Key Insights

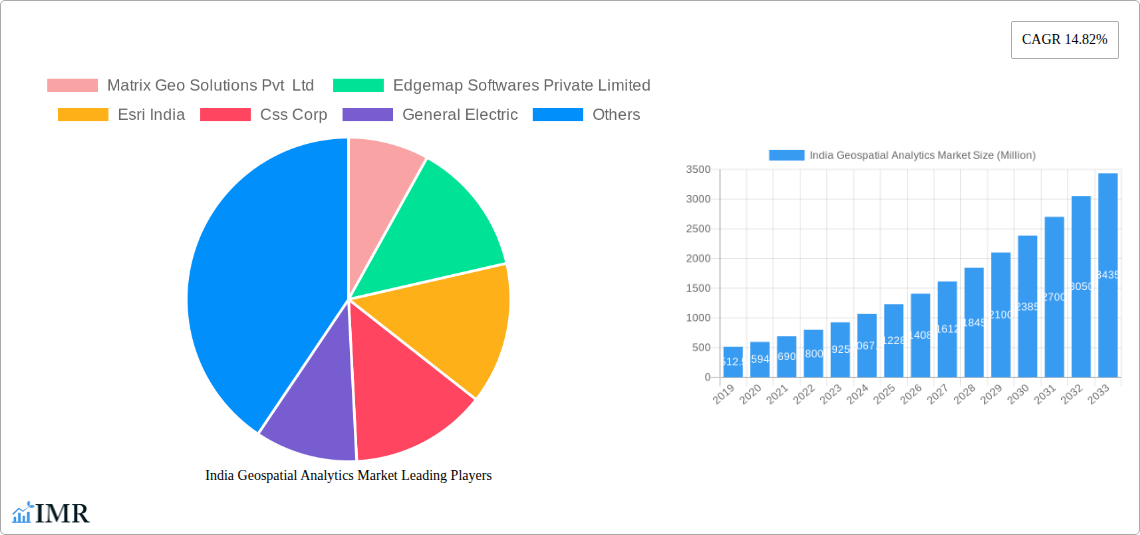

The Indian Geospatial Analytics market is poised for substantial expansion, projected to reach a value of $1.38 billion. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 14.82% between 2019 and 2033, indicating a dynamic and rapidly evolving landscape. Key drivers for this surge include the increasing adoption of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) in geospatial data processing, leading to more sophisticated analysis and actionable insights. The burgeoning need for precise location-based data across various sectors, from agriculture for optimized crop management and resource allocation to urban planning for smart city development, is a significant catalyst. Furthermore, government initiatives promoting digital infrastructure and the integration of GIS (Geographic Information System) in public services are creating fertile ground for market growth. The defense and intelligence sectors are also heavily leveraging geospatial analytics for enhanced surveillance, situational awareness, and strategic planning.

India Geospatial Analytics Market Market Size (In Million)

The market is characterized by distinct segments, with Surface Analysis and Network Analysis emerging as prominent types due to their critical role in understanding spatial relationships and patterns. Geovisualization, a crucial aspect for data interpretation, also commands significant attention. In terms of end-user verticals, Agriculture, Utility and Communication, Defense and Intelligence, and Government sectors are leading the adoption of geospatial analytics, recognizing its potential to drive efficiency and informed decision-making. The Automotive and Transportation sector is also a fast-growing segment, utilizing these analytics for route optimization, logistics management, and autonomous vehicle development. While the market demonstrates immense potential, challenges such as the need for skilled professionals in geospatial data science and the initial investment in sophisticated software and hardware could pose restraints. However, the overwhelming demand for data-driven solutions across the Indian economy, coupled with ongoing technological advancements, strongly suggests that these challenges will be overcome, paving the way for sustained and accelerated market expansion.

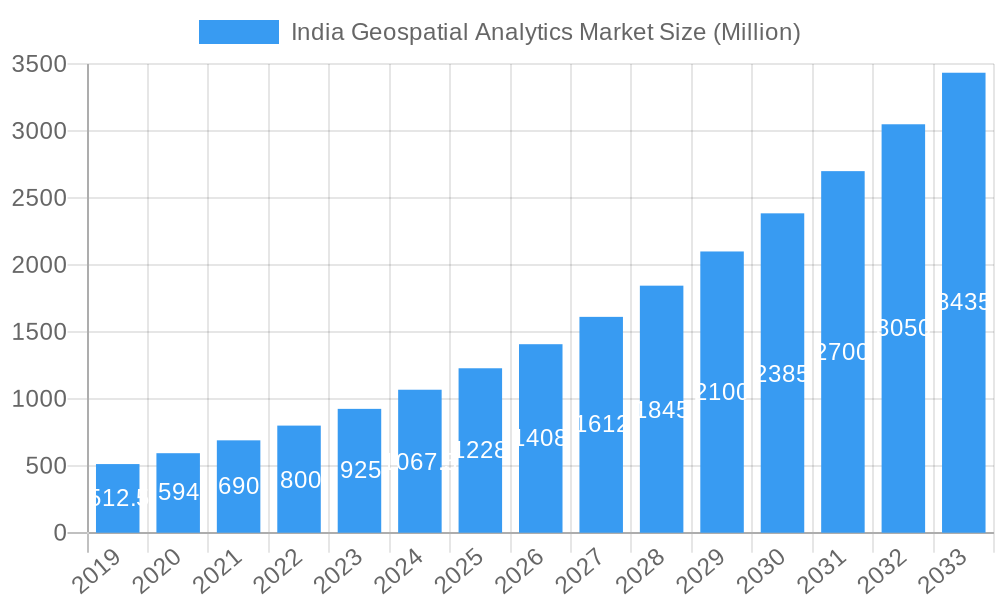

India Geospatial Analytics Market Company Market Share

This in-depth report provides a definitive analysis of the India Geospatial Analytics Market, encompassing a granular examination of market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, and a detailed player and milestone breakdown. Covering the historical period of 2019-2024, the base year of 2025, and a comprehensive forecast period of 2025-2033, this study offers critical insights for stakeholders seeking to capitalize on the burgeoning geospatial analytics sector in India. The report quantifies market size in millions, offering precise data and predictive analytics.

India Geospatial Analytics Market Market Dynamics & Structure

The India Geospatial Analytics Market exhibits a moderately concentrated structure, with a blend of established global players and agile domestic companies vying for market share. Technological innovation remains a pivotal driver, fueled by advancements in AI, machine learning, and cloud computing, which enhance analytical capabilities and data processing speeds. Regulatory frameworks, particularly those related to data privacy and national security, influence market access and data utilization. Competitive product substitutes, though present in the form of traditional data analysis tools, are increasingly being overshadowed by the sophisticated and integrated solutions offered by geospatial analytics platforms. End-user demographics are rapidly evolving, with a growing demand for location-based intelligence across diverse sectors. Mergers and acquisitions (M&A) are becoming a more prominent strategy for market consolidation and technological integration.

- Market Concentration: A moderate level of competition, with significant presence of key international GIS providers and emerging Indian startups.

- Technological Innovation Drivers: AI/ML for predictive analytics, IoT integration for real-time data, cloud-based platforms for scalability, and advanced visualization tools.

- Regulatory Frameworks: Evolving policies around data localization, privacy, and the utilization of sensitive geospatial information.

- Competitive Product Substitutes: Traditional business intelligence tools, manual data interpretation methods.

- End-User Demographics: Increasing adoption by SMEs and startups, alongside continued demand from large enterprises and government bodies.

- M&A Trends: Strategic acquisitions aimed at expanding service portfolios and gaining market access.

India Geospatial Analytics Market Growth Trends & Insights

The India Geospatial Analytics Market is poised for exceptional growth, driven by an escalating demand for data-driven decision-making across a multitude of sectors. The market size is projected to witness a substantial expansion, with adoption rates accelerating due to increased awareness of the tangible benefits of location intelligence. Technological disruptions are continuously reshaping the market, with innovations in areas like satellite imagery processing, drone-based data collection, and the integration of big data analytics with geospatial information. Consumer behavior shifts are also playing a crucial role, as businesses and individuals alike become more accustomed to and reliant on location-aware applications and services for everything from navigation to personalized recommendations. The market is expected to experience a Compound Annual Growth Rate (CAGR) of approximately 15-18% over the forecast period, signifying a robust trajectory. Market penetration is anticipated to deepen significantly as more organizations recognize the strategic imperative of leveraging geospatial insights for operational efficiency, risk management, and new market identification.

Dominant Regions, Countries, or Segments in India Geospatial Analytics Market

The Government end-user vertical is a significant and dominant segment within the India Geospatial Analytics Market, driving substantial growth and adoption. This dominance is attributable to several key factors, including the government's extensive use of geospatial data for urban planning, infrastructure development, disaster management, national security, and public service delivery. Initiatives like Smart Cities Mission, Digital India, and the development of national spatial data infrastructure have created a robust ecosystem for geospatial analytics. The sheer scale of government projects, coupled with a mandate to leverage technology for improved governance, ensures a continuous and substantial demand for sophisticated geospatial solutions.

- Government Segment Drivers:

- Smart Cities Mission: Driving demand for urban planning, traffic management, waste management, and utility monitoring solutions.

- Digital India Initiative: Fostering the adoption of digital technologies, including GIS for various government functions.

- Disaster Management: Crucial for risk assessment, response, and recovery efforts through real-time monitoring and predictive modeling.

- National Security & Defense: Essential for surveillance, border management, and strategic planning.

- Infrastructure Development: Supporting the planning and execution of large-scale projects like highways, railways, and power grids.

- Land Administration & Property Taxation: Improving accuracy and efficiency in land record management.

- Market Share & Growth Potential: The government sector is estimated to hold over 30% of the market share in terms of revenue, with a projected growth rate slightly exceeding the market average due to ongoing digital transformation initiatives.

- Economic Policies: Favorable government policies promoting technological adoption and data utilization further bolster this segment.

- Infrastructure: The expansion of digital infrastructure, including high-speed internet and cloud computing services, supports the deployment and scalability of geospatial analytics solutions for government entities.

While Government is a primary driver, the Utility and Communication segment is also showing remarkable growth, fueled by the need for network management, infrastructure monitoring, and customer service optimization. Agriculture is another key segment experiencing significant uptake due to precision farming initiatives and crop yield prediction models. Automotive and Transportation is rapidly evolving with the integration of navigation, fleet management, and the development of autonomous vehicle technologies.

India Geospatial Analytics Market Product Landscape

The India Geospatial Analytics Market is characterized by innovative product offerings designed to extract actionable insights from location-based data. Key product types include sophisticated GIS software, cloud-based analytics platforms, and specialized visualization tools. Innovations focus on enhancing data processing speeds, enabling real-time analytics, and providing intuitive user interfaces for complex data sets. Applications range from predictive modeling for urban planning and environmental monitoring to supply chain optimization and personalized marketing campaigns. Performance metrics are continually improving, with advancements in spatial resolution, temporal accuracy, and the integration of AI for automated feature extraction and analysis. Unique selling propositions often lie in the ability to seamlessly integrate diverse data sources and deliver customized solutions addressing specific industry challenges.

Key Drivers, Barriers & Challenges in India Geospatial Analytics Market

Key Drivers:

The India Geospatial Analytics Market is propelled by several potent drivers. The accelerating digital transformation across industries, coupled with the increasing volume of data generated by IoT devices and mobile applications, creates a fertile ground for location intelligence. Government initiatives promoting data-driven governance and smart infrastructure development are significant catalysts. Furthermore, the growing awareness of the economic benefits of geospatial analytics, such as improved operational efficiency, risk mitigation, and enhanced customer engagement, is driving adoption. The rapid advancements in computing power, cloud infrastructure, and AI/ML algorithms are making sophisticated geospatial analysis more accessible and affordable.

Key Barriers & Challenges:

Despite the promising outlook, the market faces certain barriers and challenges. A significant hurdle is the shortage of skilled geospatial professionals capable of developing, deploying, and interpreting complex analytics. Data privacy concerns and regulatory complexities surrounding the collection and use of sensitive location data can also impede market growth. The initial investment cost for advanced geospatial software and hardware can be substantial, posing a challenge for smaller enterprises. Moreover, data integration from disparate sources and ensuring data quality and accuracy remain ongoing technical challenges. Cybersecurity threats targeting geospatial data also represent a critical concern.

Emerging Opportunities in India Geospatial Analytics Market

Emerging opportunities in the India Geospatial Analytics Market are vast and diverse. The untapped potential in the rural and semi-urban sectors for agricultural analytics, land management, and resource monitoring presents a significant avenue for growth. The increasing adoption of AI and machine learning is opening doors for advanced predictive analytics in areas like climate change impact assessment and public health forecasting. The expansion of the drone industry for data acquisition is creating new application areas in infrastructure inspection, environmental surveys, and precision agriculture. Furthermore, the growing demand for location-based services in e-commerce, logistics, and personalized marketing offers substantial untapped market potential. Evolving consumer preferences for hyper-local services also represent a fertile ground for innovation.

Growth Accelerators in the India Geospatial Analytics Market Industry

Several catalysts are accelerating the long-term growth of the India Geospatial Analytics Market. Technological breakthroughs, such as advancements in real-time satellite imagery processing and the development of more sophisticated edge computing solutions for on-site data analysis, are key accelerators. Strategic partnerships between technology providers, data aggregators, and industry-specific solution developers are fostering greater market penetration and product innovation. Market expansion strategies, including the development of scalable and affordable subscription-based models, are making geospatial analytics accessible to a wider range of businesses. The increasing integration of geospatial capabilities into existing enterprise software suites also acts as a significant growth accelerator, embedding location intelligence into daily business operations.

Key Players Shaping the India Geospatial Analytics Market Market

- Matrix Geo Solutions Pvt Ltd

- Edgemap Softwares Private Limited

- Esri India

- Css Corp

- General Electric

- Precisely

- Google LLC

- Maxar Technologies

- Saar IT Resources Pvt

- Cybertech Systems And Software Ltd

Notable Milestones in India Geospatial Analytics Market Sector

- January 2023: Eris India announced the development of a policy map to offer data for state and policymaker decision-making, designed to provide meaningful insights into various government functions.

- July 2022: Google announced a new partnership in India with local authorities and organizations to provide customized features for the diverse needs of the country's population, alongside building more visual and accurate navigation maps.

In-Depth India Geospatial Analytics Market Market Outlook

The India Geospatial Analytics Market outlook is exceptionally promising, driven by a confluence of factors that underscore its strategic importance. Continued advancements in AI and machine learning will unlock unprecedented predictive capabilities, enabling more accurate forecasting for everything from traffic patterns to natural disaster impacts. The expansion of 5G networks will facilitate real-time data transmission and processing, powering more responsive and dynamic geospatial applications. Increased investment in smart city projects and sustainable development initiatives will fuel demand for sophisticated urban planning and resource management solutions. Strategic collaborations between global technology leaders and Indian enterprises will further accelerate innovation and market penetration, making advanced geospatial analytics more accessible and tailored to local needs. The market is on a trajectory to become a critical enabler of India's economic growth and technological advancement.

India Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geovisualization

-

2. End-user Vertical

- 2.1. Agriculture

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

India Geospatial Analytics Market Segmentation By Geography

- 1. India

India Geospatial Analytics Market Regional Market Share

Geographic Coverage of India Geospatial Analytics Market

India Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Location Based Service; Growing Availability of Spatial Data

- 3.3. Market Restrains

- 3.3.1. High Initial Cost in Implementing Geospatial Analytics Solutions

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Location Based Service

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geovisualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agriculture

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Matrix Geo Solutions Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Edgemap Softwares Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Esri India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Css Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Precisely

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Google LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maxar Technologgies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saar It Resources Pvt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cybertech Systems And Software Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Matrix Geo Solutions Pvt Ltd

List of Figures

- Figure 1: India Geospatial Analytics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Geospatial Analytics Market Share (%) by Company 2025

List of Tables

- Table 1: India Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: India Geospatial Analytics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: India Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: India Geospatial Analytics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Geospatial Analytics Market?

The projected CAGR is approximately 14.82%.

2. Which companies are prominent players in the India Geospatial Analytics Market?

Key companies in the market include Matrix Geo Solutions Pvt Ltd , Edgemap Softwares Private Limited, Esri India, Css Corp, General Electric, Precisely, Google LLC, Maxar Technologgies, Saar It Resources Pvt, Cybertech Systems And Software Ltd.

3. What are the main segments of the India Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Location Based Service; Growing Availability of Spatial Data.

6. What are the notable trends driving market growth?

Increasing Demand of Location Based Service.

7. Are there any restraints impacting market growth?

High Initial Cost in Implementing Geospatial Analytics Solutions.

8. Can you provide examples of recent developments in the market?

January 2023: Eris India, a company providing Geographic Information System (GIS) software and solutions, announced that the company is developing a policy map to offer data to help states and policymakers in decision-making. The Policy Maps have been designed to provide meaningful insights into various government functions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the India Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence