Key Insights

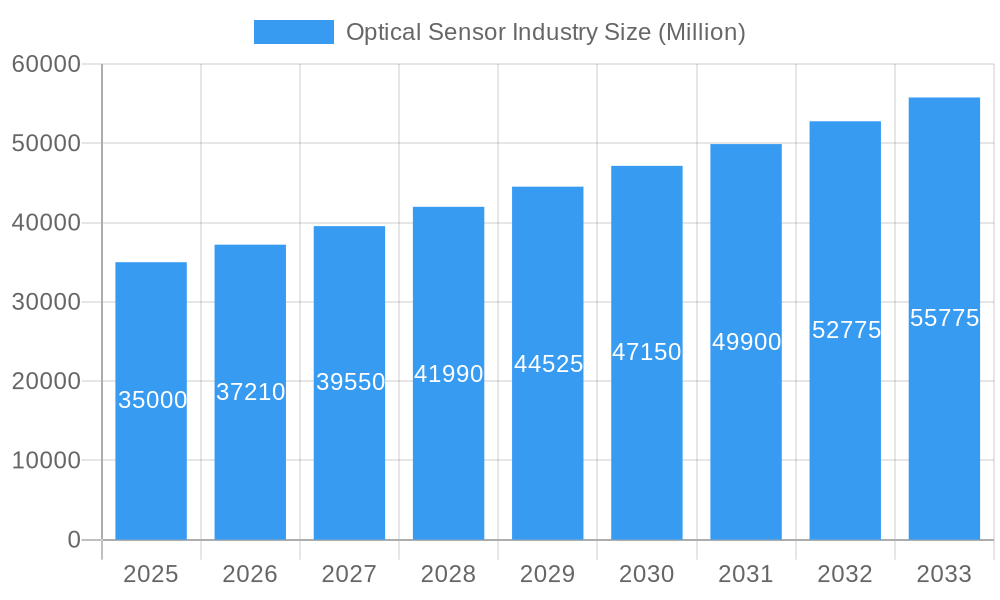

The global Optical Sensor market is projected for significant expansion, expected to reach approximately $29.2 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.3% through 2033. This growth is driven by escalating demand for advanced automation in manufacturing, healthcare, and automotive sectors. Key drivers include the integration of optical sensors for industrial quality control, object detection, process monitoring, medical diagnostics, imaging, patient monitoring, biometric authentication in consumer electronics, and advanced driver-assistance systems (ADAS) in automotive applications. The market is segmented into Extrinsic and Intrinsic Optical Sensors, with Fiber Optic, Image, Photoelectric, Ambient Light, and Proximity Sensors being crucial types. Applications encompass Industrial, Medical, Biometric, Automotive, and Consumer Electronics.

Optical Sensor Industry Market Size (In Billion)

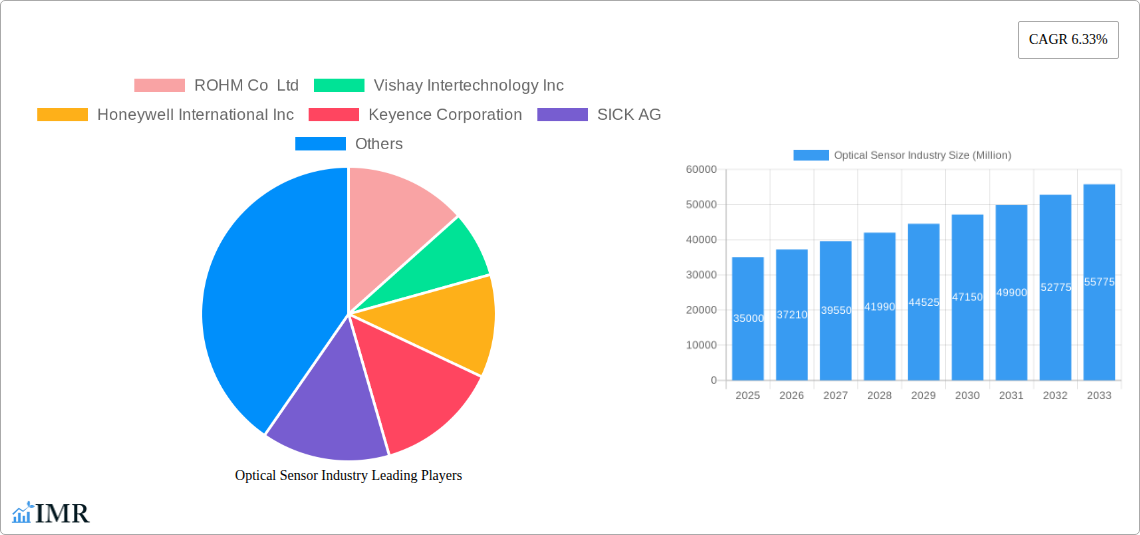

Technological advancements such as miniaturization, enhanced sensitivity, and improved power efficiency are expanding the versatility of optical sensors for diverse applications. The increasing emphasis on data-driven decision-making necessitates reliable sensing solutions, which optical sensors provide. While initial investment costs for advanced technologies and the need for skilled personnel may present challenges, the benefits of enhanced accuracy, non-contact measurement, and adaptability to harsh environments are expected to drive market growth. Leading companies like ROHM Co Ltd, Vishay Intertechnology Inc, Honeywell International Inc, and Keyence Corporation are innovating and expanding the market through R&D and strategic collaborations. The Asia Pacific region, particularly China and Japan, is poised to dominate due to its strong manufacturing base and rapid technological adoption.

Optical Sensor Industry Company Market Share

Global Optical Sensor Market: Analysis and Forecast (2019-2033)

This report provides a comprehensive analysis of the global optical sensor market, detailing its dynamics, growth trends, and future potential. Covering the historical period 2019-2024, with 2025 as the base year and a forecast period through 2033, it offers crucial insights for industry stakeholders. The report focuses on high-traffic keywords including "optical sensor market," "image sensors," "photoelectric sensors," "industrial sensors," "automotive sensors," and "medical sensors," aiming to enhance search engine visibility. Detailed market segmentation and sub-segment analysis are included, with all quantitative values presented in billions for clarity.

Optical Sensor Industry Market Dynamics & Structure

The global optical sensor market exhibits a moderately concentrated structure, with a handful of key players dominating significant market share. Technological innovation serves as the primary driver of market growth, fueled by continuous advancements in sensor miniaturization, resolution, and integration capabilities. Emerging trends like the Internet of Things (IoT) and Artificial Intelligence (AI) are creating new avenues for optical sensor adoption. Regulatory frameworks, particularly concerning data privacy and device safety in sectors like automotive and medical, are influencing product development and market entry. Competitive product substitutes, while present in some niche applications, are increasingly outpaced by the superior performance and versatility of advanced optical sensors. End-user demographics are expanding beyond traditional industrial and consumer electronics to include burgeoning segments like advanced medical diagnostics and sophisticated biometric security systems. Mergers and acquisitions (M&A) are a strategic tool for consolidation and innovation, with deal volumes and values reflecting the high growth potential and competitive intensity of this sector.

- Market Concentration: Dominated by a mix of established technology giants and specialized sensor manufacturers.

- Technological Innovation: Driven by AI integration, miniaturization, increased resolution, and enhanced sensitivity.

- Regulatory Influence: Data privacy and safety standards in automotive and medical applications are key considerations.

- End-User Demographics: Expanding into medical, automotive, and advanced consumer electronics.

- M&A Trends: Strategic acquisitions to gain market share, acquire new technologies, and expand product portfolios.

Optical Sensor Industry Growth Trends & Insights

The global optical sensor market is poised for robust expansion, projecting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated market size of $XXX billion by the end of the forecast period. This significant growth is underpinned by escalating demand across diverse applications, from industrial automation and automotive advanced driver-assistance systems (ADAS) to medical imaging and consumer electronics. The adoption rates for sophisticated optical sensors, particularly image sensors and LiDAR, are accelerating due to their indispensable role in enabling next-generation technologies. Technological disruptions, such as the development of novel sensing materials and advanced algorithms for signal processing, are continuously enhancing sensor performance and opening up new market possibilities. Consumer behavior shifts, characterized by a growing preference for smarter, more connected devices with enhanced safety and convenience features, are further catalyzing the demand for optical sensors. The increasing integration of AI and machine learning with optical sensor data is driving the development of intelligent systems capable of complex pattern recognition and real-time decision-making. Furthermore, the growing emphasis on sustainability and energy efficiency in various industries is promoting the adoption of optical sensors for optimized resource management and process control.

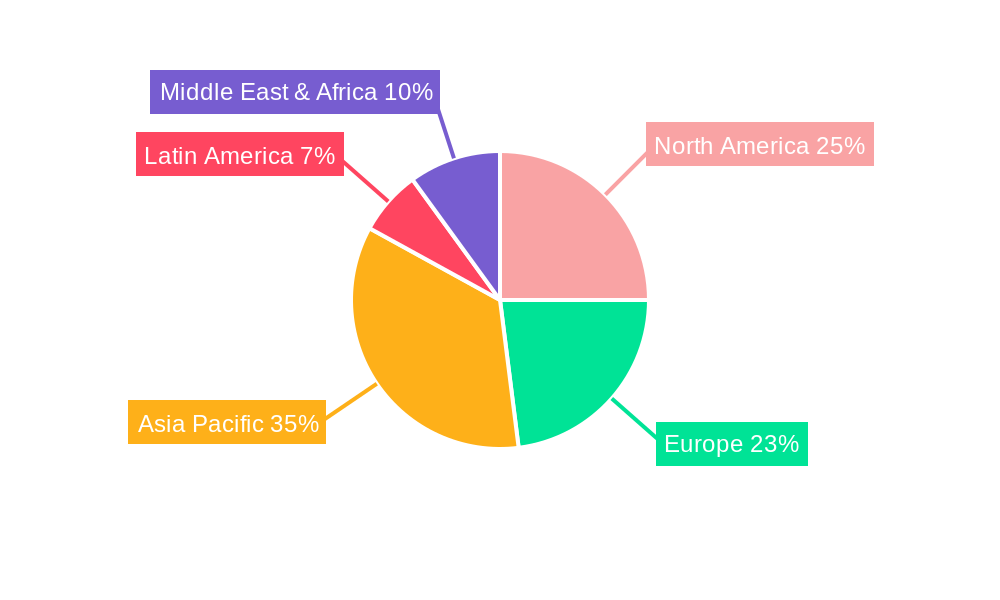

Dominant Regions, Countries, or Segments in Optical Sensor Industry

The Asia Pacific region is emerging as the dominant force in the global optical sensor market, driven by its robust manufacturing capabilities, burgeoning technological innovation hubs, and extensive consumer base. Within this region, countries like China, Japan, and South Korea are leading the charge, contributing significantly to both production and consumption of optical sensors. This dominance is fueled by several key drivers, including supportive government policies promoting technological advancement, substantial investments in research and development, and the rapid expansion of key end-use industries such as consumer electronics, automotive, and industrial automation.

Key Drivers of Dominance in Asia Pacific:

- Industrial Automation & Manufacturing: Extensive adoption of photoelectric and image sensors for quality control, robotics, and process optimization in manufacturing facilities.

- Consumer Electronics Hub: High demand for image sensors and ambient light sensors in smartphones, tablets, wearables, and smart home devices.

- Automotive Sector Growth: Increasing integration of optical sensors for ADAS, autonomous driving, and in-cabin monitoring systems, particularly in countries like China and Japan.

- Government Initiatives: Favorable policies and incentives promoting the development and adoption of advanced semiconductor and sensor technologies.

- Evolving Healthcare Infrastructure: Growing demand for advanced medical sensors in diagnostic equipment and patient monitoring systems.

The Image Sensor segment, within the broader optical sensor market, is experiencing particularly rapid growth, driven by the ubiquitous demand from the consumer electronics and automotive industries. The increasing resolution, frame rates, and functionalities of image sensors are making them indispensable for a wide array of applications, from high-definition photography and video recording to sophisticated object recognition and environmental sensing.

Optical Sensor Industry Product Landscape

The optical sensor industry is characterized by continuous product innovation, delivering enhanced performance and novel applications. Key product developments include advancements in CMOS image sensors with higher resolutions and improved low-light performance, enabling clearer imaging in challenging conditions. The integration of AI algorithms directly into sensor chips is enabling edge computing capabilities, allowing for faster data processing and reduced latency. Fiber optic sensors are seeing increased adoption in harsh industrial environments due to their immunity to electromagnetic interference and their ability to transmit data over long distances. LiDAR sensors are becoming more compact and cost-effective, paving the way for widespread use in automotive, robotics, and augmented reality applications. The development of specialized photoelectric sensors with advanced detection capabilities and wider operating ranges further expands their utility in automation and safety systems.

Key Drivers, Barriers & Challenges in Optical Sensor Industry

Key Drivers:

- Technological Advancements: Miniaturization, increased sensitivity, higher resolution, and integration of AI capabilities are pushing market boundaries.

- Growing Demand for Automation: Industrial automation, robotics, and smart manufacturing initiatives are heavily reliant on optical sensors for precision and control.

- Expansion of IoT Ecosystem: The proliferation of connected devices necessitates efficient sensing capabilities, with optical sensors playing a crucial role.

- Automotive Evolution: The surge in ADAS and autonomous driving technologies is a significant growth catalyst.

- Medical Innovations: Advancements in diagnostic imaging and patient monitoring are increasing demand for specialized medical optical sensors.

Key Barriers & Challenges:

- High Research & Development Costs: Continuous innovation requires substantial investment, posing a barrier for smaller players.

- Supply Chain Volatility: Geopolitical factors and raw material shortages can disrupt production and impact pricing.

- Technical Complexity: Integration and calibration of advanced optical sensors can be challenging for end-users.

- Stringent Regulatory Compliance: Meeting diverse regulatory standards across different industries and geographies can be complex.

- Price Sensitivity in Certain Markets: While advanced features command premiums, price remains a critical factor in mass-market applications.

Emerging Opportunities in Optical Sensor Industry

Emerging opportunities in the optical sensor industry are abundant, driven by the relentless pace of technological innovation and evolving market demands. The burgeoning field of augmented reality (AR) and virtual reality (VR) presents a significant opportunity for advanced image sensors and LiDAR technologies, enabling immersive user experiences and sophisticated spatial mapping. The increasing focus on sustainability and environmental monitoring is creating demand for optical sensors capable of detecting pollutants, monitoring resource consumption, and facilitating smart grid management. The healthcare sector continues to offer fertile ground for innovation, with opportunities in non-invasive diagnostics, wearable health trackers, and advanced robotic surgery. Furthermore, the expansion of smart city initiatives, encompassing intelligent transportation, public safety, and efficient resource allocation, will necessitate a widespread deployment of various optical sensor types. The continuous miniaturization and cost reduction of optical sensor components are also opening up avenues in niche applications and the broader consumer electronics market.

Growth Accelerators in the Optical Sensor Industry Industry

Several key catalysts are accelerating the long-term growth of the optical sensor industry. Breakthroughs in materials science are leading to the development of novel sensing materials with enhanced sensitivity, selectivity, and robustness, enabling sensors to perform in more demanding environments and detect a wider range of phenomena. Strategic partnerships and collaborations between sensor manufacturers, technology providers, and end-product developers are fostering synergistic innovation and accelerating the integration of optical sensors into new applications. For example, collaborations focused on AI-powered sensor fusion are unlocking unprecedented analytical capabilities. Furthermore, market expansion strategies targeting emerging economies and untapped application areas, coupled with the development of more accessible and user-friendly sensor solutions, are driving widespread adoption and market penetration. The increasing emphasis on data-driven decision-making across all industries is also a powerful growth accelerator, as optical sensors provide the foundational data for such insights.

Key Players Shaping the Optical Sensor Industry Market

- ROHM Co Ltd

- Vishay Intertechnology Inc

- Honeywell International Inc

- Keyence Corporation

- SICK AG

- IFM Efector Inc

- Rockwell Automation Inc

- Pepperl+Fuchs GmbH

- STMicroelectronics NV

- On Semiconductor Corporation

Notable Milestones in Optical Sensor Industry Sector

- October 2022: Lumotive and Gpixel partnered to launch a reference design platform comprising 3D lidar and CMOS image sensors to enable companies to adopt next-generation 3D lidar sensors in mobility and industrial applications like autonomous navigation of robots in logistics environments. Gpixel's GTOF0503 indirect time-of-flight image sensor pairing with Lumotive's LM10 beam steering chip provides a suitable solution for medium to long-range 3D applications. It highlights both the precision and flexibility offered by Gpixel's sensor.

- July 2022: Sony Corporation announced the upcoming release of the IMX675, a 1/3-type CMOS image sensor for security cameras with approximately 5.12 megapixels*2 that simultaneously delivers both full-pixel output of the captured image and high-speed production of areas of interest.

In-Depth Optical Sensor Industry Market Outlook

The future outlook for the optical sensor industry is exceptionally promising, driven by an interplay of technological advancements, expanding application frontiers, and evolving market demands. Key growth accelerators include the continued miniaturization and enhanced performance of image sensors, enabling sophisticated visual processing for autonomous systems and consumer devices. The increasing integration of AI at the edge, powered by advanced optical sensor data, will unlock new levels of intelligent automation and real-time analytics. Strategic partnerships focused on developing integrated sensing solutions for industries like healthcare, automotive, and industrial automation will further fuel market penetration. Emerging opportunities in augmented and virtual reality, as well as environmental monitoring, represent significant untapped potential. The industry is poised for sustained growth as optical sensors become even more integral to smart, connected, and data-driven ecosystems worldwide.

Optical Sensor Industry Segmentation

-

1. Type

- 1.1. Extrinsic Optical Sensor

- 1.2. Intrinsic Optical Sensor

-

2. Sensor Type

- 2.1. Fiber Optic Sensor

- 2.2. Image Sensor

- 2.3. Photoelectric Sensor

- 2.4. Ambient Light and Proximity Sensor

-

3. Application

- 3.1. Industrial

- 3.2. Medical

- 3.3. Biometric

- 3.4. Automotive

- 3.5. Consumer Electronics

Optical Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of the Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of the Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of the Middle East

Optical Sensor Industry Regional Market Share

Geographic Coverage of Optical Sensor Industry

Optical Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Market Penetration of Smartphones; Increasing Demand for Power-saving Devices Across Industries; Increasing Market Penetration of Automation Techniques Across Various Industries

- 3.3. Market Restrains

- 3.3.1. Adoption of Power Transistors is Analyzed Pose a Challenge for the Market

- 3.4. Market Trends

- 3.4.1. Photoelectric Sensor is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Extrinsic Optical Sensor

- 5.1.2. Intrinsic Optical Sensor

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Fiber Optic Sensor

- 5.2.2. Image Sensor

- 5.2.3. Photoelectric Sensor

- 5.2.4. Ambient Light and Proximity Sensor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Industrial

- 5.3.2. Medical

- 5.3.3. Biometric

- 5.3.4. Automotive

- 5.3.5. Consumer Electronics

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Extrinsic Optical Sensor

- 6.1.2. Intrinsic Optical Sensor

- 6.2. Market Analysis, Insights and Forecast - by Sensor Type

- 6.2.1. Fiber Optic Sensor

- 6.2.2. Image Sensor

- 6.2.3. Photoelectric Sensor

- 6.2.4. Ambient Light and Proximity Sensor

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Industrial

- 6.3.2. Medical

- 6.3.3. Biometric

- 6.3.4. Automotive

- 6.3.5. Consumer Electronics

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Extrinsic Optical Sensor

- 7.1.2. Intrinsic Optical Sensor

- 7.2. Market Analysis, Insights and Forecast - by Sensor Type

- 7.2.1. Fiber Optic Sensor

- 7.2.2. Image Sensor

- 7.2.3. Photoelectric Sensor

- 7.2.4. Ambient Light and Proximity Sensor

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Industrial

- 7.3.2. Medical

- 7.3.3. Biometric

- 7.3.4. Automotive

- 7.3.5. Consumer Electronics

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Extrinsic Optical Sensor

- 8.1.2. Intrinsic Optical Sensor

- 8.2. Market Analysis, Insights and Forecast - by Sensor Type

- 8.2.1. Fiber Optic Sensor

- 8.2.2. Image Sensor

- 8.2.3. Photoelectric Sensor

- 8.2.4. Ambient Light and Proximity Sensor

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Industrial

- 8.3.2. Medical

- 8.3.3. Biometric

- 8.3.4. Automotive

- 8.3.5. Consumer Electronics

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Extrinsic Optical Sensor

- 9.1.2. Intrinsic Optical Sensor

- 9.2. Market Analysis, Insights and Forecast - by Sensor Type

- 9.2.1. Fiber Optic Sensor

- 9.2.2. Image Sensor

- 9.2.3. Photoelectric Sensor

- 9.2.4. Ambient Light and Proximity Sensor

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Industrial

- 9.3.2. Medical

- 9.3.3. Biometric

- 9.3.4. Automotive

- 9.3.5. Consumer Electronics

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Extrinsic Optical Sensor

- 10.1.2. Intrinsic Optical Sensor

- 10.2. Market Analysis, Insights and Forecast - by Sensor Type

- 10.2.1. Fiber Optic Sensor

- 10.2.2. Image Sensor

- 10.2.3. Photoelectric Sensor

- 10.2.4. Ambient Light and Proximity Sensor

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Industrial

- 10.3.2. Medical

- 10.3.3. Biometric

- 10.3.4. Automotive

- 10.3.5. Consumer Electronics

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Optical Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Extrinsic Optical Sensor

- 11.1.2. Intrinsic Optical Sensor

- 11.2. Market Analysis, Insights and Forecast - by Sensor Type

- 11.2.1. Fiber Optic Sensor

- 11.2.2. Image Sensor

- 11.2.3. Photoelectric Sensor

- 11.2.4. Ambient Light and Proximity Sensor

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Industrial

- 11.3.2. Medical

- 11.3.3. Biometric

- 11.3.4. Automotive

- 11.3.5. Consumer Electronics

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ROHM Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Vishay Intertechnology Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Honeywell International Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Keyence Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 SICK AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 IFM Efector Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rockwell Automation Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Pepperl+Fuchs GmbH

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 STMicroelectronics NV*List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 On Semiconductor Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 ROHM Co Ltd

List of Figures

- Figure 1: Global Optical Sensor Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 5: North America Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 6: North America Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 13: Europe Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 14: Europe Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 21: Asia Pacific Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 22: Asia Pacific Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Latin America Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 29: Latin America Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 30: Latin America Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 31: Latin America Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 37: Middle East Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 38: Middle East Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: United Arab Emirates Optical Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 43: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: United Arab Emirates Optical Sensor Industry Revenue (billion), by Sensor Type 2025 & 2033

- Figure 45: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 46: United Arab Emirates Optical Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 47: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 48: United Arab Emirates Optical Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: United Arab Emirates Optical Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 3: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Optical Sensor Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 7: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 13: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Germany Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of the Europe Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 21: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: India Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of the Asia Pacific Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 29: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Mexico Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of the Latin America Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 36: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Optical Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Optical Sensor Industry Revenue billion Forecast, by Sensor Type 2020 & 2033

- Table 40: Global Optical Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Optical Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of the Middle East Optical Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Sensor Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Optical Sensor Industry?

Key companies in the market include ROHM Co Ltd, Vishay Intertechnology Inc, Honeywell International Inc, Keyence Corporation, SICK AG, IFM Efector Inc, Rockwell Automation Inc, Pepperl+Fuchs GmbH, STMicroelectronics NV*List Not Exhaustive, On Semiconductor Corporation.

3. What are the main segments of the Optical Sensor Industry?

The market segments include Type, Sensor Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Market Penetration of Smartphones; Increasing Demand for Power-saving Devices Across Industries; Increasing Market Penetration of Automation Techniques Across Various Industries.

6. What are the notable trends driving market growth?

Photoelectric Sensor is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Adoption of Power Transistors is Analyzed Pose a Challenge for the Market.

8. Can you provide examples of recent developments in the market?

October 2022 - Lumotiveand Gpixelpartnered to launch a reference design platform comprising 3D lidar and CMOS image sensors to enable companies to adopt next-generation 3D lidar sensors in mobility and industrial applications like autonomous navigation of robots in logistics environments. Gpixel'sGTOF0503 indirect time-of-flight image sensor pairing with Lumotive'sLM10 beam steering chip provides a suitable solution for medium to long-range 3D applications. It highlights both the precision and flexibility offered by Gpixel'ssensor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Sensor Industry?

To stay informed about further developments, trends, and reports in the Optical Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence