Key Insights

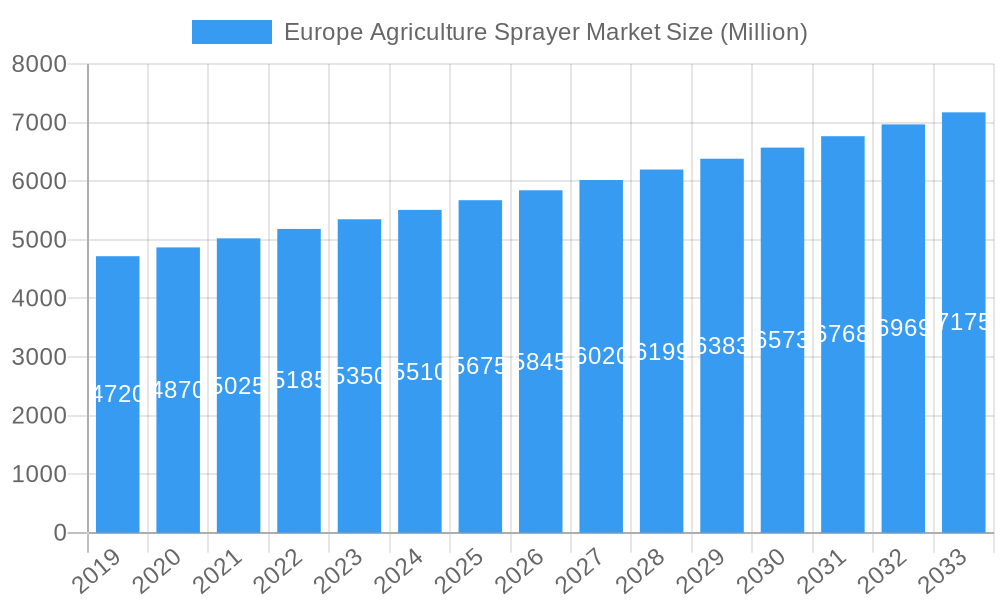

The Europe agriculture sprayer market is projected for significant expansion, with an estimated market size of $5.5 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This growth is fueled by increased agricultural mechanization, the adoption of precision farming, and the demand for effective crop protection to boost yields. European farmers are investing in advanced spraying technologies for optimized pesticide and fertilizer application, reducing waste and environmental impact. Demand for smart sprayers with GPS, sensors, and automated boom control is rising, enhancing precision and lowering operational costs. Government initiatives for sustainable agriculture and subsidies for modern farm equipment are key growth drivers. Innovations like drone-based and electric sprayers also contribute to market dynamism.

Europe Agriculture Sprayer Market Market Size (In Billion)

Despite positive trends, the market faces challenges, including the high initial cost of advanced sprayers, which can be a barrier for smaller farms. Stringent environmental regulations on pesticide use necessitate costly upgrades and technology adoption. However, manufacturers' efforts to develop cost-effective solutions and growing awareness of precision agriculture's benefits are expected to mitigate these challenges. The market encompasses production, consumption, trade, and price dynamics, with substantial intra-regional activity. Key players are innovating with enhanced precision, reduced drift, and improved operator safety to meet evolving agricultural needs.

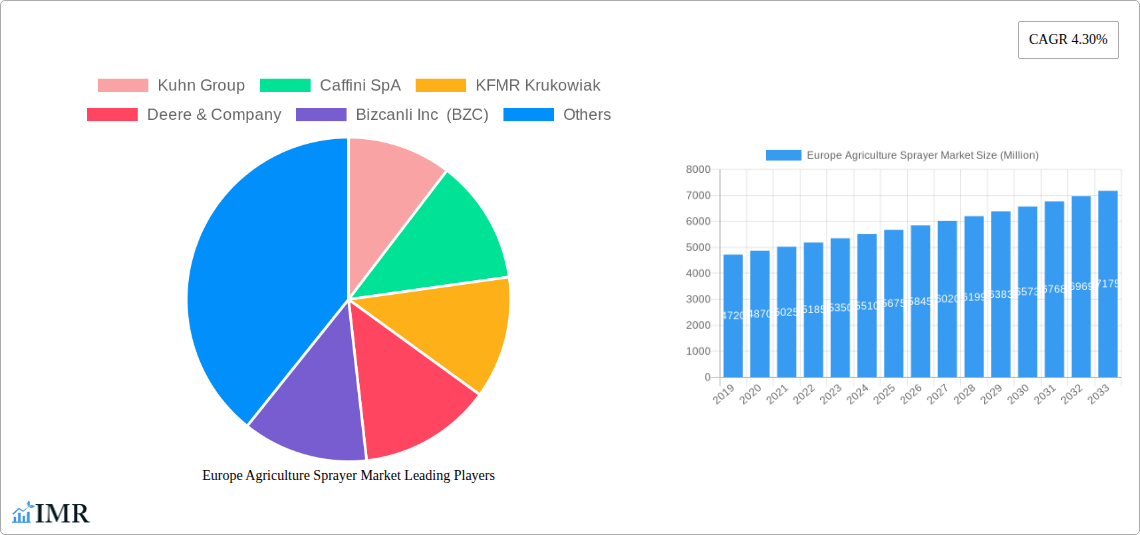

Europe Agriculture Sprayer Market Company Market Share

Europe Agriculture Sprayer Market: Analysis and Future Projections (2019-2033)

This report offers a comprehensive analysis of the Europe agriculture sprayer market, detailing its dynamics, growth, and future potential. Covering 2019-2033, with a base year of 2025 and a forecast to 2033, this research is vital for agricultural equipment manufacturers, distributors, policymakers, and investors. The study examines parent and child markets, providing granular insights into sprayer types, technologies, and applications. All values are presented in Million units for clear, actionable data.

Europe Agriculture Sprayer Market Market Dynamics & Structure

The Europe agriculture sprayer market is characterized by a moderate to high concentration, with key players like Kuhn Group, Deere & Company, and Exel Industries holding significant market shares. Technological innovation is a primary driver, fueled by the increasing demand for precision agriculture, automation, and sustainable farming practices. Regulatory frameworks, particularly those concerning environmental protection and pesticide application, are also shaping market trends, pushing for more efficient and targeted spraying solutions. Competitive product substitutes, ranging from manual sprayers to drone-based application systems, present both challenges and opportunities for traditional field crop sprayers and orchard sprayers. End-user demographics, encompassing large-scale commercial farms, smallholder farms, and specialized horticultural operations, dictate the demand for specific sprayer types and features. Mergers and acquisitions (M&A) trends, such as strategic alliances and consolidations, are observed as companies seek to expand their product portfolios and geographical reach. For instance, the acquisition of smaller innovative companies by larger corporations often aims to integrate cutting-edge technologies like sensor-based spraying or advanced data analytics. Barriers to innovation include the high cost of research and development for advanced technologies and the need for farmer training and adoption of new systems.

- Market Concentration: Dominated by a few major players, but with a growing presence of specialized and regional manufacturers.

- Technological Innovation Drivers: Precision agriculture, IoT integration, AI-powered weed detection, GPS guidance, and automated boom control are key advancements.

- Regulatory Frameworks: Strict regulations on pesticide usage, drift reduction technologies, and integrated pest management are influencing product development.

- Competitive Product Substitutes: Advanced drones, robotic sprayers, and integrated farm management software are emerging alternatives.

- End-User Demographics: Diverse needs across large-scale cereal farmers, fruit growers, vineyard managers, and vegetable producers.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand product offerings.

Europe Agriculture Sprayer Market Growth Trends & Insights

The Europe agriculture sprayer market has witnessed steady growth, driven by the imperative to enhance crop yields while minimizing environmental impact. The adoption rate of advanced spraying technologies, such as variable rate application and GPS-guided systems, is accelerating, particularly among larger agricultural enterprises. These technologies enable precise application of fertilizers and pesticides, leading to reduced chemical usage, lower operational costs, and improved crop health. Self-propelled sprayers, with their enhanced maneuverability and capacity, have seen increasing demand due to their efficiency in covering large areas. Furthermore, the growing emphasis on sustainable agriculture and organic farming practices is fostering innovation in biological sprayers and application methods that minimize chemical residues. Consumer behavior shifts towards healthier food products and greater transparency in food production are indirectly influencing the demand for advanced spraying solutions that ensure precise and responsible crop management. The market penetration of smart sprayers, equipped with sensors and data analytics, is expected to rise significantly as farmers recognize their potential for optimizing resource allocation and increasing profitability. The overall market size evolution is a testament to the continuous integration of digital technologies and automation within the agricultural sector.

- Market Size Evolution: Consistent upward trend driven by technological advancements and farmer adoption.

- Adoption Rates: Increasing adoption of precision agriculture technologies, automated systems, and smart sprayers.

- Technological Disruptions: Introduction of AI-driven weed detection, drone-based spraying, and robotic application systems.

- Consumer Behavior Shifts: Growing demand for sustainable practices and reduced chemical residues influencing sprayer design and application.

- Market Penetration: Rising penetration of GPS-guided systems, auto-steer capabilities, and data-driven application.

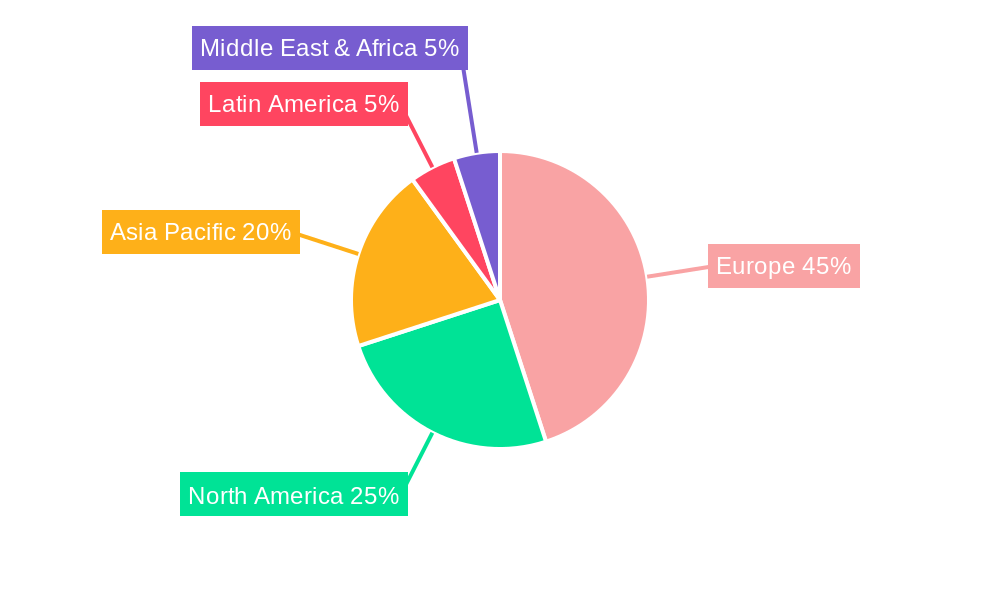

Dominant Regions, Countries, or Segments in Europe Agriculture Sprayer Market

The Europe agriculture sprayer market is a complex ecosystem with distinct regional and segmental dominance. From a Production Analysis: perspective, countries with robust manufacturing capabilities and strong agricultural machinery export bases, such as Germany, France, and Italy, are leading. These nations benefit from established industrial infrastructure, skilled labor, and significant investment in R&D. In terms of Consumption Analysis:, Western European countries like France, Germany, and Spain represent the largest markets due to their extensive agricultural land, diverse crop cultivation, and high adoption rates of advanced farming technologies. The demand for field crop sprayers, essential for large-scale cereal and oilseed production, is particularly high in these regions.

The Import Market Analysis (Value & Volume): is significantly influenced by countries that may have specialized manufacturing but rely on imports for certain advanced components or high-capacity machinery. Germany and France often lead in import volumes for sophisticated agricultural equipment. Conversely, the Export Market Analysis (Value & Volume): is dominated by countries with strong manufacturing capabilities and a global reach, exporting both finished products and components. The Netherlands, for example, is a significant exporter of specialized horticultural equipment, including advanced greenhouse sprayers.

The Price Trend Analysis: in Europe is influenced by factors such as raw material costs, technological sophistication, brand reputation, and regional demand-supply dynamics. Premium, technologically advanced sprayers command higher prices, while more basic models cater to price-sensitive markets. The increasing focus on efficiency and sustainability is driving a demand for higher-priced, feature-rich sprayers.

Key drivers for dominance in these segments include:

- Economic Policies: Government subsidies for agricultural modernization, farm mechanization, and sustainable practices play a crucial role.

- Infrastructure: Well-developed transportation networks and logistics facilitate the distribution of sprayers and their components.

- Technological Advancement: Leading countries invest heavily in R&D, fostering innovation in areas like precision spraying and automation.

- Crop Diversity: Regions with diverse agricultural outputs, such as large-scale grain farming and specialized fruit/vegetable cultivation, drive demand for a wide range of sprayer types.

The dominance is further amplified by factors like strong farmer cooperatives, access to agricultural finance, and a receptive market for new technologies. For example, the extensive use of boom sprayers in countries like Ukraine and Russia for vast arable lands highlights the importance of efficient, high-capacity machinery in specific geographies.

Europe Agriculture Sprayer Market Product Landscape

The Europe agriculture sprayer market product landscape is characterized by a spectrum of innovations aimed at enhancing efficiency, precision, and sustainability. From traditional trailer sprayers and mounted sprayers to sophisticated self-propelled units and emerging drone-based systems, the diversity caters to varied agricultural needs. Key advancements include the integration of GPS-guided steering, automatic boom height control, and section control to minimize overlap and reduce chemical waste. Smart sprayers equipped with optical sensors capable of identifying weeds and applying treatments only where needed represent a significant leap in targeted application, reducing overall pesticide usage by up to 70%. The development of lighter, more durable materials and improved fluid dynamics ensures optimal spray coverage and reduced drift, contributing to environmental protection and worker safety. These technological evolutions are critical selling propositions for manufacturers seeking to differentiate their offerings in a competitive market.

Key Drivers, Barriers & Challenges in Europe Agriculture Sprayer Market

The Europe agriculture sprayer market is propelled by several key drivers. The escalating need for increased food production to feed a growing global population, coupled with the imperative to optimize resource utilization (water, fertilizers, pesticides) due to environmental concerns, is a primary growth catalyst. Advancements in precision agriculture technologies, including GPS, sensors, and data analytics, are enabling farmers to apply inputs more efficiently, driving the demand for advanced sprayers. Furthermore, government initiatives and subsidies supporting farm modernization and sustainable agricultural practices encourage the adoption of new equipment.

Conversely, the market faces significant barriers and challenges. The high initial investment cost for sophisticated sprayer technologies can be a deterrent for small and medium-sized farms. Stringent environmental regulations and evolving pesticide policies necessitate continuous adaptation and investment in compliance technologies. Supply chain disruptions, fluctuating raw material prices, and the limited availability of skilled labor for manufacturing and maintenance also pose considerable challenges. Competitive pressures from both established players and new entrants offering innovative solutions, such as drone spraying, add another layer of complexity.

Emerging Opportunities in Europe Agriculture Sprayer Market

Emerging opportunities within the Europe agriculture sprayer market lie in the continued development and adoption of autonomous and robotic spraying systems, offering enhanced precision and reduced labor dependency. The growing demand for organic and integrated pest management (IPM) solutions is creating a niche for specialized sprayers designed for biological agents and precision application of organic inputs. Furthermore, the integration of advanced IoT platforms and artificial intelligence (AI) for real-time data analysis and predictive maintenance presents significant potential for optimizing sprayer performance and farmer decision-making. The expansion of sprayer rental services and shared-use models could also unlock market access for farmers who cannot afford outright purchase of high-end equipment, particularly in regions with a higher proportion of smallholder farms.

Growth Accelerators in the Europe Agriculture Sprayer Market Industry

Several catalysts are accelerating the growth of the Europe agriculture sprayer market. Technological breakthroughs in sensor technology and AI are enabling increasingly sophisticated weed detection and spot-spraying capabilities, leading to substantial savings in chemical inputs and a reduced environmental footprint. Strategic partnerships between sprayer manufacturers and technology providers (e.g., GPS, software developers) are fostering the development of integrated, smart farming solutions. Market expansion strategies, including the targeting of emerging agricultural economies within Europe and the development of specialized sprayers for niche crops (e.g., vineyards, orchards), are also driving growth. The increasing focus on sustainability and the circular economy within agriculture is further encouraging the development of sprayers that promote efficient resource management and minimize waste.

Key Players Shaping the Europe Agriculture Sprayer Market Market

- Kuhn Group

- Caffini SpA

- KFMR Krukowiak

- Deere & Company

- Bizcanli Inc (BZC)

- Exel Industries

- BGROUP SpA

- Hardi International AS

- Herbert Dammann GmbH

- Hockley International Limite

Notable Milestones in Europe Agriculture Sprayer Market Sector

- November 2022: John Deere announced the launch of C&Spray technology in Europe, which allows the identification of weeds and specific treatments. This system uses camera technology to detect color differences in the area. Cameras and other hardware components are built directly into the boom or machine frame.

- January 2021: Hardi introduced the self-propelled Alpha to their demonstration lineup for 2021, which features a balance between front and rear and, with its low total weight, gives optimal weight/capacity ratio and high performance even in wet terrain conditions.

- October 2021: Kuhn Vostok LLC (representative office of the French Kuhn Group) officially launched the first stage of its agricultural machinery plant in the Ramensky District of the Voronezh Region. The plant will produce grain and tilled seeders, tillage implements, equipment for spraying, fertilizing, and other equipment.

In-Depth Europe Agriculture Sprayer Market Market Outlook

The future outlook for the Europe agriculture sprayer market is exceptionally robust, characterized by continued innovation and expanding adoption of precision technologies. Growth accelerators, such as the increasing demand for sustainable agricultural practices and the integration of AI and IoT in farm management, will further fuel market expansion. The development of more affordable and accessible smart spraying solutions will democratize access to advanced technology, enabling a broader range of farmers to benefit from efficiency gains and reduced environmental impact. Strategic collaborations and market expansion into underserved regions within Europe will unlock new revenue streams and solidify the market's trajectory towards a more automated, data-driven, and sustainable agricultural future. The market is poised for significant growth in the coming years.

Europe Agriculture Sprayer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Agriculture Sprayer Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Agriculture Sprayer Market Regional Market Share

Geographic Coverage of Europe Agriculture Sprayer Market

Europe Agriculture Sprayer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. Technological Advancements in Spraying Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Agriculture Sprayer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kuhn Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caffini SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KFMR Krukowiak

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bizcanli Inc (BZC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Exel Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BGROUP SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hardi International AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Herbert Dammann GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hockley International Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kuhn Group

List of Figures

- Figure 1: Europe Agriculture Sprayer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Agriculture Sprayer Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Agriculture Sprayer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Agriculture Sprayer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Agriculture Sprayer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Agriculture Sprayer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Agriculture Sprayer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Agriculture Sprayer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Agriculture Sprayer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Agriculture Sprayer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Agriculture Sprayer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Agriculture Sprayer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Agriculture Sprayer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Agriculture Sprayer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Agriculture Sprayer Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Agriculture Sprayer Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Europe Agriculture Sprayer Market?

Key companies in the market include Kuhn Group, Caffini SpA, KFMR Krukowiak, Deere & Company, Bizcanli Inc (BZC), Exel Industries, BGROUP SpA, Hardi International AS, Herbert Dammann GmbH, Hockley International Limite.

3. What are the main segments of the Europe Agriculture Sprayer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.09 billion as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

Technological Advancements in Spraying Equipment.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

November 2022: John Deere announced the launch of C&Spray technology in Europe, which allows the identification of weeds and specific treatments. This system uses camera technology to detect color differences in the area. Cameras and other hardware components are built directly into the boom or machine frame.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Agriculture Sprayer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Agriculture Sprayer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Agriculture Sprayer Market?

To stay informed about further developments, trends, and reports in the Europe Agriculture Sprayer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence