Key Insights

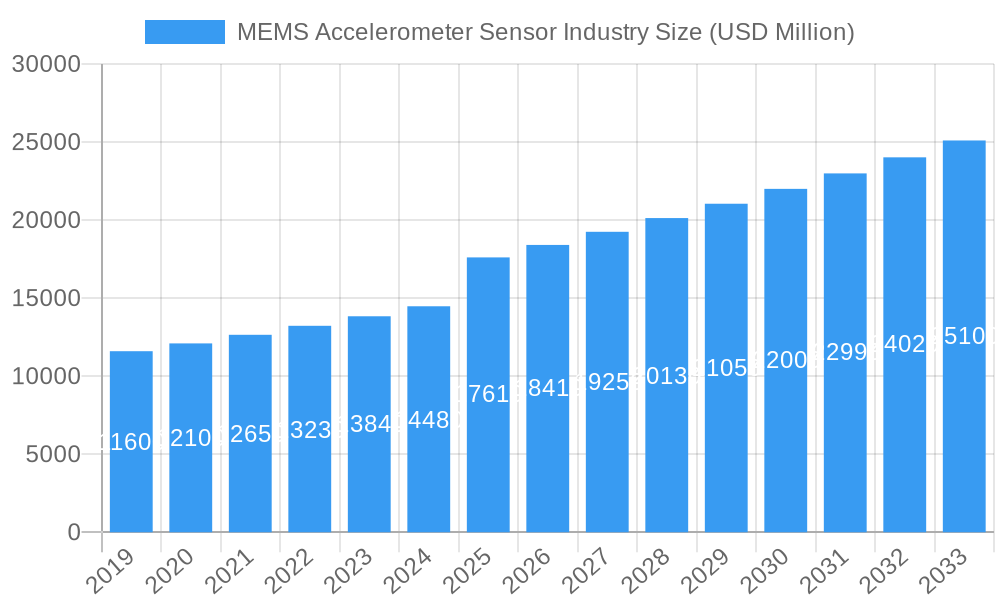

The global MEMS accelerometer sensor market is poised for significant expansion, projected to reach an estimated $17.61 billion by 2025. This robust growth is fueled by a compound annual growth rate (CAGR) of 4.6% from 2019 to 2033, indicating sustained demand and innovation within the industry. A primary driver for this market surge is the escalating adoption of MEMS accelerometers across a diverse range of applications, with Consumer Electronics and Automotive sectors leading the charge. The increasing prevalence of smartphones, wearables, gaming consoles, and advanced driver-assistance systems (ADAS) directly contributes to the demand for these compact and versatile sensors. Furthermore, the aerospace and defense sector's continuous need for precise motion sensing in navigation, stabilization, and structural health monitoring systems provides another substantial growth avenue. Emerging trends like the integration of MEMS accelerometers into the Internet of Things (IoT) ecosystem, enabling smarter devices and data collection, as well as advancements in miniaturization and power efficiency, are further propelling market expansion.

MEMS Accelerometer Sensor Industry Market Size (In Billion)

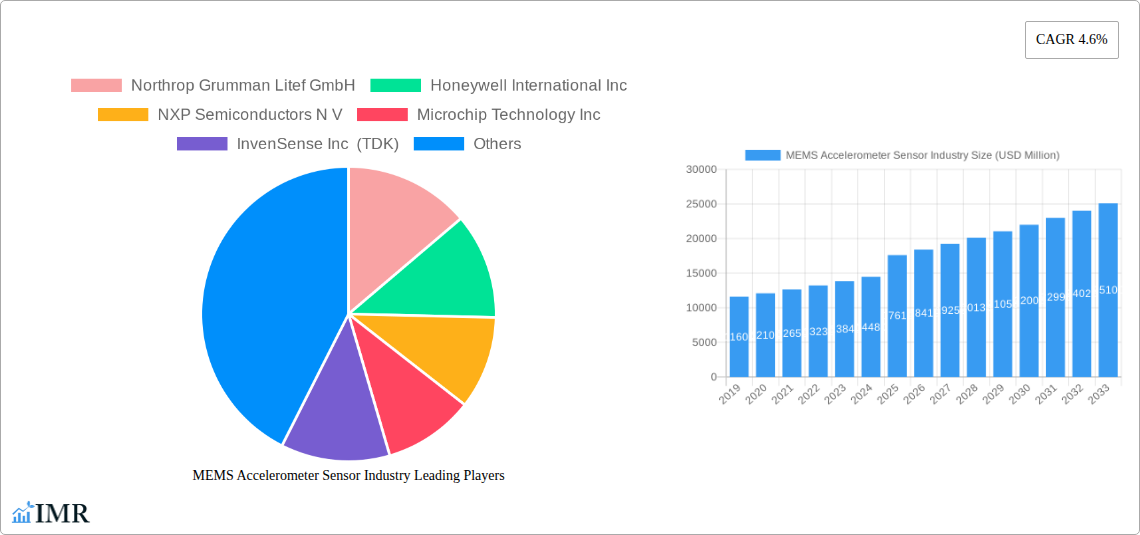

Despite the promising outlook, the MEMS accelerometer sensor market faces certain restraints. High manufacturing costs associated with complex fabrication processes and the need for specialized cleanroom facilities can pose challenges to widespread adoption, particularly for smaller players. Additionally, intense competition among established manufacturers and the constant need for technological innovation to stay ahead of the curve require significant R&D investments. However, the pervasive integration of these sensors in everyday devices, coupled with ongoing technological advancements that enhance performance and reduce costs, are expected to outweigh these restraints. The market is characterized by a dynamic competitive landscape, featuring key players like Bosch Sensortec GmbH, STMicroelectronics N.V., and Honeywell International Inc., who are actively investing in product development and strategic partnerships to capture market share. Regional analysis suggests strong growth potential across North America, Europe, and Asia Pacific, driven by robust industrial bases and high consumer electronics penetration.

MEMS Accelerometer Sensor Industry Company Market Share

Unveiling the MEMS Accelerometer Sensor Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a definitive overview of the global MEMS accelerometer sensor market, meticulously detailing its dynamics, growth trajectory, and competitive landscape. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this analysis offers unparalleled insights for stakeholders seeking to navigate this rapidly evolving sector. We delve into the intricate parent and child market structures, delivering actionable intelligence on market size, segmentation, regional dominance, and key player strategies.

MEMS Accelerometer Sensor Industry Market Dynamics & Structure

The MEMS accelerometer sensor market is characterized by a moderate to high level of concentration, with a few dominant players like Bosch Sensortec GmbH, STMicroelectronics N.V., and Analog Devices Inc. holding significant market share. Technological innovation remains a primary driver, fueled by the relentless demand for smaller, more accurate, and power-efficient sensors across diverse applications. Miniaturization, enhanced sensitivity, and integration capabilities are key innovation frontiers. Regulatory frameworks, particularly concerning data privacy and safety in automotive and consumer electronics, are shaping product development and market access. Competitive product substitutes, while emerging, are yet to significantly disrupt the entrenched MEMS accelerometer sensor market due to their cost-effectiveness and established performance. End-user demographics are increasingly tech-savvy, driving demand for sophisticated motion sensing functionalities in smart devices. Mergers and acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding product portfolios, acquiring intellectual property, and strengthening market presence. For instance, recent M&A activities have focused on acquiring companies with specialized expertise in advanced sensing technologies or direct access to high-growth end markets.

- Market Concentration: Moderate to High, driven by technological expertise and economies of scale.

- Technological Innovation Drivers: Miniaturization, improved accuracy, low power consumption, enhanced signal processing, and multi-axis sensing capabilities.

- Regulatory Frameworks: Data privacy regulations (e.g., GDPR), automotive safety standards (e.g., ISO 26262), and consumer product safety directives.

- Competitive Product Substitutes: Emerging inertial measurement units (IMUs) with integrated functionalities, but MEMS accelerometers maintain a cost-advantage.

- End-User Demographics: Growing demand from millennials and Gen Z for smart, connected devices with intuitive motion-based interactions.

- M&A Trends: Strategic acquisitions to gain access to new technologies, markets, and talent; consolidation for increased market share and R&D capabilities.

MEMS Accelerometer Sensor Industry Growth Trends & Insights

The MEMS accelerometer sensor market is poised for robust growth, projected to expand significantly from its current estimated size. This expansion is propelled by the pervasive integration of these sensors into an ever-widening array of consumer electronics, the burgeoning automotive sector embracing advanced driver-assistance systems (ADAS) and autonomous driving, and the critical role they play in aerospace and defense applications. The market size evolution is marked by a consistent upward trend, with adoption rates accelerating as the benefits of sophisticated motion sensing become more apparent and economically viable for manufacturers. Technological disruptions, such as advancements in silicon-on-insulator (SOI) technology and novel transduction mechanisms, are continuously enhancing sensor performance and enabling new use cases. Consumer behavior shifts, particularly the increasing reliance on smart devices for health tracking, gaming, and enhanced user experiences, are directly fueling demand. The CAGR is expected to remain strong, reflecting sustained innovation and broad market penetration. Market penetration is deepening across established segments and is rapidly expanding into emerging IoT applications. The increasing demand for sophisticated human-machine interfaces and the need for precise motion tracking in virtual and augmented reality environments are significant growth catalysts. Furthermore, the drive towards energy efficiency in portable electronics and wearable devices necessitates the adoption of low-power MEMS accelerometers. The expansion of the smart home ecosystem and the development of intelligent industrial automation solutions also contribute to the escalating demand. The report estimates the market size to reach XX billion units by 2033, growing at a CAGR of XX% from 2025.

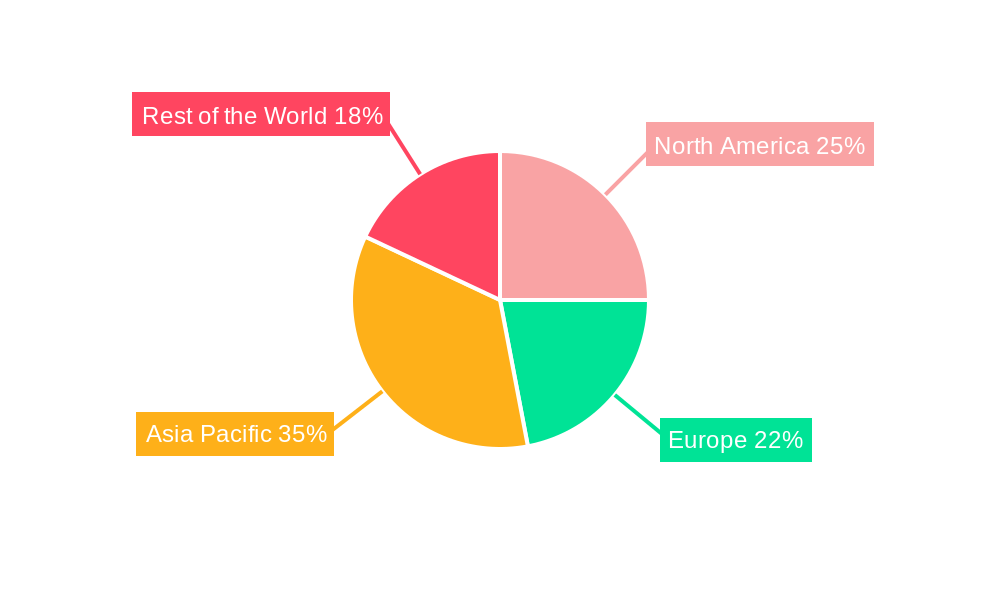

Dominant Regions, Countries, or Segments in MEMS Accelerometer Sensor Industry

The Consumer Electronics segment is currently the most dominant driver of growth in the global MEMS accelerometer sensor industry. This dominance stems from the sheer volume of devices incorporating these sensors, from smartphones and wearables to gaming consoles and smart home appliances. The pervasive demand for features like screen orientation detection, activity tracking, and gesture control in consumer devices consistently fuels market expansion. Asia-Pacific, particularly China, South Korea, and Taiwan, serves as the manufacturing hub for a vast majority of consumer electronics, further solidifying its regional dominance. The region's robust economic policies supporting technological innovation, coupled with its vast consumer base and extensive supply chain infrastructure, create a fertile ground for MEMS accelerometer adoption.

- Asia-Pacific: Leads due to high consumer electronics manufacturing output, substantial R&D investments, and a massive consumer market. Key countries include China, South Korea, and Taiwan.

- North America: Significant market due to a strong presence of technology giants, early adoption of advanced features, and a thriving gaming and AR/VR ecosystem.

- Europe: Growing demand driven by automotive sector advancements and strict safety regulations, particularly in Germany and France.

The Automotive segment is rapidly emerging as a key growth area, driven by the increasing adoption of ADAS features such as lane departure warning, adaptive cruise control, and automatic emergency braking. The trajectory towards autonomous driving further amplifies the need for highly reliable and accurate MEMS accelerometers for navigation, vehicle stability control, and collision detection. Government initiatives promoting vehicle safety and the electrification of vehicles also contribute to this segment's growth.

- Key Drivers in Automotive: Increasing adoption of ADAS, development of autonomous driving technologies, demand for enhanced vehicle safety, and the growing electric vehicle (EV) market.

- Market Share and Growth Potential: While Consumer Electronics holds the largest current share, Automotive exhibits a higher projected growth rate due to technological advancements and regulatory push.

Aerospace & Defense applications, though representing a smaller market share, are characterized by high-value, mission-critical requirements for precision and reliability. MEMS accelerometers are indispensable in inertial navigation systems, flight control, guidance systems, and unmanned aerial vehicles (UAVs). The ongoing modernization of defense equipment and the expansion of the global aerospace industry are significant contributors to this segment.

- Unique Selling Propositions in Aerospace & Defense: High reliability, extreme environment tolerance, and long-term stability are paramount.

The Other Applications segment encompasses a broad range of diverse markets, including industrial automation, healthcare (e.g., patient monitoring, prosthetics), and civil engineering (e.g., structural health monitoring). The proliferation of the Internet of Things (IoT) is a significant enabler for this segment, as MEMS accelerometers are integrated into a multitude of smart sensors for condition monitoring, predictive maintenance, and asset tracking.

- Emerging IoT Applications: Smart sensors for industrial equipment, smart city infrastructure, and wearable health monitoring devices.

MEMS Accelerometer Sensor Industry Product Landscape

The MEMS accelerometer sensor market is defined by a relentless pursuit of enhanced performance and miniaturization. Innovations are centered on developing ultra-low power consumption sensors crucial for battery-operated devices, while simultaneously achieving higher accuracy and wider dynamic range for applications demanding precise motion capture. Multi-axis sensing (3-axis and beyond) is becoming standard, offering richer data for complex motion analysis. Key product advancements include improved noise density, greater shock survivability, and integrated digital interfaces for seamless integration with microcontrollers. Unique selling propositions revolve around specialized sensor capabilities, such as high-temperature operation or resistance to specific environmental conditions, catering to niche but critical applications.

Key Drivers, Barriers & Challenges in MEMS Accelerometer Sensor Industry

Key Drivers:

- Ubiquitous Integration in Consumer Electronics: The ever-increasing demand for smart features in smartphones, wearables, and other consumer devices.

- Growth of Automotive Applications: The rapid adoption of ADAS and the development of autonomous driving technologies.

- Expansion of IoT Ecosystem: The need for motion sensing in a vast array of connected devices for monitoring and control.

- Technological Advancements: Continuous improvements in sensor accuracy, power efficiency, and miniaturization.

- Demand for Enhanced User Experiences: The desire for intuitive and interactive interfaces driven by motion.

Key Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical factors and raw material availability can impact production and pricing. For example, semiconductor shortages have periodically affected the availability of MEMS components.

- Intense Price Competition: The commoditization of basic accelerometer sensors leads to pressure on profit margins.

- High R&D Costs: Developing next-generation MEMS accelerometers requires significant investment in research and development.

- Standardization and Interoperability: Ensuring seamless integration across diverse platforms and ecosystems remains a challenge.

- Technological Obsolescence: Rapid advancements can render existing products outdated quickly.

Emerging Opportunities in MEMS Accelerometer Sensor Industry

Emerging opportunities lie in the expanding realms of the Internet of Medical Things (IoMT), where MEMS accelerometers are critical for remote patient monitoring, rehabilitation devices, and advanced prosthetics. The burgeoning market for drones and uncremented systems, both commercial and defense-oriented, presents substantial growth potential due to their reliance on accurate inertial sensing for navigation and stability. Furthermore, the increasing focus on smart cities and infrastructure monitoring, utilizing sensors for structural health analysis and environmental monitoring, offers a vast untapped market. The continued evolution of virtual reality (VR) and augmented reality (AR) technologies will also drive demand for more sophisticated and responsive motion tracking solutions.

Growth Accelerators in the MEMS Accelerometer Sensor Industry Industry

The sustained growth of the MEMS accelerometer sensor industry is being significantly accelerated by the convergence of several key factors. Foremost among these is the ongoing technological innovation, leading to sensors with unprecedented levels of accuracy, miniaturization, and power efficiency, making them suitable for an ever-wider range of applications. Strategic partnerships between sensor manufacturers and major Original Equipment Manufacturers (OEMs) are crucial, fostering co-development and ensuring early integration of new sensor technologies into leading consumer electronics and automotive platforms. The continuous expansion of the Internet of Things (IoT) ecosystem acts as a powerful market expansion strategy, as MEMS accelerometers become integral components of smart home devices, industrial automation systems, and wearable technology. Government initiatives promoting technological advancement and digitalization across various sectors also play a vital role in fostering a conducive environment for growth.

Key Players Shaping the MEMS Accelerometer Sensor Industry Market

Notable Milestones in MEMS Accelerometer Sensor Industry Sector

- 2019: Introduction of ultra-low power MEMS accelerometers for advanced wearable applications.

- 2020: Significant advancements in automotive-grade MEMS accelerometers for enhanced ADAS functionalities.

- 2021: Increased integration of AI capabilities within MEMS sensor modules for intelligent data processing.

- 2022: Development of high-sensitivity MEMS accelerometers for critical aerospace and defense navigation systems.

- 2023: Expansion of MEMS accelerometer applications in the burgeoning drone and UAV market.

- 2024: Continued miniaturization and enhanced performance metrics for next-generation consumer electronics.

In-Depth MEMS Accelerometer Sensor Industry Market Outlook

The future outlook for the MEMS accelerometer sensor industry is exceptionally bright, fueled by an accelerating wave of technological innovation and expanding application horizons. The drive towards smarter, more connected devices across all sectors will continue to underpin robust market growth. Key growth accelerators include the ongoing miniaturization and power efficiency improvements enabling seamless integration into an ever-wider array of compact and battery-constrained devices. Strategic collaborations between leading technology firms and sensor manufacturers will ensure the timely introduction of cutting-edge solutions, while the relentless expansion of the IoT ecosystem provides a vast and fertile ground for adoption. The increasing emphasis on advanced features in the automotive sector and the burgeoning demand for sophisticated motion tracking in emerging technologies like AR/VR further solidify the positive market trajectory, pointing towards sustained expansion and significant future potential.

MEMS Accelerometer Sensor Industry Segmentation

-

1. Application

- 1.1. Consumer Electronics

- 1.2. Automotive

- 1.3. Aerospace & Defense

- 1.4. Other Applications

MEMS Accelerometer Sensor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

MEMS Accelerometer Sensor Industry Regional Market Share

Geographic Coverage of MEMS Accelerometer Sensor Industry

MEMS Accelerometer Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Defense Expenditure; Adoption of Automation in Industries and Homes

- 3.3. Market Restrains

- 3.3.1. ; High Up-front Adoption Costs

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEMS Accelerometer Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronics

- 5.1.2. Automotive

- 5.1.3. Aerospace & Defense

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America MEMS Accelerometer Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Electronics

- 6.1.2. Automotive

- 6.1.3. Aerospace & Defense

- 6.1.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe MEMS Accelerometer Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Electronics

- 7.1.2. Automotive

- 7.1.3. Aerospace & Defense

- 7.1.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific MEMS Accelerometer Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Electronics

- 8.1.2. Automotive

- 8.1.3. Aerospace & Defense

- 8.1.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World MEMS Accelerometer Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Consumer Electronics

- 9.1.2. Automotive

- 9.1.3. Aerospace & Defense

- 9.1.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Northrop Grumman Litef GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Microchip Technology Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 InvenSense Inc (TDK)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KIONIX Inc (ROHM)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bosch Sensortec GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 STMicroelectronics N V

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Murata Manufacturing Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Analog Devices Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Northrop Grumman Litef GmbH

List of Figures

- Figure 1: Global MEMS Accelerometer Sensor Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America MEMS Accelerometer Sensor Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America MEMS Accelerometer Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America MEMS Accelerometer Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America MEMS Accelerometer Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe MEMS Accelerometer Sensor Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: Europe MEMS Accelerometer Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe MEMS Accelerometer Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe MEMS Accelerometer Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific MEMS Accelerometer Sensor Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Asia Pacific MEMS Accelerometer Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific MEMS Accelerometer Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific MEMS Accelerometer Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World MEMS Accelerometer Sensor Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: Rest of the World MEMS Accelerometer Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World MEMS Accelerometer Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World MEMS Accelerometer Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global MEMS Accelerometer Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEMS Accelerometer Sensor Industry?

The projected CAGR is approximately 16.91%.

2. Which companies are prominent players in the MEMS Accelerometer Sensor Industry?

Key companies in the market include Northrop Grumman Litef GmbH, Honeywell International Inc, NXP Semiconductors N V, Microchip Technology Inc, InvenSense Inc (TDK), KIONIX Inc (ROHM), Bosch Sensortec GmbH, STMicroelectronics N V, Murata Manufacturing Co Ltd, Analog Devices Inc.

3. What are the main segments of the MEMS Accelerometer Sensor Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increased Defense Expenditure; Adoption of Automation in Industries and Homes.

6. What are the notable trends driving market growth?

Automotive is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

; High Up-front Adoption Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEMS Accelerometer Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEMS Accelerometer Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEMS Accelerometer Sensor Industry?

To stay informed about further developments, trends, and reports in the MEMS Accelerometer Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence