Key Insights

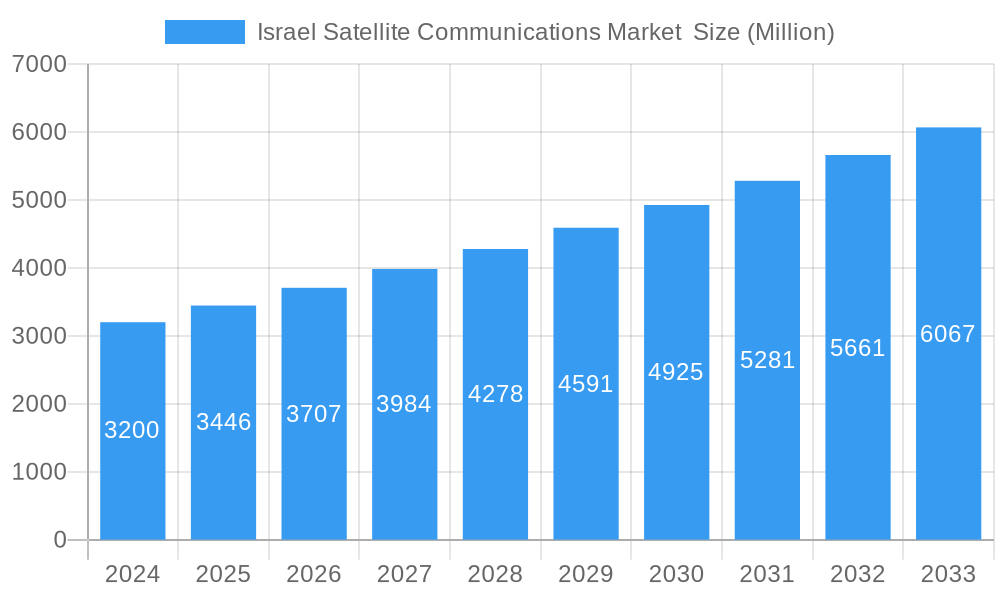

The Israel satellite communications market is poised for significant expansion, projected to reach an estimated USD 3.2 billion in 2024. This growth is fueled by a robust CAGR of 7.6% throughout the forecast period of 2025-2033. Several key drivers are propelling this upward trajectory. The increasing demand for reliable and ubiquitous connectivity, particularly in sectors like defense and government for secure communication, and maritime for operational efficiency, is a primary catalyst. The rise of enterprises seeking enhanced data transmission capabilities and the burgeoning media and entertainment industry's need for high-bandwidth solutions further bolster market adoption. Furthermore, advancements in satellite technology, including the proliferation of small satellites and the development of sophisticated ground equipment and services, are making satellite communications more accessible and cost-effective. Trends such as the adoption of LEO (Low Earth Orbit) constellations for lower latency and higher throughput, coupled with the growing integration of satellite technology with terrestrial networks, are creating new opportunities.

Israel Satellite Communications Market Market Size (In Billion)

Despite the promising outlook, certain restraints could temper rapid growth. High initial investment costs for satellite infrastructure, the complexity of regulatory frameworks in some instances, and the increasing competition from other advanced connectivity solutions like 5G present challenges. However, the inherent advantages of satellite communications, such as its ability to provide coverage in remote and underserved areas where terrestrial infrastructure is non-existent or impractical, remain a strong competitive edge. The market is segmented across various types, including ground equipment and services, and platforms such as portable, land, maritime, and airborne. The end-user verticals are diverse, with maritime, defense and government, enterprises, and media and entertainment being prominent. Leading companies like Iridium Communications Inc., SES S.A., and ViaSat Inc. are actively shaping the market landscape, with significant contributions expected from players focused on quantum communication and advanced satellite networks.

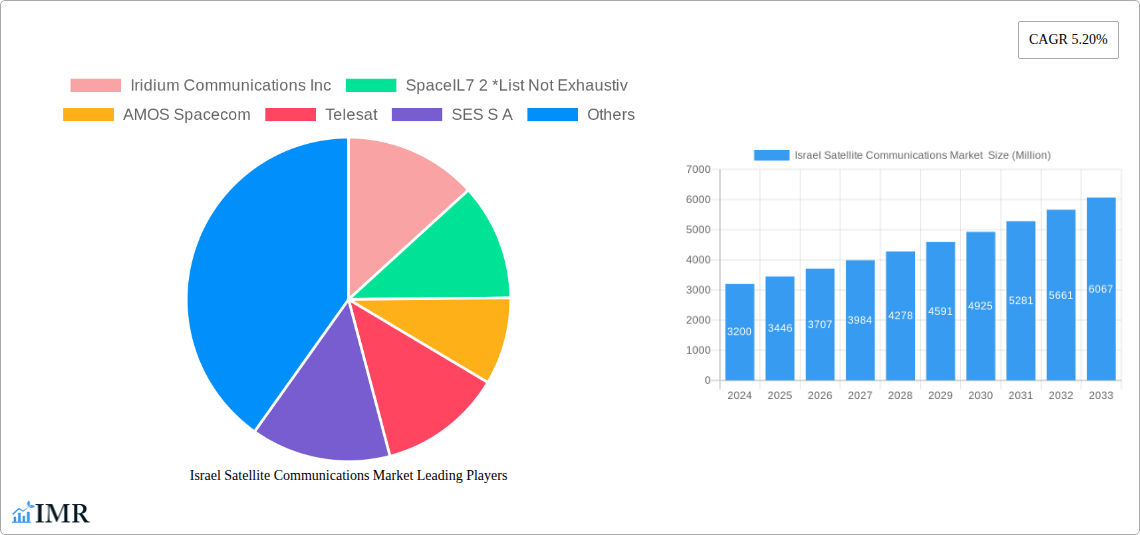

Israel Satellite Communications Market Company Market Share

Israel Satellite Communications Market: Comprehensive Market Insights and Growth Projections (2019-2033)

This in-depth report provides an exhaustive analysis of the Israel satellite communications market, offering critical insights into its structure, dynamics, growth trends, and future outlook. Covering the historical period of 2019-2024, base year of 2025, and a comprehensive forecast period of 2025-2033, this study is an essential resource for industry stakeholders. We delve into the parent and child markets, examining segments such as Ground Equipment, Services, and Platforms including Portable, Land, Maritime, and Airborne. Our analysis also scrutinizes end-user verticals like Maritime, Defense and Government, Enterprises, Media and Entertainment, and Other End-User Verticals. Quantified with data in billions, this report equips you with actionable intelligence to navigate this evolving landscape.

Israel Satellite Communications Market Market Dynamics & Structure

The Israel satellite communications market is characterized by a dynamic interplay of technological innovation, strategic partnerships, and evolving regulatory landscapes. Market concentration is influenced by established players and emerging innovators, with a constant drive for higher bandwidth and lower latency solutions. Technological innovation is a paramount driver, fueled by advancements in satellite technology, antenna design, and ground segment equipment. The burgeoning demand for quantum communication and optical satellite channels, as highlighted by TAU's initiatives, signifies a future shift. Regulatory frameworks, while supportive of technological advancement, also play a crucial role in shaping market entry and operational parameters. Competitive product substitutes, including terrestrial networks, necessitate continuous innovation in satellite service offerings to maintain market share. End-user demographics are diverse, with significant demand from the defense and government sectors, alongside growing adoption in maritime, enterprise, and media sectors. Mergers and acquisitions (M&A) trends, though perhaps not at a high volume, are strategic moves by companies to consolidate capabilities and expand market reach. The presence of companies like Iridium Communications Inc., AMOS Spacecom, and Gilat Satellite Networks Ltd. underscores the competitive intensity.

- Market Concentration: Moderately concentrated with key players dominating specific niches and services.

- Technological Innovation Drivers: Demand for high-throughput satellite (HTS) solutions, miniaturization of satellite components, advancements in digital IF/RF interoperability, and the exploration of quantum and optical communication.

- Regulatory Frameworks: Supportive of R&D and new ventures, with specific regulations governing satellite operations and spectrum allocation.

- Competitive Product Substitutes: Advancements in 5G and fiber optics present competition, driving the need for differentiated satellite offerings like specialized connectivity for remote areas and robust defense applications.

- End-User Demographics: Strong reliance from Defense and Government for secure and reliable communication, increasing interest from Maritime for connectivity and operational efficiency, and growing enterprise adoption for business continuity and remote site connectivity.

- M&A Trends: Strategic acquisitions focused on expanding service portfolios, acquiring niche technologies, or gaining market access.

Israel Satellite Communications Market Growth Trends & Insights

The Israel satellite communications market is poised for significant expansion, driven by an insatiable demand for ubiquitous and high-performance connectivity across various sectors. The market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, escalating from an estimated $xx billion in 2025 to over $xx billion by 2033. Adoption rates are accelerating, particularly in segments requiring resilient and wide-area communication capabilities. Technological disruptions, such as the advent of software-defined satellites and advanced antenna technologies, are fundamentally reshaping service delivery and enabling new applications. Consumer behavior shifts, influenced by an increasing reliance on digital services and the need for connectivity in remote or underserved regions, are further propelling market growth. The integration of satellite communications with other technologies, like AI and IoT, is unlocking novel use cases and driving demand for integrated solutions. The market's trajectory is also shaped by national strategic initiatives focusing on space exploration and communication sovereignty.

The growth in the ground equipment segment is intrinsically linked to the deployment of new satellite constellations and the upgrade of existing infrastructure. As satellite technology advances, there is a continuous need for more sophisticated ground stations, user terminals, and modems capable of handling higher data rates and advanced modulation schemes. This segment is projected to contribute significantly to the overall market value, with an estimated market size of $xx billion in 2025, growing at a CAGR of xx% to reach $xx billion by 2033.

The satellite services segment encompasses a wide array of offerings, including broadband internet, voice communications, data transmission, and specialized solutions for broadcasting, navigation, and Earth observation. This segment is expected to be the largest contributor to the market, valued at $xx billion in 2025 and forecasted to reach $xx billion by 2033, with a CAGR of xx%. The increasing demand for high-throughput satellite (HTS) services, particularly for enterprise and government applications, is a key growth driver.

Within the platform segments, Land-based solutions are anticipated to see robust growth due to the widespread need for reliable communication in remote industrial sites, disaster relief efforts, and rural connectivity projects. The Maritime sector is a crucial area, with increasing demand for onboard connectivity for crew welfare, operational efficiency, and autonomous shipping applications. The Airborne segment is also expanding, driven by the need for in-flight connectivity (IFC) for commercial airlines and secure communication for defense and surveillance aircraft. The Portable segment, encompassing satellite phones and small terminals, will continue to cater to emergency services, remote exploration, and individual connectivity needs.

Dominant Regions, Countries, or Segments in Israel Satellite Communications Market

The Defense and Government end-user vertical is currently the dominant force driving growth within the Israel satellite communications market. This dominance stems from the strategic importance of secure, reliable, and resilient communication for national security, defense operations, intelligence gathering, and emergency response. Israel's unique geopolitical landscape necessitates advanced satellite communication capabilities for border monitoring, tactical operations, and maintaining connectivity in challenging environments. The government's commitment to investing in cutting-edge defense technologies, including satellite-based surveillance and communication systems, directly fuels the demand for sophisticated satellite solutions. This vertical is projected to account for a substantial market share, estimated at xx% in 2025, with continued strong growth driven by ongoing defense modernization programs and the adoption of new technologies.

- Defense and Government:

- Key Drivers: National security mandates, advanced defense modernization, need for secure and resilient communication, intelligence, surveillance, and reconnaissance (ISR) applications, border protection, and crisis management.

- Market Share: Estimated at xx% in 2025, with a projected CAGR of xx%.

- Growth Potential: High, with continuous investment in advanced satellite capabilities.

The Maritime segment is emerging as another significant growth driver. With the expansion of maritime trade and the increasing digitalization of shipping operations, the demand for reliable connectivity at sea is soaring. This includes applications such as vessel tracking, crew welfare, real-time operational data transmission, and the enablement of smart shipping initiatives. The Israeli maritime industry, with its significant ports and naval activities, contributes to this demand.

- Maritime:

- Key Drivers: Growth in global trade, increasing need for vessel connectivity for operational efficiency and crew welfare, smart shipping initiatives, and regulatory compliance for communication at sea.

- Market Share: Estimated at xx% in 2025, with a projected CAGR of xx%.

- Growth Potential: Strong, driven by technological advancements and increasing adoption of connected vessel solutions.

The Ground Equipment segment plays a pivotal role in enabling the deployment and utilization of satellite services. This includes the development and manufacturing of advanced satellite antennas, modems, terminals, and other ground infrastructure. Israel's prowess in technological innovation, particularly in electronics and telecommunications, positions it as a key player in this segment, contributing to the overall market growth.

- Ground Equipment:

- Key Drivers: Demand for higher throughput terminals, advanced antenna technologies (e.g., phased array), interoperability standards, and the need for robust and reliable ground infrastructure.

- Market Share: Estimated at xx% in 2025, with a projected CAGR of xx%.

- Growth Potential: Steady, driven by advancements in satellite technology and increasing service demand.

The Services segment, encompassing broadband, voice, and specialized data transmission, is the largest contributor to the market in terms of revenue. The increasing demand for high-speed internet access in remote areas, coupled with the need for specialized communication solutions for media broadcasting and enterprise operations, fuels the growth of this segment.

- Services:

- Key Drivers: Increasing demand for broadband connectivity, enterprise solutions, media broadcasting needs, and the evolution of satellite as a key enabler of digital transformation.

- Market Share: Estimated at xx% in 2025, with a projected CAGR of xx%.

- Growth Potential: Significant, as satellite services become more integrated with terrestrial networks and offer enhanced capabilities.

Israel Satellite Communications Market Product Landscape

The product landscape of the Israel satellite communications market is marked by continuous innovation focused on enhancing performance, reducing size and cost, and expanding capabilities. Key product innovations include the development of advanced High Throughput Satellite (HTS) terminals capable of delivering gigabit speeds, sophisticated software-defined satellite payloads for flexible mission operations, and compact, power-efficient ground equipment. Unique selling propositions often lie in the resilience and reliability of communication solutions, particularly for defense and maritime applications. Technological advancements are pushing the boundaries in antenna design, with a growing emphasis on electronically steered phased array antennas offering rapid beam steering and multi-beam capabilities. The emerging interest in quantum communication, with initiatives like TAU-SAT3, signals a future where quantum-based satellite channels will offer unparalleled security and advanced networking possibilities. These innovations are crucial for meeting the growing demand for data-intensive applications and secure communication networks.

Key Drivers, Barriers & Challenges in Israel Satellite Communications Market

Key Drivers:

- Technological Advancements: Continuous innovation in satellite technology, including HTS, small satellites (smallsats), and software-defined payloads, is expanding capabilities and reducing costs.

- Growing Demand for Connectivity: Increasing need for reliable broadband internet and data services in underserved regions, maritime environments, and for enterprise continuity.

- Defense and Government Requirements: Strong demand from defense and government sectors for secure, resilient, and wide-area communication for national security and strategic operations.

- Space Industry Investment: Government and private sector investments in space exploration and satellite technology foster innovation and market growth.

- Emerging Applications: Growth in IoT, AI integration with satellite data, and the development of new satellite-based services create new revenue streams.

Barriers & Challenges:

- High Initial Investment Costs: The development and deployment of satellite constellations and ground infrastructure require significant capital investment.

- Regulatory Hurdles: Complex and evolving regulatory frameworks for spectrum allocation, licensing, and orbital debris management can pose challenges.

- Competition from Terrestrial Networks: Advancements in 5G and fiber optics offer competitive alternatives for certain applications, requiring satellite solutions to differentiate.

- Supply Chain Disruptions: Geopolitical events and manufacturing complexities can impact the availability of critical components for satellite production and deployment.

- Skilled Workforce Shortage: A demand for specialized expertise in satellite engineering, operations, and data analytics can pose a challenge for rapid growth.

Emerging Opportunities in Israel Satellite Communications Market

The Israel satellite communications market presents a fertile ground for emerging opportunities, driven by evolving technological landscapes and expanding application areas. The burgeoning field of Quantum Communication represents a significant frontier, with the potential to revolutionize secure data transmission. Initiatives exploring quantum-based satellite channels promise ultra-secure communication, opening doors for high-value government and enterprise applications. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) with satellite data analytics is creating opportunities for enhanced decision-making, predictive maintenance, and optimized network performance. The growing demand for Internet of Things (IoT) connectivity in remote and industrial sectors, such as agriculture, energy, and logistics, offers a substantial market for specialized satellite IoT solutions. The development of more affordable and agile Small Satellite (Smallsat) constellations for specific applications, like Earth observation and dedicated communication networks, also presents significant growth potential.

Growth Accelerators in the Israel Satellite Communications Market Industry

Several catalysts are accelerating the long-term growth of the Israel satellite communications market. Technological breakthroughs in areas such as digital intermediate frequency (IF/RF) interoperability, as demonstrated by Gilat Satellite Networks, are paving the way for a more digital and interconnected space industry, enabling greater flexibility and efficiency. Strategic partnerships between satellite operators, technology providers, and end-users are crucial for developing tailored solutions and expanding market reach. The increasing adoption of software-defined satellites allows for greater agility and adaptability in orbit, enabling operators to reconfigure services and respond to changing market demands. Furthermore, growing government support for space exploration and indigenous satellite capabilities acts as a significant accelerator, fostering innovation and domestic industry development. The ongoing advancements in miniaturization and cost reduction for satellite components also contribute to the market's expansion by making satellite solutions more accessible to a wider range of users.

Key Players Shaping the Israel Satellite Communications Market Market

- Iridium Communications Inc.

- SpaceIL

- AMOS Spacecom

- Telesat

- SES S.A.

- Gilat Satellite Networks

- Inmarsat Global Limited

- Orbit Communication Systems Ltd

- ViaSat Inc.

Notable Milestones in Israel Satellite Communications Market Sector

- March 2023: Gilat Satellite Networks Ltd. announced the successful completion of a proof of concept (PoC) for transforming analog signals to digital signals using digital intermediate frequency interoperability. The standard paves the way for the space industry's digital revolution by enabling interoperability at the IF/RF layer.

- January 2023: TAU is leading Israel's initiative to develop optical and quantum-based satellite communication channels. This satellite will travel into space in order to execute long-distance quantum communication across hundreds of kilometers or more. TAU-SAT3 is intended to prepare the path for the eventual construction at TAU of a quantum nanosatellite that will demonstrate quantum communication.

In-Depth Israel Satellite Communications Market Market Outlook

The Israel satellite communications market is projected to experience robust growth, propelled by strong technological innovation and strategic investments. The ongoing development of quantum and optical communication channels signifies a paradigm shift towards highly secure and advanced data transmission, offering immense future potential. The successful implementation of digital IF/RF interoperability by Gilat Satellite Networks further underscores the industry's move towards more flexible and efficient satellite operations. Growth accelerators, including continued government support for space initiatives and the increasing demand for resilient connectivity across defense, maritime, and enterprise sectors, will fuel market expansion. Strategic partnerships and the development of next-generation satellite technologies will be crucial in capitalizing on emerging opportunities in areas like IoT and AI-driven satellite services, solidifying Israel's position as a significant player in the global satellite communications arena.

Israel Satellite Communications Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborn3

-

3. End-User Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-User Verticals

Israel Satellite Communications Market Segmentation By Geography

- 1. Israel

Israel Satellite Communications Market Regional Market Share

Geographic Coverage of Israel Satellite Communications Market

Israel Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Satellite Communication in Security and Defence; Technological Advancement in Various Industries

- 3.3. Market Restrains

- 3.3.1. Regulatory and Licensing Requirements; Cybersecurity Threats to Satellite Communication

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Satellite Communication in Security and Defense

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborn3

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-User Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iridium Communications Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SpaceIL7 2 *List Not Exhaustiv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AMOS Spacecom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Telesat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SES S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gilat Satellite Networks

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Quantum communication

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Inmarsat global limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orbit Communication Systems Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ViaSat Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Iridium Communications Inc

List of Figures

- Figure 1: Israel Satellite Communications Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Israel Satellite Communications Market Share (%) by Company 2025

List of Tables

- Table 1: Israel Satellite Communications Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Israel Satellite Communications Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 3: Israel Satellite Communications Market Revenue undefined Forecast, by End-User Vertical 2020 & 2033

- Table 4: Israel Satellite Communications Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Israel Satellite Communications Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Israel Satellite Communications Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 7: Israel Satellite Communications Market Revenue undefined Forecast, by End-User Vertical 2020 & 2033

- Table 8: Israel Satellite Communications Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Satellite Communications Market ?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Israel Satellite Communications Market ?

Key companies in the market include Iridium Communications Inc, SpaceIL7 2 *List Not Exhaustiv, AMOS Spacecom, Telesat, SES S A, Gilat Satellite Networks, Quantum communication, Inmarsat global limited, Orbit Communication Systems Ltd, ViaSat Inc.

3. What are the main segments of the Israel Satellite Communications Market ?

The market segments include Type, Platform, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Satellite Communication in Security and Defence; Technological Advancement in Various Industries.

6. What are the notable trends driving market growth?

Increasing Demand of Satellite Communication in Security and Defense.

7. Are there any restraints impacting market growth?

Regulatory and Licensing Requirements; Cybersecurity Threats to Satellite Communication.

8. Can you provide examples of recent developments in the market?

March 2023: Gilat Satellite Networks Ltd. announced the successful completion of a proof of concept (PoC) for transforming analog signals to digital signals using digital intermediate frequency interoperability. The standard paves the way for the space industry's digital revolution by enabling interoperability at the IF/RF layer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Satellite Communications Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Satellite Communications Market ?

To stay informed about further developments, trends, and reports in the Israel Satellite Communications Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence