Key Insights

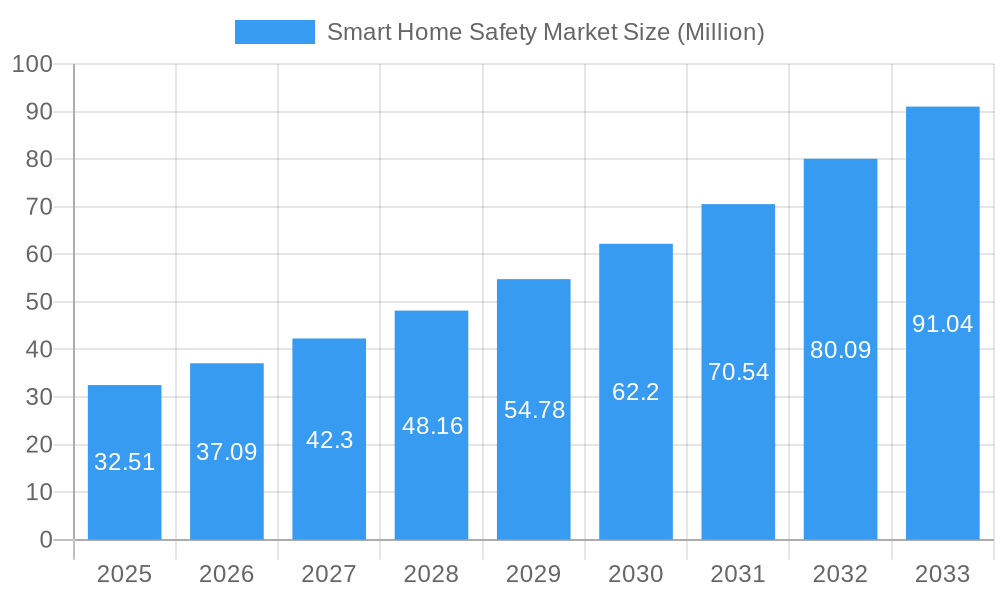

The Smart Home Safety Market is poised for significant expansion, projected to reach $32.51 million by 2025. This growth is fueled by an impressive CAGR of 14.06% during the forecast period of 2025-2033, indicating a dynamic and rapidly evolving industry. The increasing consumer demand for enhanced security and convenience, coupled with advancements in IoT technology, are primary drivers. A heightened awareness of home security concerns and the proliferation of smart home devices are compelling homeowners to invest in integrated safety solutions. The market encompasses a diverse range of products, including smart alarms, smart locks, smart sensors and detectors, and smart camera and monitoring systems, catering to a broad spectrum of consumer needs. The adoption of these technologies is being further accelerated by a growing understanding of their benefits, such as remote monitoring, automated responses to threats, and seamless integration with other smart home ecosystems.

Smart Home Safety Market Market Size (In Million)

Key trends shaping the Smart Home Safety Market include the growing adoption of AI and machine learning for predictive security analytics, enabling systems to identify potential threats before they escalate. The integration of voice assistants and the development of user-friendly mobile applications are enhancing accessibility and control for consumers. Furthermore, the increasing focus on cybersecurity within smart home devices is a critical trend, as manufacturers strive to build trust and ensure the integrity of user data. While the market is robust, potential restraints include the initial cost of some advanced systems and concerns regarding data privacy and device interoperability. However, ongoing innovation, declining hardware costs, and the availability of diverse product offerings are expected to mitigate these challenges, ensuring sustained growth across all segments and regions, with North America and Europe currently leading in adoption and Asia Pacific exhibiting substantial growth potential.

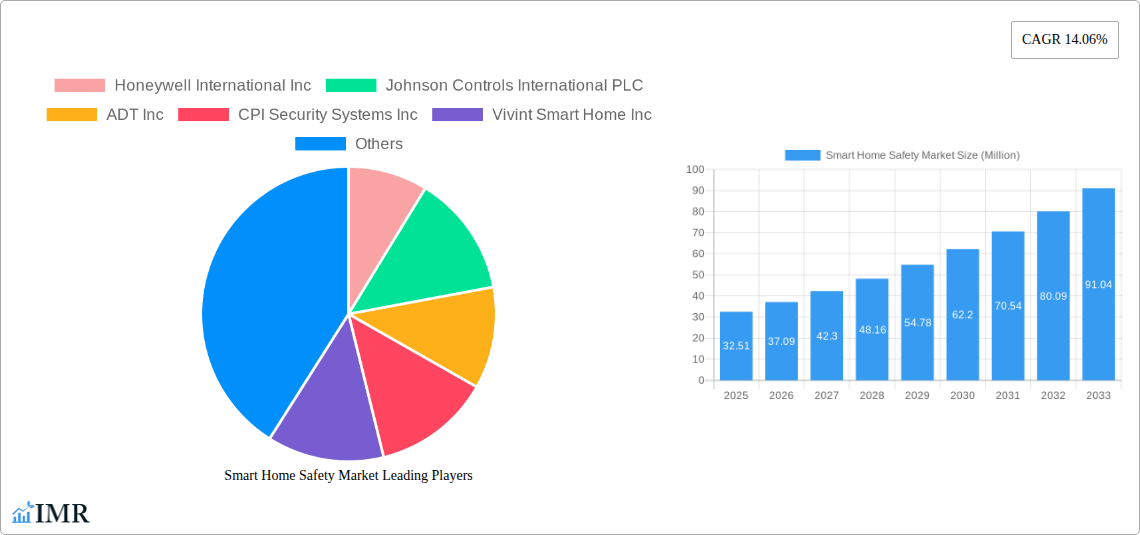

Smart Home Safety Market Company Market Share

Smart Home Safety Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock the potential of the burgeoning smart home safety market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this comprehensive analysis delves into market dynamics, growth trends, key players, and emerging opportunities. Essential for industry professionals, manufacturers, investors, and policymakers seeking to understand the evolving landscape of connected home security solutions.

Smart Home Safety Market Market Dynamics & Structure

The smart home safety market is characterized by moderate to high concentration, with leading players like Honeywell International Inc, Johnson Controls International PLC, and ADT Inc holding significant shares. Technological innovation is a primary driver, fueled by advancements in AI, IoT, and cloud computing, enabling sophisticated features like facial recognition, anomaly detection, and remote monitoring. Regulatory frameworks, while evolving, generally support market growth by emphasizing data privacy and security standards, although varying regional regulations can present challenges. Competitive product substitutes include traditional security systems and DIY solutions, but the convenience and advanced features of smart home safety products are increasingly winning consumer preference. End-user demographics are expanding from tech-savvy early adopters to a broader consumer base seeking enhanced convenience and peace of mind. Mergers and acquisitions (M&A) are also prevalent, with companies strategically acquiring smaller innovators to expand their product portfolios and market reach. For instance, the acquisition of Vivint Smart Home Inc by NRG Energy in 2023 for approximately $2.8 billion underscores the consolidation trend. Innovation barriers include the high cost of some advanced technologies and consumer concerns regarding data security and privacy. The market for smart home safety devices is projected to reach USD 120,500 Million units by 2033.

- Market Concentration: Moderate to high, with a few key players dominating.

- Technological Innovation Drivers: AI, IoT, cloud computing, machine learning.

- Regulatory Frameworks: Evolving data privacy and security standards.

- Competitive Product Substitutes: Traditional security systems, DIY solutions.

- End-User Demographics: Broadening from early adopters to mainstream consumers.

- M&A Trends: Strategic acquisitions to gain market share and technology.

- Innovation Barriers: High upfront costs, consumer privacy concerns.

Smart Home Safety Market Growth Trends & Insights

The smart home safety market is experiencing robust growth, driven by increasing consumer awareness of security needs, a desire for convenience, and the proliferation of connected devices. The market size has seen a significant expansion, estimated to reach USD 65,000 Million units in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of 15.8% during the forecast period of 2025–2033. This impressive growth is underpinned by rising disposable incomes, urbanization, and a heightened sense of personal and property security. Technological disruptions, such as the integration of AI for smarter threat detection and predictive analytics, are enhancing the appeal of these systems. Consumer behavior is shifting towards proactive security measures, with a greater willingness to invest in smart home devices that offer remote monitoring and control capabilities. The increasing adoption of 5G technology is further accelerating this trend by enabling faster data transmission for real-time video streaming and instant alerts. The market penetration of smart home safety devices is steadily increasing, moving beyond affluent households to become more accessible to the middle class. The integration of these safety devices into broader smart home ecosystems, offering a unified control experience, is also a significant growth catalyst. Furthermore, the increasing sophistication of cyber threats is paradoxically driving demand for robust and intelligent security solutions. The global smart home safety market is projected to expand significantly, reaching an estimated USD 120,500 Million units by the end of the forecast period in 2033.

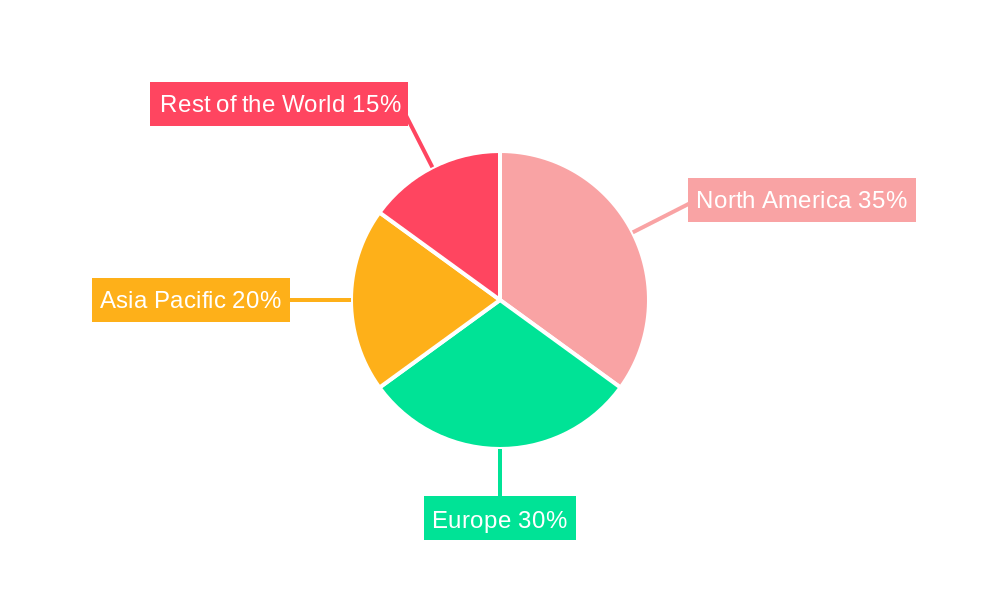

Dominant Regions, Countries, or Segments in Smart Home Safety Market

The Smart Camera and Monitoring Systems segment is emerging as the dominant force within the smart home safety market, projected to hold the largest market share and exhibit substantial growth potential. This dominance is attributed to several interconnected factors, including increasing consumer demand for visual verification of security events, advancements in camera technology (e.g., higher resolution, night vision, AI-powered analytics), and the growing appeal of remote surveillance. In North America, specifically the United States, the market for smart home safety is particularly strong, driven by high disposable incomes, advanced technological adoption rates, and a well-established infrastructure for internet connectivity and smart home ecosystems. The region benefits from a proactive approach to home security and a significant presence of key market players like Ring Inc (Amazon com Inc) and Vivint Smart Home Inc.

In Europe, countries like Germany, the UK, and France are witnessing considerable growth due to increasing awareness of home security and favorable government initiatives promoting smart city development and IoT adoption. The region's focus on data privacy, coupled with strong regulatory frameworks, is shaping the development of secure and trustworthy smart home safety solutions. Asia-Pacific, led by China and Japan, presents a rapidly expanding market, propelled by a burgeoning middle class, rapid urbanization, and significant government investment in smart infrastructure. Companies like Hangzhou Hikvision Digital Technology Co Ltd are playing a crucial role in this region's growth, offering a wide range of affordable and feature-rich smart security products. The increasing affordability of smart cameras and the integration of advanced features like person detection and package monitoring are further fueling their adoption across all regions. The convenience of being able to monitor homes remotely, check on pets or children, and receive immediate alerts in case of intrusion or environmental hazards makes smart cameras an indispensable component of modern home safety.

- Dominant Segment: Smart Camera and Monitoring Systems.

- Key Regional Drivers (North America): High disposable income, advanced tech adoption, strong infrastructure.

- Key Regional Drivers (Europe): Growing security awareness, smart city initiatives, data privacy focus.

- Key Regional Drivers (Asia-Pacific): Rising middle class, urbanization, government investment.

- Technological Advancements: Higher resolution, AI analytics, remote monitoring.

- Consumer Appeal: Visual verification, convenience, proactive security.

Smart Home Safety Market Product Landscape

The smart home safety market is characterized by continuous product innovation, focusing on enhanced functionality, seamless integration, and user-friendly interfaces. Smart alarms are evolving beyond simple siren activation to include intelligent detection of smoke, carbon monoxide, and water leaks, with integrated cellular backup for uninterrupted connectivity. Smart locks are incorporating advanced biometric authentication (fingerprint, facial recognition), remote keyless entry, and integration with virtual assistants for voice-controlled access. Smart sensors and detectors are miniaturizing and increasing their sensing capabilities, offering motion detection, door/window breach alerts, and environmental monitoring (temperature, humidity). Smart camera and monitoring systems are leading the innovation curve with features like AI-powered object recognition, advanced night vision, two-way audio communication, and cloud-based video storage. The "Always Home Cam" by Ring and the "Smart Guardian Can See" by Xiaomi exemplify this trend of integrated intelligence and advanced surveillance capabilities directly at the entry point. These products are designed for diverse applications, from deterring intruders and monitoring elderly or child occupants to detecting environmental hazards and providing evidence in case of an incident. Performance metrics are consistently improving, with faster response times, higher detection accuracy, and extended battery life becoming standard expectations.

Key Drivers, Barriers & Challenges in Smart Home Safety Market

Key Drivers: The smart home safety market is propelled by several critical drivers. Growing consumer awareness of security threats and a desire for enhanced peace of mind are paramount. The increasing adoption of smartphones and the proliferation of reliable internet connectivity create a fertile ground for connected security solutions. Technological advancements in IoT, AI, and cloud computing enable more sophisticated and user-friendly features. Furthermore, the decreasing cost of smart home devices makes them more accessible to a wider consumer base. Government initiatives promoting smart cities and connected living also act as significant accelerators.

Barriers & Challenges: Despite its growth, the market faces several barriers and challenges. Consumer concerns regarding data privacy and cybersecurity remain a significant hurdle, with potential breaches leading to a loss of trust. The high initial cost of some advanced systems can deter potential buyers. Interoperability issues between different smart home ecosystems can lead to frustration for users. Supply chain disruptions, as seen in recent years, can impact product availability and pricing. Regulatory complexities and the need for standardization across different regions also present challenges for global expansion. The competitive pressure from both established players and emerging startups can lead to price wars, impacting profit margins.

Emerging Opportunities in Smart Home Safety Market

Emerging opportunities in the smart home safety market lie in the integration of AI for more predictive and proactive security measures, moving beyond reactive alert systems. The expansion of the market into rental properties and multi-dwelling units presents a significant untapped segment. There is a growing demand for interoperable ecosystems that allow seamless communication between different smart home safety devices and other smart home appliances. The development of subscription-based services for advanced monitoring, cloud storage, and professional installation can unlock recurring revenue streams. Furthermore, the increasing focus on health and wellness creates opportunities for smart home safety devices that can detect falls, monitor air quality, and provide emergency alerts for medical situations. The integration of these systems with smart assistants for voice-controlled operation and real-time information access will continue to drive adoption.

Growth Accelerators in the Smart Home Safety Market Industry

Several factors are acting as growth accelerators for the smart home safety market. Continuous technological breakthroughs, such as the advancement of edge computing for faster on-device processing of security data and the development of more sophisticated AI algorithms for anomaly detection, are enhancing product capabilities. Strategic partnerships between smart home device manufacturers, internet service providers, and security companies are expanding market reach and offering bundled solutions. The increasing adoption of smart home technology by home builders, incorporating safety features as standard in new constructions, is a significant driver. Furthermore, the growing popularity of DIY installation options, coupled with accessible online tutorials and customer support, is lowering adoption barriers for a wider demographic. The development of robust cybersecurity protocols and transparent data usage policies is building consumer confidence, paving the way for accelerated market penetration.

Key Players Shaping the Smart Home Safety Market Market

- Honeywell International Inc

- Johnson Controls International PLC

- ADT Inc

- CPI Security Systems Inc

- Vivint Smart Home Inc

- Ring Inc (Amazon com Inc)

- Hangzhou Hikvision Digital Technology Co Ltd

- Frontpoint Security Solutions LLC

- Abode Systems Inc

- Simplisafe Inc

Notable Milestones in Smart Home Safety Market Sector

- February 2023: Xiaomi announced the expansion of its product range by launching its latest addition to the smart home product line, the Xiaomi Smart Door Lock M20 series. This product, the 'Smart Guardian Can See,' is equipped with an integrated peephole camera and a display screen, providing users with a comprehensive view of the front door in real-time, enhancing user awareness and security.

- January 2023: Ring announced the unveiling of a home security drone named Always Home Cam that can be programmed to patrol an entire house or specific rooms. After training, the mini drone can patrol one floor in your home, ideally the ground level, by walking around the space in a series of flight paths, representing a significant innovation in autonomous home surveillance.

In-Depth Smart Home Safety Market Market Outlook

The future outlook for the smart home safety market remains exceptionally positive, driven by a confluence of technological advancements, evolving consumer demands, and expanding market reach. Growth accelerators such as the continued integration of AI for predictive analytics and proactive threat mitigation, coupled with strategic partnerships that broaden access to these technologies, will continue to fuel expansion. The increasing incorporation of smart safety features in new residential constructions and the growing appeal of integrated smart home ecosystems will solidify market penetration. As cybersecurity concerns are addressed through robust protocols and transparent data handling, consumer trust will deepen, unlocking further adoption. The market is poised for sustained growth, with innovation in areas like drone-based surveillance and advanced biometric security systems shaping the next generation of home protection solutions. This robust trajectory indicates significant opportunities for stakeholders across the value chain.

Smart Home Safety Market Segmentation

-

1. Device Type

- 1.1. Smart Alarms

- 1.2. Smart Locks

- 1.3. Smart Sensors and Detectors

- 1.4. Smart Camera and Monitoring Systems

- 1.5. Other Device Types

Smart Home Safety Market Segmentation By Geography

-

1. North America

- 1.1. Unites States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Spain

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Rest of Asia Pacific

- 4. Rest of the World

Smart Home Safety Market Regional Market Share

Geographic Coverage of Smart Home Safety Market

Smart Home Safety Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness Regarding Home Security Systems

- 3.3. Market Restrains

- 3.3.1. High Initial Costs and Cybersecurity Concerns

- 3.4. Market Trends

- 3.4.1. Growing Awareness Regarding Home Security Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Home Safety Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Smart Alarms

- 5.1.2. Smart Locks

- 5.1.3. Smart Sensors and Detectors

- 5.1.4. Smart Camera and Monitoring Systems

- 5.1.5. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America Smart Home Safety Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Smart Alarms

- 6.1.2. Smart Locks

- 6.1.3. Smart Sensors and Detectors

- 6.1.4. Smart Camera and Monitoring Systems

- 6.1.5. Other Device Types

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Smart Home Safety Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Smart Alarms

- 7.1.2. Smart Locks

- 7.1.3. Smart Sensors and Detectors

- 7.1.4. Smart Camera and Monitoring Systems

- 7.1.5. Other Device Types

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Pacific Smart Home Safety Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Smart Alarms

- 8.1.2. Smart Locks

- 8.1.3. Smart Sensors and Detectors

- 8.1.4. Smart Camera and Monitoring Systems

- 8.1.5. Other Device Types

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Rest of the World Smart Home Safety Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Smart Alarms

- 9.1.2. Smart Locks

- 9.1.3. Smart Sensors and Detectors

- 9.1.4. Smart Camera and Monitoring Systems

- 9.1.5. Other Device Types

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Johnson Controls International PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ADT Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CPI Security Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vivint Smart Home Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ring Inc (Amazon com Inc )

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hangzhou Hikvision Digital Technology Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Frontpoint Security Solutions LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Abode Systems Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Simplisafe Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Smart Home Safety Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Smart Home Safety Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Smart Home Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 4: North America Smart Home Safety Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 5: North America Smart Home Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: North America Smart Home Safety Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: North America Smart Home Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Smart Home Safety Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Smart Home Safety Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Smart Home Safety Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Smart Home Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 12: Europe Smart Home Safety Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 13: Europe Smart Home Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe Smart Home Safety Market Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe Smart Home Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Smart Home Safety Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Smart Home Safety Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Smart Home Safety Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Home Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 20: Asia Pacific Smart Home Safety Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 21: Asia Pacific Smart Home Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Asia Pacific Smart Home Safety Market Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Asia Pacific Smart Home Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Smart Home Safety Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Smart Home Safety Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Smart Home Safety Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Smart Home Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 28: Rest of the World Smart Home Safety Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 29: Rest of the World Smart Home Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: Rest of the World Smart Home Safety Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: Rest of the World Smart Home Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Rest of the World Smart Home Safety Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Rest of the World Smart Home Safety Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Smart Home Safety Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Home Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global Smart Home Safety Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 3: Global Smart Home Safety Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Home Safety Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Smart Home Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Global Smart Home Safety Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 7: Global Smart Home Safety Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Smart Home Safety Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Unites States Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Unites States Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Global Smart Home Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: Global Smart Home Safety Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 15: Global Smart Home Safety Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Smart Home Safety Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: France Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global Smart Home Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 26: Global Smart Home Safety Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 27: Global Smart Home Safety Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Smart Home Safety Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: China Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: China Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Japan Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Rest of Asia Pacific Smart Home Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Asia Pacific Smart Home Safety Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Global Smart Home Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 36: Global Smart Home Safety Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 37: Global Smart Home Safety Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Smart Home Safety Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Home Safety Market?

The projected CAGR is approximately 14.06%.

2. Which companies are prominent players in the Smart Home Safety Market?

Key companies in the market include Honeywell International Inc, Johnson Controls International PLC, ADT Inc, CPI Security Systems Inc, Vivint Smart Home Inc, Ring Inc (Amazon com Inc ), Hangzhou Hikvision Digital Technology Co Ltd, Frontpoint Security Solutions LLC, Abode Systems Inc, Simplisafe Inc.

3. What are the main segments of the Smart Home Safety Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness Regarding Home Security Systems.

6. What are the notable trends driving market growth?

Growing Awareness Regarding Home Security Systems.

7. Are there any restraints impacting market growth?

High Initial Costs and Cybersecurity Concerns.

8. Can you provide examples of recent developments in the market?

February 2023: Xiaomi announced the expansion of its product range by launching its latest addition to the smart home product line, the Xiaomi Smart Door Lock M20 series. This product, the 'Smart Guardian Can See,' is equipped with an integrated peephole camera and a display screen, providing users with a comprehensive view of the front door in real-time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Home Safety Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Home Safety Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Home Safety Market?

To stay informed about further developments, trends, and reports in the Smart Home Safety Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence