Key Insights

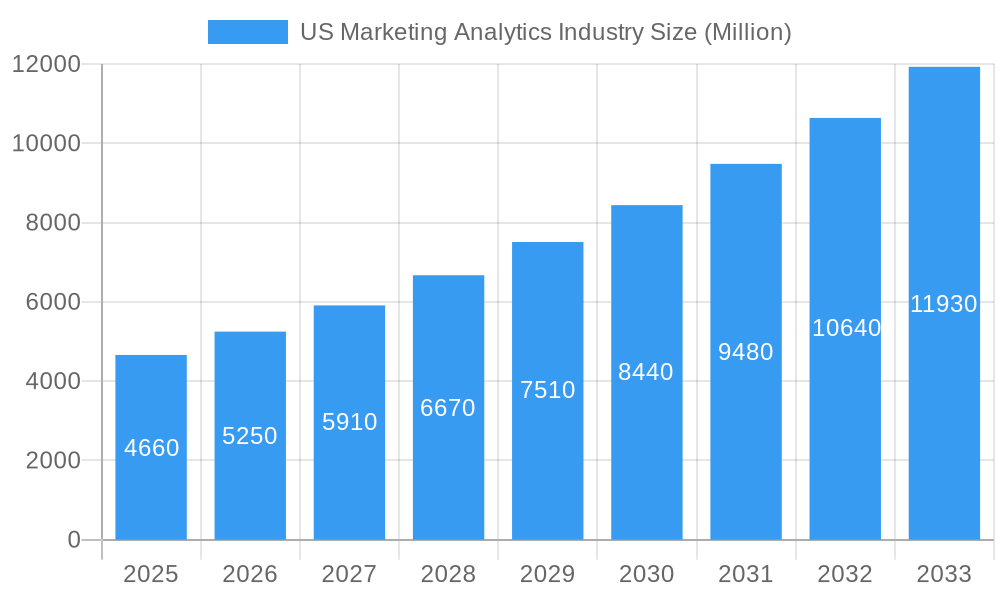

The US Marketing Analytics Industry is poised for significant expansion, with a current market size estimated at $4.66 Billion. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) exceeding 12.73%, indicating robust and sustained expansion over the forecast period of 2025-2033. Key drivers contributing to this surge include the escalating need for data-driven decision-making in marketing, the increasing adoption of advanced analytical tools, and the growing importance of personalized customer experiences. Businesses are leveraging marketing analytics to optimize campaign performance, improve customer segmentation, predict consumer behavior, and ultimately maximize return on investment (ROI). The widespread availability of sophisticated cloud-based solutions further democratizes access to these powerful tools, enabling a broader range of companies to harness the benefits of marketing analytics.

US Marketing Analytics Industry Market Size (In Billion)

The industry's trajectory is shaped by several dominant trends, including the rise of AI and machine learning in predictive analytics, the integration of real-time data processing for agile campaign adjustments, and the growing emphasis on customer journey mapping for a holistic understanding of consumer interactions. While the market is dynamic, potential restraints could include data privacy concerns and the initial investment costs associated with advanced analytical platforms, particularly for smaller enterprises. However, the overwhelming benefits of enhanced marketing effectiveness and improved customer engagement are expected to outweigh these challenges. The sector is segmented across various deployment models, with cloud solutions increasingly favored for their scalability and flexibility, and a wide array of applications, from online and email marketing to content and social media marketing, serving diverse end-user industries such as retail, BFSI, education, and healthcare.

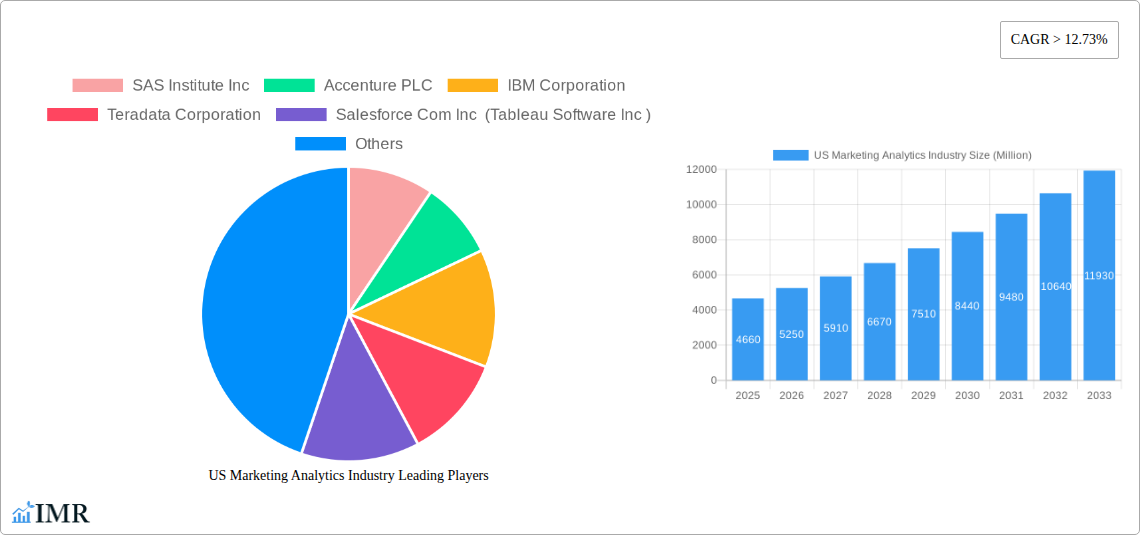

US Marketing Analytics Industry Company Market Share

US Marketing Analytics Industry Report: Unlocking Data-Driven Growth in a Dynamic Digital Landscape

This comprehensive report delves into the US marketing analytics industry, providing an in-depth analysis of its current state, future projections, and the strategic imperatives for businesses seeking to thrive in a data-intensive environment. Spanning the historical period of 2019-2024 and extending to a forecast period of 2025-2033, this study offers unparalleled insights into market dynamics, growth trends, and key player strategies. With a base year of 2025 and an estimated year of 2025, the report illuminates the immediate future and long-term trajectory of this critical sector, valuing all figures in Million units.

The US marketing analytics market is witnessing a significant transformation driven by the escalating need for personalized customer experiences, sophisticated campaign optimization, and measurable ROI. This report dissects the competitive landscape, explores the adoption of cutting-edge technologies, and forecasts market size evolution with precision. It further examines dominant regional players, emerging opportunities, and the crucial factors that will accelerate growth. This is your essential guide to navigating the complexities and capitalizing on the immense potential of US marketing analytics.

US Marketing Analytics Industry Market Dynamics & Structure

The US marketing analytics industry is characterized by a moderately concentrated market, with major players like SAS Institute Inc., Accenture PLC, IBM Corporation, Teradata Corporation, Salesforce Com Inc (Tableau Software Inc.), Microsoft Corporation, Adobe Systems Incorporated, Pegasystems Inc., Neustar Inc., Oracle Corporation, and Google LLC dominating a significant portion of market share. These giants leverage extensive R&D investments and strategic acquisitions to maintain their competitive edge. Technological innovation is a primary driver, fueled by advancements in artificial intelligence (AI), machine learning (ML), and big data processing capabilities, enabling more sophisticated predictive modeling and real-time analytics. Regulatory frameworks, particularly around data privacy (e.g., CCPA), are increasingly influencing how marketing analytics solutions are developed and deployed, demanding robust compliance features. Competitive product substitutes range from in-house analytics teams to more niche, specialized analytics tools. End-user demographics are diverse, with Retail, BFSI, Healthcare, and Manufacturing showing the highest propensity for adopting advanced marketing analytics solutions. Mergers and acquisitions (M&A) are a consistent trend, allowing companies to expand their service offerings, acquire talent, and gain market access. For instance, the acquisition of Motus Consumer Insights by Vi Labs underscores the ongoing consolidation and strategic alignment within the sector.

- Market Concentration: Dominated by a few key players, but with significant room for specialized solutions.

- Technological Innovation: Driven by AI, ML, and big data, enabling advanced predictive and prescriptive analytics.

- Regulatory Influence: Data privacy laws are shaping product development and data handling practices.

- End-User Demand: High adoption in Retail, BFSI, Healthcare, and Manufacturing sectors for data-driven decision-making.

- M&A Activity: Strategic acquisitions are common for market expansion and capability enhancement.

US Marketing Analytics Industry Growth Trends & Insights

The US marketing analytics industry is poised for robust expansion, driven by a confluence of technological advancements and evolving consumer behaviors. The market size is projected to grow at a significant Compound Annual Growth Rate (CAGR) from xx Million units in 2024 to an estimated xx Million units by 2033. This growth is fueled by the increasing adoption of cloud-based marketing analytics solutions, which offer scalability, flexibility, and cost-effectiveness compared to traditional on-premise deployments. The surge in online marketing, social media marketing, and content marketing has created a deluge of data, making sophisticated analytics indispensable for understanding customer journeys, personalizing campaigns, and optimizing marketing spend.

Technological disruptions are central to this growth trajectory. The integration of AI and ML is enabling predictive analytics for customer churn, lifetime value estimation, and campaign performance forecasting. This allows businesses to move beyond reactive analysis to proactive strategy development. Furthermore, advancements in natural language processing (NLP) are enhancing the ability to extract insights from unstructured data, such as customer reviews and social media conversations. Consumer behavior shifts, characterized by a demand for hyper-personalized experiences and seamless omnichannel interactions, are compelling marketers to leverage data analytics for a deeper understanding of individual preferences and needs. As a result, the adoption rates of advanced marketing analytics tools are accelerating across all end-user segments, with early adopters in Retail and BFSI setting benchmarks for others to follow. The ability to accurately measure marketing ROI and attribute success to specific channels is becoming paramount, further solidifying the indispensable role of marketing analytics.

Dominant Regions, Countries, or Segments in US Marketing Analytics Industry

Within the US marketing analytics industry, the Deployment: Cloud segment is emerging as the undisputed leader, driving significant market growth. The scalability, agility, and cost-efficiency offered by cloud-based solutions are highly attractive to businesses of all sizes, enabling them to access powerful analytics tools without substantial upfront infrastructure investments. This dominance is further amplified by the increasing reliance on Online Marketing and Social Media Marketing applications. These digital channels generate vast amounts of real-time data, which is best processed and analyzed through cloud-native platforms.

The Retail and BFSI (Banking, Financial Services, and Insurance) end-user segments are also pivotal in propelling the market forward. Retailers leverage marketing analytics to understand consumer purchasing patterns, personalize promotions, optimize inventory, and enhance the customer experience across various touchpoints. BFSI institutions utilize these tools for customer segmentation, risk assessment, fraud detection, personalized product offerings, and targeted marketing campaigns, all of which are critical in a highly competitive and regulated environment. The Travel and Hospitality sector is also showing considerable growth as it seeks to optimize pricing strategies, personalize travel recommendations, and improve customer loyalty.

Key drivers for the dominance of these segments include:

- Technological Infrastructure: Widespread internet penetration and robust cloud computing infrastructure in the US support the seamless deployment and operation of cloud-based analytics.

- Data Generation: The proliferation of digital channels and online activities in Retail, BFSI, and Travel & Hospitality generates immense datasets, necessitating advanced analytics for actionable insights.

- Competitive Pressures: Businesses in these sectors face intense competition, compelling them to adopt data-driven strategies for customer acquisition, retention, and competitive advantage.

- ROI Focus: The tangible return on investment derived from effective marketing analytics in these industries encourages further investment and adoption.

- Innovation Ecosystem: The US fosters a vibrant ecosystem of technology providers and startups focused on developing innovative marketing analytics solutions, particularly for cloud deployment and digital marketing applications.

The market share within the cloud deployment segment is estimated to be over xx% of the total deployment market, with Online Marketing applications accounting for an estimated xx% of the application market. Retail and BFSI are projected to hold a combined xx% of the end-user market share. The growth potential in these dominant segments is substantial, fueled by ongoing digital transformation initiatives and the continuous quest for data-driven decision-making.

US Marketing Analytics Industry Product Landscape

The US marketing analytics industry is defined by a dynamic product landscape characterized by continuous innovation and an increasing focus on integrated, AI-powered solutions. Leading companies are offering sophisticated platforms that consolidate data from disparate sources, enabling comprehensive analysis of customer behavior, campaign performance, and market trends. Key product innovations include advanced predictive modeling for customer lifetime value, real-time campaign optimization engines, and personalized content recommendation systems. The performance metrics emphasize accuracy, speed, and actionable insights, with a growing emphasis on explainable AI to build trust and transparency. Unique selling propositions often revolve around the seamless integration of data, advanced visualization capabilities, and the ability to automate complex analytical tasks. Technological advancements are rapidly incorporating AI and ML algorithms to provide deeper insights into customer intent and sentiment.

Key Drivers, Barriers & Challenges in US Marketing Analytics Industry

Key Drivers: The US marketing analytics industry is propelled by several significant drivers. The escalating demand for personalized customer experiences necessitates sophisticated data analysis to understand individual preferences and behaviors. The increasing volume and complexity of marketing data from digital channels like social media, online advertising, and e-commerce platforms require advanced analytical tools for interpretation and actionable insights. Furthermore, the growing emphasis on data-driven decision-making and the pursuit of measurable ROI across marketing campaigns are compelling businesses to invest in analytics solutions. Technological advancements, particularly in AI and ML, are continuously enhancing the capabilities of marketing analytics tools, enabling more predictive and prescriptive insights.

Barriers & Challenges: Despite the robust growth, the industry faces several barriers and challenges. Data privacy concerns and evolving regulatory landscapes, such as the California Consumer Privacy Act (CCPA), impose significant compliance burdens and can limit the scope of data utilization. The scarcity of skilled data scientists and analytics professionals poses a significant challenge in implementing and leveraging these complex technologies effectively. Integration complexities with existing legacy systems can also hinder seamless adoption. Moreover, the high cost of advanced analytics solutions can be a barrier for small and medium-sized enterprises (SMEs). Finally, the increasing sophistication of cyber threats poses a risk to the security and integrity of sensitive marketing data.

Emerging Opportunities in US Marketing Analytics Industry

Emerging opportunities in the US marketing analytics industry are abundant, driven by evolving consumer expectations and technological breakthroughs. The increasing adoption of AI and machine learning presents a significant opportunity for developing hyper-personalized marketing campaigns and predictive customer behavior models that anticipate needs. The growing demand for ethical and transparent data practices opens avenues for privacy-centric analytics solutions. Furthermore, the expansion of the Internet of Things (IoT) generates vast amounts of data that can be leveraged for contextual marketing and personalized offers in real-time. Untapped markets within emerging industries and a greater focus on the attribution of marketing efforts across complex customer journeys also represent fertile ground for innovation and growth.

Growth Accelerators in the US Marketing Analytics Industry Industry

Several key catalysts are accelerating the long-term growth of the US marketing analytics industry. Technological breakthroughs in AI, particularly in areas like natural language processing and deep learning, are unlocking more sophisticated analytical capabilities. Strategic partnerships between data providers, technology vendors, and industry-specific solution developers are fostering innovation and expanding market reach. For instance, the collaboration between Moody's and Microsoft aims to deliver advanced analytics for financial services. The ongoing digital transformation across various sectors, compelling businesses to become more data-centric, is a fundamental growth accelerator. Furthermore, the increasing understanding of marketing analytics' role in optimizing customer acquisition costs, enhancing customer lifetime value, and driving overall business growth is encouraging sustained investment and adoption.

Key Players Shaping the US Marketing Analytics Industry Market

- SAS Institute Inc.

- Accenture PLC

- IBM Corporation

- Teradata Corporation

- Salesforce Com Inc (Tableau Software Inc.)

- Microsoft Corporation

- Adobe Systems Incorporated

- Pegasystems Inc.

- Neustar Inc.

- Oracle Corporation

- Google LLC

Notable Milestones in US Marketing Analytics Industry Sector

- June 2023: Moody’s Corporation and Microsoft announced a new partnership to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and global knowledge workers. This collaboration leverages Microsoft Azure OpenAI Service and Moody’s data capabilities to enhance corporate intelligence and risk assessment.

- July 2022: Neustar, a TransUnion company, partnered with Adverity to facilitate seamless data connection for marketers, aiming to boost marketing and brand effectiveness. This partnership enables better optimization of marketing spending and ROI by allowing companies to accurately assess the effectiveness of various online and offline platforms.

- December 2022: Vi Labs, an Enterprise-AI for digital health firm, acquired Motus Consumer Insights, a marketing BI and member acquisition analytics firm. This acquisition aims to combine Vi's AI-powered customer engagement solutions with Motus's customer acquisition and site selection platforms, accelerating Vi's mission to use data and AI for healthier lifestyles.

In-Depth US Marketing Analytics Industry Market Outlook

The future outlook for the US marketing analytics industry is exceptionally promising, driven by ongoing technological advancements and the pervasive need for data-driven strategies. Growth accelerators such as the increasing adoption of AI and ML for predictive and prescriptive analytics, coupled with strategic partnerships like the one between Moody's and Microsoft, will continue to expand market capabilities. The demand for personalized customer experiences, a core tenet of modern marketing, will remain a primary driver, pushing businesses to invest in sophisticated analytics solutions. Emerging opportunities in areas like ethical AI, contextual marketing through IoT, and enhanced cross-channel attribution will create new avenues for innovation and market penetration. The industry is on a trajectory of significant expansion, offering substantial strategic opportunities for companies that can effectively leverage data to drive business outcomes and foster deeper customer relationships.

US Marketing Analytics Industry Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Application

- 2.1. Online Marketing

- 2.2. E-mail Marketing

- 2.3. Content Marketing

- 2.4. Social Media Marketing

- 2.5. Other Applications

-

3. End User

- 3.1. Retail

- 3.2. BFSI

- 3.3. Education

- 3.4. Healthcare

- 3.5. Manufacturing

- 3.6. Travel and Hospitality

- 3.7. Other End Users

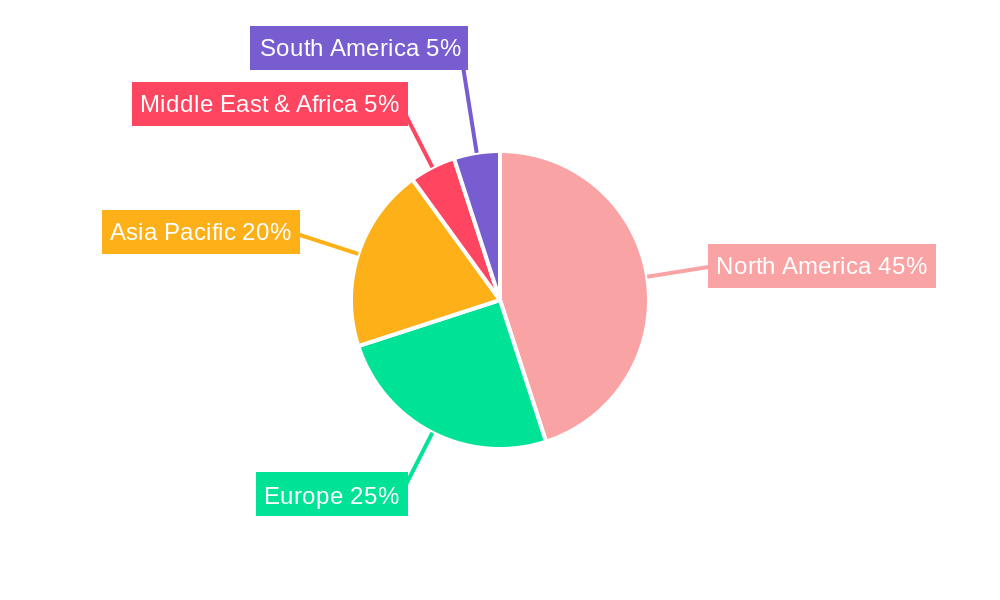

US Marketing Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Marketing Analytics Industry Regional Market Share

Geographic Coverage of US Marketing Analytics Industry

US Marketing Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 12.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Social Media Channels; Increasing Need to Utilize Marketing Budgets for an Effective ROI; Adoption of Cloud Technology and Big Data

- 3.3. Market Restrains

- 3.3.1. High Cost of Implementation and System Integration Issues for Marketing Analytics Software; Availability of Many Free Open Source Software

- 3.4. Market Trends

- 3.4.1. Adoption of Cloud Technology and Big Data is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Online Marketing

- 5.2.2. E-mail Marketing

- 5.2.3. Content Marketing

- 5.2.4. Social Media Marketing

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Retail

- 5.3.2. BFSI

- 5.3.3. Education

- 5.3.4. Healthcare

- 5.3.5. Manufacturing

- 5.3.6. Travel and Hospitality

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Online Marketing

- 6.2.2. E-mail Marketing

- 6.2.3. Content Marketing

- 6.2.4. Social Media Marketing

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Retail

- 6.3.2. BFSI

- 6.3.3. Education

- 6.3.4. Healthcare

- 6.3.5. Manufacturing

- 6.3.6. Travel and Hospitality

- 6.3.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. South America US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Online Marketing

- 7.2.2. E-mail Marketing

- 7.2.3. Content Marketing

- 7.2.4. Social Media Marketing

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Retail

- 7.3.2. BFSI

- 7.3.3. Education

- 7.3.4. Healthcare

- 7.3.5. Manufacturing

- 7.3.6. Travel and Hospitality

- 7.3.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Europe US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Online Marketing

- 8.2.2. E-mail Marketing

- 8.2.3. Content Marketing

- 8.2.4. Social Media Marketing

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Retail

- 8.3.2. BFSI

- 8.3.3. Education

- 8.3.4. Healthcare

- 8.3.5. Manufacturing

- 8.3.6. Travel and Hospitality

- 8.3.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Middle East & Africa US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Online Marketing

- 9.2.2. E-mail Marketing

- 9.2.3. Content Marketing

- 9.2.4. Social Media Marketing

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Retail

- 9.3.2. BFSI

- 9.3.3. Education

- 9.3.4. Healthcare

- 9.3.5. Manufacturing

- 9.3.6. Travel and Hospitality

- 9.3.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Asia Pacific US Marketing Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Online Marketing

- 10.2.2. E-mail Marketing

- 10.2.3. Content Marketing

- 10.2.4. Social Media Marketing

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Retail

- 10.3.2. BFSI

- 10.3.3. Education

- 10.3.4. Healthcare

- 10.3.5. Manufacturing

- 10.3.6. Travel and Hospitality

- 10.3.7. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accenture PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teradata Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Salesforce Com Inc (Tableau Software Inc )

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Adobe Systems Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pegasystems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Neustar Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oracle Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Google LLC*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global US Marketing Analytics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: South America US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: South America US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: South America US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: South America US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Europe US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Europe US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific US Marketing Analytics Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific US Marketing Analytics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Marketing Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global US Marketing Analytics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 20: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 33: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Marketing Analytics Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 43: Global US Marketing Analytics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global US Marketing Analytics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global US Marketing Analytics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Marketing Analytics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Marketing Analytics Industry?

The projected CAGR is approximately > 12.73%.

2. Which companies are prominent players in the US Marketing Analytics Industry?

Key companies in the market include SAS Institute Inc, Accenture PLC, IBM Corporation, Teradata Corporation, Salesforce Com Inc (Tableau Software Inc ), Microsoft Corporation, Adobe Systems Incorporated, Pegasystems Inc, Neustar Inc, Oracle Corporation, Google LLC*List Not Exhaustive.

3. What are the main segments of the US Marketing Analytics Industry?

The market segments include Deployment, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Social Media Channels; Increasing Need to Utilize Marketing Budgets for an Effective ROI; Adoption of Cloud Technology and Big Data.

6. What are the notable trends driving market growth?

Adoption of Cloud Technology and Big Data is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Implementation and System Integration Issues for Marketing Analytics Software; Availability of Many Free Open Source Software.

8. Can you provide examples of recent developments in the market?

June 2023 - Moody’s Corporation and Microsoft have announced a new partnership to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services and global knowledge workers. Built on a combination of Moody’s robust data and analytical capabilities and the power and scale of Microsoft Azure OpenAI Service, the partnership creates innovative offerings that enhance insights into corporate intelligence and risk assessment, powered by Microsoft AI and anchored by Moody’s proprietary data, analytics, and research.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Marketing Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Marketing Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Marketing Analytics Industry?

To stay informed about further developments, trends, and reports in the US Marketing Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence