Key Insights

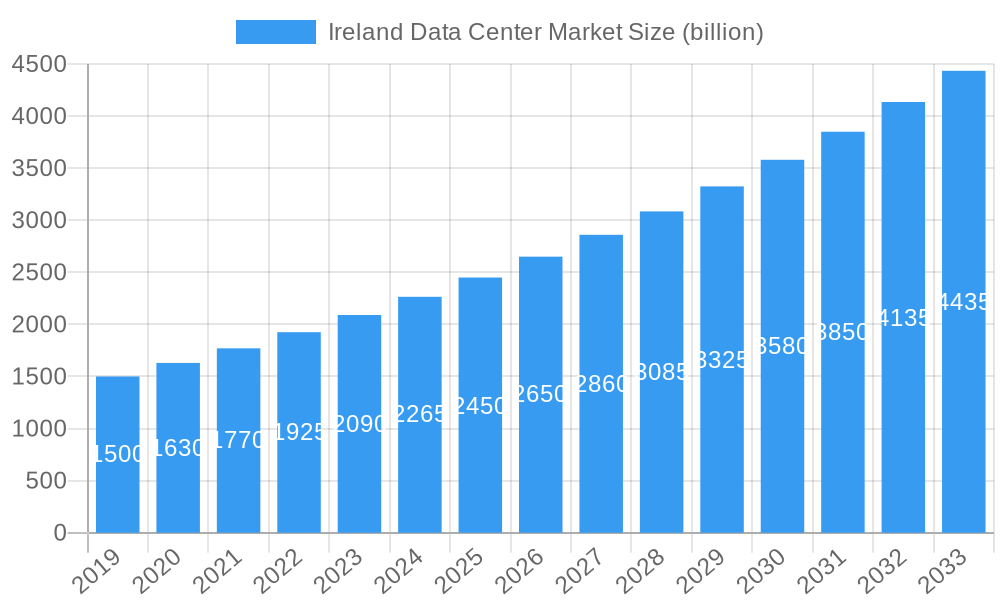

The Ireland Data Center Market is experiencing robust expansion, projected to reach USD 2.54 billion in 2024 and sustain a significant CAGR of 9.79% through 2033. This growth is primarily fueled by the insatiable demand for digital infrastructure driven by cloud computing adoption, the proliferation of data generated by businesses and consumers, and Ireland's strategic position as a gateway to Europe for major tech companies. The increasing adoption of advanced technologies like AI and IoT further necessitates sophisticated data processing and storage capabilities, acting as powerful growth catalysts. Furthermore, the continuous expansion of e-commerce and the burgeoning media and entertainment sectors contribute significantly to this upward trajectory, requiring scalable and reliable data center solutions. The market's dynamism is also evident in the diverse range of data center sizes, from small to mega facilities, and the varying tier classifications, catering to a wide spectrum of operational needs.

Ireland Data Center Market Market Size (In Billion)

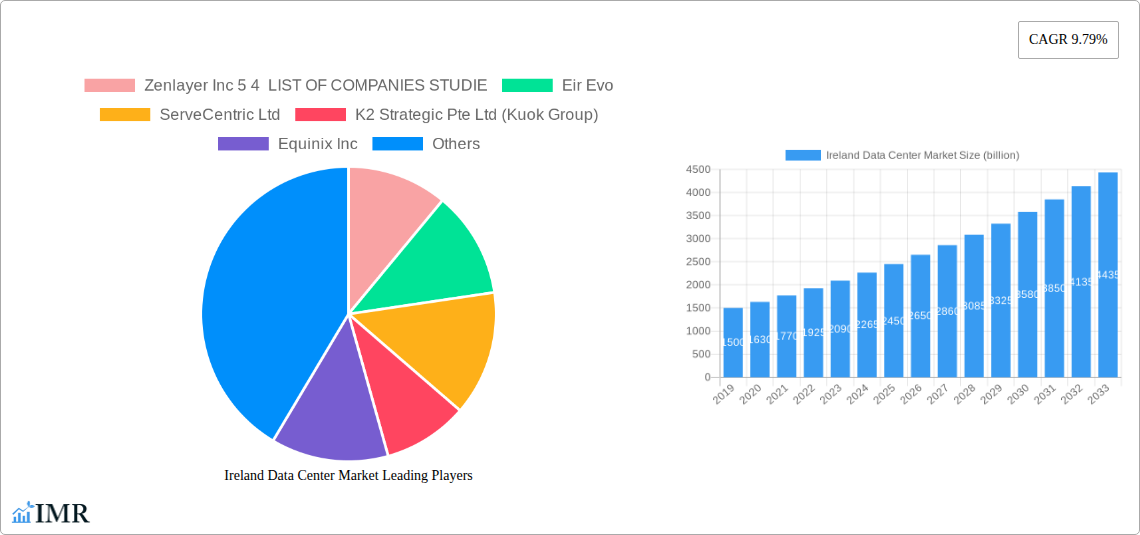

The competitive landscape is characterized by the presence of key global and local players, actively investing in capacity expansion and technological advancements. The demand for colocation services, particularly hyperscale and wholesale, is soaring as businesses increasingly outsource their IT infrastructure to specialized providers. This trend is further amplified by the stringent data privacy regulations and the need for secure, compliant data storage. While the market presents immense opportunities, potential restraints include the escalating operational costs, particularly energy consumption, and the ongoing challenges related to land acquisition and development in prime locations. However, the strong underlying demand, supported by government initiatives and a favorable business environment, suggests a promising outlook for the Ireland Data Center Market, with significant potential for continued growth and innovation in the coming years.

Ireland Data Center Market Company Market Share

Ireland Data Center Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the Ireland data center market, a rapidly expanding sector driven by digital transformation and increasing demand for cloud services, AI, and big data analytics. Covering the study period of 2019–2033, with a base year of 2025, this comprehensive market research delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, notable milestones, and an overall market outlook. We meticulously examine the parent market of European data centers and the specific child market of Ireland, offering critical insights for investors, operators, and technology providers. All values are presented in billion units.

Ireland Data Center Market Market Dynamics & Structure

The Ireland data center market is characterized by a dynamic interplay of robust growth drivers and evolving competitive forces. Market concentration is influenced by the presence of global hyperscale providers and emerging local players, with significant investments flowing into the sector. Technological innovation is a primary driver, fueled by advancements in AI, 5G deployment, and the burgeoning Internet of Things (IoT), necessitating increased compute and storage capabilities. Regulatory frameworks, particularly concerning data privacy and environmental sustainability, are shaping development strategies, encouraging the adoption of greener technologies and efficient cooling systems. Competitive product substitutes, such as edge computing solutions and hybrid cloud models, are emerging, presenting both opportunities and challenges for traditional data center providers. End-user demographics are diversifying, with BFSI, cloud providers, e-commerce, and the telecom sector leading the demand for colocation and hyperscale facilities. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring smaller entities to expand their footprint and service offerings.

- Market Concentration: Dominated by a few hyperscale providers with significant build-outs, but with a growing number of smaller, specialized operators.

- Technological Innovation Drivers: AI, Machine Learning, 5G, IoT, and Big Data analytics are demanding higher density and lower latency solutions.

- Regulatory Frameworks: GDPR compliance and increasing focus on renewable energy sources are influencing operational standards and development.

- Competitive Product Substitutes: Rise of edge data centers and hybrid cloud strategies influencing demand for distributed infrastructure.

- End-User Demographics: Strong growth from cloud service providers, BFSI, and burgeoning e-commerce sectors.

- M&A Trends: Active consolidation with strategic acquisitions by established players to enhance market share and capabilities.

Ireland Data Center Market Growth Trends & Insights

The Ireland data center market is experiencing an unprecedented surge in growth, projected to reach an estimated XX billion by 2033. The market size has seen a consistent upward trajectory from XX billion in 2019 to an estimated XX billion in 2025, showcasing a significant Compound Annual Growth Rate (CAGR). Adoption rates for high-density computing and advanced cooling technologies are rapidly increasing, driven by the insatiable demand from hyperscale cloud providers and enterprises migrating their IT infrastructure. Technological disruptions, including the widespread adoption of AI and the ongoing rollout of 5G networks, are fundamentally reshaping the data center landscape, demanding more power, higher connectivity, and robust security. Consumer behavior shifts, such as the exponential growth in online streaming, e-commerce transactions, and the reliance on cloud-based services for both personal and professional use, are directly contributing to the sustained demand for data center capacity. The market is also witnessing a significant increase in demand for hyperscale colocation, with substantial investments from global cloud giants. This growth is further amplified by Ireland's strategic location and favorable business environment.

Dominant Regions, Countries, or Segments in Ireland Data Center Market

Dublin emerges as the undisputed dominant region within the Ireland data center market, accounting for a substantial majority of the existing and planned capacity. Its strategic advantages, including a well-established digital infrastructure, a skilled workforce, and government incentives, have solidified its position as a prime location for data center development. This dominance is further propelled by the concentration of major colocation providers and hyperscalers establishing their facilities in and around the capital.

- Hotspot: Dublin:

- Dominance Factors: Proximity to major network backbones, availability of renewable energy sources, and a strong ecosystem of technology companies and skilled personnel.

- Market Share: Holds an estimated XX% of the total market capacity and new development projects.

- Growth Potential: Continued expansion of hyperscale campuses and an increasing number of enterprise clients seeking proximity to cloud providers.

Beyond Dublin, the Rest of Ireland is gradually emerging as a secondary growth hub, driven by efforts to diversify data center investments and leverage more affordable land and energy costs. While currently smaller in scale, regions outside the capital are attracting interest for their potential to host specialized facilities and contribute to the overall market expansion.

The data center size segment is heavily influenced by the proliferation of Mega and Massive facilities, primarily catering to hyperscale cloud providers and large enterprises requiring extensive power and space. The demand for these large-scale deployments significantly outpaces that of medium, small, and large data centers, reflecting the industry's trend towards consolidation and centralized computing power.

- Data Center Size:

- Mega & Massive: Leading the market due to hyperscale demand, requiring significant power and connectivity.

- Medium & Large: Catering to enterprise needs and specific hosting requirements.

- Small: Niche applications and specialized edge deployments.

In terms of Tier Type, Tier 3 and Tier 4 facilities are the most sought-after, reflecting the critical need for high availability, redundancy, and fault tolerance in modern data center operations. While Tier 1 and 2 facilities still exist, new investments and upgrades predominantly focus on meeting the stringent reliability standards of Tier 3 and 4.

- Tier Type:

- Tier 3 & 4: Preferred for high availability and critical workloads, driving new investments.

- Tier 1 & 2: Less prevalent in new builds, but may be present in legacy facilities.

The absorption landscape is dominated by Hyperscale colocation, driven by the massive build-outs of global cloud providers. Wholesale colocation also commands a significant share, serving large enterprises and content providers. Retail colocation, while present, represents a smaller segment, catering to smaller businesses and specialized hosting needs.

- Absorption by Colocation Type:

- Hyperscale: Largest segment, fueled by global cloud providers' expansion.

- Wholesale: Significant demand from enterprises and content delivery networks.

- Retail: Niche market catering to smaller businesses and specific hosting requirements.

Analyzing end-user segments, the Cloud sector is the primary driver of data center demand, followed closely by BFSI and Telecom. The increasing reliance on cloud services for computing, storage, and networking makes this sector the largest consumer of data center capacity. The financial sector's need for secure, high-performance infrastructure and the continuous evolution of telecommunications networks further bolster demand. E-Commerce also represents a rapidly growing segment.

- By End User:

- Cloud: Leading segment due to widespread adoption of cloud services.

- BFSI: High demand for secure and reliable data storage and processing.

- Telecom: Essential for network expansion and 5G infrastructure.

- E-Commerce: Growing rapidly with the surge in online retail.

- Government, Manufacturing, Media & Entertainment, Other End User: Significant contributors to demand, each with unique requirements.

Ireland Data Center Market Product Landscape

The product landscape in the Ireland data center market is characterized by a focus on high-density computing solutions, advanced cooling technologies, and robust networking capabilities. Innovations are centered around increasing power efficiency, improving thermal management, and enhancing connectivity speeds to support the growing demands of AI, big data, and IoT applications. Leading providers are offering modular data center designs, liquid cooling systems, and sophisticated power distribution units that minimize energy consumption and maximize performance. Key performance metrics revolve around power usage effectiveness (PUE), latency, uptime, and scalability, with a strong emphasis on meeting stringent sustainability targets through the integration of renewable energy sources and waste heat recovery systems. Unique selling propositions often include a combination of geographic location, competitive pricing, advanced security features, and compliance with international standards.

Key Drivers, Barriers & Challenges in Ireland Data Center Market

The Ireland data center market is propelled by several key drivers, including the escalating demand for cloud computing services, the increasing adoption of AI and big data analytics, and the continuous expansion of digital infrastructure by telecommunications companies. Ireland's attractive corporate tax regime and its position as a gateway to Europe further fuel investment. Technological advancements in server efficiency and cooling technologies also contribute to market growth.

However, significant barriers and challenges exist. The primary constraint is the availability of sufficient power capacity, particularly in certain regions, and the high cost of electricity. Stringent environmental regulations and the need for sustainable energy sources, while positive for the long term, can add complexity and cost to development projects. Supply chain disruptions for critical components and the shortage of skilled labor pose further hurdles. Competitive pressures from established global players and the need for continuous investment in infrastructure to keep pace with technological evolution also present ongoing challenges.

Emerging Opportunities in Ireland Data Center Market

Emerging opportunities in the Ireland data center market lie in the development of specialized edge data centers to support low-latency applications like autonomous vehicles and real-time analytics. The increasing focus on sustainability presents a significant opportunity for data center operators who can leverage renewable energy sources and implement circular economy principles. The growing demand for high-performance computing (HPC) for scientific research and AI training also opens new avenues for growth. Furthermore, the expansion of digital services into underserved regions within Ireland could unlock new markets and investment potential.

Growth Accelerators in the Ireland Data Center Market Industry

Growth accelerators in the Ireland data center market industry are multifaceted, encompassing technological breakthroughs, strategic partnerships, and proactive market expansion strategies. The relentless advancement in processing power and storage density, coupled with the development of more efficient cooling systems, directly fuels demand for colocation space. Strategic partnerships between data center providers, cloud service vendors, and enterprises are crucial for co-creating tailored solutions and expanding service offerings. Furthermore, government initiatives promoting digital infrastructure development and attracting foreign direct investment play a pivotal role in accelerating market expansion, ensuring Ireland remains a competitive and attractive hub for data center operations.

Key Players Shaping the Ireland Data Center Market Market

- Zenlayer Inc

- Eir Evo

- ServeCentric Ltd

- K2 Strategic Pte Ltd (Kuok Group)

- Equinix Inc

- Keppel DC REIT Management Pte Ltd

- BT Communications Limited (BT Group PLC)

- Web World Ireland

- EdgeConneX Inc

- Digital Realty Trust Inc

- CyrusOne Inc

- Sungard Availability Services LP

Notable Milestones in Ireland Data Center Market Sector

- January 2022: A company announced its new construction development in North and South Dublin, expected to be operational in 2023 and 2024 respectively, significantly boosting capacity in key locations.

- September 2019: CyrusOne announced breaking ground for its first data centre campus in Dublin. Located in Grange Castle Business Park South, the first phase of the advanced facility was ready for occupation in Q4 2020. When complete, the site will have a total power of 74MW and is already responding to customer requests for space, demonstrating early commitment and rapid execution.

In-Depth Ireland Data Center Market Market Outlook

The Ireland data center market is poised for sustained and robust growth, driven by an optimistic outlook fueled by ongoing digital transformation and increasing global demand for cloud services. Future market potential is significant, with continued investments expected in hyperscale and enterprise-grade facilities. Strategic opportunities abound for providers focusing on sustainability, energy efficiency, and offering specialized solutions for emerging technologies like AI and edge computing. The market's resilience and adaptability, coupled with Ireland's strong economic fundamentals and supportive regulatory environment, position it for continued expansion and innovation in the coming years.

Ireland Data Center Market Segmentation

-

1. Hotspot

- 1.1. Dublin

- 1.2. Rest of Ireland

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

4.3. By End User

- 4.3.1. BFSI

- 4.3.2. Cloud

- 4.3.3. E-Commerce

- 4.3.4. Government

- 4.3.5. Manufacturing

- 4.3.6. Media & Entertainment

- 4.3.7. Telecom

- 4.3.8. Other End User

Ireland Data Center Market Segmentation By Geography

- 1. Ireland

Ireland Data Center Market Regional Market Share

Geographic Coverage of Ireland Data Center Market

Ireland Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation in the Security Screening Industry

- 3.2.2 Especially to Detect Advanced Threats

- 3.2.3 etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic

- 3.3.2 etc.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ireland Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Dublin

- 5.1.2. Rest of Ireland

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.4.3. By End User

- 5.4.3.1. BFSI

- 5.4.3.2. Cloud

- 5.4.3.3. E-Commerce

- 5.4.3.4. Government

- 5.4.3.5. Manufacturing

- 5.4.3.6. Media & Entertainment

- 5.4.3.7. Telecom

- 5.4.3.8. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Ireland

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zenlayer Inc 5 4 LIST OF COMPANIES STUDIE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eir Evo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ServeCentric Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 K2 Strategic Pte Ltd (Kuok Group)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Equinix Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Keppel DC REIT Management Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BT Communications Limited (BT Group PLC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Web World Ireland

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EdgeConneX Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Digital Realty Trust Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CyrusOne Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sungard Availability Services LP

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Zenlayer Inc 5 4 LIST OF COMPANIES STUDIE

List of Figures

- Figure 1: Ireland Data Center Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Ireland Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Ireland Data Center Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 2: Ireland Data Center Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 3: Ireland Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 4: Ireland Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 5: Ireland Data Center Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Ireland Data Center Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 7: Ireland Data Center Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 8: Ireland Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 9: Ireland Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 10: Ireland Data Center Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ireland Data Center Market?

The projected CAGR is approximately 9.79%.

2. Which companies are prominent players in the Ireland Data Center Market?

Key companies in the market include Zenlayer Inc 5 4 LIST OF COMPANIES STUDIE, Eir Evo, ServeCentric Ltd, K2 Strategic Pte Ltd (Kuok Group), Equinix Inc, Keppel DC REIT Management Pte Ltd, BT Communications Limited (BT Group PLC), Web World Ireland, EdgeConneX Inc, Digital Realty Trust Inc, CyrusOne Inc, Sungard Availability Services LP.

3. What are the main segments of the Ireland Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Security Screening Industry. Especially to Detect Advanced Threats. etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic. etc.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2022: The company announced its new construction development in North and South Dublin which is expected to be operational in 2023 and 2024 respectively.September 2019: CyrusOne announced breaking ground for its first data centre campus in Dublin. Located in Grange Castle Business Park South, the first phase of the advanced facility was ready for occupation in Q4 2020. When complete the site will have a total power of 74MW and is already responding to customer requests for space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ireland Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ireland Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ireland Data Center Market?

To stay informed about further developments, trends, and reports in the Ireland Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence