Key Insights

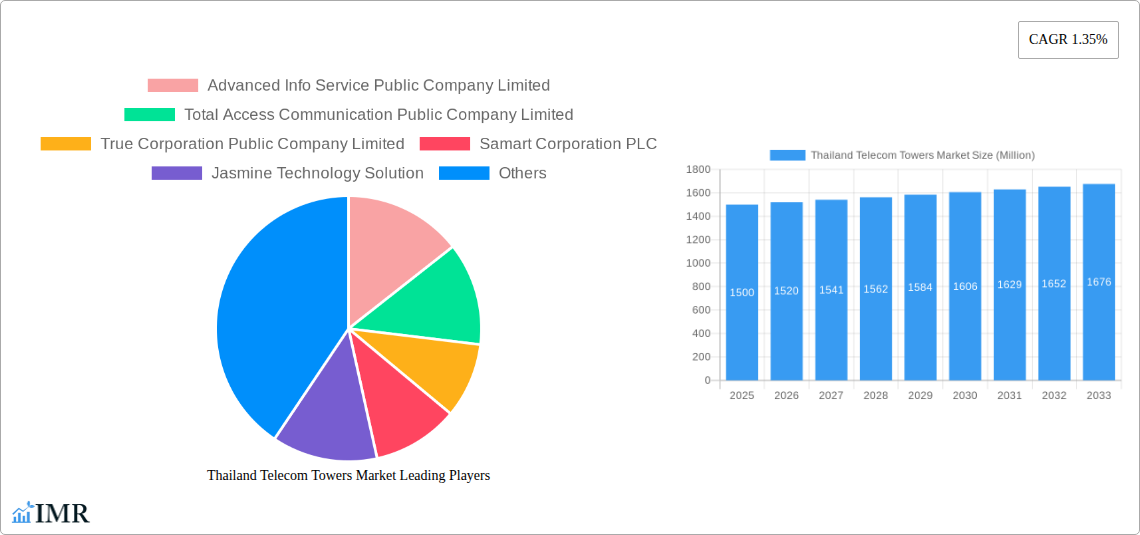

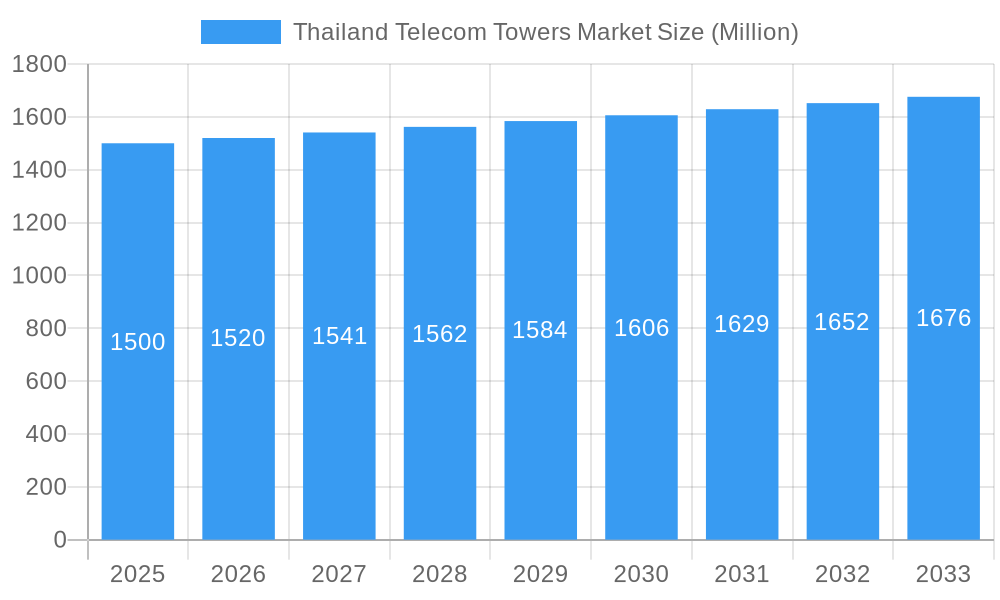

The Thailand telecom towers market, exhibiting a CAGR of 1.35%, presents a promising landscape for investors and industry players. Driven by increasing mobile data consumption, 5G network deployment, and the expanding reach of mobile connectivity across both urban and rural areas, the market is poised for steady growth. Major players like Advanced Info Service, Total Access Communication, and True Corporation, along with infrastructure providers like Samart Corporation and Jasmine Technology Solution, are key contributors to this market's development. The strategic partnerships between telecom operators and tower companies are further fueling market expansion. Government initiatives promoting digital infrastructure development and bridging the digital divide also contribute positively to the market's trajectory. While challenges such as regulatory hurdles and securing land rights for tower installations might present some constraints, the overall positive trends outweigh these limitations. The market segmentation is likely diverse, encompassing macro towers, small cells, and rooftop installations, each catering to specific network requirements and geographical locations.

Thailand Telecom Towers Market Market Size (In Billion)

Looking ahead to 2033, the market is anticipated to witness robust growth, spurred by the continuous upgrades to existing networks and investments in next-generation technologies. While precise market size figures for 2025 and beyond are unavailable, considering a base year of 2025 and a 1.35% CAGR, we can project a moderate but steady expansion. The ongoing expansion of 5G networks, coupled with increased demand for reliable connectivity, will necessitate further investment in telecom tower infrastructure. This, in turn, will drive further consolidation within the industry and potentially attract new entrants seeking to capitalize on this growth opportunity. The geographical distribution of towers will likely reflect population density and connectivity needs, with higher concentrations in urban centers.

Thailand Telecom Towers Market Company Market Share

Thailand Telecom Towers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Thailand Telecom Towers market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for telecom operators, tower companies, infrastructure investors, and technology providers seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader Telecommunications Infrastructure Market in Thailand, while the child market is specifically Telecom Tower Infrastructure.

Thailand Telecom Towers Market Dynamics & Structure

The Thailand telecom towers market is characterized by a moderately concentrated structure, with key players like Advanced Info Service Public Company Limited, Total Access Communication Public Company Limited, and True Corporation Public Company Limited holding significant market share. The market is driven by technological innovations, particularly the rollout of 5G networks and the increasing demand for higher bandwidth and improved network coverage. The regulatory framework, while generally supportive of infrastructure development, presents some challenges related to licensing and permitting. Competitive substitutes, such as distributed antenna systems (DAS), are emerging, but the overall demand for traditional macro towers remains robust.

- Market Concentration: The top three players hold approximately xx% of the market share (2025 estimate).

- Technological Innovation: 5G deployment is a major driver, leading to increased tower construction and upgrades.

- Regulatory Framework: Licensing and permitting processes influence market entry and expansion.

- Competitive Substitutes: DAS and small cells are creating competition, but macro towers remain dominant.

- M&A Activity: The historical period (2019-2024) saw xx M&A deals, with an estimated value of xx Million USD.

Thailand Telecom Towers Market Growth Trends & Insights

The Thailand telecom towers market has witnessed substantial growth during the historical period (2019-2024). Driven primarily by the expansion of mobile broadband services, particularly 4G and the ongoing rollout of 5G, the market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a CAGR of xx%. This growth is further fueled by increasing smartphone penetration, rising data consumption, and government initiatives promoting digital infrastructure development. Technological disruptions, such as the adoption of IoT and the increasing demand for private 5G networks, are further shaping market dynamics. Consumer behavior shifts towards higher data usage and reliance on mobile devices are reinforcing this upward trend. We project a CAGR of xx% from 2025 to 2033, reaching a market size of xx Million units by 2033. Market penetration is expected to reach xx% by 2033.

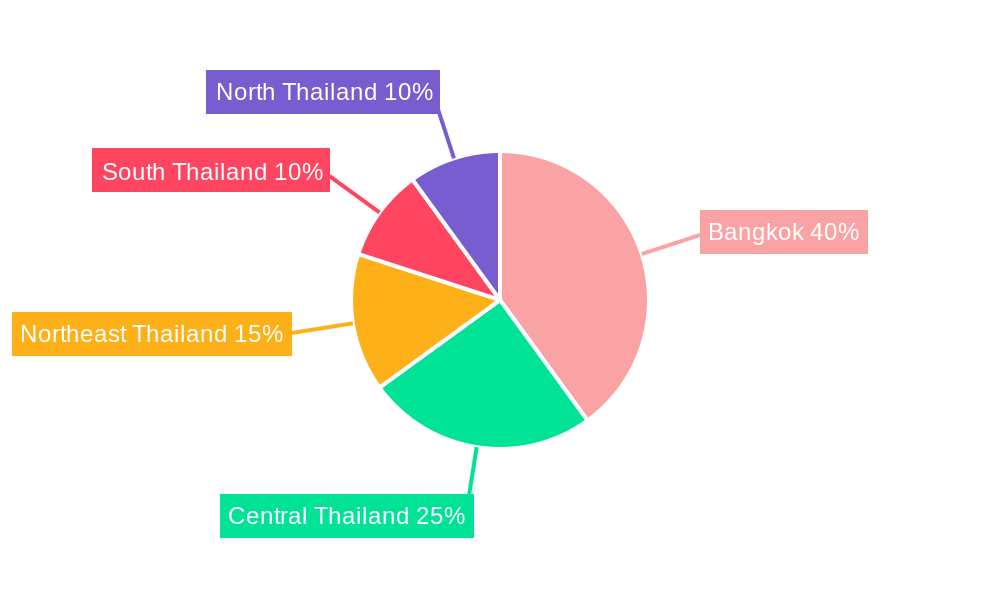

Dominant Regions, Countries, or Segments in Thailand Telecom Towers Market

Bangkok and other major metropolitan areas constitute the dominant segment in the Thailand telecom towers market, accounting for approximately xx% of the total market size in 2025. This dominance is attributable to higher population density, increased mobile penetration, and greater demand for high-speed data services. However, significant growth opportunities exist in expanding the infrastructure into rural and less developed regions. The government's push for nationwide digital connectivity is expected to fuel growth in these areas.

- Key Drivers in Bangkok Metropolitan Area: High population density, high smartphone penetration, and robust demand for high-bandwidth services.

- Growth Potential in Rural Areas: Government initiatives to improve digital infrastructure and the increasing affordability of mobile services.

- Market Share: Bangkok and surrounding areas hold approximately xx% of the market share (2025 estimate).

- Growth Potential: Rural areas exhibit a significant growth potential, estimated at xx% CAGR from 2025-2033.

Thailand Telecom Towers Market Product Landscape

The Thailand telecom towers market encompasses a range of products, including traditional macro towers, mini-towers, and rooftop installations. Technological advancements focus on improving tower efficiency, reducing environmental impact, and enhancing network capacity. Products are differentiated based on their height, load capacity, materials used, and integration with other network technologies. This includes advancements in materials for better durability and reduced weight, as well as integration of smart functionalities and remote monitoring capabilities.

Key Drivers, Barriers & Challenges in Thailand Telecom Towers Market

Key Drivers:

- 5G Network Rollout: The deployment of 5G requires extensive tower infrastructure upgrades and new tower construction.

- Government Initiatives: Government policies promoting digital infrastructure development provide impetus for growth.

- Increasing Smartphone Penetration: The rise in smartphone users fuels data consumption, leading to increased demand for network capacity.

Key Challenges:

- Regulatory Hurdles: Obtaining permits and licenses for tower construction can be time-consuming and costly, impacting project timelines and profitability.

- Land Acquisition: Securing suitable land for tower construction, especially in densely populated areas, can pose challenges.

- Competition: The market is characterized by intense competition among tower companies and other infrastructure providers. This competition drives down prices and reduces profit margins.

Emerging Opportunities in Thailand Telecom Towers Market

- Rural Network Expansion: Significant opportunities exist in extending telecom infrastructure to underserved rural communities.

- Private 5G Networks: Businesses are increasingly deploying private 5G networks, generating demand for specialized tower solutions.

- Tower Colocation: Increased demand for tower colocation services to accommodate multiple operators and technologies.

Growth Accelerators in the Thailand Telecom Towers Market Industry

The long-term growth of the Thailand telecom towers market will be fueled by the continued rollout of 5G, the expansion of IoT deployments, the rising adoption of cloud services, and the government's ongoing investments in digital infrastructure. Strategic partnerships between tower companies and telecom operators, along with innovative financing models, will further accelerate growth.

Key Players Shaping the Thailand Telecom Towers Market Market

- Advanced Info Service Public Company Limited

- Total Access Communication Public Company Limited

- True Corporation Public Company Limited

- Samart Corporation PLC

- Jasmine Technology Solution

- Ericsson

- Interlink Telecom Public Company Limited

- Sky Tower PLC

- List Not Exhaustive

Notable Milestones in Thailand Telecom Towers Market Sector

- July 2024: Ericsson Thailand announces its vision to drive Thailand's digital transformation through 5G infrastructure development.

- June 2024: mu Space and Interlink Telecom sign an MOU to explore opportunities in satellite and telecommunications networks.

- June 2024: Advanced Info Service (AIS) partners with Gulf Energy to develop solar-powered telecom infrastructure in remote areas.

- January 2024: National Telecoms Public Company Limited (NT) partners with Evolution DC Thailand to enhance Thailand's digital infrastructure.

In-Depth Thailand Telecom Towers Market Market Outlook

The future of the Thailand telecom towers market appears bright, driven by continued technological advancements, increasing demand for data, and supportive government policies. Strategic investments in infrastructure modernization, coupled with the expansion of 5G networks and the adoption of innovative technologies like edge computing and IoT, are poised to fuel significant growth. The focus on sustainable infrastructure, including initiatives such as solar-powered towers, will also contribute to the market's long-term sustainability and expansion.

Thailand Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Thailand Telecom Towers Market Segmentation By Geography

- 1. Thailand

Thailand Telecom Towers Market Regional Market Share

Geographic Coverage of Thailand Telecom Towers Market

Thailand Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. High Rooftop Installation Augment's the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Advanced Info Service Public Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total Access Communication Public Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 True Corporation Public Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samart Corporation PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jasmine Technology Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ericsson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Interlink Telecom Public Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sky Tower PLC*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Advanced Info Service Public Company Limited

List of Figures

- Figure 1: Thailand Telecom Towers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Thailand Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 2: Thailand Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 3: Thailand Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 4: Thailand Telecom Towers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Thailand Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 6: Thailand Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 7: Thailand Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 8: Thailand Telecom Towers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Telecom Towers Market?

The projected CAGR is approximately 2.62%.

2. Which companies are prominent players in the Thailand Telecom Towers Market?

Key companies in the market include Advanced Info Service Public Company Limited, Total Access Communication Public Company Limited, True Corporation Public Company Limited, Samart Corporation PLC, Jasmine Technology Solution, Ericsson, Interlink Telecom Public Company Limited, Sky Tower PLC*List Not Exhaustive.

3. What are the main segments of the Thailand Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

High Rooftop Installation Augment's the Market Growth.

7. Are there any restraints impacting market growth?

Connecting/Improving Connectivity to Rural Areas; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

July 2024: Ericsson Thailand introduced its ambitious vision to drive the digital transformation of Thailand based on the strong 5G infrastructure it is creating in the country. Leveraging its state-of-the-art 5G network solutions together with its extensive experience and expertise in establishing efficient, reliable, and sustainable 5G networks worldwide, Ericsson is well poised to play a pivotal role in accelerating Thailand’s journey toward becoming a digital economy.June 2024: In a collaboration, mu Space and Advanced Technology Co. Ltd (“mu Space”) and Interlink Telecom Public Company Limited (“ITEL”) signed a Memorandum of Understanding (MOU) to explore new opportunities in satellite and telecommunications networks and services. This MOU sets the stage for combining the expertise and resources of both industry leaders to drive innovation and expand service offerings in Thailand and beyond.June 2024: Advanced Info Service (AIS), Thailand's key digital network provider, teamed up with Gulf Energy Development, a key player in sustainable energy and infrastructure in the region. Together, they aim to set up solar-powered telecommunication infrastructure in the country's remote areas.January 2024: National Telecoms Public Company Limited (NT) partnered with Evolution DC Thailand Company Limited (EDC), a joint venture formed by Central Pattana (CPN) and Evolution Data Centres. Together, they aim to enhance Thailand's digital infrastructure, steering the nation closer to its goal of becoming a central digital hub in ASEAN.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Thailand Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence