Key Insights

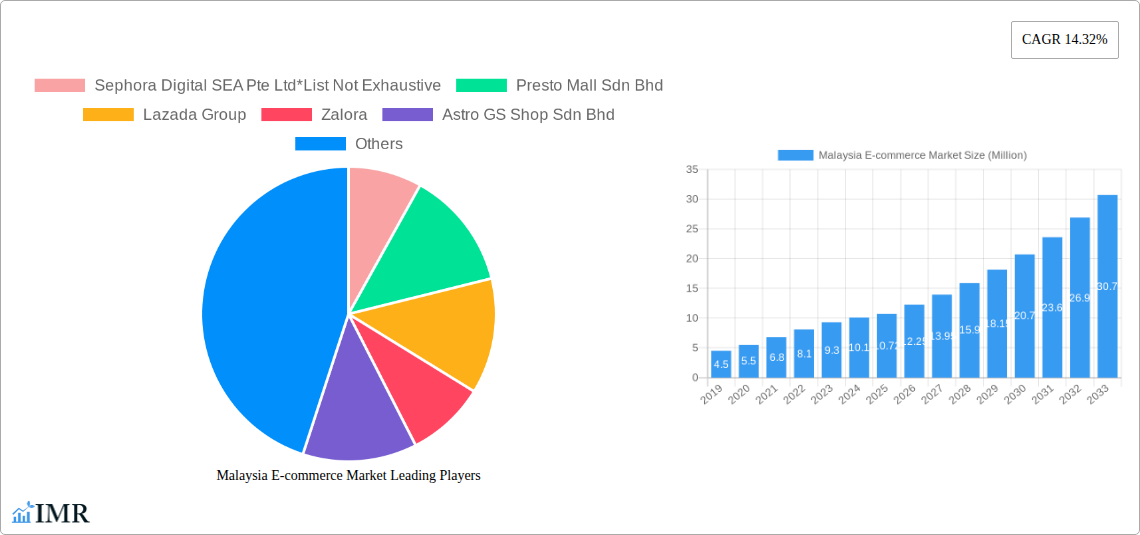

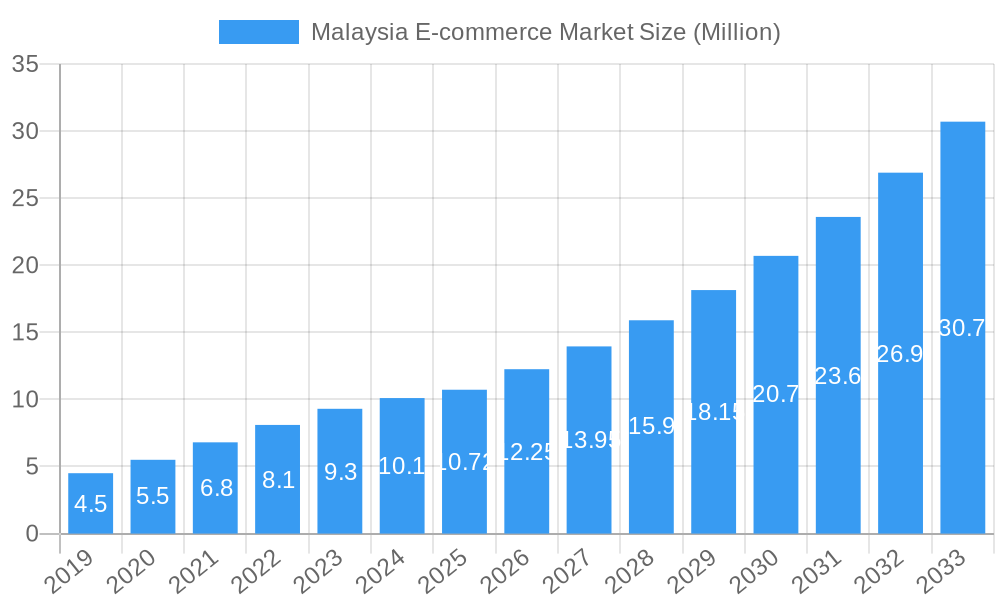

The Malaysian e-commerce market is poised for substantial expansion, projected to reach an impressive 10.72 billion units by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 14.32%. This robust growth is fueled by a confluence of accelerating digital adoption, increasing internet penetration, and a burgeoning middle class with growing disposable incomes. The market is characterized by a dynamic shift towards online purchasing for a wide array of goods and services, encompassing everything from daily necessities to discretionary items. Key drivers include the convenience and accessibility offered by online platforms, the increasing trust consumers place in digital transactions, and the continuous innovation by e-commerce players in logistics, payment solutions, and personalized customer experiences. The government's commitment to fostering a digital economy further bolsters this growth trajectory, with initiatives aimed at enhancing digital infrastructure and promoting online businesses.

Malaysia E-commerce Market Market Size (In Million)

The market's segmentation reveals a strong presence of B2C e-commerce, with segments like Fashion and Apparel, Beauty and Personal Care, and Consumer Electronics leading the charge. The increasing sophistication of online shopping experiences, coupled with effective marketing strategies, contributes significantly to the dominance of these categories. While B2B e-commerce also presents opportunities, the current momentum leans heavily towards consumer-driven online retail. Emerging trends such as the rise of social commerce, live streaming sales, and the increasing adoption of mobile commerce are further reshaping the landscape. However, potential restraints such as logistical challenges in certain remote areas, evolving regulatory frameworks, and the need for continuous investment in cybersecurity and fraud prevention will require strategic attention from market participants to ensure sustained and inclusive growth. Companies like Shopee, Lazada Group, and Presto Mall Sdn Bhd are at the forefront, actively shaping this evolving market.

Malaysia E-commerce Market Company Market Share

Unveiling the Dynamic Malaysia E-commerce Market: A Comprehensive Report (2019-2033)

This in-depth report offers a definitive analysis of the burgeoning Malaysia E-commerce Market, providing critical insights for stakeholders navigating this rapidly evolving digital landscape. Covering the historical period from 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this study delves into market dynamics, growth trends, dominant segments, product innovation, key drivers, challenges, opportunities, and the influential players shaping Malaysia's online retail future. We meticulously analyze both the broad Malaysia E-commerce Market and its granular components, including the B2C e-commerce market segmented by applications such as Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverage, Furniture and Home, and Others (Toys, DIY, Media, etc.). Furthermore, the report examines the B2B e-commerce market, providing a comprehensive view of the entire digital commerce ecosystem.

Malaysia E-commerce Market Market Dynamics & Structure

The Malaysia E-commerce Market is characterized by a moderate to high level of market concentration, with key players like Shopee and Lazada dominating significant market share, particularly in the B2C segment. Technological innovation is a primary driver, fueled by increasing smartphone penetration, robust internet infrastructure, and a growing digital-native consumer base. Regulatory frameworks, such as the Malaysia Digital initiative launched in July 2022, are actively shaping the market by promoting digital adoption and attracting investment. Competitive product substitutes are abundant across all segments, pushing businesses to differentiate through superior customer experience, pricing, and product variety. End-user demographics reveal a young, tech-savvy population with rising disposable incomes, creating a fertile ground for online retail growth. Mergers and Acquisitions (M&A) trends are emerging as larger players seek to consolidate their market position and expand their service offerings. For instance, strategic partnerships and acquisitions are crucial for expanding reach into diverse segments like Beauty and Personal Care and Fashion and Apparel.

- Market Concentration: Dominated by a few major e-commerce platforms, with a growing presence of niche players.

- Technological Innovation: Driven by mobile-first strategies, AI-powered personalization, and advancements in logistics and payment solutions.

- Regulatory Frameworks: Government initiatives like Malaysia Digital are fostering a conducive environment for e-commerce growth.

- Competitive Landscape: Intense competition across all product categories, with price, convenience, and product authenticity as key differentiators.

- End-User Demographics: A young, digitally connected population with increasing purchasing power and a preference for online shopping convenience.

- M&A Trends: Strategic acquisitions and partnerships aimed at market consolidation and service diversification.

Malaysia E-commerce Market Growth Trends & Insights

The Malaysia E-commerce Market has experienced a remarkable growth trajectory, consistently outperforming traditional retail channels. This expansion is underpinned by a significant surge in adoption rates, driven by convenience, wider product selection, and competitive pricing. Technological disruptions, including the proliferation of mobile commerce and the integration of AI for personalized shopping experiences, have fundamentally reshaped consumer behavior. Malaysians are increasingly embracing online platforms for their everyday purchases, from essential goods to discretionary items. The B2C e-commerce market, in particular, is witnessing substantial growth, fueled by evolving consumer preferences and a robust digital infrastructure. Mobile commerce, representing a substantial portion of overall e-commerce transactions, is projected to continue its rapid ascent. The B2B e-commerce market is also on an upward trajectory, as businesses recognize the efficiency and cost-effectiveness of digital procurement. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% over the forecast period, with market penetration reaching significant levels as more consumers and businesses transition to online channels.

- Market Size Evolution: Consistent year-on-year growth, exceeding the performance of brick-and-mortar retail.

- Adoption Rates: Rapid increase in e-commerce adoption across diverse demographics and product categories.

- Technological Disruptions: Mobile commerce, AI, and advanced payment gateways are transforming the shopping experience.

- Consumer Behavior Shifts: Growing preference for online shopping due to convenience, variety, and competitive pricing.

- CAGR: Projected to be xx% for the forecast period 2025-2033, indicating sustained growth.

- Market Penetration: Increasing proportion of retail sales conducted online, reflecting a fundamental shift in consumer habits.

Dominant Regions, Countries, or Segments in Malaysia E-commerce Market

The B2C e-commerce market is the primary engine driving the Malaysia E-commerce Market, with a significant emphasis on key application segments. Fashion and Apparel stands out as a dominant segment, owing to its broad appeal, frequent purchase cycles, and the ease of online browsing and purchasing. This is closely followed by Consumer Electronics, driven by demand for the latest gadgets and technological innovations. The Beauty and Personal Care segment also exhibits strong growth, facilitated by the increasing influence of social media and online beauty influencers. Food and Beverage is emerging as a significant player, particularly with the rise of online grocery delivery services and meal kit subscriptions. Furniture and Home products are gaining traction as consumers become more comfortable purchasing larger items online. The Others (Toys, DIY, Media, etc.) segment, while diverse, collectively contributes to the market's expansion. The B2B e-commerce market, while currently smaller in overall value compared to B2C, is projected to grow substantially from 2017-2027, driven by digitalization efforts among Malaysian businesses.

Key drivers for segment dominance include:

- Economic Policies: Government support for digital transformation and e-commerce infrastructure development.

- Infrastructure: Advancements in logistics, warehousing, and payment gateways facilitating seamless online transactions.

- Consumer Demographics: A young, digitally inclined population actively participating in online shopping.

- Digital Marketing Reach: Effective online advertising and social media campaigns driving consumer engagement.

Factors contributing to market share and growth potential vary by segment:

- Fashion and Apparel: High repeat purchase rates and the influence of fast fashion trends.

- Consumer Electronics: Constant product innovation and competitive pricing strategies.

- Beauty and Personal Care: Strong influencer marketing and a focus on product discovery.

- Food and Beverage: Growing demand for convenience and same-day delivery services.

- Furniture and Home: Increasing adoption of online home decor solutions and virtual showroom experiences.

- B2B E-commerce: Growing adoption of e-procurement platforms for increased operational efficiency and cost savings.

The market size for the B2B e-commerce market for the period of 2017-2027 is estimated to reach xx Billion units.

Malaysia E-commerce Market Product Landscape

The product landscape within the Malaysia E-commerce Market is characterized by a constant influx of innovative offerings and evolving consumer demands. From the latest smartphones and smart home devices in Consumer Electronics to on-trend apparel and accessories in Fashion and Apparel, the market caters to a wide spectrum of needs. The Beauty and Personal Care segment thrives on new product launches, organic and halal-certified options, and personalized skincare solutions. Food and Beverage offerings are expanding to include gourmet items, ready-to-eat meals, and health-conscious options. In Furniture and Home, personalized décor and sustainable materials are gaining prominence. Technological advancements are enhancing product performance metrics, such as battery life in electronics or fabric technology in apparel. Unique selling propositions often revolve around product authenticity, competitive pricing, and the convenience of doorstep delivery, further enhanced by advancements in logistics and fulfillment.

Key Drivers, Barriers & Challenges in Malaysia E-commerce Market

Key Drivers:

- Technological Advancements: Widespread smartphone adoption, high internet penetration, and the growth of 5G infrastructure are crucial enablers.

- Government Support: Initiatives like Malaysia Digital aim to foster a robust digital economy, encouraging investment and innovation.

- Growing Middle Class: Increasing disposable incomes and a rising preference for convenience drive online spending.

- Mobile Commerce Dominance: The ubiquitous nature of smartphones makes mobile shopping the preferred channel for many consumers.

- E-wallet and Digital Payment Adoption: Seamless and secure payment options are vital for facilitating online transactions.

Barriers & Challenges:

- Logistics and Infrastructure Gaps: While improving, last-mile delivery challenges, especially in rural areas, can hinder growth.

- Trust and Security Concerns: Consumer apprehension regarding online fraud and data privacy remains a significant barrier.

- Counterfeit Products: The proliferation of fake goods erodes consumer trust and brand reputation, as highlighted by Lazada's anti-counterfeiting efforts.

- Intense Competition: A crowded marketplace leads to price wars and pressure on profit margins.

- Digital Literacy Gaps: While improving, some segments of the population may still face challenges with online navigation and transactions.

- Returns and Exchanges Complexity: Managing product returns efficiently and cost-effectively is a logistical challenge for many e-commerce businesses.

Emerging Opportunities in Malaysia E-commerce Market

The Malaysia E-commerce Market presents numerous untapped opportunities for growth and innovation. The increasing adoption of B2B e-commerce platforms signifies a significant potential for businesses to streamline their procurement processes. The Food and Beverage segment, particularly with the rise of specialized dietary needs and the demand for local produce, offers fertile ground for niche online retailers. Furthermore, the growth of cross-border e-commerce, both inbound and outbound, presents opportunities for businesses to expand their reach. The integration of Augmented Reality (AR) and Virtual Reality (VR) in online shopping experiences, especially for Fashion and Apparel and Furniture and Home, can significantly enhance customer engagement and reduce return rates. The increasing focus on sustainability and ethical sourcing also creates opportunities for eco-conscious brands to capture a growing segment of the market.

Growth Accelerators in the Malaysia E-commerce Market Industry

Several catalysts are accelerating the growth of the Malaysia E-commerce Market. Technological breakthroughs, such as advancements in artificial intelligence for personalized recommendations and predictive analytics, are enhancing customer experiences and driving sales. Strategic partnerships between e-commerce platforms, logistics providers, and payment gateways are crucial for creating a seamless and efficient ecosystem. The expansion of e-commerce into Tier 2 and Tier 3 cities, coupled with improved internet connectivity in these regions, is tapping into previously underserved markets. Furthermore, the ongoing efforts by the Malaysian government to promote digital economy initiatives, including incentives for startups and SMEs, are fostering a dynamic and competitive environment. The increasing adoption of m-commerce, driven by the widespread use of smartphones, continues to be a significant growth accelerator.

Key Players Shaping the Malaysia E-commerce Market Market

- Sephora Digital SEA Pte Ltd

- Presto Mall Sdn Bhd

- Lazada Group

- Zalora

- Astro GS Shop Sdn Bhd

- Lelong my

- ezbuy (EZbuy Holdings Limited)

- Hermo Creative (M) Sdn Bhd

- Shopee

- eBay Inc

Notable Milestones in Malaysia E-commerce Market Sector

- May 2022: Malaysia registered an 89% smartphone adoption rate, with over 29.5 million Malaysians (more than 89% of the population) using the Internet. This signifies a massive potential user base for e-commerce.

- May 2022 (Cont.): Malaysia's mobile commerce market was projected to develop at a rate of 19.7% CAGR, expected to reach RM41.11 billion (USD 8.78 Billion) by 2023, exceeding the country's overall e-commerce growth. This highlights the increasing importance of mobile-first strategies.

- July 2022: The Malaysian government introduced Malaysia Digital, a national strategic initiative to boost the digital economy, attract investment, and empower Malaysian businesses and citizens in the global digital landscape, fostering a conducive environment for e-commerce growth.

- September 2022: Lazada Group formed an e-commerce anti-counterfeiting cooperation with partners like BMW and HP. This initiative, along with the formation of the Southeast Asian e-commerce Anti-Counterfeiting Working Group (Seca), demonstrates a commitment to protecting intellectual property rights and consumer trust in online marketplaces.

In-Depth Malaysia E-commerce Market Market Outlook

The Malaysia E-commerce Market is poised for sustained and robust growth in the coming years, driven by a convergence of favorable factors. Continued technological innovation, particularly in mobile technology and digital payments, will further entrench online shopping as a primary retail channel. Government initiatives aimed at digitalizing the economy and supporting SMEs will create a more inclusive and dynamic marketplace. Emerging opportunities in segments like Food and Beverage and the expanding B2B e-commerce sector will offer new avenues for growth. As consumer trust in online platforms strengthens, fueled by increased security measures and efforts to combat counterfeit products, market penetration is expected to deepen across all demographics. Strategic collaborations and investments in logistics infrastructure will be key to unlocking the full potential of this vibrant market. The outlook remains exceptionally positive, signaling a significant transformation in Malaysia's retail landscape.

Malaysia E-commerce Market Segmentation

-

1. B2C ecommerce

-

1.1. Market Segmentation - by Application

- 1.1.1. Beauty and Personal Care

- 1.1.2. Consumer Electronics

- 1.1.3. Fashion and Apparel

- 1.1.4. Food and Beverage

- 1.1.5. Furniture and Home

- 1.1.6. Others (Toys, DIY, Media, etc.)

-

1.1. Market Segmentation - by Application

-

2. Application

- 2.1. Beauty and Personal Care

- 2.2. Consumer Electronics

- 2.3. Fashion and Apparel

- 2.4. Food and Beverage

- 2.5. Furniture and Home

- 2.6. Others (Toys, DIY, Media, etc.)

- 3. Beauty and Personal Care

- 4. Consumer Electronics

- 5. Fashion and Apparel

- 6. Food and Beverage

- 7. Furniture and Home

- 8. Others (Toys, DIY, Media, etc.)

-

9. B2B ecommerce

- 9.1. Market size for the period of 2017-2027

Malaysia E-commerce Market Segmentation By Geography

- 1. Malaysia

Malaysia E-commerce Market Regional Market Share

Geographic Coverage of Malaysia E-commerce Market

Malaysia E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in adoption of digital Solutions; Promotion of e-commerce by the Government Sectors

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. Government initiatives supporting the increased adoption of digital solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 5.1.1. Market Segmentation - by Application

- 5.1.1.1. Beauty and Personal Care

- 5.1.1.2. Consumer Electronics

- 5.1.1.3. Fashion and Apparel

- 5.1.1.4. Food and Beverage

- 5.1.1.5. Furniture and Home

- 5.1.1.6. Others (Toys, DIY, Media, etc.)

- 5.1.1. Market Segmentation - by Application

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beauty and Personal Care

- 5.2.2. Consumer Electronics

- 5.2.3. Fashion and Apparel

- 5.2.4. Food and Beverage

- 5.2.5. Furniture and Home

- 5.2.6. Others (Toys, DIY, Media, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Beauty and Personal Care

- 5.4. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.5. Market Analysis, Insights and Forecast - by Fashion and Apparel

- 5.6. Market Analysis, Insights and Forecast - by Food and Beverage

- 5.7. Market Analysis, Insights and Forecast - by Furniture and Home

- 5.8. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.9. Market Analysis, Insights and Forecast - by B2B ecommerce

- 5.9.1. Market size for the period of 2017-2027

- 5.10. Market Analysis, Insights and Forecast - by Region

- 5.10.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by B2C ecommerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sephora Digital SEA Pte Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Presto Mall Sdn Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lazada Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zalora

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astro GS Shop Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lelong my

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ezbuy (EZbuy Holdings Limited)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hermo Creative (M) Sdn Bhd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shopee

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 eBay Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sephora Digital SEA Pte Ltd*List Not Exhaustive

List of Figures

- Figure 1: Malaysia E-commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia E-commerce Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia E-commerce Market Revenue Million Forecast, by B2C ecommerce 2020 & 2033

- Table 2: Malaysia E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Malaysia E-commerce Market Revenue Million Forecast, by Beauty and Personal Care 2020 & 2033

- Table 4: Malaysia E-commerce Market Revenue Million Forecast, by Consumer Electronics 2020 & 2033

- Table 5: Malaysia E-commerce Market Revenue Million Forecast, by Fashion and Apparel 2020 & 2033

- Table 6: Malaysia E-commerce Market Revenue Million Forecast, by Food and Beverage 2020 & 2033

- Table 7: Malaysia E-commerce Market Revenue Million Forecast, by Furniture and Home 2020 & 2033

- Table 8: Malaysia E-commerce Market Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 9: Malaysia E-commerce Market Revenue Million Forecast, by B2B ecommerce 2020 & 2033

- Table 10: Malaysia E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 11: Malaysia E-commerce Market Revenue Million Forecast, by B2C ecommerce 2020 & 2033

- Table 12: Malaysia E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Malaysia E-commerce Market Revenue Million Forecast, by Beauty and Personal Care 2020 & 2033

- Table 14: Malaysia E-commerce Market Revenue Million Forecast, by Consumer Electronics 2020 & 2033

- Table 15: Malaysia E-commerce Market Revenue Million Forecast, by Fashion and Apparel 2020 & 2033

- Table 16: Malaysia E-commerce Market Revenue Million Forecast, by Food and Beverage 2020 & 2033

- Table 17: Malaysia E-commerce Market Revenue Million Forecast, by Furniture and Home 2020 & 2033

- Table 18: Malaysia E-commerce Market Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 19: Malaysia E-commerce Market Revenue Million Forecast, by B2B ecommerce 2020 & 2033

- Table 20: Malaysia E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia E-commerce Market?

The projected CAGR is approximately 14.32%.

2. Which companies are prominent players in the Malaysia E-commerce Market?

Key companies in the market include Sephora Digital SEA Pte Ltd*List Not Exhaustive, Presto Mall Sdn Bhd, Lazada Group, Zalora, Astro GS Shop Sdn Bhd, Lelong my, ezbuy (EZbuy Holdings Limited), Hermo Creative (M) Sdn Bhd, Shopee, eBay Inc.

3. What are the main segments of the Malaysia E-commerce Market?

The market segments include B2C ecommerce, Application, Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverage, Furniture and Home, Others (Toys, DIY, Media, etc.), B2B ecommerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in adoption of digital Solutions; Promotion of e-commerce by the Government Sectors.

6. What are the notable trends driving market growth?

Government initiatives supporting the increased adoption of digital solutions.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

May 2022 -Malaysia registered 89% smartphone adoption rate. Over 29.5 million Malaysians, or more than 89% of the nation's population, use the Internet. Malaysia's mobile commerce market is expected to develop at a rate of 19.7% CAGR to reach RM41.11 billion (USD 8.78 Billion) by 2023, exceeding the country's overall e-commerce growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia E-commerce Market?

To stay informed about further developments, trends, and reports in the Malaysia E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence