Key Insights

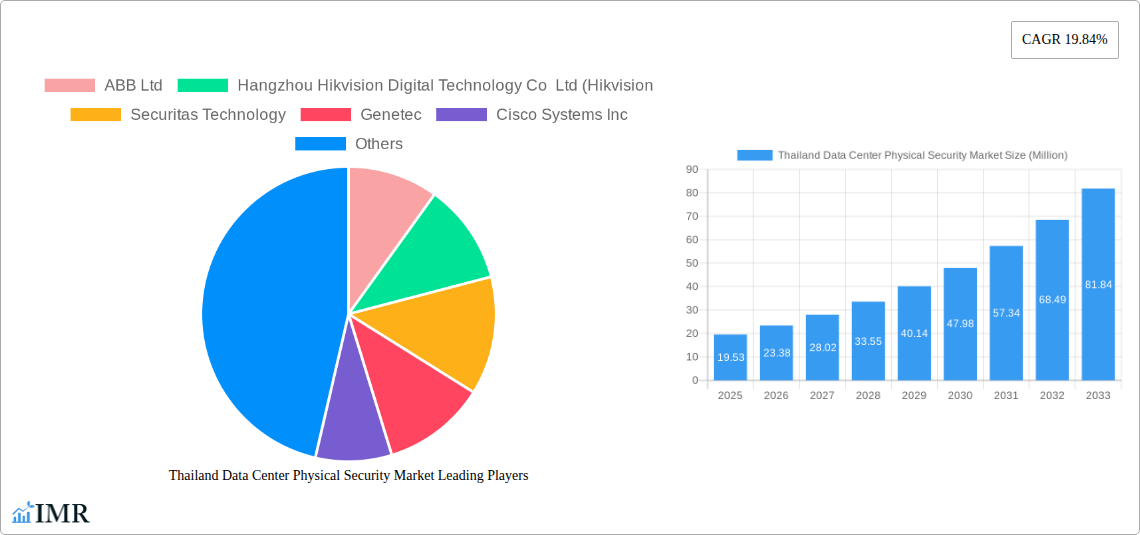

The Thailand Data Center Physical Security Market is poised for significant expansion, driven by the nation's burgeoning digital infrastructure and the escalating demand for robust protection of sensitive data. With a current market size of $19.53 million and a projected Compound Annual Growth Rate (CAGR) of 19.84%, the market is expected to witness robust growth from 2025 to 2033. This impressive trajectory is fueled by a confluence of factors, including the increasing adoption of cloud computing, the rapid growth of the IT and Telecommunication sector, and the government's focus on digital transformation initiatives. Furthermore, the BFSI and Healthcare sectors are investing heavily in advanced physical security solutions to safeguard critical customer information and comply with stringent regulatory requirements. The rising threat landscape, encompassing physical intrusions and cyber-physical attacks, further accentuates the need for comprehensive security measures within data centers.

Thailand Data Center Physical Security Market Market Size (In Million)

Key trends shaping this market include the widespread deployment of advanced video surveillance systems with AI-powered analytics for proactive threat detection and real-time monitoring. Access control solutions, incorporating biometric authentication and intelligent card systems, are becoming indispensable for restricting unauthorized entry. The market also sees a growing demand for integrated security platforms that combine various physical security elements into a cohesive and manageable system. While the market is experiencing strong tailwinds, potential restraints such as the high initial investment costs for sophisticated security systems and a shortage of skilled professionals for installation and maintenance may present challenges. However, the overwhelming imperative to secure critical data infrastructure is expected to propel sustained investment and innovation in the Thailand Data Center Physical Security Market, making it a dynamic and attractive sector for stakeholders.

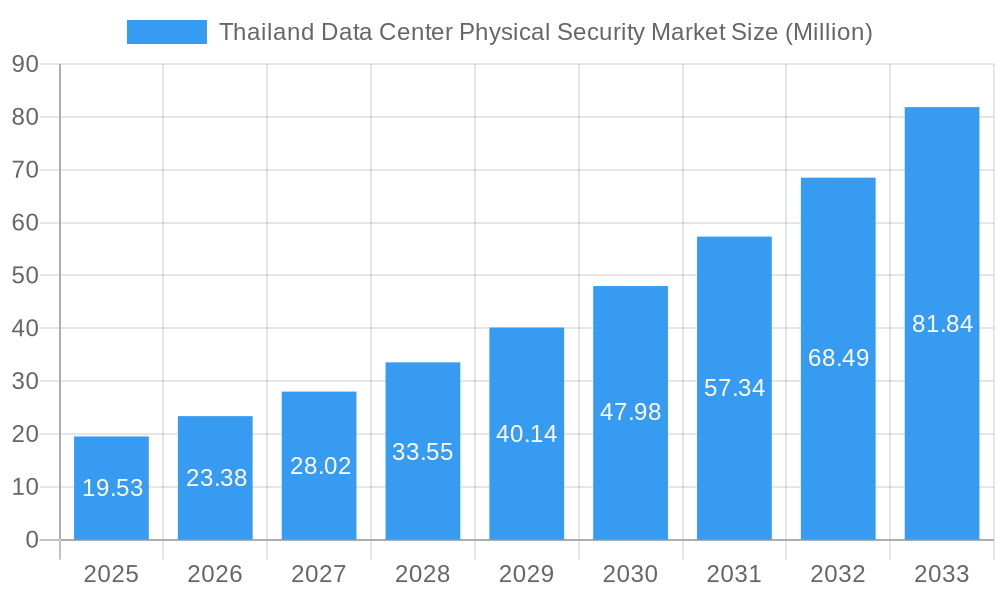

Thailand Data Center Physical Security Market Company Market Share

Unveiling the Thailand Data Center Physical Security Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a strategic overview of the Thailand Data Center Physical Security Market, meticulously analyzing its dynamics, growth trajectory, and key players. With a study period spanning 2019–2033, the report offers crucial insights into the base year (2025), estimated year (2025), and a detailed forecast period (2025–2033), building upon the historical period (2019–2024). We dissect the market by Solution Type (Video Surveillance, Access Control Solutions, Other), Service Type (Consulting Services, Professional Services, Others including System Integration Services), and End User (IT & Telecommunication, BFSI, Government, Healthcare, Other End Users), presenting all quantitative values in Million Units. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving landscape of data center security in Thailand.

Thailand Data Center Physical Security Market Market Dynamics & Structure

The Thailand Data Center Physical Security Market is characterized by a dynamic interplay of technological advancements, evolving regulatory mandates, and increasing demand for robust security solutions. Market concentration is observed to be moderately fragmented, with a growing number of specialized vendors vying for market share. Key drivers of technological innovation include the escalating sophistication of cyber threats, which necessitates parallel advancements in physical security to create a comprehensive defense posture. Regulatory frameworks, particularly those pertaining to data privacy and critical infrastructure protection, are increasingly stringent, compelling data center operators to invest in state-of-the-art physical security measures. Competitive product substitutes, while present, often fall short in offering the integrated, multi-layered security approach demanded by modern data centers. End-user demographics reveal a significant shift towards cloud adoption and digital transformation initiatives, directly influencing the need for secure and resilient data center infrastructure. Mergers and acquisitions (M&A) trends are also becoming more prominent as larger security providers aim to consolidate their offerings and expand their reach within the Thai market.

- Market Concentration: Moderately fragmented with key players and emerging specialized vendors.

- Technological Innovation Drivers: Rising cyber threats, demand for integrated security, AI-powered surveillance, advanced access control systems.

- Regulatory Frameworks: Growing emphasis on data privacy laws (e.g., PDPA), critical infrastructure protection, and compliance standards driving security investments.

- Competitive Product Substitutes: While alternatives exist, integrated solutions offering comprehensive physical security are gaining prominence.

- End-User Demographics: Proliferation of cloud services, IoT adoption, and digital transformation initiatives are fueling demand for secure data centers.

- M&A Trends: Increasing consolidation through strategic acquisitions to expand service portfolios and market presence.

Thailand Data Center Physical Security Market Growth Trends & Insights

The Thailand Data Center Physical Security Market is poised for significant expansion, driven by a confluence of factors that are reshaping the digital infrastructure landscape. Market size is projected to experience a robust Compound Annual Growth Rate (CAGR) over the forecast period, reflecting the escalating importance of securing sensitive data and critical IT operations. Adoption rates for advanced physical security solutions, such as AI-powered video analytics and biometric access control, are accelerating as organizations recognize the limitations of traditional security systems in mitigating modern threats. Technological disruptions, including the integration of IoT devices for enhanced monitoring and the use of sophisticated cybersecurity measures to protect physical infrastructure from remote attacks, are becoming mainstream. Consumer behavior shifts are also playing a pivotal role; businesses are increasingly prioritizing data integrity and availability, making physical security a non-negotiable aspect of their IT strategy. The growing number of data center construction projects and expansions across Thailand, fueled by the nation's digital economy ambitions, directly translates to increased demand for comprehensive physical security solutions. Furthermore, the rise of edge computing and distributed data center models introduces new security challenges that demand adaptable and scalable physical security implementations. The overall market penetration of sophisticated physical security systems is expected to deepen as awareness of their benefits and necessity grows among data center operators.

Dominant Regions, Countries, or Segments in Thailand Data Center Physical Security Market

The Thailand Data Center Physical Security Market is experiencing substantial growth, with specific segments and end-users emerging as key drivers. Within Solution Type, Video Surveillance is a dominant segment, expected to capture a significant market share due to its critical role in real-time monitoring, incident detection, and evidence gathering. The increasing deployment of high-definition IP cameras, thermal imaging, and AI-driven video analytics for threat detection and anomaly identification are propelling its growth. Access Control Solutions represent another vital segment, focusing on preventing unauthorized entry into sensitive areas through advanced technologies like smart cards, biometrics (fingerprint, facial recognition), and multi-factor authentication systems. The IT & Telecommunication sector stands out as a primary End User, owing to the sheer volume of data processed and stored within their facilities, necessitating the highest levels of physical security. This sector's continuous investment in expanding network infrastructure and cloud services directly correlates with demand for robust data center security. The BFSI (Banking, Financial Services, and Insurance) sector also exerts significant influence, driven by stringent regulatory requirements for data protection and the high value of financial information. Government initiatives promoting digital transformation and national cybersecurity further bolster demand from the Government end-user segment. Emerging trends in healthcare, with the increasing digitization of patient records, are also contributing to the growth of the Healthcare segment. Infrastructure development in key industrial zones and economic corridors is also a significant factor, leading to the establishment of new data centers and thus amplifying the demand for comprehensive physical security.

- Dominant Solution Type: Video Surveillance, driven by AI analytics and high-resolution imaging.

- Key Solution Type: Access Control Solutions, focusing on multi-factor authentication and biometric technologies.

- Leading End User: IT & Telecommunication, due to extensive data handling and cloud infrastructure growth.

- Significant End User: BFSI, driven by regulatory compliance and the sensitive nature of financial data.

- Growing End User: Government, fueled by national digital transformation agendas and cybersecurity initiatives.

- Emerging End User: Healthcare, as patient data digitization increases.

- Infrastructure Influence: Growth in economic zones and industrial corridors spurring new data center development and security needs.

Thailand Data Center Physical Security Market Product Landscape

The product landscape of the Thailand Data Center Physical Security Market is characterized by continuous innovation and the integration of advanced technologies. Leading manufacturers are focusing on developing intelligent surveillance systems that leverage AI for real-time threat detection, facial recognition, and behavioral analysis. Access control solutions are evolving to incorporate more sophisticated biometric modalities and unified platforms that seamlessly integrate with other security systems. Furthermore, there's a growing emphasis on developing cybersecurity-hardened physical security devices to protect against remote tampering and data breaches. Performance metrics such as reliability, scalability, and ease of integration are crucial selling points, with vendors highlighting enhanced operational efficiency and reduced false alarms. Unique selling propositions often revolve around cutting-edge algorithms for threat identification, robust encryption for data transmission, and seamless integration capabilities with existing IT infrastructure.

Key Drivers, Barriers & Challenges in Thailand Data Center Physical Security Market

Key Drivers: The Thailand Data Center Physical Security Market is propelled by several significant forces. The escalating number of cyber threats and the increasing sophistication of attacks necessitate robust physical security to create a layered defense. Growing adoption of cloud computing and the digital transformation across industries are expanding the data center footprint, directly increasing the demand for security solutions. Stringent government regulations and compliance mandates related to data protection and critical infrastructure resilience are compelling investments. The continuous need to protect sensitive data and ensure business continuity further drives the adoption of advanced security technologies.

Barriers & Challenges: Despite strong growth potential, the market faces several hurdles. High initial investment costs for advanced physical security systems can be a significant barrier, particularly for smaller data center operators. A shortage of skilled professionals trained in the installation, maintenance, and operation of complex security systems presents a persistent challenge. Evolving threat landscapes require constant updates and adaptations of security protocols, which can be resource-intensive. Furthermore, integrating disparate legacy security systems with newer technologies can be complex and costly. Supply chain disruptions impacting the availability of critical security components and the need for continuous compliance with ever-changing regulatory frameworks also pose considerable challenges.

Emerging Opportunities in Thailand Data Center Physical Security Market

Emerging opportunities in the Thailand Data Center Physical Security Market are abundant and diverse. The rise of edge computing and distributed data centers presents a significant opportunity for vendors offering scalable and adaptable physical security solutions tailored for smaller, localized facilities. The growing demand for smart city initiatives and the increasing deployment of IoT devices are creating a need for enhanced physical security in interconnected infrastructure. Furthermore, the focus on sustainability and energy efficiency in data center operations is driving opportunities for security solutions that can also contribute to these goals, such as intelligent lighting and access control systems that optimize energy consumption. The increasing adoption of AI and machine learning in physical security offers a fertile ground for innovative solutions that provide predictive analytics and automated threat response, moving beyond traditional reactive measures.

Growth Accelerators in the Thailand Data Center Physical Security Market Industry

Several catalysts are accelerating the long-term growth of the Thailand Data Center Physical Security Market. Technological breakthroughs in areas such as advanced AI-powered video analytics, quantum-resistant encryption for access control, and sophisticated threat detection systems are continuously pushing the boundaries of what is possible. Strategic partnerships between security solution providers, data center developers, and IT service companies are fostering an ecosystem of integrated security offerings. Market expansion strategies, including the development of cost-effective solutions for small and medium-sized enterprises (SMEs) and the increasing focus on managed security services, are broadening the market's reach. The ongoing digital transformation initiatives by the Thai government and private sector, coupled with Thailand's strategic location in Southeast Asia, are further solidifying its position as a key data center hub, thereby driving sustained demand for high-level physical security.

Key Players Shaping the Thailand Data Center Physical Security Market Market

- ABB Ltd

- Hangzhou Hikvision Digital Technology Co Ltd (Hikvision)

- Securitas Technology

- Genetec

- Cisco Systems Inc

- Johnson Controls

- Schneider Electric

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- ASSA ABLOY

Notable Milestones in Thailand Data Center Physical Security Market Sector

- February 2024: In the latest release of the Axis operating system, AXIS OS, Axis Communications AB announced that more than 200 network devices, including cameras, intercoms, and 11.8 audio speakers, are supported by the IEEE MAC 802.1sec security standard. Demonstrating the company's continued commitment to device and data security, Axis has become the first manufacturer of physical safety products supporting MACsec Media Access Control Security. This advancement significantly enhances the security posture of connected devices within data centers, reducing vulnerabilities to network-based threats.

- April 2023: Schneider Electric launched a new service offer, EcoCare for Modular Data Centers services membership. Members of this innovative service plan benefit from specialized expertise to maximize modular data centers' uptime with 24/7 proactive remote monitoring and condition-based maintenance. Members draw benefit from support provided in the form of a dedicated customer success management team, who become their coach, planning on-site and remote services team, monitoring maintenance and infrastructure needs at a system level, rather than an ad-hoc approach for each asset only when problems arise. This initiative highlights a shift towards proactive, service-oriented security and maintenance, crucial for high-availability data center operations.

In-Depth Thailand Data Center Physical Security Market Market Outlook

The Thailand Data Center Physical Security Market is on an upward trajectory, fueled by the accelerating digital economy and the paramount importance of data protection. Growth accelerators such as advancements in AI-driven analytics for threat detection, the expanding reach of cloud computing, and stringent regulatory frameworks will continue to shape market dynamics. Strategic partnerships and the development of integrated, multi-layered security solutions will be crucial for market participants to capitalize on the increasing demand for resilient and secure data center infrastructure. The market's future outlook points towards a greater emphasis on intelligent, proactive, and automated physical security measures, ensuring the integrity and availability of critical data assets in Thailand.

Thailand Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Other

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Thailand Data Center Physical Security Market Segmentation By Geography

- 1. Thailand

Thailand Data Center Physical Security Market Regional Market Share

Geographic Coverage of Thailand Data Center Physical Security Market

Thailand Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Data Traffic and Need for Secured Connectivity is Promoting the Growth of the Data Center Physical Security Market; Rise in Cyber Threats is Causing the Data Center Physical Security Market to Grow

- 3.3. Market Restrains

- 3.3.1 Limited IT Budgets

- 3.3.2 Availability of Low-cost Substitutes

- 3.3.3 and Piracy is Discouraging the Potential Growth of Data Center Physical Security Market

- 3.4. Market Trends

- 3.4.1. Video surveillance Segment Holds Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Data Center Physical Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd (Hikvision

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Securitas Technology

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Genetec

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson Controls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch Sicherheitssysteme GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axis Communications AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ASSA ABLOY

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Thailand Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Data Center Physical Security Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 2: Thailand Data Center Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Thailand Data Center Physical Security Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Thailand Data Center Physical Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Thailand Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 6: Thailand Data Center Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Thailand Data Center Physical Security Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Thailand Data Center Physical Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Data Center Physical Security Market?

The projected CAGR is approximately 19.84%.

2. Which companies are prominent players in the Thailand Data Center Physical Security Market?

Key companies in the market include ABB Ltd, Hangzhou Hikvision Digital Technology Co Ltd (Hikvision, Securitas Technology, Genetec, Cisco Systems Inc, Johnson Controls, Schneider Electric, Bosch Sicherheitssysteme GmbH, Axis Communications AB, ASSA ABLOY.

3. What are the main segments of the Thailand Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Data Traffic and Need for Secured Connectivity is Promoting the Growth of the Data Center Physical Security Market; Rise in Cyber Threats is Causing the Data Center Physical Security Market to Grow.

6. What are the notable trends driving market growth?

Video surveillance Segment Holds Significant Share.

7. Are there any restraints impacting market growth?

Limited IT Budgets. Availability of Low-cost Substitutes. and Piracy is Discouraging the Potential Growth of Data Center Physical Security Market.

8. Can you provide examples of recent developments in the market?

February 2024: In the latest release of the Axis operating system, AXIS OS, Axis Communications AB announced that more than 200 network devices, including cameras, intercoms, and 11.8 audio speakers, are supported by the IEEE MAC 802.1sec security standard. Demonstrating the company's continued commitment to device and data security, Axis has become the first manufacturer of physical safety products supporting MACsec Media Access Control Security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Thailand Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence