Key Insights

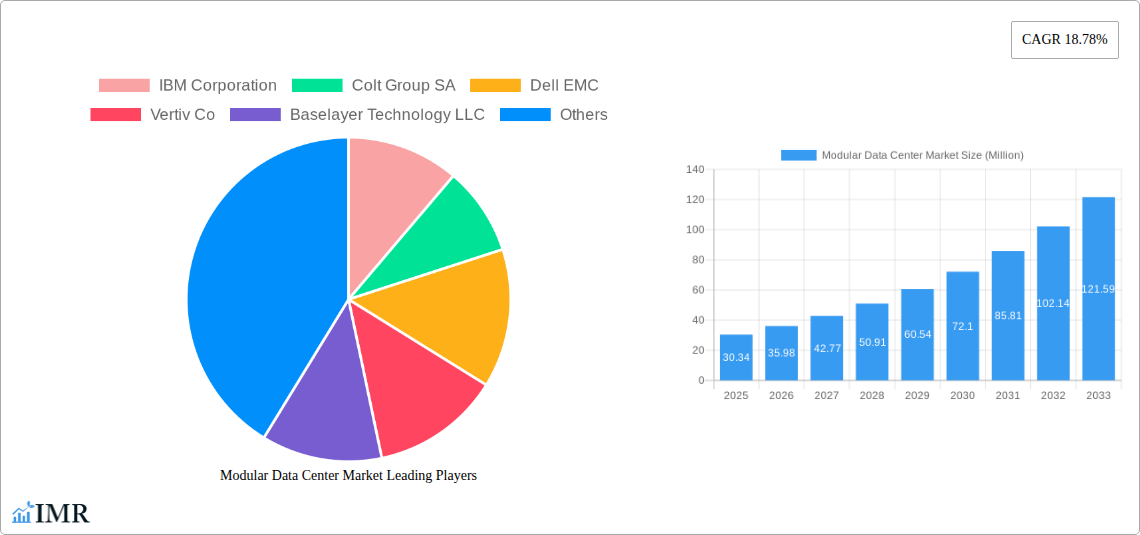

The Modular Data Center Market is poised for substantial expansion, projected to reach a market size of $30.34 million in 2025, driven by an impressive CAGR of 18.78% during the forecast period of 2025-2033. This robust growth is underpinned by a confluence of factors, including the escalating demand for agility and scalability in IT infrastructure, particularly in the face of rapidly evolving data requirements. Key drivers such as the increasing adoption of high-performance computing (HPC) and edge computing solutions, coupled with the ongoing need for data center expansion and the proliferation of starter data centers, are fueling this surge. The inherent flexibility and cost-effectiveness of modular data centers, which allow for rapid deployment and customization, are making them an increasingly attractive option for organizations across various sectors. Furthermore, the growing emphasis on disaster backup and recovery strategies within businesses necessitates resilient and readily deployable infrastructure, a niche perfectly addressed by modular solutions.

Modular Data Center Market Market Size (In Million)

The market's trajectory is further shaped by critical trends in cloud adoption, IoT proliferation, and the exponential growth of data. Enterprises are increasingly leveraging modular data centers to support these initiatives due to their ability to be deployed closer to data sources, reducing latency and enhancing processing efficiency. While the market exhibits strong growth potential, certain restraints, such as the initial capital investment for some advanced configurations and the availability of skilled personnel for deployment and maintenance, require strategic consideration. However, the overwhelming advantages in terms of speed of deployment, scalability, and cost predictability are expected to outweigh these challenges. The IT, Telecom, BFSI, and Government sectors are anticipated to be major end-users, with notable contributions expected from North America and Asia Pacific regions, reflecting their advanced technological infrastructure and significant digital transformation efforts.

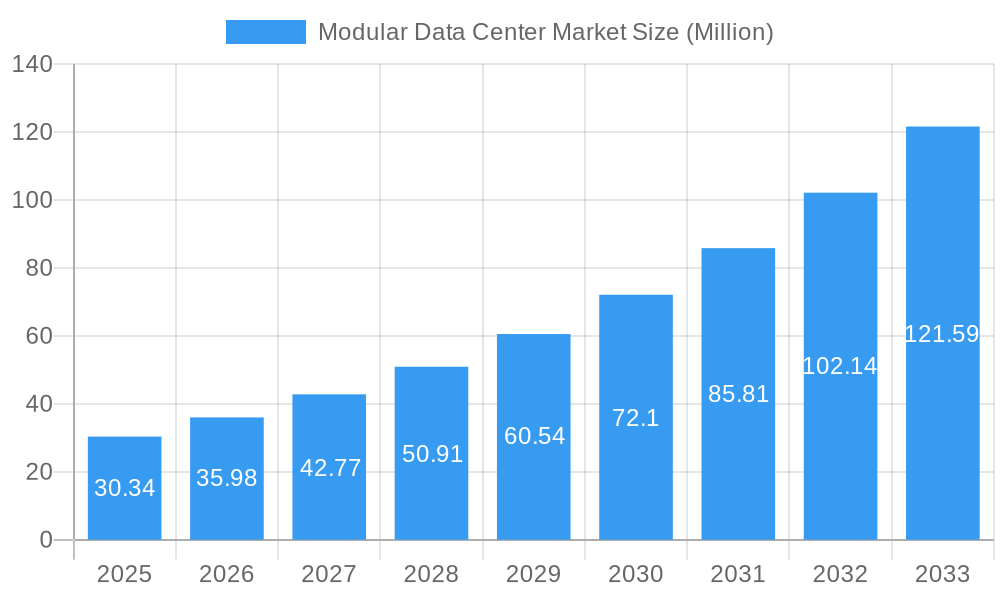

Modular Data Center Market Company Market Share

Global Modular Data Center Market Report: Unleashing Agility and Scalability in Data Infrastructure

This comprehensive report delves into the dynamic global modular data center market, a sector experiencing robust expansion driven by the escalating demand for agile, scalable, and cost-effective data infrastructure solutions. Explore the intricate market dynamics, growth trajectories, and emerging opportunities that are reshaping the future of data management. With a detailed analysis spanning the historical period (2019–2024) and a forecast period (2025–2033), this report provides invaluable insights for industry stakeholders. The base year is 2025, with the estimated year also being 2025.

Modular Data Center Market Dynamics & Structure

The modular data center market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and increasing end-user adoption. Market concentration is moderately fragmented, with key players actively pursuing strategic initiatives to capture market share. Technological innovation remains a primary driver, fueled by the relentless pursuit of enhanced energy efficiency, faster deployment times, and improved density in edge computing and high performance computing environments. Regulatory frameworks are evolving to support the deployment of sustainable and secure data centers, while competitive product substitutes, such as traditional brick-and-mortar data centers, are increasingly being challenged by the agility and cost-effectiveness of modular solutions. End-user demographics are broadening, with significant uptake observed across IT, Telecom, BFSI, and Government sectors. Mergers and acquisitions (M&A) activity is on the rise as companies seek to consolidate their offerings and expand their geographical reach within the containerized data center and prefabricated data center segments. Barriers to innovation include the need for standardization in a rapidly evolving technology landscape and the initial capital investment required for advanced modular designs. The market is projected to witness a significant compound annual growth rate (CAGR) due to these multifaceted dynamics.

- Market Concentration: Moderately fragmented with strategic M&A activities.

- Technological Innovation Drivers: Energy efficiency, rapid deployment, edge computing demands, density improvements.

- Regulatory Frameworks: Focus on sustainability, security, and standardization.

- Competitive Product Substitutes: Traditional data centers, cloud-based solutions.

- End-User Demographics: IT, Telecom, BFSI, Government, Other Enterprises.

- M&A Trends: Consolidation for market expansion and integrated solution offerings.

- Innovation Barriers: Standardization, initial capital investment, integration complexities.

Modular Data Center Market Growth Trends & Insights

The modular data center market is poised for substantial growth, driven by an accelerated adoption rate across diverse industries seeking greater agility and scalability. Market size evolution is directly correlated with the increasing digitization of economies and the proliferation of data-intensive applications. Technological disruptions, such as advancements in power management and cooling systems, are enhancing the performance and sustainability of modular solutions. Consumer behavior shifts, characterized by a preference for flexible, on-demand IT infrastructure, are further propelling the demand for portable data centers and expandable data centers. The market penetration of modular data centers is expected to surge as businesses recognize their ability to reduce deployment times from months to weeks, thereby accelerating time-to-market for new services and applications. The rise of disaster backup solutions and the growing need for localized data processing in edge computing scenarios are significant growth catalysts. Furthermore, the trend towards green digitalization and the imperative to reduce carbon footprints are favoring the energy-efficient designs inherent in many modular data center offerings. The overall market is expected to witness a robust CAGR of approximately 12-15% over the forecast period.

Dominant Regions, Countries, or Segments in Modular Data Center Market

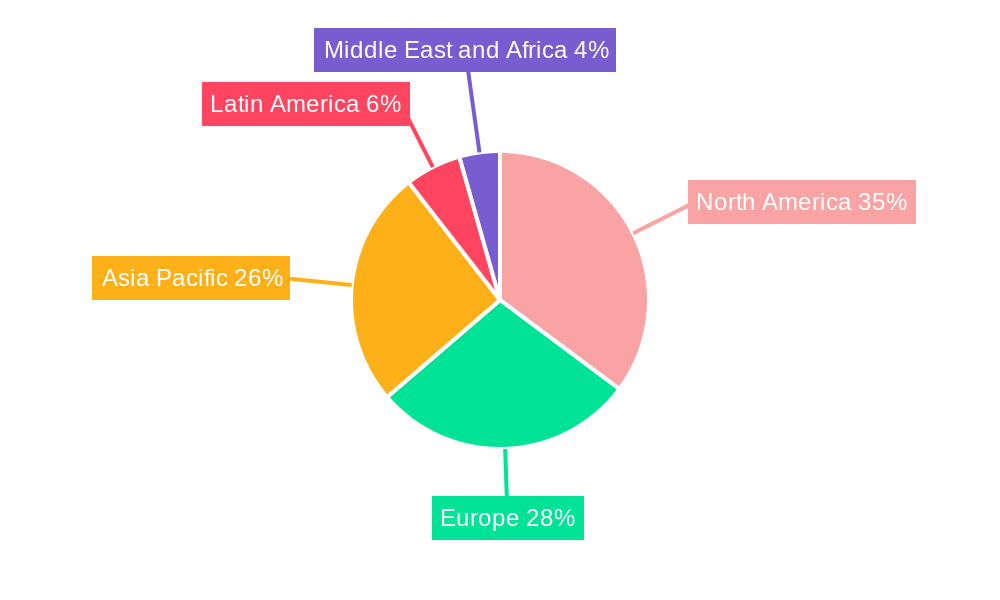

North America currently dominates the modular data center market, driven by its mature IT infrastructure, significant investments in digital transformation across the IT, Telecom, and BFSI sectors, and a strong emphasis on technological innovation, particularly in edge computing and high performance computing. The presence of leading technology companies and a favorable regulatory environment that supports data center expansion contribute to its leading position.

- Dominant Region: North America.

- Key Countries: United States, Canada.

- Leading Segments:

- Solution and Services: Function: Data Center Expansion and Starter Data Centers are experiencing significant demand as organizations look for rapid scaling capabilities.

- Application: High Performance/ Edge Computing is a major growth driver, fueled by the deployment of IoT devices and the need for real-time data processing. Disaster Backup also holds substantial market share due to its critical role in business continuity.

- End User: The IT and Telecom sectors are leading in adoption, followed closely by BFSI and Government agencies investing in modernized infrastructure.

Factors contributing to North America's dominance include:

- Economic Policies: Favorable incentives for technology investments and data center development.

- Infrastructure: Extensive network connectivity and a well-developed power grid supporting data center operations.

- Technological Adoption: Early and widespread adoption of cutting-edge technologies, including AI and IoT, driving demand for high-performance computing and edge solutions.

- Market Share: North America is estimated to hold over 35% of the global modular data center market share.

- Growth Potential: Continued investments in hyperscale and enterprise data centers, coupled with the burgeoning edge computing market, ensure robust growth potential for the region. The increasing adoption of modular solutions for critical applications like disaster recovery and remote site deployments further solidifies its position.

Modular Data Center Market Product Landscape

The modular data center market showcases a diverse product landscape characterized by continuous innovation and application-specific designs. Products range from compact, self-contained starter data centers ideal for small businesses and remote deployments to large-scale, multi-rack solutions designed for enterprise-level expansion and high performance computing. Key advancements focus on enhanced power and cooling efficiency, integrated security features, and simplified deployment processes. Many solutions offer pre-configured IT hardware, networking capabilities, and specialized software, delivering plug-and-play functionality for rapid deployment. Performance metrics are driven by density, energy efficiency (PUE), and modularity, allowing for seamless scaling to meet fluctuating demand. Unique selling propositions often lie in the speed of deployment, reduced on-site construction, and the ability to precisely match capacity to requirements, thereby minimizing overprovisioning and operational costs. The integration of advanced cooling technologies, such as liquid cooling, and sustainable power solutions are increasingly becoming standard features.

Key Drivers, Barriers & Challenges in Modular Data Center Market

Key Drivers:

The modular data center market is propelled by several key drivers. The escalating demand for agility and scalability in IT infrastructure is paramount, enabling businesses to rapidly adapt to changing market needs. The increasing adoption of edge computing and the proliferation of IoT devices necessitate localized data processing capabilities, which modular data centers effectively address. Furthermore, the pursuit of cost savings and reduced deployment times compared to traditional data centers is a significant incentive. Sustainability initiatives and the need for energy-efficient solutions also play a crucial role, as modular designs often incorporate advanced cooling and power management systems.

Barriers & Challenges:

Despite the promising growth, the modular data center market faces certain barriers and challenges. Supply chain disruptions and the availability of specialized components can impact production timelines and costs, with an estimated impact of 5-10% on project costs during critical shortages. Regulatory hurdles and the need for standardized compliance in different regions can also present complexities. Competition from established traditional data center providers and the initial capital investment required for some advanced modular solutions can be restrictive. Security concerns and the integration of modular components with existing IT infrastructure require careful planning and execution.

Emerging Opportunities in Modular Data Center Market

Emerging opportunities in the modular data center market are abundant, particularly in untapped geographies and niche applications. The growing need for localized data processing in emerging markets, coupled with the expansion of 5G networks, presents a significant opportunity for edge data centers. Innovative applications in areas like autonomous vehicles, smart cities, and remote healthcare are driving the demand for high-density, low-latency computing solutions. Evolving consumer preferences for sustainable and energy-efficient infrastructure are also creating opportunities for manufacturers to develop greener modular data center designs. The increasing trend of hybrid and multi-cloud strategies is fostering demand for modular solutions that can seamlessly integrate with cloud environments, offering flexibility and control.

Growth Accelerators in the Modular Data Center Market Industry

Several catalysts are accelerating the growth of the modular data center market. Technological breakthroughs in areas such as AI-driven power management, advanced cooling techniques, and highly integrated pre-fabricated modules are enhancing efficiency and reducing operational costs. Strategic partnerships between data center providers, IT hardware manufacturers, and telecommunications companies are crucial for expanding market reach and offering comprehensive solutions. Market expansion strategies, including entry into new geographical regions and the development of specialized modular offerings for specific industry verticals, are further fueling growth. The increasing demand for hyperscale data centers that can be deployed quickly and cost-effectively also acts as a significant growth accelerator.

Key Players Shaping the Modular Data Center Market Market

- IBM Corporation

- Colt Group SA

- Dell EMC

- Vertiv Co

- Baselayer Technology LLC

- Cannon Technologies Ltd

- Schneider Electric SE

- Rittal Gmbh & Co KG

- Huawei Technologies Co Ltd

- HPE Company

- Bladeroom Group Ltd

- Instant Data Centers LLC

Notable Milestones in Modular Data Center Market Sector

- June 2023: Hewlett Packard Enterprise announced an expanded partnership with Equinix to extend the HPE GreenLake private cloud portfolio at Equinix International Business Exchange (IBX) data centers. Hewlett Packard Enterprise will pre-provision HPE GreenLake for Private Cloud Enterprise and HPE GreenLake for Private Cloud Business Edition at strategic Equinix data centers around the world, giving customers rapid access to a broad range of private cloud offerings for more incredible speed, agility, flexibility, and choice in their hybrid cloud strategy.

- November 2022: Huawei introduced two new additions to its Smart Modular Data Center and SmartLi uninterruptible power supply (UPS) series - FusionModule2000 6.0, a modular small/medium-sized data center solution, and UPS2000-H, a small-footprint power supply solution running on SmartLi Mini. These new solutions allow channel partners to take a competitive edge in the market while providing an efficient way of driving green digitalization for businesses cost-effectively.

In-Depth Modular Data Center Market Market Outlook

The modular data center market is set for an exceptionally bright future, driven by persistent demand for rapid, scalable, and efficient data infrastructure. Growth accelerators such as advancements in AI for operational optimization, the expanding reach of 5G networks powering edge deployments, and a global push towards sustainable IT practices will continue to fuel market expansion. Strategic alliances and the increasing commoditization of pre-engineered modules will democratize access to advanced data center capabilities. The market's outlook is characterized by continuous innovation in areas like thermal management and power density, ensuring that modular data centers remain at the forefront of technological evolution. Organizations will increasingly leverage modular solutions for their agility, cost-effectiveness, and ability to meet the ever-growing demands of data-intensive applications, securing a significant share of the overall data center infrastructure market.

Modular Data Center Market Segmentation

-

1. Solution and Services

- 1.1. Function

-

2. Application

- 2.1. Disaster Backup

- 2.2. High Performance/ Edge Computing

- 2.3. Data Center Expansion

- 2.4. Starter Data Centers

-

3. End User

- 3.1. IT

- 3.2. Telecom

- 3.3. BFSI

- 3.4. Government

- 3.5. Other En

Modular Data Center Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Modular Data Center Market Regional Market Share

Geographic Coverage of Modular Data Center Market

Modular Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mobility and Scalability of Modular Data Centers; Disaster Recovery Advantages

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Professionals and Outdated Cybersecurity Technology

- 3.4. Market Trends

- 3.4.1. IT Sector to Hold Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Modular Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution and Services

- 5.1.1. Function

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Disaster Backup

- 5.2.2. High Performance/ Edge Computing

- 5.2.3. Data Center Expansion

- 5.2.4. Starter Data Centers

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT

- 5.3.2. Telecom

- 5.3.3. BFSI

- 5.3.4. Government

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution and Services

- 6. North America Modular Data Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution and Services

- 6.1.1. Function

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Disaster Backup

- 6.2.2. High Performance/ Edge Computing

- 6.2.3. Data Center Expansion

- 6.2.4. Starter Data Centers

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. IT

- 6.3.2. Telecom

- 6.3.3. BFSI

- 6.3.4. Government

- 6.3.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Solution and Services

- 7. Europe Modular Data Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution and Services

- 7.1.1. Function

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Disaster Backup

- 7.2.2. High Performance/ Edge Computing

- 7.2.3. Data Center Expansion

- 7.2.4. Starter Data Centers

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. IT

- 7.3.2. Telecom

- 7.3.3. BFSI

- 7.3.4. Government

- 7.3.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Solution and Services

- 8. Asia Pacific Modular Data Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution and Services

- 8.1.1. Function

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Disaster Backup

- 8.2.2. High Performance/ Edge Computing

- 8.2.3. Data Center Expansion

- 8.2.4. Starter Data Centers

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. IT

- 8.3.2. Telecom

- 8.3.3. BFSI

- 8.3.4. Government

- 8.3.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Solution and Services

- 9. Latin America Modular Data Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution and Services

- 9.1.1. Function

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Disaster Backup

- 9.2.2. High Performance/ Edge Computing

- 9.2.3. Data Center Expansion

- 9.2.4. Starter Data Centers

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. IT

- 9.3.2. Telecom

- 9.3.3. BFSI

- 9.3.4. Government

- 9.3.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Solution and Services

- 10. Middle East and Africa Modular Data Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution and Services

- 10.1.1. Function

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Disaster Backup

- 10.2.2. High Performance/ Edge Computing

- 10.2.3. Data Center Expansion

- 10.2.4. Starter Data Centers

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. IT

- 10.3.2. Telecom

- 10.3.3. BFSI

- 10.3.4. Government

- 10.3.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Solution and Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IBM Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Colt Group SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dell EMC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vertiv Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Baselayer Technology LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cannon Technologies Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rittal Gmbh & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Huawei Technologies Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HPE Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bladeroom Group Ltd *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Instant Data Centers LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 IBM Corporation

List of Figures

- Figure 1: Global Modular Data Center Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Modular Data Center Market Revenue (Million), by Solution and Services 2025 & 2033

- Figure 3: North America Modular Data Center Market Revenue Share (%), by Solution and Services 2025 & 2033

- Figure 4: North America Modular Data Center Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Modular Data Center Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Modular Data Center Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Modular Data Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Modular Data Center Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Modular Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Modular Data Center Market Revenue (Million), by Solution and Services 2025 & 2033

- Figure 11: Europe Modular Data Center Market Revenue Share (%), by Solution and Services 2025 & 2033

- Figure 12: Europe Modular Data Center Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Modular Data Center Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Modular Data Center Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Modular Data Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Modular Data Center Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Modular Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Modular Data Center Market Revenue (Million), by Solution and Services 2025 & 2033

- Figure 19: Asia Pacific Modular Data Center Market Revenue Share (%), by Solution and Services 2025 & 2033

- Figure 20: Asia Pacific Modular Data Center Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Modular Data Center Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Modular Data Center Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Modular Data Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Modular Data Center Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Modular Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Modular Data Center Market Revenue (Million), by Solution and Services 2025 & 2033

- Figure 27: Latin America Modular Data Center Market Revenue Share (%), by Solution and Services 2025 & 2033

- Figure 28: Latin America Modular Data Center Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Modular Data Center Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Modular Data Center Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Latin America Modular Data Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Modular Data Center Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Modular Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Modular Data Center Market Revenue (Million), by Solution and Services 2025 & 2033

- Figure 35: Middle East and Africa Modular Data Center Market Revenue Share (%), by Solution and Services 2025 & 2033

- Figure 36: Middle East and Africa Modular Data Center Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Modular Data Center Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Modular Data Center Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East and Africa Modular Data Center Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Modular Data Center Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Modular Data Center Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2020 & 2033

- Table 2: Global Modular Data Center Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Modular Data Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Modular Data Center Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2020 & 2033

- Table 6: Global Modular Data Center Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Modular Data Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Modular Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2020 & 2033

- Table 10: Global Modular Data Center Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Modular Data Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Modular Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2020 & 2033

- Table 14: Global Modular Data Center Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Modular Data Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Modular Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2020 & 2033

- Table 18: Global Modular Data Center Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Modular Data Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Modular Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Modular Data Center Market Revenue Million Forecast, by Solution and Services 2020 & 2033

- Table 22: Global Modular Data Center Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Modular Data Center Market Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global Modular Data Center Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Modular Data Center Market?

The projected CAGR is approximately 18.78%.

2. Which companies are prominent players in the Modular Data Center Market?

Key companies in the market include IBM Corporation, Colt Group SA, Dell EMC, Vertiv Co, Baselayer Technology LLC, Cannon Technologies Ltd, Schneider Electric SE, Rittal Gmbh & Co KG, Huawei Technologies Co Ltd, HPE Company, Bladeroom Group Ltd *List Not Exhaustive, Instant Data Centers LLC.

3. What are the main segments of the Modular Data Center Market?

The market segments include Solution and Services, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Mobility and Scalability of Modular Data Centers; Disaster Recovery Advantages.

6. What are the notable trends driving market growth?

IT Sector to Hold Significant Market Growth.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Professionals and Outdated Cybersecurity Technology.

8. Can you provide examples of recent developments in the market?

June 2023: Hewlett Packard Enterprise announced an expanded partnership with Equinix to extend the HPE GreenLake private cloud portfolio at Equinix International Business Exchange (IBX) data centers. Hewlett Packard Enterprise will pre-provision HPE GreenLake for Private Cloud Enterprise and HPE GreenLake for Private Cloud Business Edition at strategic Equinix data centers around the world, giving customers rapid access to a broad range of private cloud offerings for more incredible speed, agility, flexibility, and choice in their hybrid cloud strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Modular Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Modular Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Modular Data Center Market?

To stay informed about further developments, trends, and reports in the Modular Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence