Key Insights

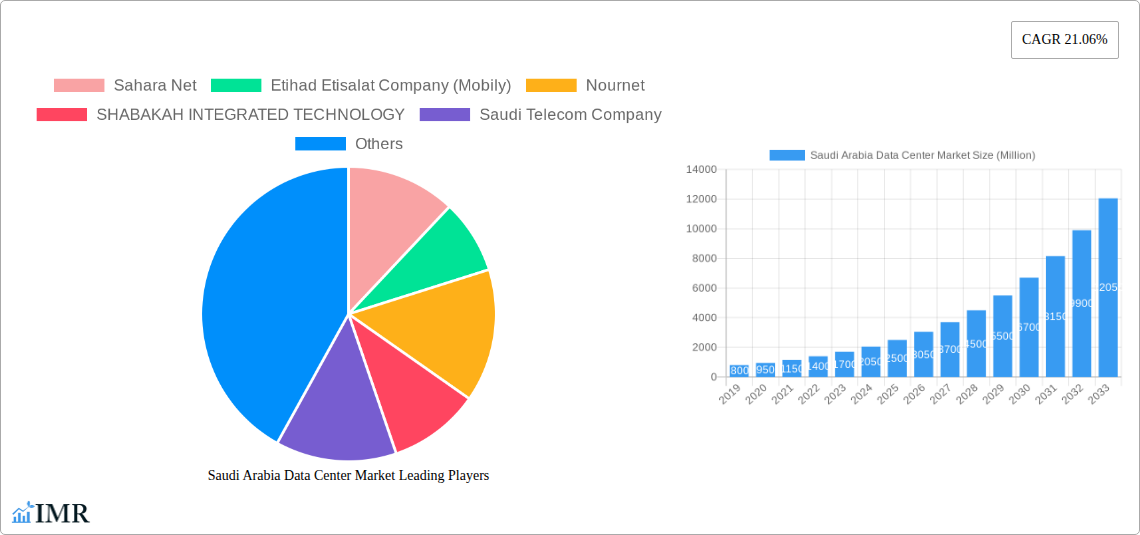

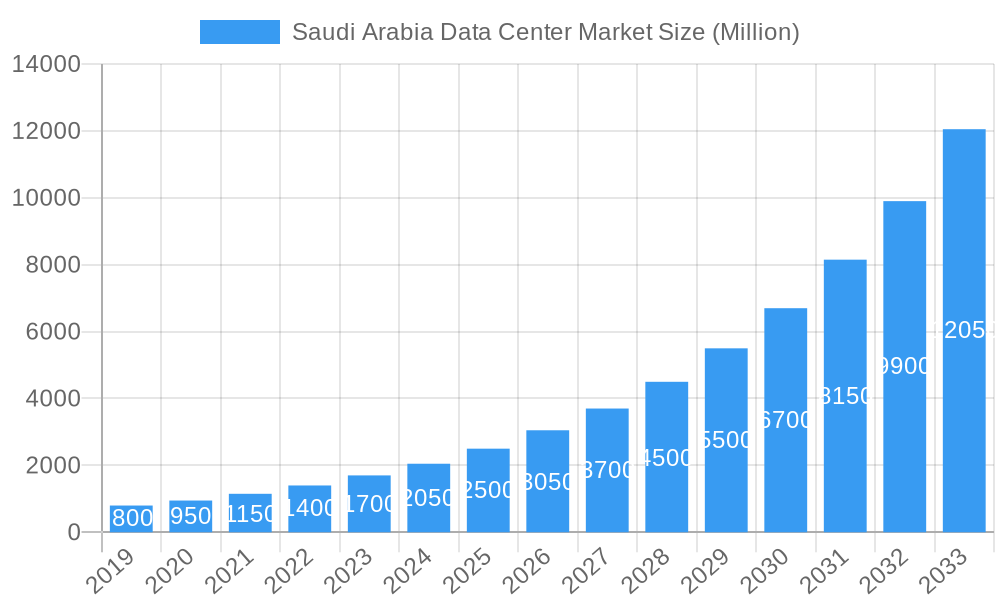

The Saudi Arabia Data Center Market is poised for substantial expansion, driven by a confluence of escalating digital transformation initiatives and the Kingdom's ambitious Vision 2030 economic diversification plan. With an estimated market size of USD 2,500 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 21.06% through 2033, the market is set to witness remarkable value appreciation. Key growth drivers include the burgeoning demand for cloud computing services, the rapid adoption of 5G technology, and the increasing need for robust data infrastructure to support emerging technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). Furthermore, significant government investment in digital infrastructure and a strategic focus on attracting foreign direct investment in the technology sector are creating a fertile ground for data center development. The market is witnessing a pronounced trend towards the construction of large and mega-sized facilities to cater to the growing needs of hyperscale cloud providers and enterprise clients. Riyadh, as the capital and economic hub, is leading the charge in data center deployment, followed by other key regions within Saudi Arabia.

Saudi Arabia Data Center Market Market Size (In Million)

The market dynamics are further shaped by a growing demand for colocation services, particularly hyperscale and wholesale models, as businesses increasingly opt to outsource their data infrastructure management. This trend is fueled by the BFSI, E-Commerce, Government, and Telecom sectors, which are investing heavily in digital solutions and require reliable, scalable, and secure data storage and processing capabilities. However, challenges such as the high capital expenditure associated with establishing large-scale data centers and the need for a highly skilled workforce can present moderate restraints. Emerging trends like the focus on sustainable data center operations and the integration of advanced cooling technologies are also gaining traction, reflecting a commitment to environmental responsibility. The competitive landscape is characterized by the presence of key players like Saudi Telecom Company, Mobily, and Gulf Data Hub, all actively expanding their footprints and service offerings to capitalize on this high-growth market.

Saudi Arabia Data Center Market Company Market Share

Saudi Arabia Data Center Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Saudi Arabia Data Center Market, offering critical insights into its rapid evolution and future trajectory. Spanning the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand market dynamics, growth trends, and investment opportunities. We meticulously dissect the market by colocation type (hyperscale, retail, wholesale), data center size (small to mega), tier type (Tier 1, 2, 3, 4), and absorption levels, while examining key end-user segments including BFSI, Cloud, E-Commerce, Government, Manufacturing, Media & Entertainment, and Telecom. Explore regional dynamics, technological advancements, regulatory landscapes, and the competitive strategies of leading players like Saudi Telecom Company (STC), Sahara Net, Mobily, and Gulf Data Hub.

Saudi Arabia Data Center Market Market Dynamics & Structure

The Saudi Arabia Data Center Market is characterized by a dynamic interplay of factors driving its robust expansion. Market concentration is gradually shifting with the emergence of hyperscale facilities, yet a fragmented landscape of smaller providers caters to niche demands. Technological innovation is a primary driver, fueled by the Kingdom's Vision 2030 objectives and a burgeoning digital economy. Regulatory frameworks are evolving to support data localization and attract foreign investment, creating a more favorable environment for data center development. Competitive product substitutes are minimal, with the focus being on enhancing existing colocation, cloud, and managed services. End-user demographics are increasingly sophisticated, demanding higher levels of reliability, scalability, and security. Mergers and acquisitions (M&A) are on the rise as established players seek to consolidate market share and expand their service offerings. For instance, the separation of Saudi Telecom Company's data center business into a new subsidiary signals a strategic move towards greater focus and potential for future growth through partnerships or acquisitions.

- Market Concentration: Increasing dominance of hyperscale providers alongside a diverse range of smaller players.

- Technological Innovation: Driven by AI, cloud computing adoption, and the need for advanced digital infrastructure.

- Regulatory Frameworks: Evolving policies promoting data localization and cybersecurity.

- End-User Demographics: Growing demand for sophisticated, scalable, and secure data solutions across all sectors.

- M&A Trends: Active consolidation and strategic partnerships to enhance market presence.

Saudi Arabia Data Center Market Growth Trends & Insights

The Saudi Arabia Data Center Market is poised for exceptional growth, projected to expand at a significant CAGR (Compound Annual Growth Rate) throughout the forecast period. This expansion is underpinned by a confluence of factors including substantial government investment in digital transformation, the rapid adoption of cloud services across enterprises, and the burgeoning e-commerce sector. The increasing demand for data-intensive applications, such as Artificial Intelligence (AI) and Internet of Things (IoT), necessitates the development of more advanced and scalable data center infrastructure. Market penetration is deepening as businesses of all sizes recognize the strategic imperative of robust data management and processing capabilities. Technological disruptions, including advancements in cooling technologies, power efficiency, and high-density computing, are further shaping the market landscape, enabling the deployment of more powerful and sustainable data centers. Consumer behavior shifts towards digital-first interactions are directly translating into increased data consumption and, consequently, a higher demand for data center capacity. The Kingdom's commitment to diversifying its economy away from oil, with Vision 2030 at its core, is a monumental catalyst, fostering an environment ripe for digital innovation and the expansion of its data center ecosystem. This projected growth is not merely incremental; it represents a fundamental transformation of Saudi Arabia's digital infrastructure, positioning it as a regional hub for data and cloud services. The projected market size evolution indicates a sustained upward trend, with significant investments anticipated in both greenfield developments and the expansion of existing facilities to accommodate future demand.

Dominant Regions, Countries, or Segments in Saudi Arabia Data Center Market

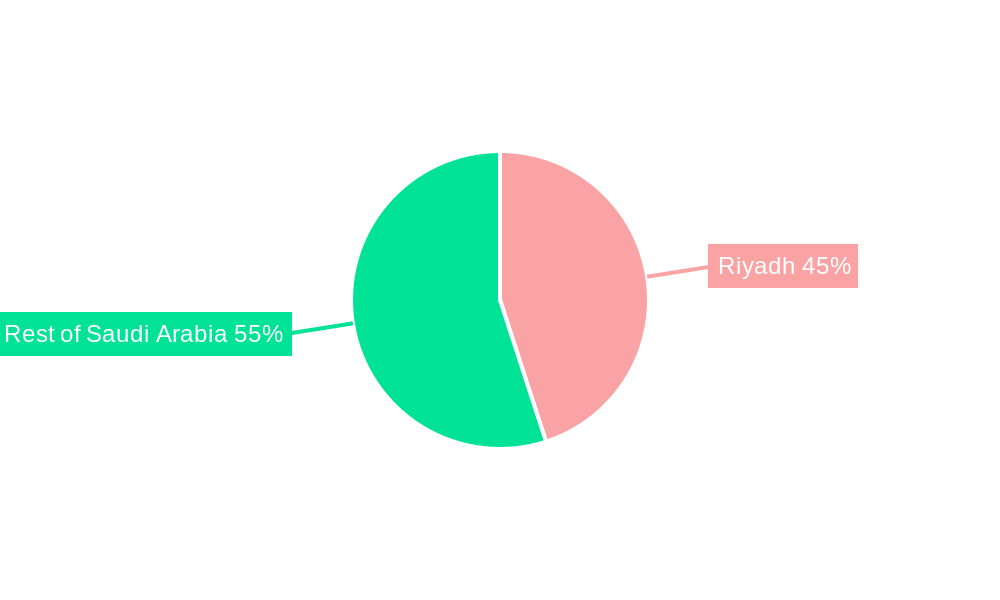

Riyadh, as the capital and economic heart of Saudi Arabia, emerges as the dominant Hotspot within the data center market, driven by its concentration of government entities, major corporations, and a rapidly growing tech startup ecosystem. Its strategic importance is amplified by its central location and robust connectivity, making it the preferred choice for hyperscale deployments and enterprise data centers. The "Rest of Saudi Arabia" also presents significant growth potential, particularly in key industrial and commercial hubs like Jeddah and Dammam, as these regions develop their digital infrastructure to support economic diversification initiatives.

In terms of Data Center Size, the "Mega" and "Large" segments are witnessing the most substantial growth, fueled by hyperscale cloud providers and large enterprises requiring vast amounts of computing power and storage. This trend is directly linked to the increasing adoption of cloud computing and the demand for high-performance computing capabilities.

The market is increasingly gravitating towards higher Tier Types, with a strong emphasis on Tier 3 and Tier 4 facilities. This preference stems from the critical need for high availability, fault tolerance, and business continuity, especially among BFSI and Government end-users who cannot afford any downtime.

Colocation Type is seeing a clear shift towards "Hyperscale" colocation as major cloud providers establish or expand their presence in the Kingdom. "Wholesale" colocation also plays a crucial role in catering to the needs of large enterprises, while "Retail" colocation serves the smaller businesses and startups requiring flexible and scalable solutions.

Across End User segments, "Cloud" services are the primary growth engine, necessitating the infrastructure that data centers provide. The "Government" sector is a significant contributor, driven by digital transformation initiatives and the need for secure data storage and processing. "BFSI" and "E-Commerce" are also key drivers, with increasing digital transactions and online services demanding robust data center capabilities.

- Hotspot Dominance: Riyadh leads due to its concentration of businesses, government, and talent.

- Data Center Size Expansion: Mega and Large facilities are leading growth to support hyperscale and enterprise needs.

- Tier Type Preference: Strong demand for Tier 3 and Tier 4 for enhanced reliability and uptime.

- Colocation Evolution: Hyperscale colocation is a primary growth driver, supported by wholesale and retail.

- End-User Segment Growth: Cloud, Government, BFSI, and E-Commerce are key demand generators.

Saudi Arabia Data Center Market Product Landscape

The Saudi Arabia Data Center Market product landscape is characterized by innovation focused on efficiency, scalability, and sustainability. Key product developments include advanced cooling solutions, such as liquid cooling and free cooling systems, designed to manage the heat generated by high-density computing environments and reduce energy consumption. High-performance computing (HPC) servers, designed for complex data analysis and AI workloads, are becoming increasingly prevalent. Furthermore, advancements in modular data center designs offer rapid deployment and scalability, catering to the dynamic needs of the market. Innovations in power management, including uninterruptible power supplies (UPS) and intelligent power distribution units (PDUs), are crucial for ensuring continuous operations. Cybersecurity solutions are also a critical component, with a focus on advanced threat detection and prevention systems. The performance metrics emphasize lower latency, higher processing speeds, and enhanced energy efficiency, with unique selling propositions revolving around reliability, cost-effectiveness, and the ability to support cutting-edge digital technologies.

Key Drivers, Barriers & Challenges in Saudi Arabia Data Center Market

Key Drivers: The primary forces propelling the Saudi Arabia Data Center Market include the Kingdom's ambitious Vision 2030, which emphasizes digital transformation and economic diversification, leading to substantial investments in cloud computing and IT infrastructure. The rapid adoption of digital services across sectors like BFSI, e-commerce, and government is creating an insatiable demand for data storage and processing. Furthermore, growing investments in AI, IoT, and big data analytics are necessitating the deployment of advanced data center facilities. Government initiatives promoting data localization and cloud adoption also serve as significant drivers.

Barriers & Challenges: Supply chain disruptions and the availability of skilled labor pose significant challenges to the rapid expansion of the data center market. Regulatory hurdles, while evolving, can sometimes create complexities in project development and operation. Intense competitive pressures among local and international players necessitate continuous innovation and cost optimization. The high initial capital expenditure required for building and maintaining data centers can also be a barrier for smaller entities. Moreover, ensuring energy efficiency and sustainability in the face of increasing power demands is a critical challenge that requires innovative solutions.

Emerging Opportunities in Saudi Arabia Data Center Market

Emerging opportunities in the Saudi Arabia Data Center Market are abundant, driven by the nation's forward-looking economic agenda. The burgeoning demand for specialized cloud services, such as private and hybrid cloud solutions tailored for specific industries like healthcare and manufacturing, presents a significant untapped market. The development of edge data centers to support the proliferation of IoT devices and real-time data processing in remote areas is another promising avenue. Furthermore, the increasing focus on artificial intelligence and machine learning applications creates opportunities for data centers equipped with high-performance computing capabilities and specialized AI infrastructure. The Kingdom's ambition to become a regional hub for digital services also opens doors for international colocation providers and hyperscalers to expand their footprint.

Growth Accelerators in the Saudi Arabia Data Center Market Industry

Several key catalysts are accelerating long-term growth in the Saudi Arabia Data Center Market. Technological breakthroughs in areas like AI-powered data center management, advancements in renewable energy integration for sustainable operations, and the development of more energy-efficient cooling systems are critical enablers. Strategic partnerships between technology providers, telecommunication companies, and colocation providers are fostering ecosystem development and driving innovation. Market expansion strategies, including the development of data center clusters in strategic locations and the creation of specialized zones for digital infrastructure, are further bolstering growth. The government's continued commitment to fostering a conducive investment climate, coupled with a focus on talent development in the digital sector, acts as a powerful accelerator for sustained market expansion and innovation.

Key Players Shaping the Saudi Arabia Data Center Market Market

- Sahara Net

- Etihad Etisalat Company (Mobily)

- Nournet

- SHABAKAH INTEGRATED TECHNOLOGY

- Saudi Telecom Company

- CLOUD LAYERS FOR INFORMATION TECHNOLOGY CO (Nashirnet)

- Gulf Data Hub

- Systems Of Strategic Business Solutions

- Electronia

- ETIHAD ATHEEB TELECOMMUNICATION COMPANY

- Detecon Al Saudia DETASAD Co Ltd

- HostGee Cloud Hosting Inc

Notable Milestones in Saudi Arabia Data Center Market Sector

- April 2022: Saudi Telecom Company (STC) announced plans to deliver 16 new data center facilities with a combined capacity of 17,000 storing units across eight parallel sites in six cities. This massive expansion, with a projected maximum capacity of 125MW, is set to be completed in three phases, starting with three facilities in Riyadh, Jeddah, and Medina, followed by four in the second phase and nine in the third, significantly boosting Saudi Arabia's data center infrastructure.

- February 2022: Saudi Telecom Company (STC) took a strategic step by announcing the separation of its data center business into a new, wholly-owned subsidiary. This move signals a dedicated focus on growing its data center offerings and potentially attracting external investment or partnerships to accelerate development.

- November 2018: Detecon Al Saudia DETASAD Co. Ltd. secured a significant contract to manage and operate the Saudi Electricity Company (SEC) Data Centers in four major cities: Riyadh, Dammam, Jeddah, and Abha. This four-year contract highlighted the growing importance of specialized operational expertise in managing critical data infrastructure.

In-Depth Saudi Arabia Data Center Market Market Outlook

The In-Depth Saudi Arabia Data Center Market Outlook forecasts a period of sustained and accelerated growth, driven by a powerful combination of government initiatives, technological adoption, and evolving business needs. The continued impetus from Vision 2030 will remain a central pillar, fostering an environment conducive to significant investments in digital infrastructure. Strategic partnerships between local and international players will be crucial in developing state-of-the-art facilities and introducing cutting-edge technologies. The expansion of hyperscale cloud services and the increasing demand for edge computing solutions will shape the market's physical and logical topology. Opportunities for sustainable data center development, utilizing renewable energy sources, will become increasingly important. Overall, the market is on a trajectory to become a regional powerhouse, attracting global players and driving innovation across the digital landscape.

Saudi Arabia Data Center Market Segmentation

-

1. Hotspot

- 1.1. Riyadh

- 1.2. Rest of Saudi Arabia

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Saudi Arabia Data Center Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Data Center Market Regional Market Share

Geographic Coverage of Saudi Arabia Data Center Market

Saudi Arabia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Riyadh

- 5.1.2. Rest of Saudi Arabia

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sahara Net

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Etihad Etisalat Company (Mobily)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nournet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SHABAKAH INTEGRATED TECHNOLOGY

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saudi Telecom Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLOUD LAYERS FOR INFORMATION TECHNOLOGY CO (Nashirnet)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulf Data Hub

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Systems Of Strategic Business Solutions5 4 LIST OF COMPANIES STUDIE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electronia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ETIHAD ATHEEB TELECOMMUNICATION COMPANY

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Detecon Al Saudia DETASAD Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 HostGee Cloud Hosting Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Sahara Net

List of Figures

- Figure 1: Saudi Arabia Data Center Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 2: Saudi Arabia Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 3: Saudi Arabia Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 4: Saudi Arabia Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 5: Saudi Arabia Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 6: Saudi Arabia Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 7: Saudi Arabia Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Saudi Arabia Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 9: Saudi Arabia Data Center Market Revenue undefined Forecast, by Colocation Type 2020 & 2033

- Table 10: Saudi Arabia Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 11: Saudi Arabia Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Saudi Arabia Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Saudi Arabia Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 14: Saudi Arabia Data Center Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Saudi Arabia Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 16: Saudi Arabia Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 17: Saudi Arabia Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 18: Saudi Arabia Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 19: Saudi Arabia Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 20: Saudi Arabia Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 21: Saudi Arabia Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 22: Saudi Arabia Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 23: Saudi Arabia Data Center Market Revenue undefined Forecast, by Colocation Type 2020 & 2033

- Table 24: Saudi Arabia Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 25: Saudi Arabia Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 26: Saudi Arabia Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Saudi Arabia Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Saudi Arabia Data Center Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Data Center Market?

The projected CAGR is approximately 10.02%.

2. Which companies are prominent players in the Saudi Arabia Data Center Market?

Key companies in the market include Sahara Net, Etihad Etisalat Company (Mobily), Nournet, SHABAKAH INTEGRATED TECHNOLOGY, Saudi Telecom Company, CLOUD LAYERS FOR INFORMATION TECHNOLOGY CO (Nashirnet), Gulf Data Hub, Systems Of Strategic Business Solutions5 4 LIST OF COMPANIES STUDIE, Electronia, ETIHAD ATHEEB TELECOMMUNICATION COMPANY, Detecon Al Saudia DETASAD Co Ltd, HostGee Cloud Hosting Inc.

3. What are the main segments of the Saudi Arabia Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

April 2022: Saudi Telecom Company (STC) to deliver 16 facilities with 17,000 storing units serving eight parallel sites across six cities. The maximum capacity is expected to reach 125MW. The project will be completed in three phases: in phase 1: three data centres in Riyadh, Jeddah and Medina; four in the second phase; and the remaining nine in the third phase.February 2022: Saudi Telecom Company (STC) to separate its data center business into a new wholly-owned subsidiary.November 2018: Detecon Al Saudia DETASAD Co. Ltd. Awarded and signed a contract to manage and operate SEC (Saudi Electricity Company) Data Centers in 4 cities (Riyadh, Dammam, Jeddah, Abha) for 4 years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Data Center Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence