Key Insights

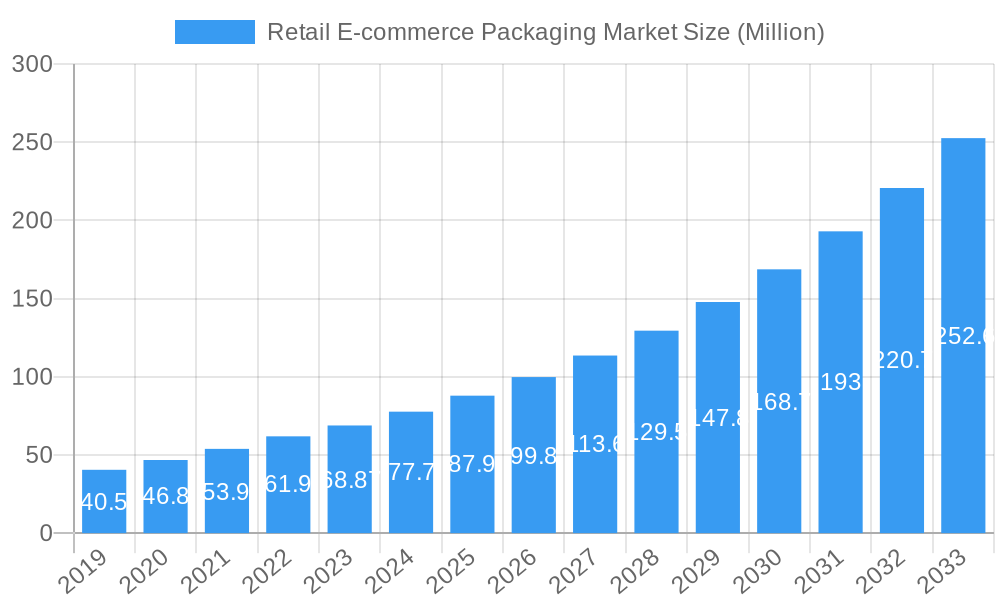

The Retail E-commerce Packaging Market is experiencing robust growth, currently valued at approximately $68.87 million, with an impressive Compound Annual Growth Rate (CAGR) of 13.83%. This dynamic expansion is primarily fueled by the escalating global adoption of online shopping, a trend significantly accelerated by recent lifestyle shifts and technological advancements. Consumers are increasingly prioritizing convenience, speed, and sustainability in their purchasing journey, placing greater demand on effective and environmentally conscious packaging solutions. Key drivers include the continuous innovation in packaging materials, such as the development of lightweight, durable, and recyclable options, alongside the increasing integration of smart packaging technologies for enhanced traceability and consumer engagement. Furthermore, the burgeoning expansion of the e-commerce sector across emerging economies, coupled with the diversification of product categories sold online, from electronics to perishable goods, is creating substantial opportunities for packaging manufacturers. The market's trajectory is set to witness sustained upward momentum as e-commerce penetration continues to deepen across all consumer segments and geographic regions.

Retail E-commerce Packaging Market Market Size (In Million)

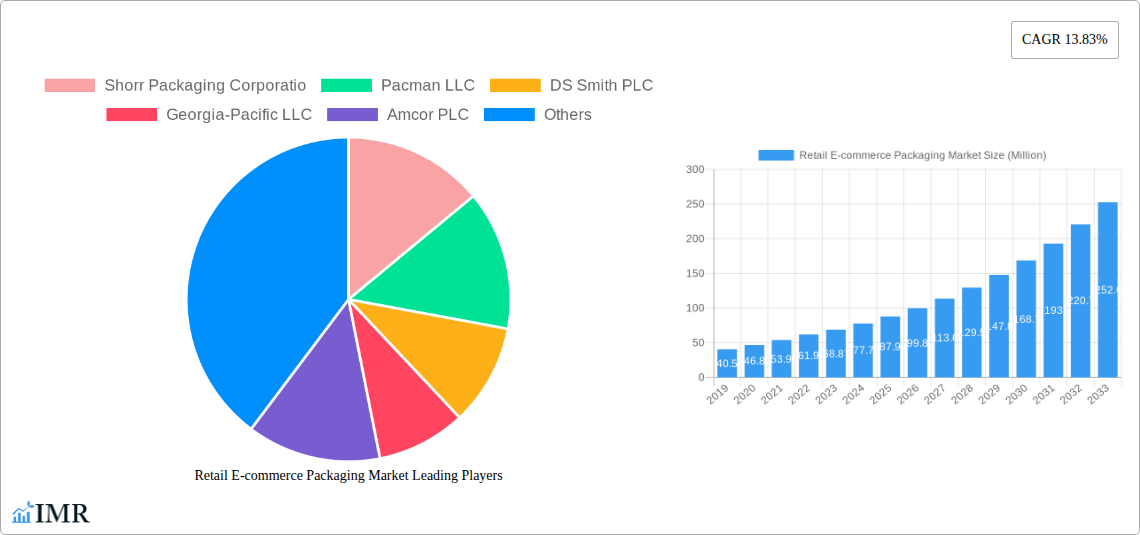

The market's segmentation reveals distinct patterns of demand. In terms of material type, plastic packaging continues to hold a significant share due to its versatility and cost-effectiveness, though corrugated and paper-based alternatives are gaining substantial traction due to growing environmental concerns and regulatory pressures favoring sustainable solutions. The "Other Materials" segment is also poised for growth with the introduction of biodegradable and compostable options. From an end-user perspective, the Fashion and Apparel sector remains a dominant force, but the Food and Beverages and Consumer Electronics segments are experiencing particularly rapid growth, driven by the expansion of online grocery delivery services and the increasing popularity of direct-to-consumer electronics sales. Restraints such as rising raw material costs and complex supply chain logistics are being actively addressed through technological advancements and strategic partnerships. Major players like Smurfit Kappa Group, Amcor PLC, and DS Smith PLC are at the forefront of innovation, investing heavily in research and development to meet the evolving needs of the e-commerce landscape and capitalize on its expansive growth potential.

Retail E-commerce Packaging Market Company Market Share

This comprehensive report delves deep into the Retail E-commerce Packaging Market, a dynamic and rapidly expanding sector crucial for the success of online retail. Analyzing the market from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025–2033, this study provides unparalleled insights into market size, growth trajectories, competitive landscapes, and future opportunities. We present all values in Million Units for clear quantitative understanding.

This report offers critical intelligence for manufacturers, suppliers, investors, and industry stakeholders seeking to navigate and capitalize on the burgeoning e-commerce packaging demand. It dissects parent and child markets to provide a holistic view, ensuring maximum strategic advantage.

Retail E-commerce Packaging Market Dynamics & Structure

The Retail E-commerce Packaging Market exhibits a moderately consolidated structure, characterized by the presence of large multinational corporations and a growing number of regional and specialized players. Technological innovation remains a primary driver, with a continuous push towards sustainable materials, smart packaging solutions, and optimized designs that enhance unboxing experiences and reduce shipping costs. Regulatory frameworks, particularly those focusing on environmental sustainability and single-use plastic reduction, are increasingly shaping material choices and product development. Competitive product substitutes are abundant, ranging from traditional cardboard boxes to innovative molded pulp and biodegradable plastics, intensifying the need for differentiation. End-user demographics are diverse, with a significant influence from younger, digitally-native consumers who prioritize convenience, aesthetics, and eco-friendliness. Mergers and acquisitions (M&A) are active, with companies seeking to expand their geographic reach, diversify their product portfolios, and integrate supply chains. For instance, the last five years have seen an estimated 50+ significant M&A deals in the broader packaging industry, with a growing focus on e-commerce specific solutions. Innovation barriers include high development costs for novel materials and the need for extensive testing to ensure product protection throughout the complex e-commerce supply chain.

- Market Concentration: Moderately consolidated with key global players holding substantial market share.

- Technological Innovation Drivers: Sustainability, enhanced consumer experience, cost optimization, and automation in fulfillment.

- Regulatory Frameworks: Increasing emphasis on recyclability, biodegradability, and waste reduction mandates.

- Competitive Product Substitutes: A wide array, from traditional corrugated to advanced bio-plastics and reusable packaging.

- End-User Demographics: Growing influence of environmentally conscious and experience-seeking consumers.

- M&A Trends: Strategic acquisitions to broaden product lines and market presence.

- Innovation Barriers: R&D investment, material validation, and scalability of new technologies.

Retail E-commerce Packaging Market Growth Trends & Insights

The Retail E-commerce Packaging Market is experiencing robust growth, fueled by the persistent surge in online retail sales across the globe. From a market size of approximately 12,500 Million Units in 2019, it is projected to reach an estimated 20,500 Million Units by 2025, demonstrating a significant upward trajectory. This expansion is driven by an increasing adoption rate of e-commerce by consumers of all demographics, further accelerated by events and trends that necessitate remote shopping. Technological disruptions are continuously reshaping the industry, with advancements in material science leading to the development of lighter, stronger, and more sustainable packaging solutions. The shift towards a circular economy is a prominent theme, prompting greater investment in recycled content and recyclability. Consumer behavior has fundamentally shifted, with online shoppers now expecting not only swift delivery but also a premium unboxing experience, influencing packaging design and functionality. Brands are increasingly leveraging packaging as a key touchpoint for brand storytelling and customer engagement, moving beyond mere protection. The Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is anticipated to be between 7.5% and 8.8%, indicating sustained high growth. Market penetration of specialized e-commerce packaging solutions, such as customizable mailers and protective inserts, is expected to rise significantly as businesses optimize their logistics and customer satisfaction metrics. The integration of smart technologies for traceability and inventory management within packaging is another emerging trend gaining traction.

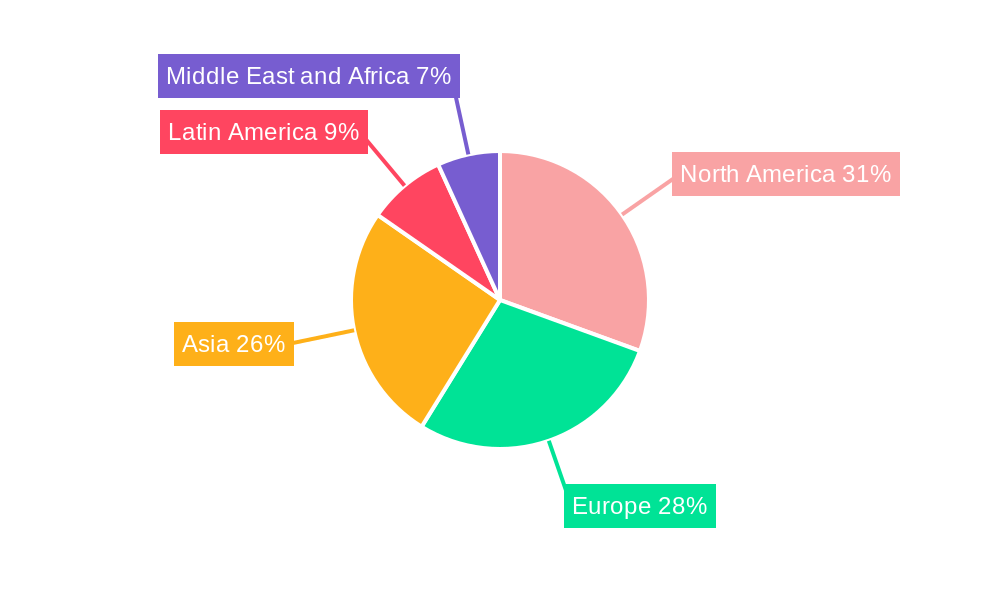

Dominant Regions, Countries, or Segments in Retail E-commerce Packaging Market

The Corrugated material type is currently the dominant segment within the Retail E-commerce Packaging Market, largely due to its inherent strength, versatility, recyclability, and cost-effectiveness. This segment is projected to account for over 55% of the total market volume by 2025, valued at approximately 11,275 Million Units. North America and Europe are the leading regions, driven by their mature e-commerce markets, robust logistics infrastructure, and stringent environmental regulations that favor sustainable packaging solutions.

Dominant Segment (Material Type): Corrugated packaging, with its excellent protective qualities and sustainability credentials, continues to lead the market.

- Key Drivers: High strength-to-weight ratio, cost-effectiveness, widespread availability of recycled content, and ease of customization for shipping needs.

- Growth Potential: Continued innovation in lighter-weight corrugated grades and enhanced printing capabilities for branding.

Dominant End User: The Fashion and Apparel segment is a significant growth engine for e-commerce packaging.

- Key Drivers: High volume of online purchases, demand for visually appealing and brand-expressive packaging, and a growing trend towards sustainable and re-usable fashion packaging.

- Market Share: Estimated to represent over 25% of the total e-commerce packaging market by 2025.

Leading Region: North America.

- Key Drivers: Well-established e-commerce infrastructure, high consumer spending on online retail, and proactive adoption of sustainable packaging solutions driven by both consumer demand and regulatory initiatives.

- Market Size (2025): Expected to reach around 5,000 Million Units.

Leading Country: The United States, within North America, consistently leads due to its vast consumer base and advanced online retail ecosystem.

Retail E-commerce Packaging Market Product Landscape

The product landscape of the Retail E-commerce Packaging Market is characterized by a surge in innovative solutions designed to enhance protection, sustainability, and the unboxing experience. From highly customizable corrugated mailers that perfectly fit product dimensions to biodegradable pouches and void-fill materials made from recycled paper, product development is intensely focused on minimizing material usage while maximizing performance. Amcor PLC's advancements in flexible e-commerce packaging, offering lightweight and durable alternatives to rigid formats, and Mondi PLC's focus on sustainable paper-based solutions for online grocery are notable. The performance metrics being optimized include puncture resistance, cushioning properties, moisture barrier capabilities, and ease of opening and disposal. Unique selling propositions often revolve around the integration of eco-friendly materials, smart design for optimized shipping density, and aesthetic appeal that reinforces brand identity, driving consumer loyalty.

Key Drivers, Barriers & Challenges in Retail E-commerce Packaging Market

Key Drivers: The exponential growth of e-commerce, coupled with increasing consumer demand for sustainable and convenient packaging, are the primary forces propelling the Retail E-commerce Packaging Market. Technological advancements in material science, enabling lighter, stronger, and more eco-friendly packaging, also act as significant accelerators. Furthermore, supportive government policies promoting recycling and waste reduction, alongside strategic investments by key players in innovation and capacity expansion, are crucial drivers.

Barriers & Challenges: Supply chain disruptions, including raw material price volatility and transportation logistics complexities, pose significant challenges. Stringent regulatory hurdles related to packaging waste and material composition in different regions can also create barriers. Intense competitive pressures among packaging manufacturers, leading to price sensitivity, and the high initial investment required for implementing advanced, sustainable packaging solutions are further restraints. The need for continuous innovation to meet evolving consumer expectations and the costs associated with re-tooling manufacturing processes also present hurdles.

Emerging Opportunities in Retail E-commerce Packaging Market

Emerging opportunities within the Retail E-commerce Packaging Market lie in the development and adoption of reusable packaging systems for subscription services and closed-loop delivery models. The increasing demand for personalized and premium unboxing experiences presents opportunities for innovative structural designs, custom printing, and integrated sensory elements. Untapped markets in developing economies with rapidly growing e-commerce penetration offer significant growth potential. Furthermore, the integration of smart packaging solutions for enhanced traceability, anti-counterfeiting, and consumer engagement through QR codes or NFC tags represents a nascent but promising avenue. The expansion of specialized packaging for niche e-commerce sectors like fresh food delivery and pharmaceuticals, requiring specific barrier properties and temperature control, is also a key area for growth.

Growth Accelerators in the Retail E-commerce Packaging Market Industry

Growth in the Retail E-commerce Packaging Market is being significantly accelerated by technological breakthroughs in sustainable material development, such as advanced bioplastics and compostable fibers, which address growing environmental concerns. Strategic partnerships between packaging manufacturers and e-commerce platforms or major retailers are fostering innovation and ensuring wider adoption of new packaging solutions. Market expansion strategies, including geographical diversification into emerging economies and the development of specialized packaging tailored to specific product categories, are also key catalysts. The continuous drive for operational efficiency through automation in packaging design and production, leading to cost reductions and faster turnaround times, further fuels long-term growth.

Key Players Shaping the Retail E-commerce Packaging Market Market

- Shorr Packaging Corporation

- Pacman LLC

- DS Smith PLC

- Georgia-Pacific LLC

- Amcor PLC

- Mondi PLC

- Rengo Co Ltd

- International Paper Company

- Smurfit Kappa Group PLC

- Nippon Paper Industries Co Ltd

- Sealed Air Corporation

- Klabin SA

Notable Milestones in Retail E-commerce Packaging Market Sector

- 2022: Smurfit Kappa Group PLC launches a new range of sustainable e-commerce packaging solutions designed for enhanced recyclability and reduced material usage.

- 2023: Amcor PLC introduces advanced flexible packaging solutions for e-commerce, offering superior protection with a significantly reduced carbon footprint.

- 2023: Mondi PLC expands its portfolio of paper-based e-commerce packaging, focusing on solutions for the growing online grocery market.

- 2024: DS Smith PLC announces significant investments in innovative corrugated packaging designs to improve shipping efficiency and reduce void fill for e-commerce shipments.

- 2024: Sealed Air Corporation develops new cushioning materials derived from recycled sources, enhancing sustainability in their e-commerce packaging offerings.

In-Depth Retail E-commerce Packaging Market Market Outlook

The Retail E-commerce Packaging Market is poised for sustained and robust growth, driven by fundamental shifts in consumer behavior and the ongoing expansion of online retail. Future market potential is significantly enhanced by the increasing demand for sustainable and circular packaging solutions, creating opportunities for material innovation and the adoption of reusable systems. Strategic opportunities abound for companies that can effectively leverage technological advancements to offer smart, customized, and environmentally responsible packaging. The continued globalization of e-commerce will also drive demand in emerging markets, requiring adaptable and scalable packaging solutions. The industry's trajectory indicates a strong focus on reducing waste, enhancing consumer experience, and optimizing supply chain efficiency, all of which will shape the future competitive landscape and innovation priorities.

Retail E-commerce Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Corrugated

- 1.3. Paper

- 1.4. Other Materials

-

2. End User

- 2.1. Fashion and Apparel

- 2.2. Consumer Electronics

- 2.3. Food and Beverages

- 2.4. Personal Care Products

- 2.5. Other End Users

Retail E-commerce Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. India

- 3.2. China

- 3.3. Japan

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

Retail E-commerce Packaging Market Regional Market Share

Geographic Coverage of Retail E-commerce Packaging Market

Retail E-commerce Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Proliferation of Online Retailing and Emergence of Omni-channel Presence; Rising Usage of Lightweight Flexible Packaging; Increasing Biodegradable Plastic Packaging for Online Retail

- 3.3. Market Restrains

- 3.3.1. Trust and Security Concerns may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail E-commerce Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Corrugated

- 5.1.3. Paper

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Fashion and Apparel

- 5.2.2. Consumer Electronics

- 5.2.3. Food and Beverages

- 5.2.4. Personal Care Products

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Retail E-commerce Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.2. Corrugated

- 6.1.3. Paper

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Fashion and Apparel

- 6.2.2. Consumer Electronics

- 6.2.3. Food and Beverages

- 6.2.4. Personal Care Products

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Retail E-commerce Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.2. Corrugated

- 7.1.3. Paper

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Fashion and Apparel

- 7.2.2. Consumer Electronics

- 7.2.3. Food and Beverages

- 7.2.4. Personal Care Products

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Retail E-commerce Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.2. Corrugated

- 8.1.3. Paper

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Fashion and Apparel

- 8.2.2. Consumer Electronics

- 8.2.3. Food and Beverages

- 8.2.4. Personal Care Products

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Retail E-commerce Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.2. Corrugated

- 9.1.3. Paper

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Fashion and Apparel

- 9.2.2. Consumer Electronics

- 9.2.3. Food and Beverages

- 9.2.4. Personal Care Products

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Retail E-commerce Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastic

- 10.1.2. Corrugated

- 10.1.3. Paper

- 10.1.4. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Fashion and Apparel

- 10.2.2. Consumer Electronics

- 10.2.3. Food and Beverages

- 10.2.4. Personal Care Products

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shorr Packaging Corporatio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pacman LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DS Smith PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Georgia-Pacific LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amcor PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondi PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rengo Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Paper Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Smurfit Kappa Group PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nippon Paper Industries Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sealed Air Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Klabin SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Shorr Packaging Corporatio

List of Figures

- Figure 1: Global Retail E-commerce Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Retail E-commerce Packaging Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Retail E-commerce Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 4: North America Retail E-commerce Packaging Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 5: North America Retail E-commerce Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Retail E-commerce Packaging Market Volume Share (%), by Material Type 2025 & 2033

- Figure 7: North America Retail E-commerce Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 8: North America Retail E-commerce Packaging Market Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Retail E-commerce Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Retail E-commerce Packaging Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Retail E-commerce Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Retail E-commerce Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Retail E-commerce Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Retail E-commerce Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Retail E-commerce Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 16: Europe Retail E-commerce Packaging Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 17: Europe Retail E-commerce Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Europe Retail E-commerce Packaging Market Volume Share (%), by Material Type 2025 & 2033

- Figure 19: Europe Retail E-commerce Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Europe Retail E-commerce Packaging Market Volume (K Unit), by End User 2025 & 2033

- Figure 21: Europe Retail E-commerce Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Retail E-commerce Packaging Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Retail E-commerce Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Retail E-commerce Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Retail E-commerce Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Retail E-commerce Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Retail E-commerce Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 28: Asia Retail E-commerce Packaging Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 29: Asia Retail E-commerce Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Asia Retail E-commerce Packaging Market Volume Share (%), by Material Type 2025 & 2033

- Figure 31: Asia Retail E-commerce Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 32: Asia Retail E-commerce Packaging Market Volume (K Unit), by End User 2025 & 2033

- Figure 33: Asia Retail E-commerce Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Retail E-commerce Packaging Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Retail E-commerce Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Retail E-commerce Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Retail E-commerce Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Retail E-commerce Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Retail E-commerce Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 40: Latin America Retail E-commerce Packaging Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 41: Latin America Retail E-commerce Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 42: Latin America Retail E-commerce Packaging Market Volume Share (%), by Material Type 2025 & 2033

- Figure 43: Latin America Retail E-commerce Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Latin America Retail E-commerce Packaging Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Latin America Retail E-commerce Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Latin America Retail E-commerce Packaging Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Latin America Retail E-commerce Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Retail E-commerce Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Retail E-commerce Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Retail E-commerce Packaging Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Retail E-commerce Packaging Market Revenue (Million), by Material Type 2025 & 2033

- Figure 52: Middle East and Africa Retail E-commerce Packaging Market Volume (K Unit), by Material Type 2025 & 2033

- Figure 53: Middle East and Africa Retail E-commerce Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 54: Middle East and Africa Retail E-commerce Packaging Market Volume Share (%), by Material Type 2025 & 2033

- Figure 55: Middle East and Africa Retail E-commerce Packaging Market Revenue (Million), by End User 2025 & 2033

- Figure 56: Middle East and Africa Retail E-commerce Packaging Market Volume (K Unit), by End User 2025 & 2033

- Figure 57: Middle East and Africa Retail E-commerce Packaging Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: Middle East and Africa Retail E-commerce Packaging Market Volume Share (%), by End User 2025 & 2033

- Figure 59: Middle East and Africa Retail E-commerce Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Retail E-commerce Packaging Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Retail E-commerce Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Retail E-commerce Packaging Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 3: Global Retail E-commerce Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 8: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 9: Global Retail E-commerce Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 18: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 19: Global Retail E-commerce Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 21: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Germany Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 30: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 31: Global Retail E-commerce Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 33: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: India Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: India Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: China Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: China Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Japan Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Japan Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 42: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 43: Global Retail E-commerce Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 45: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 47: Brazil Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Brazil Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Argentina Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Argentina Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 52: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Material Type 2020 & 2033

- Table 53: Global Retail E-commerce Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 54: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 55: Global Retail E-commerce Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Retail E-commerce Packaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 57: United Arab Emirates Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: United Arab Emirates Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Africa Retail E-commerce Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Retail E-commerce Packaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail E-commerce Packaging Market?

The projected CAGR is approximately 13.83%.

2. Which companies are prominent players in the Retail E-commerce Packaging Market?

Key companies in the market include Shorr Packaging Corporatio, Pacman LLC, DS Smith PLC, Georgia-Pacific LLC, Amcor PLC, Mondi PLC, Rengo Co Ltd, International Paper Company, Smurfit Kappa Group PLC, Nippon Paper Industries Co Ltd, Sealed Air Corporation, Klabin SA.

3. What are the main segments of the Retail E-commerce Packaging Market?

The market segments include Material Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 68.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Proliferation of Online Retailing and Emergence of Omni-channel Presence; Rising Usage of Lightweight Flexible Packaging; Increasing Biodegradable Plastic Packaging for Online Retail.

6. What are the notable trends driving market growth?

Consumer Electronics Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Trust and Security Concerns may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail E-commerce Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail E-commerce Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail E-commerce Packaging Market?

To stay informed about further developments, trends, and reports in the Retail E-commerce Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence