Key Insights

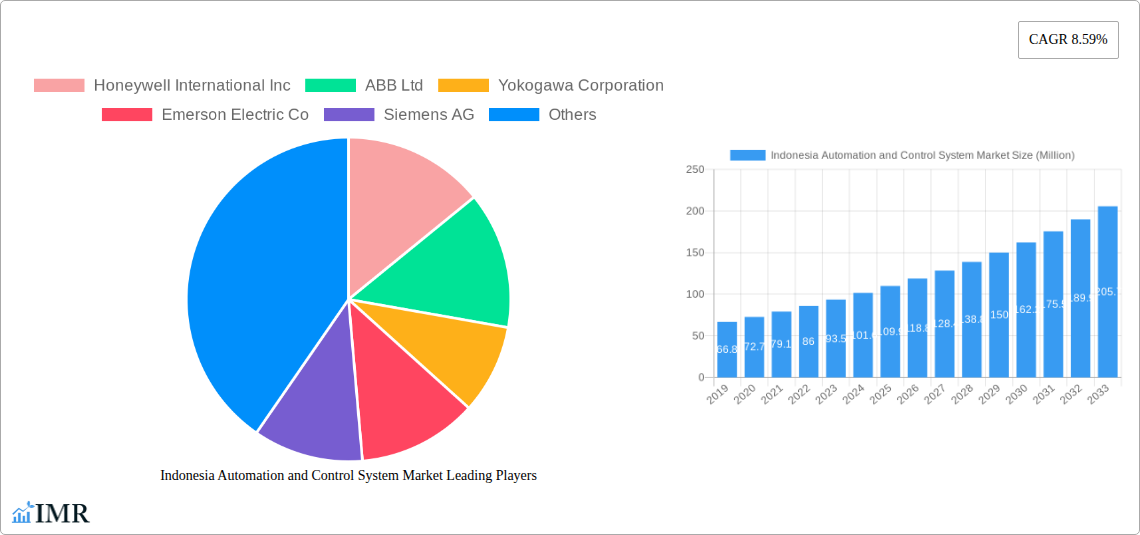

The Indonesia Automation and Control System Market is poised for significant expansion, projected to reach a substantial USD 109.90 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.59% expected to persist through 2033. This robust growth is underpinned by the increasing adoption of advanced automation technologies across key industrial sectors. The demand for Programmable Logic Controllers (PLCs), Supervisory Control and Data Acquisition (SCADA) systems, and Distributed Control Systems (DCS) is a primary driver, facilitating enhanced operational efficiency, improved process control, and greater data visibility. Furthermore, the integration of Human Machine Interfaces (HMIs) is streamlining user interaction with complex industrial processes, while the growing emphasis on industrial safety is propelling the adoption of dedicated safety systems. The surge in industrial robotics, driven by the need for precision and speed in manufacturing and assembly, alongside the critical role of electric drives (AC, DC, and servo) in optimizing energy consumption and machine performance, are also significant contributors to market expansion.

Indonesia Automation and Control System Market Market Size (In Million)

The dynamic landscape of the Indonesian economy, characterized by rapid industrialization, is fueling this automation and control system market growth. Prominent end-user industries such as Oil & Gas, Power, and Chemical & Petrochemical are heavily investing in these solutions to meet stringent production targets, enhance safety standards, and comply with evolving environmental regulations. The Food & Beverage sector is increasingly adopting automation for quality control and to meet growing consumer demand. Similarly, Metals & Mining and Water and Wastewater treatment facilities are leveraging automation for more efficient resource management and operational reliability. Leading global players like Honeywell International Inc., ABB Ltd., Siemens AG, and Rockwell Automation Inc. are actively participating in this market, introducing innovative solutions and expanding their presence to cater to the burgeoning demand. The Indonesian market is witnessing a convergence of technological advancements and a strong commitment from industries to embrace smart manufacturing principles, positioning it as a key growth region for automation and control systems in Southeast Asia.

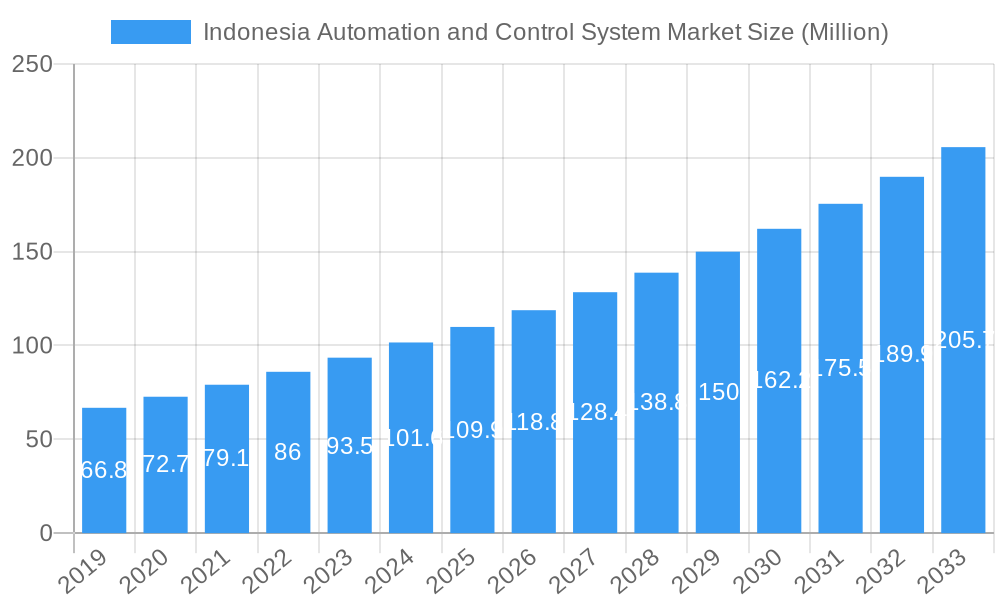

Indonesia Automation and Control System Market Company Market Share

Unlock the potential of Indonesia's rapidly expanding automation and control system market with this comprehensive industry report. Covering a detailed study period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, this report offers unparalleled insights into market dynamics, growth trends, and future opportunities. Discover the intricate parent and child market landscape, meticulously segmented by product and end-user industry, to identify high-growth areas and strategic investment avenues. This report is designed for industry professionals, investors, and stakeholders seeking to capitalize on the digital transformation sweeping across Indonesia's industrial sectors.

Indonesia Automation and Control System Market Market Dynamics & Structure

The Indonesian automation and control system market is characterized by a moderately concentrated competitive landscape, with key global players such as Honeywell International Inc., ABB Ltd, Yokogawa Corporation, Emerson Electric Co, Siemens AG, Schneider Electric Co, and Rockwell Automation Inc. holding significant market share. However, the presence of local players like PT FANUC Indonesia and a growing number of smaller, specialized firms fosters healthy competition and innovation. Technological innovation is a primary driver, fueled by the increasing demand for enhanced operational efficiency, productivity, and safety across industries. The adoption of Industry 4.0 principles, including the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, is accelerating this trend.

- Market Concentration: Dominated by a few multinational corporations, with increasing fragmentation at the lower end.

- Technological Innovation Drivers: Industry 4.0 adoption, demand for energy efficiency, predictive maintenance, and smart manufacturing.

- Regulatory Frameworks: Government initiatives promoting industrial digitalization, standardization in safety protocols, and environmental regulations influencing control system choices.

- Competitive Product Substitutes: While core automation components have established substitutes, integration platforms and software solutions are seeing rapid evolution.

- End-User Demographics: A diverse range of industries, from the established Oil & Gas and Power sectors to rapidly growing Food & Beverage and Metals & Mining, each with unique automation needs.

- M&A Trends: Expected to see strategic acquisitions focused on expanding product portfolios, geographical reach, and acquiring niche technological capabilities. Estimated M&A deal volumes in the parent market are projected to reach xx by 2025.

Indonesia Automation and Control System Market Growth Trends & Insights

The Indonesian automation and control system market is poised for substantial growth, driven by a confluence of economic development, industrial expansion, and a strong government push towards technological advancement. The estimated market size for 2025 is expected to reach approximately $3,200 Million units, with a projected Compound Annual Growth Rate (CAGR) of 10.5% from 2025 to 2033. This robust expansion is underpinned by increasing investments in infrastructure, a growing manufacturing base, and the imperative for businesses to adopt advanced technologies to remain competitive.

The adoption rates for various automation and control solutions are accelerating. Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA) systems continue to be foundational, witnessing steady uptake across all major industries. Distributed Control Systems (DCS) are integral to large-scale process industries like Oil & Gas and Chemical & Petrochemical, where precision and reliability are paramount. Human Machine Interfaces (HMIs) are evolving from simple dashboards to sophisticated visualization tools, enhancing operator interaction and decision-making. Safety systems are gaining prominence due to stricter safety regulations and a heightened awareness of operational risks, with an estimated market penetration of xx% by 2025.

Technological disruptions are primarily centered around the integration of digital technologies. The Industrial Internet of Things (IIoT) is enabling real-time data collection and analysis, paving the way for predictive maintenance and optimized production schedules. Artificial intelligence and machine learning are being integrated into control systems for advanced analytics, anomaly detection, and autonomous operations. This shift is significantly influencing consumer behavior, with end-users demanding more integrated, intelligent, and cloud-enabled solutions. The Food & Beverage sector, for instance, is increasingly adopting automation to ensure product quality, traceability, and compliance with stringent food safety standards. The Metals & Mining industry is leveraging automation for enhanced safety in hazardous environments and for optimizing resource extraction.

The "Other End-User Industries" segment, encompassing sectors like pharmaceuticals, automotive, and consumer goods, is also demonstrating significant growth potential as these industries increasingly embrace automation to boost efficiency and output. The growing demand for customized solutions and the increasing affordability of advanced automation technologies are further fueling market penetration. The overall market penetration of automation solutions is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Indonesia Automation and Control System Market

The Indonesian automation and control system market is experiencing robust growth across its diverse segments, with specific areas demonstrating exceptional momentum. The Parent Market encompassing the overarching automation and control systems, is driven by several key factors.

Among the Product Segments, Programmable Logic Controllers (PLCs) currently hold a dominant position and are projected to continue their lead. This is due to their versatility, cost-effectiveness, and widespread applicability across small, medium, and large-scale industrial operations in Indonesia. The increasing demand for process automation in the manufacturing and assembly sectors directly fuels PLC adoption. The estimated market share for PLCs in 2025 is approximately 25%.

Closely following are Supervisory Control and Data Acquisition (SCADA) systems, which are critical for monitoring and controlling geographically dispersed assets. Their importance in the Oil & Gas and Power sectors, two of Indonesia's largest industries, makes them a significant growth driver. The increasing need for real-time operational data and centralized control further propels SCADA adoption. The market share for SCADA is projected at 20% for 2025.

The Distributed Control System (DCS) segment, while historically dominant in large process industries, is also witnessing sustained growth, particularly within the Chemical & Petrochemical and Water and Wastewater industries. The emphasis on process optimization, safety, and complex control loops ensures the continued relevance of DCS. Its estimated market share for 2025 is 18%.

Human Machine Interfaces (HMIs) are experiencing rapid adoption as they are essential for intuitive operator interaction with automated systems. Their integration with SCADA and DCS systems makes them a crucial component, with an estimated market share of 15%. Safety Systems are increasingly gaining traction due to stringent regulatory requirements and a growing emphasis on worker well-being, projected at 12% market share for 2025. Industrial Robotics and Electric Drives (including AC, DC, and Servo) are also significant growth segments, driven by the automotive, electronics, and general manufacturing sectors, collectively accounting for the remaining 10% market share.

In terms of End-User Industries, the Oil & Gas sector continues to be a dominant force in the Indonesian automation and control system market. This is attributed to the vast exploration and production activities, the presence of large refineries, and the continuous need for sophisticated automation to ensure safety, efficiency, and environmental compliance in this capital-intensive industry. The sector's estimated contribution to the market in 2025 is around 28%.

The Power industry is another major contributor, driven by the government's focus on expanding power generation capacity and modernizing existing infrastructure. The integration of smart grid technologies and renewable energy sources further necessitates advanced automation and control solutions. Its estimated market share for 2025 is 22%.

The Chemical & Petrochemical industry is also a significant segment, driven by Indonesia's growing demand for downstream petrochemical products. The complex and hazardous nature of chemical processes requires highly reliable and precise control systems. Its estimated market share for 2025 is 19%.

The Food & Beverage sector is emerging as a rapidly growing segment, fueled by increasing domestic consumption, export opportunities, and a growing emphasis on product quality, traceability, and automation to meet international standards. Its projected market share for 2025 is 15%. The Metals & Mining and Water and Wastewater industries, along with "Other End-User Industries" like automotive and electronics, collectively constitute the remaining 16% of the market share for 2025, each presenting unique growth opportunities.

Indonesia Automation and Control System Market Product Landscape

The product landscape of the Indonesian automation and control system market is characterized by continuous innovation and an increasing focus on integrated, intelligent solutions. Programmable Logic Controllers (PLCs) are evolving with enhanced processing power, network connectivity, and advanced programming capabilities to handle complex control tasks. Supervisory Control and Data Acquisition (SCADA) systems are incorporating cloud connectivity and advanced analytics for remote monitoring and predictive maintenance. Distributed Control Systems (DCS) are offering greater scalability and integration with enterprise resource planning (ERP) systems. Human Machine Interfaces (HMIs) are becoming more intuitive and feature-rich, with touch screen technology, advanced graphics, and mobile access. Safety systems are integrating functional safety standards and intelligent diagnostics for increased reliability. Industrial robotics are becoming more collaborative and AI-driven, while Electric Drives are offering higher energy efficiency and precise motion control. These advancements collectively enhance operational efficiency, reduce downtime, and improve product quality across various industries.

Key Drivers, Barriers & Challenges in Indonesia Automation and Control System Market

Key Drivers:

- Industry 4.0 Adoption: The push towards smart manufacturing and digital transformation is a primary catalyst.

- Demand for Operational Efficiency: Businesses are seeking to optimize production, reduce waste, and improve productivity.

- Government Initiatives: Supportive policies for industrial automation and digitalization by the Indonesian government.

- Growing Manufacturing Sector: Expansion and modernization of manufacturing facilities across various industries.

- Increased Focus on Safety: Stringent regulations and awareness regarding workplace safety are driving the adoption of safety systems.

- Energy Efficiency Mandates: The need to reduce energy consumption is promoting the use of energy-efficient drives and control systems.

Key Barriers & Challenges:

- High Initial Investment: The upfront cost of advanced automation systems can be a barrier for small and medium-sized enterprises (SMEs).

- Skilled Workforce Shortage: A lack of adequately trained personnel to install, operate, and maintain complex automation systems.

- Cybersecurity Concerns: As systems become more connected, the risk of cyber threats increases, requiring robust security measures.

- Integration Complexity: Integrating new automation systems with existing legacy infrastructure can be challenging.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of automation components, with estimated impacts on project timelines of up to xx%.

- Economic Volatility: Fluctuations in the Indonesian economy can affect investment decisions in automation projects.

Emerging Opportunities in Indonesia Automation and Control System Market

Emerging opportunities in the Indonesian automation and control system market are abundant, particularly in the realm of smart manufacturing and predictive maintenance. The increasing adoption of IoT devices and AI-powered analytics presents a significant opportunity for service-based revenue models, where companies offer continuous monitoring and optimization services rather than just selling hardware. The Food & Beverage industry, with its growing demand for traceability and quality control, represents a largely untapped market for advanced automation solutions. Furthermore, the Water and Wastewater sector is poised for significant growth as the government invests in improving water infrastructure and treatment facilities, requiring sophisticated control systems for efficient management. The "Other End-User Industries" segment, including the burgeoning electric vehicle (EV) manufacturing and electronics assembly sectors, also offers substantial untapped potential for customized automation solutions. The development of edge computing solutions for real-time data processing at the source is another promising area.

Growth Accelerators in the Indonesia Automation and Control System Market Industry

Several key catalysts are accelerating long-term growth in the Indonesian automation and control system market. The sustained push towards digitalization and Industry 4.0 adoption by both government and industry leaders is a fundamental accelerator. Strategic partnerships between global automation giants and local Indonesian companies are facilitating knowledge transfer, market penetration, and the development of localized solutions. Technological breakthroughs in areas like artificial intelligence, machine learning, and the Industrial Internet of Things (IIoT) are continuously creating new applications and improving the capabilities of existing systems. Market expansion strategies, including increased investment in research and development and the establishment of local manufacturing and service centers, are also playing a crucial role. The Indonesian government's commitment to developing advanced manufacturing hubs and special economic zones provides a fertile ground for the widespread adoption of cutting-edge automation technologies.

Key Players Shaping the Indonesia Automation and Control System Market Market

- Honeywell International Inc.

- ABB Ltd

- Yokogawa Corporation

- Emerson Electric Co

- Siemens AG

- Schneider Electric Co

- Rockwell Automation Inc.

- PT FANUC Indonesia

Notable Milestones in Indonesia Automation and Control System Market Sector

- 2020: Siemens AG launches its first Digitalization Hub in Indonesia, fostering innovation in Industry 4.0 solutions.

- 2021: PT FANUC Indonesia secures a significant contract for robotic automation in a major automotive plant, boosting industrial robotics adoption.

- 2022: Emerson Electric Co. announces expansion of its presence in Indonesia, focusing on solutions for the growing Oil & Gas sector.

- 2023: Schneider Electric Co. partners with a local utility company to implement advanced SCADA systems for grid modernization.

- Q1 2024: Rockwell Automation Inc. introduces new PLCs with enhanced cybersecurity features to address growing industry concerns.

- Q2 2024: ABB Ltd invests in expanding its local service and support network across key industrial regions in Indonesia.

- Q3 2024: Yokogawa Corporation announces a new initiative to promote digital transformation in the Indonesian Chemical & Petrochemical sector.

- Q4 2024: Honeywell International Inc. showcases its latest integrated automation solutions for smart manufacturing at a major Indonesian industry exhibition.

In-Depth Indonesia Automation and Control System Market Market Outlook

The future outlook for the Indonesian automation and control system market is exceptionally bright, driven by the strong momentum of digital transformation and sustained industrial growth. Growth accelerators such as the ongoing adoption of Industry 4.0 principles, coupled with supportive government policies promoting technological advancement, will continue to propel market expansion. Strategic partnerships, ongoing technological innovations, and a focus on expanding local manufacturing and service capabilities will further solidify Indonesia's position as a key market for automation solutions. The increasing demand for integrated, intelligent, and sustainable systems across diverse end-user industries presents a wealth of strategic opportunities for market players. The market is projected to witness significant value creation and technological evolution throughout the forecast period, making it a prime area for investment and development.

Indonesia Automation and Control System Market Segmentation

-

1. Product

- 1.1. Programmable Logic Controller

- 1.2. Supervisory Control and Data Acquisition

- 1.3. Distributed Control System

- 1.4. Human Machine Interface

- 1.5. Safety Systems

- 1.6. Industrial Robotics

- 1.7. Electric

- 1.8. Drives (includes AC,DC and Servo)

-

2. End-User Industry

- 2.1. Oil & Gas

- 2.2. Power

- 2.3. Chemical & Petrochemical

- 2.4. Food & Beverage

- 2.5. Metals & Mining

- 2.6. Water and Wastewater

- 2.7. Other End-User Industries

Indonesia Automation and Control System Market Segmentation By Geography

- 1. Indonesia

Indonesia Automation and Control System Market Regional Market Share

Geographic Coverage of Indonesia Automation and Control System Market

Indonesia Automation and Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Flourishing Power Sector and Increased Power Generation Capacities in Indonesia; Evolution and Development of Wireless Protocols and Wireless Sensor Network Technology in Indonesia; Development of Industries and Investments to Increase Capacities

- 3.3. Market Restrains

- 3.3.1. High Capital Investments; Fluctuating Commodity Prices and Volatile Economic Scenario

- 3.4. Market Trends

- 3.4.1. Food and Beverages to Drive the Indonesia Automation and Control System Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Automation and Control System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Programmable Logic Controller

- 5.1.2. Supervisory Control and Data Acquisition

- 5.1.3. Distributed Control System

- 5.1.4. Human Machine Interface

- 5.1.5. Safety Systems

- 5.1.6. Industrial Robotics

- 5.1.7. Electric

- 5.1.8. Drives (includes AC,DC and Servo)

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil & Gas

- 5.2.2. Power

- 5.2.3. Chemical & Petrochemical

- 5.2.4. Food & Beverage

- 5.2.5. Metals & Mining

- 5.2.6. Water and Wastewater

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yokogawa Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emerson Electric Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rockwell Automation Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT FANUC Indonesia*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Indonesia Automation and Control System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Automation and Control System Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Automation and Control System Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Indonesia Automation and Control System Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Indonesia Automation and Control System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Automation and Control System Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Indonesia Automation and Control System Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Indonesia Automation and Control System Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Automation and Control System Market?

The projected CAGR is approximately 8.59%.

2. Which companies are prominent players in the Indonesia Automation and Control System Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Yokogawa Corporation, Emerson Electric Co, Siemens AG, Schneider Electric Co, Rockwell Automation Inc, PT FANUC Indonesia*List Not Exhaustive.

3. What are the main segments of the Indonesia Automation and Control System Market?

The market segments include Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Flourishing Power Sector and Increased Power Generation Capacities in Indonesia; Evolution and Development of Wireless Protocols and Wireless Sensor Network Technology in Indonesia; Development of Industries and Investments to Increase Capacities.

6. What are the notable trends driving market growth?

Food and Beverages to Drive the Indonesia Automation and Control System Market.

7. Are there any restraints impacting market growth?

High Capital Investments; Fluctuating Commodity Prices and Volatile Economic Scenario.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Automation and Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Automation and Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Automation and Control System Market?

To stay informed about further developments, trends, and reports in the Indonesia Automation and Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence