Key Insights

The global IT Device Market is projected to expand significantly, reaching an estimated $21.1 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 13.2% through 2033. This growth is primarily propelled by escalating demand for advanced personal computing devices and the pervasive integration of smartphones into daily life. Key drivers include continuous innovation in PC technology, a rising preference for high-performance, lightweight laptops, and the enduring utility of desktops for professional and gaming applications. The smartphone sector, encompassing both feature phones and advanced models, remains a crucial growth engine, fueled by increasing mobile technology adoption in emerging economies and the rapid evolution of mobile applications and services. The widespread adoption of remote and hybrid work models further intensifies the demand for dependable and efficient IT devices across all categories.

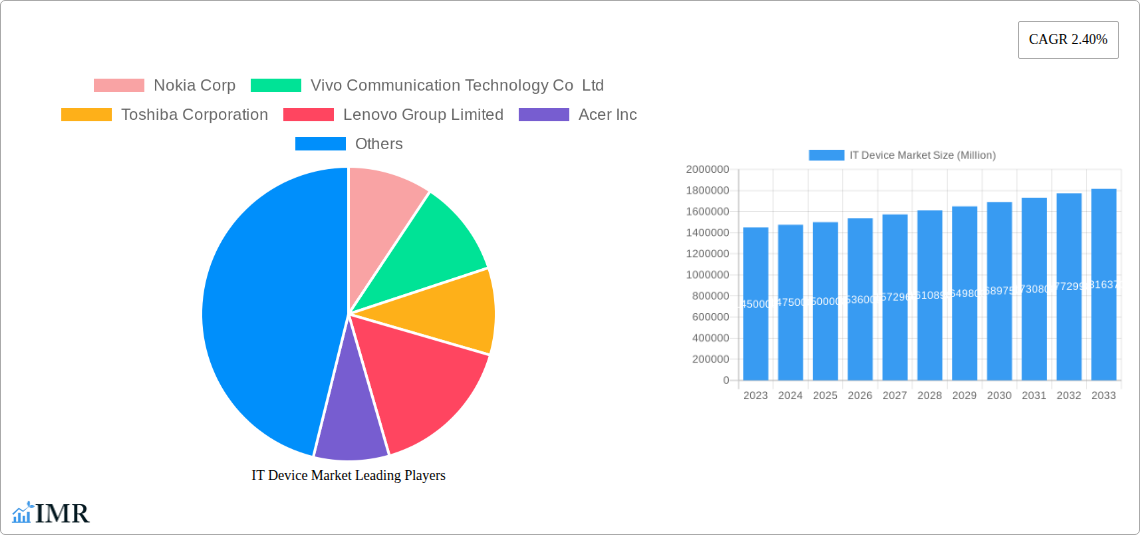

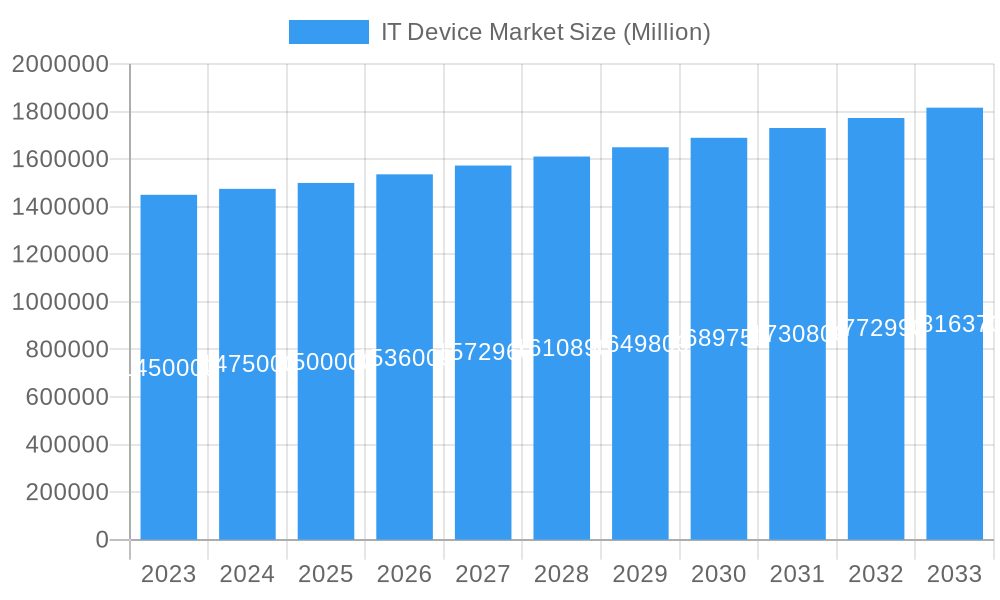

IT Device Market Market Size (In Billion)

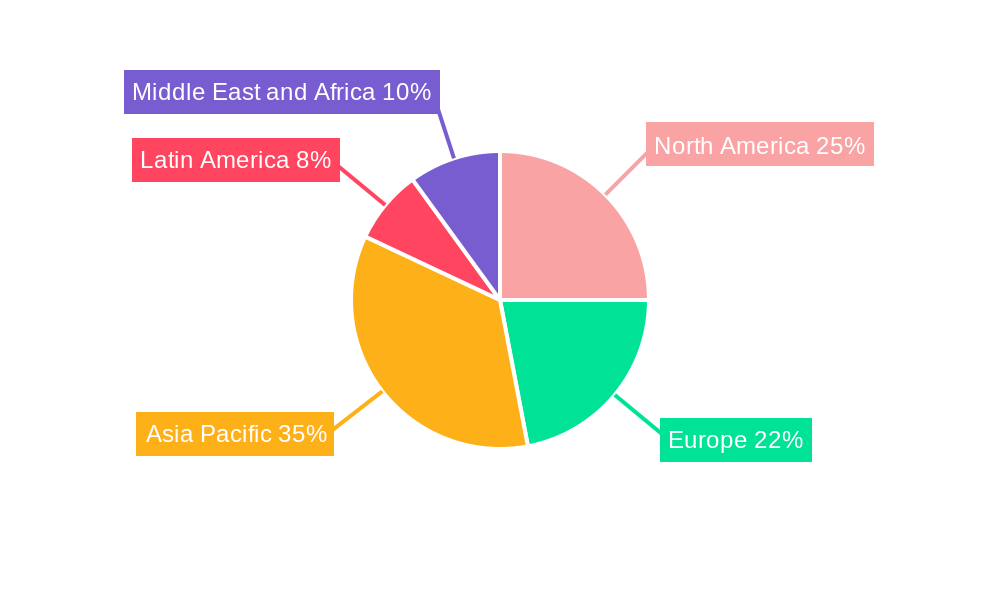

Market dynamics are further shaped by the growing emphasis on sustainable manufacturing, the integration of AI and ML into devices, and the burgeoning demand for specialized gaming and creator PCs. Potential growth constraints include supply chain volatilities, fluctuating raw material costs, and market saturation in developed regions. The competitive landscape is characterized by major players such as Samsung Electronics, Apple, and Lenovo, alongside emerging brands like Realme and Honor, all actively pursuing market share through product innovation, competitive pricing, and strategic expansion. The Asia Pacific region is anticipated to maintain its leading position due to its extensive consumer base and rapid technological adoption.

IT Device Market Company Market Share

IT Device Market Analysis Report: Navigating the Evolving Landscape of PCs, Smartphones, and Beyond (2019-2033)

This comprehensive IT Device Market report delves into the dynamic global market for personal computers, mobile phones, and tablets, providing an in-depth analysis from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study meticulously examines market size, growth trajectories, key drivers, emerging opportunities, and the competitive landscape. We explore parent and child market segments, offering granular insights into the evolution of PCs (Laptops, Desktop PCs, Tablets) and Phones (Landline Phones, Smartphones, Feature Phones). This report is an essential resource for industry stakeholders, including manufacturers, suppliers, investors, and policymakers, seeking to understand and capitalize on the rapidly transforming IT device ecosystem.

IT Device Market Market Dynamics & Structure

The global IT Device Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, particularly in the smartphone and premium PC segments. Technological innovation serves as a primary driver, with rapid advancements in processing power, display technology, connectivity (5G), and AI integration continuously reshaping product offerings and consumer expectations. Regulatory frameworks, primarily concerning data privacy, cybersecurity, and environmental standards, are increasingly influencing product development and market access. Competitive product substitutes are abundant, especially within the PC segment where the lines between laptops, tablets, and even smartphones blur with the advent of 2-in-1 devices and advanced mobile computing capabilities. End-user demographics exhibit a growing demand for personalized, portable, and powerful devices across all age groups, fueled by remote work trends and digital entertainment consumption. Mergers and acquisitions (M&A) are an ongoing trend, with companies seeking to expand their product portfolios, gain access to new technologies, and consolidate market positions. For instance, Xiaomi Corporation and Realme Mobile Telecommunications Corp Ltd have significantly impacted the smartphone market through aggressive market penetration and competitive pricing strategies.

- Market Concentration: Dominated by major players like Samsung Electronics Co Ltd, Apple Inc, and Lenovo Group Limited, with significant presence from Xiaomi Corporation, Dell Inc, and HP Inc.

- Technological Innovation Drivers: Miniaturization, AI and machine learning integration, enhanced battery technology, foldable displays, and advanced camera systems.

- Regulatory Frameworks: GDPR, CCPA, and evolving cybersecurity mandates influencing device design and data handling.

- Competitive Product Substitutes: Proliferation of hybrid devices blurring segment lines; cloud-based computing offering alternatives to high-end hardware for specific tasks.

- End-User Demographics: Increasing adoption among emerging economies, demand for sustainable and eco-friendly devices, and a growing preference for integrated ecosystems.

- M&A Trends: Strategic acquisitions focused on chip manufacturing, AI software, and emerging technologies like augmented reality (AR) and virtual reality (VR). The LG Corporation's divestment from its smartphone business marked a significant market shift.

IT Device Market Growth Trends & Insights

The IT Device Market is poised for robust growth driven by sustained demand across both consumer and enterprise sectors, alongside continuous technological evolution. Over the historical period (2019-2024), the market witnessed significant shifts, with the pandemic accelerating the adoption of PCs and tablets for remote work and education. The estimated year (2025) sees a continued upward trajectory, with global shipments projected to reach 3,500 million units. The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of approximately 5.8%, fueled by innovation in smartphones, the resurgence of desktop PCs in professional settings, and the growing popularity of specialized computing devices.

The market size evolution is a testament to the indispensable nature of these devices in modern life. Smartphone penetration continues to be a primary growth engine, especially in developing regions, with brands like Vivo Communication Technology Co Ltd and Honor Technology Inc aggressively expanding their market share. Adoption rates for laptops and tablets remain high, driven by hybrid work models and the demand for flexible computing solutions. Technological disruptions, such as the widespread adoption of 5G connectivity and the increasing integration of AI capabilities into everyday devices, are creating new product categories and enhancing user experiences. Consumer behavior shifts are evident, with a growing emphasis on sustainability, personalized user experiences, and seamless integration across multiple devices within a brand's ecosystem. The premiumization trend continues, with consumers willing to invest in high-performance devices offering advanced features and superior build quality, benefiting companies like Apple Inc and Samsung Electronics Co Ltd.

Furthermore, the growing demand for gaming devices, as exemplified by Razer Inc, and specialized professional workstations from manufacturers like Dell Inc and Toshiba Corporation are contributing to market diversification. The increasing digitalization of industries, from healthcare to finance, is also driving the demand for robust and secure IT devices, presenting opportunities for companies like Microsoft Corporation with its Surface line.

Dominant Regions, Countries, or Segments in IT Device Market

The smartphones segment is the undisputed dominant force within the global IT Device Market, consistently driving volume and revenue. Its pervasive reach across all demographics and geographies makes it the primary growth engine.

Key Drivers for Smartphone Dominance:

- Ubiquitous Connectivity: Essential for communication, information access, entertainment, and commerce, particularly with the widespread rollout of 5G networks globally.

- Affordability and Accessibility: The availability of feature phones and budget-friendly smartphones makes them accessible to a vast population in emerging economies, significantly boosting unit sales. Xiaomi Corporation and Realme Mobile Telecommunications Corp Ltd are key players in this segment.

- Innovation and Feature Richness: Continuous advancements in camera technology, processing power, battery life, and display quality keep consumer interest high and encourage upgrade cycles.

- Ecosystem Integration: Brands like Apple Inc and Samsung Electronics Co Ltd leverage their integrated ecosystems of devices, software, and services to foster customer loyalty and drive sales.

- Digitalization of Services: The reliance on smartphones for mobile banking, e-commerce, social media, and digital entertainment further solidifies their position.

While smartphones lead in volume, the PCs segment, particularly laptops, is experiencing a significant resurgence and demonstrates robust growth potential, especially in the professional and educational spheres.

Key Drivers for PC Growth:

- Hybrid Work and Remote Learning: The enduring shift towards flexible work and educational models necessitates powerful and portable computing devices.

- Productivity and Performance Demands: Professionals and creatives require robust processing power and multitasking capabilities offered by laptops and desktop PCs.

- Gaming and Content Creation: The burgeoning gaming market and the rise of content creators are driving demand for high-performance gaming laptops and workstations from companies like ASUSTek Computer Inc, Micro-Star International Co, and Dell Inc.

- Technological Advancements: Introduction of powerful new processors, improved graphics capabilities, and innovative form factors like foldable laptops (e.g., Lenovo Group Limited's ThinkPad X1 Fold) are attracting consumers.

- Enterprise Upgrades: Businesses are investing in modernizing their IT infrastructure, leading to increased demand for corporate laptops and desktops.

Regional Dominance:

Asia-Pacific is the largest and fastest-growing region for IT devices, driven by its massive population, increasing disposable incomes, and rapid digitalization. China, India, and Southeast Asian countries are significant markets for both smartphones and PCs. North America and Europe remain mature markets with a strong demand for premium devices and advanced technologies.

IT Device Market Product Landscape

The IT Device Market is defined by a constant stream of product innovations aimed at enhancing performance, portability, and user experience. Smartphones continue to push boundaries with advanced camera systems, foldable displays, and powerful AI capabilities. Laptops are evolving with thinner and lighter designs, longer battery life, and more powerful processors, catering to both professionals and consumers. Tablets offer a versatile computing experience, bridging the gap between smartphones and laptops, with an increasing focus on stylus support for productivity. Gaming devices are becoming more sophisticated, offering high refresh rates, advanced cooling solutions, and immersive audio. Unique selling propositions often lie in the integration of proprietary AI, optimized operating systems, and robust build quality, as seen with Apple Inc's iPhone and MacBook lines.

Key Drivers, Barriers & Challenges in IT Device Market

Key Drivers:

- Technological Advancements: Continuous innovation in processors, connectivity (5G), display technology, and AI integration.

- Growing Demand for Mobility and Connectivity: Essential for personal and professional life.

- Digital Transformation: Increasing reliance on IT devices across all industries for productivity and operations.

- Emerging Economies: Rising disposable incomes and increased internet penetration in developing nations.

- Replacement Cycles: Consumers upgrading devices for better performance, features, and aesthetics.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical factors, component shortages, and logistics issues can impact production and availability.

- Economic Slowdowns and Inflation: Reduced consumer spending power can dampen demand.

- Increasing Competition and Price Wars: Especially in the smartphone segment, leading to thinner profit margins.

- Evolving Regulatory Landscapes: Data privacy, environmental regulations, and trade policies can create compliance challenges.

- Shortening Product Lifecycles: Rapid technological evolution necessitates continuous investment in R&D and manufacturing.

Emerging Opportunities in IT Device Market

The IT Device Market presents numerous emerging opportunities. The burgeoning market for wearable technology, including smartwatches and fitness trackers, continues to expand, offering complementary revenue streams. The development of immersive technologies like Augmented Reality (AR) and Virtual Reality (VR) devices presents a significant future growth avenue, requiring powerful and specialized hardware. Furthermore, the demand for sustainable and eco-friendly devices is growing, presenting opportunities for manufacturers to innovate in materials and production processes. The increasing focus on edge computing and the Internet of Things (IoT) will also drive demand for specialized and connected devices. The expansion of services built around hardware, such as cloud storage, streaming platforms, and subscription-based software, offers recurring revenue models.

Growth Accelerators in the IT Device Market Industry

Several catalysts are accelerating long-term growth in the IT Device Market. The widespread adoption of 5G technology is a significant growth accelerator, enabling faster data speeds and new applications for mobile devices. The continuous advancements in Artificial Intelligence (AI) and Machine Learning (ML) are leading to smarter, more personalized user experiences and the development of new device functionalities. Strategic partnerships between hardware manufacturers and software developers are crucial for creating integrated ecosystems that enhance user value. Market expansion into developing economies, driven by increasing digital literacy and affordability, is a consistent growth driver. The development of innovative form factors and new device categories, such as foldable PCs and advanced AR/VR headsets, will also fuel future growth.

Key Players Shaping the IT Device Market Market

- Nokia Corporation

- Vivo Communication Technology Co Ltd

- Toshiba Corporation

- Lenovo Group Limited

- Acer Inc

- Samsung Electronics Co Ltd

- Microsoft Corporation

- Realme Mobile Telecommunications Corp Ltd

- Xiaomi Corporation

- Dell Inc

- Micro-Star International Co

- ASUSTek Computer Inc

- Honor Technology Inc

- Razer Inc

- Apple Inc

- LG Corporation

Notable Milestones in IT Device Market Sector

- September 2022: Apple launched iPhone 14 and iPhone 14 Plus, featuring significant camera improvements for low-light performance, enhanced 5G and eSIM connectivity, and the powerful A15 Bionic chip for extended battery life, all integrated with iOS 16 for increased efficiency.

- September 2022: Lenovo unveiled the ThinkPad X1 Fold at IFA 2022, its second-generation foldable device, boasting a larger screen, Windows 11, and Intel's 12th generation mobile CPUs, signaling continued innovation in PC form factors.

In-Depth IT Device Market Market Outlook

The IT Device Market outlook remains exceptionally positive, propelled by a confluence of powerful growth accelerators. The continued evolution of mobile technology, especially the expansive deployment of 5G, will unlock new possibilities for smartphones and other connected devices. The increasing integration of AI across all device categories will drive smarter functionalities and personalized experiences, enhancing user value. Strategic alliances and ecosystem development will foster deeper customer engagement and create lock-in effects for dominant players. Furthermore, significant untapped potential in emerging markets, coupled with a sustained demand for advanced computing solutions in professional and creative sectors, promises continued market expansion. The exploration and maturation of new device categories, such as AR/VR headsets, represent substantial future revenue streams, positioning the IT device market for sustained innovation and growth through 2033.

IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

IT Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. Australia

- 3.2. China

- 3.3. India

- 3.4. Japan

- 3.5. Indonesia

- 3.6. Malaysia

- 3.7. South Korea

- 3.8. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Mexico

- 4.4. Colombia

- 4.5. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Qatar

- 5.4. Kuwait

- 5.5. South Africa

- 5.6. Egypt

- 5.7. Nigeria

- 5.8. Rest of Middle East and Africa

IT Device Market Regional Market Share

Geographic Coverage of IT Device Market

IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G Enabled Mobile Devices; Growing Mobile Broadband Penetration; Technology Advancement in the APAC Region

- 3.3. Market Restrains

- 3.3.1. Contracting Demand for Desktop Computers

- 3.4. Market Trends

- 3.4.1. Robust Contribution from Mobile Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IT Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America IT Device Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. PC's

- 6.1.1.1. Laptops

- 6.1.1.2. Desktop PCs

- 6.1.1.3. Tablets

- 6.1.2. Phones

- 6.1.2.1. Landline Phones

- 6.1.2.2. Smartphones

- 6.1.2.3. Feature Phones

- 6.1.1. PC's

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe IT Device Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. PC's

- 7.1.1.1. Laptops

- 7.1.1.2. Desktop PCs

- 7.1.1.3. Tablets

- 7.1.2. Phones

- 7.1.2.1. Landline Phones

- 7.1.2.2. Smartphones

- 7.1.2.3. Feature Phones

- 7.1.1. PC's

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific IT Device Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. PC's

- 8.1.1.1. Laptops

- 8.1.1.2. Desktop PCs

- 8.1.1.3. Tablets

- 8.1.2. Phones

- 8.1.2.1. Landline Phones

- 8.1.2.2. Smartphones

- 8.1.2.3. Feature Phones

- 8.1.1. PC's

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America IT Device Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. PC's

- 9.1.1.1. Laptops

- 9.1.1.2. Desktop PCs

- 9.1.1.3. Tablets

- 9.1.2. Phones

- 9.1.2.1. Landline Phones

- 9.1.2.2. Smartphones

- 9.1.2.3. Feature Phones

- 9.1.1. PC's

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. PC's

- 10.1.1.1. Laptops

- 10.1.1.2. Desktop PCs

- 10.1.1.3. Tablets

- 10.1.2. Phones

- 10.1.2.1. Landline Phones

- 10.1.2.2. Smartphones

- 10.1.2.3. Feature Phones

- 10.1.1. PC's

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nokia Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vivo Communication Technology Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toshiba Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lenovo Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acer Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Samsung Electronics Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microsoft Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Realme Mobile Telecommunications Corp Ltd*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Xiaomi Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dell Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Micro-Star International Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ASUSTek Computer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Honor Technology Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Razer Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Apple Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 LG Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Nokia Corp

List of Figures

- Figure 1: Global IT Device Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America IT Device Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America IT Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America IT Device Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America IT Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe IT Device Market Revenue (billion), by Type 2025 & 2033

- Figure 7: Europe IT Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe IT Device Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe IT Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific IT Device Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Asia Pacific IT Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific IT Device Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific IT Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America IT Device Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Latin America IT Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America IT Device Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America IT Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa IT Device Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Middle East and Africa IT Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa IT Device Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa IT Device Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IT Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global IT Device Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global IT Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global IT Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Global IT Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global IT Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Germany IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global IT Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global IT Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Australia IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: China IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: India IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Indonesia IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Malaysia IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global IT Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global IT Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Mexico IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Colombia IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global IT Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global IT Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Qatar IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Kuwait IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: South Africa IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Egypt IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Nigeria IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East and Africa IT Device Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Device Market?

The projected CAGR is approximately 13.2%.

2. Which companies are prominent players in the IT Device Market?

Key companies in the market include Nokia Corp, Vivo Communication Technology Co Ltd, Toshiba Corporation, Lenovo Group Limited, Acer Inc, Samsung Electronics Co Ltd, Microsoft Corporation, Realme Mobile Telecommunications Corp Ltd*List Not Exhaustive, Xiaomi Corporation, Dell Inc, Micro-Star International Co, ASUSTek Computer Inc, Honor Technology Inc, Razer Inc, Apple Inc, LG Corporation.

3. What are the main segments of the IT Device Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G Enabled Mobile Devices; Growing Mobile Broadband Penetration; Technology Advancement in the APAC Region.

6. What are the notable trends driving market growth?

Robust Contribution from Mobile Segment.

7. Are there any restraints impacting market growth?

Contracting Demand for Desktop Computers.

8. Can you provide examples of recent developments in the market?

September 2022: Apple, the leading telephone brand in the world, launched iPhone 14 and iPhone 14 Plus. Both devices include a potent new main camera with a significant improvement in low-light performance, improved connection with 5G and eSIM, and the phenomenal A15 Bionic performance, which contributes to even longer battery life. This, combined with iOS 16's close integration, makes iPhone more efficient than ever.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IT Device Market?

To stay informed about further developments, trends, and reports in the IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence