Key Insights

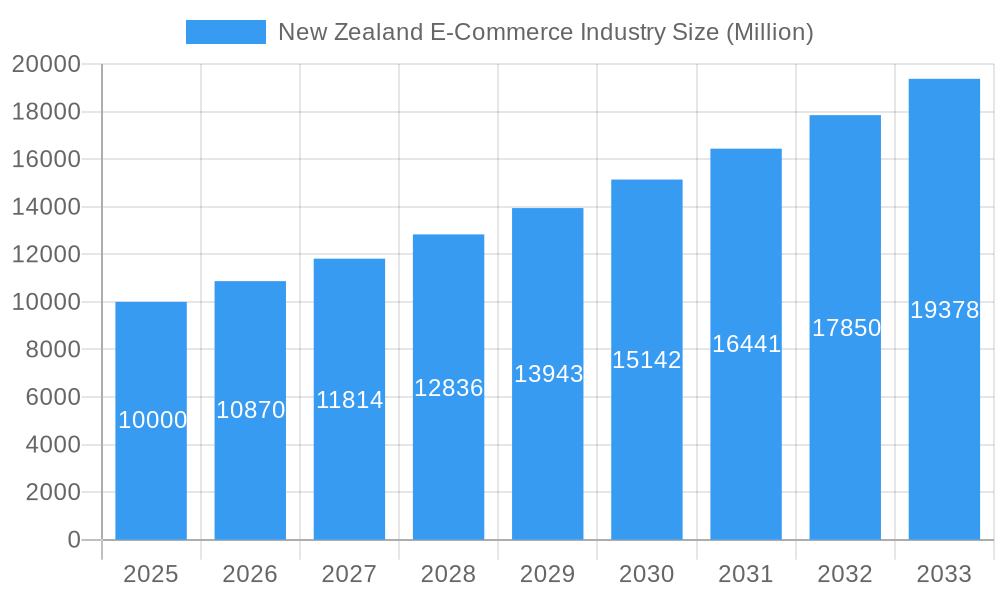

The New Zealand e-commerce market, valued at $6.8 billion in 2025, is projected for significant growth through 2033. This expansion is propelled by increasing internet and smartphone penetration, growing consumer preference for convenience, and the widespread adoption of digital payment systems. Key growth drivers include competitive pricing from major retailers, innovative e-commerce platforms, and enhanced delivery services. However, market restraints such as geographical limitations and logistical challenges persist, alongside ongoing concerns regarding online security and data privacy. The market is segmented by application, including electronics, apparel, groceries, and more, enabling detailed analysis of niche growth trends. The competitive landscape is dynamic, featuring both multinational corporations and local e-commerce leaders.

New Zealand E-Commerce Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained positive growth, fueled by expanding internet access, robust e-commerce infrastructure, and evolving consumer behavior. Government initiatives supporting digital commerce, advancements in logistics, and the preferences of a digitally adept consumer base will influence this trajectory. While logistical and cybersecurity challenges will continue, market participants are expected to invest in mitigation strategies, supporting a positive outlook for the New Zealand e-commerce sector. Continuous analysis of specific market segments and consumer trends is vital for identifying optimization opportunities and future market leadership. The compound annual growth rate (CAGR) for the market is 0.6%.

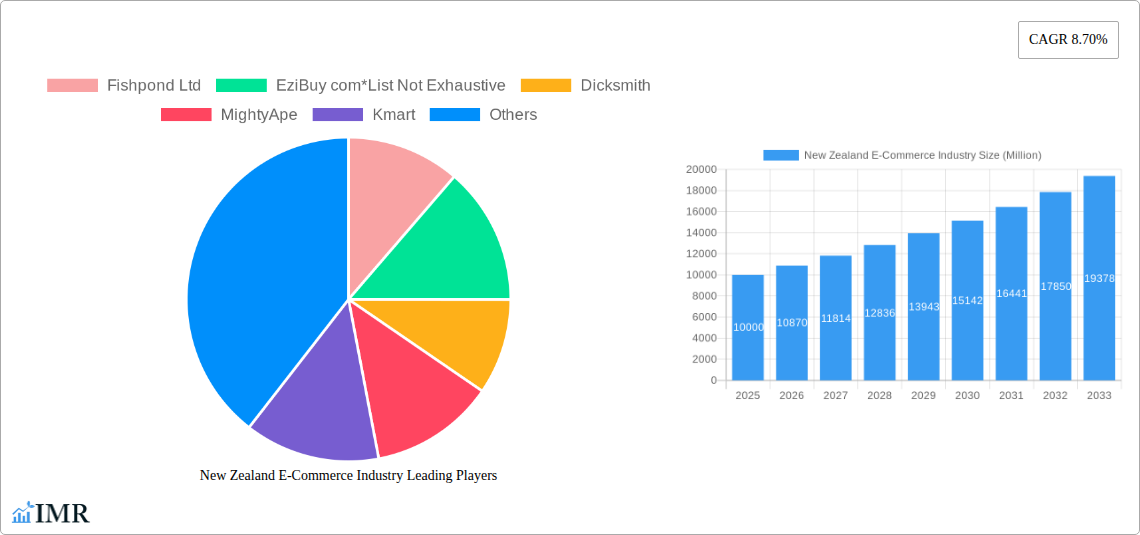

New Zealand E-Commerce Industry Company Market Share

New Zealand E-Commerce Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the New Zealand e-commerce market, offering invaluable insights for businesses, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth trends, key players, and emerging opportunities within this rapidly evolving sector. We delve into specific segments like online grocery and fashion retail, highlighting key players such as The Warehouse NZ and Trade Me, providing a complete picture of New Zealand's digital marketplace.

Keywords: New Zealand e-commerce, online retail New Zealand, New Zealand online shopping, e-commerce market New Zealand, New Zealand digital market, online grocery New Zealand, fashion e-commerce New Zealand, Trade Me, The Warehouse NZ, Fishpond, EziBuy, Mighty Ape, Kmart NZ, Countdown NZ, market analysis New Zealand, e-commerce trends New Zealand, New Zealand e-commerce growth, NZ e-commerce forecast

New Zealand E-Commerce Industry Market Dynamics & Structure

The New Zealand e-commerce market exhibits a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with several large players holding significant shares alongside numerous smaller businesses. Technological innovation, driven by advancements in mobile commerce, payment gateways, and logistics, is a key driver. The regulatory framework, including consumer protection laws and data privacy regulations, significantly impacts market operations. Competitive product substitutes, particularly physical retail, pose a challenge, while the growth of online marketplaces offers opportunities. End-user demographics show a high penetration rate among younger generations, with a growing adoption among older demographics. M&A activity has been moderate, with a few significant deals in recent years.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Strong influence from mobile commerce and improved logistics.

- Regulatory Framework: Consumer protection laws and data privacy regulations are prominent.

- Competitive Substitutes: Physical retail remains a significant competitor.

- End-User Demographics: High penetration among younger generations, expanding to older demographics.

- M&A Activity: Moderate activity, with approximately xx deals annually in the historical period.

New Zealand E-Commerce Industry Growth Trends & Insights

The New Zealand e-commerce market has experienced significant growth over the historical period (2019-2024), fueled by increasing internet penetration, rising smartphone usage, and a shift in consumer shopping preferences towards convenience. The market size, valued at xx Million in 2024, is projected to reach xx Million in 2025 and xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by technological advancements like improved mobile payment systems and same-day delivery options, as well as shifting consumer behavior towards online shopping for convenience and wider product selection. Adoption rates are high among younger demographics and steadily increasing among older age groups. Technological disruptions, such as the rise of social commerce and the integration of artificial intelligence, are reshaping the market landscape. Increased competition from both domestic and international players is expected in the coming years further driving adoption and innovation.

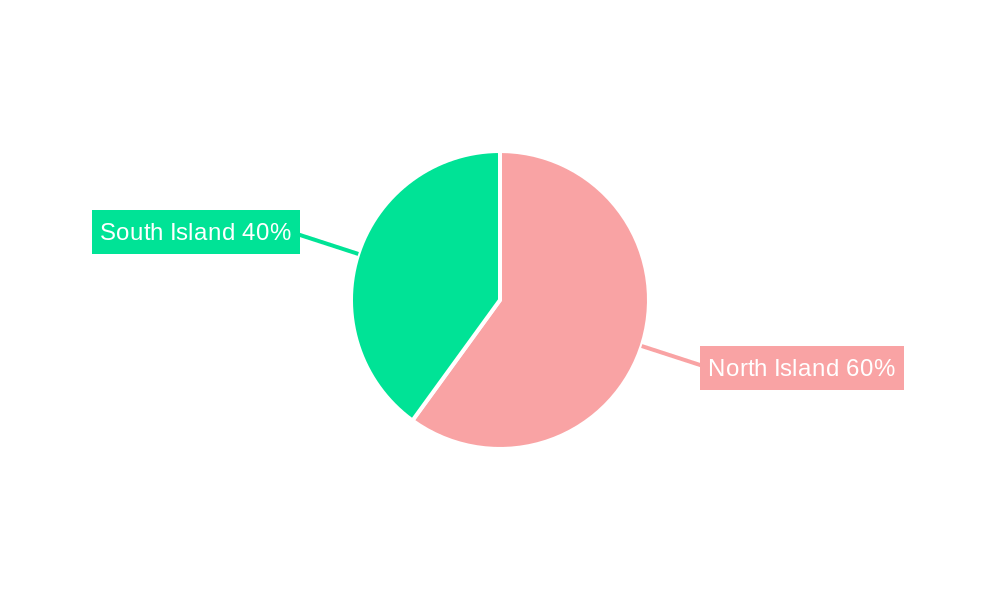

Dominant Regions, Countries, or Segments in New Zealand E-Commerce Industry

The Auckland region leads the New Zealand e-commerce market, driven by high population density, strong internet infrastructure, and a higher concentration of businesses. Other major urban areas like Wellington and Christchurch also contribute significantly. Within market segmentation by application, online retail (fashion, electronics, home goods) and online grocery are the dominant segments. The strong growth of online grocery is fueled by increasing convenience and the expansion of online delivery services. Economic policies promoting digitalization and investments in infrastructure further contribute to the dominance of these regions and segments.

- Key Drivers:

- High population density in Auckland and other major cities.

- Advanced internet infrastructure and logistics networks.

- Growing adoption of online shopping across demographics.

- Government initiatives to support e-commerce growth.

- Dominance Factors:

- Market share: Auckland holds approximately xx% of the total market.

- Growth potential: Online grocery and fashion e-commerce are expected to maintain high growth rates.

New Zealand E-Commerce Industry Product Landscape

The New Zealand e-commerce landscape is characterized by a diverse range of products, spanning from everyday essentials to specialized goods. Product innovation focuses on personalized shopping experiences, enhanced product discovery tools, and seamless integration across multiple channels. Performance metrics such as conversion rates, average order value, and customer retention are key indicators of success. Unique selling propositions often revolve around localized delivery, personalized customer service, and innovative payment options. Advancements in mobile technologies, particularly in mobile-first shopping experiences and augmented reality features, are transforming the product landscape.

Key Drivers, Barriers & Challenges in New Zealand E-Commerce Industry

Key Drivers:

- Increasing internet and smartphone penetration.

- Growing consumer preference for online shopping convenience.

- Government initiatives promoting digital economy growth.

- Technological advancements such as improved logistics and payment systems.

Key Challenges:

- High delivery costs, particularly in rural areas.

- Concerns regarding data security and consumer privacy.

- Intense competition from both domestic and international players.

- Limited access to reliable internet in some regions, impacting rural e-commerce development. This results in an estimated xx Million loss in potential revenue annually.

Emerging Opportunities in New Zealand E-Commerce Industry

Untapped market segments, such as specialized niche products or services catering to specific demographics, present significant opportunities. Innovative applications, such as personalized recommendations powered by AI, provide enhanced customer experiences. The evolving consumer preference for sustainable and ethical products offers new avenues for growth. Expansion into cross-border e-commerce, particularly targeting the Australian market, could further unlock growth potential.

Growth Accelerators in the New Zealand E-Commerce Industry

Technological breakthroughs in areas such as Artificial Intelligence (AI)-powered personalized shopping experiences and improved last-mile delivery solutions will significantly accelerate growth. Strategic partnerships between e-commerce businesses and logistics providers can optimize delivery networks. Market expansion strategies focused on reaching new customer segments and diversifying product offerings will further fuel expansion.

Key Players Shaping the New Zealand E-Commerce Industry Market

- Fishpond Ltd

- EziBuy

- Dicksmith

- MightyApe

- Kmart

- Countdown co nz

- Grabone

- Trade Me

- Briscoe

- The Warehouse NZ

- Priceme

- Farmers

Notable Milestones in New Zealand E-Commerce Industry Sector

- March 2022: MyDeal announces plans to expand into the New Zealand market.

- April 2022: Launch of Andoo, an e-commerce-only retailer offering next-day delivery in Auckland and Hamilton.

In-Depth New Zealand E-Commerce Industry Market Outlook

The New Zealand e-commerce market is poised for sustained growth driven by technological advancements, changing consumer preferences, and government support. Strategic opportunities exist in tapping into underserved market segments, innovating delivery solutions, and leveraging data analytics to personalize customer experiences. The market's future success hinges on addressing challenges related to infrastructure, logistics, and cybersecurity. The forecast predicts robust growth, with significant potential for both established and emerging players to capitalize on the evolving landscape.

New Zealand E-Commerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market Size (GMV) for the Period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty and Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion and Apparel

- 1.2.4. Food and Beverages

- 1.2.5. Furniture and Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market Size (GMV) for the Period of 2017-2027

-

3. Application

- 3.1. Beauty and Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion and Apparel

- 3.4. Food and Beverages

- 3.5. Furniture and Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty and Personal Care

- 5. Consumer Electronics

- 6. Fashion and Apparel

- 7. Food and Beverages

- 8. Furniture and Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market Size for the Period of 2017-2027

New Zealand E-Commerce Industry Segmentation By Geography

- 1. New Zealand

New Zealand E-Commerce Industry Regional Market Share

Geographic Coverage of New Zealand E-Commerce Industry

New Zealand E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Online Shoppers is Expected to Boost the Market; Rising Adoption of Buy Now Pay Later Services

- 3.3. Market Restrains

- 3.3.1. ; Technology is Expensive to Integrate and Comparatively Slower Charging

- 3.4. Market Trends

- 3.4.1. Increasing Online Shoppers is Expected to Boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market Size (GMV) for the Period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty and Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion and Apparel

- 5.1.2.4. Food and Beverages

- 5.1.2.5. Furniture and Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market Size (GMV) for the Period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty and Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion and Apparel

- 5.3.4. Food and Beverages

- 5.3.5. Furniture and Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty and Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion and Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food and Beverages

- 5.8. Market Analysis, Insights and Forecast - by Furniture and Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market Size for the Period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fishpond Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EziBuy com*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dicksmith

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MightyApe

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kmart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Countdown co nz

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grabone

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Me

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Briscoe

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Warehouse NZ

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Priceme

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Farmers

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Fishpond Ltd

List of Figures

- Figure 1: New Zealand E-Commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: New Zealand E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: New Zealand E-Commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 2: New Zealand E-Commerce Industry Revenue billion Forecast, by Market Size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 3: New Zealand E-Commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: New Zealand E-Commerce Industry Revenue billion Forecast, by Beauty and Personal Care 2020 & 2033

- Table 5: New Zealand E-Commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 6: New Zealand E-Commerce Industry Revenue billion Forecast, by Fashion and Apparel 2020 & 2033

- Table 7: New Zealand E-Commerce Industry Revenue billion Forecast, by Food and Beverages 2020 & 2033

- Table 8: New Zealand E-Commerce Industry Revenue billion Forecast, by Furniture and Home 2020 & 2033

- Table 9: New Zealand E-Commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: New Zealand E-Commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 11: New Zealand E-Commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: New Zealand E-Commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 13: New Zealand E-Commerce Industry Revenue billion Forecast, by Market Size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 14: New Zealand E-Commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: New Zealand E-Commerce Industry Revenue billion Forecast, by Beauty and Personal Care 2020 & 2033

- Table 16: New Zealand E-Commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 17: New Zealand E-Commerce Industry Revenue billion Forecast, by Fashion and Apparel 2020 & 2033

- Table 18: New Zealand E-Commerce Industry Revenue billion Forecast, by Food and Beverages 2020 & 2033

- Table 19: New Zealand E-Commerce Industry Revenue billion Forecast, by Furniture and Home 2020 & 2033

- Table 20: New Zealand E-Commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: New Zealand E-Commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 22: New Zealand E-Commerce Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand E-Commerce Industry?

The projected CAGR is approximately 0.6%.

2. Which companies are prominent players in the New Zealand E-Commerce Industry?

Key companies in the market include Fishpond Ltd, EziBuy com*List Not Exhaustive, Dicksmith, MightyApe, Kmart, Countdown co nz, Grabone, Trade Me, Briscoe, The Warehouse NZ, Priceme, Farmers.

3. What are the main segments of the New Zealand E-Commerce Industry?

The market segments include B2C E-commerce, Market Size (GMV) for the Period of 2017-2027, Application, Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverages, Furniture and Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Online Shoppers is Expected to Boost the Market; Rising Adoption of Buy Now Pay Later Services.

6. What are the notable trends driving market growth?

Increasing Online Shoppers is Expected to Boost the Market.

7. Are there any restraints impacting market growth?

; Technology is Expensive to Integrate and Comparatively Slower Charging.

8. Can you provide examples of recent developments in the market?

March 2022 - Australian e-commerce company MyDeal announced its plans to expand into New Zealand during the first half of the calendar year. After that, the company is eyeing moving further abroad, entering the UK and the US markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand E-Commerce Industry?

To stay informed about further developments, trends, and reports in the New Zealand E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence