Key Insights

The US Outdoor LED Lighting Market is projected for substantial growth, estimated to reach $35.78 billion by 2025, with a compound annual growth rate (CAGR) of 21.3% through 2033. This expansion is fueled by increasing smart city investments and a continuous demand for energy-efficient, sustainable lighting. Public sector adoption for streets, roadways, and public spaces is a key driver, spurred by government mandates to upgrade traditional lighting to LED for cost savings and environmental advantages. Urban development trends, alongside enhanced safety and security needs, further propel the adoption of advanced outdoor LED systems. The integration of IoT and intelligent control systems offers new market opportunities through dynamic lighting, remote monitoring, and predictive maintenance.

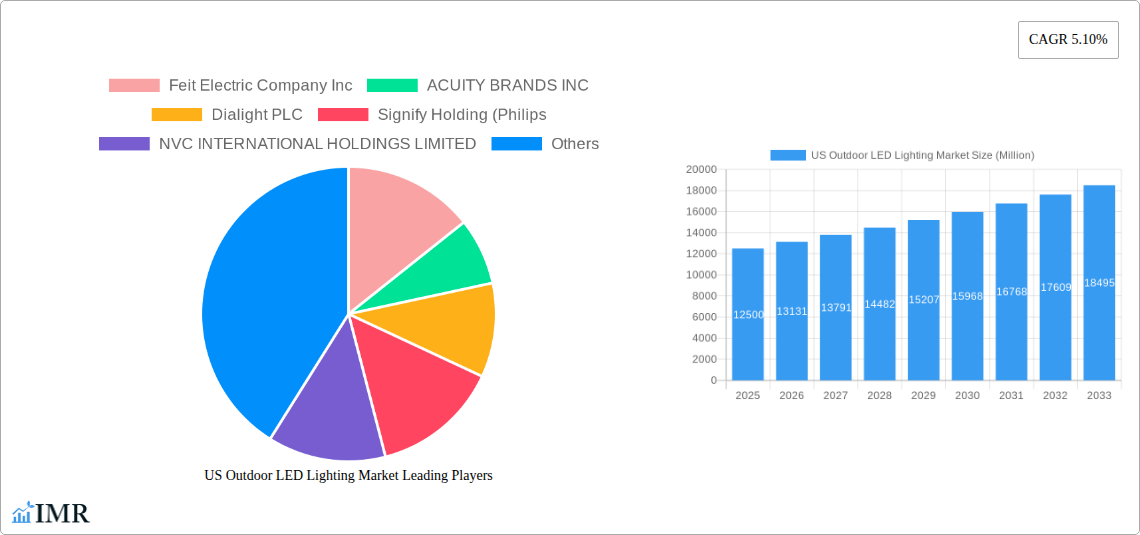

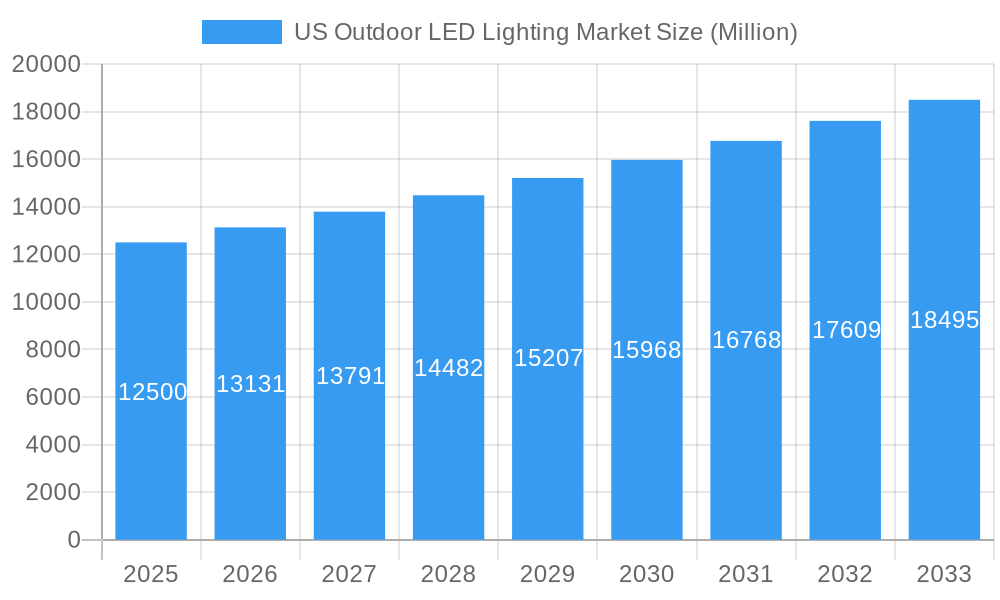

US Outdoor LED Lighting Market Market Size (In Billion)

Technological advancements in LED efficacy, durability, and controllability enhance performance over traditional lighting. While market growth is strong, initial high capital expenditure for large deployments and the requirement for skilled labor for complex smart systems present challenges. However, long-term operational cost savings and extended LED fixture lifespans are addressing these initial investment concerns. Leading companies such as Signify Holding, Feit Electric Company, and ACUITY BRANDS INC. are driving innovation and expanding product offerings for residential, commercial, and industrial applications. Continuous advancements in luminaire design and growing consumer awareness of LED benefits solidify a positive outlook for the US Outdoor LED Lighting Market.

US Outdoor LED Lighting Market Company Market Share

Unveiling the US Outdoor LED Lighting Market: A Comprehensive Industry Report

This in-depth report provides a definitive analysis of the US Outdoor LED Lighting Market, meticulously examining its intricate dynamics, growth trajectories, and future potential. Spanning from 2019–2033, with a deep dive into the Base Year (2025) and a robust Forecast Period (2025–2033), this research empowers industry professionals with actionable insights. Explore market segmentation, including Outdoor Lighting: Public Places, Streets and Roadways, and Others, and understand the influence of key players like Feit Electric Company Inc, ACUITY BRANDS INC, Dialight PLC, Signify Holding (Philips), NVC INTERNATIONAL HOLDINGS LIMITED, LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, Current Lighting Solutions LLC, Cree LED (SMART Global Holdings Inc), and Panasonic Holdings Corporation. All values are presented in Million units, offering a clear quantitative perspective.

US Outdoor LED Lighting Market Market Dynamics & Structure

The US Outdoor LED Lighting Market is characterized by a dynamic interplay of factors shaping its competitive landscape and technological advancements. Market concentration is moderately fragmented, with both established giants and agile innovators vying for market share. Technological innovation serves as a primary driver, fueled by the relentless pursuit of energy efficiency, enhanced illumination quality, and smart integration capabilities. Regulatory frameworks, including energy performance standards and safety mandates, are increasingly influencing product development and adoption. Competitive product substitutes, though diminishing with the LED revolution, still exist in legacy lighting technologies, creating a need for compelling value propositions. End-user demographics are diversifying, with increasing demand from both municipal entities seeking cost savings and sustainability, and commercial sectors prioritizing enhanced security and aesthetic appeal. Mergers and acquisitions (M&A) trends are a significant indicator of market consolidation and strategic expansion, with companies seeking to broaden their product portfolios and geographical reach. For instance, recent M&A activities indicate a growing interest in companies with expertise in smart city solutions and advanced control systems.

- Market Concentration: Moderately fragmented, with a mix of large corporations and specialized manufacturers.

- Technological Innovation Drivers: Energy efficiency improvements, smart lighting controls (IoT integration), improved color rendering index (CRI), and enhanced durability.

- Regulatory Frameworks: Federal and state energy efficiency standards (e.g., Energy Star), UL safety certifications, and municipal procurement guidelines.

- Competitive Product Substitutes: While LED adoption is high, some markets may still have legacy HID or fluorescent lighting systems requiring replacement.

- End-User Demographics: Municipalities, transportation authorities, commercial property owners, industrial facilities, and residential landscaping sectors.

- M&A Trends: Strategic acquisitions aimed at expanding smart city capabilities, acquiring niche technologies, and increasing market share in specific application areas.

US Outdoor LED Lighting Market Growth Trends & Insights

The US Outdoor LED Lighting Market is poised for substantial growth, driven by a confluence of economic, technological, and environmental factors. The market size is projected to witness a steady expansion over the forecast period, reflecting the ongoing transition from traditional lighting technologies to more efficient and sustainable LED solutions. Adoption rates are accelerating across various sectors, with municipal governments leading the charge in upgrading streetlights and public infrastructure to reduce energy consumption and operational costs. Technological disruptions, such as the integration of smart sensors and advanced controls, are further enhancing the value proposition of outdoor LED lighting by enabling dynamic dimming, remote monitoring, and predictive maintenance. Consumer behavior shifts are also playing a crucial role, with a growing emphasis on sustainability, safety, and the aesthetic enhancement of public and private spaces. This evolution is creating a demand for sophisticated lighting solutions that offer not only illumination but also contribute to smart city initiatives and improved quality of life. The market penetration of LED technology in outdoor applications is already significant, but there remains substantial room for growth as older infrastructure is replaced and new installations are developed.

The US Outdoor LED Lighting Market is experiencing a significant CAGR, indicative of its robust expansion. This growth is underpinned by several key trends:

- Energy Efficiency Mandates: Growing pressure from federal and state governments to reduce energy consumption is a primary catalyst for LED adoption. The long-term cost savings associated with LED technology make it an attractive investment for municipalities and businesses alike.

- Smart City Integration: The increasing adoption of smart city technologies, including interconnected lighting networks, smart sensors for traffic management, and public safety monitoring, is driving demand for intelligent outdoor LED lighting solutions. These systems offer enhanced control, data collection, and operational efficiency.

- Infrastructure Modernization: Significant investments in upgrading aging infrastructure, including roadways, bridges, and public spaces, are creating substantial opportunities for new outdoor LED lighting installations. These projects often prioritize durability, longevity, and energy efficiency.

- Enhanced Safety and Security: Improved illumination levels and uniformity provided by LED lighting contribute to enhanced public safety and security in streets, parks, and commercial areas. This is a key consideration for urban planners and law enforcement agencies.

- Aesthetic Appeal and Urban Design: Modern outdoor LED lighting fixtures offer a wide range of design options and color temperatures, allowing for the aesthetic enhancement of urban environments, architectural landmarks, and landscaping. This trend is particularly prevalent in commercial and hospitality sectors.

- Technological Advancements: Continuous innovation in LED technology, leading to higher lumen outputs, improved color rendering, longer lifespans, and greater resistance to environmental factors, is making LED solutions more competitive and versatile.

- Declining LED Costs: The ongoing reduction in the cost of LED components and manufacturing processes is making these solutions more accessible and cost-effective, further accelerating adoption rates across all market segments.

- Environmental Consciousness: A growing public and governmental awareness of environmental issues and the need for sustainable solutions is driving the demand for energy-efficient lighting options like LEDs. Their lower carbon footprint and reduced energy consumption align with these environmental goals.

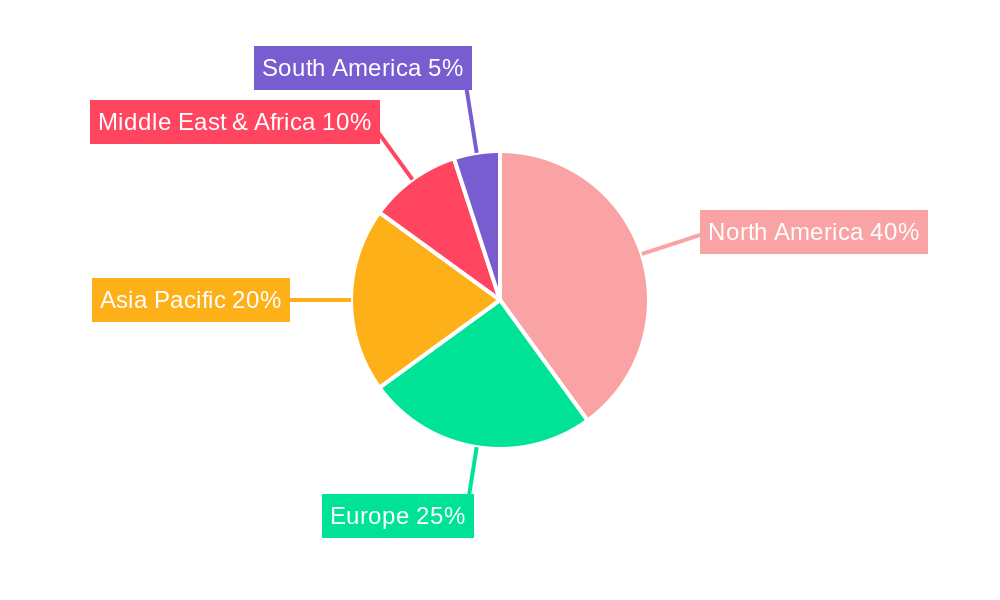

Dominant Regions, Countries, or Segments in US Outdoor LED Lighting Market

Within the vast US Outdoor LED Lighting Market, the Streets and Roadways segment stands out as a dominant force, consistently driving market growth. This dominance is attributed to a multitude of factors, including substantial government investment in infrastructure development and maintenance, coupled with stringent energy efficiency regulations that mandate the upgrade of municipal lighting systems. The sheer scale of public road networks across the nation necessitates extensive lighting solutions, making this segment a perpetual source of demand. Furthermore, the push towards smart city initiatives often prioritizes intelligent street lighting for traffic management, public safety, and data collection, further solidifying its leading position.

Streets and Roadways: This segment represents the largest market share due to ongoing infrastructure projects, energy efficiency mandates, and the integration of smart city technologies.

- Key Drivers: Government funding for road infrastructure, municipal energy reduction targets, smart city deployment initiatives, enhanced traffic safety requirements, and the lifecycle replacement of aging infrastructure.

- Market Share: Estimated to hold over 40% of the total US Outdoor LED Lighting Market.

- Growth Potential: High, driven by continued technological advancements in smart lighting controls and the widespread need for uniform and reliable illumination for transportation networks.

Public Places: This segment encompasses parks, plazas, campuses, and other communal outdoor areas. While its market share is smaller than Streets and Roadways, it is experiencing significant growth due to increasing urbanization and the focus on creating safe and inviting public spaces.

- Key Drivers: Urban revitalization projects, emphasis on pedestrian safety and ambiance, demand for decorative and functional lighting, and the integration of smart lighting for energy management and security.

- Growth Potential: Moderate to high, with a focus on aesthetic appeal and intelligent lighting solutions that enhance user experience.

Others: This broad category includes a variety of applications such as industrial sites, sports facilities, parking lots, security lighting, and architectural accent lighting. This segment is characterized by specialized needs and technological sophistication.

- Key Drivers: Industrial safety regulations, demand for high-intensity lighting in specific applications (e.g., sports stadiums), security concerns for commercial and industrial properties, and the growing use of LED lighting for architectural illumination and visual appeal.

- Growth Potential: Moderate, with opportunities in niche applications and the development of specialized high-performance LED solutions.

The dominance of the Streets and Roadways segment is further amplified by its direct link to public sector spending and long-term infrastructure planning. Federal and state initiatives aimed at improving transportation networks, reducing carbon emissions, and enhancing urban livability consistently funnel resources into this area, ensuring a sustained demand for advanced LED lighting solutions. The ongoing replacement of older, less efficient lighting systems in this segment, often driven by compliance with new energy codes and the desire for lower operational costs, contributes to a steady and predictable market size. The increasing integration of smart technologies, such as motion sensors and adaptive lighting controls, within streetlights is also transforming this segment, moving beyond mere illumination to encompass data collection and management capabilities, further cementing its leading position in the US Outdoor LED Lighting Market.

US Outdoor LED Lighting Market Product Landscape

The US Outdoor LED Lighting Market is witnessing a surge in product innovation, characterized by enhanced performance metrics and diverse applications. Manufacturers are continuously introducing luminaires with higher lumen outputs, superior color rendering indices (CRIs) for improved visual clarity, and extended lifespans, significantly reducing maintenance costs. Smart lighting capabilities, including integrated sensors, wireless controls, and dimming functionalities, are becoming standard features, enabling dynamic illumination and energy optimization. The product landscape encompasses a wide array of fixtures, from energy-efficient streetlights and durable industrial floodlights to aesthetically pleasing architectural and landscape lighting, catering to the varied needs of public, commercial, and industrial sectors. Unique selling propositions often revolve around advanced thermal management for longevity, robust weather resistance, and seamless integration with existing smart city infrastructure.

Key Drivers, Barriers & Challenges in US Outdoor LED Lighting Market

Key Drivers:

- Energy Efficiency and Cost Savings: The inherent energy efficiency of LEDs translates to significant operational cost reductions for end-users, particularly municipalities and large commercial entities. This is a paramount driver for adoption.

- Government Mandates and Incentives: Federal and state regulations promoting energy conservation and sustainability, alongside financial incentives for adopting LED technology, accelerate market growth.

- Technological Advancements: Continuous innovation in LED efficiency, lifespan, color quality, and smart control integration makes them increasingly attractive and versatile.

- Improved Safety and Security: Enhanced illumination provided by LEDs contributes to increased safety and security in public and private outdoor spaces.

Barriers & Challenges:

- Initial Cost of Investment: While long-term savings are substantial, the upfront cost of LED fixtures and smart control systems can be a barrier for some smaller municipalities or businesses.

- Standardization and Interoperability: The lack of universal standards for smart lighting systems can pose challenges for seamless integration and interoperability between different manufacturers' products.

- Supply Chain Disruptions: Global supply chain issues, including the availability of raw materials and components, can impact production timelines and pricing.

- Skilled Workforce Shortage: The installation and maintenance of advanced LED and smart lighting systems require a skilled workforce, and a shortage in this area can hinder widespread adoption.

Emerging Opportunities in US Outdoor LED Lighting Market

Emerging opportunities in the US Outdoor LED Lighting Market lie in the continued expansion of smart city initiatives, the development of specialized lighting solutions for emerging applications like electric vehicle charging infrastructure, and the growing demand for energy-harvesting lighting systems. The integration of AI and machine learning for predictive maintenance and adaptive lighting control presents a significant avenue for innovation. Furthermore, the increasing focus on public well-being and mental health is driving interest in human-centric lighting solutions that can dynamically adjust color temperature and intensity to improve mood and productivity in outdoor public spaces. The renovation of existing commercial and industrial properties also presents a substantial market for retrofitting with advanced LED lighting.

Growth Accelerators in the US Outdoor LED Lighting Market Industry

Several key catalysts are accelerating the growth of the US Outdoor LED Lighting Market Industry. The relentless pursuit of sustainability by both governments and corporations is a primary driver, pushing for reduced energy consumption and a smaller carbon footprint. Continuous technological breakthroughs in LED efficiency, lumen output, and color quality are making these solutions more compelling. Strategic partnerships between lighting manufacturers and technology companies specializing in IoT, data analytics, and smart grid solutions are fostering the development of integrated and intelligent lighting ecosystems. Furthermore, market expansion strategies, including the development of new product lines tailored to specific applications and the penetration of underserved geographical regions, are fueling sustained growth.

Key Players Shaping the US Outdoor LED Lighting Market Market

- Feit Electric Company Inc

- ACUITY BRANDS INC

- Dialight PLC

- Signify Holding (Philips)

- NVC INTERNATIONAL HOLDINGS LIMITED

- LEDVANCE GmbH (MLS Co Ltd)

- EGLO Leuchten GmbH

- Current Lighting Solutions LLC

- Cree LED (SMART Global Holdings Inc)

- Panasonic Holdings Corporation

Notable Milestones in US Outdoor LED Lighting Market Sector

- May 2023: Cyclone Lighting debuted its Elencia luminaire, offering an upscale look for outdoor post-top lighting with high-performance optics and a revised, modern lantern style.

- May 2023: Dialight introduced the ProSite High Mast, expanding its ProSite Floodlight range. This model is designed for mounting heights up to 130 feet, catering to diverse outdoor industrial applications like airports, container yards, and transportation hubs, providing up to 65,000 lumens for improved site security.

- April 2023: Hydrel announced the addition of the M9700 RGBW fixture to its M9000 ingrade luminaire family, enhancing its offerings in architectural and landscape lighting systems with advanced color-changing capabilities.

In-Depth US Outdoor LED Lighting Market Market Outlook

The US Outdoor LED Lighting Market is set for a robust and sustained growth trajectory, driven by an unwavering commitment to energy efficiency, technological innovation, and the expanding smart city agenda. Future market potential is significant, with ongoing infrastructure upgrades and the replacement of legacy lighting systems presenting substantial opportunities. Strategic opportunities abound in the development of highly integrated smart lighting solutions that offer advanced data analytics, predictive maintenance capabilities, and seamless connectivity with other urban infrastructure. The market is expected to witness a diversification of applications, with specialized LED solutions emerging for areas such as autonomous vehicle infrastructure, advanced public safety systems, and sustainable urban development projects. The continued decline in LED costs, coupled with increasing environmental awareness, will further solidify LED's dominance in outdoor illumination.

US Outdoor LED Lighting Market Segmentation

-

1. Outdoor Lighting

- 1.1. Public Places

- 1.2. Streets and Roadways

- 1.3. Others

US Outdoor LED Lighting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Outdoor LED Lighting Market Regional Market Share

Geographic Coverage of US Outdoor LED Lighting Market

US Outdoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts

- 3.3. Market Restrains

- 3.3.1. Regulation Compliance Associated with Laser Usage

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Outdoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.1.1. Public Places

- 5.1.2. Streets and Roadways

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6. North America US Outdoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6.1.1. Public Places

- 6.1.2. Streets and Roadways

- 6.1.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 7. South America US Outdoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 7.1.1. Public Places

- 7.1.2. Streets and Roadways

- 7.1.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 8. Europe US Outdoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 8.1.1. Public Places

- 8.1.2. Streets and Roadways

- 8.1.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 9. Middle East & Africa US Outdoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 9.1.1. Public Places

- 9.1.2. Streets and Roadways

- 9.1.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 10. Asia Pacific US Outdoor LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 10.1.1. Public Places

- 10.1.2. Streets and Roadways

- 10.1.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Feit Electric Company Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ACUITY BRANDS INC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dialight PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Signify Holding (Philips

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NVC INTERNATIONAL HOLDINGS LIMITED

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LEDVANCE GmbH (MLS Co Ltd)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EGLO Leuchten GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Current Lighting Solutions LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cree LED (SMART Global Holdings Inc )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Feit Electric Company Inc

List of Figures

- Figure 1: Global US Outdoor LED Lighting Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global US Outdoor LED Lighting Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America US Outdoor LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 4: North America US Outdoor LED Lighting Market Volume (K Units), by Outdoor Lighting 2025 & 2033

- Figure 5: North America US Outdoor LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 6: North America US Outdoor LED Lighting Market Volume Share (%), by Outdoor Lighting 2025 & 2033

- Figure 7: North America US Outdoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 8: North America US Outdoor LED Lighting Market Volume (K Units), by Country 2025 & 2033

- Figure 9: North America US Outdoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America US Outdoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America US Outdoor LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 12: South America US Outdoor LED Lighting Market Volume (K Units), by Outdoor Lighting 2025 & 2033

- Figure 13: South America US Outdoor LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 14: South America US Outdoor LED Lighting Market Volume Share (%), by Outdoor Lighting 2025 & 2033

- Figure 15: South America US Outdoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 16: South America US Outdoor LED Lighting Market Volume (K Units), by Country 2025 & 2033

- Figure 17: South America US Outdoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America US Outdoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe US Outdoor LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 20: Europe US Outdoor LED Lighting Market Volume (K Units), by Outdoor Lighting 2025 & 2033

- Figure 21: Europe US Outdoor LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 22: Europe US Outdoor LED Lighting Market Volume Share (%), by Outdoor Lighting 2025 & 2033

- Figure 23: Europe US Outdoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe US Outdoor LED Lighting Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe US Outdoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Outdoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa US Outdoor LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 28: Middle East & Africa US Outdoor LED Lighting Market Volume (K Units), by Outdoor Lighting 2025 & 2033

- Figure 29: Middle East & Africa US Outdoor LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 30: Middle East & Africa US Outdoor LED Lighting Market Volume Share (%), by Outdoor Lighting 2025 & 2033

- Figure 31: Middle East & Africa US Outdoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Outdoor LED Lighting Market Volume (K Units), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Outdoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa US Outdoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific US Outdoor LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 36: Asia Pacific US Outdoor LED Lighting Market Volume (K Units), by Outdoor Lighting 2025 & 2033

- Figure 37: Asia Pacific US Outdoor LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 38: Asia Pacific US Outdoor LED Lighting Market Volume Share (%), by Outdoor Lighting 2025 & 2033

- Figure 39: Asia Pacific US Outdoor LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Asia Pacific US Outdoor LED Lighting Market Volume (K Units), by Country 2025 & 2033

- Figure 41: Asia Pacific US Outdoor LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Outdoor LED Lighting Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 2: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Outdoor Lighting 2020 & 2033

- Table 3: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 6: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Outdoor Lighting 2020 & 2033

- Table 7: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Country 2020 & 2033

- Table 9: United States US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United States US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 11: Canada US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 16: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Outdoor Lighting 2020 & 2033

- Table 17: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Brazil US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Brazil US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Argentina US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Argentina US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 25: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 26: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Outdoor Lighting 2020 & 2033

- Table 27: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Country 2020 & 2033

- Table 29: United Kingdom US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Germany US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: France US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Italy US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Spain US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Spain US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Russia US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Benelux US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Benelux US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Nordics US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Nordics US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 48: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Outdoor Lighting 2020 & 2033

- Table 49: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Country 2020 & 2033

- Table 51: Turkey US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Turkey US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Israel US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Israel US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: GCC US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: GCC US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: North Africa US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: North Africa US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 59: South Africa US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 64: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Outdoor Lighting 2020 & 2033

- Table 65: Global US Outdoor LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global US Outdoor LED Lighting Market Volume K Units Forecast, by Country 2020 & 2033

- Table 67: China US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: China US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: India US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: India US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Japan US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: South Korea US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Korea US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: ASEAN US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: ASEAN US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Oceania US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Oceania US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific US Outdoor LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific US Outdoor LED Lighting Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Outdoor LED Lighting Market?

The projected CAGR is approximately 21.3%.

2. Which companies are prominent players in the US Outdoor LED Lighting Market?

Key companies in the market include Feit Electric Company Inc, ACUITY BRANDS INC, Dialight PLC, Signify Holding (Philips, NVC INTERNATIONAL HOLDINGS LIMITED, LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, Current Lighting Solutions LLC, Cree LED (SMART Global Holdings Inc ), Panasonic Holdings Corporation.

3. What are the main segments of the US Outdoor LED Lighting Market?

The market segments include Outdoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulation Compliance Associated with Laser Usage.

8. Can you provide examples of recent developments in the market?

May 2023: Cyclone Lighting, a well-known manufacturer of outdoor luminaires, has announced the debut of its Elencia luminaire. Outdoor post-top lighting has an upscale look thanks to high-performance optics and revised, modern lantern style.May 2023: Dialight, a company in hazardous and industrial LED lighting innovation, has introduced the ProSite High Mast, an expansion of the company's extremely successful ProSite Floodlight range. This new model is carefully constructed to withstand mounting heights of up to 130 feet for a wide range of outdoor industrial applications such as airports, container yards, rail yards, product stockpiles, transportation, perimeter lighting, and parking applications. With a total lumen output of up to 65,000, the ProSite High Mast improves site security by providing uniform, crisp, and clear illumination.April 2023: Hydrel, an established innovator and producer of outdoor architectural and landscape lighting systems, announced the addition of the M9700 RGBW fixture to its M9000 ingrade luminaire family.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Outdoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Outdoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Outdoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the US Outdoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence