Key Insights

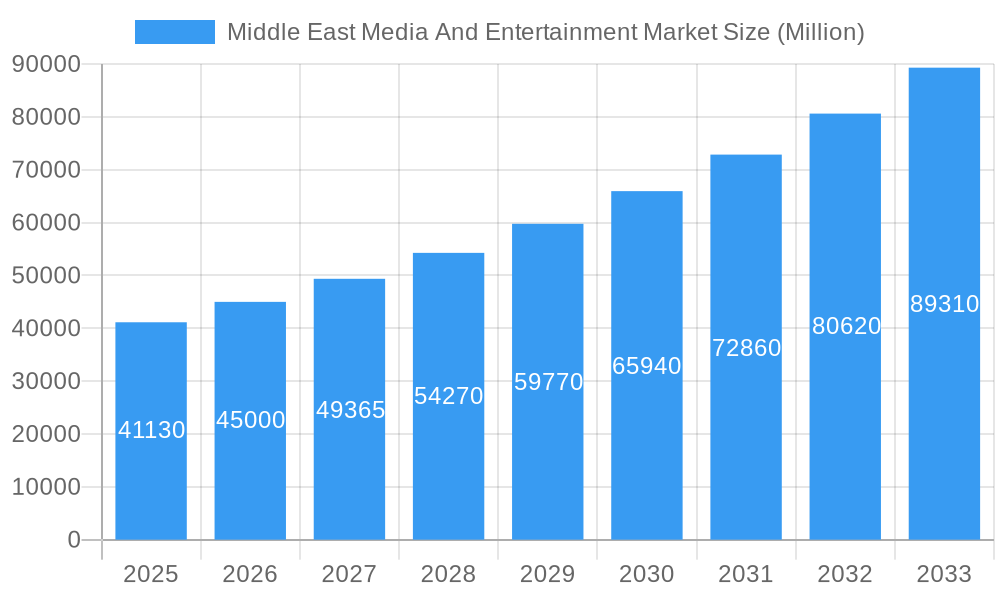

The Middle East Media and Entertainment market is experiencing robust growth, projected to reach a market size of $41.13 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.41% from 2025 to 2033. This expansion is driven by several key factors. The rising adoption of digital technologies, including streaming services and online gaming, fuels significant demand. Increased internet penetration and smartphone usage across the region are creating a larger addressable market for media and entertainment companies. Furthermore, substantial investments in infrastructure and content creation, particularly in areas like video-on-demand and digital music, are catalyzing market growth. Government initiatives promoting the development of the creative industries also play a crucial role. While challenges such as content piracy and regulatory hurdles exist, the overall market trajectory remains positive.

Middle East Media And Entertainment Market Market Size (In Billion)

The market segmentation reveals considerable diversity. Digital music and music streaming represent a major segment, reflecting the growing popularity of online audio consumption. Video games and video-on-demand services are equally important contributors, showcasing a clear preference for digital entertainment formats. E-publishing, advertising (including outdoor and internet advertising), and internet access services also contribute significantly to the market's overall value. Geographically, Saudi Arabia, the UAE, and Qatar are leading the market, driven by higher disposable incomes and strong technological adoption. However, growth opportunities exist in other Middle Eastern countries as internet penetration and digital literacy increase. This growth will also be fostered by the continuous evolution and diversification of digital content, expanding the options available to consumers and opening opportunities for media companies to innovate and cater to evolving preferences.

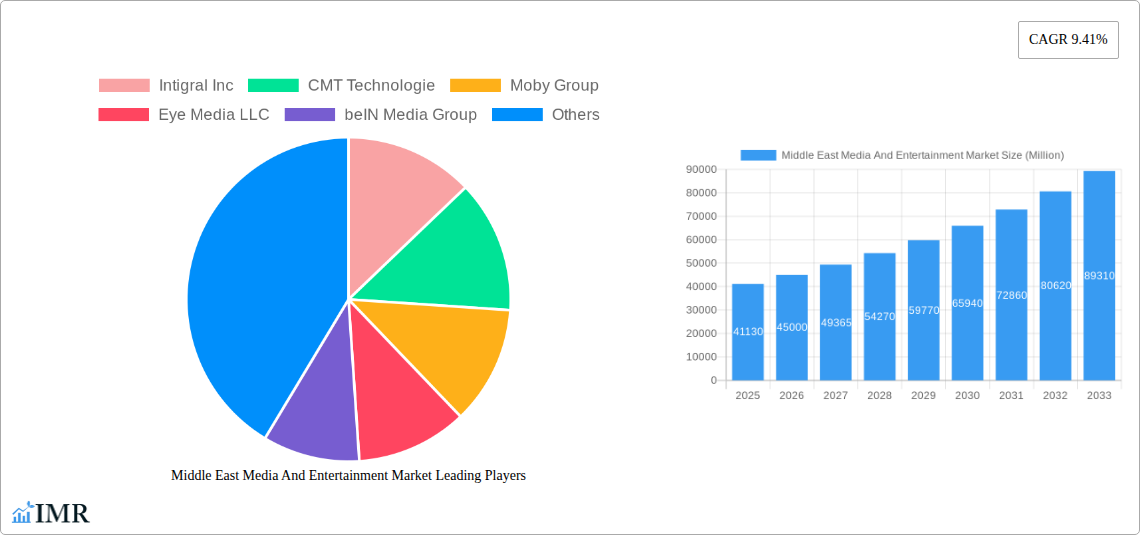

Middle East Media And Entertainment Market Company Market Share

Middle East Media & Entertainment Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East media and entertainment market, covering the period from 2019 to 2033. It examines market dynamics, growth trends, dominant segments, key players, and future opportunities across various segments, including digital music, video-on-demand, and advertising. The report leverages extensive data and expert analysis to offer invaluable insights for industry professionals and investors. This report is crucial for understanding the evolving landscape of the Middle East media and entertainment sector, a rapidly growing market with significant potential.

Middle East Media & Entertainment Market Dynamics & Structure

This section analyzes the structure and dynamics of the Middle East media and entertainment market (2019-2024). We explore market concentration, technological innovation, regulatory frameworks, competitive substitutes, and M&A trends. The market size in 2025 is estimated at xx Million.

- Market Concentration: The market exhibits a moderate level of concentration, with a few major players holding significant market share. The top 5 players account for approximately xx% of the total market revenue.

- Technological Innovation: Streaming services, mobile gaming, and digital advertising are key drivers of innovation. However, challenges remain in terms of internet penetration and infrastructure in certain regions.

- Regulatory Frameworks: Government regulations concerning content, licensing, and broadcasting vary across the region and influence market dynamics.

- Competitive Product Substitutes: The increasing popularity of free and low-cost content presents a challenge to traditional paid media platforms.

- End-User Demographics: A young and tech-savvy population fuels demand for digital media and entertainment services. The rising disposable incomes in key markets are further supporting this demand.

- M&A Trends: The period 2019-2024 witnessed xx M&A deals, largely driven by strategic expansion and consolidation within the industry. Further consolidation is predicted in the coming years.

Middle East Media & Entertainment Market Growth Trends & Insights

The Middle East media and entertainment market experienced significant growth during the historical period (2019-2024), driven by rising internet and smartphone penetration, increasing disposable incomes, and a preference for digital content. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fuelled by:

- Increasing adoption of streaming platforms.

- The rapid expansion of mobile gaming.

- Growth in digital advertising revenue.

- The increasing popularity of e-publishing.

- Growing investment in local content production.

Market penetration of key segments, like video-on-demand and music streaming, is expected to increase significantly, exceeding xx% by 2033. Changes in consumer behavior, such as increased reliance on mobile devices for entertainment consumption, are also impacting market growth.

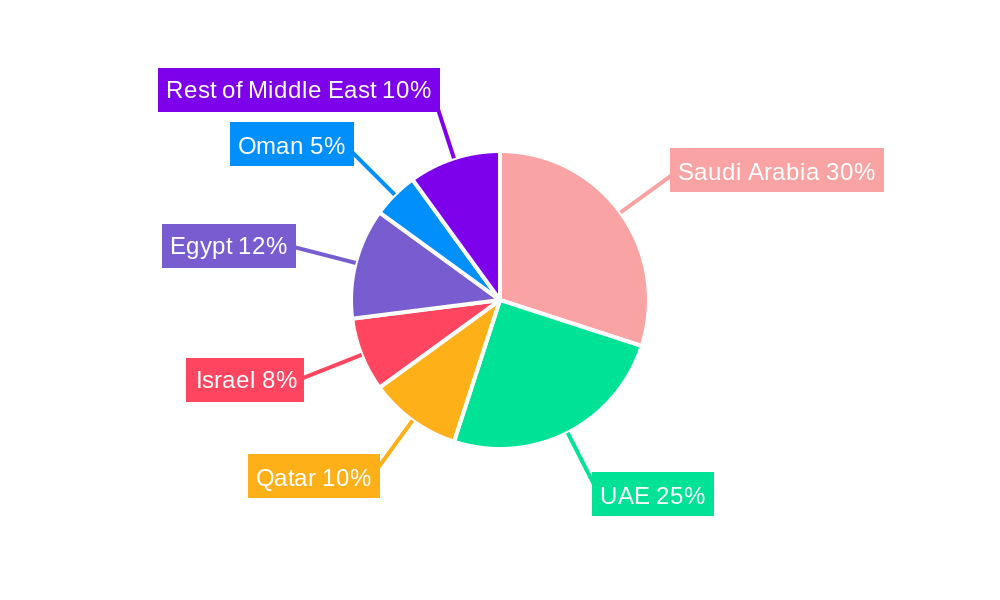

Dominant Regions, Countries, or Segments in Middle East Media & Entertainment Market

Saudi Arabia, the UAE, and Qatar are the leading markets within the Middle East media and entertainment sector. However, other countries in the region are showing strong growth potential.

By Country:

- Saudi Arabia: Holds the largest market share due to its large population, high disposable incomes, and government initiatives promoting the media and entertainment sector. Growth drivers include significant investment in infrastructure and entertainment venues.

- United Arab Emirates: A strong presence of international media companies and a well-developed infrastructure contribute to its significant market share. The UAE's focus on tourism and entertainment further boosts market growth.

- Qatar: Significant investments in sports and entertainment, coupled with its strategic location, contribute to the country's growth within the regional market.

By Type:

- Video-on-demand (VOD): This segment is the fastest-growing, driven by the popularity of streaming platforms and increased internet penetration.

- Digital Music & Music Streaming: This segment is experiencing strong growth, fueled by the rising popularity of mobile music streaming services.

- Advertising: The digital advertising segment shows substantial growth potential, although traditional outdoor advertising remains significant.

Middle East Media & Entertainment Market Product Landscape

The Middle East media and entertainment market is characterized by a diverse range of products and services, including streaming platforms, mobile games, digital music services, and various advertising formats. Recent innovations focus on improving user experience through personalized content recommendations, enhanced interactive features in gaming, and sophisticated ad targeting techniques. The competition is fierce, with companies striving to provide unique content and user-friendly interfaces to gain market share.

Key Drivers, Barriers & Challenges in Middle East Media & Entertainment Market

Key Drivers:

- Growing smartphone and internet penetration.

- Rising disposable incomes.

- Government support for the media and entertainment industry.

- Increasing demand for local and regional content.

Key Barriers and Challenges:

- Regulatory hurdles related to content licensing and broadcasting.

- Competition from international media companies.

- Piracy and copyright infringement.

- Infrastructure limitations in certain regions. The cost of high-speed internet access presents a significant barrier for some consumers.

Emerging Opportunities in Middle East Media And Entertainment Market

Emerging opportunities include the expansion of e-sports, augmented reality/virtual reality (AR/VR) applications in entertainment, and the growth of influencer marketing. Untapped markets exist in smaller countries within the region, and further growth is anticipated through creative partnerships, and development of localized content, thus catering to specific cultural nuances.

Growth Accelerators in the Middle East Media And Entertainment Market Industry

Long-term growth will be fueled by technological advancements like 5G, enhancing streaming capabilities and interactive experiences. Strategic partnerships between international and regional players will contribute significantly. Government initiatives aimed at diversifying economies and promoting the creative sector will further catalyze market expansion.

Key Players Shaping the Middle East Media And Entertainment Market Market

- Intigral Inc

- CMT Technologie

- Moby Group

- Eye Media LLC

- beIN Media Group

- Zawya Ltd (Refinitiv)

- Orbit Showtime Network

- Arab Media Group

- Abu Dhabi Media

- MBC Group

Notable Milestones in Middle East Media & Entertainment Market Sector

- March 2024: Intigral partners with Moonbug Entertainment to launch "Blippi & Friends" channel on STC TV and Jawwy TV. This significantly expands children's content offerings on these popular platforms.

- November 2023: Arabian Publishing Media partners with Beautiful Minds Media GmbH to introduce the Madame brand to the region. This signifies a strategic move towards luxury lifestyle content, broadening the market's offerings.

In-Depth Middle East Media & Entertainment Market Outlook

The Middle East media and entertainment market presents significant long-term growth potential, driven by ongoing digital transformation and evolving consumer preferences. Strategic investments in infrastructure, technology, and localized content, coupled with supportive government policies, will accelerate market expansion. Companies that adapt to changing consumer behaviors and leverage innovative technologies are poised to capture significant market share in the years to come.

Middle East Media And Entertainment Market Segmentation

-

1. Type

-

1.1. Digital Music

- 1.1.1. Music Downloads

- 1.1.2. Music Streaming

- 1.2. Video Games

-

1.3. Video-on-demand

- 1.3.1. SvoD

- 1.3.2. TVoD

- 1.3.3. Video Downloads

- 1.3.4. Video Downloads/EST

- 1.4. E-publishing

-

1.5. Advertising

- 1.5.1. Digital Advertising

- 1.5.2. Newspaper

- 1.5.3. Magazine

- 1.5.4. Television

- 1.5.5. Radio

- 1.5.6. Outdoor Advertising

- 1.6. Internet Access

-

1.1. Digital Music

Middle East Media And Entertainment Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Media And Entertainment Market Regional Market Share

Geographic Coverage of Middle East Media And Entertainment Market

Middle East Media And Entertainment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming

- 3.2.2 OTT

- 3.2.3 and Internet Advertising

- 3.3. Market Restrains

- 3.3.1. Significant Increase in Piracy Leading to Loss of Revenue

- 3.4. Market Trends

- 3.4.1. Internet Access Segment to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Media And Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Digital Music

- 5.1.1.1. Music Downloads

- 5.1.1.2. Music Streaming

- 5.1.2. Video Games

- 5.1.3. Video-on-demand

- 5.1.3.1. SvoD

- 5.1.3.2. TVoD

- 5.1.3.3. Video Downloads

- 5.1.3.4. Video Downloads/EST

- 5.1.4. E-publishing

- 5.1.5. Advertising

- 5.1.5.1. Digital Advertising

- 5.1.5.2. Newspaper

- 5.1.5.3. Magazine

- 5.1.5.4. Television

- 5.1.5.5. Radio

- 5.1.5.6. Outdoor Advertising

- 5.1.6. Internet Access

- 5.1.1. Digital Music

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intigral Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMT Technologie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Moby Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eye Media LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 beIN Media Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zawya Ltd (Refinitiv)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orbit Showtime Network

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arab Media Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abu Dhabi Media

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MBC Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Intigral Inc

List of Figures

- Figure 1: Middle East Media And Entertainment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Media And Entertainment Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Media And Entertainment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East Media And Entertainment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Middle East Media And Entertainment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Middle East Media And Entertainment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: United Arab Emirates Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Israel Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Kuwait Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Oman Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Bahrain Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Jordan Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Lebanon Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Media And Entertainment Market?

The projected CAGR is approximately 9.41%.

2. Which companies are prominent players in the Middle East Media And Entertainment Market?

Key companies in the market include Intigral Inc, CMT Technologie, Moby Group, Eye Media LLC, beIN Media Group, Zawya Ltd (Refinitiv), Orbit Showtime Network, Arab Media Group, Abu Dhabi Media, MBC Group.

3. What are the main segments of the Middle East Media And Entertainment Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming. OTT. and Internet Advertising.

6. What are the notable trends driving market growth?

Internet Access Segment to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Significant Increase in Piracy Leading to Loss of Revenue.

8. Can you provide examples of recent developments in the market?

March 2024 - Intigral, the media arm of STC Group, announced a partnership with Moonbug Entertainment, a subsidiary of Candle Media. The partnership aims to launch a new linear channel called "Blippi & Friends" on its streaming platforms, STC TV and Jawwy TV. The channel will be available for viewers across the MENA region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Media And Entertainment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Media And Entertainment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Media And Entertainment Market?

To stay informed about further developments, trends, and reports in the Middle East Media And Entertainment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence