Key Insights

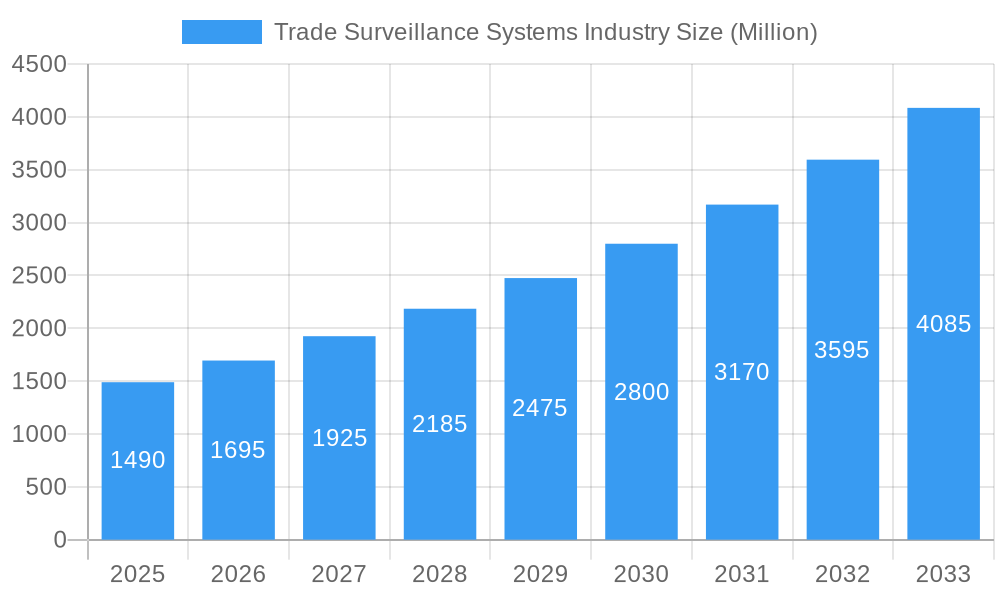

The global Trade Surveillance Systems market is poised for substantial expansion, projected to reach $1.49 billion by 2025. This growth is fueled by an impressive compound annual growth rate (CAGR) of 13.9% from 2019 to 2033, indicating a robust and sustained upward trajectory for the industry. The primary drivers behind this market surge are the increasing complexity of financial regulations worldwide, the escalating volume of trading activities across diverse asset classes, and the growing adoption of advanced technologies like AI and machine learning for enhanced detection of market abuse. Financial institutions are heavily investing in sophisticated trade surveillance solutions to ensure compliance, mitigate financial and reputational risks, and maintain market integrity. The market's expansion is further propelled by the need to monitor cross-border transactions and the growing sophistication of illicit trading practices, demanding more comprehensive and intelligent surveillance tools.

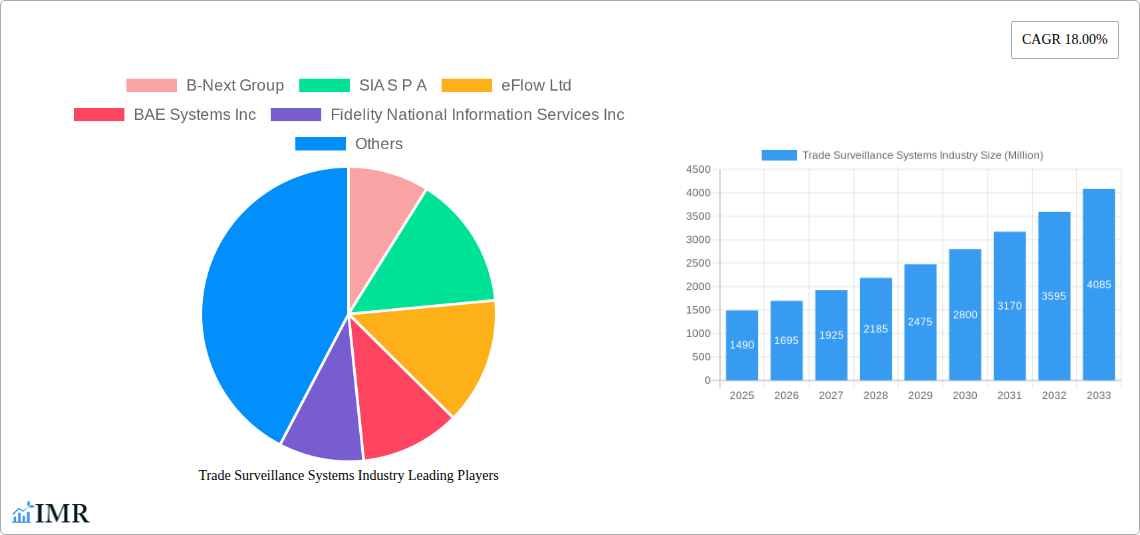

Trade Surveillance Systems Industry Market Size (In Billion)

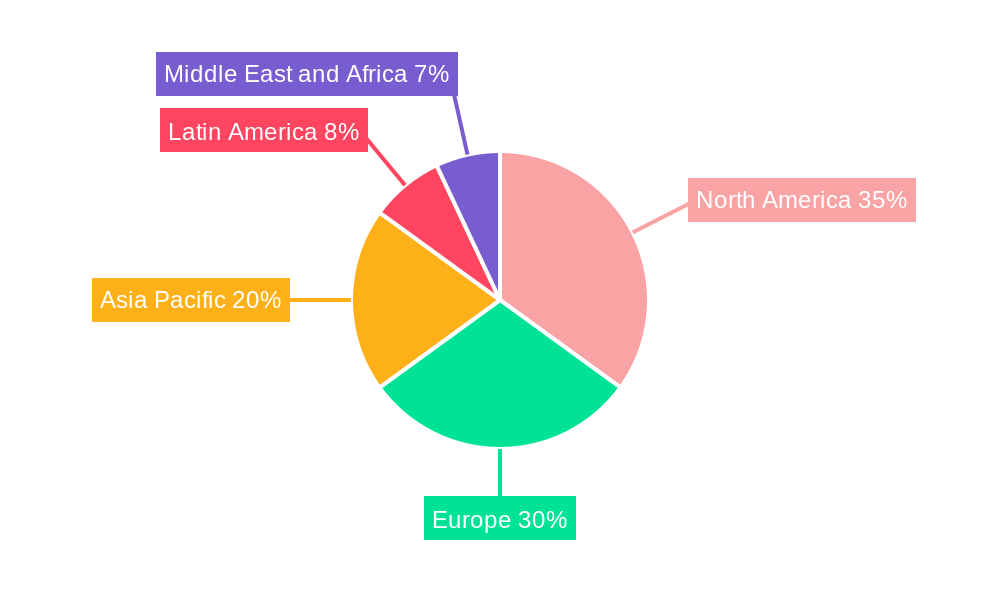

The market segmentation reveals a dynamic landscape. In terms of components, the demand for both integrated "Solutions" and specialized "Services" is on the rise, with financial firms seeking end-to-end capabilities and expert support. Deployment-wise, while "On-Premise" solutions continue to hold relevance for certain institutions with specific data security requirements, the market is witnessing a significant shift towards "On-Cloud" deployments due to their scalability, cost-effectiveness, and ease of integration. Geographically, North America and Europe currently lead the market share, driven by stringent regulatory frameworks and a high concentration of financial activity. However, the Asia Pacific region, particularly China and India, is emerging as a key growth engine, fueled by rapid financial market development and increasing regulatory oversight. Key players like B-Next Group, SIA S.P.A., and Nasdaq Inc. are actively innovating and expanding their offerings to capture this burgeoning market.

Trade Surveillance Systems Industry Company Market Share

This in-depth report provides a comprehensive analysis of the global Trade Surveillance Systems industry, offering critical insights for stakeholders navigating this dynamic and rapidly evolving market. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this research delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, emerging opportunities, and significant players. Leveraging high-traffic keywords such as "trade surveillance solutions," "financial regulatory technology," "compliance software," "market abuse detection," and "anti-money laundering technology," this report is optimized for maximum search engine visibility and engagement among industry professionals, including compliance officers, financial institutions, technology providers, and investors. Explore parent and child market segmentation for a granular understanding of growth potential. All monetary values are presented in billion units.

Trade Surveillance Systems Industry Market Dynamics & Structure

The global Trade Surveillance Systems market is characterized by a moderately concentrated landscape, driven by increasing regulatory scrutiny and the imperative for financial institutions to prevent market abuse and ensure compliance. Technological innovation, particularly in Artificial Intelligence (AI) and Machine Learning (ML), is a significant driver, enabling more sophisticated anomaly detection and pattern recognition. Robust regulatory frameworks worldwide are mandating stricter surveillance, thereby shaping market demand. Competitive product substitutes, while present in simpler forms, are increasingly being overshadowed by advanced, integrated solutions. End-user demographics are expanding beyond traditional large financial institutions to include mid-sized firms and emerging FinTech players. Merger and acquisition (M&A) trends are actively reshaping the competitive landscape as larger players seek to acquire innovative technologies and expand their market reach. For instance, the acquisition of NetReveal by SymphonyAI from BAE Systems highlights a strategic move to bolster financial vertical expansion.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized providers.

- Technological Innovation Drivers: AI/ML for predictive analytics, big data processing, natural language processing (NLP) for communication surveillance.

- Regulatory Frameworks: Growing stringency of regulations such as MiFID II, MAR, Dodd-Frank, and BSA, driving demand for advanced compliance solutions.

- Competitive Product Substitutes: Traditional manual monitoring, basic alert systems, but increasingly being replaced by comprehensive surveillance platforms.

- End-User Demographics: Investment banks, hedge funds, asset managers, brokers, exchanges, and increasingly, FinTech startups.

- M&A Trends: Strategic acquisitions to gain market share, acquire cutting-edge technology, and consolidate offerings.

Trade Surveillance Systems Industry Growth Trends & Insights

The Trade Surveillance Systems market is poised for substantial growth, driven by a confluence of escalating regulatory pressures and the inherent need for financial firms to mitigate financial crime and operational risks. The market size is projected to witness a robust CAGR of xx% from 2025 to 2033, reaching an estimated $XX billion by 2033. Adoption rates for advanced trade surveillance solutions are accelerating, as organizations recognize the limitations of legacy systems in detecting increasingly complex forms of market manipulation and insider trading. Technological disruptions, particularly the integration of AI and ML, are revolutionizing market abuse detection capabilities, moving from reactive alert systems to proactive risk identification. Shifts in consumer behavior, influenced by a greater demand for transparency and ethical financial practices, further bolster the need for robust surveillance. The evolution towards cloud-based deployment models is also a significant trend, offering scalability, flexibility, and cost-efficiency for financial institutions of all sizes. The increasing volume and velocity of financial transactions necessitate sophisticated real-time surveillance, pushing market penetration of advanced solutions higher.

- Market Size Evolution: Projected to grow from an estimated $XX billion in 2025 to $XX billion by 2033.

- CAGR: Expected to be in the range of xx% during the forecast period (2025-2033).

- Adoption Rates: Steadily increasing, driven by regulatory compliance and risk management imperatives.

- Technological Disruptions: AI, ML, big data analytics, and cloud computing are transforming surveillance capabilities.

- Consumer Behavior Shifts: Growing demand for ethical and transparent financial markets.

- Market Penetration: Deepening across financial institutions of all tiers, with a significant uptake in cloud-based solutions.

Dominant Regions, Countries, or Segments in Trade Surveillance Systems Industry

North America currently dominates the Trade Surveillance Systems market, driven by its highly developed financial infrastructure, stringent regulatory environment, and a high concentration of global financial institutions. The United States, in particular, leads due to robust enforcement actions by regulatory bodies like the SEC and CFTC, compelling firms to invest heavily in compliance technology. The Component: Solutions segment, encompassing sophisticated software platforms, is the primary growth engine within this region, accounting for a significant market share. The increasing adoption of Deployment: On-Cloud solutions further fuels growth, offering scalability and cost-effectiveness for financial firms.

Europe is a close second, with the European Union's comprehensive regulatory landscape, including MiFID II and MAR, creating substantial demand for effective trade surveillance. Countries like the UK and Germany are key contributors to market growth. Asia-Pacific presents a rapidly expanding market, fueled by the growth of financial markets in countries like China, Japan, and India, coupled with evolving regulatory frameworks that are increasingly aligning with international standards. The Component: Services segment, including implementation, consulting, and maintenance, is experiencing robust growth across all major regions as firms seek expert support in deploying and optimizing their surveillance systems.

- Dominant Region: North America, particularly the United States.

- Key Drivers in North America: Stringent regulations, large financial institutions, advanced technological adoption.

- Dominant Segment (Component): Solutions, providing comprehensive surveillance capabilities.

- Dominant Deployment: On-Cloud, offering flexibility and scalability.

- Key Drivers in Europe: MiFID II, MAR, and other EU directives.

- Emerging Market: Asia-Pacific, driven by market growth and evolving regulations.

- Growing Segment (Component): Services, supporting complex implementations and ongoing compliance.

Trade Surveillance Systems Industry Product Landscape

The product landscape for Trade Surveillance Systems is characterized by continuous innovation, focusing on enhancing detection capabilities, improving user experience, and enabling real-time monitoring. Key product innovations include AI-powered anomaly detection engines capable of identifying complex trading patterns indicative of market abuse, such as spoofing, layering, and wash trading. Advanced Natural Language Processing (NLP) is integrated for the surveillance of communications (emails, chats, voice calls) to detect insider trading and misconduct. Performance metrics are increasingly focused on reducing false positives, enhancing alert accuracy, and providing comprehensive audit trails. Unique selling propositions revolve around the ability of these systems to offer end-to-end surveillance, integrating pre-trade risk controls with post-trade market abuse detection across various asset classes.

Key Drivers, Barriers & Challenges in Trade Surveillance Systems Industry

Key Drivers:

- Increasing Regulatory Scrutiny: Growing global focus on financial market integrity and the prevention of market abuse.

- Technological Advancements: AI, ML, and big data analytics enabling more sophisticated detection and analysis.

- Need for Risk Mitigation: Financial institutions' imperative to protect against financial losses and reputational damage.

- Globalization of Financial Markets: Increased cross-border trading necessitates comprehensive, unified surveillance.

Barriers & Challenges:

- High Implementation Costs: Significant upfront investment required for advanced surveillance systems.

- Data Integration Complexity: Challenges in integrating data from disparate systems and formats.

- Regulatory Uncertainty: Evolving and sometimes divergent regulatory requirements across jurisdictions.

- Talent Shortage: Lack of skilled professionals to manage and operate complex surveillance systems.

- False Positives: The persistent challenge of minimizing inaccurate alerts, which can overwhelm compliance teams.

Emerging Opportunities in Trade Surveillance Systems Industry

Emerging opportunities in the Trade Surveillance Systems industry lie in the expansion of surveillance to new asset classes like digital assets and cryptocurrencies, which present unique regulatory and detection challenges. The increasing adoption of AI-driven predictive analytics for proactive risk identification, rather than solely reactive detection, offers significant potential. Furthermore, there is a growing demand for integrated compliance solutions that combine trade surveillance with other regulatory requirements, such as AML and KYC, providing a holistic approach to financial crime prevention. Untapped markets in developing economies with rapidly growing financial sectors also present substantial growth potential.

Growth Accelerators in the Trade Surveillance Systems Industry Industry

Long-term growth in the Trade Surveillance Systems industry is being accelerated by advancements in AI and ML, leading to more intelligent and efficient detection of sophisticated market abuse. Strategic partnerships between technology providers and financial institutions are crucial for developing tailored solutions and ensuring seamless integration. Market expansion strategies, including targeting mid-sized firms and offering specialized surveillance solutions for niche asset classes, are also significant growth catalysts. The continuous evolution of cloud computing infrastructure further enables greater scalability and accessibility of advanced surveillance technologies, driving wider adoption.

Key Players Shaping the Trade Surveillance Systems Industry Market

- B-Next Group

- SIA S P A

- eFlow Ltd

- BAE Systems Inc

- Fidelity National Information Services Inc

- Software AG

- Nasdaq Inc

- Aquis Technologies

- Nice Ltd

- ACA Compliance Group Holdings LLC

- Trillium Management LLC

Notable Milestones in Trade Surveillance Systems Industry Sector

- July 2022: SymphonyAI acquired NetReveal from BAE Systems, significantly expanding its financial vertical capabilities.

- February 2022: Software AG acquired StreamSets, enhancing its data integration capabilities for hybrid and multi-cloud environments, crucial for modern data-driven surveillance.

- February 2022: INVESTRE partnered with Aquis to pioneer tokenized retail trading of UCITS funds, marking a significant advancement in fintech and fund industry technology.

In-Depth Trade Surveillance Systems Industry Market Outlook

The future outlook for the Trade Surveillance Systems industry is exceptionally promising, fueled by persistent regulatory evolution and the ongoing digital transformation within financial services. Growth accelerators will continue to be driven by technological breakthroughs in AI, enabling predictive analytics and the detection of increasingly nuanced market manipulation schemes. Strategic partnerships between FinTech innovators and established financial institutions will foster the development of more comprehensive and integrated compliance solutions. The expansion into underserved markets and the increasing demand for cloud-native surveillance platforms will further solidify the industry's growth trajectory. The market is set to witness a higher degree of specialization, with solutions catering to specific asset classes and unique regulatory challenges, ensuring robust future market potential and sustained strategic opportunities.

Trade Surveillance Systems Industry Segmentation

-

1. Component

- 1.1. Solutions

- 1.2. Services

-

2. Deployment

- 2.1. On-Premise

- 2.2. On-Cloud

Trade Surveillance Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Italy

- 2.4. France

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia and New Zealand

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East and Africa

Trade Surveillance Systems Industry Regional Market Share

Geographic Coverage of Trade Surveillance Systems Industry

Trade Surveillance Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Need for Market Surveillance and growing regulatory compliance; Growing Sophistication of Trade Surveillance via Advanced Analytics

- 3.2.2 AI

- 3.2.3 ML

- 3.2.4 etc.

- 3.3. Market Restrains

- 3.3.1. High Initial R&D Expenditure

- 3.4. Market Trends

- 3.4.1. Cloud-based Platforms Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trade Surveillance Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premise

- 5.2.2. On-Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Trade Surveillance Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solutions

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-Premise

- 6.2.2. On-Cloud

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Trade Surveillance Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solutions

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-Premise

- 7.2.2. On-Cloud

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Trade Surveillance Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solutions

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-Premise

- 8.2.2. On-Cloud

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Trade Surveillance Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solutions

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-Premise

- 9.2.2. On-Cloud

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Trade Surveillance Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solutions

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-Premise

- 10.2.2. On-Cloud

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 B-Next Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SIA S P A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 eFlow Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BAE Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fidelity National Information Services Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Software AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nasdaq Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aquis Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nice Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ACA Compliance Group Holdings LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Trillium Management LLC*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 B-Next Group

List of Figures

- Figure 1: Global Trade Surveillance Systems Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Trade Surveillance Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Trade Surveillance Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Trade Surveillance Systems Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 5: North America Trade Surveillance Systems Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Trade Surveillance Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Trade Surveillance Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Trade Surveillance Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 9: Europe Trade Surveillance Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Trade Surveillance Systems Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 11: Europe Trade Surveillance Systems Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Trade Surveillance Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Trade Surveillance Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Trade Surveillance Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 15: Asia Pacific Trade Surveillance Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Trade Surveillance Systems Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 17: Asia Pacific Trade Surveillance Systems Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 18: Asia Pacific Trade Surveillance Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Trade Surveillance Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Trade Surveillance Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 21: Latin America Trade Surveillance Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Latin America Trade Surveillance Systems Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 23: Latin America Trade Surveillance Systems Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 24: Latin America Trade Surveillance Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Trade Surveillance Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Trade Surveillance Systems Industry Revenue (undefined), by Component 2025 & 2033

- Figure 27: Middle East and Africa Trade Surveillance Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East and Africa Trade Surveillance Systems Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 29: Middle East and Africa Trade Surveillance Systems Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Middle East and Africa Trade Surveillance Systems Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Trade Surveillance Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 3: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 6: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 10: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 11: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Germany Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Italy Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Russia Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 19: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 20: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: China Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: India Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia and New Zealand Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 28: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 29: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Brazil Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Mexico Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Trade Surveillance Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 34: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 35: Global Trade Surveillance Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Trade Surveillance Systems Industry?

The projected CAGR is approximately 13.9%.

2. Which companies are prominent players in the Trade Surveillance Systems Industry?

Key companies in the market include B-Next Group, SIA S P A, eFlow Ltd, BAE Systems Inc, Fidelity National Information Services Inc, Software AG, Nasdaq Inc, Aquis Technologies, Nice Ltd, ACA Compliance Group Holdings LLC, Trillium Management LLC*List Not Exhaustive.

3. What are the main segments of the Trade Surveillance Systems Industry?

The market segments include Component, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Market Surveillance and growing regulatory compliance; Growing Sophistication of Trade Surveillance via Advanced Analytics. AI. ML. etc..

6. What are the notable trends driving market growth?

Cloud-based Platforms Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

High Initial R&D Expenditure.

8. Can you provide examples of recent developments in the market?

July 2022: SymphonyAI, a leader in high-value enterprise AI SaaS for strategic industries, announced the acquisition of NetReveal from BAE Systems. This acquisition is a significant step forward in SymphonyAI's financial vertical expansion strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Trade Surveillance Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Trade Surveillance Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Trade Surveillance Systems Industry?

To stay informed about further developments, trends, and reports in the Trade Surveillance Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence