Key Insights

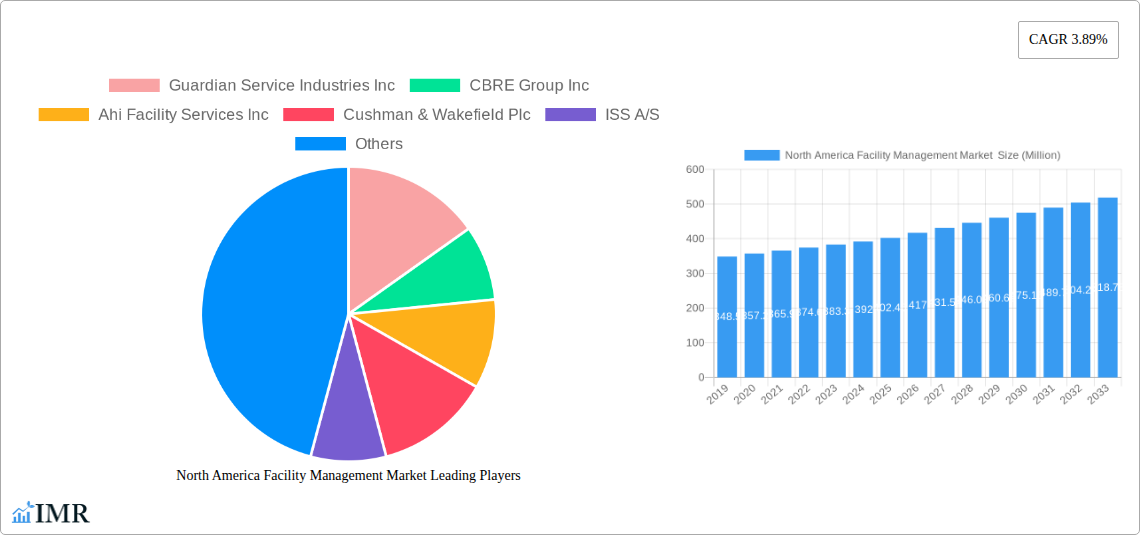

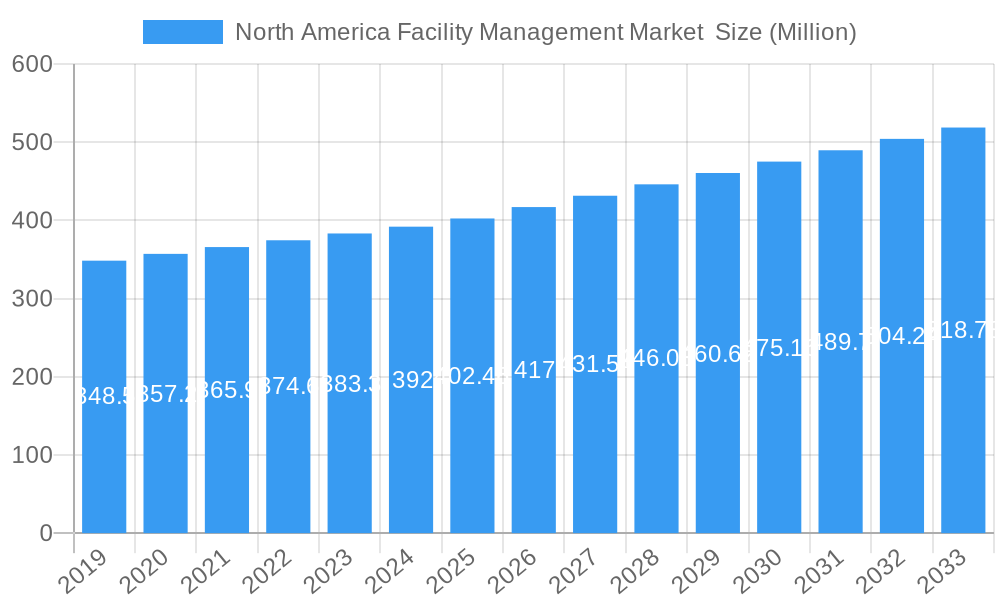

The North America Facility Management Market is poised for steady growth, projected to reach a significant valuation of approximately USD 402.46 million by 2025. This expansion is underpinned by a projected Compound Annual Growth Rate (CAGR) of 3.89% throughout the forecast period of 2025-2033. The market's robust trajectory is propelled by a confluence of critical drivers. Increasing demand for operational efficiency and cost optimization across commercial and industrial sectors is a primary catalyst. Businesses are recognizing the strategic importance of outsourcing non-core functions to specialized facility management providers to streamline operations, enhance productivity, and focus on their core competencies. Furthermore, the growing emphasis on sustainability and energy efficiency in buildings is driving the adoption of advanced facility management solutions that promote greener practices and reduced environmental impact. Technological advancements, including the integration of IoT, AI, and advanced analytics, are also revolutionizing how facilities are managed, leading to predictive maintenance, optimized resource allocation, and enhanced occupant comfort and safety.

North America Facility Management Market Market Size (In Million)

The market landscape is characterized by a dynamic interplay of various segments. The preference for outsourced facility management, encompassing single, bundled, and integrated service models, is steadily increasing as organizations seek comprehensive and cost-effective solutions. Within offerings, both hard facility management (technical aspects like building maintenance, HVAC, and security) and soft facility management (non-technical aspects like cleaning, catering, and reception services) are experiencing consistent demand. Key end-user verticals such as commercial (office buildings, retail spaces), institutional (healthcare, education), and public/infrastructure sectors are significant contributors to market expansion. The North American region, encompassing the United States, Canada, and Mexico, represents a mature yet continuously evolving market for facility management services, driven by established economic activity and a proactive approach to operational excellence. Leading companies within the industry are actively investing in innovative technologies and strategic partnerships to cater to the diverse and evolving needs of their clientele.

North America Facility Management Market Company Market Share

North America Facility Management Market: Comprehensive Market Analysis and Growth Outlook (2019-2033)

This in-depth report offers a definitive analysis of the North America Facility Management Market, providing critical insights for stakeholders navigating this dynamic sector. Spanning a study period from 2019 to 2033, with a base year of 2025, the report delves into market dynamics, growth trends, regional dominance, product innovation, key drivers and challenges, emerging opportunities, and the competitive landscape. With a focus on high-traffic keywords such as "facility management," "outsourced facility management," "hard FM," "soft FM," "commercial facility management," and "industrial facility management," this report is optimized for maximum search engine visibility and industry professional engagement. We present all values in million units for clarity and actionable insights.

North America Facility Management Market Market Dynamics & Structure

The North America facility management market is characterized by a moderate to high level of concentration, with several large players dominating the landscape. Technological innovation is a significant driver, with advancements in IoT, AI, and data analytics transforming how facilities are managed. For instance, the integration of predictive maintenance powered by AI is reducing downtime and operational costs, a trend actively pursued by companies like CBRE Group Inc. and Jones Lang Lasalle IP Inc. Regulatory frameworks, particularly those pertaining to sustainability, safety, and energy efficiency, are increasingly shaping market practices. Building codes and environmental standards often mandate specific facility management practices, influencing the adoption of green building technologies and energy-saving solutions.

- Market Concentration: Dominated by a mix of global giants and specialized regional providers.

- Technological Innovation Drivers:

- IoT-enabled smart buildings for real-time monitoring and control.

- AI and machine learning for predictive maintenance and resource optimization.

- Integrated Workplace Management Systems (IWMS) for streamlined operations.

- Regulatory Frameworks:

- Environmental protection agencies (e.g., EPA) influencing sustainable practices.

- Occupational Safety and Health Administration (OSHA) standards impacting safety protocols.

- Local building codes and energy efficiency mandates.

- Competitive Product Substitutes: While direct substitutes for comprehensive facility management are limited, individual services like cleaning, security, or maintenance can be sourced independently, posing a competitive pressure on bundled offerings.

- End-User Demographics: A growing demand for flexible workspaces, smart building technologies, and a focus on employee well-being across commercial and institutional sectors.

- M&A Trends: Active consolidation is observed as larger players acquire specialized firms to broaden service portfolios and market reach. Recent deal volumes suggest a strategic focus on acquiring capabilities in digital facility management and sustainability services. For example, a surge in acquisitions of proptech companies by established facility management providers is evident.

North America Facility Management Market Growth Trends & Insights

The North America facility management market is poised for robust expansion, driven by increasing complexity in building operations, a growing emphasis on cost optimization, and the accelerating adoption of advanced technologies. The market size evolution is projected to witness a healthy Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, reaching an estimated value of $350,000 million by 2033. This growth is underpinned by a significant shift towards outsourced facility management, as organizations seek to leverage specialized expertise and focus on their core competencies. The adoption rate of integrated FM solutions, which bundle a wide range of services, is particularly high, signifying a trend towards comprehensive service providers.

Technological disruptions are fundamentally reshaping the industry. The integration of Internet of Things (IoT) sensors in buildings is enabling real-time data collection on energy consumption, space utilization, and equipment performance. This data, when analyzed through AI and machine learning algorithms, allows for predictive maintenance, proactive issue resolution, and optimized resource allocation. For instance, smart lighting systems and intelligent HVAC controls are becoming standard, contributing to significant energy savings and reduced operational expenditures. Furthermore, the rise of the "smart building" concept, where integrated systems create a more efficient and user-friendly environment, is a major growth catalyst.

Consumer behavior shifts also play a crucial role. There's a growing demand for healthier and more sustainable work environments, pushing facility managers to adopt green cleaning practices, implement energy-efficient technologies, and manage waste effectively. The focus on employee well-being and productivity is leading to an increased demand for services that enhance the occupant experience, such as advanced climate control, improved air quality monitoring, and personalized workspace solutions. The hybrid work model, while impacting office space utilization, is also driving a need for more agile and responsive facility management to cater to fluctuating occupancy levels and diverse user needs. The "as-a-service" model is gaining traction, with clients preferring flexible, outcome-based contracts over traditional fixed-term agreements. This shift emphasizes the value of measurable outcomes and operational efficiency. The increasing complexity of managing modern buildings, with their integrated technological systems and sustainability requirements, further solidifies the need for professional facility management expertise.

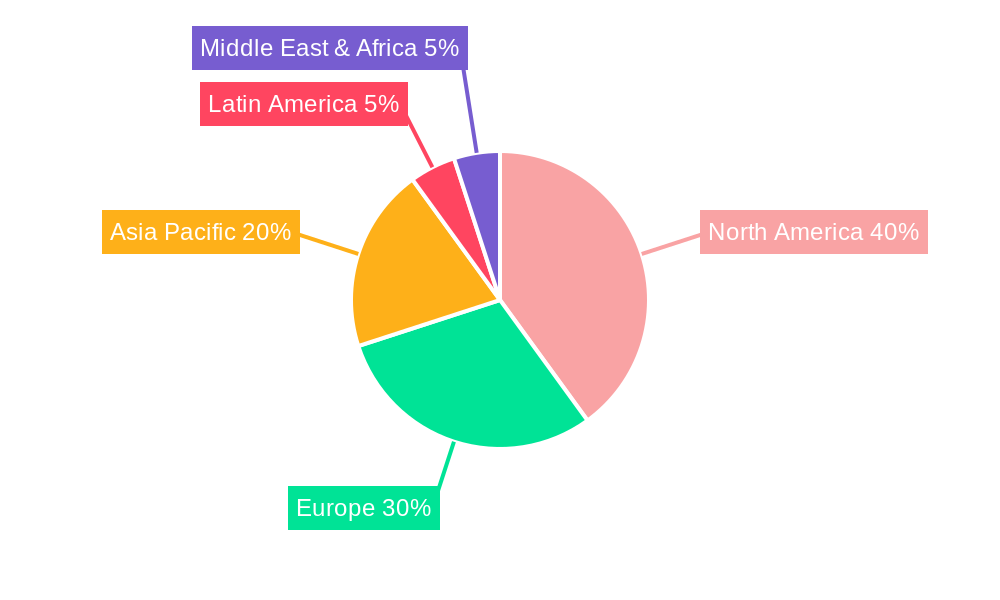

Dominant Regions, Countries, or Segments in North America Facility Management Market

The North America facility management market is segmented across various dimensions, each exhibiting distinct growth dynamics and regional strengths. Among the Type of facility management, Outsourced Facility Management is the dominant force and projected to continue its upward trajectory. Within outsourced FM, Integrated FM services are experiencing the most substantial growth, driven by organizations seeking a single point of accountability for all their facility needs. This model offers economies of scale, enhanced efficiency, and a streamlined approach to managing complex building operations. The Commercial end-user vertical stands out as the primary driver of market growth, owing to the sheer volume of office buildings, retail spaces, and corporate campuses requiring sophisticated facility management.

Dominant Segment by Type: Outsourced Facility Management, particularly Integrated FM.

- Key Drivers: Cost optimization, access to specialized expertise, focus on core business, and demand for comprehensive service providers.

- Market Share Contribution: Outsourced FM is estimated to hold over 60% of the total market share, with Integrated FM showing a CAGR of around 7.5% within this segment.

- Growth Potential: High, as businesses increasingly delegate non-core functions.

Dominant Offering Type: Soft FM services are currently leading in terms of market penetration, encompassing areas like cleaning, security, catering, and landscaping. However, Hard FM services (e.g., HVAC maintenance, electrical systems, plumbing) are experiencing significant growth due to the increasing complexity of building infrastructure and the demand for proactive maintenance to ensure operational continuity and energy efficiency. The integration of IoT in Hard FM is revolutionizing maintenance practices.

Dominant End-User Vertical: Commercial sector.

- Key Drivers: Extensive real estate portfolio, increasing adoption of smart building technologies, demand for enhanced employee experience, and stringent safety and compliance regulations in corporate environments.

- Market Share Contribution: Commercial properties account for an estimated 40% of the total facility management market.

- Growth Potential: Strong, fueled by new construction, retrofitting projects, and evolving workplace strategies.

Country-Specific Dominance: Within North America, the United States represents the largest and most influential market due to its extensive commercial and industrial infrastructure, higher adoption rates of advanced technologies, and a well-established outsourced service provider ecosystem. Canada follows with steady growth, driven by similar trends in its major urban centers.

North America Facility Management Market Product Landscape

The product landscape in the North America facility management market is characterized by the integration of cutting-edge technologies aimed at enhancing operational efficiency, sustainability, and occupant experience. Key innovations include advanced Building Management Systems (BMS) and Integrated Workplace Management Systems (IWMS) that offer real-time data analytics for energy consumption, space utilization, and predictive maintenance. Software solutions leveraging AI and machine learning are now capable of forecasting equipment failures, optimizing HVAC systems for energy savings, and automating routine tasks. Furthermore, the application of IoT sensors for environmental monitoring (air quality, temperature) and security surveillance is becoming increasingly prevalent. These technological advancements translate into tangible performance metrics such as reduced operational costs, improved energy efficiency by up to 15%, and enhanced occupant satisfaction scores.

Key Drivers, Barriers & Challenges in North America Facility Management Market

Key Drivers: The North America facility management market is propelled by several factors. Increasing operational costs for businesses are driving the adoption of outsourced services to optimize expenditure. The growing demand for sustainability and energy efficiency is a significant catalyst, with regulations and corporate social responsibility initiatives pushing for greener building practices and reduced carbon footprints. Technological advancements, particularly in AI, IoT, and data analytics, are enabling smarter building operations and predictive maintenance, leading to greater efficiency and cost savings. Furthermore, a focus on enhancing employee productivity and well-being is driving demand for comfortable and safe working environments, which facility management services directly support.

Barriers & Challenges: Despite the growth prospects, the market faces several hurdles. High initial investment costs for implementing advanced technologies can be a barrier for smaller businesses. Finding and retaining skilled labor remains a persistent challenge, particularly for specialized technical roles. Regulatory complexities and compliance requirements across different jurisdictions can create administrative burdens. Cybersecurity risks associated with connected building systems are a growing concern. Additionally, the fragmented nature of the market with numerous small and medium-sized enterprises can lead to price competition and consolidation pressures, impacting profit margins. The resistance to change from traditional operational models can also slow down the adoption of new technologies and service approaches.

Emerging Opportunities in North America Facility Management Market

Emerging opportunities within the North America facility management market are diverse and fueled by evolving business needs and technological progress. The growing emphasis on sustainability and ESG (Environmental, Social, and Governance) compliance presents a significant opportunity for providers offering green building solutions, waste management optimization, and energy retrofitting services. The expansion of flexible and hybrid work models is creating demand for agile facility management solutions that can adapt to fluctuating occupancy levels and varied workspace configurations, including smart office technology integration. Furthermore, the increasing adoption of proptech (property technology) is opening doors for data-driven facility management, predictive analytics, and the development of smart, responsive buildings. Opportunities also lie in providing specialized services for the rapidly growing industrial automation and logistics sectors, as well as catering to the increasing demands of healthcare and educational institutions for safe, hygienic, and technologically advanced facilities. The integration of AI-powered chatbots and virtual assistants for occupant services also represents an untapped area for enhanced customer engagement.

Growth Accelerators in the North America Facility Management Market Industry

Long-term growth in the North America facility management market will be significantly accelerated by several key catalysts. Continuous technological innovation, especially in the realm of AI-driven predictive maintenance, IoT integration for real-time monitoring, and the development of sophisticated IWMS platforms, will be crucial. Strategic partnerships and collaborations between facility management providers, technology companies, and real estate developers will foster integrated solutions and expand market reach. Government initiatives and incentives promoting energy efficiency, smart city development, and green building standards will further stimulate demand. Moreover, market expansion strategies focused on underserved segments and specialized services, such as retrofitting older buildings with smart technologies and providing facility management for the burgeoning data center industry, will drive sustained growth. The increasing awareness of the link between effective facility management and overall business performance will also act as a powerful growth accelerator.

Key Players Shaping the North America Facility Management Market Market

- Guardian Service Industries Inc.

- CBRE Group Inc.

- Ahi Facility Services Inc.

- Cushman & Wakefield Plc

- ISS A/S

- Smi Facility Services

- Emeric Facility Services Llc

- Shine Facility Services

- Sodexo Inc.

- Jones Lang Lasalle Ip Inc.

Notable Milestones in North America Facility Management Market Sector

- 2020: Increased adoption of remote monitoring and digital tools due to the pandemic, accelerating the shift towards smart facility management.

- 2021: Growing emphasis on occupant health and safety, leading to enhanced cleaning protocols and air quality management services.

- 2022: Significant investment in proptech solutions aimed at optimizing building performance and occupant experience.

- 2023: Rise in M&A activities as larger players seek to expand their service portfolios and technological capabilities.

- 2024: Growing integration of AI and IoT for predictive maintenance and energy efficiency solutions across commercial and industrial sectors.

In-Depth North America Facility Management Market Market Outlook

The outlook for the North America facility management market remains exceptionally positive, fueled by a confluence of robust growth accelerators. The ongoing digital transformation, characterized by the pervasive integration of AI, IoT, and advanced data analytics, will continue to redefine operational paradigms. Strategic partnerships and a conscious push towards sustainable practices will solidify the market's commitment to ESG principles, creating new avenues for specialized service providers. Furthermore, the continuous evolution of workplace strategies and the demand for resilient, adaptable, and occupant-centric facilities will ensure a sustained need for comprehensive and innovative facility management solutions. The market is poised for further consolidation and technological advancement, promising significant value creation and enhanced operational efficiencies for businesses across the region.

North America Facility Management Market Segmentation

-

1. Type

- 1.1. In-house Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

1.3. By Offering Type

- 1.3.1. Hard FM

- 1.3.2. Soft FM

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Institutional

- 2.3. Public/Infrastructure

- 2.4. Industrial

- 2.5. Other End-user Verticals

North America Facility Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Facility Management Market Regional Market Share

Geographic Coverage of North America Facility Management Market

North America Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend Toward Commoditization of Facility Management; Growing Investments in Commercial Properties

- 3.3. Market Restrains

- 3.3.1. Lack of Managerial Awareness

- 3.4. Market Trends

- 3.4.1. Hard FM Services are Expected to Hold Significant Share the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-house Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.1.3. By Offering Type

- 5.1.3.1. Hard FM

- 5.1.3.2. Soft FM

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Institutional

- 5.2.3. Public/Infrastructure

- 5.2.4. Industrial

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Guardian Service Industries Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CBRE Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ahi Facility Services Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cushman & Wakefield Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ISS A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Smi Facility Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emeric Facility Services Llc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shine Facility Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sodexo Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jones Lang Lasalle Ip Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Guardian Service Industries Inc

List of Figures

- Figure 1: North America Facility Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: North America Facility Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Facility Management Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: North America Facility Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Facility Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America Facility Management Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: North America Facility Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Facility Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Facility Management Market ?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the North America Facility Management Market ?

Key companies in the market include Guardian Service Industries Inc, CBRE Group Inc, Ahi Facility Services Inc, Cushman & Wakefield Plc, ISS A/S, Smi Facility Services, Emeric Facility Services Llc, Shine Facility Services, Sodexo Inc, Jones Lang Lasalle Ip Inc.

3. What are the main segments of the North America Facility Management Market ?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 402.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend Toward Commoditization of Facility Management; Growing Investments in Commercial Properties.

6. What are the notable trends driving market growth?

Hard FM Services are Expected to Hold Significant Share the Market.

7. Are there any restraints impacting market growth?

Lack of Managerial Awareness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Facility Management Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Facility Management Market ?

To stay informed about further developments, trends, and reports in the North America Facility Management Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence