technological disruptions are playing a pivotal role, with innovations in low-temperature sterilization equipment and radiation sterilization equipment catering to heat-sensitive medical devices, thereby expanding the application scope. The shift in consumer behavior, particularly among healthcare professionals, emphasizes a proactive approach to infection prevention rather than a reactive one, leading to higher investments in state-of-the-art infection control solutions.

The increasing number of surgical procedures performed globally, coupled with a rise in the immunocompromised patient population, directly correlates with a heightened risk of HAIs, further stimulating demand for effective prevention and control measures. Furthermore, government initiatives and healthcare policy mandates aimed at reducing HAI rates and improving patient safety are acting as significant growth accelerators. These policies often incentivize healthcare facilities to adopt best practices and invest in advanced infection prevention technologies. The penetration of high-traffic keywords such as "healthcare-associated infections solutions," "sterilization equipment market," "disinfectant market trends," and "surgical site infection prevention" within industry discourse and market research highlights the critical focus on these areas.

The market's evolution is also influenced by the expanding end-user base, encompassing not only traditional Hospitals and Intensive Care Units but also Ambulatory Surgical and Diagnostic Centers, and Nursing Homes and Maternity Centers, each presenting unique infection control challenges and demands. The projected market size for the Hospital-Acquired Infections industry is estimated to reach a substantial value of $XX million units by 2025 and is anticipated to grow to $YY million units by 2033, reflecting a consistent and strong growth trajectory. This growth is expected to be sustained by ongoing research and development, leading to the introduction of even more sophisticated and effective HAI prevention and control products. The industry is moving towards integrated solutions that combine advanced hardware with intelligent software for monitoring and data analysis, offering a holistic approach to infection prevention.

Dominant Regions, Countries, or Segments in Hospital-Acquired Infections Industry

The Hospital-Acquired Infections (HAIs) industry is witnessing significant growth and innovation, with specific regions, countries, and segments emerging as dominant forces. North America, particularly the United States, currently stands as a leading market due to its advanced healthcare infrastructure, stringent regulatory environment, and high healthcare expenditure. The region's proactive approach to patient safety and infection control, coupled with substantial investments in healthcare technologies, drives the demand for sophisticated sterilization and disinfection solutions.

Within the Product segment, Sterilants collectively represent the largest market share, with Steam Sterilization equipment holding a significant portion due to its efficacy, cost-effectiveness, and widespread adoption across healthcare settings. However, Low Temperature Sterilization Equipment is rapidly gaining traction, particularly for heat-sensitive medical devices, driven by technological advancements and the increasing complexity of surgical instruments. Disinfectants also form a crucial segment, with a growing demand for broad-spectrum, fast-acting, and safe formulations that can combat a wide range of pathogens, including multidrug-resistant organisms (MDROs).

In terms of Indication, Bloodstream Infections and Surgical Site Infections are primary drivers of market growth, given their high prevalence, associated morbidity and mortality, and significant economic burden on healthcare systems. The increasing number of invasive procedures directly correlates with the incidence of these infections, thus propelling the demand for effective preventive measures. Hospital Acquired Pneumonia also represents a substantial segment, particularly in intensive care units.

The dominant End User segment is unequivocally Hospitals and Intensive Care Units. These settings have the highest concentration of vulnerable patients, complex procedures, and a critical need for robust infection control protocols. The increasing complexity of medical devices and the growing number of elective surgeries performed in Ambulatory Surgical and Diagnostic Centers are also contributing significantly to market expansion in this segment. While Nursing Homes and Maternity Centers represent a smaller share, their infection control needs are growing, especially with an aging population and an increasing focus on hygiene in maternal care.

The dominance of these segments and regions is reinforced by several factors:

- Economic Policies: Favorable reimbursement policies and government incentives for infection control initiatives in North America and Europe.

- Infrastructure: Well-established healthcare infrastructure with advanced technological adoption in developed nations.

- Awareness and Education: High levels of awareness among healthcare professionals and the public regarding HAI risks and prevention strategies.

- Regulatory Compliance: Strict adherence to regulatory standards, pushing for the adoption of best-in-class infection prevention products.

- Technological Advancements: Continuous innovation in sterilization and disinfection technologies, leading to superior product performance and expanded applications.

The market share of North America in the global HAI market is estimated to be around 40%, followed by Europe at approximately 30%. Asia Pacific is emerging as a high-growth region due to increasing healthcare investments and a rising awareness of infection control.

Hospital-Acquired Infections Industry Product Landscape

The Hospital-Acquired Infections (HAIs) product landscape is dynamic, characterized by a focus on efficacy, safety, and technological integration. Key product categories include advanced sterilants such as steam sterilization equipment, effective low-temperature sterilization equipment for sensitive instruments, and radiation sterilization equipment for specific applications. The market also features a wide array of disinfectants, ranging from traditional quaternary ammonium compounds and peracetic acid formulations to novel, broad-spectrum solutions designed to combat multidrug-resistant organisms. Other products encompass infection surveillance systems, antimicrobial coatings, and personal protective equipment, all contributing to a comprehensive approach to HAI prevention. Unique selling propositions often lie in rapid disinfection times, enhanced material compatibility, reduced environmental impact, and integrated data management capabilities for improved compliance and operational efficiency. Technological advancements are leading to more intelligent and automated sterilization processes, minimizing human error and maximizing patient safety.

Key Drivers, Barriers & Challenges in Hospital-Acquired Infections Industry

The Hospital-Acquired Infections (HAIs) industry is propelled by several key drivers, including the escalating global incidence of HAIs, increasing healthcare expenditure, and stringent regulatory mandates aimed at improving patient safety. Technological advancements in sterilization and disinfection, coupled with a growing awareness among healthcare professionals and patients about infection risks, further fuel market growth. The rising number of surgical procedures and the increasing prevalence of immunocompromised patients also contribute significantly.

However, the industry faces several barriers and challenges. High initial investment costs for advanced sterilization and disinfection equipment can be a significant deterrent, especially for smaller healthcare facilities. Stringent and evolving regulatory approvals can lead to extended product development timelines and increased compliance costs. The emergence of antibiotic-resistant bacteria necessitates continuous innovation and development of novel antimicrobial agents, posing a continuous R&D challenge. Supply chain disruptions, particularly for raw materials used in disinfectant formulations, can impact product availability and pricing. Competitive pressures from established players and the threat of product obsolescence due to rapid technological changes also present hurdles.

Emerging Opportunities in Hospital-Acquired Infections Industry

Emerging opportunities in the Hospital-Acquired Infections (HAIs) industry lie in the development of more targeted and personalized infection prevention strategies. The increasing adoption of antimicrobial stewardship programs creates a demand for disinfectants and sterilants with specific efficacy against identified pathogens. Untapped markets in developing economies, with their rapidly expanding healthcare sectors and increasing focus on patient safety, present significant growth potential. Innovative applications of nanotechnology in disinfectant formulations, offering enhanced antimicrobial properties and reduced toxicity, are another exciting avenue. The growing demand for environmentally friendly and sustainable infection control solutions also presents a significant opportunity for product innovation. Furthermore, the integration of artificial intelligence and machine learning in infection surveillance systems offers opportunities to predict and prevent outbreaks more effectively.

Growth Accelerators in the Hospital-Acquired Infections Industry Industry

Several factors are accelerating the growth of the Hospital-Acquired Infections (HAIs) industry. Technological breakthroughs, such as the development of novel sterilization methods like hydrogen peroxide plasma and vaporized hydrogen peroxide (VHP) systems, are expanding treatment options for a wider range of medical devices. Strategic partnerships between equipment manufacturers and disinfectant formulators are leading to the creation of integrated, synergistic solutions that offer enhanced efficacy and convenience. Market expansion strategies, particularly in emerging economies with growing healthcare infrastructure, are opening up new revenue streams. Government initiatives and public health campaigns aimed at reducing HAI rates are creating a favorable environment for investment in infection prevention technologies. The increasing focus on antimicrobial resistance (AMR) is driving research into new antimicrobial agents and disinfection protocols, further stimulating innovation and market demand.

Key Players Shaping the Hospital-Acquired Infections Industry Market

- Becton Dickinson and Company

- Metall Zug Group (Belimed)

- Tuttnauer

- Fortive Corporation

- Cantel Medical

- 3M Company

- Getinge AB

- S C Johnson & Son Inc

- Sotera Health

- STERIS PLC

Notable Milestones in Hospital-Acquired Infections Industry Sector

- June 2022: Sonoma Pharmaceuticals, Inc. and the MicroSafe Group DMCC reported that Nanocyn hospital-grade disinfectant has been added to the list of COVID-19 disinfectants maintained by the United States Environmental Protection Agency's List N. This milestone validates the efficacy of Nanocyn against a critical pathogen and enhances its market adoption.

- March 2022: PDI launched Sani-24 Germicidal Disposable Wipe, Sani-HyPerCide Germicidal Disposable Wipe, and Sani-HyPerCide Germicidal Spray. These innovative disinfectants were developed to support infection prevention professionals in combating the rise of healthcare-associated infections (HAIs) and the ongoing battle against COVID-19, marking significant product development in the disinfectant segment.

In-Depth Hospital-Acquired Infections Industry Market Outlook

The Hospital-Acquired Infections (HAIs) industry is poised for substantial growth, driven by ongoing technological innovations and a persistent global imperative to enhance patient safety. Future market potential is largely anchored in the development of more intelligent, automated, and integrated infection prevention systems. Strategic opportunities lie in expanding the reach of advanced sterilization equipment, particularly low-temperature sterilization, to cater to a wider array of medical devices and settings. The increasing prevalence of multidrug-resistant organisms will continue to drive demand for novel, broad-spectrum disinfectants with enhanced efficacy and improved safety profiles. Furthermore, the growing emphasis on data analytics and artificial intelligence in healthcare will foster the adoption of sophisticated infection surveillance and control platforms. Investments in research and development for sustainable and eco-friendly infection control solutions will also shape the market landscape. The forecast period of 2025–2033 indicates a robust expansion, with an estimated market size projected to reach $YY million units by 2033, driven by these key growth accelerators and the unwavering commitment to reducing the burden of HAIs.

Hospital-Acquired Infections Industry Segmentation

-

1. Product

-

1.1. Sterilants

- 1.1.1. Heat Sterilization Equipment

- 1.1.2. Low Temperature Sterilization Equipment

- 1.1.3. Radiation Sterilization Equipment

- 1.1.4. Steam Sterilization

- 1.1.5. Other Sterilants

- 1.2. Disinfectants

- 1.3. Other Products

-

1.1. Sterilants

-

2. Indication

- 2.1. Hospital Acquired Pneumonia

- 2.2. Bloodstream Infections

- 2.3. Surgical Site Infections

- 2.4. Gastrointestinal Infections

- 2.5. Urinary Tract Infections

- 2.6. Other Indications

-

3. End User

- 3.1. Hospitals and Intensive Care Units

- 3.2. Ambulatory Surgical and Diagnostic Centers

- 3.3. Nursing Homes and Maternity Centers

Hospital-Acquired Infections Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Hospital-Acquired Infections Industry Regional Market Share

Geographic Coverage of Hospital-Acquired Infections Industry

Hospital-Acquired Infections Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Hospital Stay Due to Chronic Diseases and Surgeries; Rise in the Incidences of Different Types of Hospital Acquired Infections; Innovative Technologies Implemented in Devices that Control Infection

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Regarding Hospital Acquired Infection; Stringent Regulatory Requirements

- 3.4. Market Trends

- 3.4.1. Disinfectant Segment is Expected to Hold Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Sterilants

- 5.1.1.1. Heat Sterilization Equipment

- 5.1.1.2. Low Temperature Sterilization Equipment

- 5.1.1.3. Radiation Sterilization Equipment

- 5.1.1.4. Steam Sterilization

- 5.1.1.5. Other Sterilants

- 5.1.2. Disinfectants

- 5.1.3. Other Products

- 5.1.1. Sterilants

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Hospital Acquired Pneumonia

- 5.2.2. Bloodstream Infections

- 5.2.3. Surgical Site Infections

- 5.2.4. Gastrointestinal Infections

- 5.2.5. Urinary Tract Infections

- 5.2.6. Other Indications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals and Intensive Care Units

- 5.3.2. Ambulatory Surgical and Diagnostic Centers

- 5.3.3. Nursing Homes and Maternity Centers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Sterilants

- 6.1.1.1. Heat Sterilization Equipment

- 6.1.1.2. Low Temperature Sterilization Equipment

- 6.1.1.3. Radiation Sterilization Equipment

- 6.1.1.4. Steam Sterilization

- 6.1.1.5. Other Sterilants

- 6.1.2. Disinfectants

- 6.1.3. Other Products

- 6.1.1. Sterilants

- 6.2. Market Analysis, Insights and Forecast - by Indication

- 6.2.1. Hospital Acquired Pneumonia

- 6.2.2. Bloodstream Infections

- 6.2.3. Surgical Site Infections

- 6.2.4. Gastrointestinal Infections

- 6.2.5. Urinary Tract Infections

- 6.2.6. Other Indications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals and Intensive Care Units

- 6.3.2. Ambulatory Surgical and Diagnostic Centers

- 6.3.3. Nursing Homes and Maternity Centers

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Sterilants

- 7.1.1.1. Heat Sterilization Equipment

- 7.1.1.2. Low Temperature Sterilization Equipment

- 7.1.1.3. Radiation Sterilization Equipment

- 7.1.1.4. Steam Sterilization

- 7.1.1.5. Other Sterilants

- 7.1.2. Disinfectants

- 7.1.3. Other Products

- 7.1.1. Sterilants

- 7.2. Market Analysis, Insights and Forecast - by Indication

- 7.2.1. Hospital Acquired Pneumonia

- 7.2.2. Bloodstream Infections

- 7.2.3. Surgical Site Infections

- 7.2.4. Gastrointestinal Infections

- 7.2.5. Urinary Tract Infections

- 7.2.6. Other Indications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals and Intensive Care Units

- 7.3.2. Ambulatory Surgical and Diagnostic Centers

- 7.3.3. Nursing Homes and Maternity Centers

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Sterilants

- 8.1.1.1. Heat Sterilization Equipment

- 8.1.1.2. Low Temperature Sterilization Equipment

- 8.1.1.3. Radiation Sterilization Equipment

- 8.1.1.4. Steam Sterilization

- 8.1.1.5. Other Sterilants

- 8.1.2. Disinfectants

- 8.1.3. Other Products

- 8.1.1. Sterilants

- 8.2. Market Analysis, Insights and Forecast - by Indication

- 8.2.1. Hospital Acquired Pneumonia

- 8.2.2. Bloodstream Infections

- 8.2.3. Surgical Site Infections

- 8.2.4. Gastrointestinal Infections

- 8.2.5. Urinary Tract Infections

- 8.2.6. Other Indications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals and Intensive Care Units

- 8.3.2. Ambulatory Surgical and Diagnostic Centers

- 8.3.3. Nursing Homes and Maternity Centers

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Sterilants

- 9.1.1.1. Heat Sterilization Equipment

- 9.1.1.2. Low Temperature Sterilization Equipment

- 9.1.1.3. Radiation Sterilization Equipment

- 9.1.1.4. Steam Sterilization

- 9.1.1.5. Other Sterilants

- 9.1.2. Disinfectants

- 9.1.3. Other Products

- 9.1.1. Sterilants

- 9.2. Market Analysis, Insights and Forecast - by Indication

- 9.2.1. Hospital Acquired Pneumonia

- 9.2.2. Bloodstream Infections

- 9.2.3. Surgical Site Infections

- 9.2.4. Gastrointestinal Infections

- 9.2.5. Urinary Tract Infections

- 9.2.6. Other Indications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals and Intensive Care Units

- 9.3.2. Ambulatory Surgical and Diagnostic Centers

- 9.3.3. Nursing Homes and Maternity Centers

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Hospital-Acquired Infections Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Sterilants

- 10.1.1.1. Heat Sterilization Equipment

- 10.1.1.2. Low Temperature Sterilization Equipment

- 10.1.1.3. Radiation Sterilization Equipment

- 10.1.1.4. Steam Sterilization

- 10.1.1.5. Other Sterilants

- 10.1.2. Disinfectants

- 10.1.3. Other Products

- 10.1.1. Sterilants

- 10.2. Market Analysis, Insights and Forecast - by Indication

- 10.2.1. Hospital Acquired Pneumonia

- 10.2.2. Bloodstream Infections

- 10.2.3. Surgical Site Infections

- 10.2.4. Gastrointestinal Infections

- 10.2.5. Urinary Tract Infections

- 10.2.6. Other Indications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals and Intensive Care Units

- 10.3.2. Ambulatory Surgical and Diagnostic Centers

- 10.3.3. Nursing Homes and Maternity Centers

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Metall Zug Group (Belimed)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tuttnauer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fortive Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cantel Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Getinge AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 S C Johnson & Son Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sotera Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 STERIS PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Hospital-Acquired Infections Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospital-Acquired Infections Industry Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Hospital-Acquired Infections Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Hospital-Acquired Infections Industry Revenue (Million), by Indication 2025 & 2033

- Figure 5: North America Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 6: North America Hospital-Acquired Infections Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Hospital-Acquired Infections Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Hospital-Acquired Infections Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Hospital-Acquired Infections Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Hospital-Acquired Infections Industry Revenue (Million), by Product 2025 & 2033

- Figure 11: Europe Hospital-Acquired Infections Industry Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Hospital-Acquired Infections Industry Revenue (Million), by Indication 2025 & 2033

- Figure 13: Europe Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 14: Europe Hospital-Acquired Infections Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Hospital-Acquired Infections Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Hospital-Acquired Infections Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Hospital-Acquired Infections Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by Product 2025 & 2033

- Figure 19: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by Indication 2025 & 2033

- Figure 21: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 22: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Hospital-Acquired Infections Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Hospital-Acquired Infections Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East and Africa Hospital-Acquired Infections Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million), by Indication 2025 & 2033

- Figure 29: Middle East and Africa Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 30: Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East and Africa Hospital-Acquired Infections Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Hospital-Acquired Infections Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Hospital-Acquired Infections Industry Revenue (Million), by Product 2025 & 2033

- Figure 35: South America Hospital-Acquired Infections Industry Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Hospital-Acquired Infections Industry Revenue (Million), by Indication 2025 & 2033

- Figure 37: South America Hospital-Acquired Infections Industry Revenue Share (%), by Indication 2025 & 2033

- Figure 38: South America Hospital-Acquired Infections Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: South America Hospital-Acquired Infections Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Hospital-Acquired Infections Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Hospital-Acquired Infections Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 3: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 7: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 14: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 24: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 34: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Indication 2020 & 2033

- Table 41: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Hospital-Acquired Infections Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Hospital-Acquired Infections Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospital-Acquired Infections Industry?

The projected CAGR is approximately 3.97%.

2. Which companies are prominent players in the Hospital-Acquired Infections Industry?

Key companies in the market include Becton Dickinson and Company, Metall Zug Group (Belimed), Tuttnauer, Fortive Corporation, Cantel Medical, 3M Company, Getinge AB, S C Johnson & Son Inc, Sotera Health, STERIS PLC.

3. What are the main segments of the Hospital-Acquired Infections Industry?

The market segments include Product, Indication, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Hospital Stay Due to Chronic Diseases and Surgeries; Rise in the Incidences of Different Types of Hospital Acquired Infections; Innovative Technologies Implemented in Devices that Control Infection.

6. What are the notable trends driving market growth?

Disinfectant Segment is Expected to Hold Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness Regarding Hospital Acquired Infection; Stringent Regulatory Requirements.

8. Can you provide examples of recent developments in the market?

In June 2022, Sonoma Pharmaceuticals, Inc. and the MicroSafe Group DMCC reported that Nanocyn hospital-grade disinfectant has been added to the list of COVID-19 disinfectants maintained by the United States Environmental Protection Agency's List N.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospital-Acquired Infections Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospital-Acquired Infections Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospital-Acquired Infections Industry?

To stay informed about further developments, trends, and reports in the Hospital-Acquired Infections Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence