Key Insights

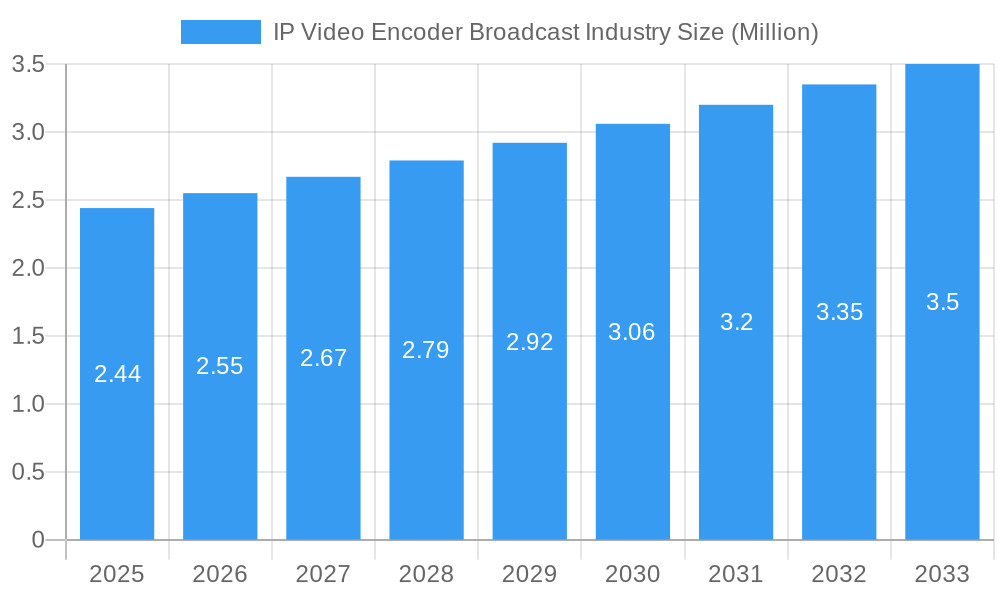

The IP Video Encoder Broadcast Industry is experiencing robust expansion, with a current market size estimated at 2.44 Million and projected to grow at a Compound Annual Growth Rate (CAGR) of 4.60% through 2033. This growth is fueled by a confluence of escalating demand for high-quality video content across diverse platforms and advancements in compression technologies that enable more efficient and cost-effective video delivery. The increasing adoption of IP-based infrastructure within the broadcast sector, driven by its flexibility, scalability, and enhanced workflow capabilities, is a primary catalyst. Furthermore, the proliferation of streaming services, the rise of 4K and 8K content, and the continuous need for reliable video backhauling and distribution solutions are significant contributors to this upward trajectory. The industry is witnessing a paradigm shift towards IP, impacting traditional broadcast workflows and paving the way for new content creation and distribution models.

IP Video Encoder Broadcast Industry Market Size (In Million)

Key growth drivers for the IP Video Encoder Broadcast Industry include the ever-increasing consumer appetite for on-demand and live streaming content, necessitating sophisticated encoding solutions. The transition from traditional broadcast infrastructure to IP-based networks is a fundamental trend, offering greater agility and cost savings for broadcasters. Emerging trends such as the integration of AI and machine learning in video encoding for optimization and content analysis, the growing adoption of cloud-based encoding solutions for enhanced scalability and accessibility, and the demand for ultra-low latency encoding for live event broadcasting are shaping the market landscape. While the industry benefits from these advancements, potential restraints could include the high initial investment costs for IP infrastructure upgrades and the ongoing need for skilled professionals to manage complex IP-based broadcast systems. Nevertheless, the industry's capacity to deliver superior video experiences across various applications, from Pay TV to Digital Terrestrial Television and security, positions it for sustained and significant growth.

IP Video Encoder Broadcast Industry Company Market Share

IP Video Encoder Broadcast Industry Market Dynamics & Structure

The IP Video Encoder Broadcast Industry is characterized by a moderately concentrated market, driven by relentless technological innovation in compression standards like HEVC and AV1, and the increasing demand for high-quality, low-latency video streaming. Regulatory frameworks, particularly those concerning content delivery and digital rights management, play a significant role in shaping market strategies. Competitive product substitutes include traditional broadcast infrastructure and evolving cloud-based encoding solutions. End-user demographics are expanding beyond traditional broadcasters to include content creators, enterprises, and security firms. Merger and acquisition (M&A) trends are evident as larger players seek to consolidate market share and acquire specialized technological expertise.

- Market Concentration: Dominated by a few key players, with a growing number of niche providers offering specialized solutions.

- Technological Innovation: Driven by advancements in video compression codecs, AI-powered encoding, and cloud-native architectures.

- Regulatory Frameworks: Evolving regulations around content delivery standards, latency, and cybersecurity influence product development.

- Competitive Product Substitutes: Cloud encoding services and software-defined video processing offer alternatives to hardware encoders.

- End-User Demographics: Expansion into corporate video, live event streaming, and government applications.

- M&A Trends: Strategic acquisitions to gain access to new technologies and expand product portfolios.

IP Video Encoder Broadcast Industry Growth Trends & Insights

The IP Video Encoder Broadcast Industry is experiencing robust growth, projected to reach xx Million units by 2033, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is fueled by the pervasive adoption of IP-based broadcasting across all segments, from Pay TV to Broadcast and Digital Terrestrial Television (DTT), and an increasing demand for high-definition and ultra-high-definition content delivery. The proliferation of Over-The-Top (OTT) services and the rise of live streaming events have significantly boosted the demand for efficient and scalable video encoding solutions. Technological disruptions, such as the maturation of HEVC and the emergence of AV1, are enabling higher video quality at reduced bitrates, thereby optimizing bandwidth utilization and reducing operational costs for service providers. Consumer behavior shifts towards on-demand content consumption and multi-screen viewing further reinforce the need for flexible and adaptive IP video encoding. The Security and Surveillance segment is also contributing substantially to market growth, with an increasing integration of IP video encoders for real-time monitoring and data analysis. This dynamic landscape presents significant opportunities for innovation and market penetration for companies offering advanced, reliable, and cost-effective IP video encoding solutions. The base year 2025 is estimated to see a market size of xx Million units, serving as a crucial benchmark for future growth projections. The historical period of 2019-2024 has laid the foundation for this accelerated growth, marked by increasing investments in IP infrastructure and digital transformation within the broadcast sector. The forecast period of 2025-2033 is poised to witness transformative advancements and widespread adoption, solidifying the IP Video Encoder Broadcast Industry's pivotal role in the modern media ecosystem.

Dominant Regions, Countries, or Segments in IP Video Encoder Broadcast Industry

The Broadcast and Digital Terrestrial Television (DTT) segment, encompassing Contribution Video Encoders, Backhaul and Distribution Video Encoders, and DTT Video Encoders, is a dominant force driving growth in the IP Video Encoder Broadcast Industry. This dominance stems from the fundamental need for efficient and high-quality video signal transmission within traditional broadcasting workflows, which are increasingly migrating to IP-based infrastructures. The ongoing transition from analog to digital broadcasting globally, coupled with the demand for more channels and higher resolution content (HD and UHD), makes this segment a critical area for IP video encoder deployment.

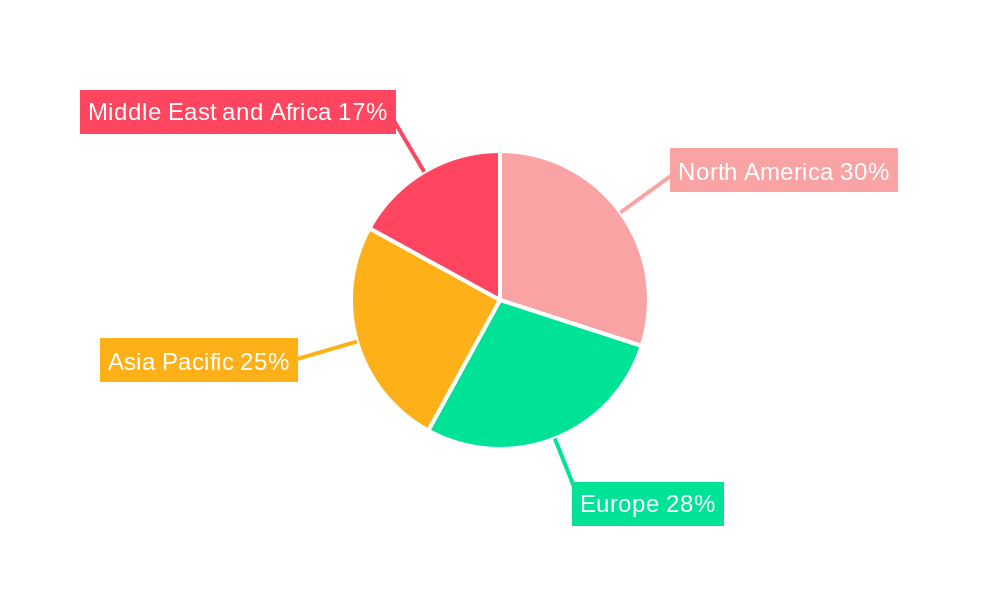

North America and Europe currently lead in market share due to their advanced digital infrastructure, high disposable incomes, and established Pay TV and DTT ecosystems. However, the Asia-Pacific region is emerging as a significant growth engine, driven by rapid digitalization, a burgeoning middle class, and increasing investments in broadcasting technologies, especially in countries like China and India.

Key drivers for the dominance of this segment include:

- Transition to IP Infrastructure: Broadcasters are actively replacing legacy SDI infrastructure with IP-based solutions to enhance flexibility, scalability, and cost-efficiency.

- Demand for High-Quality Content: The consumer appetite for HD, UHD, and HDR content necessitates advanced encoding capabilities to deliver superior viewing experiences.

- Growth of DTT Services: Digital Terrestrial Television remains a primary mode of content delivery in many regions, requiring robust encoding for efficient spectrum utilization.

- Content Contribution and Distribution: The need for reliable, low-latency contribution encoders for live events and high-bandwidth distribution encoders for content syndication fuels demand.

- Technological Advancements: Continuous improvements in compression algorithms (HEVC, AV1) allow for better quality at lower bitrates, making IP encoding more viable.

While Pay TV also represents a substantial market, and Security and Surveillance is a growing application, the foundational role of IP video encoders in the core broadcast chain – from capturing and transporting content to final transmission – solidifies the Broadcast and DTT segment's leading position. The market share within this segment is further dissected by the specific sub-segments: Contribution encoders, vital for live event acquisition, are experiencing rapid adoption due to the proliferation of remote production. Backhaul and Distribution encoders are essential for delivering content to headends and CDN infrastructure. DTT encoders are crucial for terrestrial broadcasters to optimize their spectrum allocation and deliver services to terrestrial receivers. The economic policies supporting digital media development and infrastructure upgrades in these dominant regions are critical enablers of this sustained growth.

IP Video Encoder Broadcast Industry Product Landscape

The IP Video Encoder Broadcast Industry product landscape is characterized by a wave of innovation focused on enhancing efficiency, quality, and flexibility. Manufacturers are pushing the boundaries of video compression technologies, with significant advancements in HEVC (H.265) and the emerging AV1 codec, enabling higher resolutions and improved picture quality at substantially reduced bitrates. This translates to cost savings for broadcasters and better viewing experiences for consumers. Product portfolios now emphasize low-latency encoding for live streaming applications, critical for sports, news, and interactive content. Furthermore, the integration of AI and machine learning is enabling intelligent encoding, optimizing bit allocation based on content complexity and real-time network conditions. Cloud-native and software-defined encoders are gaining traction, offering unparalleled scalability and adaptability for dynamic broadcast environments. The product landscape also features specialized encoders for specific applications, such as contribution, distribution, and terrestrial broadcasting, each tailored with unique performance metrics and feature sets to meet stringent industry demands.

Key Drivers, Barriers & Challenges in IP Video Encoder Broadcast Industry

The IP Video Encoder Broadcast Industry is propelled by several key drivers. The insatiable global demand for high-quality video content across multiple platforms, including OTT, Pay TV, and DTT, is a primary growth catalyst. The ongoing transition to IP-based broadcast infrastructure, offering greater flexibility and scalability, is also a significant driver. Technological advancements in video compression (HEVC, AV1) that enable better quality at lower bitrates are crucial. The proliferation of live streaming events and the increasing adoption of remote production workflows further boost demand for low-latency, efficient encoding solutions.

However, the industry faces several barriers and challenges. High upfront investment costs for advanced IP encoding hardware and infrastructure can be a deterrent for smaller broadcasters. The complexity of integrating new IP-based systems with existing legacy infrastructure poses technical challenges. Cybersecurity threats and the need for robust data protection in IP environments require constant vigilance and investment. Furthermore, the fragmented nature of standards and proprietary solutions can lead to interoperability issues. Supply chain disruptions, as seen in recent global events, can impact hardware availability and lead times, affecting project timelines and costs. Regulatory hurdles related to content distribution and spectrum management also present ongoing challenges.

Emerging Opportunities in IP Video Encoder Broadcast Industry

Emerging opportunities within the IP Video Encoder Broadcast Industry lie in the expanding realm of immersive experiences and personalized content delivery. The growing adoption of 5G technology opens avenues for ultra-low latency streaming and higher bandwidth applications, such as live 4K/8K broadcasting and augmented/virtual reality (AR/VR) content encoding. The increasing demand for user-generated content and live event streaming on social media platforms presents a significant opportunity for more accessible and affordable IP encoder solutions. Furthermore, the integration of AI and machine learning for automated content analysis, dynamic bitrate optimization, and intelligent watermarking offers untapped potential for enhanced encoding capabilities and new service offerings. The rise of cloud-based encoding platforms also presents an opportunity for greater scalability and flexibility, catering to a wider range of users from large broadcasters to independent content creators.

Growth Accelerators in the IP Video Encoder Broadcast Industry Industry

The long-term growth of the IP Video Encoder Broadcast Industry is being accelerated by several transformative factors. The continued global rollout of fiber optic networks and 5G infrastructure is providing the necessary bandwidth and low latency for high-quality IP video transmission, unlocking new possibilities for content delivery. Strategic partnerships between encoder manufacturers, cloud providers, and content delivery networks (CDNs) are creating more integrated and seamless end-to-end solutions, simplifying adoption for broadcasters. Market expansion into emerging economies, where digital transformation in the media sector is rapidly gaining momentum, presents substantial growth potential. Moreover, ongoing research and development into next-generation compression codecs and AI-driven encoding technologies promise to deliver even greater efficiencies and higher quality, further stimulating market demand and innovation.

Key Players Shaping the IP Video Encoder Broadcast Industry Market

- MediaKind

- Harmonic Inc

- Cisco Systems Inc

- ATEME

- Imagine Communications

- Z3 Technology

- Commscope Holding Company Inc

- Telairity (VITEC)

- Axis Communications AB (Canon Inc)

- Adtec Digital

Notable Milestones in IP Video Encoder Broadcast Industry Sector

- April 2024: Ideal Systems, an Asian broadcast systems integrator, announced plans to unveil an innovative software-based encoder at Broadcast Asia. Developed by TotalMedia, this encoder integrates with Ideal Systems' "Alice" platform and Bitmovin for cloud encoding, offering Asian broadcasters a cost-effective and scalable solution.

- November 2023: Matrox Video unveiled the Matrox Maevex 7100 Series, new single-channel 4K60 AVC/HEVC encoders designed for low-latency, high-quality, low-bitrate encoding of single HDMI sources, ideal for streaming, content contribution, and collaborative applications.

In-Depth IP Video Encoder Broadcast Industry Market Outlook

The IP Video Encoder Broadcast Industry is poised for substantial growth, driven by the relentless digital transformation across the media and entertainment landscape. Accelerating factors such as the widespread adoption of IP-based workflows, advancements in compression technologies like HEVC and AV1, and the expansion of 5G networks are creating an ecosystem ripe for innovation and increased demand. The increasing prevalence of high-resolution content (4K/8K), immersive experiences such as AR/VR, and the continuous rise of live streaming events will further necessitate more efficient, scalable, and low-latency encoding solutions. Strategic collaborations, especially in the cloud and CDN space, are simplifying content delivery chains and opening up new market opportunities. The industry's future outlook is characterized by a strong emphasis on AI-driven intelligence in encoding, enhanced cybersecurity, and the development of cost-effective solutions that cater to a diverse range of broadcasters, from large enterprises to independent content creators, ensuring a dynamic and evolving market.

IP Video Encoder Broadcast Industry Segmentation

-

1. Application

-

1.1. Pay TV

- 1.1.1. Cable Video Encoder

- 1.1.2. Satellite Video Encoder

- 1.1.3. IPTV Video Encoder

-

1.2. Broadcast and Digital Terrestrial Television (DTT)

- 1.2.1. Contribution Video Encoder

- 1.2.2. Backhaul and Distribution Video Encoder

- 1.2.3. DTT Video Encoder

- 1.3. Security and Surveillance

-

1.1. Pay TV

IP Video Encoder Broadcast Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Brazil

- 1.4. Mexico

- 1.5. Rest of the Americas

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Poland

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. South Korea

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. United Arab Emirates

- 4.4. Saudi Arabia

- 4.5. South Africa

- 4.6. Rest of Middle East and Africa

IP Video Encoder Broadcast Industry Regional Market Share

Geographic Coverage of IP Video Encoder Broadcast Industry

IP Video Encoder Broadcast Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Video Streaming Platforms; Easy Integration of Hardware Encoders with Video Cameras; Cloud Video Encoding Technology to Drive the Demand

- 3.3. Market Restrains

- 3.3.1. Operational and ROI Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Popularity of Video Streaming Platforms is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IP Video Encoder Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pay TV

- 5.1.1.1. Cable Video Encoder

- 5.1.1.2. Satellite Video Encoder

- 5.1.1.3. IPTV Video Encoder

- 5.1.2. Broadcast and Digital Terrestrial Television (DTT)

- 5.1.2.1. Contribution Video Encoder

- 5.1.2.2. Backhaul and Distribution Video Encoder

- 5.1.2.3. DTT Video Encoder

- 5.1.3. Security and Surveillance

- 5.1.1. Pay TV

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Americas IP Video Encoder Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pay TV

- 6.1.1.1. Cable Video Encoder

- 6.1.1.2. Satellite Video Encoder

- 6.1.1.3. IPTV Video Encoder

- 6.1.2. Broadcast and Digital Terrestrial Television (DTT)

- 6.1.2.1. Contribution Video Encoder

- 6.1.2.2. Backhaul and Distribution Video Encoder

- 6.1.2.3. DTT Video Encoder

- 6.1.3. Security and Surveillance

- 6.1.1. Pay TV

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe IP Video Encoder Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pay TV

- 7.1.1.1. Cable Video Encoder

- 7.1.1.2. Satellite Video Encoder

- 7.1.1.3. IPTV Video Encoder

- 7.1.2. Broadcast and Digital Terrestrial Television (DTT)

- 7.1.2.1. Contribution Video Encoder

- 7.1.2.2. Backhaul and Distribution Video Encoder

- 7.1.2.3. DTT Video Encoder

- 7.1.3. Security and Surveillance

- 7.1.1. Pay TV

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific IP Video Encoder Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pay TV

- 8.1.1.1. Cable Video Encoder

- 8.1.1.2. Satellite Video Encoder

- 8.1.1.3. IPTV Video Encoder

- 8.1.2. Broadcast and Digital Terrestrial Television (DTT)

- 8.1.2.1. Contribution Video Encoder

- 8.1.2.2. Backhaul and Distribution Video Encoder

- 8.1.2.3. DTT Video Encoder

- 8.1.3. Security and Surveillance

- 8.1.1. Pay TV

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa IP Video Encoder Broadcast Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pay TV

- 9.1.1.1. Cable Video Encoder

- 9.1.1.2. Satellite Video Encoder

- 9.1.1.3. IPTV Video Encoder

- 9.1.2. Broadcast and Digital Terrestrial Television (DTT)

- 9.1.2.1. Contribution Video Encoder

- 9.1.2.2. Backhaul and Distribution Video Encoder

- 9.1.2.3. DTT Video Encoder

- 9.1.3. Security and Surveillance

- 9.1.1. Pay TV

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 MediaKind

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Harmonic Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cisco Systems Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ATEME

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Imagine Communications

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Z3 Technology

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Commscope Holding Company Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Telairity (VITEC)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Axis Communications AB (Canon Inc )*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Adtec Digital

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 MediaKind

List of Figures

- Figure 1: Global IP Video Encoder Broadcast Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Americas IP Video Encoder Broadcast Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: Americas IP Video Encoder Broadcast Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Americas IP Video Encoder Broadcast Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Americas IP Video Encoder Broadcast Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe IP Video Encoder Broadcast Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe IP Video Encoder Broadcast Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe IP Video Encoder Broadcast Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe IP Video Encoder Broadcast Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific IP Video Encoder Broadcast Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific IP Video Encoder Broadcast Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific IP Video Encoder Broadcast Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific IP Video Encoder Broadcast Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa IP Video Encoder Broadcast Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Middle East and Africa IP Video Encoder Broadcast Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Middle East and Africa IP Video Encoder Broadcast Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East and Africa IP Video Encoder Broadcast Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Brazil IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Mexico IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of the Americas IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global IP Video Encoder Broadcast Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Turkey IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Israel IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: United Arab Emirates IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Africa IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa IP Video Encoder Broadcast Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IP Video Encoder Broadcast Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the IP Video Encoder Broadcast Industry?

Key companies in the market include MediaKind, Harmonic Inc, Cisco Systems Inc, ATEME, Imagine Communications, Z3 Technology, Commscope Holding Company Inc, Telairity (VITEC), Axis Communications AB (Canon Inc )*List Not Exhaustive, Adtec Digital.

3. What are the main segments of the IP Video Encoder Broadcast Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Video Streaming Platforms; Easy Integration of Hardware Encoders with Video Cameras; Cloud Video Encoding Technology to Drive the Demand.

6. What are the notable trends driving market growth?

Increasing Popularity of Video Streaming Platforms is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Operational and ROI Concerns.

8. Can you provide examples of recent developments in the market?

April 2024: Ideal Systems, an Asian broadcast systems integrator, announced its plans to unveil an innovative software-based encoder at the upcoming Broadcast Asia exhibition in Singapore. Developed by TotalMedia, this encoder is a strategic addition to its suite of video processing tools. Its seamless integration with Ideal Systems' "Alice" platform and Bitmovin for cloud encoding offers Asian broadcasters a cost-effective and scalable solution. This collaboration aims to optimize encoding processes, ensuring compatibility with existing media workflows and flexibility for new ones.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IP Video Encoder Broadcast Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IP Video Encoder Broadcast Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IP Video Encoder Broadcast Industry?

To stay informed about further developments, trends, and reports in the IP Video Encoder Broadcast Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence