Key Insights

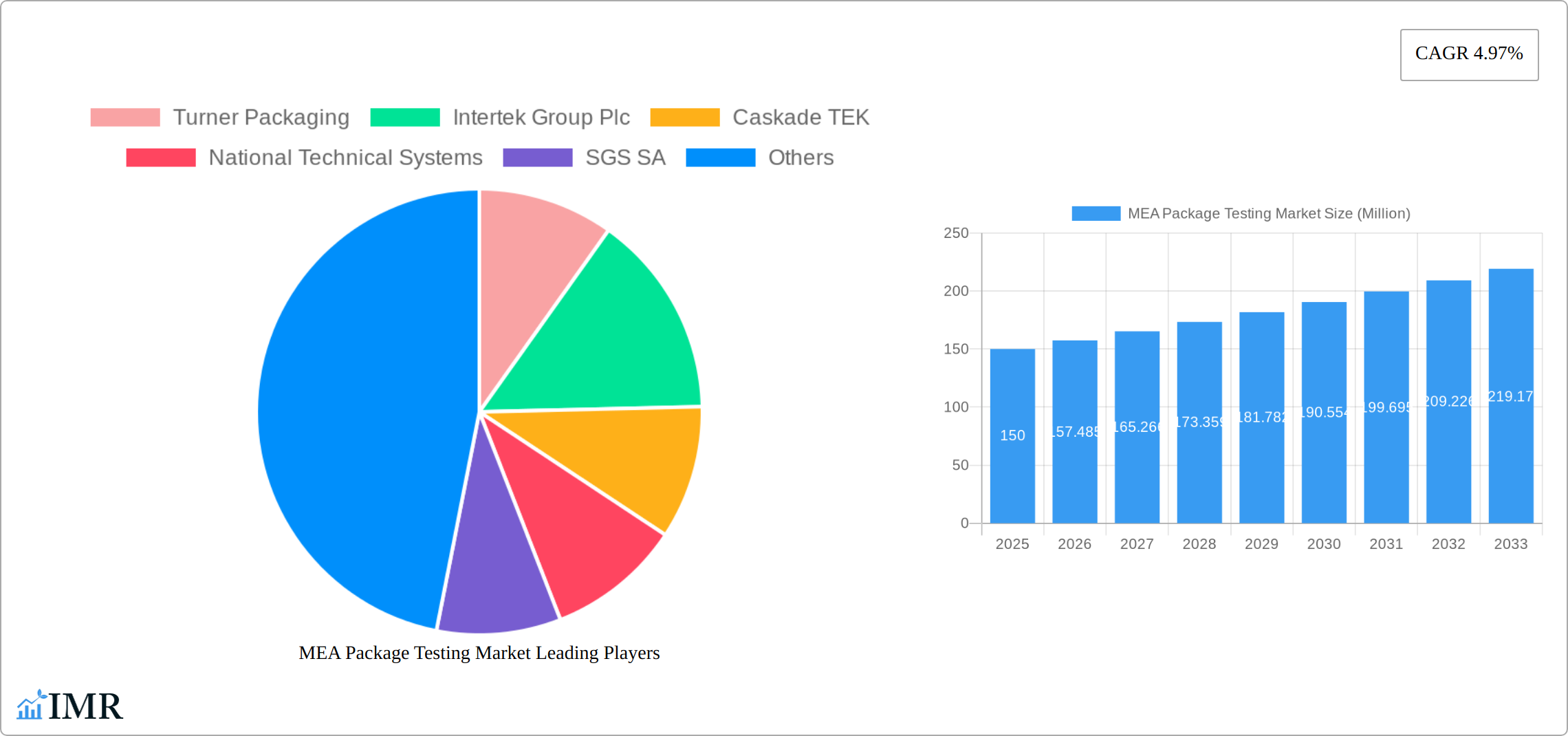

The Middle East and Africa (MEA) Package Testing market is poised for substantial expansion, projected to reach $14.8 billion by 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 9.65%. This growth is primarily propelled by the burgeoning e-commerce sector, necessitating robust package integrity during transit. Heightened consumer demand for product quality and safety, coupled with increasingly stringent regulatory mandates across MEA nations for sectors like food & beverage, pharmaceuticals, and consumer goods, further drives the adoption of comprehensive testing protocols. The market is segmented by material types (glass, paper, plastic, metal), testing methodologies (physical, chemical, environmental), and end-user industries. While industry leaders such as Intertek Group Plc and SGS SA hold significant market share, emerging specialized companies are fostering innovation and service differentiation.

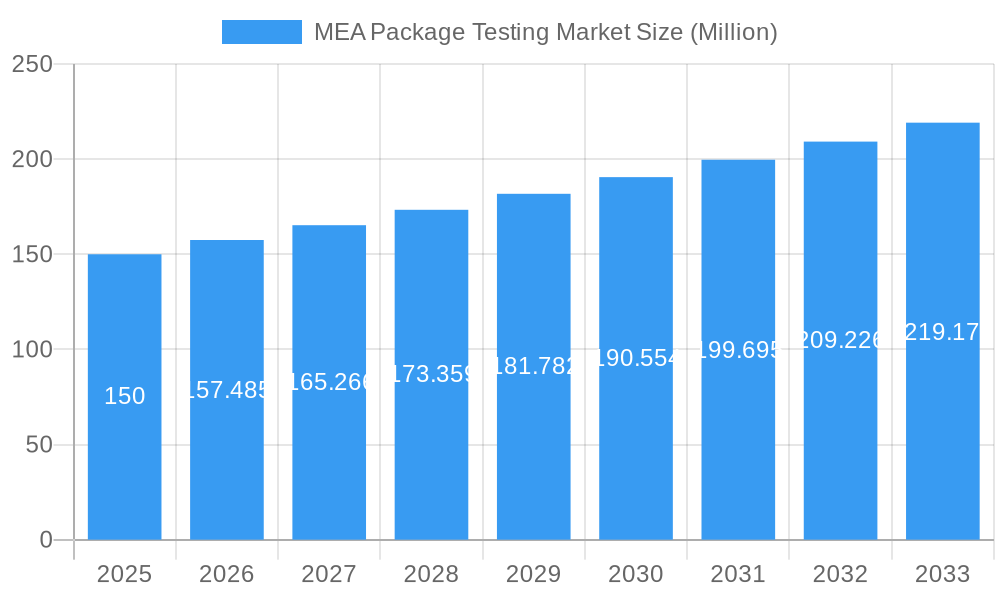

MEA Package Testing Market Market Size (In Billion)

Economic dynamism and infrastructure development in key markets, including Saudi Arabia and the UAE, are expected to fuel accelerated growth. Significant investments in logistics and supply chain optimization within these nations are directly stimulating demand for advanced package testing solutions. Potential challenges include raw material price volatility and the imperative for continuous technological advancement to align with evolving testing standards. Nevertheless, the MEA Package Testing market presents a favorable outlook with considerable growth prospects for established and new entrants.

MEA Package Testing Market Company Market Share

MEA Package Testing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) Package Testing Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report segments the market by primary material (Glass, Paper, Plastic, Metal), type of testing (Physical Performance Testing, Chemical Testing, Environmental Testing), end-user vertical (Food and Beverage, Healthcare, Industrial, Personal and Household Products, Other End-User), and country (Saudi Arabia, United Arab Emirates, South Africa, Rest of Middle East and Africa). The total market size is projected to reach xx Million units by 2033.

MEA Package Testing Market Market Dynamics & Structure

The MEA package testing market is characterized by moderate concentration, with several multinational players and regional specialists competing. Technological innovation, driven by increasing e-commerce and stringent regulatory requirements, is a key driver. Regulatory frameworks vary across countries, impacting testing standards and compliance costs. While sustainable packaging materials are gaining traction, traditional materials remain dominant. The market also witnesses considerable M&A activity, reflecting the industry's consolidation trend.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share (xx%).

- Technological Innovation: Driven by automation, advanced analytical techniques (e.g., spectroscopy), and digitalization of testing processes.

- Regulatory Framework: Diverse across MEA countries, influencing testing protocols and compliance. Stringent regulations in the food and healthcare sectors are fostering market growth.

- Competitive Product Substitutes: Limited direct substitutes, but alternative testing methods and service providers create competitive pressure.

- End-User Demographics: Growing population, rising disposable incomes, and increasing e-commerce activity are key drivers for market expansion.

- M&A Trends: Moderate M&A activity observed in recent years, driven by strategic expansion and technological capability enhancement. Approximately xx M&A deals were recorded between 2019 and 2024.

MEA Package Testing Market Growth Trends & Insights

The MEA package testing market exhibits robust growth, driven by increasing demand for quality assurance and safety across various sectors. The market is experiencing a CAGR of xx% during the forecast period. E-commerce boom fuels demand for robust packaging and rigorous testing. Technological advancements, such as automated testing equipment and advanced analytical methods, are enhancing efficiency and accuracy. Consumer preference for sustainable packaging materials is pushing for innovative testing solutions. Market penetration is increasing across segments, particularly in the food & beverage and healthcare sectors.

The growth trajectory is influenced by factors such as increasing urbanization, evolving consumer expectations, and the expansion of the logistics and supply chain industries across the region. Furthermore, government initiatives promoting industrial growth and stringent quality control measures are contributing to the market's expansion. The adoption rate of advanced testing technologies is increasing steadily, further bolstering market growth.

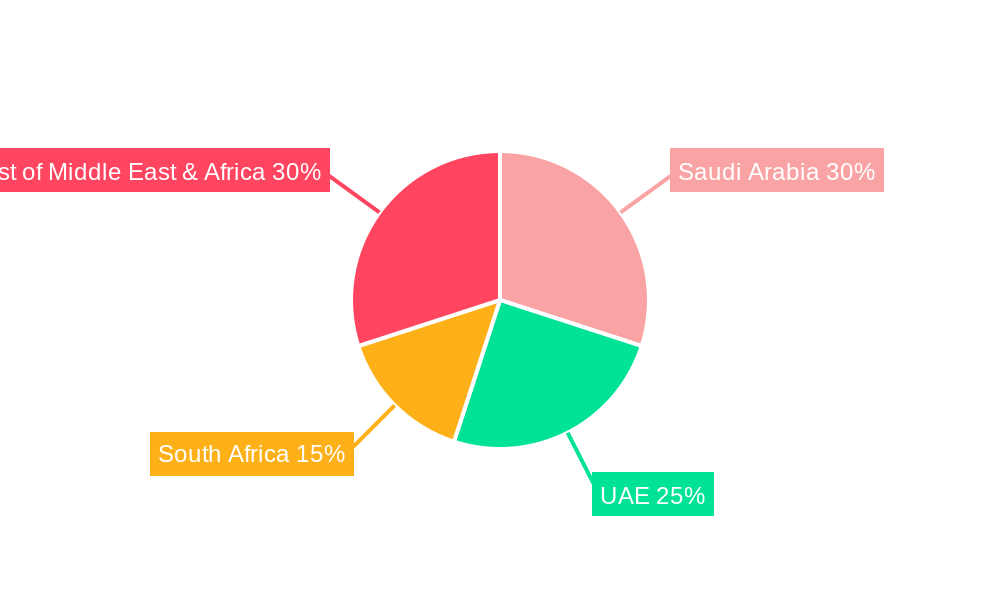

Dominant Regions, Countries, or Segments in MEA Package Testing Market

Saudi Arabia and the United Arab Emirates (UAE) are currently at the forefront of the MEA package testing market. This leadership is underpinned by their robust economic expansion, substantial investments in state-of-the-art infrastructure, and the presence of stringent and well-established regulatory frameworks. The food and beverage sector stands out as the dominant end-user vertical, driven by high consumption rates and complex supply chain requirements. Following closely is the healthcare sector, where product integrity and safety are paramount. In terms of packaging materials, plastic packaging continues to hold the largest market share, primarily due to its inherent cost-effectiveness, remarkable versatility, and suitability for a wide array of products. When examining the types of testing, physical performance testing emerges as the largest segment, underscoring the critical importance placed on the structural integrity, durability, and resilience of packaging solutions across the region.

- Key Drivers:

- Sustained Economic Growth: Consistent and high GDP growth rates in key economies like Saudi Arabia and the UAE fuel increased consumer spending and a higher demand for packaged goods.

- Pervasive Infrastructure Development: Extensive and ongoing investments in logistics networks, warehousing, and broader supply chain infrastructure facilitate the movement and distribution of packaged goods, necessitating reliable testing.

- Stringent Regulatory Compliance: The implementation of strict quality standards and safety regulations, particularly for sensitive sectors like food, beverages, and healthcare, mandates comprehensive package testing to ensure compliance and consumer safety.

- Booming E-commerce Sector: The rapid and continuous growth of online retail channels leads to an increased volume of shipped products, often with more complex transit requirements, thus amplifying the need for robust packaging testing to prevent damage during delivery.

- Dominance Factors: The significant market share enjoyed by Saudi Arabia and the UAE can be attributed to several factors: a high volume of packaged goods produced and consumed, a robust and actively enforced regulatory landscape, and the established presence of major global and regional players in the packaging and testing industries. Market share for Saudi Arabia is estimated at approximately 25-30%, and for the UAE at around 20-25%.

MEA Package Testing Market Product Landscape

The MEA package testing market is characterized by a comprehensive suite of testing services designed to meet the diverse needs of its industries. This includes a wide array of physical, chemical, and environmental tests, meticulously tailored to suit various packaging materials such as plastics, paperboard, glass, and metals, as well as specific end-use applications across food & beverage, healthcare, electronics, and consumer goods. Product innovations within this sector are heavily focused on enhancing efficiency and accuracy. Key advancements are centered around the integration of automation for faster sample processing, the development of higher throughput testing systems to accommodate increased demand, and the adoption of more sophisticated analytical techniques. These technological leaps are directly addressing the escalating demand for quicker turnaround times in testing results and a marked improvement in the overall reliability and precision of the data generated. Unique selling propositions often revolve around specialized testing capabilities for niche packaging materials like flexible films and multi-layer laminates, alongside superior analytical precision that surpasses traditional, less sensitive methods, ensuring the highest levels of product protection and integrity.

Key Drivers, Barriers & Challenges in MEA Package Testing Market

Key Drivers: The MEA package testing market is experiencing robust growth propelled by several interconnected factors. The increasing demand for stringent quality control measures across a multitude of industries is a primary catalyst, as businesses strive to maintain brand reputation and consumer trust. The burgeoning adoption of e-commerce significantly amplifies the need for packaging that can withstand the rigors of transit, directly boosting testing requirements. Furthermore, the introduction and adoption of more sophisticated packaging materials, often with complex barrier properties and functional requirements, necessitate advanced testing protocols. Government-led initiatives and regulations that emphasize product safety and compliance, coupled with a growing, informed consumer awareness regarding product quality and safety, are also powerful drivers pushing the market forward.

Key Challenges: Despite the positive growth trajectory, the market faces significant hurdles. The high cost of acquiring and maintaining advanced testing equipment can present a substantial barrier to entry, particularly for smaller and medium-sized enterprises (SMEs) within the region. A prevalent issue is the lack of a sufficiently skilled workforce with specialized expertise in advanced testing methodologies. Additionally, the lack of standardized testing methodologies across different countries within the MEA region can create complexities and inconsistencies. The market also experiences intense competition from both established global players and emerging local service providers, which can put pressure on pricing and profit margins.

Emerging Opportunities in MEA Package Testing Market

Significant untapped potential lies within the rapidly evolving landscape of sustainable packaging. The growing global imperative for environmental responsibility presents a substantial opportunity for expanding testing services for eco-friendly and sustainable packaging materials, such as biodegradable plastics, compostable materials, and recycled content solutions. Emerging opportunities are also evident in the development of specialized testing services tailored for unique and high-value product categories, including pharmaceuticals, cosmetics, and sensitive electronics, where specific performance criteria are critical. The integration of cutting-edge technologies like Artificial Intelligence (AI) and Machine Learning (ML) offers a transformative opportunity to revolutionize testing efficiency, enabling predictive analysis and optimized testing strategies. Furthermore, the pervasive trend towards digitalization opens avenues for developing and offering innovative cloud-based testing data management systems, providing clients with seamless access, secure storage, and advanced analytics capabilities for their testing results.

Growth Accelerators in the MEA Package Testing Market Industry

Technological breakthroughs, such as advancements in analytical techniques and automation, are key growth drivers. Strategic collaborations between testing service providers and packaging manufacturers can improve efficiency and enhance product quality. Government initiatives promoting food safety and product quality standardization will play a critical role in driving long-term growth.

Key Players Shaping the MEA Package Testing Market Market

- Turner Packaging

- Intertek Group Plc

- Caskade TEK

- National Technical Systems

- SGS SA

- DDL Inc

- Nefab AB

- Advance Packaging

- Bureau Veritas SA

- Eurofins Scientific SE

- CSZ Testing Services Laboratories

Notable Milestones in MEA Package Testing Market Sector

- October 2022: Aramex successfully completed drone package delivery tests in Oman, advancing high-tech package delivery solutions.

- September 2022: Eurofins Scientific acquired a majority stake in QSAI Analysis and Research Center Co., Ltd., enhancing its food testing capabilities in Japan and the MEA region.

In-Depth MEA Package Testing Market Market Outlook

The MEA package testing market is strategically positioned for substantial and sustained growth over the coming decade. This optimistic outlook is fueled by the confluence of the aforementioned drivers, including robust economic development, increasing regulatory stringency, and evolving consumer demands. To capitalize on this growth, companies will need to focus on strategic initiatives such as forming strategic partnerships with packaging manufacturers and end-users, investing in and adopting cutting-edge technological innovations to enhance service offerings, and actively pursuing expansion into underserved or emerging markets within the broader MEA region. The market presents considerable potential for agile and forward-thinking companies that can adeptly navigate the dynamic regulatory landscapes, embrace and leverage advanced technologies to deliver highly efficient, accurate, and reliable testing services, thereby solidifying their competitive edge and contributing to the overall quality and safety of packaged goods across the region.

MEA Package Testing Market Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-User Vertical

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and HouseHold Products

- 3.5. Other End-User

MEA Package Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Package Testing Market Regional Market Share

Geographic Coverage of MEA Package Testing Market

MEA Package Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Paper and Paperboard is One of the Factor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and HouseHold Products

- 5.3.5. Other End-User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. North America MEA Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 6.1.1. Glass

- 6.1.2. Paper

- 6.1.3. Plastic

- 6.1.4. Metal

- 6.2. Market Analysis, Insights and Forecast - by Type of Testing

- 6.2.1. Physical Performance Testing

- 6.2.2. Chemical Testing

- 6.2.3. Environmental Testing

- 6.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.3.1. Food and Beverage

- 6.3.2. Healthcare

- 6.3.3. Industrial

- 6.3.4. Personal and HouseHold Products

- 6.3.5. Other End-User

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 7. South America MEA Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 7.1.1. Glass

- 7.1.2. Paper

- 7.1.3. Plastic

- 7.1.4. Metal

- 7.2. Market Analysis, Insights and Forecast - by Type of Testing

- 7.2.1. Physical Performance Testing

- 7.2.2. Chemical Testing

- 7.2.3. Environmental Testing

- 7.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.3.1. Food and Beverage

- 7.3.2. Healthcare

- 7.3.3. Industrial

- 7.3.4. Personal and HouseHold Products

- 7.3.5. Other End-User

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 8. Europe MEA Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 8.1.1. Glass

- 8.1.2. Paper

- 8.1.3. Plastic

- 8.1.4. Metal

- 8.2. Market Analysis, Insights and Forecast - by Type of Testing

- 8.2.1. Physical Performance Testing

- 8.2.2. Chemical Testing

- 8.2.3. Environmental Testing

- 8.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.3.1. Food and Beverage

- 8.3.2. Healthcare

- 8.3.3. Industrial

- 8.3.4. Personal and HouseHold Products

- 8.3.5. Other End-User

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 9. Middle East & Africa MEA Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 9.1.1. Glass

- 9.1.2. Paper

- 9.1.3. Plastic

- 9.1.4. Metal

- 9.2. Market Analysis, Insights and Forecast - by Type of Testing

- 9.2.1. Physical Performance Testing

- 9.2.2. Chemical Testing

- 9.2.3. Environmental Testing

- 9.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.3.1. Food and Beverage

- 9.3.2. Healthcare

- 9.3.3. Industrial

- 9.3.4. Personal and HouseHold Products

- 9.3.5. Other End-User

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 10. Asia Pacific MEA Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Primary Material

- 10.1.1. Glass

- 10.1.2. Paper

- 10.1.3. Plastic

- 10.1.4. Metal

- 10.2. Market Analysis, Insights and Forecast - by Type of Testing

- 10.2.1. Physical Performance Testing

- 10.2.2. Chemical Testing

- 10.2.3. Environmental Testing

- 10.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 10.3.1. Food and Beverage

- 10.3.2. Healthcare

- 10.3.3. Industrial

- 10.3.4. Personal and HouseHold Products

- 10.3.5. Other End-User

- 10.1. Market Analysis, Insights and Forecast - by Primary Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Turner Packaging

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intertek Group Plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Caskade TEK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 National Technical Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SGS SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DDL Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nefab AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Advance Packaging

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bureau Veritas SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eurofins Scientific SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CSZ Testing Services Laboratories

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Turner Packaging

List of Figures

- Figure 1: Global MEA Package Testing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America MEA Package Testing Market Revenue (billion), by Primary Material 2025 & 2033

- Figure 3: North America MEA Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 4: North America MEA Package Testing Market Revenue (billion), by Type of Testing 2025 & 2033

- Figure 5: North America MEA Package Testing Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 6: North America MEA Package Testing Market Revenue (billion), by End-User Vertical 2025 & 2033

- Figure 7: North America MEA Package Testing Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 8: North America MEA Package Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America MEA Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America MEA Package Testing Market Revenue (billion), by Primary Material 2025 & 2033

- Figure 11: South America MEA Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 12: South America MEA Package Testing Market Revenue (billion), by Type of Testing 2025 & 2033

- Figure 13: South America MEA Package Testing Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 14: South America MEA Package Testing Market Revenue (billion), by End-User Vertical 2025 & 2033

- Figure 15: South America MEA Package Testing Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 16: South America MEA Package Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America MEA Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe MEA Package Testing Market Revenue (billion), by Primary Material 2025 & 2033

- Figure 19: Europe MEA Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 20: Europe MEA Package Testing Market Revenue (billion), by Type of Testing 2025 & 2033

- Figure 21: Europe MEA Package Testing Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 22: Europe MEA Package Testing Market Revenue (billion), by End-User Vertical 2025 & 2033

- Figure 23: Europe MEA Package Testing Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 24: Europe MEA Package Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe MEA Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa MEA Package Testing Market Revenue (billion), by Primary Material 2025 & 2033

- Figure 27: Middle East & Africa MEA Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 28: Middle East & Africa MEA Package Testing Market Revenue (billion), by Type of Testing 2025 & 2033

- Figure 29: Middle East & Africa MEA Package Testing Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 30: Middle East & Africa MEA Package Testing Market Revenue (billion), by End-User Vertical 2025 & 2033

- Figure 31: Middle East & Africa MEA Package Testing Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 32: Middle East & Africa MEA Package Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa MEA Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific MEA Package Testing Market Revenue (billion), by Primary Material 2025 & 2033

- Figure 35: Asia Pacific MEA Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 36: Asia Pacific MEA Package Testing Market Revenue (billion), by Type of Testing 2025 & 2033

- Figure 37: Asia Pacific MEA Package Testing Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 38: Asia Pacific MEA Package Testing Market Revenue (billion), by End-User Vertical 2025 & 2033

- Figure 39: Asia Pacific MEA Package Testing Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 40: Asia Pacific MEA Package Testing Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific MEA Package Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Package Testing Market Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Global MEA Package Testing Market Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: Global MEA Package Testing Market Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 4: Global MEA Package Testing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global MEA Package Testing Market Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: Global MEA Package Testing Market Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 7: Global MEA Package Testing Market Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 8: Global MEA Package Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global MEA Package Testing Market Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 13: Global MEA Package Testing Market Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 14: Global MEA Package Testing Market Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 15: Global MEA Package Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global MEA Package Testing Market Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 20: Global MEA Package Testing Market Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 21: Global MEA Package Testing Market Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 22: Global MEA Package Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global MEA Package Testing Market Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 33: Global MEA Package Testing Market Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 34: Global MEA Package Testing Market Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 35: Global MEA Package Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global MEA Package Testing Market Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 43: Global MEA Package Testing Market Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 44: Global MEA Package Testing Market Revenue billion Forecast, by End-User Vertical 2020 & 2033

- Table 45: Global MEA Package Testing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific MEA Package Testing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Package Testing Market?

The projected CAGR is approximately 9.65%.

2. Which companies are prominent players in the MEA Package Testing Market?

Key companies in the market include Turner Packaging, Intertek Group Plc, Caskade TEK, National Technical Systems, SGS SA, DDL Inc, Nefab AB, Advance Packaging, Bureau Veritas SA, Eurofins Scientific SE, CSZ Testing Services Laboratories.

3. What are the main segments of the MEA Package Testing Market?

The market segments include Primary Material, Type of Testing, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Paper and Paperboard is One of the Factor Driving the Market.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

October 2022 - Aramex completed successful drone package delivery tests in Oman. After Aramex began using drone technology for door-to-door deliveries, high-tech package delivery moved closer. After successfully completing test flights in Oman, the business has advanced the prospect of drones delivering items to your door. UVL Robotics, a US-based startup, teamed up with the biggest delivery service in the Middle East to carry out the test flights.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Package Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Package Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Package Testing Market?

To stay informed about further developments, trends, and reports in the MEA Package Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence