Key Insights

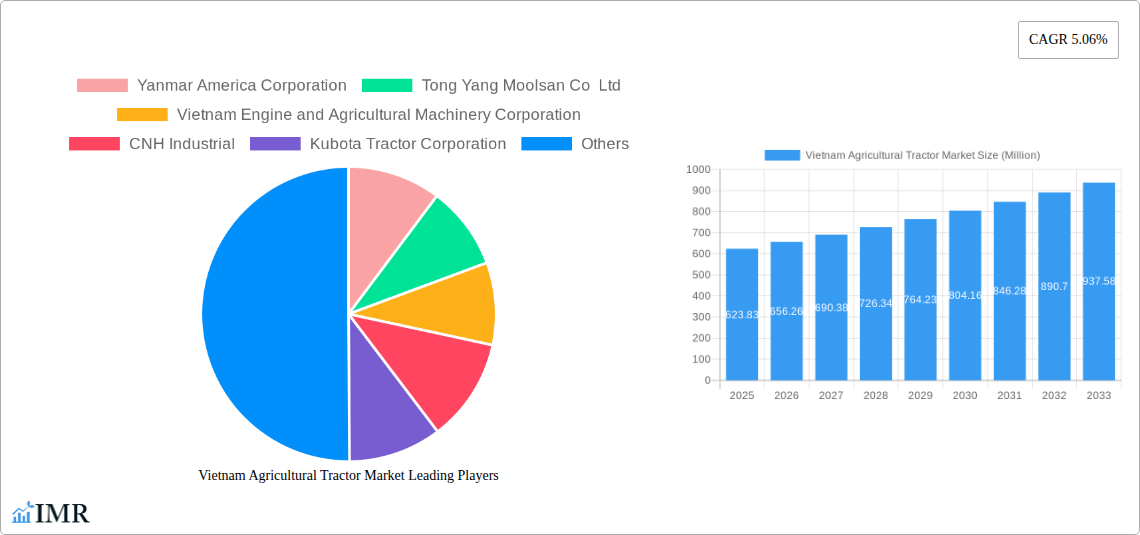

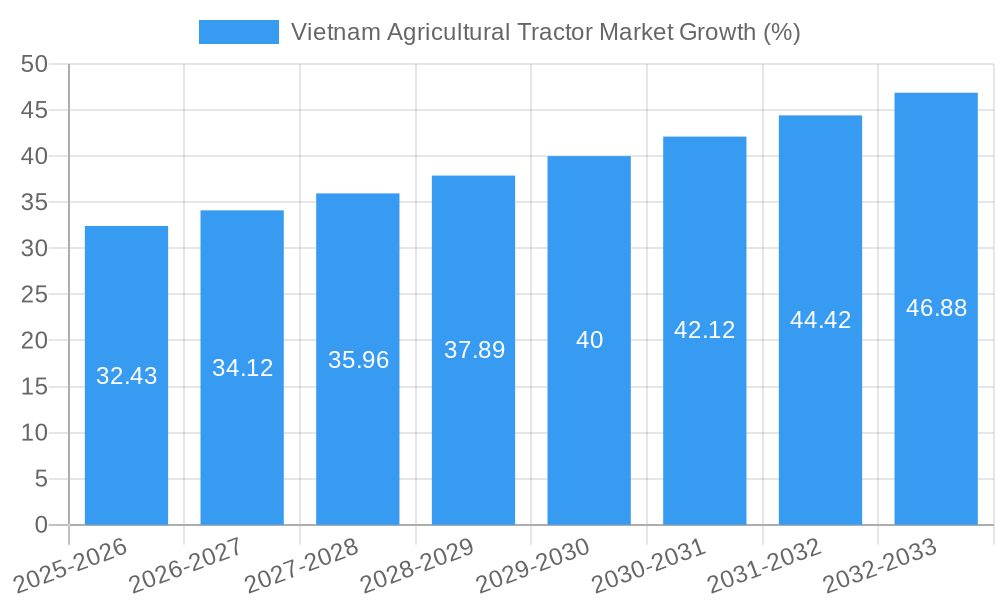

The Vietnam agricultural tractor market, valued at $623.83 million in 2025, is projected to experience robust growth, driven by increasing agricultural mechanization needs and government initiatives promoting modernization in the farming sector. A Compound Annual Growth Rate (CAGR) of 5.06% from 2025 to 2033 indicates a significant expansion of the market. Key drivers include rising labor costs, increasing demand for efficient farming practices to boost crop yields, and government subsidies encouraging the adoption of advanced agricultural machinery. Growth is further fueled by expanding cultivated land and a shift towards large-scale commercial farming. The market segmentation by engine power (less than 15 HP, 15-30 HP, 31-45 HP, 46-75 HP, and more than 75 HP) reflects the diverse needs of Vietnamese farmers, with a likely higher demand for tractors in the 15-45 HP range suitable for paddy fields and smaller farms. Leading players like Yanmar America Corporation, Kubota Tractor Corporation, and AGCO Corporation are actively competing in this market, focusing on product innovation and distribution networks. However, challenges remain, including high initial investment costs for tractors, limited access to credit for smallholder farmers, and the need for improved infrastructure to support efficient distribution and maintenance. The competitive landscape is characterized by a mix of international and domestic manufacturers, with domestic players like Truong Hai Auto Corporation (THACO) playing an increasingly important role. The market's future trajectory is significantly influenced by government policies, economic growth, and technological advancements.

The forecast period of 2025-2033 will witness a substantial increase in the market size, fueled by continued mechanization, expanding agricultural production, and improving rural infrastructure. The market's growth trajectory is largely dependent on factors such as the availability of financing options for farmers, the implementation of effective government support programs, and the pace of technological innovation in tractor design and efficiency. The continued dominance of key international players will likely face competition from emerging local manufacturers who offer cost-effective and locally adapted solutions. Specific segments within the engine power categories are expected to show varying growth rates, reflecting the needs of different farming operations. Monitoring these factors is crucial for understanding the dynamic nature of the Vietnam agricultural tractor market and for informed investment decisions.

Vietnam Agricultural Tractor Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Vietnam agricultural tractor market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, using 2025 as the base year. The study segments the market by engine power (Less than 15 HP, 15 to 30 HP, 31 to 45 HP, 46-75 HP, More than 75 HP), offering granular insights into market size and growth across various segments. This report is essential for industry professionals, investors, and anyone seeking to understand the evolving landscape of Vietnam's agricultural machinery sector. The total market size in 2025 is estimated at xx Million units.

Vietnam Agricultural Tractor Market Dynamics & Structure

The Vietnam agricultural tractor market is characterized by a moderate level of concentration, with a few dominant players and a larger number of smaller, regional operators. Technological innovation, driven by increasing demand for efficiency and productivity, is a key driver. Government regulations concerning emission standards and safety are shaping market trends. The market also faces competition from substitute technologies like manual labor and smaller machinery, particularly in smaller farms. The end-user demographics encompass a diverse range of farms, from small-scale family operations to larger commercial agricultural enterprises. Mergers and acquisitions (M&A) activity remains relatively low, but strategic partnerships and distribution agreements are increasingly common.

- Market Concentration: Moderately concentrated, with xx% market share held by the top 3 players in 2025.

- Technological Innovation: Focus on fuel efficiency, automation, and precision agriculture are driving innovation.

- Regulatory Framework: Government policies promoting agricultural modernization and mechanization are influencing market growth.

- Competitive Substitutes: Manual labor and smaller, less powerful machinery pose competition, especially in smaller farms.

- End-User Demographics: A mix of smallholder farmers and larger commercial agricultural businesses.

- M&A Trends: Low M&A activity, but increased strategic alliances and distribution partnerships are observed.

Vietnam Agricultural Tractor Market Growth Trends & Insights

The Vietnam agricultural tractor market has experienced steady growth over the historical period (2019-2024), driven by factors such as rising agricultural output, government initiatives supporting agricultural modernization, and increasing farmer incomes. The adoption rate of tractors has been increasing, particularly in regions with favorable infrastructure and access to credit. Technological advancements, such as the introduction of more fuel-efficient and technologically advanced models, have further fueled market expansion. Consumer behavior is shifting towards a preference for more powerful and feature-rich tractors. The market is expected to continue this growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx% in terms of unit sales. Market penetration is expected to reach xx% by 2033. [Note: XXX refers to market research data used for analysis. This section needs specific data insertion relevant to the market. Placeholders will not be used.]

Dominant Regions, Countries, or Segments in Vietnam Agricultural Tractor Market

The Mekong Delta region is expected to be the dominant region for agricultural tractor sales in Vietnam, owing to its extensive rice cultivation and large agricultural land area. The 15 to 30 HP segment is currently the largest segment in terms of unit sales. This segment caters largely to the needs of smallholder farmers who constitute a significant portion of the market. Growth in this segment is being propelled by increased government subsidies and financing schemes targeting small-scale farmers. The higher HP segments (46-75 HP and above) show potential for future growth as the demand from larger commercial farms increases.

- Key Drivers in Mekong Delta: Extensive rice cultivation, large agricultural land, and government investment in agricultural infrastructure.

- 15-30 HP Segment Dominance: High demand from smallholder farmers, supported by government subsidies.

- Growth Potential in Higher HP Segments: Driven by the increasing number of larger commercial farms.

Vietnam Agricultural Tractor Market Product Landscape

The Vietnam agricultural tractor market offers a range of products catering to diverse needs and budgets. Tractors vary significantly in terms of engine power, features, and technological advancements. Many models are designed for specific tasks, such as rice cultivation or general agricultural operations. Newer models frequently incorporate advanced features like GPS-guided systems, improved fuel efficiency, and enhanced operator comfort. The market is witnessing a trend towards the adoption of tractors equipped with implements to perform various agricultural operations, resulting in greater efficiency.

Key Drivers, Barriers & Challenges in Vietnam Agricultural Tractor Market

Key Drivers:

- Increasing agricultural output and mechanization needs.

- Government support for agricultural modernization.

- Rising farmer incomes and improved access to credit.

- Technological advancements leading to more efficient and productive tractors.

Challenges and Restraints:

- High initial investment costs for tractors can be a barrier for smaller farmers.

- Infrastructure limitations in certain regions can hinder the accessibility of tractors.

- Competition from substitute technologies and cheaper imports.

- Fluctuations in fuel prices and the availability of spare parts can impact operational costs. A potential xx% increase in fuel costs could negatively impact market growth.

Emerging Opportunities in Vietnam Agricultural Tractor Market

- Expanding into untapped markets: Reaching remote areas with improved infrastructure and outreach programs.

- Developing specialized tractors: Designing machines tailored to specific crops and terrains.

- Leveraging digital technologies: Integrating precision farming technologies into tractors for increased efficiency and yield.

- Promoting sustainable agriculture practices: Offering fuel-efficient and environmentally friendly tractors.

Growth Accelerators in the Vietnam Agricultural Tractor Market Industry

Technological breakthroughs, particularly in fuel efficiency and automation, are poised to significantly accelerate market growth. Strategic partnerships between tractor manufacturers and agricultural input suppliers can enhance distribution networks and reach a wider customer base. Government policies promoting agricultural modernization and financial incentives for tractor purchases remain crucial catalysts for long-term growth. Expansion into new markets and the introduction of innovative financing schemes can unlock further growth potential.

Key Players Shaping the Vietnam Agricultural Tractor Market Market

- Yanmar America Corporation

- Tong Yang Moolsan Co Ltd

- Vietnam Engine and Agricultural Machinery Corporation

- CNH Industrial

- Kubota Tractor Corporation

- AGCO Corporation

- Truong Hai Auto Corporation (THACO)

- Belarus

- CLAAS KGaA mbH

- ShanDong Huaxin Machinery Co Ltd

Notable Milestones in Vietnam Agricultural Tractor Market Sector

- January 2023: New Holland unveiled a prototype T7 methane-powered tractor, extending operational times.

- January 2023: Yanmar opened a new dealership in Hai Duong province, boosting regional sales.

- January 2022: Yanmar expanded its dealership network to three additional provinces, improving market access.

In-Depth Vietnam Agricultural Tractor Market Market Outlook

The Vietnam agricultural tractor market is poised for robust growth over the forecast period, driven by increasing mechanization needs, government support, and technological advancements. Strategic opportunities exist for companies to capitalize on the expanding market by focusing on fuel efficiency, automation, and customized solutions for diverse farming practices. Investment in rural infrastructure and the expansion of financing options for farmers will further accelerate market expansion. The potential for growth is significant, presenting attractive opportunities for both domestic and international players.

Vietnam Agricultural Tractor Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Vietnam Agricultural Tractor Market Segmentation By Geography

- 1. Vietnam

Vietnam Agricultural Tractor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Skilled Labor Shortage; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center

- 3.4. Market Trends

- 3.4.1. Shortage of Agricultural Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Agricultural Tractor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Yanmar America Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tong Yang Moolsan Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vietnam Engine and Agricultural Machinery Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CNH Industrial

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kubota Tractor Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGCO Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Truong Hai Auto Corporation (THACO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Belarus

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CLAAS KGaA mbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ShanDong Huaxin Machinery Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Yanmar America Corporation

List of Figures

- Figure 1: Vietnam Agricultural Tractor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Agricultural Tractor Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Vietnam Agricultural Tractor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Agricultural Tractor Market?

The projected CAGR is approximately 5.06%.

2. Which companies are prominent players in the Vietnam Agricultural Tractor Market?

Key companies in the market include Yanmar America Corporation, Tong Yang Moolsan Co Ltd, Vietnam Engine and Agricultural Machinery Corporation, CNH Industrial, Kubota Tractor Corporation, AGCO Corporation, Truong Hai Auto Corporation (THACO, Belarus, CLAAS KGaA mbH, ShanDong Huaxin Machinery Co Ltd.

3. What are the main segments of the Vietnam Agricultural Tractor Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 623.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Skilled Labor Shortage; Favorable Government Policies.

6. What are the notable trends driving market growth?

Shortage of Agricultural Labor.

7. Are there any restraints impacting market growth?

Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center.

8. Can you provide examples of recent developments in the market?

January 2023: New Holland revealed a prototype T7 methane power tractor that runs on a liquified version of the gas, giving longer working times to fill. The new tractor has four times the fuel storage of the firm's existing methane-powered T6, which utilizes compressed gas (CNG).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Agricultural Tractor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Agricultural Tractor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Agricultural Tractor Market?

To stay informed about further developments, trends, and reports in the Vietnam Agricultural Tractor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence