Key Insights

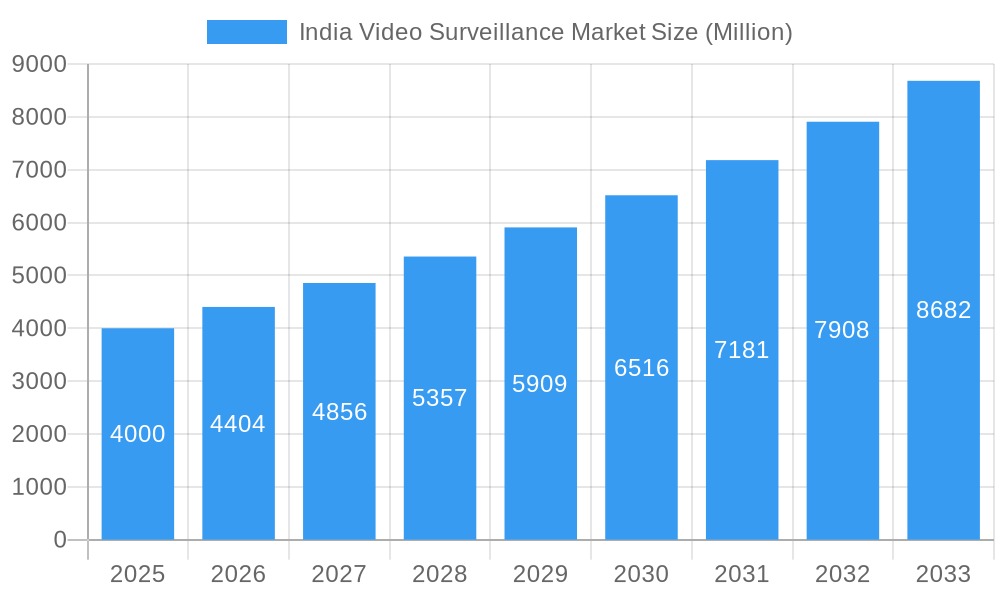

The India video surveillance market is experiencing robust growth, driven by increasing security concerns across various sectors, including residential, commercial, and governmental. The market's expansion is fueled by the rising adoption of advanced technologies like AI-powered analytics, cloud-based video management systems (VMS), and Internet of Things (IoT) integration. Government initiatives promoting smart cities and improved infrastructure are also significant contributors. A compound annual growth rate (CAGR) of 10.10% from 2019 to 2033 suggests a significant market expansion. While precise market size figures for the past years are unavailable, we can infer substantial growth based on the provided 2025 market size of 4 million USD (assuming this refers to the total market value). This projection indicates a significant and expanding market opportunity. The competitive landscape is characterized by a mix of global giants and domestic players, suggesting potential for both established and emerging companies. Challenges include the need for robust cybersecurity measures to address data breaches and the high initial investment costs for advanced surveillance systems. However, the long-term benefits of enhanced security and operational efficiency are driving market growth. The segmentation details are unavailable, but likely include types of surveillance equipment (IP cameras, CCTV, etc.), applications (residential, commercial, industrial, governmental), and technology (analytics, cloud, etc.). This market’s success will hinge on its ability to manage the balance between security enhancements and the privacy concerns of the population.

India Video Surveillance Market Market Size (In Billion)

This rapid expansion will likely see a substantial increase in market size by 2033. Applying the 10.10% CAGR to the 2025 estimated value of $4 million USD indicates a continued upward trajectory. The market's growth will be influenced by technological advancements, government policies, and the increasing affordability of video surveillance solutions. Competitive pressures will likely drive innovation and cost reductions, further fueling market expansion. The increasing integration of video surveillance with other technologies, such as access control systems, will contribute significantly to future growth, creating a more comprehensive security infrastructure. Strong growth in the next few years is projected, particularly in the smart cities and critical infrastructure sectors which are demanding improved security.

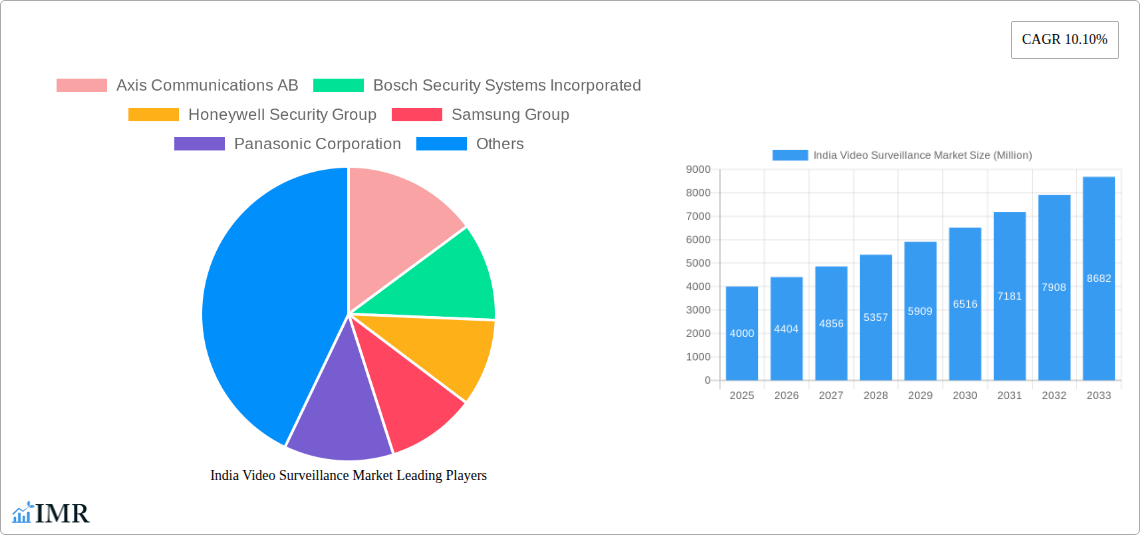

India Video Surveillance Market Company Market Share

India Video Surveillance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India video surveillance market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive market research and incorporates recent industry developments to offer actionable insights. The market is segmented into various categories, including but not limited to, by technology, by application, and by end user. The total addressable market size for video surveillance in India is estimated at XX Million units in 2025.

India Video Surveillance Market Dynamics & Structure

The Indian video surveillance market is characterized by moderate concentration, with both multinational and domestic players vying for market share. Technological innovation, particularly in AI-powered analytics and cloud-based solutions, is a primary driver. The regulatory landscape, including data privacy concerns and government initiatives promoting smart cities, significantly impacts market growth. The market experiences competition from alternative security solutions, but the increasing demand for enhanced security and safety outweighs these challenges. The end-user demographics are diverse, encompassing government agencies, commercial establishments, and residential sectors. M&A activity in the sector is relatively high, with larger players acquiring smaller companies to expand their product portfolios and market reach.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on AI-powered analytics, cloud storage, and IoT integration.

- Regulatory Framework: Government initiatives promoting smart cities and data privacy regulations are key influencers.

- Competitive Substitutes: Traditional security methods, but video surveillance is increasingly preferred for its capabilities.

- End-User Demographics: Government, commercial, and residential sectors are key drivers.

- M&A Trends: Significant M&A activity observed in the recent past, with xx deals completed in the last 5 years.

India Video Surveillance Market Growth Trends & Insights

The Indian video surveillance market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is fueled by increasing urbanization, rising security concerns, and government initiatives promoting smart city development. The adoption rate is expected to accelerate further during the forecast period (2025-2033), driven by technological advancements such as AI-powered analytics and the decreasing cost of high-resolution cameras. Consumer behavior is shifting towards more sophisticated surveillance solutions with integrated features, such as facial recognition and license plate reading. Market penetration is currently at xx% and is projected to reach xx% by 2033. Technological disruptions, such as the emergence of 5G and edge computing, are expected to further boost market expansion. The overall market size is predicted to reach XX Million units by 2033.

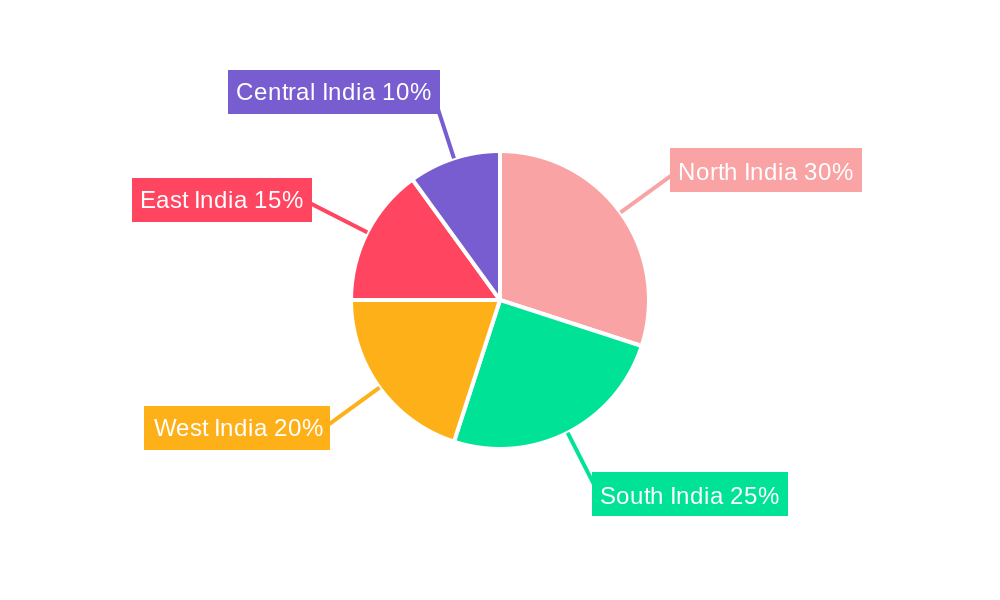

Dominant Regions, Countries, or Segments in India Video Surveillance Market

Metropolitan areas such as Mumbai, Delhi, Bangalore, and Chennai are leading the market growth due to higher security concerns, rapid urbanization, and significant investments in smart city infrastructure. The government sector represents a large portion of the market, driven by substantial investments in public safety and security.

- Key Drivers:

- Rapid urbanization and infrastructure development.

- Increasing security concerns in major cities.

- Government initiatives promoting smart city projects.

- Growing adoption of advanced surveillance technologies.

- Dominance Factors:

- High population density and security risks in metropolitan areas.

- Significant government investments in public safety infrastructure.

- Favorable economic conditions and increasing disposable incomes.

India Video Surveillance Market Product Landscape

The market offers a diverse range of products, including IP cameras, analog cameras, CCTV systems, video management software (VMS), and cloud-based solutions. Recent innovations focus on high-resolution imaging, advanced analytics (e.g., facial recognition, object detection), and improved network connectivity. Unique selling propositions often include cost-effectiveness, ease of use, and integration capabilities with other security systems. Technological advancements are centered on AI, machine learning, and improved data processing capabilities, enabling more accurate and efficient surveillance.

Key Drivers, Barriers & Challenges in India Video Surveillance Market

Key Drivers:

- Increasing crime rates and security concerns.

- Government initiatives for smart cities and public safety.

- Growing adoption of advanced technologies like AI and cloud computing.

- Rising disposable incomes and increased spending on security solutions.

Challenges and Restraints:

- High initial investment costs for advanced systems.

- Concerns regarding data privacy and security breaches.

- Lack of skilled professionals for installation and maintenance.

- Competition from cheaper, lower-quality products.

- Complex regulatory landscape regarding data storage and usage. This contributes to a xx% decrease in projected market growth for the next 5 years.

Emerging Opportunities in India Video Surveillance Market

- Expansion into rural markets with affordable, basic systems.

- Integration of video surveillance with other IoT devices.

- Development of specialized solutions for various sectors (healthcare, retail).

- Growth in demand for AI-powered analytics and predictive policing solutions.

Growth Accelerators in the India Video Surveillance Market Industry

Technological breakthroughs in AI, IoT, and cloud computing, combined with strategic partnerships between technology providers and system integrators, are fueling market growth. Furthermore, government policies promoting smart city development and public safety are creating a favorable environment for expansion, and this is forecasted to produce a xx% increase in the CAGR by 2030.

Key Players Shaping the India Video Surveillance Market Market

- Axis Communications AB

- Bosch Security Systems Incorporated

- Honeywell Security Group

- Samsung Group

- Panasonic Corporation

- FLIR Systems Inc

- Schneider Electric SE

- Aditya Infotech Ltd

- Videocon Industries Ltd

- Zicom Electronic Security Systems

- Dahua Technology India Pvt Ltd

- D-Link India Limited

- Godrej Security Solution

- Digitals India Security Products Pvt Ltd

- Total Surveillance Solutions Pvt Ltd

- *List Not Exhaustive

Notable Milestones in India Video Surveillance Market Sector

- January 2024: Transline Technologies wins a contract from Indian Oil Corporation (IOCL) to implement an IP-based CCTV surveillance system in Telangana and Andhra Pradesh. This highlights the growing demand for advanced surveillance solutions in the energy sector.

- October 2023: Hikvision launches its industry-first 2 MP analog cameras with F1.0 aperture. This signifies a significant technological advancement in analog camera technology, potentially increasing market adoption of analog solutions.

In-Depth India Video Surveillance Market Market Outlook

The future of the India video surveillance market is bright, with continued growth driven by technological innovations, government support, and increasing security concerns. Strategic opportunities exist for companies focusing on AI-powered analytics, cloud-based solutions, and customized applications for various sectors. The market's potential is vast, and companies that adapt to evolving technologies and consumer preferences are poised for significant success.

India Video Surveillance Market Segmentation

-

1. Type

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Cameras

- 1.1.1.3. Hybrid

- 1.1.2. Storage

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management Software

- 1.3. Services (VSaaS)

-

1.1. Hardware

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Infrastructure

- 2.3. Institutional

- 2.4. Industrial

- 2.5. Defense

- 2.6. Residential

India Video Surveillance Market Segmentation By Geography

- 1. India

India Video Surveillance Market Regional Market Share

Geographic Coverage of India Video Surveillance Market

India Video Surveillance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Demand of IP Cameras; Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics

- 3.3. Market Restrains

- 3.3.1. Augmented Demand of IP Cameras; Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics

- 3.4. Market Trends

- 3.4.1. Rising Smart City Initiatives is Driving the Demand for Video Surveillance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Cameras

- 5.1.1.1.3. Hybrid

- 5.1.1.2. Storage

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management Software

- 5.1.3. Services (VSaaS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Infrastructure

- 5.2.3. Institutional

- 5.2.4. Industrial

- 5.2.5. Defense

- 5.2.6. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Axis Communications AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security Systems Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell Security Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FLIR Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aditya Infotech Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Videocon Industries Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zicom Electronic Security Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology India Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 D-Link India Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Godrej Security Solution

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Digitals India Security Products Pvt Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Total Surveillance Solutions Pvt Ltd*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Axis Communications AB

List of Figures

- Figure 1: India Video Surveillance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Video Surveillance Market Share (%) by Company 2025

List of Tables

- Table 1: India Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Video Surveillance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: India Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: India Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 5: India Video Surveillance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Video Surveillance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Video Surveillance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: India Video Surveillance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: India Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: India Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 11: India Video Surveillance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Video Surveillance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Video Surveillance Market?

The projected CAGR is approximately 10.10%.

2. Which companies are prominent players in the India Video Surveillance Market?

Key companies in the market include Axis Communications AB, Bosch Security Systems Incorporated, Honeywell Security Group, Samsung Group, Panasonic Corporation, FLIR Systems Inc, Schneider Electric SE, Aditya Infotech Ltd, Videocon Industries Ltd, Zicom Electronic Security Systems, Dahua Technology India Pvt Ltd, D-Link India Limited, Godrej Security Solution, Digitals India Security Products Pvt Ltd, Total Surveillance Solutions Pvt Ltd*List Not Exhaustive.

3. What are the main segments of the India Video Surveillance Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 4 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Demand of IP Cameras; Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics.

6. What are the notable trends driving market growth?

Rising Smart City Initiatives is Driving the Demand for Video Surveillance.

7. Are there any restraints impacting market growth?

Augmented Demand of IP Cameras; Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics.

8. Can you provide examples of recent developments in the market?

January 2024: The Delhi-based tech company Transline Technologies announced receiving a contract from Indian Oil Corporation (IOCL) to implement an IP-based CCTV surveillance system in Telangana and Andhra Pradesh. The company will be responsible for the designing, supplying, installing, testing, and commissioning of the surveillance system, which will include explosion-proof cameras with advanced analytics, servers, high-definition LEDs, redundant servers, client workstations, storage devices, networking components, poles, display monitors, LED floodlights, VMS, and analytic software.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Video Surveillance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Video Surveillance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Video Surveillance Market?

To stay informed about further developments, trends, and reports in the India Video Surveillance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence