Key Insights

The Japan Telecom Towers market, exhibiting a Compound Annual Growth Rate (CAGR) of 1.28% from 2019-2024, is projected to continue its steady expansion through 2033. This growth is fueled by the increasing demand for higher bandwidth and improved network coverage, particularly in urban centers and expanding suburban areas. The rising adoption of 5G technology and the growing need for robust infrastructure to support the increasing number of connected devices are key drivers. Major players like Rakuten Mobile Inc., SoftBank Group Corp., and KDDI Corporation are strategically investing in tower infrastructure expansion and modernization to meet this burgeoning demand. However, regulatory hurdles related to site acquisition and construction permits, along with high capital expenditure requirements, pose significant challenges to market expansion. The market is segmented by tower type (macro, micro, small cells), ownership structure (owned, leased), and geographic location. Competition is intense among established players, leading to strategic partnerships and mergers & acquisitions aimed at consolidating market share.

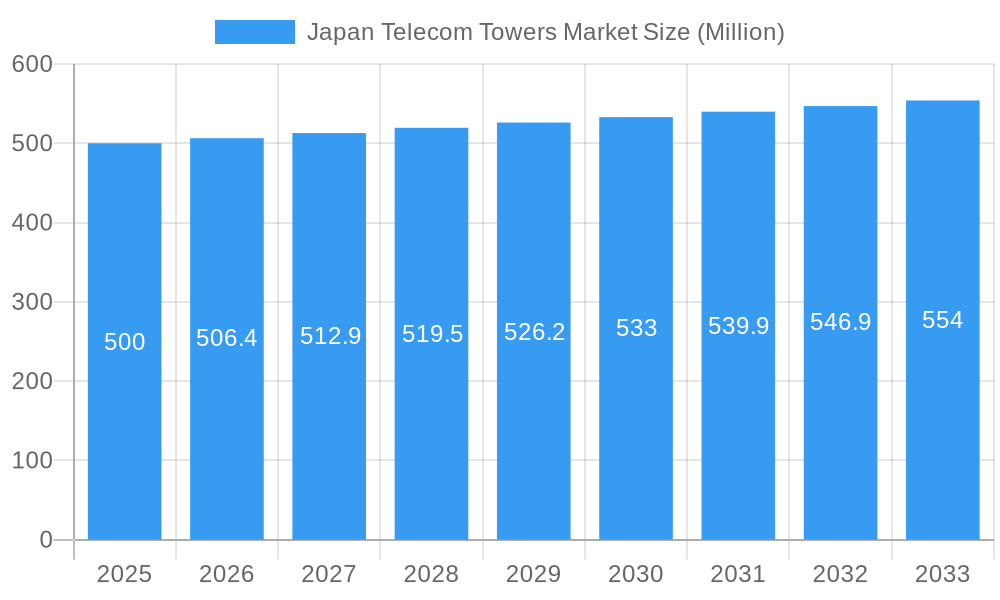

Japan Telecom Towers Market Market Size (In Million)

The forecast period (2025-2033) suggests continued growth, albeit at a potentially moderated pace compared to the historical period. The market's maturity level and the existing infrastructure capacity may contribute to this moderation. While precise market sizing data is not available, considering the CAGR of 1.28% and a plausible current market size (let's assume, for illustrative purposes, a 2025 market size of ¥500 million), a modest growth trajectory is anticipated. This growth will likely be fueled by ongoing 5G rollout, supporting technologies (like edge computing), and the increasing demand from the burgeoning IoT sector. Further regional analysis, though data is absent, would likely reveal variations in growth rates depending on population density, technological adoption rates, and government policies. Therefore, companies focused on strategic partnerships, technology upgrades, and efficient operational management will likely be the best positioned for success in this competitive yet promising market.

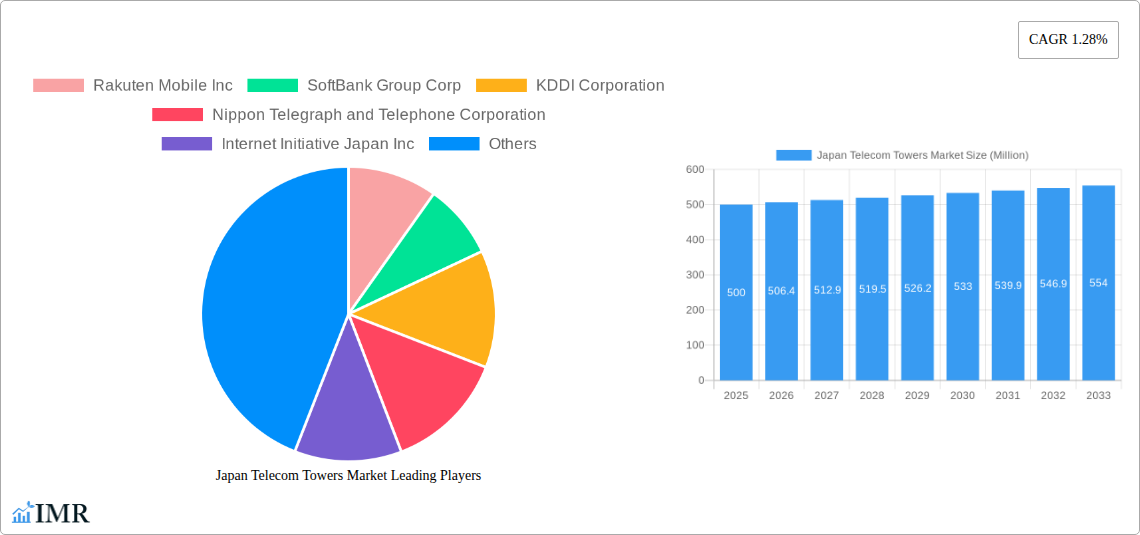

Japan Telecom Towers Market Company Market Share

Japan Telecom Towers Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Japan Telecom Towers Market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This in-depth analysis is crucial for telecom operators, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader Japanese telecommunications infrastructure sector, while the child market is specifically focused on the deployment and management of telecom towers.

Japan Telecom Towers Market Dynamics & Structure

The Japan Telecom Towers market exhibits a moderately concentrated structure, with several major players holding significant market share. The market is driven by technological innovations such as 5G deployment, increasing demand for mobile broadband services, and government initiatives to enhance digital infrastructure. Stringent regulatory frameworks influence market dynamics, impacting tower construction and licensing. The competitive landscape is characterized by both established players and emerging entrants, with mergers and acquisitions playing a notable role in shaping the industry. The market also faces challenges from alternative technologies and competitive pressures.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: 5G rollout is the primary driver, with ongoing investments in small cells and distributed antenna systems (DAS).

- Regulatory Landscape: Licencing requirements and spectrum allocation policies influence tower construction and operation.

- Competitive Substitutes: Fiber optic networks and alternative deployment methods present some competitive pressure.

- M&A Activity: The number of M&A deals in the sector has averaged xx per year over the historical period (2019-2024).

- Innovation Barriers: High capital expenditure requirements and complex permitting processes pose challenges to new entrants.

Japan Telecom Towers Market Growth Trends & Insights

The Japan Telecom Towers market has experienced consistent growth over the historical period (2019-2024), driven by factors including increasing smartphone penetration, the rise of IoT applications, and the expansion of 5G networks. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by continuous investment in network infrastructure upgrades, particularly in urban and suburban areas. Consumer demand for higher data speeds and improved network coverage continues to be a significant driver of this expansion. Technological advancements, such as the introduction of innovative antenna technologies (e.g., glass antennas), are further accelerating market expansion. Market penetration is expected to increase from xx% in 2025 to xx% in 2033, highlighting the substantial growth potential within the market.

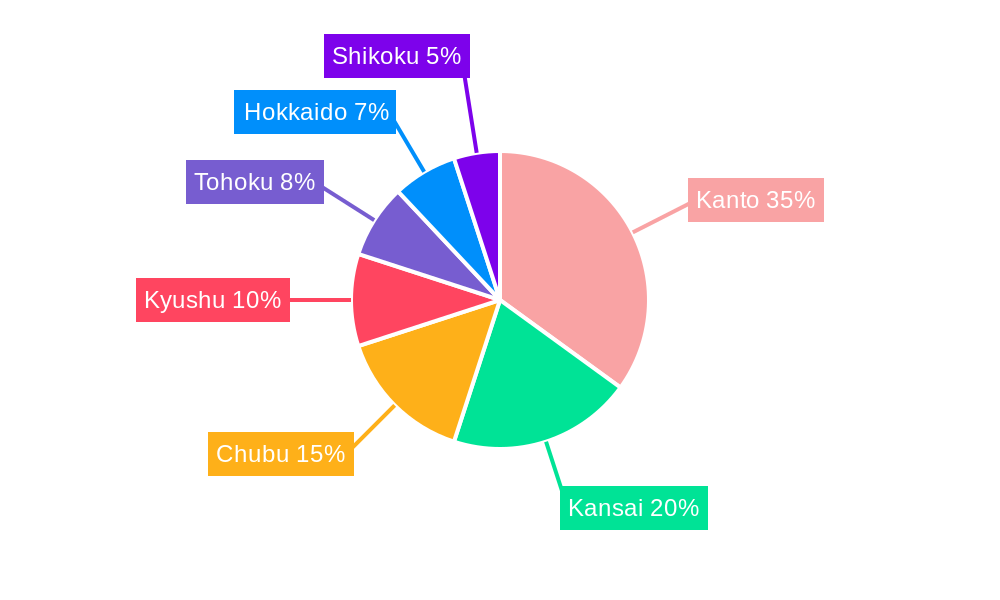

Dominant Regions, Countries, or Segments in Japan Telecom Towers Market

The Kanto region, encompassing Tokyo and surrounding prefectures, represents the dominant market segment, driven by high population density and intense demand for mobile connectivity. This region benefits from robust infrastructure development and substantial investments in 5G networks. Other major urban centers like Osaka and Nagoya also contribute significantly to market growth. The strong economic performance of Japan, coupled with government support for digitalization, underpins the overall market expansion.

- Key Drivers: High population density in urban areas, robust digital infrastructure investments, and government policies promoting 5G deployment.

- Dominance Factors: Superior network coverage needs in highly populated areas, and significant investments by major telecom operators.

- Growth Potential: Continued expansion of 5G networks and increasing demand for data services in secondary urban centers and rural areas.

Japan Telecom Towers Market Product Landscape

The market encompasses various types of telecom towers, including macrocells, microcells, and small cells, each catering to specific coverage and capacity requirements. Innovation is focused on enhancing antenna technologies to improve signal strength, energy efficiency, and aesthetic integration. Performance metrics are centered on network capacity, coverage area, and signal quality, with increasing emphasis on 5G network optimization and data throughput. Recent innovations like JTower’s glass antenna showcase a shift towards more integrated and aesthetically pleasing infrastructure solutions.

Key Drivers, Barriers & Challenges in Japan Telecom Towers Market

Key Drivers:

- Increasing demand for higher bandwidth driven by 5G adoption and IoT devices.

- Government investment in infrastructure modernization and digitalization initiatives.

- Growing mobile data consumption and user demand for better network coverage.

Challenges & Restraints:

- High initial investment costs associated with tower construction and deployment.

- Land acquisition and permitting complexities in urban areas.

- Competition from alternative technologies like fiber optic networks and small cells. This has a quantifiable impact, reducing projected growth by an estimated xx million units by 2033.

Emerging Opportunities in Japan Telecom Towers Market

- Private 5G networks: Opportunities in deploying dedicated 5G networks for businesses and industries.

- Smart city infrastructure: Integrating telecom towers with smart city technologies such as environmental monitoring and traffic management.

- Rural broadband expansion: Addressing the digital divide by deploying telecom towers in underserved rural areas.

Growth Accelerators in the Japan Telecom Towers Market Industry

Strategic partnerships between tower companies, telecom operators, and technology providers are driving innovation and accelerating market growth. Technological breakthroughs, like the development of more energy-efficient and aesthetically integrated antenna solutions, are also crucial catalysts. The ongoing expansion of 5G networks is a key growth engine, creating significant demand for new tower infrastructure and upgrades. Furthermore, government support for digital transformation initiatives further fuels market expansion.

Key Players Shaping the Japan Telecom Towers Market Market

- Rakuten Mobile Inc

- SoftBank Group Corp

- KDDI Corporation

- Nippon Telegraph and Telephone Corporation

- Internet Initiative Japan Inc

- JSAT Corporation

- TOKAI Communications Corporation

- Wowow Inc

- Okinawa Cellular Telephone Company

- Mitsui & Co Lt

Notable Milestones in Japan Telecom Towers Market Sector

- August 2024: JTower announces a glass antenna for 5G services in Tokyo, demonstrating technological innovation and collaboration among industry players.

- February 2024: NTT Docomo partners with NEC to expand its 5G open RAN networking gear business internationally, signifying a shift in the competitive landscape.

In-Depth Japan Telecom Towers Market Market Outlook

The Japan Telecom Towers market is poised for sustained growth, driven by the continued rollout of 5G networks, increasing mobile data consumption, and the emergence of new applications such as the Internet of Things (IoT). Strategic partnerships, technological advancements, and government initiatives will further shape the market landscape. Significant investment opportunities exist for companies involved in tower construction, maintenance, and related technologies. The market's future growth trajectory will depend on the successful deployment of 5G and its seamless integration into various sectors, creating a robust and interconnected digital ecosystem.

Japan Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Japan Telecom Towers Market Segmentation By Geography

- 1. Japan

Japan Telecom Towers Market Regional Market Share

Geographic Coverage of Japan Telecom Towers Market

Japan Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G is Expected to be a Catalyst for the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rakuten Mobile Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SoftBank Group Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KDDI Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Telegraph and Telephone Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Internet Initiative Japan Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JSAT Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TOKAI Communications Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wowow Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Okinawa Cellular Telephone Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsui & Co Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Mobile Inc

List of Figures

- Figure 1: Japan Telecom Towers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Japan Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 2: Japan Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 3: Japan Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 4: Japan Telecom Towers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Japan Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 6: Japan Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 7: Japan Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 8: Japan Telecom Towers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Telecom Towers Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Japan Telecom Towers Market?

Key companies in the market include Rakuten Mobile Inc, SoftBank Group Corp, KDDI Corporation, Nippon Telegraph and Telephone Corporation, Internet Initiative Japan Inc, JSAT Corporation, TOKAI Communications Corporation, Wowow Inc, Okinawa Cellular Telephone Company, Mitsui & Co Lt.

3. What are the main segments of the Japan Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G is Expected to be a Catalyst for the Market's Growth.

7. Are there any restraints impacting market growth?

Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

August 2024: JTower, a Japanese tower operator, announced a glass antenna, asserting its capability to "transform windows into base stations" for 5G services in Tokyo. In an official statement, JTower revealed its collaboration with fellow Japanese carrier NTT DoCoMo and glass producer AGC. Together, they installed the innovative glass antenna at the Shinjuku 3Chome East Building in Tokyo, linking it to JTower's 5G carrier-neutral network infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Japan Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence