Key Insights

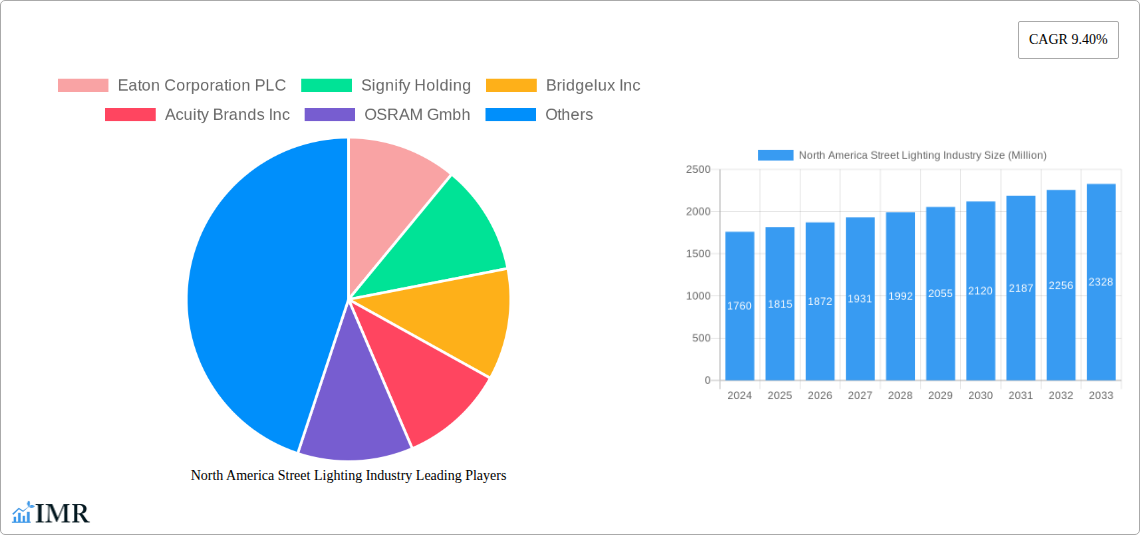

The North America Street Lighting market is projected for robust expansion, driven by an increasing focus on energy efficiency, public safety, and the integration of smart city technologies. With a current estimated market size of USD 1.76 billion in 2024, the industry is on a trajectory to experience significant growth. This expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 3.2%, signaling sustained and steady advancement over the forecast period. Key drivers for this growth include government initiatives promoting LED adoption for reduced energy consumption and operational costs, alongside a growing demand for intelligent lighting solutions that offer advanced features like remote monitoring, dimming capabilities, and integration with other smart city infrastructure. The transition from conventional lighting to advanced LED and smart lighting systems is a prominent trend, reflecting a broader shift towards sustainable urban development and enhanced public services.

North America Street Lighting Industry Market Size (In Billion)

The market's growth is further propelled by investments in upgrading aging street lighting infrastructure across the United States, Canada, and Mexico. While the initial investment in smart lighting technology can be a restraint, the long-term benefits of energy savings, reduced maintenance, and improved light quality are increasingly outweighing these concerns. The market is segmented into various lighting types, with Smart Lighting poised to capture a significant share due to its versatility and data-driven capabilities. LEDs dominate the light source segment due to their superior energy efficiency and lifespan compared to fluorescent and HID lamps. The offerings are diverse, encompassing hardware, sophisticated software for control and management, and comprehensive services for installation and maintenance, catering to the evolving needs of municipalities and urban planners.

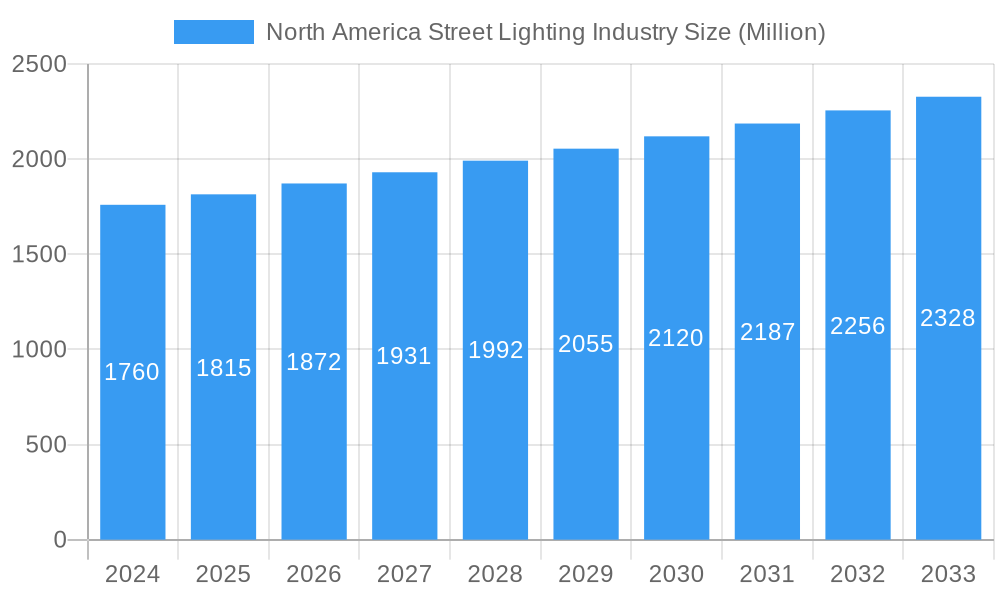

North America Street Lighting Industry Company Market Share

North America Street Lighting Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Street Lighting Industry, a critical infrastructure sector undergoing significant transformation. With a focus on market dynamics, growth trends, dominant segments, and future opportunities, this report is an essential resource for industry professionals, investors, and policymakers. Our analysis covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. We have integrated high-traffic keywords to ensure maximum search engine visibility and deliver actionable insights.

North America Street Lighting Industry Market Dynamics & Structure

The North America Street Lighting industry is characterized by a moderate to high market concentration, with a few key players dominating the landscape. Technological innovation, particularly in smart lighting and LED technology, is a primary driver of market evolution, enhancing energy efficiency and offering advanced functionalities. Regulatory frameworks, including energy efficiency mandates and smart city initiatives, are shaping market adoption and investment. Competitive product substitutes, such as improved conventional lighting technologies and alternative illumination solutions, pose a constant challenge, albeit with smart and LED solutions offering superior performance. End-user demographics, ranging from municipal governments to utility companies, influence demand patterns and product preferences. Mergers and acquisitions (M&A) trends are active, with $1.5 billion in reported deal volumes in the historical period, indicating consolidation and strategic expansion. Innovation barriers, such as the high initial cost of smart city infrastructure and the need for skilled labor for implementation and maintenance, require careful consideration.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized regional players.

- Technological Innovation: Driven by advancements in LED efficiency, sensor integration, and IoT connectivity for smart streetlights.

- Regulatory Frameworks: Mandates for energy efficiency, smart city adoption, and public safety standards influence product development and deployment.

- Competitive Landscape: Intense competition from established players and emerging innovators, with a focus on value-added solutions.

- End-User Demographics: Municipalities, utility companies, and transportation authorities are key decision-makers, prioritizing cost-effectiveness, sustainability, and smart functionalities.

- M&A Trends: Strategic acquisitions to gain market share, acquire new technologies, and expand product portfolios.

- Innovation Barriers: High upfront investment, interoperability challenges, and data security concerns for smart lighting systems.

North America Street Lighting Industry Growth Trends & Insights

The North America Street Lighting market is poised for robust growth, projected to reach an estimated $15.8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period (2025-2033). This expansion is fueled by increasing urbanization, a growing emphasis on energy efficiency, and the widespread adoption of smart city technologies. The transition from conventional lighting to smart lighting solutions is a significant trend, driven by the desire for enhanced operational efficiency, reduced energy consumption, and improved public safety. Market penetration of smart streetlights is projected to accelerate, reaching 45% by 2033. Technological disruptions, such as the integration of Artificial Intelligence (AI) for adaptive lighting and predictive maintenance, are further enhancing the appeal of modern street lighting systems. Consumer behavior shifts are also playing a role, with municipalities and citizens increasingly valuing sustainable and technologically advanced infrastructure. The market size evolved from an estimated $10.2 billion in 2019 to $13.5 billion in 2024, demonstrating consistent upward momentum.

The increasing adoption of LEDs across North America is a foundational growth accelerator. Historically, the industry has relied on less energy-efficient technologies like fluorescent lights and HID lamps. However, the superior lifespan, reduced energy consumption, and improved light quality of LEDs have made them the standard for new installations and retrofitting projects. This shift alone contributes significantly to market expansion by reducing operational costs for municipalities and utility providers.

Furthermore, the burgeoning smart city movement is a pivotal catalyst. Governments and urban planners are increasingly investing in interconnected infrastructure that leverages data for improved urban management. Smart streetlights are at the forefront of this movement, acting as nodes for collecting environmental data, managing traffic flow, enhancing public safety through intelligent surveillance, and even providing Wi-Fi hotspots. The demand for integrated software and services that enable these smart functionalities is growing exponentially, creating new revenue streams beyond hardware sales.

The economic landscape also supports this growth. While initial investment in smart lighting can be higher, the long-term savings in energy and maintenance, coupled with potential revenue generation from data services, present a compelling financial case. Government incentives and grant programs aimed at promoting energy efficiency and technological upgrades further stimulate market adoption.

Looking ahead, the increasing focus on sustainability and environmental consciousness among the public and governing bodies will continue to drive demand for energy-efficient and eco-friendly lighting solutions. The ability of smart streetlights to dim or turn off when not needed, coupled with their longer lifespan and reduced waste associated with replacements, aligns perfectly with these sustainability goals. The report will delve deeper into specific regional growth patterns and the influence of various sub-segments within the market.

Dominant Regions, Countries, or Segments in North America Street Lighting Industry

The United States currently stands as the dominant country within the North America Street Lighting industry, accounting for approximately 65% of the total market share. This dominance is driven by a combination of factors including a large existing infrastructure, significant government investment in smart city initiatives, and strong economic policies that encourage technological adoption. The country's extensive urban and suburban areas necessitate a vast network of streetlights, creating a continuous demand for both new installations and upgrades.

Within the Lighting Type segment, Smart Lighting is emerging as the fastest-growing category, projected to capture 55% of the market by 2033. This growth is attributed to its advanced capabilities in energy management, remote monitoring, and integration with other urban IoT systems. Conventional Lighting, while still significant, is gradually being phased out in favor of more efficient and intelligent solutions.

In terms of Light Source, LEDs have firmly established their dominance, representing over 80% of the market in 2025. Their superior energy efficiency, longevity, and versatility make them the preferred choice for modern street lighting projects, significantly outperforming Fluorescent Lights and HID Lamps in most applications.

Regarding Offering, the Hardware segment currently holds the largest market share. However, the Software and Services segment is experiencing rapid growth, driven by the increasing demand for integrated control systems, data analytics platforms, and maintenance services associated with smart lighting deployments. By 2033, the Software and Services segment is expected to represent 30% of the total market value.

Key drivers for the dominance of the US market include:

- Large-scale Smart City Projects: Major urban centers are actively investing in smart infrastructure, with street lighting being a core component.

- Federal and State Funding: Government grants and incentives for energy efficiency and sustainable infrastructure development.

- Technological Innovation Hubs: Proximity to leading technology developers and manufacturers fosters early adoption.

- Aging Infrastructure Replacement: A significant portion of existing street lighting infrastructure requires modernization, driving demand for new solutions.

The growth potential in Canada and Mexico, while currently smaller, is substantial, driven by similar trends towards energy efficiency and smart urban development. Continued investment in infrastructure upgrades and the adoption of advanced lighting technologies will be crucial for these regions to capture a larger market share in the coming years.

North America Street Lighting Industry Product Landscape

The North America Street Lighting industry product landscape is characterized by a rapid evolution towards intelligent and sustainable illumination solutions. Modern streetlights are no longer just passive light sources; they are increasingly equipped with advanced features such as integrated sensors for traffic monitoring, environmental data collection (e.g., air quality, noise pollution), and even public safety surveillance. The core of these advancements lies in the widespread adoption of LED technology, offering superior energy efficiency, extended lifespan, and enhanced light quality compared to traditional lighting sources. Furthermore, the integration of smart control systems, managed through robust software platforms, enables remote dimming, scheduling, and fault detection, leading to significant operational cost savings and improved serviceability for municipalities and utility providers. Unique selling propositions often revolve around the customizable nature of smart lighting systems, allowing for tailored illumination levels based on time of day, traffic conditions, and specific area requirements, thereby optimizing energy consumption while enhancing public safety and aesthetic appeal.

Key Drivers, Barriers & Challenges in North America Street Lighting Industry

Key Drivers:

- Energy Efficiency Mandates: Government regulations and sustainability goals are pushing for the adoption of energy-saving lighting technologies.

- Smart City Initiatives: The growing trend of smart urban development is integrating intelligent street lighting into broader city infrastructure for data collection and management.

- Technological Advancements: Continuous improvements in LED efficiency, control systems, and IoT integration are making smart lighting more attractive and cost-effective.

- Reduced Operational Costs: Long-term savings in energy consumption and maintenance associated with LED and smart lighting solutions.

- Enhanced Public Safety: The ability of smart lighting to provide better illumination and integrate with surveillance systems improves urban safety.

Barriers & Challenges:

- High Initial Investment: The upfront cost of smart lighting systems, including hardware, software, and installation, can be a significant barrier for some municipalities.

- Interoperability and Standardization: Lack of universal standards for smart lighting components can lead to compatibility issues and vendor lock-in.

- Cybersecurity Concerns: As streetlights become more connected, ensuring the security of the network against cyber threats is paramount.

- Data Management and Privacy: The collection and management of data from smart streetlights raise questions about data privacy and usage policies.

- Skilled Workforce Shortage: The implementation, maintenance, and operation of complex smart lighting systems require a skilled workforce, which may be in short supply.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of key components, affecting project timelines and budgets.

- Regulatory Hurdles: Navigating complex procurement processes and obtaining necessary permits can be time-consuming.

Emerging Opportunities in North America Street Lighting Industry

Emerging opportunities in the North America Street Lighting industry lie in the data analytics and service-based models. As smart streetlights become more prevalent, they generate vast amounts of data that can be leveraged for various urban applications beyond illumination. This includes traffic management optimization, environmental monitoring, and even predictive maintenance for city assets. Furthermore, the integration of street lighting with other smart city components, such as electric vehicle (EV) charging infrastructure and 5G small cell deployment, presents significant cross-sector opportunities. The development of localized manufacturing and customized solutions for specific regional needs also represents a growing niche. The increasing focus on resilience and grid modernization within urban infrastructure also opens doors for smart street lighting to play a role in distributed energy management and microgrid applications.

Growth Accelerators in the North America Street Lighting Industry Industry

The long-term growth of the North America Street Lighting industry is being significantly accelerated by the ongoing digital transformation of urban environments. The widespread adoption of IoT devices and the increasing demand for data-driven decision-making by city planners are creating a fertile ground for smart street lighting. Strategic partnerships between lighting manufacturers, technology providers, and telecommunication companies are crucial for developing integrated smart city solutions. Market expansion strategies are increasingly focusing on retrofitting existing infrastructure with smart capabilities, alongside new deployments. Furthermore, innovations in areas like adaptive lighting algorithms and predictive maintenance software are enhancing the value proposition of smart streetlights, driving greater adoption and investment. The continuous drive towards sustainability and the circular economy is also encouraging the development of more durable, energy-efficient, and recyclable lighting components.

Key Players Shaping the North America Street Lighting Industry Market

- Eaton Corporation PLC

- Signify Holding

- Bridgelux Inc

- Acuity Brands Inc

- OSRAM Gmbh

- General Electric Company

- Cree Inc

- Liveable Cities (LED Roadway Lighting Ltd)

- Hubbell Incorporated

- Leotek Electronics USA LLC

Notable Milestones in North America Street Lighting Industry Sector

- 2019: Increased government funding for smart city initiatives across major US municipalities, boosting demand for smart lighting solutions.

- 2020: Significant advancements in LED efficiency and lumen output, leading to further cost reductions and performance improvements.

- 2021: Growing adoption of integrated sensors for traffic monitoring and environmental data collection within street lighting systems.

- 2022: Key partnerships formed between lighting manufacturers and telecommunications companies to integrate 5G small cell technology into streetlight infrastructure.

- 2023: Emergence of advanced analytics platforms for street lighting, enabling predictive maintenance and energy optimization.

- 2024: Continued growth in the retrofit market as municipalities upgrade older, less efficient lighting systems with modern LED and smart technologies.

In-Depth North America Street Lighting Industry Market Outlook

The North America Street Lighting industry is poised for continued expansion, driven by the relentless pursuit of energy efficiency, sustainability, and smart urban living. The market's future trajectory will be shaped by the increasing integration of advanced analytics and artificial intelligence into street lighting systems, enabling proactive maintenance and dynamic illumination adjustments. Strategic collaborations between hardware manufacturers, software developers, and utility providers will be pivotal in creating comprehensive and interconnected urban infrastructure solutions. The growing emphasis on resilient infrastructure and grid modernization presents further opportunities for smart streetlights to contribute to energy management and grid stability. As municipalities increasingly prioritize data-driven decision-making, the value proposition of smart lighting as a platform for urban data collection and utilization will only grow, ensuring sustained investment and innovation in this critical sector.

North America Street Lighting Industry Segmentation

-

1. Lighting Type

- 1.1. Conventional Lighting

- 1.2. Smart Lighting

-

2. Light Source

- 2.1. LEDs

- 2.2. Fluorescent Lights

- 2.3. HID Lamps

-

3. Offering

- 3.1. Hardware

- 3.2. Software and Services

North America Street Lighting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Street Lighting Industry Regional Market Share

Geographic Coverage of North America Street Lighting Industry

North America Street Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Demand for Intelligent Solutions

- 3.2.2 such as Smart Street Lighting in Street Lighting Systems; Government Support in Implementation of LED Lights in Street Lighting; Increasing Adoption of Smart City Infrastructure to Drive the Street Lighting Market

- 3.3. Market Restrains

- 3.3.1. Challenges Associated With LED Driver Failure and High Cost Associated With Installation

- 3.4. Market Trends

- 3.4.1. LED Segment is Expected to Hold the Largest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Street Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 5.1.1. Conventional Lighting

- 5.1.2. Smart Lighting

- 5.2. Market Analysis, Insights and Forecast - by Light Source

- 5.2.1. LEDs

- 5.2.2. Fluorescent Lights

- 5.2.3. HID Lamps

- 5.3. Market Analysis, Insights and Forecast - by Offering

- 5.3.1. Hardware

- 5.3.2. Software and Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Eaton Corporation PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Signify Holding

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bridgelux Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Acuity Brands Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OSRAM Gmbh

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Electric Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cree Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Liveable Cities (LED Roadway Lighting Ltd )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hubbell Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Leotek Electronics USA LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Eaton Corporation PLC

List of Figures

- Figure 1: North America Street Lighting Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Street Lighting Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Street Lighting Industry Revenue undefined Forecast, by Lighting Type 2020 & 2033

- Table 2: North America Street Lighting Industry Volume K Unit Forecast, by Lighting Type 2020 & 2033

- Table 3: North America Street Lighting Industry Revenue undefined Forecast, by Light Source 2020 & 2033

- Table 4: North America Street Lighting Industry Volume K Unit Forecast, by Light Source 2020 & 2033

- Table 5: North America Street Lighting Industry Revenue undefined Forecast, by Offering 2020 & 2033

- Table 6: North America Street Lighting Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 7: North America Street Lighting Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: North America Street Lighting Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Street Lighting Industry Revenue undefined Forecast, by Lighting Type 2020 & 2033

- Table 10: North America Street Lighting Industry Volume K Unit Forecast, by Lighting Type 2020 & 2033

- Table 11: North America Street Lighting Industry Revenue undefined Forecast, by Light Source 2020 & 2033

- Table 12: North America Street Lighting Industry Volume K Unit Forecast, by Light Source 2020 & 2033

- Table 13: North America Street Lighting Industry Revenue undefined Forecast, by Offering 2020 & 2033

- Table 14: North America Street Lighting Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 15: North America Street Lighting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Street Lighting Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States North America Street Lighting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States North America Street Lighting Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Street Lighting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Street Lighting Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Street Lighting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Street Lighting Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Street Lighting Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the North America Street Lighting Industry?

Key companies in the market include Eaton Corporation PLC, Signify Holding, Bridgelux Inc, Acuity Brands Inc, OSRAM Gmbh, General Electric Company, Cree Inc, Liveable Cities (LED Roadway Lighting Ltd ), Hubbell Incorporated, Leotek Electronics USA LLC.

3. What are the main segments of the North America Street Lighting Industry?

The market segments include Lighting Type, Light Source, Offering.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Intelligent Solutions. such as Smart Street Lighting in Street Lighting Systems; Government Support in Implementation of LED Lights in Street Lighting; Increasing Adoption of Smart City Infrastructure to Drive the Street Lighting Market.

6. What are the notable trends driving market growth?

LED Segment is Expected to Hold the Largest Share.

7. Are there any restraints impacting market growth?

Challenges Associated With LED Driver Failure and High Cost Associated With Installation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Street Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Street Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Street Lighting Industry?

To stay informed about further developments, trends, and reports in the North America Street Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence