Key Insights

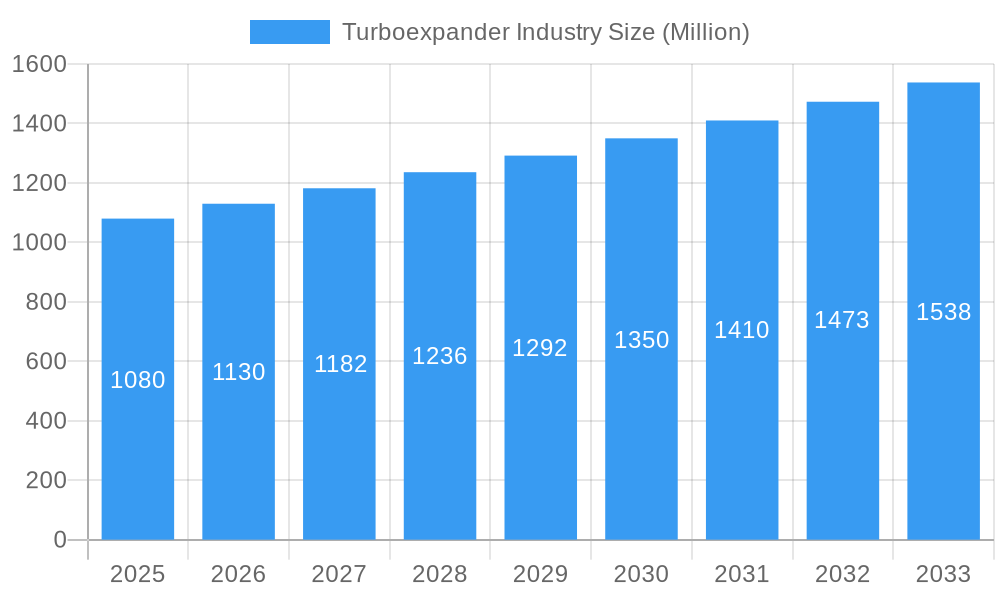

The global turboexpander market is poised for robust growth, projected to reach an estimated market size of USD 1.08 billion in 2025, driven by a Compound Annual Growth Rate (CAGR) of 4.60% over the forecast period. This expansion is primarily fueled by the increasing demand for energy efficiency and the growing need for cryogenic applications across various industries. Key drivers include the burgeoning oil and gas sector's requirement for gas processing and liquefaction, alongside the power generation industry's focus on waste heat recovery and emissions reduction. Furthermore, the surge in energy recovery initiatives and the development of advanced industrial processes are creating significant opportunities for turboexpander adoption. The market's expansion is also being influenced by technological advancements in turboexpander design, leading to improved performance, efficiency, and reliability, thereby making them a more attractive investment for businesses seeking to optimize their operations and comply with stricter environmental regulations.

Turboexpander Industry Market Size (In Billion)

The turboexpander market is segmented by loading devices and end-user industries, with compressor and generator loading devices holding significant share. The oil and gas industry remains a dominant end-user, benefiting from turboexpanders in natural gas processing, LNG production, and refinery operations. The power generation sector is another key contributor, utilizing turboexpanders for waste heat recovery and expanding gases in various power cycles. The trend towards greater energy recovery and the circular economy further bolsters demand. While the market demonstrates strong growth potential, certain restraints, such as the high initial capital investment for turboexpander systems and the availability of alternative technologies, could pose challenges. However, the long-term benefits of operational efficiency, cost savings, and environmental compliance are expected to outweigh these restraints, positioning the turboexpander market for sustained and significant expansion in the coming years.

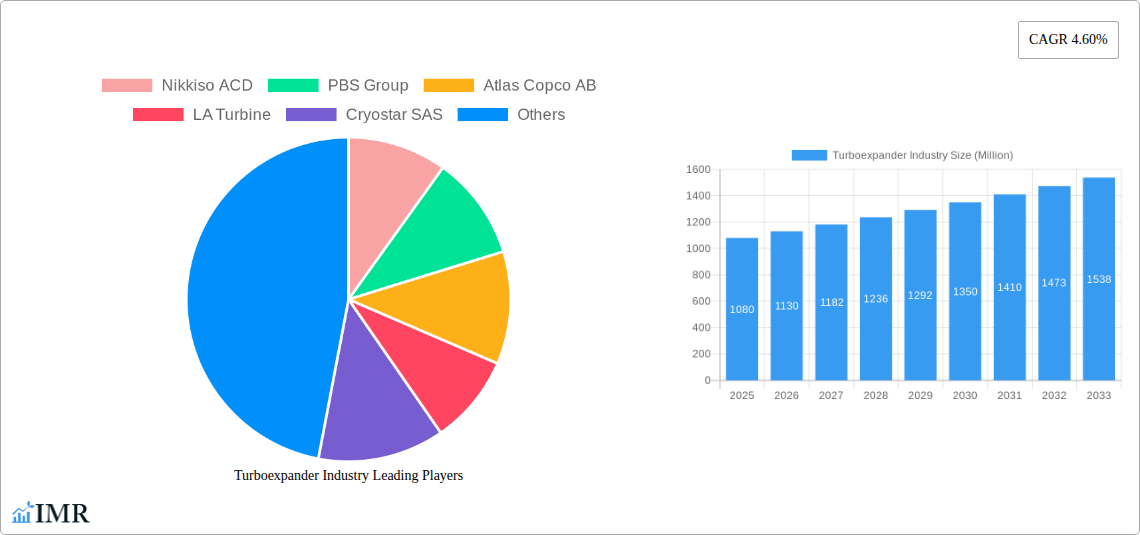

Turboexpander Industry Company Market Share

Turboexpander Industry Market Report: Unlocking Energy Recovery and Efficiency (2019-2033)

This comprehensive report delivers an in-depth analysis of the global Turboexpander Industry, providing critical insights into market dynamics, growth trends, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this study is essential for stakeholders seeking to navigate this rapidly evolving sector. We meticulously examine parent and child markets, offering a granular view of market segmentation and drivers, with all quantitative data presented in Million units.

Turboexpander Industry Market Dynamics & Structure

The global Turboexpander Industry exhibits a moderately concentrated market structure, characterized by a blend of established global players and emerging regional specialists. Technological innovation is a primary driver, fueled by increasing demand for energy efficiency and waste heat recovery solutions across various end-user sectors. Regulatory frameworks, particularly those promoting emissions reduction and sustainable energy practices, are significantly influencing market adoption. Competitive product substitutes, such as mechanical compressors and alternative energy recovery systems, present a challenge, but the unique benefits of turboexpanders in specific applications maintain their competitive edge. End-user demographics are shifting, with a growing emphasis on the Oil and Gas, Power Generation, and Energy Recovery segments. Mergers and acquisitions (M&A) trends are indicative of consolidation and strategic expansion, with an estimated xx M&A deals recorded during the historical period (2019-2024). Innovation barriers include the high initial capital expenditure for advanced turboexpander systems and the need for specialized expertise in design and maintenance.

- Market Concentration: Moderately concentrated with key players holding significant shares.

- Technological Innovation Drivers: Demand for energy efficiency, waste heat recovery, and emissions reduction.

- Regulatory Frameworks: Supportive policies for renewable energy and industrial decarbonization.

- Competitive Product Substitutes: Mechanical compressors, advanced heat exchangers.

- End-User Demographics: Strong growth in Oil & Gas, Power Generation, and Energy Recovery sectors.

- M&A Trends: Strategic acquisitions for market expansion and technology integration.

- Innovation Barriers: High initial investment, skilled workforce requirements.

Turboexpander Industry Growth Trends & Insights

The Turboexpander Industry is poised for robust growth, driven by an escalating global focus on energy conservation and the imperative to reduce industrial operational costs. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), expanding from an estimated xx Million units in 2025 to xx Million units by 2033. Adoption rates are accelerating, particularly within the Oil and Gas sector, where turboexpanders are integral to processes like natural gas processing and LNG production. Technological disruptions, such as advancements in material science leading to more durable and efficient turboexpander designs, are further stimulating market penetration. Consumer behavior shifts are evident, with industries increasingly prioritizing solutions that offer a compelling return on investment through energy savings and environmental compliance. The market penetration for industrial turboexpanders is estimated to reach xx% by 2033.

The report's exhaustive analysis, leveraging proprietary market intelligence and extensive industry data, delves into the intricate interplay of factors shaping the turboexpander landscape. We meticulously dissect the market size evolution, tracing its trajectory from the historical period (2019-2024) through to the projected future. Adoption rates across various end-user industries are quantified, highlighting the increasing acceptance of turboexpander technology as a vital tool for energy optimization. Technological disruptions, including the development of more compact and efficient designs, are examined for their impact on market accessibility and performance. Furthermore, the report scrutinizes evolving consumer behavior, characterized by a heightened awareness of the economic and environmental benefits associated with advanced energy recovery systems. This holistic approach ensures a comprehensive understanding of the forces propelling the Turboexpander Industry forward, providing actionable insights for strategic decision-making and investment planning.

Dominant Regions, Countries, or Segments in Turboexpander Industry

The Oil and Gas segment is unequivocally the dominant force driving growth within the global Turboexpander Industry. Its pervasive use in critical processes such as natural gas processing, liquefaction, and refining operations positions it at the forefront of market expansion. This dominance is further amplified by substantial investments in upstream and midstream infrastructure, particularly in regions with significant hydrocarbon reserves. The Energy Recovery segment also exhibits substantial growth potential, as industries globally seek to harness waste heat and pressure to generate electricity and reduce energy consumption.

Dominant Segment: Oil and Gas:

- Key Drivers: Natural gas processing, LNG production, refining operations, petrochemical industry demands.

- Market Share: Estimated xx% of the global market in 2025.

- Growth Potential: Driven by increasing global energy demand and the need for efficient processing of hydrocarbons.

Growing Segment: Energy Recovery:

- Key Drivers: Industrial energy efficiency mandates, carbon footprint reduction initiatives, cost optimization in manufacturing.

- Market Share: Projected to grow at a CAGR of xx% from 2025 to 2033.

- Growth Potential: Significant opportunities in sectors like cement, steel, and chemical manufacturing.

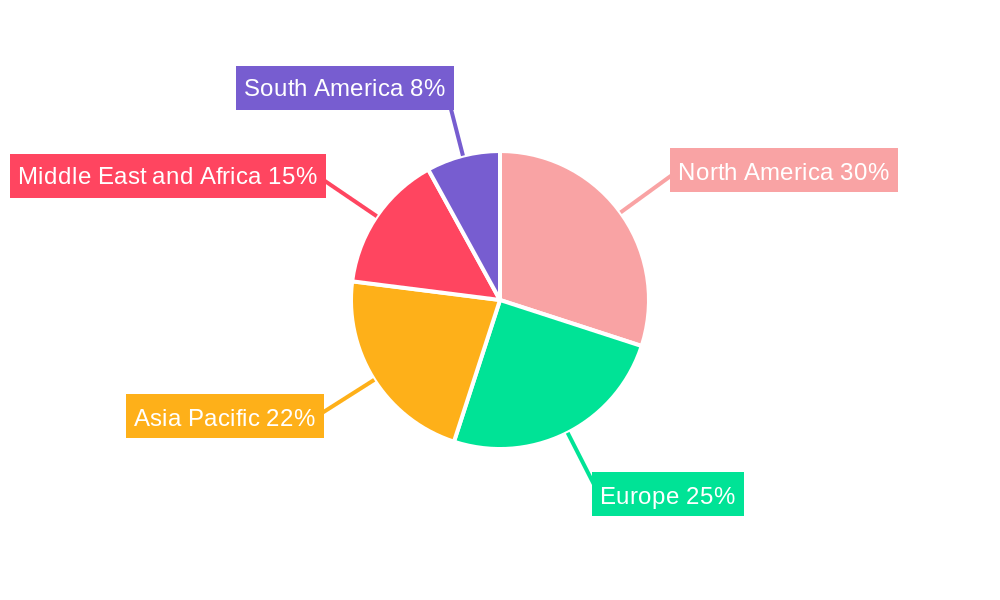

Leading Regions:

- North America: Strong presence of Oil and Gas operations, coupled with government incentives for energy efficiency.

- Asia Pacific: Rapid industrialization, increasing demand for power generation, and investments in LNG infrastructure.

- Middle East: Extensive Oil and Gas sector and significant investments in downstream processing.

Country-Specific Dominance: The United States, driven by its extensive shale gas production and LNG export capabilities, remains a key market. China's burgeoning industrial sector and commitment to cleaner energy practices are also significant growth contributors.

The dominance of the Oil and Gas sector is underpinned by the inherent need for efficient pressure reduction and expansion processes within its value chain. Turboexpanders play a crucial role in these applications, enabling cost savings and environmental benefits. The Energy Recovery segment, while currently smaller, is rapidly gaining traction as industries worldwide prioritize sustainability and operational efficiency. Economic policies and infrastructure development in key regions are critical enablers of growth for both segments.

Turboexpander Industry Product Landscape

The Turboexpander Industry is characterized by continuous product innovation, with a focus on enhanced efficiency, reliability, and expanded application scope. Leading manufacturers are developing advanced turboexpander generators that harness waste energy, such as in city gas transportation routes, as demonstrated by the recent developments from Sapphire Technologies and TB Global Technologies Ltd. These innovations are crucial for improving overall energy recovery and reducing operational costs. Applications span from cryogenic processes in LNG production to power generation from industrial waste heat and pressure. Performance metrics are consistently improving, with higher adiabatic efficiencies and wider operating ranges becoming standard. Unique selling propositions often revolve around custom-engineered solutions tailored to specific industrial needs, improved uptime through robust designs, and advanced control systems for optimal performance.

Key Drivers, Barriers & Challenges in Turboexpander Industry

Key Drivers:

- Increasing demand for energy efficiency and cost reduction across industries.

- Growing global focus on emissions reduction and sustainable energy practices.

- Expansion of the Oil and Gas sector, particularly in natural gas processing and LNG production.

- Government incentives and regulatory support for energy recovery and renewable energy integration.

- Technological advancements leading to more efficient and reliable turboexpander systems.

Barriers & Challenges:

- High initial capital investment for advanced turboexpander systems.

- Availability of skilled personnel for installation, operation, and maintenance.

- Competition from alternative energy recovery technologies.

- Supply chain disruptions impacting the availability of critical components.

- Stringent regulatory compliance in certain geographical regions.

- Fluctuations in global energy prices impacting investment decisions.

Emerging Opportunities in Turboexpander Industry

Emerging opportunities in the Turboexpander Industry lie in the untapped potential of smaller-scale industrial applications and the integration of turboexpander technology with renewable energy sources. The development of more compact and cost-effective designs is crucial for expanding market reach into sectors previously underserved. Furthermore, the growing emphasis on the hydrogen economy presents significant opportunities for turboexpanders in gas compression and processing. Innovative applications in waste heat recovery from data centers and advanced manufacturing processes are also on the horizon. Evolving consumer preferences for sustainable and energy-efficient solutions will continue to fuel demand for these advanced technologies.

Growth Accelerators in the Turboexpander Industry Industry

Catalysts driving long-term growth in the Turboexpander Industry include significant technological breakthroughs in materials science and aerodynamic design, leading to enhanced performance and lifespan. Strategic partnerships between turboexpander manufacturers and end-users are crucial for co-developing customized solutions and accelerating adoption. Market expansion strategies, focusing on emerging economies and new application areas like industrial waste heat-to-power systems, will also play a pivotal role. The increasing integration of turboexpanders into smart grids and distributed energy systems further amplifies their growth potential.

Key Players Shaping the Turboexpander Industry Market

- Nikkiso ACD

- PBS Group

- Atlas Copco AB

- LA Turbine

- Cryostar SAS

- Air Products and Chemicals Inc

- Elliott Group

- Baker Hughes Company

- Blair Engineering

Notable Milestones in Turboexpander Industry Sector

- August 2023: Sapphire Technologies and TB Global Technologies Ltd. announced the development of a turboexpander generator that harnesses waste energy in city gas transportation routes. Two FreeSpin In-line Turbo Expanders (FIT) were successfully commissioned at the Toho Gasin’s Yokkaichi liquefied natural gas (LNG) terminal in Japan.

- October 2022: Sapphire Technologies, a developer and manufacturer of energy recovery systems for hydrogen and natural gas industrial applications, signed an agreement to collaborate with Tallgrass Energy, a leading US energy infrastructure company. It is to pursue a nationwide clean energy project to install 72 turbo expander systems over the next three years.

In-Depth Turboexpander Industry Market Outlook

The Turboexpander Industry is set for substantial future growth, propelled by the increasing imperative for energy efficiency and decarbonization across critical industrial sectors. The market's trajectory is characterized by continuous innovation, with a strong focus on developing advanced systems capable of maximizing energy recovery from waste heat and pressure. Strategic partnerships and market expansion into emerging economies will be key to unlocking new revenue streams. The ongoing development of more compact, cost-effective, and highly efficient turboexpanders will broaden their applicability, driving adoption across a wider range of industries. The industry's outlook is exceptionally positive, driven by global sustainability initiatives and the inherent economic advantages of turboexpander technology in optimizing industrial processes.

Turboexpander Industry Segmentation

-

1. Loading Devices

- 1.1. Compressor

- 1.2. Generator

- 1.3. Hydraulic Brake

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Energy Recovery

- 2.4. Other End-user Industries

Turboexpander Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Qatar

- 5.5. Rest of Middle East and Africa

Turboexpander Industry Regional Market Share

Geographic Coverage of Turboexpander Industry

Turboexpander Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Adaption of Natural Gas for Power Generation and Fuel for Various Industries

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Share of Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Power Generation Segment to Have a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Turboexpander Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Loading Devices

- 5.1.1. Compressor

- 5.1.2. Generator

- 5.1.3. Hydraulic Brake

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Energy Recovery

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Loading Devices

- 6. North America Turboexpander Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Loading Devices

- 6.1.1. Compressor

- 6.1.2. Generator

- 6.1.3. Hydraulic Brake

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Power Generation

- 6.2.3. Energy Recovery

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Loading Devices

- 7. Europe Turboexpander Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Loading Devices

- 7.1.1. Compressor

- 7.1.2. Generator

- 7.1.3. Hydraulic Brake

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Power Generation

- 7.2.3. Energy Recovery

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Loading Devices

- 8. Asia Pacific Turboexpander Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Loading Devices

- 8.1.1. Compressor

- 8.1.2. Generator

- 8.1.3. Hydraulic Brake

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Power Generation

- 8.2.3. Energy Recovery

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Loading Devices

- 9. South America Turboexpander Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Loading Devices

- 9.1.1. Compressor

- 9.1.2. Generator

- 9.1.3. Hydraulic Brake

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Power Generation

- 9.2.3. Energy Recovery

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Loading Devices

- 10. Middle East and Africa Turboexpander Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Loading Devices

- 10.1.1. Compressor

- 10.1.2. Generator

- 10.1.3. Hydraulic Brake

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Power Generation

- 10.2.3. Energy Recovery

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Loading Devices

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nikkiso ACD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PBS Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Atlas Copco AB

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LA Turbine

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cryostar SAS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Air Products and Chemicals Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elliott Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Baker Hughes Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Blair Engineering

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Nikkiso ACD

List of Figures

- Figure 1: Global Turboexpander Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Turboexpander Industry Revenue (Million), by Loading Devices 2025 & 2033

- Figure 3: North America Turboexpander Industry Revenue Share (%), by Loading Devices 2025 & 2033

- Figure 4: North America Turboexpander Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Turboexpander Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Turboexpander Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Turboexpander Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Turboexpander Industry Revenue (Million), by Loading Devices 2025 & 2033

- Figure 9: Europe Turboexpander Industry Revenue Share (%), by Loading Devices 2025 & 2033

- Figure 10: Europe Turboexpander Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Turboexpander Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Turboexpander Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Turboexpander Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Turboexpander Industry Revenue (Million), by Loading Devices 2025 & 2033

- Figure 15: Asia Pacific Turboexpander Industry Revenue Share (%), by Loading Devices 2025 & 2033

- Figure 16: Asia Pacific Turboexpander Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Turboexpander Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Turboexpander Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Turboexpander Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Turboexpander Industry Revenue (Million), by Loading Devices 2025 & 2033

- Figure 21: South America Turboexpander Industry Revenue Share (%), by Loading Devices 2025 & 2033

- Figure 22: South America Turboexpander Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Turboexpander Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Turboexpander Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Turboexpander Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Turboexpander Industry Revenue (Million), by Loading Devices 2025 & 2033

- Figure 27: Middle East and Africa Turboexpander Industry Revenue Share (%), by Loading Devices 2025 & 2033

- Figure 28: Middle East and Africa Turboexpander Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Turboexpander Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Turboexpander Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Turboexpander Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Turboexpander Industry Revenue Million Forecast, by Loading Devices 2020 & 2033

- Table 2: Global Turboexpander Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Turboexpander Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Turboexpander Industry Revenue Million Forecast, by Loading Devices 2020 & 2033

- Table 5: Global Turboexpander Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Turboexpander Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Turboexpander Industry Revenue Million Forecast, by Loading Devices 2020 & 2033

- Table 11: Global Turboexpander Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Turboexpander Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Turboexpander Industry Revenue Million Forecast, by Loading Devices 2020 & 2033

- Table 19: Global Turboexpander Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Turboexpander Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Turboexpander Industry Revenue Million Forecast, by Loading Devices 2020 & 2033

- Table 27: Global Turboexpander Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Turboexpander Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Chile Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Turboexpander Industry Revenue Million Forecast, by Loading Devices 2020 & 2033

- Table 34: Global Turboexpander Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Turboexpander Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: United Arab Emirates Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Qatar Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Turboexpander Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turboexpander Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Turboexpander Industry?

Key companies in the market include Nikkiso ACD, PBS Group, Atlas Copco AB, LA Turbine, Cryostar SAS, Air Products and Chemicals Inc *List Not Exhaustive, Elliott Group, Baker Hughes Company, Blair Engineering.

3. What are the main segments of the Turboexpander Industry?

The market segments include Loading Devices, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.08 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Adaption of Natural Gas for Power Generation and Fuel for Various Industries.

6. What are the notable trends driving market growth?

Power Generation Segment to Have a Significant Share.

7. Are there any restraints impacting market growth?

4.; Increasing Share of Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

August 2023: Sapphire Technologies and TB Global Technologies Ltd. announced the development of a turboexpander generator that harnesses waste energy in city gas transportation routes. Two FreeSpin In-line Turbo Expanders (FIT) were successfully commissioned at the Toho Gasin’s Yokkaichi liquefied natural gas (LNG) terminal in Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turboexpander Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turboexpander Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turboexpander Industry?

To stay informed about further developments, trends, and reports in the Turboexpander Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence