Key Insights

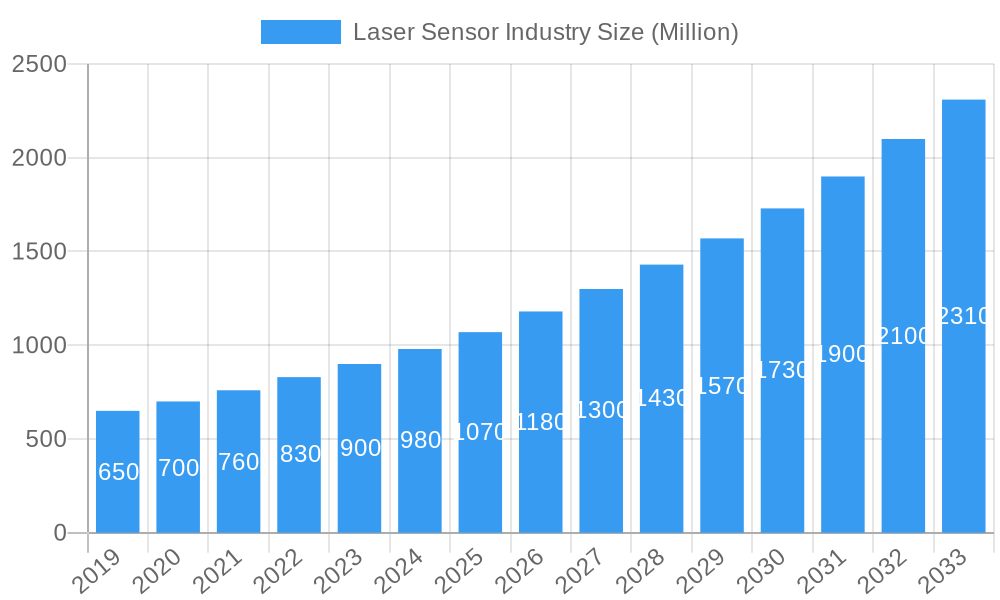

The global Laser Sensor Market is poised for significant expansion, projected to reach an estimated XX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.61% anticipated throughout the forecast period of 2025-2033. This impressive growth trajectory is primarily fueled by the escalating demand for automation and precision across a multitude of industries. The inherent advantages of laser sensors, including their high accuracy, speed, and non-contact measurement capabilities, make them indispensable in modern manufacturing and industrial processes. Key drivers include the proliferation of smart factories, the increasing adoption of Industry 4.0 technologies, and the continuous innovation in sensor technology leading to more sophisticated and cost-effective solutions. The expansion of the automotive sector, driven by advancements in autonomous driving and electric vehicles, along with the critical need for precision in electronics manufacturing for miniaturization and complex assembly, are further propelling market growth. The aviation industry's focus on quality control and component inspection also contributes significantly to this upward trend.

Laser Sensor Industry Market Size (In Million)

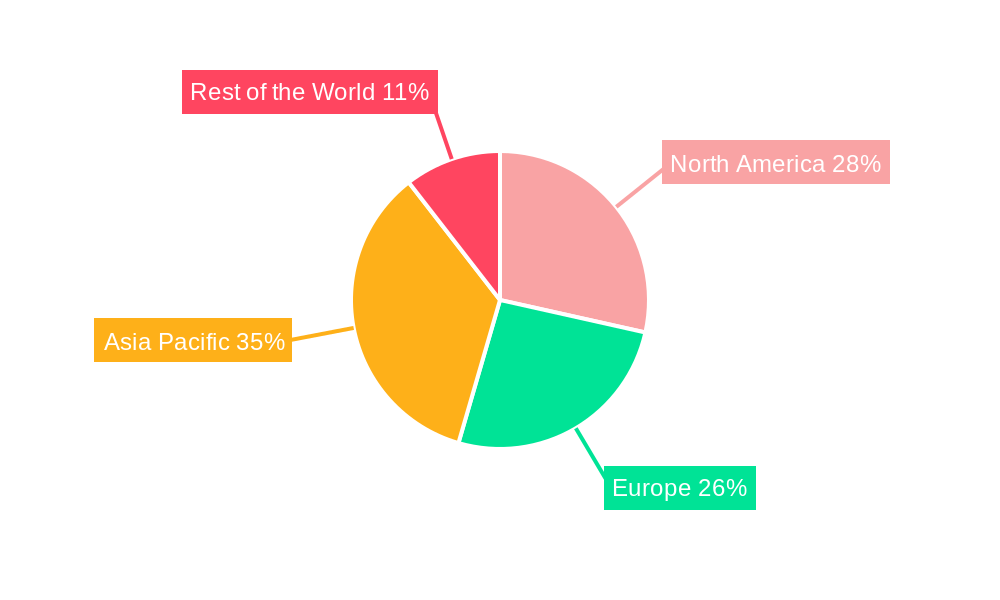

The market is segmented into key components, with both hardware and software, as well as associated services, playing crucial roles in delivering comprehensive solutions. End-user industries such as Electronics Manufacturing, Aviation, Construction, and Automotive are the primary beneficiaries and adopters of laser sensor technology. The geographical landscape indicates a strong presence and anticipated growth in North America and Europe, driven by their advanced industrial infrastructure and early adoption of automation. The Asia Pacific region, particularly China, Japan, India, and South Korea, is emerging as a powerhouse of growth, owing to its rapidly expanding manufacturing base and government initiatives promoting technological adoption. While the market exhibits strong growth potential, potential restraints may include the initial capital investment for advanced systems and the need for skilled personnel to operate and maintain them. However, ongoing technological advancements and the increasing return on investment from enhanced productivity and reduced errors are expected to mitigate these challenges, ensuring a dynamic and expanding laser sensor market.

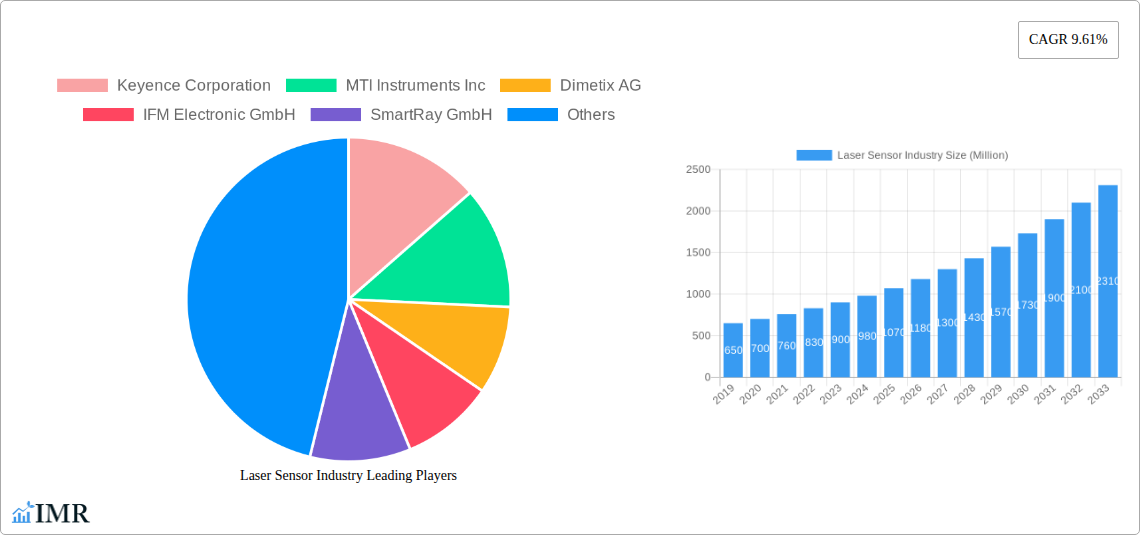

Laser Sensor Industry Company Market Share

Laser Sensor Industry Market Dynamics & Structure

The global laser sensor market exhibits a moderate to high concentration, driven by significant technological innovation and a growing demand for precision measurement and automation across various industries. Key players such as Keyence Corporation, IFM Electronic GmbH, and Rockwell Automation Inc. hold substantial market shares, investing heavily in research and development to enhance sensor capabilities. The primary drivers for technological innovation include the miniaturization of laser sensor components, increased accuracy, faster response times, and the integration of advanced features like AI and IoT connectivity for enhanced data analytics and remote monitoring. Regulatory frameworks, particularly concerning safety standards and data privacy in industrial applications, are also shaping market development. Competitive product substitutes, while present in some niche applications (e.g., ultrasonic or vision sensors), are increasingly being outpaced by the superior performance and versatility of laser-based technologies. End-user demographics are shifting towards sectors demanding higher precision and automation, with electronics manufacturing and automotive leading the charge. Mergers and acquisitions (M&A) activity, while not rampant, is strategic, with larger players acquiring smaller, innovative firms to expand their product portfolios or gain access to new technologies. The industry faces barriers to innovation, including the high cost of R&D and the need for specialized expertise.

- Market Concentration: Moderate to High, with key players like Keyence, IFM Electronic, and Rockwell Automation leading.

- Technological Innovation Drivers: Miniaturization, increased accuracy, faster response times, AI/IoT integration.

- Regulatory Frameworks: Focus on safety standards and data privacy in industrial automation.

- Competitive Substitutes: Ultrasonic and vision sensors offer alternatives but are often surpassed by laser sensor performance.

- End-User Demographics: Growth driven by electronics manufacturing, automotive, and aerospace industries.

- M&A Trends: Strategic acquisitions by major players to enhance technological capabilities.

- Innovation Barriers: High R&D costs, need for specialized engineering talent.

Laser Sensor Industry Growth Trends & Insights

The global laser sensor market is poised for robust expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This growth is fueled by an escalating need for precision, automation, and quality control across a diverse range of industrial sectors, including automotive manufacturing, electronics assembly, aerospace, and construction. The base year of 2025 estimates the market size at around $4,200 Million units, with projections indicating a significant increase by the forecast period's end. Adoption rates for laser sensors are accelerating as businesses recognize their ability to enhance operational efficiency, reduce errors, and improve product quality. Technological disruptions are playing a pivotal role, with advancements in solid-state laser technology, improved detection algorithms, and the integration of machine learning capabilities enabling more sophisticated sensing solutions. These innovations are driving the development of smart sensors that can collect, analyze, and transmit data in real-time, facilitating predictive maintenance and optimized production processes.

Consumer behavior shifts, particularly within the industrial procurement landscape, are favoring solutions that offer a higher return on investment through increased productivity and reduced downtime. The demand for Industry 4.0 compliant sensors, capable of seamless integration into connected manufacturing environments, is a key trend. This includes a growing interest in laser triangulation sensors, time-of-flight sensors, and LiDAR for applications ranging from precise distance measurement and object detection to 3D scanning and autonomous navigation. The COVID-19 pandemic, while initially causing some supply chain disruptions, ultimately accelerated the adoption of automation and advanced sensing technologies as businesses sought to enhance resilience and optimize remote operations. Market penetration is expanding beyond traditional manufacturing into emerging applications like smart agriculture, robotics, and advanced logistics. The increasing complexity of manufactured goods and the stringent quality requirements in sectors like medical devices and pharmaceuticals further bolster the demand for high-precision laser sensing solutions. Furthermore, the declining cost of sophisticated laser components and the increasing availability of skilled personnel are making these technologies more accessible to a wider range of businesses.

Dominant Regions, Countries, or Segments in Laser Sensor Industry

The Electronics Manufacturing end-user industry segment is currently the most dominant driver of growth within the global laser sensor market. In 2025, this segment is estimated to account for approximately 28% of the total market revenue, valued at roughly $1,176 Million units. Its dominance stems from the relentless demand for precision and miniaturization in the production of electronic components, semiconductors, and consumer electronics. The intricate nature of these manufacturing processes necessitates highly accurate measurement, inspection, and alignment capabilities, where laser sensors excel.

- Asia Pacific Region: This region, particularly countries like China, South Korea, and Japan, represents the largest and fastest-growing geographical market for laser sensors. In 2025, it is projected to hold a market share of over 40%, valued at approximately $1,680 Million units. This is primarily attributed to the concentration of global electronics manufacturing hubs, significant investments in automation, and government initiatives promoting smart manufacturing.

- Key Drivers in Electronics Manufacturing:

- High Precision Requirements: The miniaturization of electronic components requires sub-micron level accuracy for placement, soldering, and inspection.

- Automation & Efficiency: Laser sensors are crucial for high-speed, automated assembly lines, reducing manual intervention and increasing throughput.

- Quality Control: Inspection of solder joints, component alignment, and surface defects relies heavily on the precise measurements provided by laser sensors.

- Technological Advancements: The continuous innovation in semiconductor manufacturing and display technologies directly drives the demand for advanced laser sensing solutions.

- Hardware and Software Component Segment: Within the component market, the "Hardware" sub-segment, encompassing the sensor devices themselves, is leading. This is closely followed by the "Software" sub-segment, which is experiencing rapid growth due to the increasing integration of AI, IoT, and data analytics capabilities for advanced sensor functionality. In 2025, the Hardware segment is estimated at $2,940 Million units, while Software is valued at $1,260 Million units.

Laser Sensor Industry Product Landscape

The laser sensor product landscape is characterized by continuous innovation in precision, speed, and connectivity. Leading manufacturers are developing compact, robust sensors with enhanced resolutions and extended measurement ranges. Innovations include advanced signal processing for improved noise immunity, laser triangulation sensors for accurate 3D profiling, and time-of-flight sensors for non-contact distance measurement in challenging environments. Applications span high-speed object detection in automated assembly, precise guidance for robotic arms, quality inspection of manufactured goods, and sophisticated measurement in construction and surveying. Unique selling propositions focus on reliability, ease of integration into existing systems, and the ability to deliver real-time data for process optimization.

Key Drivers, Barriers & Challenges in Laser Sensor Industry

Key Drivers: The laser sensor industry is propelled by the accelerating global adoption of Industry 4.0, the escalating demand for automation and precision in manufacturing, and the continuous miniaturization of electronic devices. Advancements in AI and IoT integration are enabling smarter, more connected sensing solutions. Government initiatives promoting smart cities and infrastructure development, particularly in construction and automotive, also act as significant growth catalysts.

Key Barriers & Challenges: High initial investment costs for advanced laser sensor systems can be a barrier for smaller enterprises. Intense competition from alternative sensing technologies in certain applications, coupled with the need for highly skilled personnel for installation and maintenance, present ongoing challenges. Supply chain disruptions, as witnessed in recent years, can impact the availability of critical components and lead to price volatility. Regulatory compliance for specific industries, such as aerospace and medical devices, also adds complexity.

Emerging Opportunities in Laser Sensor Industry

Emerging opportunities lie in the expanding applications of laser sensors in the healthcare sector for minimally invasive surgical guidance and advanced diagnostics. The growing adoption of autonomous vehicles and smart mobility solutions presents a significant market for LiDAR and other laser-based navigation sensors. Furthermore, the development of smart agriculture technologies, requiring precise environmental monitoring and crop analysis, offers untapped potential. The integration of laser sensors with augmented reality (AR) for industrial training and maintenance is another promising avenue.

Growth Accelerators in the Laser Sensor Industry Industry

The long-term growth of the laser sensor industry is being accelerated by groundbreaking technological breakthroughs, such as the development of quantum cascade lasers for enhanced spectral analysis and the continued improvement in the energy efficiency and cost-effectiveness of solid-state laser sources. Strategic partnerships between sensor manufacturers and automation solution providers are facilitating market penetration into new verticals. Market expansion strategies, including the development of specialized sensor solutions tailored for emerging markets like renewable energy infrastructure and advanced materials manufacturing, are also key growth accelerators.

Key Players Shaping the Laser Sensor Industry Market

- Keyence Corporation

- MTI Instruments Inc

- Dimetix AG

- IFM Electronic GmbH

- SmartRay GmbH

- Rockwell Automation Inc

- Micro-Epsilon Messtechnik GmbH & Co KG

- First Sensor AG*List Not Exhaustive

- Baumer Electric AG

Notable Milestones in Laser Sensor Industry Sector

- 2019: Introduction of advanced AI-powered laser sensors for defect detection in electronics manufacturing.

- 2020: Significant advancements in LiDAR technology for automotive applications, enabling higher resolution and longer range.

- 2021: Increased demand for non-contact laser measurement solutions in healthcare for infection control.

- 2022: Development of miniaturized, high-precision laser triangulation sensors for intricate robotics.

- 2023: Enhanced integration of laser sensors with IoT platforms for predictive maintenance and remote monitoring.

- 2024: Focus on sustainable manufacturing driving demand for energy-efficient laser sensing solutions.

In-Depth Laser Sensor Industry Market Outlook

The future outlook for the laser sensor industry is exceptionally bright, driven by sustained innovation and expanding applications. Growth accelerators include the continued convergence of laser sensing with AI and machine learning, enabling autonomous decision-making in industrial processes. Strategic partnerships will be crucial for unlocking new markets and developing integrated solutions. The industry's ability to adapt to evolving technological demands and its intrinsic role in the advancement of automation and precision across diverse sectors ensure continued market expansion and significant future potential.

Laser Sensor Industry Segmentation

-

1. Component

- 1.1. Hardware and Software

- 1.2. Services

-

2. End-user Industry

- 2.1. Electronics Manufacturing

- 2.2. Aviation

- 2.3. Construction

- 2.4. Automotive

- 2.5. Other End-user Industries

Laser Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Laser Sensor Industry Regional Market Share

Geographic Coverage of Laser Sensor Industry

Laser Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Adoption of Industry 4.0 and Smart Manufacturing Practices; Reduction of Price Leading to Large Scale Application

- 3.3. Market Restrains

- 3.3.1. ; High Requirement of Power and Energy Density for Measuring Smaller Beams

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware and Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Electronics Manufacturing

- 5.2.2. Aviation

- 5.2.3. Construction

- 5.2.4. Automotive

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware and Software

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Electronics Manufacturing

- 6.2.2. Aviation

- 6.2.3. Construction

- 6.2.4. Automotive

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware and Software

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Electronics Manufacturing

- 7.2.2. Aviation

- 7.2.3. Construction

- 7.2.4. Automotive

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware and Software

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Electronics Manufacturing

- 8.2.2. Aviation

- 8.2.3. Construction

- 8.2.4. Automotive

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware and Software

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Electronics Manufacturing

- 9.2.2. Aviation

- 9.2.3. Construction

- 9.2.4. Automotive

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Keyence Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 MTI Instruments Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dimetix AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 IFM Electronic GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SmartRay GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Rockwell Automation Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Micro-Epsilon Messtechnik GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 First Sensor AG*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Baumer Electric AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Keyence Corporation

List of Figures

- Figure 1: Global Laser Sensor Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Laser Sensor Industry Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Laser Sensor Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Laser Sensor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Laser Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Laser Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Laser Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Laser Sensor Industry Revenue (undefined), by Component 2025 & 2033

- Figure 9: Europe Laser Sensor Industry Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Laser Sensor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Laser Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Laser Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Laser Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Laser Sensor Industry Revenue (undefined), by Component 2025 & 2033

- Figure 15: Asia Pacific Laser Sensor Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Laser Sensor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Laser Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Laser Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Laser Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Laser Sensor Industry Revenue (undefined), by Component 2025 & 2033

- Figure 21: Rest of the World Laser Sensor Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Rest of the World Laser Sensor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Laser Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Laser Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Laser Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Laser Sensor Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Laser Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 10: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Laser Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Germany Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 17: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Laser Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: India Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 25: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Laser Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Sensor Industry?

The projected CAGR is approximately 10.54%.

2. Which companies are prominent players in the Laser Sensor Industry?

Key companies in the market include Keyence Corporation, MTI Instruments Inc, Dimetix AG, IFM Electronic GmbH, SmartRay GmbH, Rockwell Automation Inc, Micro-Epsilon Messtechnik GmbH & Co KG, First Sensor AG*List Not Exhaustive, Baumer Electric AG.

3. What are the main segments of the Laser Sensor Industry?

The market segments include Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Adoption of Industry 4.0 and Smart Manufacturing Practices; Reduction of Price Leading to Large Scale Application.

6. What are the notable trends driving market growth?

Automotive is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High Requirement of Power and Energy Density for Measuring Smaller Beams.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laser Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laser Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laser Sensor Industry?

To stay informed about further developments, trends, and reports in the Laser Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence