Key Insights

The Indian lighting market is projected for significant expansion, expected to reach 354.33 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 10.97% through 2033. Key growth catalysts include rapid urbanization, enhanced infrastructure development, increasing adoption of energy-efficient and smart lighting solutions, and rising disposable incomes boosting demand for advanced residential and commercial lighting. The widespread adoption of LED technology, supported by government incentives and falling costs, is a major contributor. Initiatives like the Smart Cities Mission and the integration of IoT in buildings are fostering growth in intelligent lighting systems.

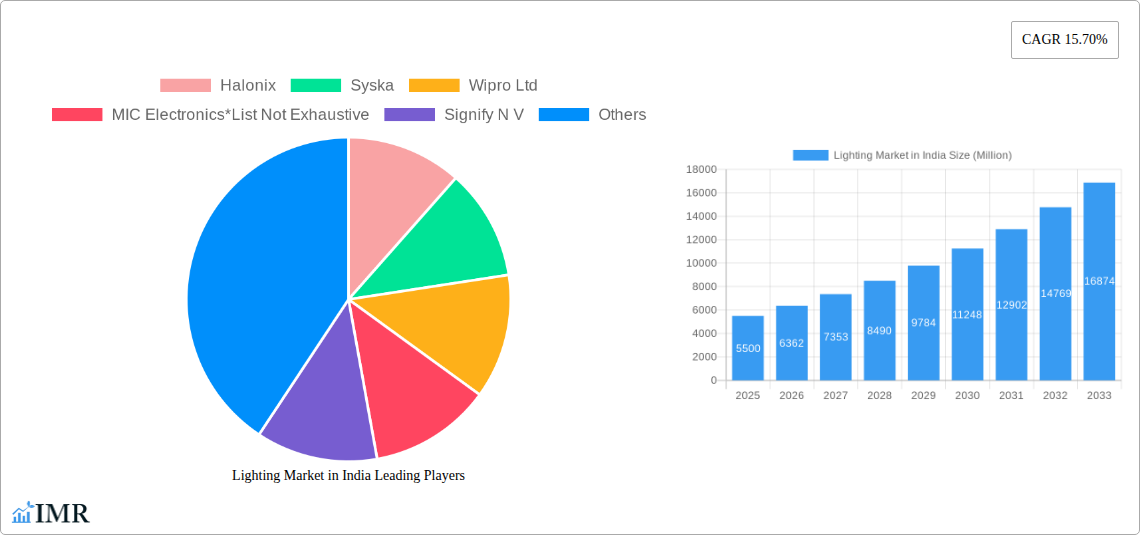

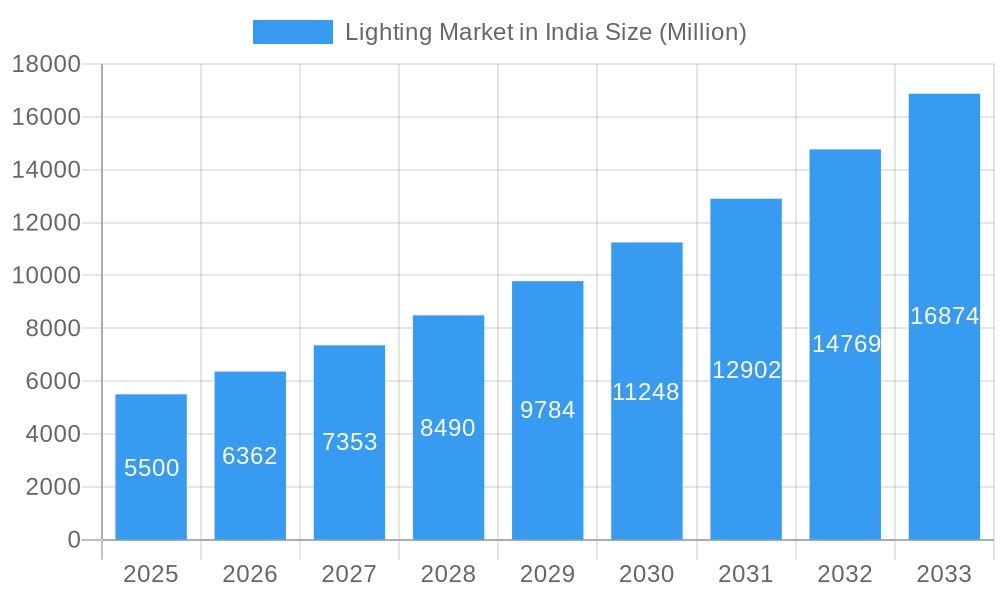

Lighting Market in India Market Size (In Million)

The market encompasses diverse product types, light sources, distribution channels, and applications. Luminaires and lamps are dominant product categories, with LED technology leading across all segments. Distribution occurs through direct sales, wholesalers, electricians, specialized retailers, and general retail, serving varied customer needs. Applications span commercial (offices, retail, hospitality), industrial, outdoor, and residential sectors. Leading companies like Signify NV, Havells India Limited, Wipro Ltd, and Crompton Greaves Consumer Electricals Limited are actively influencing the market through innovation, strategic alliances, and expansive distribution networks. The market's future trend emphasizes sustainable and intelligent lighting to align with evolving consumer demands and regulatory requirements.

Lighting Market in India Company Market Share

This report offers a comprehensive analysis of the Indian lighting market from 2019 to 2033, with 2025 as the base year. It provides detailed insights into market segmentation, growth drivers, emerging opportunities, and competitive strategies. This report is an essential resource for manufacturers, distributors, investors, and policymakers navigating the dynamic Indian lighting sector. All data is presented in millions for clear, actionable insights.

Lighting Market in India Market Dynamics & Structure

The Indian lighting market is characterized by a dynamic interplay of factors shaping its structure and evolution. Market concentration is observed to be moderate, with a few large players holding significant shares, particularly in the LED segment, alongside a fragmented base of smaller manufacturers. Technological innovation is primarily driven by the rapid adoption of energy-efficient LED lighting solutions, spurred by government initiatives and growing environmental awareness. Regulatory frameworks, including Bureau of Energy Efficiency (BEE) star ratings and phased bans on incandescent bulbs, significantly influence product development and market entry. Competitive product substitutes are abundant, ranging from traditional lighting to emerging smart lighting solutions, forcing manufacturers to continuously innovate in terms of features, energy efficiency, and cost-effectiveness. End-user demographics are diverse, encompassing a growing urban population with increasing disposable incomes, a burgeoning industrial sector demanding specialized lighting, and a vast rural population with evolving lighting needs. Mergers and acquisitions (M&A) trends are notable as larger companies aim to consolidate market share and expand their product portfolios. For instance, recent years have seen strategic acquisitions aimed at bolstering capabilities in smart lighting and specialized industrial solutions.

- Market Concentration: Moderate, with dominant players in LED and a fragmented smaller manufacturer base.

- Technological Drivers: LED adoption, smart lighting integration, and energy efficiency mandates.

- Regulatory Impact: BEE star ratings, phased incandescent bulb bans, and import regulations.

- Competitive Landscape: Intense competition from domestic and international players, with product substitution a constant factor.

- End-User Dynamics: Shifting preferences towards energy-saving, aesthetically pleasing, and connected lighting solutions.

- M&A Activity: Strategic acquisitions and partnerships to enhance market reach and technological capabilities.

Lighting Market in India Growth Trends & Insights

The Indian lighting market is poised for robust expansion, driven by a confluence of economic, technological, and social factors. Market size evolution is marked by a significant shift from conventional lighting to LED, which now dominates the landscape and is expected to continue its upward trajectory. The adoption rates of smart lighting and IoT-enabled solutions are accelerating, particularly in commercial and premium residential segments, reflecting a growing demand for convenience, energy management, and enhanced living experiences. Technological disruptions, such as advancements in luminaire design, color rendering capabilities, and integrated controls, are reshaping product offerings and consumer expectations. Consumer behavior shifts are evident, with a growing emphasis on energy savings, longer product lifespans, and the aesthetic appeal of lighting. The increasing urbanization and rising disposable incomes are fueling demand for sophisticated lighting solutions across all application areas. The government's push for energy efficiency and sustainable development through various schemes and policies further acts as a powerful catalyst for market growth. The forecast period is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 15%, indicating substantial market penetration and revenue generation. The penetration of LED lighting is projected to reach over 90% of the total lighting market by 2033.

- Market Size Growth: Sustained upward trend driven by LED adoption and new technology integration.

- Adoption Rates: Rapid increase in LED adoption, with smart lighting gaining significant traction.

- Technological Disruptions: Innovations in LED efficiency, smart controls, and integrated lighting systems.

- Consumer Behavior: Prioritization of energy efficiency, longevity, aesthetics, and smart home integration.

- Urbanization Impact: Increased demand for modern and high-performance lighting solutions in cities.

- Government Support: Policies promoting energy conservation and adoption of energy-efficient technologies.

- Projected CAGR (2025-2033): ~15%

- LED Market Penetration by 2033: >90%

Dominant Regions, Countries, or Segments in Lighting Market in India

The Indian lighting market's dominance is shaped by distinct regional strengths and segment-specific growth drivers. The Commercial application segment, particularly offices and retail spaces, currently drives significant market growth. This is underpinned by rapid infrastructure development, the expansion of corporate sectors, and the increasing focus on creating aesthetically pleasing and energy-efficient retail environments. The increasing investment in smart buildings and the demand for sophisticated lighting control systems further bolster this segment's dominance. Among the types of products, Luminaires/Fixtures command the largest market share, reflecting the transition towards integrated lighting solutions over standalone lamps. Within light sources, LED continues its undisputed reign, owing to its superior energy efficiency, longevity, and versatility. The distribution channel of Wholesalers/Electricians remains crucial for widespread market reach, especially for the residential and smaller commercial sectors, although direct sales to developers are gaining prominence in large-scale projects.

- Dominant Application Segment: Commercial (Offices, Retail & Hospitality)

- Key Drivers: Infrastructure development, corporate expansion, retail modernization, smart building initiatives.

- Market Share Contribution: Estimated at 35% of the total market in 2025.

- Growth Potential: High, fueled by ongoing commercial construction and retrofitting projects.

- Dominant Product Type: Luminaires/Fixtures

- Key Drivers: Trend towards integrated lighting, demand for design flexibility, and energy-efficient solutions.

- Market Share Contribution: Estimated at 60% of the total product segment.

- Dominant Light Source: LED

- Key Drivers: Superior energy efficiency, longer lifespan, cost-effectiveness, diverse product range.

- Market Share Contribution: Dominant share of over 85% in the light source segment.

- Key Distribution Channel: Wholesalers/Electricians

- Key Drivers: Extensive reach into diverse market segments, established networks, accessibility for smaller projects.

- Growth Potential: Stable, with increasing influence of direct sales for large projects.

- Leading Region: North India (driven by government initiatives and urban development in NCR) and West India (due to strong industrial and commercial presence).

Lighting Market in India Product Landscape

The Indian lighting market showcases a vibrant product landscape driven by innovation and evolving consumer demands. LED luminaires and fixtures represent the forefront of product development, offering enhanced energy efficiency, superior lumen output, and a wide array of design options. This includes sophisticated downlights, track lights, linear lighting, and decorative fixtures tailored for specific applications. Smart lighting solutions, featuring Bluetooth and Wi-Fi connectivity, are gaining significant traction, enabling users to control lighting intensity, color temperature, and schedules remotely via mobile applications. Performance metrics such as efficacy (lumens per watt), color rendering index (CRI), and lifespan are becoming critical differentiators, with consumers increasingly prioritizing quality and long-term value. The integration of advanced technologies like dimming capabilities, tunable white, and human-centric lighting are also emerging as key selling propositions.

Key Drivers, Barriers & Challenges in Lighting Market in India

Key Drivers:

- Energy Efficiency Mandates and Government Initiatives: Programs like Perform, Achieve, Trade (PAT) and the push for LED adoption are significant growth catalysts.

- Rapid Urbanization and Infrastructure Development: Increasing construction of residential, commercial, and industrial spaces fuels demand for lighting solutions.

- Technological Advancements in LED and Smart Lighting: Innovations in efficiency, design, and connectivity are driving product upgrades.

- Increasing Disposable Incomes and Consumer Awareness: Growing demand for aesthetically pleasing, energy-saving, and technologically advanced lighting.

- Focus on Sustainable Development: Environmental concerns are propelling the shift towards eco-friendly lighting options.

Barriers & Challenges:

- Price Sensitivity and Affordability: While LED costs have reduced, affordability remains a concern for a significant portion of the population.

- Substandard Product Market: The presence of uncertified and low-quality products can erode consumer trust and impact the reputation of genuine manufacturers.

- Supply Chain Disruptions and Raw Material Volatility: Global supply chain issues and fluctuating raw material prices can impact production costs and availability.

- Skilled Workforce Shortage: A lack of trained professionals for installation and maintenance of advanced lighting systems can hinder adoption.

- Intense Competition and Price Wars: A highly competitive market often leads to price wars, affecting profit margins.

- Power Quality Issues: Inconsistent power supply in some regions can affect the performance and lifespan of lighting products.

Emerging Opportunities in Lighting Market in India

Emerging opportunities in the Indian lighting market lie in the burgeoning smart lighting and IoT integration space, catering to the growing demand for connected homes and smart cities. The healthcare sector presents a significant untapped market for specialized lighting solutions that enhance patient well-being and facilitate advanced medical procedures. Furthermore, the increasing adoption of solar-powered lighting solutions in rural and remote areas offers a substantial growth avenue, addressing energy access challenges and promoting sustainable development. The retrofitting of existing infrastructure, particularly in older commercial buildings and public spaces, presents a considerable opportunity for upgrading to energy-efficient and technologically advanced lighting systems.

Growth Accelerators in the Lighting Market in India Industry

Several key catalysts are accelerating the long-term growth of the Indian lighting market. The continued government focus on energy conservation and the promotion of smart city initiatives will provide a consistent demand for advanced lighting solutions. Technological breakthroughs in areas like Li-Fi (Light Fidelity) and advanced human-centric lighting are poised to create new market segments and product categories. Strategic partnerships between domestic and international players, as well as collaborations with real estate developers and smart home technology providers, will foster market penetration and innovation. The expansion of manufacturing capabilities within India, driven by initiatives like 'Make in India', will further reduce costs and improve accessibility.

Key Players Shaping the Lighting Market in India Market

- Halonix

- Syska

- Wipro Ltd

- MIC Electronics

- Signify N V

- Surya Roshini

- Crompton Greaves Consumer Electricals Limited

- Bajaj Electricals Ltd

- Havells India Limited

Notable Milestones in Lighting Market in India Sector

- May 2023: Signify N.V. illuminated 43 villages in Majuli Island, Assam, with Solar Lights through its Har Gaon Roshan CSR Program, enhancing rural safety and sustainable development.

- June 2022: Tolez launched a futuristic, wall-hanging artwork with customizable RGB ambient light, enhancing home entertainment and relaxation experiences with its mood-setting capabilities.

In-Depth Lighting Market in India Market Outlook

The Indian lighting market is on an accelerated growth trajectory, driven by a strong foundation of government support, rapid technological advancements, and evolving consumer preferences. The ongoing transition towards energy-efficient LED solutions, coupled with the burgeoning demand for smart and connected lighting, presents immense opportunities for innovation and market expansion. The focus on sustainable development and the increasing penetration of smart technologies in residential and commercial spaces will act as significant growth accelerators. Strategic investments in research and development, coupled with robust distribution networks, will be crucial for players to capitalize on the vast untapped potential within this dynamic market. The market is projected to witness sustained growth, offering lucrative prospects for stakeholders across the value chain.

Lighting Market in India Segmentation

-

1. Type of Product

- 1.1. Luminaires/Fixtures

- 1.2. Lamps

-

2. Light Source

- 2.1. LED

- 2.2. Conventional

-

3. Distribution Channel

- 3.1. Direct Sales/Developers/Contract

- 3.2. Wholesalers/Electricians

- 3.3. Lighting Specialists and Others

-

4. Application

-

4.1. Commercial

- 4.1.1. Offices

- 4.1.2. Retail & Hospitality

- 4.1.3. Healthcare Facilities

- 4.1.4. Others

-

4.2. Industrial

- 4.2.1. Process Industries

- 4.2.2. Discrete Industries

- 4.2.3. Warehouses and Other Industrial Setups

- 4.3. Outdoor

- 4.4. Residential

-

4.1. Commercial

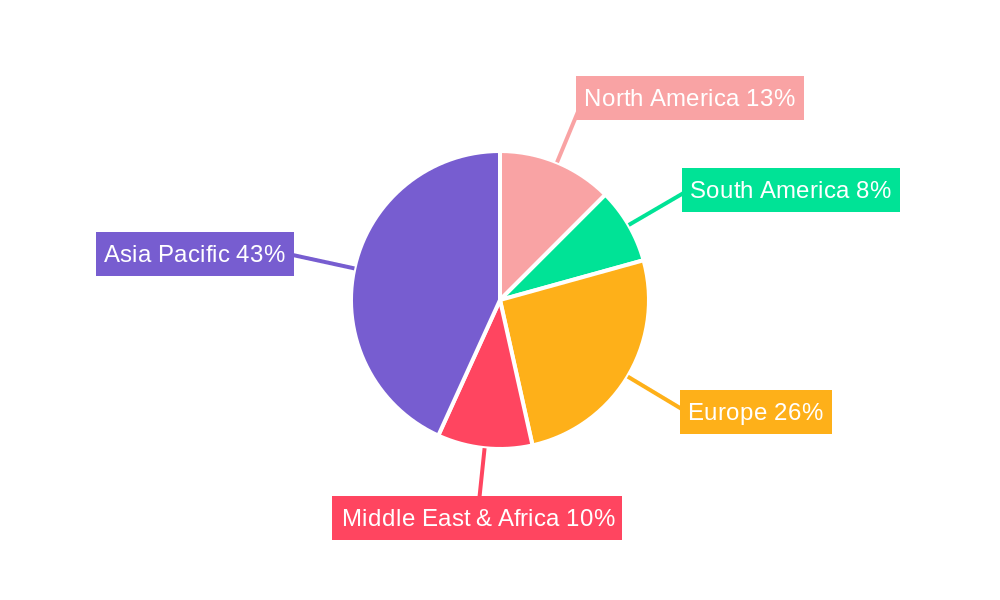

Lighting Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Lighting Market in India Regional Market Share

Geographic Coverage of Lighting Market in India

Lighting Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Need for Energy-efficient Lighting Systems; Favorable Government Regulations

- 3.3. Market Restrains

- 3.3.1. High Initial Investment

- 3.4. Market Trends

- 3.4.1. LED is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lighting Market in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 5.1.1. Luminaires/Fixtures

- 5.1.2. Lamps

- 5.2. Market Analysis, Insights and Forecast - by Light Source

- 5.2.1. LED

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales/Developers/Contract

- 5.3.2. Wholesalers/Electricians

- 5.3.3. Lighting Specialists and Others

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Commercial

- 5.4.1.1. Offices

- 5.4.1.2. Retail & Hospitality

- 5.4.1.3. Healthcare Facilities

- 5.4.1.4. Others

- 5.4.2. Industrial

- 5.4.2.1. Process Industries

- 5.4.2.2. Discrete Industries

- 5.4.2.3. Warehouses and Other Industrial Setups

- 5.4.3. Outdoor

- 5.4.4. Residential

- 5.4.1. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 6. North America Lighting Market in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 6.1.1. Luminaires/Fixtures

- 6.1.2. Lamps

- 6.2. Market Analysis, Insights and Forecast - by Light Source

- 6.2.1. LED

- 6.2.2. Conventional

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales/Developers/Contract

- 6.3.2. Wholesalers/Electricians

- 6.3.3. Lighting Specialists and Others

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Commercial

- 6.4.1.1. Offices

- 6.4.1.2. Retail & Hospitality

- 6.4.1.3. Healthcare Facilities

- 6.4.1.4. Others

- 6.4.2. Industrial

- 6.4.2.1. Process Industries

- 6.4.2.2. Discrete Industries

- 6.4.2.3. Warehouses and Other Industrial Setups

- 6.4.3. Outdoor

- 6.4.4. Residential

- 6.4.1. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 7. South America Lighting Market in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 7.1.1. Luminaires/Fixtures

- 7.1.2. Lamps

- 7.2. Market Analysis, Insights and Forecast - by Light Source

- 7.2.1. LED

- 7.2.2. Conventional

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales/Developers/Contract

- 7.3.2. Wholesalers/Electricians

- 7.3.3. Lighting Specialists and Others

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Commercial

- 7.4.1.1. Offices

- 7.4.1.2. Retail & Hospitality

- 7.4.1.3. Healthcare Facilities

- 7.4.1.4. Others

- 7.4.2. Industrial

- 7.4.2.1. Process Industries

- 7.4.2.2. Discrete Industries

- 7.4.2.3. Warehouses and Other Industrial Setups

- 7.4.3. Outdoor

- 7.4.4. Residential

- 7.4.1. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 8. Europe Lighting Market in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 8.1.1. Luminaires/Fixtures

- 8.1.2. Lamps

- 8.2. Market Analysis, Insights and Forecast - by Light Source

- 8.2.1. LED

- 8.2.2. Conventional

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales/Developers/Contract

- 8.3.2. Wholesalers/Electricians

- 8.3.3. Lighting Specialists and Others

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Commercial

- 8.4.1.1. Offices

- 8.4.1.2. Retail & Hospitality

- 8.4.1.3. Healthcare Facilities

- 8.4.1.4. Others

- 8.4.2. Industrial

- 8.4.2.1. Process Industries

- 8.4.2.2. Discrete Industries

- 8.4.2.3. Warehouses and Other Industrial Setups

- 8.4.3. Outdoor

- 8.4.4. Residential

- 8.4.1. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 9. Middle East & Africa Lighting Market in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 9.1.1. Luminaires/Fixtures

- 9.1.2. Lamps

- 9.2. Market Analysis, Insights and Forecast - by Light Source

- 9.2.1. LED

- 9.2.2. Conventional

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales/Developers/Contract

- 9.3.2. Wholesalers/Electricians

- 9.3.3. Lighting Specialists and Others

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Commercial

- 9.4.1.1. Offices

- 9.4.1.2. Retail & Hospitality

- 9.4.1.3. Healthcare Facilities

- 9.4.1.4. Others

- 9.4.2. Industrial

- 9.4.2.1. Process Industries

- 9.4.2.2. Discrete Industries

- 9.4.2.3. Warehouses and Other Industrial Setups

- 9.4.3. Outdoor

- 9.4.4. Residential

- 9.4.1. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 10. Asia Pacific Lighting Market in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 10.1.1. Luminaires/Fixtures

- 10.1.2. Lamps

- 10.2. Market Analysis, Insights and Forecast - by Light Source

- 10.2.1. LED

- 10.2.2. Conventional

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Direct Sales/Developers/Contract

- 10.3.2. Wholesalers/Electricians

- 10.3.3. Lighting Specialists and Others

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Commercial

- 10.4.1.1. Offices

- 10.4.1.2. Retail & Hospitality

- 10.4.1.3. Healthcare Facilities

- 10.4.1.4. Others

- 10.4.2. Industrial

- 10.4.2.1. Process Industries

- 10.4.2.2. Discrete Industries

- 10.4.2.3. Warehouses and Other Industrial Setups

- 10.4.3. Outdoor

- 10.4.4. Residential

- 10.4.1. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Halonix

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Syska

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wipro Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MIC Electronics*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Signify N V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Surya Roshini

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crompton Greaves Consumer Electricals Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bajaj Electricals Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Havells India Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Halonix

List of Figures

- Figure 1: Global Lighting Market in India Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Lighting Market in India Revenue (million), by Type of Product 2025 & 2033

- Figure 3: North America Lighting Market in India Revenue Share (%), by Type of Product 2025 & 2033

- Figure 4: North America Lighting Market in India Revenue (million), by Light Source 2025 & 2033

- Figure 5: North America Lighting Market in India Revenue Share (%), by Light Source 2025 & 2033

- Figure 6: North America Lighting Market in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: North America Lighting Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Lighting Market in India Revenue (million), by Application 2025 & 2033

- Figure 9: North America Lighting Market in India Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Lighting Market in India Revenue (million), by Country 2025 & 2033

- Figure 11: North America Lighting Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Lighting Market in India Revenue (million), by Type of Product 2025 & 2033

- Figure 13: South America Lighting Market in India Revenue Share (%), by Type of Product 2025 & 2033

- Figure 14: South America Lighting Market in India Revenue (million), by Light Source 2025 & 2033

- Figure 15: South America Lighting Market in India Revenue Share (%), by Light Source 2025 & 2033

- Figure 16: South America Lighting Market in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 17: South America Lighting Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: South America Lighting Market in India Revenue (million), by Application 2025 & 2033

- Figure 19: South America Lighting Market in India Revenue Share (%), by Application 2025 & 2033

- Figure 20: South America Lighting Market in India Revenue (million), by Country 2025 & 2033

- Figure 21: South America Lighting Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Lighting Market in India Revenue (million), by Type of Product 2025 & 2033

- Figure 23: Europe Lighting Market in India Revenue Share (%), by Type of Product 2025 & 2033

- Figure 24: Europe Lighting Market in India Revenue (million), by Light Source 2025 & 2033

- Figure 25: Europe Lighting Market in India Revenue Share (%), by Light Source 2025 & 2033

- Figure 26: Europe Lighting Market in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 27: Europe Lighting Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Europe Lighting Market in India Revenue (million), by Application 2025 & 2033

- Figure 29: Europe Lighting Market in India Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Lighting Market in India Revenue (million), by Country 2025 & 2033

- Figure 31: Europe Lighting Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Lighting Market in India Revenue (million), by Type of Product 2025 & 2033

- Figure 33: Middle East & Africa Lighting Market in India Revenue Share (%), by Type of Product 2025 & 2033

- Figure 34: Middle East & Africa Lighting Market in India Revenue (million), by Light Source 2025 & 2033

- Figure 35: Middle East & Africa Lighting Market in India Revenue Share (%), by Light Source 2025 & 2033

- Figure 36: Middle East & Africa Lighting Market in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Middle East & Africa Lighting Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Middle East & Africa Lighting Market in India Revenue (million), by Application 2025 & 2033

- Figure 39: Middle East & Africa Lighting Market in India Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East & Africa Lighting Market in India Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Lighting Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Lighting Market in India Revenue (million), by Type of Product 2025 & 2033

- Figure 43: Asia Pacific Lighting Market in India Revenue Share (%), by Type of Product 2025 & 2033

- Figure 44: Asia Pacific Lighting Market in India Revenue (million), by Light Source 2025 & 2033

- Figure 45: Asia Pacific Lighting Market in India Revenue Share (%), by Light Source 2025 & 2033

- Figure 46: Asia Pacific Lighting Market in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 47: Asia Pacific Lighting Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Asia Pacific Lighting Market in India Revenue (million), by Application 2025 & 2033

- Figure 49: Asia Pacific Lighting Market in India Revenue Share (%), by Application 2025 & 2033

- Figure 50: Asia Pacific Lighting Market in India Revenue (million), by Country 2025 & 2033

- Figure 51: Asia Pacific Lighting Market in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lighting Market in India Revenue million Forecast, by Type of Product 2020 & 2033

- Table 2: Global Lighting Market in India Revenue million Forecast, by Light Source 2020 & 2033

- Table 3: Global Lighting Market in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Lighting Market in India Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Lighting Market in India Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Lighting Market in India Revenue million Forecast, by Type of Product 2020 & 2033

- Table 7: Global Lighting Market in India Revenue million Forecast, by Light Source 2020 & 2033

- Table 8: Global Lighting Market in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global Lighting Market in India Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Lighting Market in India Revenue million Forecast, by Country 2020 & 2033

- Table 11: United States Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Canada Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Lighting Market in India Revenue million Forecast, by Type of Product 2020 & 2033

- Table 15: Global Lighting Market in India Revenue million Forecast, by Light Source 2020 & 2033

- Table 16: Global Lighting Market in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 17: Global Lighting Market in India Revenue million Forecast, by Application 2020 & 2033

- Table 18: Global Lighting Market in India Revenue million Forecast, by Country 2020 & 2033

- Table 19: Brazil Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Lighting Market in India Revenue million Forecast, by Type of Product 2020 & 2033

- Table 23: Global Lighting Market in India Revenue million Forecast, by Light Source 2020 & 2033

- Table 24: Global Lighting Market in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Lighting Market in India Revenue million Forecast, by Application 2020 & 2033

- Table 26: Global Lighting Market in India Revenue million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Germany Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: France Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Italy Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Spain Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Russia Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Global Lighting Market in India Revenue million Forecast, by Type of Product 2020 & 2033

- Table 37: Global Lighting Market in India Revenue million Forecast, by Light Source 2020 & 2033

- Table 38: Global Lighting Market in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Lighting Market in India Revenue million Forecast, by Application 2020 & 2033

- Table 40: Global Lighting Market in India Revenue million Forecast, by Country 2020 & 2033

- Table 41: Turkey Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Israel Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: GCC Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: Global Lighting Market in India Revenue million Forecast, by Type of Product 2020 & 2033

- Table 48: Global Lighting Market in India Revenue million Forecast, by Light Source 2020 & 2033

- Table 49: Global Lighting Market in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 50: Global Lighting Market in India Revenue million Forecast, by Application 2020 & 2033

- Table 51: Global Lighting Market in India Revenue million Forecast, by Country 2020 & 2033

- Table 52: China Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 53: India Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Japan Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Lighting Market in India Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lighting Market in India?

The projected CAGR is approximately 10.97%.

2. Which companies are prominent players in the Lighting Market in India?

Key companies in the market include Halonix, Syska, Wipro Ltd, MIC Electronics*List Not Exhaustive, Signify N V, Surya Roshini, Crompton Greaves Consumer Electricals Limited, Bajaj Electricals Ltd, Havells India Limited.

3. What are the main segments of the Lighting Market in India?

The market segments include Type of Product, Light Source, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 354.33 million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Need for Energy-efficient Lighting Systems; Favorable Government Regulations.

6. What are the notable trends driving market growth?

LED is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

High Initial Investment.

8. Can you provide examples of recent developments in the market?

May 2023 - Signify N.V. has announced it has illuminated 43 villages in Majuli Island, Assam, to increase the safety of local inhabitants by lighting up their streets with Solar Lights. The project executed in partnership with (ESAF) is part of the company’s Har Gaon Roshan CSR Program, that focuses on sustainable rural development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lighting Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lighting Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lighting Market in India?

To stay informed about further developments, trends, and reports in the Lighting Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence