Key Insights

The global Lab Automation in Protein Engineering Market is projected for significant expansion, reaching an estimated size of $2.36 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.8%. This growth is propelled by the increasing demand for accelerated protein analysis, the development of novel biotherapeutics, and the critical need for high-throughput screening in drug discovery. The integration of AI and machine learning into laboratory workflows is further enhancing protein characterization and engineering capabilities.

Lab Automation in Protein Engineering Market Market Size (In Billion)

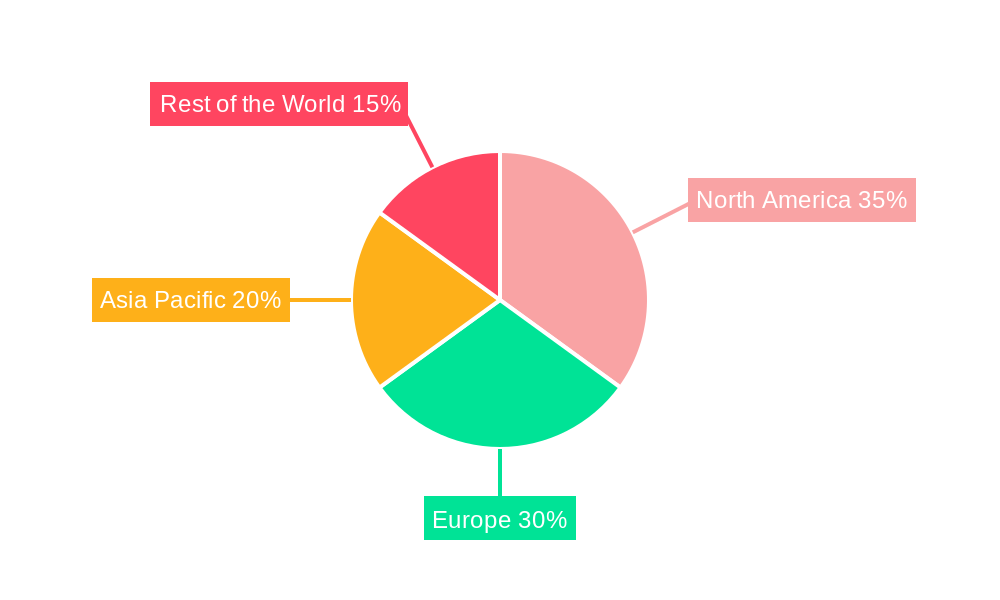

Key market segments, including automated liquid handlers and robotic arms, are vital for streamlining experimental processes, minimizing errors, and improving the speed and reproducibility of research. Advancements in laboratory equipment precision and miniaturization, alongside the growing emphasis on personalized medicine and tailored protein therapies, are also contributing to market growth. While high initial investment costs and the requirement for skilled personnel may present challenges, increased R&D spending in life sciences and continuous innovation from leading companies are expected to drive the market forward. North America and Europe are anticipated to maintain dominance due to robust research infrastructure and substantial biotechnology investments, while the Asia Pacific region is poised for the fastest growth.

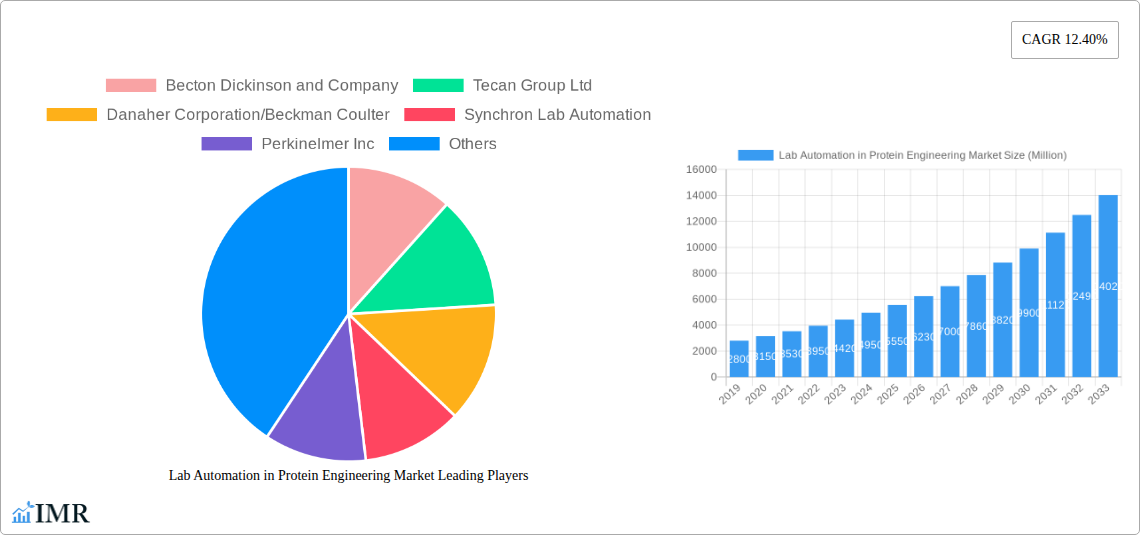

Lab Automation in Protein Engineering Market Company Market Share

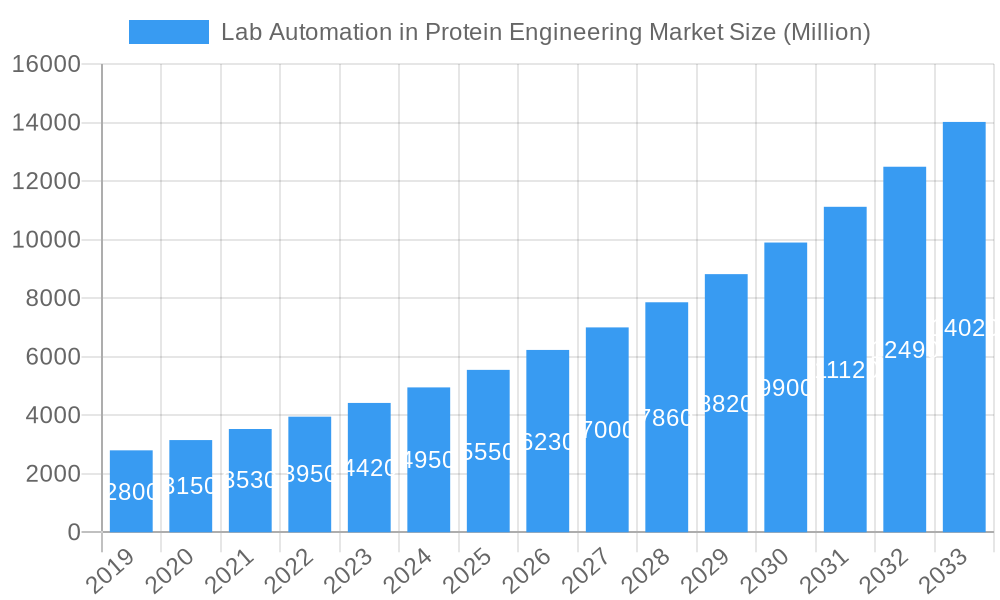

Comprehensive Lab Automation in Protein Engineering Market Analysis (2019-2033)

This in-depth report provides a definitive analysis of the Lab Automation in Protein Engineering Market. It forecasts significant growth for protein engineering automation from an estimated $2.36 billion in 2025 to an projected value by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.8%. Explore intricate market dynamics, cutting-edge technological advancements, and emerging opportunities shaping protein engineering laboratories worldwide. The report meticulously examines the parent market of lab automation and the burgeoning child market of protein engineering automation, offering a holistic view for stakeholders.

Lab Automation in Protein Engineering Market Market Dynamics & Structure

The Lab Automation in Protein Engineering Market is characterized by a dynamic interplay of intense technological innovation and strategic market consolidation. Driven by the imperative for faster drug discovery and development cycles, companies are heavily investing in advanced robotic systems and artificial intelligence-driven platforms. Regulatory frameworks, particularly those in the pharmaceutical and biotechnology sectors, are increasingly stringent, compelling organizations to adopt highly validated and compliant automation solutions to ensure data integrity and product quality. Competitive product substitutes, while emerging, often struggle to match the integrated capabilities and scalability offered by dedicated protein engineering automation systems. End-user demographics span academic research institutions, contract research organizations (CROs), and large pharmaceutical and biotechnology companies, each with distinct needs and adoption curves. Mergers and acquisition (M&A) trends are prominent, with larger players acquiring specialized technology providers to broaden their portfolios and enhance their competitive edge. For instance, the last two years have seen xx significant M&A deals within the broader lab automation space, indicating a strong trend towards market consolidation. The market concentration, while growing, still allows for niche players to thrive by offering specialized solutions.

- Market Concentration: Moderate, with increasing consolidation driven by strategic acquisitions.

- Technological Innovation Drivers: Need for high-throughput screening, precision protein design, and personalized medicine.

- Regulatory Frameworks: Strict compliance requirements in biopharmaceutical development drive adoption of validated automation.

- Competitive Product Substitutes: Emerging AI-driven platforms and advanced manual techniques, though lacking full integration.

- End-User Demographics: Academic research, CROs, large pharma & biotech.

- M&A Trends: Frequent acquisitions of specialized automation companies by larger entities to expand service offerings.

Lab Automation in Protein Engineering Market Growth Trends & Insights

The Lab Automation in Protein Engineering Market is experiencing an unprecedented surge in growth, propelled by an escalating demand for efficient and scalable solutions in biopharmaceutical research and development. The estimated market size of $1,500 Million in 2025 is projected to witness substantial expansion, reaching an estimated $3,000 Million by 2033. This remarkable growth is underscored by an accelerated adoption rate of automated liquid handling systems and robotic platforms, as laboratories strive to enhance throughput and reduce human error. Technological disruptions, including advancements in artificial intelligence for protein design and machine learning for data analysis, are further fueling market penetration, which is currently estimated at xx% for advanced automation solutions in leading research facilities. Consumer behavior shifts are evident, with a growing preference for integrated, walk-away solutions that minimize manual intervention and maximize experimental reproducibility. The market is witnessing a paradigm shift from single-point automation to comprehensive, end-to-end laboratory automation workflows. This transition is critical for addressing the complex challenges in protein engineering, such as high-throughput screening of enzyme variants, directed evolution experiments, and the production of recombinant proteins for therapeutic applications. The increasing complexity of protein-based therapeutics, including antibodies, peptides, and gene therapies, necessitates sophisticated automation to accelerate their discovery and development pipelines. Furthermore, the rise of personalized medicine and the need to rapidly develop custom protein therapeutics for individual patients are significant growth drivers. The integration of advanced robotics, high-content imaging, and sophisticated data management software is enabling researchers to conduct more experiments in less time, with greater accuracy and cost-effectiveness. The market's trajectory is strongly influenced by government funding for life sciences research and the growing pipeline of biologics in clinical development. The overall market penetration of lab automation in protein engineering, while already significant in established markets, is poised for substantial expansion into emerging economies and smaller research groups as the cost-effectiveness and benefits become more widely recognized. The CAGR for the forecast period 2025-2033 is projected at xx%, indicating a sustained period of robust expansion and innovation.

Dominant Regions, Countries, or Segments in Lab Automation in Protein Engineering Market

The Automated Liquid Handlers segment is unequivocally the dominant force driving growth within the Lab Automation in Protein Engineering Market. This segment, estimated to contribute $600 Million to the global market in 2025, is projected to expand significantly due to its fundamental role in high-throughput screening, assay development, and sample preparation. Key drivers for this dominance include the sheer volume of liquid handling tasks required in protein engineering, from dispensing reagents and diluting samples to performing complex multi-step assays. The increasing complexity of protein engineering workflows, such as directed evolution and combinatorial library screening, directly correlates with the demand for precise and efficient automated liquid handling. The robust infrastructure for biopharmaceutical research and development in North America, particularly the United States, plays a crucial role in this segment's leadership. Favorable government policies, substantial private sector investment in life sciences, and a high concentration of leading pharmaceutical and biotechnology companies create a fertile ground for the adoption of advanced liquid handling technologies. For example, the US market for automated liquid handlers in protein engineering is estimated at $250 Million in 2025. Europe, driven by countries like Germany, the UK, and Switzerland, represents another significant market for automated liquid handlers, with an estimated market size of $200 Million in 2025. This region benefits from a strong academic research base and a well-established biopharmaceutical industry. The Asia-Pacific region, with countries like China and India, is emerging as a rapidly growing market, driven by increasing R&D expenditure and government initiatives to promote biotechnology. The growth potential in this region is immense, with an estimated market size of $100 Million in 2025, expected to witness a high CAGR. The technological advancements in automated liquid handlers, including miniaturization, increased dispensing accuracy, and integration with other automation components, further solidify their dominance. The ability to perform a vast number of experiments with minimal human intervention directly translates to accelerated research timelines and reduced operational costs, making them indispensable tools in modern protein engineering laboratories.

- Dominant Segment: Automated Liquid Handlers

- Market Size (2025): $600 Million

- Key Drivers: High-throughput screening, assay development, sample preparation, directed evolution, combinatorial library screening.

- Regional Dominance (North America):

- Market Size (2025): $250 Million

- Drivers: Favorable policies, significant R&D investment, concentration of leading biopharma companies.

- Regional Significance (Europe):

- Market Size (2025): $200 Million

- Drivers: Strong academic research, established biopharmaceutical industry.

- Emerging Market (Asia-Pacific):

- Market Size (2025): $100 Million

- Drivers: Increasing R&D expenditure, government initiatives.

Lab Automation in Protein Engineering Market Product Landscape

The product landscape for lab automation in protein engineering is marked by continuous innovation focused on enhancing throughput, precision, and integration. Key offerings include advanced automated liquid handlers capable of handling diverse sample volumes and assay types, sophisticated robotic arms for seamless plate and tube manipulation, and intelligent automated storage and retrieval systems (AS/RS) for efficient sample management. Applications span high-throughput screening of enzyme variants, antibody discovery, protein-protein interaction studies, and the development of novel therapeutic proteins. Performance metrics emphasize speed, accuracy, reproducibility, and reduced assay volumes, enabling researchers to achieve more in less time. Unique selling propositions often lie in modular designs, intuitive software interfaces, and the ability to integrate with existing laboratory infrastructure.

Key Drivers, Barriers & Challenges in Lab Automation in Protein Engineering Market

Key Drivers:

- Accelerated Drug Discovery & Development: The paramount need to bring new protein-based therapeutics to market faster is a primary driver.

- Demand for High-Throughput Screening: Protein engineering requires testing vast numbers of variants, making automation essential.

- Increasing Complexity of Protein Designs: Advanced protein engineering methodologies necessitate precise and reproducible automated workflows.

- Focus on Personalized Medicine: The growing demand for tailor-made protein therapeutics requires agile and scalable automation.

- Technological Advancements: Continuous innovation in robotics, AI, and software is enhancing automation capabilities.

Barriers & Challenges:

- High Initial Investment Cost: The upfront cost of sophisticated automation systems can be a significant barrier for smaller labs.

- Integration Complexity: Integrating diverse automation components and legacy systems can be challenging.

- Skilled Workforce Requirements: Operating and maintaining advanced automation requires specialized training and expertise.

- Regulatory Hurdles: Ensuring compliance with stringent biopharmaceutical regulations can be complex for automated processes.

- Scalability for Niche Applications: While mature for high-throughput, scaling automation for very niche protein engineering applications can be difficult.

Emerging Opportunities in Lab Automation in Protein Engineering Market

Emerging opportunities lie in the development of AI-powered predictive modeling for protein design, which can further streamline experimental workflows and reduce reliance on extensive physical screening. The integration of lab automation with cloud-based data analytics platforms offers a significant opportunity for real-time data interpretation and enhanced decision-making. Furthermore, the burgeoning field of synthetic biology, with its intricate protein engineering requirements, presents a vast untapped market. Exploring novel applications in diagnostics, industrial enzymes, and sustainable materials development through advanced protein engineering automation also offers substantial growth potential.

Growth Accelerators in the Lab Automation in Protein Engineering Market Industry

Several catalysts are accelerating the growth of the Lab Automation in Protein Engineering Market. Technological breakthroughs in areas like CRISPR-based protein engineering and machine learning for protein structure prediction are creating new demands for sophisticated automation. Strategic partnerships between automation providers and bioinformatics companies are fostering integrated solutions that bridge the gap between experimental design and data analysis. Market expansion strategies, including the development of more affordable and modular automation solutions, are crucial for penetrating emerging markets and smaller research groups, thereby broadening the adoption base and driving sustained growth.

Key Players Shaping the Lab Automation in Protein Engineering Market Market

- Becton Dickinson and Company

- Tecan Group Ltd

- Danaher Corporation/Beckman Coulter

- Synchron Lab Automation

- Perkinelmer Inc

- F Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc

- Eli Lilly and Company

- Siemens Healthineers AG

- Agilent Technologies Inc

- Hudson Robotics Inc

Notable Milestones in Lab Automation in Protein Engineering Market Sector

- October 2022: Thermo Fisher Scientific releases the first fully automated, all-in-one sample preparation system, the EXTREVA ASE Accelerated Solvent Extractor. This innovation enables a walk-away sample-to-vial workflow for analysts, automating extraction and concentration from solid and semi-solid samples, thus significantly reducing manual intervention and potential errors.

- March 2022: Beckman Coulter Life Sciences (a subsidiary of Danaher Corporation) introduces the CellMek SPS, a fully automated sample preparation system designed to address bottlenecks in clinical flow cytometry. This system enhances lab productivity by automating labor-intensive preparatory techniques and simplifying data management for various sample types.

In-Depth Lab Automation in Protein Engineering Market Market Outlook

The future outlook for the Lab Automation in Protein Engineering Market is exceptionally promising, driven by a confluence of technological advancements and an increasing global demand for innovative protein-based solutions. Growth accelerators such as the integration of artificial intelligence for predictive protein design, the expansion of cloud-based data analytics, and the burgeoning field of synthetic biology will unlock significant new avenues for market players. Strategic partnerships and the development of scalable, cost-effective automation solutions are vital for penetrating emerging markets and broadening the accessibility of these critical technologies. The market is poised for sustained expansion as researchers continue to push the boundaries of protein engineering for therapeutic, diagnostic, and industrial applications.

Lab Automation in Protein Engineering Market Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Other Equipment

Lab Automation in Protein Engineering Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Protein Engineering Market Regional Market Share

Geographic Coverage of Lab Automation in Protein Engineering Market

Lab Automation in Protein Engineering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated

- 3.3. Market Restrains

- 3.3.1. Expensive Initial Setup

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handler Equipment Accounted for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Other Equipment

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Other Equipment

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Other Equipment

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Protein Engineering Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Other Equipment

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Becton Dickinson and Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tecan Group Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Danaher Corporation/Beckman Coulter

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Synchron Lab Automation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Perkinelmer Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 F Hoffmann-La Roche Ltd*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Thermo Fisher Scientific Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eli Lilly and Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Siemens Healthineers AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Agilent Technologies Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hudson Robotics Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Lab Automation in Protein Engineering Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Lab Automation in Protein Engineering Market Revenue (billion), by Equipment 2025 & 2033

- Figure 3: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 4: North America Lab Automation in Protein Engineering Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Lab Automation in Protein Engineering Market Revenue (billion), by Equipment 2025 & 2033

- Figure 7: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 8: Europe Lab Automation in Protein Engineering Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Lab Automation in Protein Engineering Market Revenue (billion), by Equipment 2025 & 2033

- Figure 11: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 12: Asia Pacific Lab Automation in Protein Engineering Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Lab Automation in Protein Engineering Market Revenue (billion), by Equipment 2025 & 2033

- Figure 15: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 16: Rest of the World Lab Automation in Protein Engineering Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Lab Automation in Protein Engineering Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 2: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 4: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 6: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 8: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 10: Global Lab Automation in Protein Engineering Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Protein Engineering Market?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the Lab Automation in Protein Engineering Market?

Key companies in the market include Becton Dickinson and Company, Tecan Group Ltd, Danaher Corporation/Beckman Coulter, Synchron Lab Automation, Perkinelmer Inc, F Hoffmann-La Roche Ltd*List Not Exhaustive, Thermo Fisher Scientific Inc, Eli Lilly and Company, Siemens Healthineers AG, Agilent Technologies Inc, Hudson Robotics Inc.

3. What are the main segments of the Lab Automation in Protein Engineering Market?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated.

6. What are the notable trends driving market growth?

Automated Liquid Handler Equipment Accounted for the Largest Market Share.

7. Are there any restraints impacting market growth?

Expensive Initial Setup.

8. Can you provide examples of recent developments in the market?

October 2022 - Thermo Fisher Scientific releases the first fully automated, all-in-one sample preparation system. The new EXTREVA ASE Accelerated Solvent Extractor from Thermo Scientific is the first system to automatically extract and concentrate analytes of interest from solid and semi-solid samples, such as persistent organic pollutants (POPs), polycyclic aromatic hydrocarbons (PAHs), or pesticides, in a single instrument, obviating the need for manual sample transfer for a walk-away sample-to-vial workflow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Protein Engineering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Protein Engineering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Protein Engineering Market?

To stay informed about further developments, trends, and reports in the Lab Automation in Protein Engineering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence