Key Insights

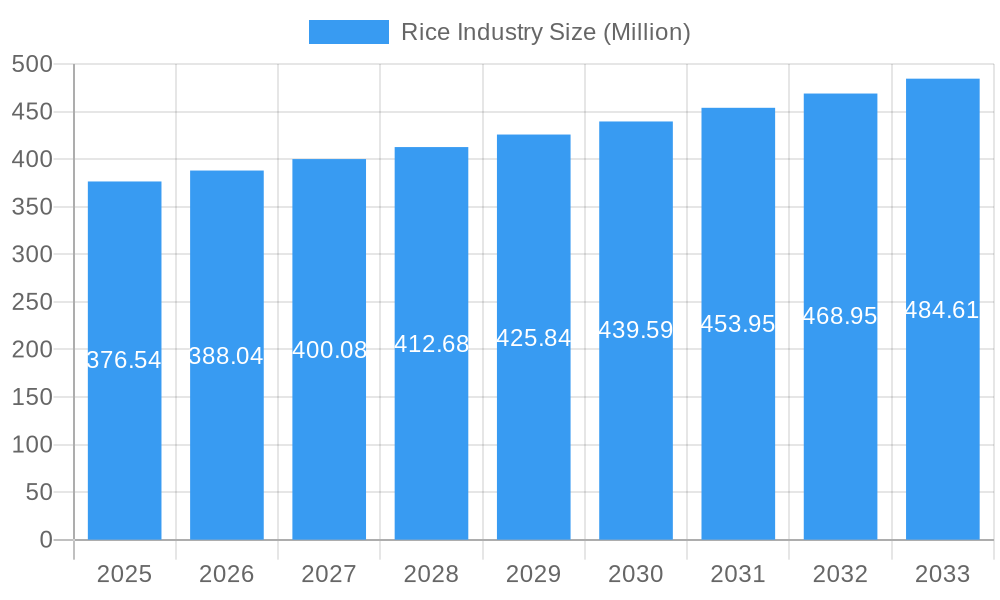

The global Rice Industry is projected to reach a substantial market size of $376.54 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 3.00% through 2033. This robust growth is underpinned by several dynamic market drivers. A primary driver is the escalating global population, which consistently increases the demand for rice as a staple food source, particularly in developing economies. Furthermore, advancements in agricultural technology, including improved seed varieties, precision farming techniques, and efficient irrigation systems, are enhancing rice yields and quality, contributing to market expansion. Growing consumer awareness regarding the health benefits of rice, such as its status as a gluten-free grain and a source of energy, is also spurring demand. The increasing popularity of rice-based products and convenience foods, driven by urbanization and evolving consumer lifestyles, further fuels market growth. Supply chain efficiencies and diversified product offerings by key players are also playing a crucial role in market stability and expansion.

Rice Industry Market Size (In Million)

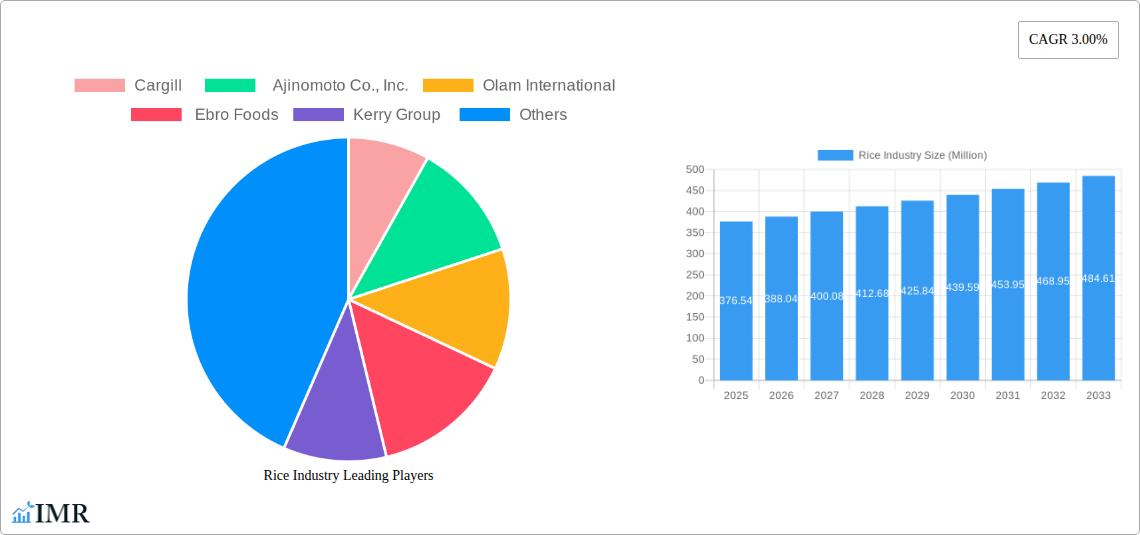

The rice market is characterized by a range of significant trends and strategic initiatives. The rising demand for specialty and organic rice varieties, catering to niche consumer preferences for health and premium products, represents a key trend. Innovations in processing and packaging technologies are improving shelf life and convenience, making rice products more accessible and appealing. The integration of sustainable farming practices and ethical sourcing is gaining traction, driven by corporate social responsibility and increasing consumer demand for environmentally conscious products. Conversely, certain restraints temper this growth. Volatile weather patterns and climate change pose significant risks to rice cultivation, impacting supply and price stability. Fluctuations in global commodity prices and trade policies can also create market uncertainties. The increasing competition from other staple grains and alternative food sources presents another challenge. However, the concerted efforts of leading companies like Cargill, Ajinomoto Co., Inc., Olam International, Ebro Foods, and Kerry Group in product innovation, market penetration, and strategic collaborations are instrumental in navigating these challenges and capitalizing on emerging opportunities.

Rice Industry Company Market Share

Here's a compelling, SEO-optimized report description for the Rice Industry, designed for maximum visibility and engagement with industry professionals.

Report Title: Global Rice Market Analysis 2025-2033: Growth, Trends, Opportunities, and Key Player Strategies

Report Description:

Gain a comprehensive understanding of the dynamic global rice market with our in-depth analysis spanning 2019–2033. This report provides critical insights into rice production analysis, rice consumption analysis, rice import market analysis, rice export market analysis, rice price trend analysis, and rice industry developments. We dissect the market's structure, identifying key drivers, barriers, challenges, and emerging opportunities, with a specific focus on the parent and child rice market segments. Analyze the strategies of leading companies including Cargill, Ajinomoto Co., Inc., Olam International, Ebro Foods, and Kerry Group. This report is essential for stakeholders seeking to navigate the evolving landscape of the rice industry, capitalizing on growth accelerators and understanding future market potential. All values are presented in million units for clear quantitative analysis.

Rice Industry Market Dynamics & Structure

The global rice industry exhibits a moderately concentrated market structure, with a few dominant players holding significant market share. Technological innovation is a key driver, particularly in areas like genetically modified rice strains for increased yield and disease resistance, precision agriculture for optimized cultivation, and advanced processing techniques to enhance shelf life and nutritional value. Regulatory frameworks, encompassing food safety standards, import/export policies, and agricultural subsidies, significantly influence market entry and operational costs. Competitive product substitutes, such as other grains (wheat, corn) and alternative carbohydrate sources, pose a constant challenge, necessitating continuous innovation and value proposition enhancement in rice products. End-user demographics are diverse, ranging from staple food consumers in developing nations to health-conscious individuals seeking specific rice varieties in developed markets. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their geographical reach, secure supply chains, and acquire new technologies.

- Market Concentration: Dominated by a few large-scale agricultural corporations and national food producers.

- Technological Innovation Drivers:

- Development of high-yield and climate-resilient rice varieties.

- Adoption of smart farming technologies for efficient resource management.

- Advancements in food processing and packaging for extended shelf life.

- Regulatory Frameworks: Stringent food safety regulations (e.g., HACCP, ISO 22000) and trade agreements impact market access.

- Competitive Product Substitutes: Wheat, corn, barley, and other staple grains.

- End-User Demographics: Broad consumer base, with growing demand for specialized and organic rice.

- M&A Trends: Strategic acquisitions to strengthen global supply chains and market presence.

Rice Industry Growth Trends & Insights

The global rice market is on a steady growth trajectory, driven by a burgeoning global population, particularly in Asia and Africa, where rice is a primary staple. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) of approximately 3.5% over the forecast period (2025–2033). Adoption rates for improved rice varieties and modern farming techniques are increasing, leading to enhanced productivity and reduced post-harvest losses. Technological disruptions are continuously shaping the industry, from AI-powered crop monitoring to blockchain-based supply chain traceability, enhancing efficiency and consumer trust. Consumer behavior shifts are playing a pivotal role, with a rising demand for value-added rice products, including parboiled rice, brown rice, basmati rice, and jasmine rice, catering to health and dietary preferences. The market penetration of specialized rice products is growing, especially in urban and developed markets. The base year of 2025 sets the stage for a detailed analysis of these trends.

The historical period from 2019 to 2024 laid the groundwork for current market dynamics, characterized by fluctuating prices due to climatic conditions and global trade policies, alongside steady demand. The estimated year 2025 is crucial for calibrating the present market standing and projecting future movements. Understanding the interplay between these trends is vital for strategic planning and investment decisions within the rice sector. The increasing awareness of the health benefits associated with certain rice varieties, such as their low glycemic index and rich fiber content, is further fueling demand for these niche products. Furthermore, advancements in food processing technologies are enabling the development of convenient, ready-to-cook, and ready-to-eat rice products, appealing to busy urban lifestyles and expanding the market beyond traditional household consumption. The influence of e-commerce platforms in making a wider variety of rice products accessible to consumers is also a significant factor driving market penetration and growth.

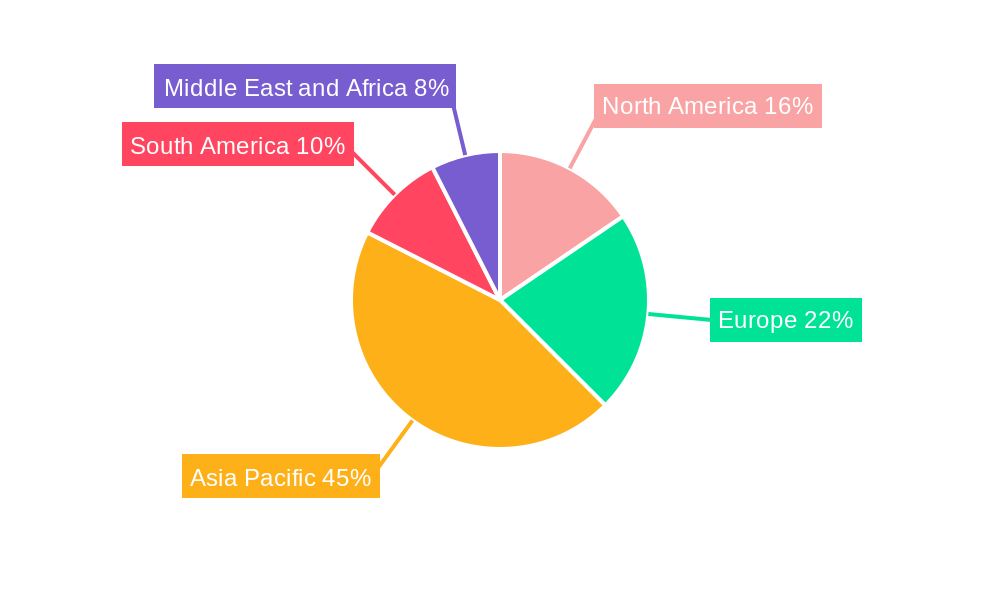

Dominant Regions, Countries, or Segments in Rice Industry

The Asia-Pacific region stands as the undisputed dominant force in the global rice industry, consistently leading in rice production analysis, rice consumption analysis, rice import market analysis, and rice export market analysis. Countries like China and India collectively account for a significant portion of global rice output and consumption, driven by their vast populations and the rice-centric nature of their diets.

Production Analysis: Asia-Pacific's dominance in production is attributed to its favorable climate, extensive arable land, and well-established irrigation systems. Countries in Southeast Asia, such as Vietnam, Thailand, and Indonesia, are also major producers. The child market segment of specific rice varieties like Basmati in India and Jasmine in Thailand significantly contributes to the region's export value.

Consumption Analysis: The sheer size of the population in countries like China and India makes them the largest consumers of rice globally. The staple nature of rice in their diets, coupled with a growing middle class, sustains this high consumption. The parent market segment of basic white rice continues to dominate consumption, but there's a discernible shift towards healthier brown rice and specialty rice.

Import Market Analysis (Value & Volume): While Asia-Pacific is a net exporter, certain countries within the region, along with nations in the Middle East and Africa, are significant importers. These imports are crucial for meeting domestic demand and diversifying food security. The volume of imports is substantial, with an estimated xx million metric tons annually in 2025. The value of the import market for rice in 2025 is projected to be around $xx billion.

Export Market Analysis (Value & Volume): Thailand, Vietnam, India, and Pakistan are the leading rice exporters, commanding a substantial share of the global export market. The child market segments of premium varieties like Basmati and Jasmine rice contribute significantly to the export value, estimated at xx million metric tons in 2025, with a market value of approximately $xx billion.

Price Trend Analysis: Regional price trends are influenced by factors such as weather patterns, government policies, and global demand-supply dynamics. The estimated average global paddy rice price in 2025 is projected to be around $xxx per metric ton. Fluctuations in these prices directly impact the economic viability of producers and the affordability for consumers.

Industry Developments: The region is a hotbed for innovation in rice cultivation and processing, with significant investments in research and development to improve crop yields and sustainability.

Rice Industry Product Landscape

The rice industry offers a diverse product landscape, ranging from raw, unprocessed paddy to highly processed and value-added items. Raw rice, in its various types like white, brown, parboiled, and specialty varieties (Basmati, Jasmine, Arborio), forms the foundational product. Innovation is evident in the development of fortified rice, enriched with essential vitamins and minerals, addressing micronutrient deficiencies in developing regions. Performance metrics for rice are evaluated based on factors like grain quality, milling recovery, nutritional content, and cooking characteristics. Unique selling propositions often revolve around geographical origin, distinct aroma and flavor profiles, and perceived health benefits. Technological advancements are enabling the creation of convenient, instant rice products, pre-cooked rice, and rice-based snacks and ingredients, catering to evolving consumer lifestyles and dietary needs.

Key Drivers, Barriers & Challenges in Rice Industry

Key Drivers:

- Growing Global Population: Increasing demand for a staple food in major consuming regions.

- Dietary Habits: Rice remains a cornerstone of diets in Asia, Africa, and parts of South America.

- Technological Advancements: Improved seed varieties, farming techniques, and processing technologies boost yields and product quality.

- Government Support and Policies: Subsidies and trade policies in key producing nations influence supply and prices.

- Rising Disposable Incomes: Leading to increased consumption of premium and specialty rice varieties.

Key Barriers & Challenges:

- Climate Change Vulnerability: Rice cultivation is highly susceptible to unpredictable weather patterns, leading to yield fluctuations.

- Water Scarcity: Rice cultivation is water-intensive, posing challenges in regions facing water stress.

- Supply Chain Inefficiencies: Post-harvest losses and logistical challenges impact profitability and availability.

- Price Volatility: Fluctuations in global commodity prices can affect farmer incomes and consumer affordability.

- Pest and Disease Outbreaks: Significant threats to crop yields, requiring effective management strategies.

- Regulatory Hurdles: Varied international trade policies and food safety standards can complicate market access.

Emerging Opportunities in Rice Industry

Emerging opportunities in the rice industry lie in the growing demand for functional and specialty rice products. This includes organic and sustainably grown rice, catering to environmentally conscious consumers, and fortified rice variants designed to combat malnutrition in vulnerable populations. The expansion of the ready-to-eat and ready-to-cook rice segments presents significant potential, driven by urbanization and changing lifestyles. Furthermore, untapped markets in Africa and other developing regions, where rice consumption is on the rise, offer substantial growth prospects. Innovations in rice processing for derived products, such as rice flour, rice bran oil, and rice-based beverages, also represent a significant avenue for diversification and value creation.

Growth Accelerators in the Rice Industry Industry

Long-term growth in the rice industry will be significantly accelerated by ongoing technological breakthroughs in crop science, focusing on developing climate-resilient and high-yield rice varieties that can withstand drought, salinity, and disease. Strategic partnerships between research institutions, agricultural technology companies, and rice farmers are crucial for the widespread adoption of these innovations. Market expansion strategies targeting underserved regions with increasing rice demand, coupled with investments in improving post-harvest infrastructure and supply chain efficiency, will further fuel growth. The development of advanced processing techniques to create novel rice-based food products and ingredients will also act as a powerful accelerator, diversifying revenue streams and catering to evolving consumer preferences.

Key Players Shaping the Rice Industry Market

- Cargill

- Ajinomoto Co., Inc.

- Olam International

- Ebro Foods

- Kerry Group

Notable Milestones in Rice Industry Sector

- 2020: Increased adoption of drone technology for precision rice farming in Southeast Asia.

- 2021: Global initiatives launched to develop drought-tolerant rice varieties.

- 2022: Rise in demand for premium Basmati rice in Western markets.

- 2023: Significant investments in blockchain technology for rice supply chain traceability.

- 2024: Introduction of new fortified rice blends to combat micronutrient deficiencies.

In-Depth Rice Industry Market Outlook

The future outlook for the rice industry is exceptionally promising, driven by consistent population growth and evolving consumer preferences for healthier and more convenient food options. Strategic investments in climate-resilient crop development and sustainable farming practices will be pivotal in ensuring long-term supply stability. The expansion of value-added rice products, including organic and fortified varieties, coupled with advancements in processing technologies, will unlock new revenue streams and market segments. Collaborations to enhance supply chain efficiencies and reduce post-harvest losses will further bolster industry performance. Overall, the rice industry is poised for sustained growth, presenting significant opportunities for innovation and strategic market expansion.

Rice Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Rice Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

-

3. Asia Pacific

- 3.1. China

- 3.2. Australia

- 3.3. India

- 3.4. Indonesia

- 3.5. Thailand

- 3.6. Vietnam

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Egypt

Rice Industry Regional Market Share

Geographic Coverage of Rice Industry

Rice Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Growing preference for specialty rice varieties leads to increased trade

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Rice Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Rice Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Rice Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Rice Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Rice Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Middle East and Africa Rice Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ajinomoto Co. Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Olam International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ebro Foods

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kerry Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Cargill

List of Figures

- Figure 1: Rice Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Rice Industry Share (%) by Company 2025

List of Tables

- Table 1: Rice Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Rice Industry Volume Metric Tons Forecast, by Production Analysis 2020 & 2033

- Table 3: Rice Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Rice Industry Volume Metric Tons Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Rice Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Rice Industry Volume Metric Tons Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Rice Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Rice Industry Volume Metric Tons Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Rice Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Rice Industry Volume Metric Tons Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Rice Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Rice Industry Volume Metric Tons Forecast, by Region 2020 & 2033

- Table 13: Rice Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Rice Industry Volume Metric Tons Forecast, by Production Analysis 2020 & 2033

- Table 15: Rice Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Rice Industry Volume Metric Tons Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Rice Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Rice Industry Volume Metric Tons Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Rice Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Rice Industry Volume Metric Tons Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Rice Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Rice Industry Volume Metric Tons Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Rice Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Rice Industry Volume Metric Tons Forecast, by Country 2020 & 2033

- Table 25: United States Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United States Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 27: Canada Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Canada Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 29: Rice Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 30: Rice Industry Volume Metric Tons Forecast, by Production Analysis 2020 & 2033

- Table 31: Rice Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 32: Rice Industry Volume Metric Tons Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Rice Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Rice Industry Volume Metric Tons Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Rice Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 36: Rice Industry Volume Metric Tons Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 37: Rice Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 38: Rice Industry Volume Metric Tons Forecast, by Price Trend Analysis 2020 & 2033

- Table 39: Rice Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Rice Industry Volume Metric Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 45: France Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 47: Italy Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 49: Spain Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Spain Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 51: Rice Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 52: Rice Industry Volume Metric Tons Forecast, by Production Analysis 2020 & 2033

- Table 53: Rice Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Rice Industry Volume Metric Tons Forecast, by Consumption Analysis 2020 & 2033

- Table 55: Rice Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Rice Industry Volume Metric Tons Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 57: Rice Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 58: Rice Industry Volume Metric Tons Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 59: Rice Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 60: Rice Industry Volume Metric Tons Forecast, by Price Trend Analysis 2020 & 2033

- Table 61: Rice Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Rice Industry Volume Metric Tons Forecast, by Country 2020 & 2033

- Table 63: China Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: China Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 65: Australia Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Australia Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 67: India Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: India Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 69: Indonesia Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Indonesia Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 71: Thailand Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Thailand Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 73: Vietnam Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Vietnam Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 75: Rice Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 76: Rice Industry Volume Metric Tons Forecast, by Production Analysis 2020 & 2033

- Table 77: Rice Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 78: Rice Industry Volume Metric Tons Forecast, by Consumption Analysis 2020 & 2033

- Table 79: Rice Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 80: Rice Industry Volume Metric Tons Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 81: Rice Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 82: Rice Industry Volume Metric Tons Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 83: Rice Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 84: Rice Industry Volume Metric Tons Forecast, by Price Trend Analysis 2020 & 2033

- Table 85: Rice Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 86: Rice Industry Volume Metric Tons Forecast, by Country 2020 & 2033

- Table 87: Brazil Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Brazil Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 89: Argentina Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Argentina Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 91: Rice Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 92: Rice Industry Volume Metric Tons Forecast, by Production Analysis 2020 & 2033

- Table 93: Rice Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 94: Rice Industry Volume Metric Tons Forecast, by Consumption Analysis 2020 & 2033

- Table 95: Rice Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 96: Rice Industry Volume Metric Tons Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 97: Rice Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 98: Rice Industry Volume Metric Tons Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 99: Rice Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 100: Rice Industry Volume Metric Tons Forecast, by Price Trend Analysis 2020 & 2033

- Table 101: Rice Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 102: Rice Industry Volume Metric Tons Forecast, by Country 2020 & 2033

- Table 103: South Africa Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: South Africa Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

- Table 105: Egypt Rice Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 106: Egypt Rice Industry Volume (Metric Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rice Industry?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Rice Industry?

Key companies in the market include Cargill , Ajinomoto Co., Inc., Olam International , Ebro Foods, Kerry Group .

3. What are the main segments of the Rice Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 376.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Growing preference for specialty rice varieties leads to increased trade.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rice Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rice Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rice Industry?

To stay informed about further developments, trends, and reports in the Rice Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence