Key Insights

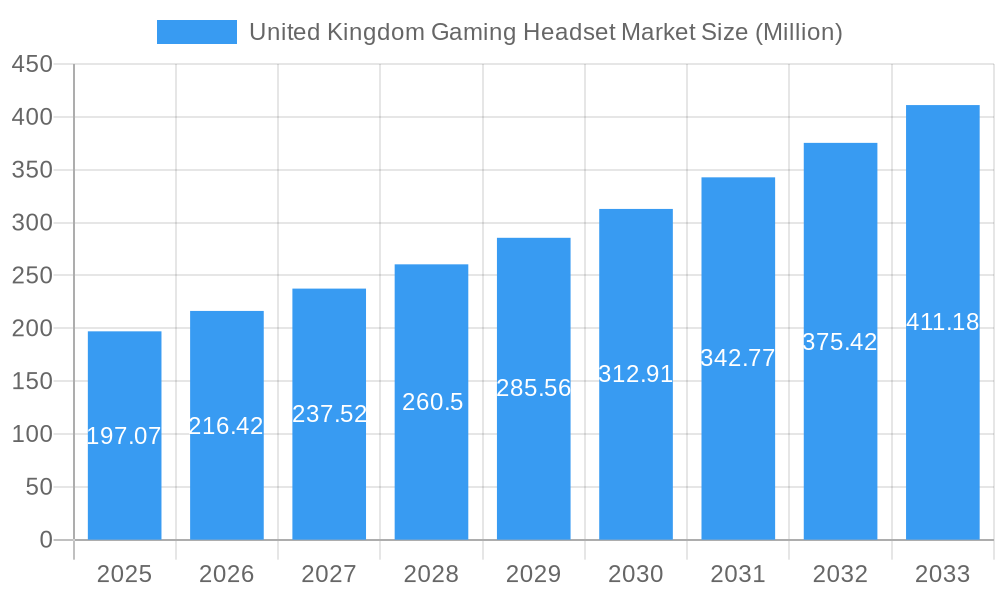

The United Kingdom's gaming headset market is poised for significant expansion, with an estimated market size of $197.07 million in 2025. This robust growth is fueled by a compelling CAGR of 9.85% projected over the forecast period of 2025-2033. The market's dynamism is driven by several key factors, including the increasing popularity of esports, the continuous innovation in audio technology leading to more immersive gaming experiences, and the growing penetration of high-speed internet enabling seamless online multiplayer gaming. Furthermore, the rising disposable incomes among the UK's gaming demographic contribute to a greater willingness to invest in premium gaming peripherals. The demand is further propelled by the expanding content ecosystem, with new game releases and the sustained popularity of existing titles encouraging players to upgrade their equipment for optimal performance and enjoyment. The shift towards cloud gaming services also necessitates reliable and high-quality audio solutions.

United Kingdom Gaming Headset Market Market Size (In Million)

Key trends shaping the UK gaming headset market include a strong preference for wireless connectivity, offering unparalleled freedom of movement and convenience. However, wired headsets continue to hold a significant share due to their cost-effectiveness and the absence of latency concerns, particularly appealing to competitive gamers. The market is segmenting further, with specialized console headsets and PC headsets catering to distinct user needs and platform preferences. Sales channels are also diversifying, with online retail experiencing substantial growth, mirroring broader e-commerce trends, while traditional retail outlets continue to serve a segment of the market. Major players such as Logitech International SA, Corsair Gaming Inc, Razer Inc, SteelSeries, and Turtle Beach Corporation are actively innovating, introducing features like advanced noise cancellation, spatial audio, and ergonomic designs to capture market share amidst this competitive landscape. While the market is experiencing robust growth, potential restraints could include economic downturns impacting consumer spending on discretionary items like gaming peripherals, and increasing competition from alternative audio solutions.

United Kingdom Gaming Headset Market Company Market Share

United Kingdom Gaming Headset Market: Comprehensive Market Analysis and Growth Outlook (2019-2033)

This in-depth report provides a definitive analysis of the United Kingdom Gaming Headset Market, offering critical insights into its dynamics, growth trends, and future outlook. Covering the historical period from 2019 to 2024 and forecasting through 2033, with 2025 as the base and estimated year, this report is an essential resource for industry stakeholders, investors, and manufacturers seeking to capitalize on this rapidly evolving sector. We delve into parent and child market segmentation, leveraging high-traffic keywords to ensure maximum search engine visibility and engagement. All quantitative values are presented in Million Units for clear market comprehension.

United Kingdom Gaming Headset Market Market Dynamics & Structure

The United Kingdom gaming headset market exhibits a moderately concentrated structure, with a few key players holding significant market share. Logitech International S.A., Corsair Gaming Inc., Razer Inc., SteelSeries, and Turtle Beach Corporation are prominent companies driving innovation and competition. Technological innovation remains a primary driver, with advancements in audio quality, wireless connectivity, and ergonomic design continually shaping product offerings. Regulatory frameworks, primarily concerning consumer electronics safety and data privacy, are generally supportive but require adherence. Competitive product substitutes, such as high-fidelity headphones and integrated audio solutions, exist but often lack the specialized gaming features offered by dedicated headsets. End-user demographics are diverse, encompassing casual gamers, esports enthusiasts, and professional streamers, all demanding distinct functionalities. Mergers and acquisitions (M&A) activity, while not intensely high, is observed as companies seek to expand their product portfolios and market reach. For instance, the acquisition of headset brands by larger electronics conglomerates or strategic partnerships aimed at integrating advanced audio technologies are key trends. Barriers to innovation include the high cost of R&D for cutting-edge features and the challenge of maintaining competitive pricing in a price-sensitive segment.

- Market Concentration: Moderately concentrated with dominant players.

- Technological Innovation: Driven by audio fidelity, wireless tech, and comfort.

- Regulatory Frameworks: Focus on safety and data privacy.

- Competitive Substitutes: High-fidelity headphones, integrated audio.

- End-User Demographics: Casual gamers, esports athletes, streamers.

- M&A Trends: Strategic acquisitions for portfolio expansion.

- Innovation Barriers: R&D costs, pricing pressures.

United Kingdom Gaming Headset Market Growth Trends & Insights

The United Kingdom gaming headset market is poised for substantial growth, fueled by an increasing number of individuals engaging in video gaming across all age groups. Market size evolution is characterized by a steady upward trajectory, with adoption rates for gaming headsets climbing significantly year-on-year. Technological disruptions, such as the widespread adoption of low-latency wireless technologies and advanced spatial audio, are enhancing the immersive gaming experience, driving consumer demand for premium headsets. Consumer behavior shifts are also playing a pivotal role; with the rise of esports and content creation, gamers are increasingly viewing headsets as essential peripherals for both competitive play and communication. The growing popularity of cloud gaming platforms and cross-platform play further necessitates versatile headsets compatible with multiple devices. Penetration rates are projected to increase as gaming becomes more mainstream and accessible. The market is witnessing a surge in demand for wireless gaming headsets due to the convenience and freedom of movement they offer. Furthermore, the integration of advanced microphone technology and noise-cancellation features is becoming a key differentiator, catering to the needs of streamers and content creators who prioritize clear communication and an uninterrupted audio experience. The average selling price (ASP) is expected to see a gradual increase, driven by the introduction of higher-end, feature-rich models. The overall CAGR for the forecast period is projected to be robust, reflecting the sustained interest in gaming and the continuous innovation within the headset segment.

Dominant Regions, Countries, or Segments in United Kingdom Gaming Headset Market

The United Kingdom gaming headset market is predominantly driven by the PC Headset segment, closely followed by Console Headsets. This dominance stems from the sheer volume of PC gaming enthusiasts and the robust esports ecosystem in the UK, where PC gaming often forms the foundation. Within the PC Headset segment, Wireless connectivity is experiencing exponential growth, surpassing Wired options in popularity. This shift is attributed to the demand for greater freedom of movement and a tidier gaming setup, aligning with modern consumer preferences for convenience and aesthetics. The Online sales channel is also a significant driver, with e-commerce platforms offering a wider selection, competitive pricing, and convenient home delivery. Retail stores, while still relevant, are increasingly playing a role in product discovery and brand experience rather than being the primary purchase point for many consumers.

- Dominant Segment (Compatibility Type): PC Headset.

- Key Drivers: High PC gaming population, thriving esports scene, extensive game library available on PC.

- Market Share: Projected to hold over 60% of the market.

- Growth Potential: Continued innovation in PC gaming hardware and software.

- Dominant Segment (Connectivity Type): Wireless.

- Key Drivers: Demand for convenience, aesthetics, and freedom of movement.

- Market Share: Rapidly increasing, projected to exceed 70% of the wireless segment by 2033.

- Growth Potential: Advancements in battery life, latency reduction, and multi-device connectivity.

- Dominant Segment (Sales Channel): Online.

- Key Drivers: Wider product selection, competitive pricing, convenient purchasing process, accessibility.

- Market Share: Expected to account for over 75% of total sales.

- Growth Potential: Continued e-commerce growth and integration of advanced online retail technologies.

- Console Headsets: While secondary to PC headsets, console gaming remains a strong market, with PlayStation and Xbox headsets showing steady demand. Economic policies supporting consumer spending and infrastructure facilitating online gaming contribute to this segment's growth.

United Kingdom Gaming Headset Market Product Landscape

The United Kingdom gaming headset market is characterized by a continuous stream of product innovations aimed at enhancing the gamer's experience. Key advancements include the integration of high-fidelity audio drivers for immersive soundscapes, sophisticated noise-cancellation technologies for microphones to ensure clear in-game communication, and ergonomic designs focused on long-wear comfort. Many new releases emphasize low-latency wireless connectivity, offering performance comparable to wired connections. Furthermore, the inclusion of customizable RGB lighting, advanced companion apps for audio equalization, and durable, premium materials are becoming standard features in mid-to-high-end gaming headsets. These product enhancements cater to the discerning gamer seeking a competitive edge and an elevated entertainment experience.

Key Drivers, Barriers & Challenges in United Kingdom Gaming Headset Market

Key Drivers: The primary forces propelling the United Kingdom gaming headset market include the sustained growth of the video game industry, the increasing popularity of esports and competitive gaming, and the rising trend of game streaming and content creation. Technological advancements in audio fidelity, wireless connectivity, and microphone quality are also significant drivers. Economic factors, such as disposable income and a strong consumer appetite for gaming peripherals, further bolster market expansion.

Barriers & Challenges: Key challenges include intense market competition, leading to price wars and pressure on profit margins. Supply chain disruptions, particularly for electronic components, can impact production and availability. Regulatory hurdles related to product safety and environmental standards, though generally manageable, require adherence. Moreover, the rapid pace of technological change necessitates continuous R&D investment to remain competitive, posing a financial challenge for smaller manufacturers. The threat of counterfeit products and intellectual property infringement also presents a concern.

Emerging Opportunities in United Kingdom Gaming Headset Market

Emerging opportunities lie in the development of highly specialized headsets for niche gaming genres, such as VR gaming, which demands advanced spatial audio and comfort. The growing popularity of mobile gaming also presents an untapped market for high-quality, portable gaming headsets. Furthermore, the integration of haptic feedback technology within headsets could offer a new dimension of immersion. The increasing demand for sustainable and eco-friendly gaming peripherals also represents a significant opportunity for brands that can offer environmentally conscious products.

Growth Accelerators in the United Kingdom Gaming Headset Market Industry

Catalysts driving long-term growth include continuous technological breakthroughs in audio processing, wireless communication, and battery technology. Strategic partnerships between headset manufacturers and game developers can lead to co-branded products and integrated audio experiences that enhance gameplay. Market expansion strategies targeting new demographic segments, such as older gamers or casual players seeking better audio quality for entertainment, can also accelerate growth. The increasing adoption of cloud gaming and subscription services also fuels demand for versatile and high-performance headsets.

Key Players Shaping the United Kingdom Gaming Headset Market Market

- Logitech International S.A.

- Corsair Gaming Inc.

- Razer Inc.

- SteelSeries

- Turtle Beach Corporation

Notable Milestones in United Kingdom Gaming Headset Market Sector

- June 2024: AVID Products introduced its newest headset, the AVIGA gaming headset, showcasing cutting-edge technology. The AVIGA is crafted to offer top-tier sound quality, exceptional performance, and comfort, all at an affordable price. With this launch, AVID Products seeks to enhance the esports experience for gamers across the spectrum.

- May 2024: SteelSeries unveiled its latest headset line, the Arctis Nova 5 series, accompanied by the debut of the Nova 5 Companion App. This app boasts an impressive repertoire of over 100 gaming audio presets. While the series is tailored for PC gaming, it also offers specialized versions for PlayStation (Arctis Nova 5P) and Xbox (Arctis Nova 5X), ensuring compatibility across a broad spectrum of devices.

In-Depth United Kingdom Gaming Headset Market Market Outlook

The United Kingdom gaming headset market is set for continued robust growth, propelled by ongoing technological advancements and a deepening integration of gaming into mainstream entertainment. The increasing adoption of higher fidelity audio technologies and low-latency wireless connectivity will continue to drive upgrades and attract new consumers. Strategic partnerships between hardware manufacturers and game developers, alongside the expansion of cloud gaming services, will further solidify the demand for premium gaming audio solutions. The market's outlook is bright, with ample room for innovation in areas such as virtual and augmented reality audio, offering exciting prospects for stakeholders willing to invest in cutting-edge products and strategic market penetration.

United Kingdom Gaming Headset Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

United Kingdom Gaming Headset Market Segmentation By Geography

- 1. United Kingdom

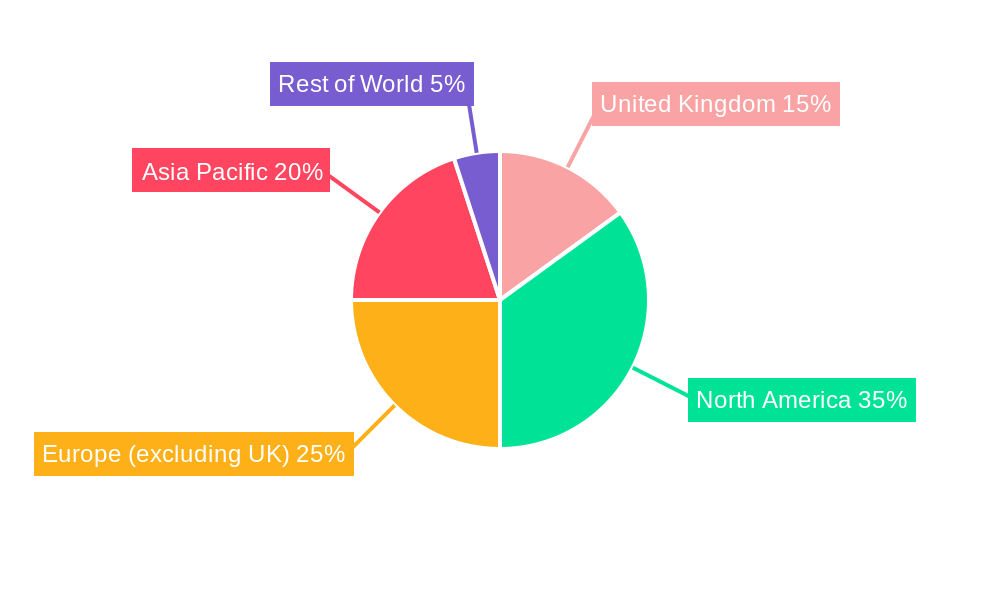

United Kingdom Gaming Headset Market Regional Market Share

Geographic Coverage of United Kingdom Gaming Headset Market

United Kingdom Gaming Headset Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Wireless Headsets is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Gaming Headset Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logitech International S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Corsair Gaming Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Razer Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SteelSeries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Turtle Beach Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Logitech International S A

List of Figures

- Figure 1: United Kingdom Gaming Headset Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Gaming Headset Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 2: United Kingdom Gaming Headset Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 3: United Kingdom Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 4: United Kingdom Gaming Headset Market Volume Million Forecast, by Connectivity Type 2020 & 2033

- Table 5: United Kingdom Gaming Headset Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: United Kingdom Gaming Headset Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 7: United Kingdom Gaming Headset Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United Kingdom Gaming Headset Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: United Kingdom Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 10: United Kingdom Gaming Headset Market Volume Million Forecast, by Compatibility Type 2020 & 2033

- Table 11: United Kingdom Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 12: United Kingdom Gaming Headset Market Volume Million Forecast, by Connectivity Type 2020 & 2033

- Table 13: United Kingdom Gaming Headset Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: United Kingdom Gaming Headset Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 15: United Kingdom Gaming Headset Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Gaming Headset Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Gaming Headset Market?

The projected CAGR is approximately 9.85%.

2. Which companies are prominent players in the United Kingdom Gaming Headset Market?

Key companies in the market include Logitech International S A, Corsair Gaming Inc, Razer Inc, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the United Kingdom Gaming Headset Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 197.07 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Wireless Headsets is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2024: AVID Products introduced its newest headset, the AVIGA gaming headset, showcasing cutting-edge technology. The AVIGA is crafted to offer top-tier sound quality, exceptional performance, and comfort, all at an affordable price. With this launch, AVID Products seeks to enhance the esports experience for gamers across the spectrum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Gaming Headset Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Gaming Headset Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Gaming Headset Market?

To stay informed about further developments, trends, and reports in the United Kingdom Gaming Headset Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence