Key Insights

The Middle East manned guarding services market is poised for substantial expansion, driven by escalating security imperatives across commercial, industrial, and multi-unit residential sectors. Projected to reach $28.56 billion by 2025, the market is experiencing a Compound Annual Growth Rate (CAGR) of 4.8%. This growth trajectory is underpinned by increasing urbanization, rising crime incidence, and the widespread adoption of advanced security solutions by both public and private organizations. Key growth accelerators include geopolitical volatility, significant infrastructure development, and a growing demand for robust physical security across finance, healthcare, and retail industries. The competitive landscape features established entities like G4S Middle East and Transguard Group, alongside prominent regional players such as Sharaf Din Group and Arabian Security & Safety Services. Market dynamics are influenced by fluctuating oil prices and regulatory frameworks impacting operational costs and service delivery.

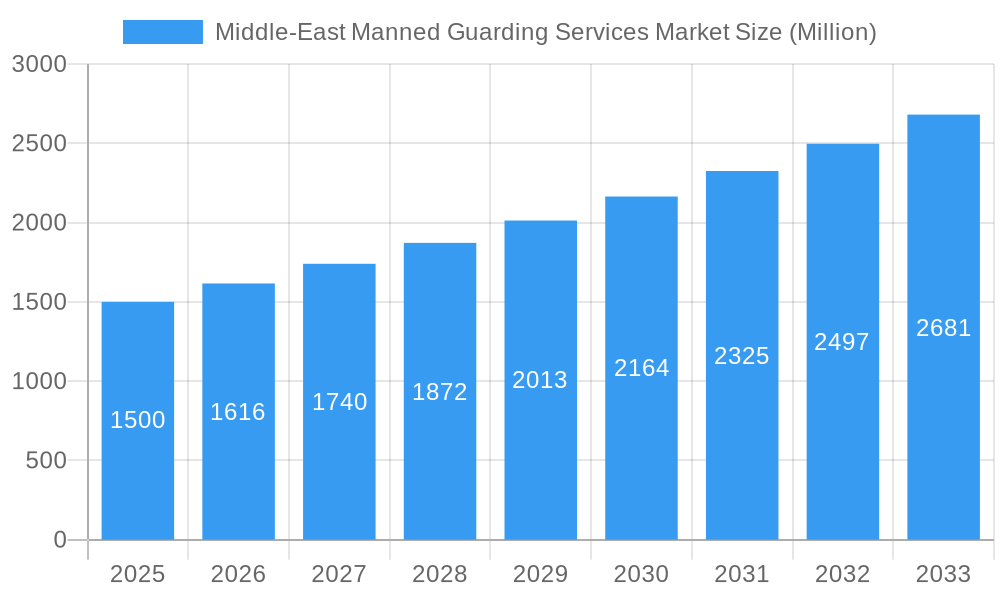

Middle-East Manned Guarding Services Market Market Size (In Billion)

The market is forecast to maintain its robust growth through 2033, propelled by technological innovations in security systems and their seamless integration with manned guarding services. The increasing adoption of smart security solutions and comprehensive integrated systems, augmenting traditional human guarding, will shape market evolution. Significant regional growth is anticipated, with the UAE and Saudi Arabia spearheading market expansion due to substantial investments in infrastructure and security. Market segmentation by end-user (commercial, industrial, multi-house residential) will continue to present lucrative opportunities as diverse sectors prioritize enhanced security. Intense competition is expected, yet opportunities will emerge for service providers offering specialized, technology-integrated guarding solutions.

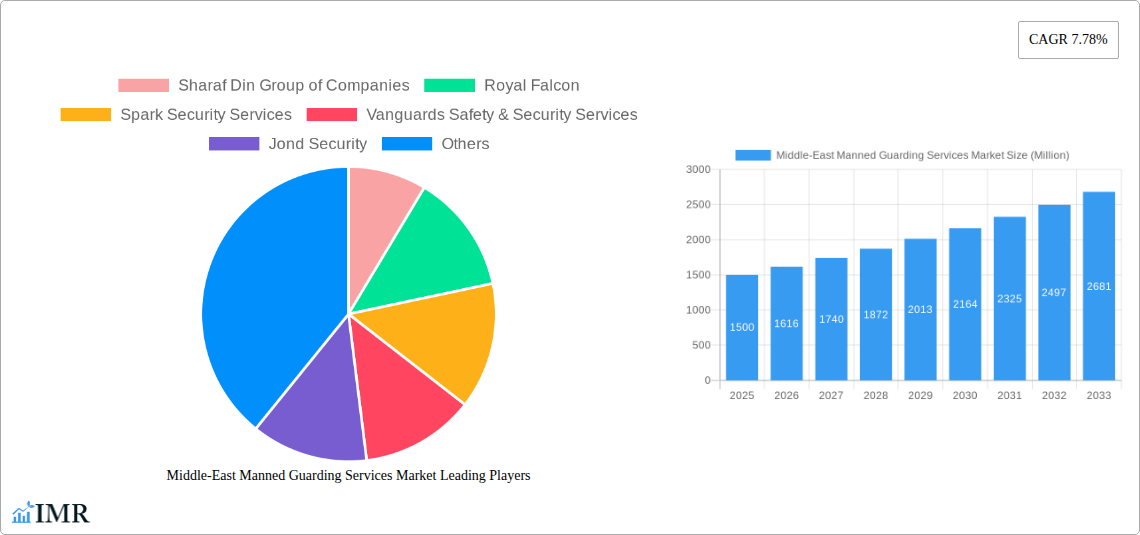

Middle-East Manned Guarding Services Market Company Market Share

Middle-East Manned Guarding Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle-East Manned Guarding Services market, encompassing market dynamics, growth trends, regional dominance, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is crucial for security providers, investors, and industry stakeholders seeking to understand and navigate this dynamic market. The parent market is the broader Middle East security services market, while the child market is specifically manned guarding services.

Middle-East Manned Guarding Services Market Dynamics & Structure

The Middle East manned guarding services market is characterized by a moderately concentrated landscape, with several large players commanding significant market share. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033. Technological innovation, primarily in surveillance technologies and security management software, is a key driver. However, regulatory frameworks and licensing requirements pose challenges. The market witnesses substantial M&A activity, with xx deals recorded in the historical period (2019-2024). Substitute services, such as electronic surveillance systems, are gaining traction, but manned guarding remains crucial due to the need for human judgment and interaction. End-user demographics, particularly the growth of commercial and industrial sectors, fuel market expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Integration of AI, CCTV, and access control systems drives growth but faces integration challenges.

- Regulatory Framework: Stringent licensing and security protocols impact market entry and operations.

- Competitive Substitutes: Electronic security systems pose a moderate threat, but manned guarding remains essential.

- End-User Demographics: Growth in commercial and industrial sectors significantly drives demand.

- M&A Trends: xx M&A deals in 2019-2024, indicating consolidation and expansion strategies.

Middle-East Manned Guarding Services Market Growth Trends & Insights

The Middle East manned guarding services market has witnessed steady growth during the historical period (2019-2024), driven by increasing security concerns, infrastructure development, and economic expansion across the region. The market size grew from xx Million in 2019 to xx Million in 2024. Adoption rates have been high, particularly in commercial and industrial sectors. Technological disruptions, such as the introduction of smart security solutions, have improved efficiency and enhanced security measures. Shifts in consumer behavior, with a focus on enhanced security and risk mitigation, are fueling demand. The forecast period (2025-2033) projects a sustained growth trajectory, propelled by investments in infrastructure projects and the expanding commercial landscape. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Dominant Regions, Countries, or Segments in Middle-East Manned Guarding Services Market

The UAE and Saudi Arabia are the dominant markets within the Middle East manned guarding services sector, driven by robust economic growth, large-scale infrastructure projects, and a heightened focus on security. The commercial segment constitutes the largest share of the market, followed by industrial and multi-house residential sectors.

- Key Drivers (UAE & Saudi Arabia):

- Strong economic growth and investments in infrastructure.

- Increased security concerns across various sectors.

- Government initiatives promoting security and safety standards.

- Dominance Factors:

- Large market size and high demand for security services.

- Presence of major players with established networks.

- Favorable regulatory environment and government support.

- Growth Potential:

- Expansion into emerging sectors like healthcare and tourism.

- Adoption of advanced security technologies.

- Rising awareness of security risks and proactive risk mitigation measures.

Middle-East Manned Guarding Services Market Product Landscape

The market offers a range of services, including static guarding, mobile patrolling, event security, and specialized security solutions. Product innovations focus on integrating technology, such as body-worn cameras, GPS tracking, and access control systems, to enhance efficiency and accountability. Key performance metrics include response times, incident reporting, and client satisfaction. Unique selling propositions center on technological integration, customized security solutions, and stringent training programs for security personnel.

Key Drivers, Barriers & Challenges in Middle-East Manned Guarding Services Market

Key Drivers: Increased security concerns due to geopolitical factors, rapid urbanization, and growth of critical infrastructure. Government initiatives promoting security standards and regulations also play a significant role. Economic growth across the region stimulates demand for security personnel across various sectors.

Challenges: Intense competition among established and emerging players leads to price pressures. Regulatory hurdles and licensing requirements can impede market entry. Supply chain issues, particularly in sourcing qualified and trained personnel, pose a significant challenge. The potential for labor shortages and the need for ongoing training further add to the difficulties.

Emerging Opportunities in Middle-East Manned Guarding Services Market

Untapped markets include specialized sectors like healthcare, logistics, and events management. Innovative applications, such as drone surveillance and AI-powered security analytics, represent growth avenues. Evolving consumer preferences toward more technologically advanced and responsive security solutions present an opportunity for providers to differentiate their offerings. Government initiatives for digital transformation in security can help drive adoption of new technologies.

Growth Accelerators in the Middle-East Manned Guarding Services Market Industry

Technological advancements in surveillance systems, access control, and security analytics are key growth drivers. Strategic partnerships between security firms and technology providers are accelerating the adoption of innovative solutions. Market expansion strategies, including geographical expansion and diversification into new sectors, are essential for long-term growth.

Key Players Shaping the Middle-East Manned Guarding Services Market Market

- Sharaf Din Group of Companies

- Royal Falcon

- Spark Security Services

- Vanguards Safety & Security Services

- Jond Security

- G4S Middle East

- Transguard Group

- Arabian Security & Safety Services Co Limited

- Hemaya Security Services

Notable Milestones in Middle-East Manned Guarding Services Market Sector

- June 2022: Transguard Group reinforced its partnership with a UAE-based airline, expanding its services to include check-in agents. This signifies the diversification of services offered by major players.

- May 2022: Transguard Group partnered with ICCA Dubai to launch Smart Solutions, a training program for Smart Kitchen Aides and Stewards. This reflects the industry's focus on upskilling its workforce and enhancing service quality.

In-Depth Middle-East Manned Guarding Services Market Market Outlook

The Middle East manned guarding services market is poised for sustained growth, driven by ongoing infrastructure development, increasing security concerns, and the adoption of advanced security technologies. Strategic partnerships, investments in training and technology, and expansion into new market segments will be crucial for long-term success. The market presents significant opportunities for established players and new entrants alike, with a focus on innovation, efficiency, and delivering high-quality security solutions to meet the evolving needs of the region.

Middle-East Manned Guarding Services Market Segmentation

-

1. End-user

- 1.1. Commercial

- 1.2. Industrial

- 1.3. Multi-house residential

-

2. Geography

- 2.1. UAE

- 2.2. Saudi Arabia

- 2.3. Qatar

- 2.4. Rest of Middle-East

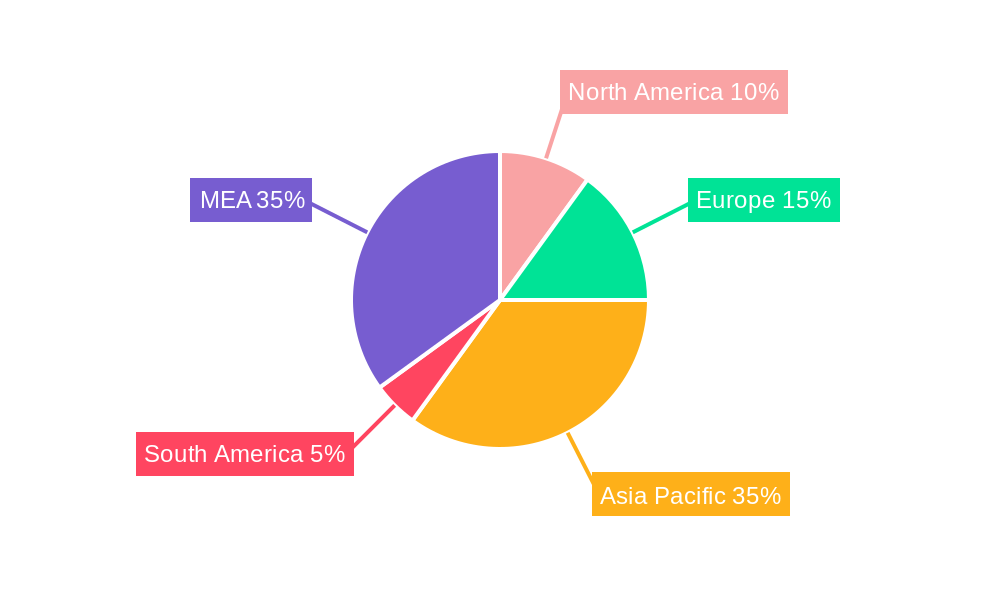

Middle-East Manned Guarding Services Market Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. Qatar

- 4. Rest of Middle East

Middle-East Manned Guarding Services Market Regional Market Share

Geographic Coverage of Middle-East Manned Guarding Services Market

Middle-East Manned Guarding Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing construction activity in the commercial & industrial domain; Rising awareness on the need to outsource manned security services to competent vendors; Changing geopolitical scenario in the region expected to drive growth

- 3.3. Market Restrains

- 3.3.1. Increasing Security Concerns

- 3.4. Market Trends

- 3.4.1. Rising awareness on the need to outsource manned security services to competent vendors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle-East Manned Guarding Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Commercial

- 5.1.2. Industrial

- 5.1.3. Multi-house residential

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. UAE

- 5.2.2. Saudi Arabia

- 5.2.3. Qatar

- 5.2.4. Rest of Middle-East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. Qatar

- 5.3.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. UAE Middle-East Manned Guarding Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 6.1.1. Commercial

- 6.1.2. Industrial

- 6.1.3. Multi-house residential

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. UAE

- 6.2.2. Saudi Arabia

- 6.2.3. Qatar

- 6.2.4. Rest of Middle-East

- 6.1. Market Analysis, Insights and Forecast - by End-user

- 7. Saudi Arabia Middle-East Manned Guarding Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 7.1.1. Commercial

- 7.1.2. Industrial

- 7.1.3. Multi-house residential

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. UAE

- 7.2.2. Saudi Arabia

- 7.2.3. Qatar

- 7.2.4. Rest of Middle-East

- 7.1. Market Analysis, Insights and Forecast - by End-user

- 8. Qatar Middle-East Manned Guarding Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 8.1.1. Commercial

- 8.1.2. Industrial

- 8.1.3. Multi-house residential

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. UAE

- 8.2.2. Saudi Arabia

- 8.2.3. Qatar

- 8.2.4. Rest of Middle-East

- 8.1. Market Analysis, Insights and Forecast - by End-user

- 9. Rest of Middle East Middle-East Manned Guarding Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 9.1.1. Commercial

- 9.1.2. Industrial

- 9.1.3. Multi-house residential

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. UAE

- 9.2.2. Saudi Arabia

- 9.2.3. Qatar

- 9.2.4. Rest of Middle-East

- 9.1. Market Analysis, Insights and Forecast - by End-user

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sharaf Din Group of Companies

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Royal Falcon

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Spark Security Services

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Vanguards Safety & Security Services

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Jond Security

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 G4S Middle East

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Transguard Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Arabian Security & Safety Services Co Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hemaya Security Services

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Sharaf Din Group of Companies

List of Figures

- Figure 1: Global Middle-East Manned Guarding Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: UAE Middle-East Manned Guarding Services Market Revenue (billion), by End-user 2025 & 2033

- Figure 3: UAE Middle-East Manned Guarding Services Market Revenue Share (%), by End-user 2025 & 2033

- Figure 4: UAE Middle-East Manned Guarding Services Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: UAE Middle-East Manned Guarding Services Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: UAE Middle-East Manned Guarding Services Market Revenue (billion), by Country 2025 & 2033

- Figure 7: UAE Middle-East Manned Guarding Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Saudi Arabia Middle-East Manned Guarding Services Market Revenue (billion), by End-user 2025 & 2033

- Figure 9: Saudi Arabia Middle-East Manned Guarding Services Market Revenue Share (%), by End-user 2025 & 2033

- Figure 10: Saudi Arabia Middle-East Manned Guarding Services Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: Saudi Arabia Middle-East Manned Guarding Services Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Saudi Arabia Middle-East Manned Guarding Services Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Saudi Arabia Middle-East Manned Guarding Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Qatar Middle-East Manned Guarding Services Market Revenue (billion), by End-user 2025 & 2033

- Figure 15: Qatar Middle-East Manned Guarding Services Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Qatar Middle-East Manned Guarding Services Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Qatar Middle-East Manned Guarding Services Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Qatar Middle-East Manned Guarding Services Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Qatar Middle-East Manned Guarding Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of Middle East Middle-East Manned Guarding Services Market Revenue (billion), by End-user 2025 & 2033

- Figure 21: Rest of Middle East Middle-East Manned Guarding Services Market Revenue Share (%), by End-user 2025 & 2033

- Figure 22: Rest of Middle East Middle-East Manned Guarding Services Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Rest of Middle East Middle-East Manned Guarding Services Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest of Middle East Middle-East Manned Guarding Services Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of Middle East Middle-East Manned Guarding Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 2: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 5: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 8: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 11: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 14: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Middle-East Manned Guarding Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East Manned Guarding Services Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Middle-East Manned Guarding Services Market?

Key companies in the market include Sharaf Din Group of Companies, Royal Falcon, Spark Security Services, Vanguards Safety & Security Services, Jond Security, G4S Middle East, Transguard Group, Arabian Security & Safety Services Co Limited, Hemaya Security Services.

3. What are the main segments of the Middle-East Manned Guarding Services Market?

The market segments include End-user, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing construction activity in the commercial & industrial domain; Rising awareness on the need to outsource manned security services to competent vendors; Changing geopolitical scenario in the region expected to drive growth.

6. What are the notable trends driving market growth?

Rising awareness on the need to outsource manned security services to competent vendors.

7. Are there any restraints impacting market growth?

Increasing Security Concerns.

8. Can you provide examples of recent developments in the market?

June 2022 - Transguard Group, the UAE's leading business solutions provider, announced it has further reinforced its partnership with a UAE-based airline to include check-in agents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East Manned Guarding Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East Manned Guarding Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East Manned Guarding Services Market?

To stay informed about further developments, trends, and reports in the Middle-East Manned Guarding Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence