Key Insights

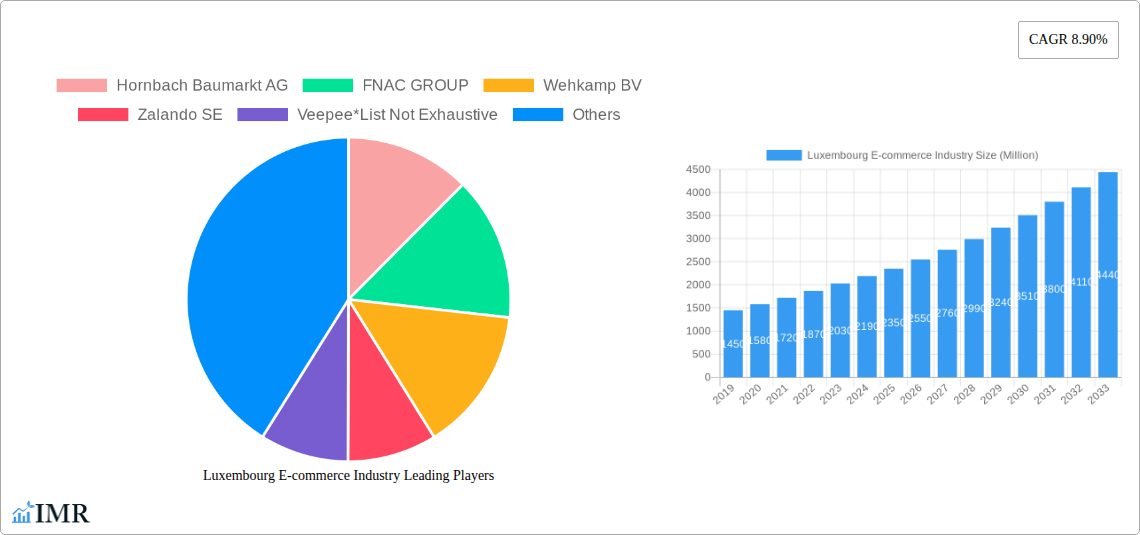

The Luxembourg e-commerce market is projected for significant expansion, forecast to reach $216 million by 2025, at a Compound Annual Growth Rate (CAGR) of 8.9% through 2033. This growth is driven by widespread online shopping adoption, fueled by evolving digital behaviors and high internet penetration. The B2C segment is a primary driver, with strong demand in Fashion & Apparel, Beauty & Personal Care, and Consumer Electronics, catering to a Luxembourgish consumer base valuing convenience, variety, and competitive pricing.

Luxembourg E-commerce Industry Market Size (In Million)

Advancing smartphone penetration, sophisticated logistics, and increasing trust in online payments further support this growth. The B2B e-commerce segment offers substantial opportunities as businesses adopt digital procurement. Major players like Amazon and Alibaba Group, alongside specialized retailers, are actively influencing the market through strategic investments. Potential challenges include evolving data privacy regulations and intense competition. Nevertheless, the outlook for Luxembourg's e-commerce ecosystem remains highly positive.

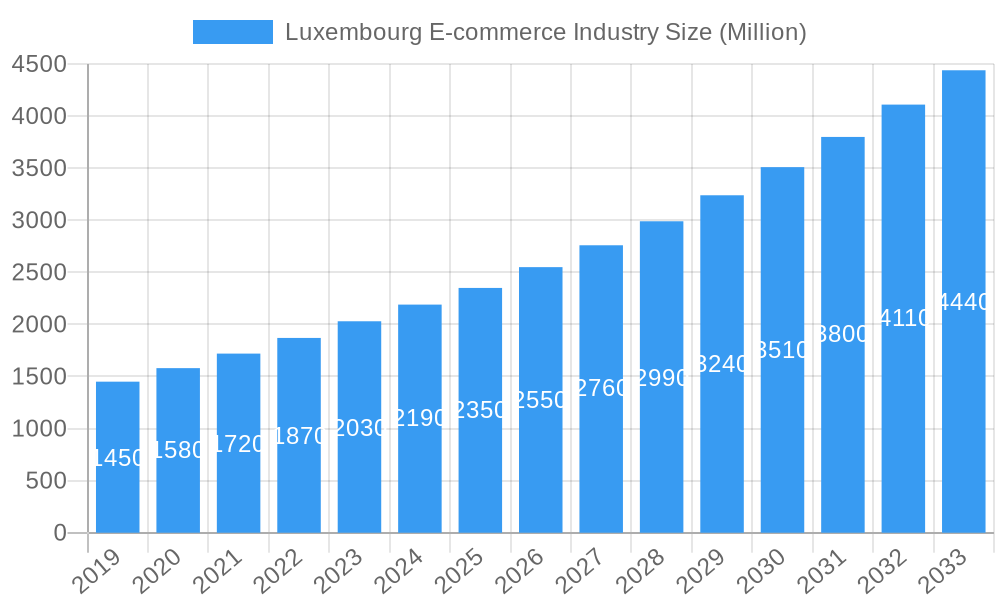

Luxembourg E-commerce Industry Company Market Share

Luxembourg E-commerce Industry Report: Growth, Trends, and Opportunities (2019-2033)

Unlock the insights into Luxembourg's rapidly expanding e-commerce landscape. This comprehensive report delves into the market dynamics, growth trajectories, and competitive strategies shaping the future of online retail in the Grand Duchy. Analyze key segments, including B2C and B2B e-commerce, with detailed market size projections in millions for the period of 2017-2027 and a forecast period of 2025-2033. Understand the influence of dominant players and emerging trends that are redefining consumer behavior and business operations. Essential for industry professionals, investors, and strategic planners seeking to capitalize on Luxembourg's digital commerce potential.

Luxembourg E-commerce Industry Market Dynamics & Structure

The Luxembourg e-commerce industry is characterized by a moderate market concentration, with a growing number of international players establishing a significant presence alongside local businesses. Technological innovation is a key driver, fueled by increasing internet penetration and the adoption of advanced digital solutions for online sales and customer engagement. Regulatory frameworks, while supportive of digital trade, are evolving to address cross-border e-commerce nuances and data protection. Competitive product substitutes exist, particularly in traditional retail sectors, but the convenience and growing variety offered by online platforms are increasingly winning over consumers. End-user demographics are diverse, with a significant portion of the population being digitally savvy and accustomed to online shopping. Mergers and acquisitions (M&A) trends are present, indicating consolidation and strategic expansion efforts by key market participants to enhance their market share and operational capabilities.

- Market Concentration: Moderately concentrated, with key international players holding substantial market share.

- Technological Innovation Drivers: High internet penetration, adoption of AI in customer service, and advanced logistics solutions.

- Regulatory Frameworks: Evolving regulations focusing on consumer protection, data privacy (GDPR), and cross-border e-commerce.

- Competitive Product Substitutes: Traditional brick-and-mortar retail remains a substitute, though e-commerce offers superior convenience and variety.

- End-User Demographics: A digitally proficient population with increasing online purchasing power and a preference for convenience.

- M&A Trends: Strategic acquisitions and partnerships aimed at expanding market reach and product portfolios.

Luxembourg E-commerce Industry Growth Trends & Insights

The Luxembourg e-commerce industry is poised for robust growth, projected to witness a significant Compound Annual Growth Rate (CAGR) from 2019 to 2033. This expansion is driven by an increasing adoption rate of online shopping channels across various demographics, spurred by evolving consumer behaviors that prioritize convenience, wider product selection, and competitive pricing. Technological disruptions, including the widespread adoption of mobile commerce (m-commerce) and advancements in artificial intelligence for personalized customer experiences, are further accelerating this growth. Consumer behavior shifts are evident, with a discernible move towards omnichannel shopping strategies, where online and offline experiences are seamlessly integrated. Market penetration is expected to deepen, reaching new customer segments as digital literacy improves and the infrastructure supporting online transactions becomes more sophisticated. The market size is projected to reach xx million units by 2025, with continued upward trajectory throughout the forecast period.

Dominant Regions, Countries, or Segments in Luxembourg E-commerce Industry

The B2C e-commerce segment is the primary driver of market growth in Luxembourg, showcasing impressive market size expansion from 2017 to 2027. Within B2C, the Fashion & Apparel segment consistently emerges as a dominant force, driven by the high demand for trendy clothing, footwear, and accessories, coupled with frequent online promotions and easy return policies. Consumer Electronics also holds a significant share, benefiting from rapid technological advancements and a consumer base eager to upgrade their gadgets. The Furniture & Home segment is witnessing substantial growth as consumers increasingly opt for online purchasing of home goods and décor, facilitated by improved visualization tools and logistics.

The market segmentation by application reveals a diversified landscape:

- Fashion & Apparel: Leads in GMV due to strong brand presence and consumer preference for online fashion retail.

- Consumer Electronics: A consistent high-performer driven by innovation and demand for new technology.

- Furniture & Home: Experiencing significant growth with enhanced online shopping experiences.

- Beauty & Personal Care: Steady growth fueled by direct-to-consumer brands and a focus on wellness.

- Food & Beverage: Growing adoption, especially for specialty items and convenience.

- Others (Toys, DIY, Media, etc.): A diverse category with specific niche growth drivers.

The B2B e-commerce market, while currently smaller than B2C, is also demonstrating strong growth potential from 2017 to 2027. This is attributed to an increasing number of businesses adopting digital procurement solutions, streamlining their supply chains, and leveraging online platforms for sourcing goods and services. Key drivers for dominance include Luxembourg's strategic location within Europe, its robust digital infrastructure, and a business-friendly environment that encourages digital transformation. Market share within B2C is distributed among both large international e-commerce giants and specialized local online retailers, with the former often dominating in terms of overall GMV.

Luxembourg E-commerce Industry Product Landscape

The Luxembourg e-commerce industry is characterized by a dynamic product landscape driven by continuous innovation and expanding product categories. Consumers can now access a vast array of goods, from high-fashion apparel and cutting-edge consumer electronics to a growing selection of organic food items and sustainable home furnishings. Product innovations are frequently introduced, with brands leveraging digital platforms to showcase unique selling propositions such as personalized offerings, eco-friendly materials, and advanced technological features. Performance metrics are increasingly tracked through online channels, providing data-driven insights into product appeal and customer satisfaction. The integration of augmented reality for virtual try-ons in fashion and advanced product visualization for furniture are among the technological advancements enhancing the online shopping experience.

Key Drivers, Barriers & Challenges in Luxembourg E-commerce Industry

Key Drivers:

- Digital Infrastructure: Extensive high-speed internet availability and robust logistics networks.

- Consumer Adoption: High digital literacy and a growing preference for online shopping convenience.

- Cross-Border E-commerce: Luxembourg's central European location facilitates seamless international online trade.

- Government Support: Initiatives promoting digitalization and e-commerce growth.

- Technological Advancements: Mobile commerce, AI-driven personalization, and secure payment gateways.

Barriers & Challenges:

- Supply Chain Complexities: Managing international logistics and last-mile delivery efficiently.

- Regulatory Compliance: Navigating evolving data privacy and consumer protection laws across borders.

- Customer Acquisition Costs: Intense competition driving up marketing and advertising expenses.

- Building Trust: Overcoming consumer concerns regarding online security and product authenticity.

- Skilled Workforce: Demand for specialized e-commerce talent in areas like digital marketing and data analytics.

Emerging Opportunities in Luxembourg E-commerce Industry

Emerging opportunities in the Luxembourg e-commerce industry lie in the expansion of niche markets, such as sustainable and ethical products, catering to a growing environmentally conscious consumer base. The increasing demand for personalized shopping experiences presents opportunities for AI-driven recommendations and customized product bundles. Furthermore, the burgeoning online grocery sector and specialized food delivery services offer untapped potential. The development of innovative payment solutions, including contactless and cryptocurrency options, also presents a significant avenue for growth. Leveraging cross-border e-commerce for smaller businesses to reach international customers is another key opportunity.

Growth Accelerators in the Luxembourg E-commerce Industry Industry

Catalysts driving long-term growth in the Luxembourg e-commerce industry include continued investment in advanced digital infrastructure, such as 5G networks and enhanced cybersecurity measures, which will foster greater trust and efficiency. Strategic partnerships between e-commerce platforms, logistics providers, and technology companies are crucial for streamlining operations and enhancing customer experience. Market expansion strategies, including the development of localized online marketplaces and targeted marketing campaigns for diverse demographics, will further fuel growth. The adoption of sustainable practices within e-commerce operations, from packaging to delivery, will also resonate with consumers and drive long-term brand loyalty.

Key Players Shaping the Luxembourg E-commerce Industry Market

- Hornbach Baumarkt AG

- FNAC GROUP

- Wehkamp BV

- Zalando SE

- Veepee

- Luxcaddy

- Amazon com Inc

- Alibaba Group

- Next Germany GMBH

- Auchan Retail

Notable Milestones in Luxembourg E-commerce Industry Sector

- June 2022: Orange, the telecommunications retailer, introduced a click-to-call service on its website to promote its online sales, enabling its telesales team to arrange callbacks for customer queries and order management.

- November 2022: EY and Shopify announced a partnership to promote online business growth and increase the sale of potential products, with EY providing assistance in resource planning, CRM, and inventory management for Shopify.

In-Depth Luxembourg E-commerce Industry Market Outlook

The Luxembourg e-commerce industry is set for a promising future, with growth accelerators focusing on enhancing digital infrastructure and fostering strategic collaborations. The increasing adoption of AI for personalized customer journeys and the expansion of sustainable e-commerce practices are key to capturing future market share. Investing in localized content and payment solutions will be crucial for deeper market penetration. The industry's outlook is characterized by continued innovation, a focus on customer-centricity, and the leveraging of technological advancements to create seamless and efficient online shopping experiences, ultimately driving significant economic value and market expansion.

Luxembourg E-commerce Industry Segmentation

-

1. B2C ecommerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B ecommerce

- 10.1. Market size for the period of 2017-2027

Luxembourg E-commerce Industry Segmentation By Geography

- 1. Luxembourg

Luxembourg E-commerce Industry Regional Market Share

Geographic Coverage of Luxembourg E-commerce Industry

Luxembourg E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased adoption of Digital Solutions; Range of payments to serve diverse and underbanked shoppers

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Increased adoption of Digital Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Luxembourg E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B ecommerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Luxembourg

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hornbach Baumarkt AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FNAC GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wehkamp BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zalando SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Veepee*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Luxcaddy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon com Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alibaba Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Next Germany GMBH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Auchan Retail

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hornbach Baumarkt AG

List of Figures

- Figure 1: Luxembourg E-commerce Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Luxembourg E-commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Luxembourg E-commerce Industry Revenue million Forecast, by B2C ecommerce 2020 & 2033

- Table 2: Luxembourg E-commerce Industry Revenue million Forecast, by Market size (GMV) for the period of 2017-2027 2020 & 2033

- Table 3: Luxembourg E-commerce Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Luxembourg E-commerce Industry Revenue million Forecast, by Beauty & Personal Care 2020 & 2033

- Table 5: Luxembourg E-commerce Industry Revenue million Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Luxembourg E-commerce Industry Revenue million Forecast, by Fashion & Apparel 2020 & 2033

- Table 7: Luxembourg E-commerce Industry Revenue million Forecast, by Food & Beverage 2020 & 2033

- Table 8: Luxembourg E-commerce Industry Revenue million Forecast, by Furniture & Home 2020 & 2033

- Table 9: Luxembourg E-commerce Industry Revenue million Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Luxembourg E-commerce Industry Revenue million Forecast, by B2B ecommerce 2020 & 2033

- Table 11: Luxembourg E-commerce Industry Revenue million Forecast, by Region 2020 & 2033

- Table 12: Luxembourg E-commerce Industry Revenue million Forecast, by B2C ecommerce 2020 & 2033

- Table 13: Luxembourg E-commerce Industry Revenue million Forecast, by Market size (GMV) for the period of 2017-2027 2020 & 2033

- Table 14: Luxembourg E-commerce Industry Revenue million Forecast, by Application 2020 & 2033

- Table 15: Luxembourg E-commerce Industry Revenue million Forecast, by Beauty & Personal Care 2020 & 2033

- Table 16: Luxembourg E-commerce Industry Revenue million Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Luxembourg E-commerce Industry Revenue million Forecast, by Fashion & Apparel 2020 & 2033

- Table 18: Luxembourg E-commerce Industry Revenue million Forecast, by Food & Beverage 2020 & 2033

- Table 19: Luxembourg E-commerce Industry Revenue million Forecast, by Furniture & Home 2020 & 2033

- Table 20: Luxembourg E-commerce Industry Revenue million Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Luxembourg E-commerce Industry Revenue million Forecast, by B2B ecommerce 2020 & 2033

- Table 22: Luxembourg E-commerce Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxembourg E-commerce Industry?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Luxembourg E-commerce Industry?

Key companies in the market include Hornbach Baumarkt AG, FNAC GROUP, Wehkamp BV, Zalando SE, Veepee*List Not Exhaustive, Luxcaddy, Amazon com Inc, Alibaba Group, Next Germany GMBH, Auchan Retail.

3. What are the main segments of the Luxembourg E-commerce Industry?

The market segments include B2C ecommerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B ecommerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 216 million as of 2022.

5. What are some drivers contributing to market growth?

Increased adoption of Digital Solutions; Range of payments to serve diverse and underbanked shoppers.

6. What are the notable trends driving market growth?

Increased adoption of Digital Solutions.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

June 2022: To promote its online sales, Orange, the telecommunications retailer, introduced a click-to-call service on its website. Through this service, the brand's telesales team will arrange a callback to answer customer queries and manage orders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxembourg E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxembourg E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxembourg E-commerce Industry?

To stay informed about further developments, trends, and reports in the Luxembourg E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence