Key Insights

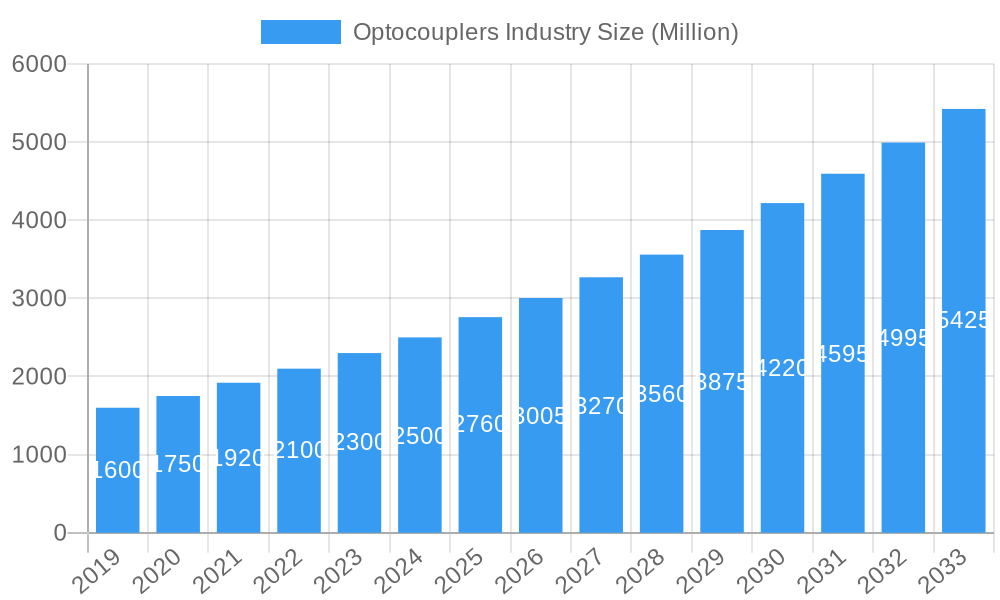

The global optocouplers market is poised for significant expansion, projected to reach USD 2.76 billion by 2025 and continue its robust growth trajectory with a Compound Annual Growth Rate (CAGR) of 8.99% through 2033. This substantial market value underscores the increasing reliance on optocouplers across a diverse range of industries, driven by their critical role in signal isolation, noise reduction, and overvoltage protection. Key growth catalysts include the burgeoning automotive sector, particularly the electrification of vehicles which necessitates advanced power management and control systems, and the relentless demand for sophisticated consumer electronics. The communication industry's ongoing evolution, with the deployment of 5G infrastructure and the proliferation of smart devices, further fuels the need for high-performance optocouplers. Industrial automation, a sector continuously seeking to enhance efficiency and safety through improved control systems, also represents a major driver. Emerging trends such as the miniaturization of electronic components, the development of higher speed and more efficient optocouplers, and the integration of advanced features are expected to shape market dynamics. The increasing adoption of IoT devices and smart grids also presents new avenues for market penetration.

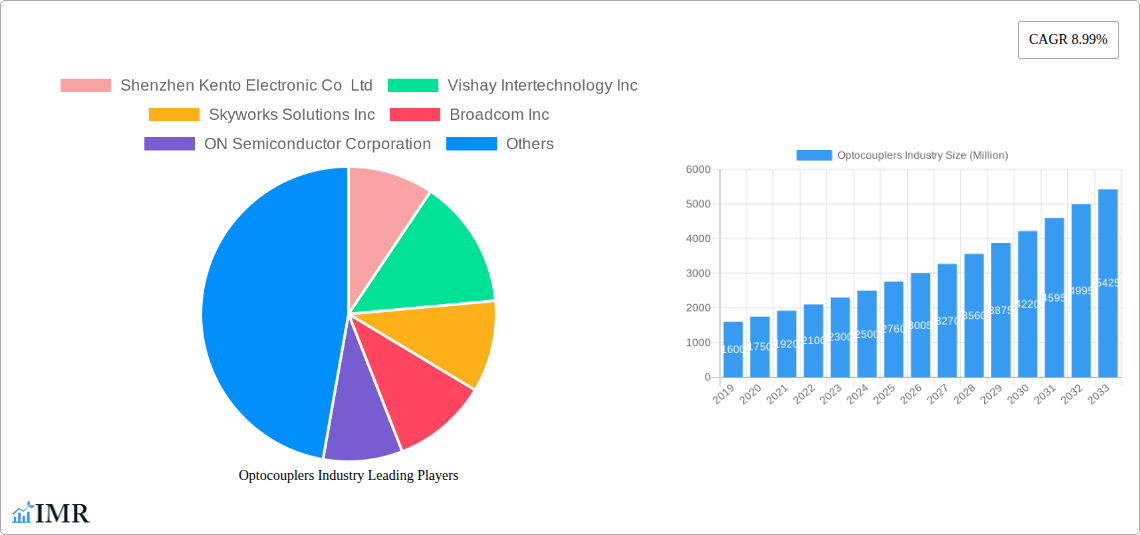

Optocouplers Industry Market Size (In Billion)

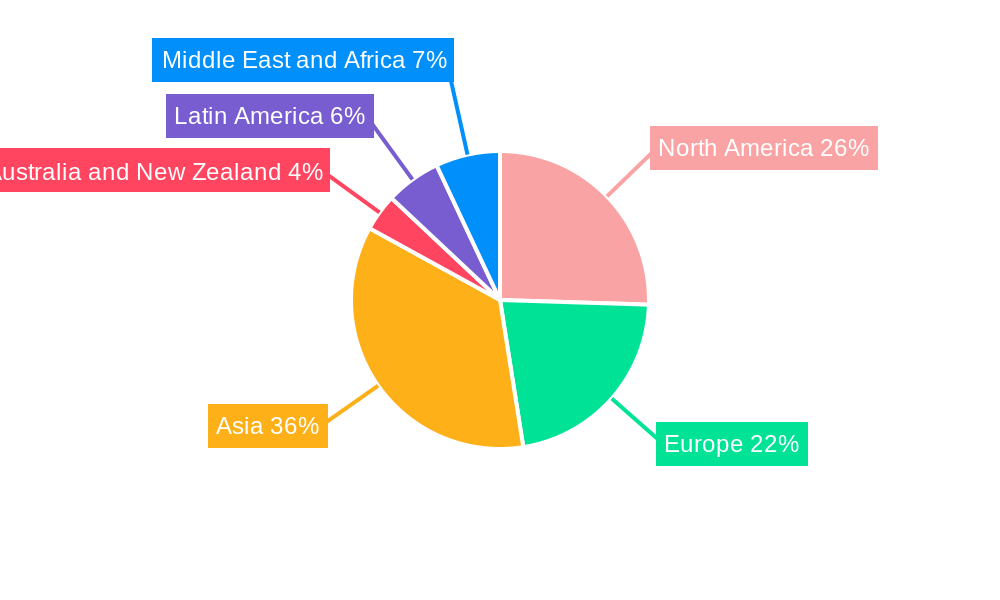

However, the market also faces certain restraints that could temper its growth. The fluctuating raw material costs, particularly for key components, can impact manufacturing expenses and influence pricing strategies. Intense competition among a significant number of established and emerging players, including giants like Broadcom Inc., ON Semiconductor Corporation, and Vishay Intertechnology Inc., could lead to price pressures and necessitate continuous innovation. Furthermore, the development of alternative isolation technologies, while currently less prevalent, poses a potential long-term threat. Despite these challenges, the inherent reliability and cost-effectiveness of optocouplers in many critical applications are expected to ensure sustained demand. The market's segmentation by product type, with phototransistor-based optocouplers and optocouplers based on Photo TRIAC holding significant shares, highlights established technological preferences, while advancements in other types cater to niche and evolving requirements. Regional analysis indicates strong market presence in Asia, driven by its manufacturing prowess and rapid industrialization, followed by North America and Europe, which are characterized by advanced technological adoption and robust R&D investments.

Optocouplers Industry Company Market Share

Here is a comprehensive, SEO-optimized report description for the Optocouplers Industry, designed for maximum visibility and engagement.

Report Title: Global Optocouplers Market: Trends, Opportunities, and Forecast 2025-2033 – Driving Innovation in Industrial Automation, Consumer Electronics, and Automotive Sectors

Report Description:

Dive into the dynamic Optocouplers Market with our in-depth analysis covering the historical period of 2019–2024 and a detailed forecast from 2025–2033. This report offers a critical examination of the global optocoupler industry, exploring its intricate structure, growth trajectories, and the pivotal role it plays across key end-user industries including Automotive, Consumer Electronics, Communication, and Industrial applications. Understand the market dynamics driven by high-speed optocouplers, phototransistor-based optocouplers, and advancements in photo TRIAC and photo SCR technologies. We meticulously analyze the parent market for optocouplers and its crucial child markets, providing unparalleled insights into market concentration, technological innovation drivers, evolving regulatory frameworks, and the competitive landscape. This report is an essential resource for industry professionals seeking to capitalize on the burgeoning demand for reliable signal isolation and power control solutions.

Optocouplers Industry Market Dynamics & Structure

The global optocouplers market exhibits a moderate to high level of concentration, with a few key players holding significant market share. Technological innovation serves as a primary driver, pushing the development of higher speed, greater isolation voltage, and lower power consumption optocouplers. Regulatory frameworks, particularly those related to electrical safety and industrial automation standards, indirectly influence market growth by mandating the use of reliable isolation components. Competitive product substitutes, such as solid-state relays and digital isolators, pose a challenge, yet optocouplers retain their advantage in specific applications due to cost-effectiveness and simplicity. End-user demographics are increasingly skewed towards industrial automation and automotive sectors, demanding more robust and advanced optocoupling solutions. Merger and acquisition trends, while not as pronounced as in some other semiconductor segments, are observed as companies seek to consolidate product portfolios or gain access to new technologies and markets. For instance, the integration of advanced CMOS logic in new optocoupler introductions signifies a trend towards enhanced digital system compatibility.

- Market Concentration: Dominated by a mix of established semiconductor giants and specialized optocoupler manufacturers.

- Technological Innovation: Driven by the need for higher data rates (e.g., 25 MBd), improved CMR (Common Mode Rejection), and miniaturization.

- Regulatory Influence: Standards in industrial control and automotive safety increasingly favor components with high isolation capabilities.

- Competitive Landscape: Faces competition from digital isolators but maintains a strong position in cost-sensitive and high-voltage applications.

- End-User Demand: Surging demand from the Industrial and Automotive sectors for enhanced safety and performance.

- M&A Activity: Strategic acquisitions aim to broaden product offerings and enhance technological capabilities.

Optocouplers Industry Growth Trends & Insights

The global optocouplers market is projected to experience robust growth driven by the escalating demand for sophisticated electronic components across various industries. The Automotive sector, with its increasing integration of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and infotainment systems, is a significant growth engine, requiring high-reliability optocouplers for power management and signal isolation. Similarly, the Industrial sector's relentless pursuit of automation, smart manufacturing, and the Industrial Internet of Things (IIoT) necessitates advanced optocoupling solutions for control systems, motor drives, and power supplies. The Consumer Electronics segment, while more price-sensitive, continues to drive volume, with optocouplers finding applications in power adapters, home appliances, and LED lighting. The Communication sector also contributes to growth, particularly with the expansion of 5G infrastructure and data centers, which demand efficient and reliable signal isolation.

Technological advancements, such as the introduction of high-speed optocouplers capable of transmitting data at 25 MBd (as exemplified by Vishay Intertechnology's VOIH72A), are expanding the application scope of optocouplers into faster digital interfaces. Furthermore, the development of opto-emulators like those introduced by Texas Instruments (TI) addresses key limitations of traditional optocouplers, such as LED aging effects, by leveraging advanced silicon dioxide (SiO2) based isolation technology. This innovation promises improved signal integrity, lower power consumption, and extended lifespan in demanding high-voltage industrial and automotive applications, potentially reshaping the competitive landscape. The adoption rate of these new technologies is expected to accelerate as manufacturers increasingly prioritize reliability, efficiency, and longevity in their product designs. Consumer behavior shifts towards more feature-rich and energy-efficient devices indirectly fuel the demand for sophisticated components like advanced optocouplers. The market penetration of optocouplers is set to deepen as their capabilities align with evolving technological requirements across the global economy. The CAGR for the forecast period is predicted to be around 6.5%, indicating a healthy expansion driven by these interconnected trends.

Dominant Regions, Countries, or Segments in Optocouplers Industry

The global optocouplers market is experiencing significant growth, with distinct regional and segment-based dominance. Asia Pacific, particularly China, stands out as the dominant region, driven by its massive manufacturing base for consumer electronics, industrial equipment, and automotive components. The region’s robust supply chain infrastructure, coupled with substantial government investments in technological advancement and industrialization, fuels the demand for optocouplers. Within the product type segments, Phototransistor-based Optocouplers continue to hold the largest market share due to their widespread application in various industrial and consumer electronics interfaces, offering a balance of performance and cost-effectiveness. However, the Optocoupler based on Photo TRIAC and Optocoupler with Photo SCR segments are experiencing accelerated growth, propelled by the expanding renewable energy sector, electric vehicle charging infrastructure, and industrial motor control applications that require higher power handling capabilities.

In terms of end-user industries, the Industrial sector is the most significant driver of optocoupler demand. The ongoing trend of Industry 4.0, smart factories, and the proliferation of IIoT devices necessitate reliable isolation for control systems, power supplies, and sensor interfaces to ensure operational integrity and safety. The Automotive sector is rapidly emerging as a key growth catalyst. The electrification of vehicles, the integration of sophisticated ADAS, and the increasing complexity of in-car electronics are creating substantial demand for optocouplers with higher voltage ratings, faster switching speeds, and improved reliability to manage power distribution, battery management systems, and signal integrity. Countries like Germany, Japan, and South Korea, with their advanced automotive manufacturing ecosystems, are key markets within this segment. Communication infrastructure, including 5G deployment and data centers, also contributes to the market’s growth, demanding high-performance optocouplers for signal isolation and power management. The combined influence of these dominant regions and end-user industries, supported by their respective economic policies and infrastructure development, solidifies the outlook for the optocouplers market. The Industrial and Automotive segments, in particular, are poised to continue their upward trajectory, offering substantial market share and growth potential in the coming years.

Optocouplers Industry Product Landscape

The optocoupler product landscape is characterized by continuous innovation aimed at enhancing performance and expanding application capabilities. Key product advancements include the development of higher speed optocouplers, exemplified by Vishay's VOIH72A capable of 25 MBd data transmission, crucial for modern digital systems. Innovations also focus on increased isolation voltages, improved common-mode transient immunity (CMTI), and reduced power consumption, making them ideal for power-sensitive and high-voltage applications. The introduction of opto-emulators by companies like Texas Instruments, leveraging SiO2 isolation, addresses traditional limitations such as LED aging, offering greater longevity and signal integrity. These developments cater to the growing demands of the Automotive, Industrial, and Communication sectors for more robust, efficient, and reliable electronic components, driving the adoption of advanced phototransistor-based, photo TRIAC, and photo SCR optocouplers.

Key Drivers, Barriers & Challenges in Optocouplers Industry

Key Drivers: The optocouplers industry is propelled by several key forces. The relentless push for industrial automation and Industry 4.0 mandates reliable signal isolation for control systems and IIoT devices. The rapid growth of the automotive sector, particularly electric vehicles and ADAS, drives demand for high-voltage and high-speed optocouplers. Advancements in consumer electronics, such as smart home devices and LED lighting, also contribute significantly. Furthermore, the need for robust power supply isolation across various applications remains a fundamental driver.

Barriers & Challenges: Despite strong growth, the industry faces significant challenges. Competition from digital isolators poses a threat, especially in applications demanding higher speeds and tighter timing. Supply chain disruptions, as witnessed in recent years, can impact material availability and lead times, affecting production. Increasingly stringent regulatory requirements in specific sectors necessitate constant product redesign and re-certification. Price pressure, particularly from low-cost manufacturers, can challenge profit margins. Developing miniaturized optocouplers with higher isolation while maintaining cost-effectiveness is an ongoing technological hurdle.

Emerging Opportunities in Optocouplers Industry

Emerging opportunities in the optocouplers industry lie in the burgeoning fields of renewable energy and smart grid technologies. The increasing global focus on sustainable energy solutions is driving demand for optocouplers in solar inverters, wind turbine control systems, and smart grid infrastructure, where reliable power isolation and control are paramount. The continued expansion of the Internet of Things (IoT) ecosystem, encompassing smart cities, smart agriculture, and industrial IoT (IIoT), presents a vast untapped market for optocouplers in sensor networks, edge computing devices, and data acquisition systems, demanding miniaturized and low-power solutions. Furthermore, the evolution of advanced medical devices and wearable technology is creating new avenues for optocouplers that require high isolation for patient safety and signal integrity.

Growth Accelerators in the Optocouplers Industry Industry

The long-term growth of the optocouplers industry is significantly accelerated by technological breakthroughs in materials science and packaging, enabling the development of optocouplers with enhanced performance characteristics such as higher voltage ratings, faster response times, and improved resistance to harsh environments. Strategic partnerships and collaborations between optocoupler manufacturers and end-product developers, particularly in the automotive and industrial sectors, foster innovation and accelerate the adoption of new optocoupling solutions tailored to specific application needs. Market expansion strategies targeting developing economies with growing industrial and automotive sectors, coupled with localized manufacturing and support, also serve as crucial catalysts for sustained growth.

Key Players Shaping the Optocouplers Industry Market

- Shenzhen Kento Electronic Co Ltd

- Vishay Intertechnology Inc

- Skyworks Solutions Inc

- Broadcom Inc

- ON Semiconductor Corporation

- Senba Sensing Technology Co Ltd

- Renesas Electronics Corporation

- Standex Electronics Inc

- Sharp Devices Europe

- LITE-ON Technology Inc (Lite-On Technology Corporation

- Isocom Components Ltd

- Everlight Electronics Co Ltd

- Panasonic Corporation

- Toshiba Electronic Devices & Storage Corporation (Toshiba Corp )

Notable Milestones in Optocouplers Industry Sector

- May 2024: Vishay Intertechnology, Inc. launched the VOIH72A, a high-speed optocoupler with 25 MBd data transmission capability and a CMOS logic interface, designed for industrial settings with minimal pulse width distortion and low supply current.

- September 2024: Texas Instruments (TI) introduced a new range of signal isolation semiconductors, opto-emulators (ISOM8710 and ISOM8110), designed to enhance signal integrity, reduce power consumption, and extend the lifespan of high-voltage industrial and automotive applications by utilizing unique SiO2-based isolation technology to overcome LED aging issues.

In-Depth Optocouplers Industry Market Outlook

The future outlook for the optocouplers industry remains exceptionally strong, fueled by ongoing technological advancements and the persistent demand for reliable electrical isolation across critical sectors. The increasing complexity and electrification of automotive systems, the expansion of industrial automation and IIoT, and the growth in consumer electronics will continue to be primary growth accelerators. The introduction of innovative solutions like opto-emulators and higher-speed phototransistor-based optocouplers will broaden their application scope and address evolving market needs. Strategic investments in research and development, coupled with efforts to optimize supply chains and expand manufacturing capabilities, will be crucial for market players to capitalize on the projected growth. The industry is well-positioned to benefit from the global transition towards smarter, more efficient, and safer electronic systems.

Optocouplers Industry Segmentation

-

1. Product Type

- 1.1. Phototransistor-based Optocoupler

- 1.2. Optocoup

- 1.3. Optocoupler based on Photo TRIAC

- 1.4. Optocoupler with Photo SCR

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Consumer Electronics

- 2.3. Communication

- 2.4. Industrial

- 2.5. Other End-user Industries

Optocouplers Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Optocouplers Industry Regional Market Share

Geographic Coverage of Optocouplers Industry

Optocouplers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Hybrid Electric Vehicles; Increasing Industrial Automation

- 3.3. Market Restrains

- 3.3.1. Intrinsic Wear-out

- 3.4. Market Trends

- 3.4.1. Increasing Industrial Automation to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optocouplers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Phototransistor-based Optocoupler

- 5.1.2. Optocoup

- 5.1.3. Optocoupler based on Photo TRIAC

- 5.1.4. Optocoupler with Photo SCR

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics

- 5.2.3. Communication

- 5.2.4. Industrial

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Optocouplers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Phototransistor-based Optocoupler

- 6.1.2. Optocoup

- 6.1.3. Optocoupler based on Photo TRIAC

- 6.1.4. Optocoupler with Photo SCR

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Consumer Electronics

- 6.2.3. Communication

- 6.2.4. Industrial

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Optocouplers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Phototransistor-based Optocoupler

- 7.1.2. Optocoup

- 7.1.3. Optocoupler based on Photo TRIAC

- 7.1.4. Optocoupler with Photo SCR

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Consumer Electronics

- 7.2.3. Communication

- 7.2.4. Industrial

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Optocouplers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Phototransistor-based Optocoupler

- 8.1.2. Optocoup

- 8.1.3. Optocoupler based on Photo TRIAC

- 8.1.4. Optocoupler with Photo SCR

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Consumer Electronics

- 8.2.3. Communication

- 8.2.4. Industrial

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia and New Zealand Optocouplers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Phototransistor-based Optocoupler

- 9.1.2. Optocoup

- 9.1.3. Optocoupler based on Photo TRIAC

- 9.1.4. Optocoupler with Photo SCR

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Consumer Electronics

- 9.2.3. Communication

- 9.2.4. Industrial

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Optocouplers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Phototransistor-based Optocoupler

- 10.1.2. Optocoup

- 10.1.3. Optocoupler based on Photo TRIAC

- 10.1.4. Optocoupler with Photo SCR

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Consumer Electronics

- 10.2.3. Communication

- 10.2.4. Industrial

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Optocouplers Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Phototransistor-based Optocoupler

- 11.1.2. Optocoup

- 11.1.3. Optocoupler based on Photo TRIAC

- 11.1.4. Optocoupler with Photo SCR

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Automotive

- 11.2.2. Consumer Electronics

- 11.2.3. Communication

- 11.2.4. Industrial

- 11.2.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Shenzhen Kento Electronic Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Vishay Intertechnology Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Skyworks Solutions Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Broadcom Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 ON Semiconductor Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Senba Sensing Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Renesas Electronics Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Standex Electronics Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sharp Devices Europe

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 LITE-ON Technology Inc (Lite-On Technology Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Isocom Components Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Everlight Electronics Co Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Panasonic Corporation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Toshiba Electronic Devices & Storage Corporation (Toshiba Corp )

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Shenzhen Kento Electronic Co Ltd

List of Figures

- Figure 1: Global Optocouplers Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Optocouplers Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Optocouplers Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Optocouplers Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Optocouplers Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Optocouplers Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Optocouplers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Optocouplers Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Optocouplers Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Optocouplers Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Optocouplers Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Optocouplers Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Optocouplers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Optocouplers Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Optocouplers Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Optocouplers Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Optocouplers Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Optocouplers Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Optocouplers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Optocouplers Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Australia and New Zealand Optocouplers Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Australia and New Zealand Optocouplers Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Australia and New Zealand Optocouplers Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Australia and New Zealand Optocouplers Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Optocouplers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Optocouplers Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Latin America Optocouplers Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Latin America Optocouplers Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Latin America Optocouplers Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Latin America Optocouplers Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Optocouplers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Optocouplers Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 33: Middle East and Africa Optocouplers Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Middle East and Africa Optocouplers Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Middle East and Africa Optocouplers Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Optocouplers Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Optocouplers Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Optocouplers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Optocouplers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Optocouplers Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Optocouplers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Optocouplers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Optocouplers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Optocouplers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Optocouplers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Optocouplers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Optocouplers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Optocouplers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Optocouplers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Optocouplers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Optocouplers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Optocouplers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Optocouplers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Optocouplers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Optocouplers Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Optocouplers Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Optocouplers Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Optocouplers Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optocouplers Industry?

The projected CAGR is approximately 8.99%.

2. Which companies are prominent players in the Optocouplers Industry?

Key companies in the market include Shenzhen Kento Electronic Co Ltd, Vishay Intertechnology Inc, Skyworks Solutions Inc, Broadcom Inc, ON Semiconductor Corporation, Senba Sensing Technology Co Ltd, Renesas Electronics Corporation, Standex Electronics Inc, Sharp Devices Europe, LITE-ON Technology Inc (Lite-On Technology Corporation, Isocom Components Ltd, Everlight Electronics Co Ltd, Panasonic Corporation, Toshiba Electronic Devices & Storage Corporation (Toshiba Corp ).

3. What are the main segments of the Optocouplers Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Hybrid Electric Vehicles; Increasing Industrial Automation.

6. What are the notable trends driving market growth?

Increasing Industrial Automation to Drive the Market.

7. Are there any restraints impacting market growth?

Intrinsic Wear-out.

8. Can you provide examples of recent developments in the market?

May 2024 - Vishay Intertechnology, Inc. has introduced a new high-speed optocoupler, the VOIH72A, capable of transmitting data at 25 MBd. It includes a CMOS logic interface for digital input and output to make integration into digital systems easier. Created for use in industrial settings, this product provides a minimal 6 ns maximum pulse width distortion and requires only 2 mA of supply current. It can operate at voltages ranging from 2.7V to 5.5V and temperatures up to +110°C. The optocoupler includes CMOS logic for its digital input and output, allowing for a high-speed data rate of 25 MBd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optocouplers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optocouplers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optocouplers Industry?

To stay informed about further developments, trends, and reports in the Optocouplers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence