Key Insights

The North American Feed Testing Market is projected for substantial expansion. Valued at $539.05 million in the base year of 2025, the market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.7% through 2033. Key growth catalysts include escalating demand for premium animal feed, increasingly rigorous regulatory frameworks, and heightened consumer consciousness regarding food safety and animal welfare. The market's trajectory is further influenced by the imperative to manage zoonotic diseases through precise feed analysis and the widespread adoption of advanced, efficient testing technologies. Growing global demand for animal protein directly correlates with increased production needs, thus driving the demand for comprehensive feed testing to optimize animal health and productivity.

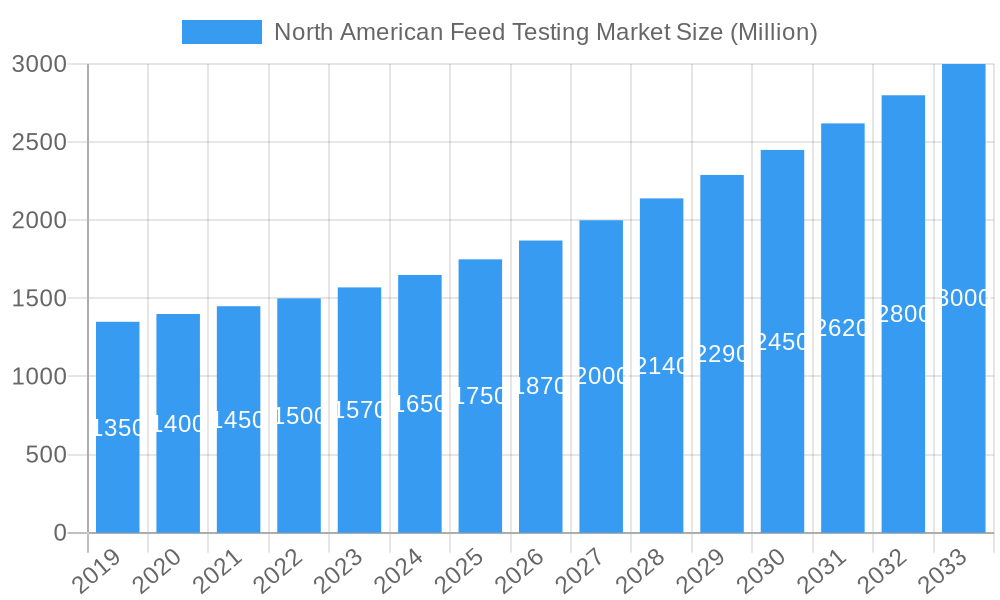

North American Feed Testing Market Market Size (In Million)

Significant R&D investments by industry leaders such as Eurofins Scientific, NSF International, and Intertek Group PLC are propelling innovation in testing methodologies and service portfolios. Emerging trends, including specialized testing for mycotoxins and pesticide residues, and scrutiny of novel feed ingredient safety, are defining market evolution. While high equipment costs and the requirement for skilled labor present potential challenges, particularly for smaller entities, the fundamental need for dependable and accurate feed testing, supported by supportive government initiatives for animal health and food safety, will ensure robust market growth. The market is expected to reach an estimated size exceeding $3,000 million by 2033.

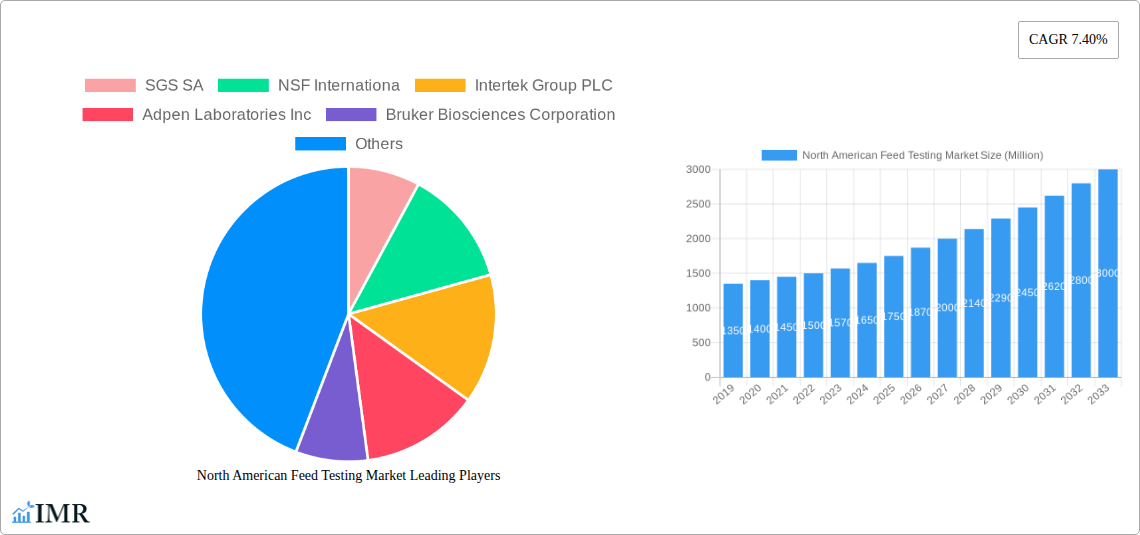

North American Feed Testing Market Company Market Share

North American Feed Testing Market Market Dynamics & Structure

The North American feed testing market is characterized by a moderate to high market concentration, with key players like SGS SA, NSF International, Intertek Group PLC, and Eurofins Scientific holding significant shares. This concentration is driven by the high capital investment required for advanced laboratory infrastructure and specialized personnel. Technological innovation is a primary driver, with advancements in analytical techniques like mass spectrometry and polymerase chain reaction (PCR) enabling more accurate and comprehensive testing for contaminants, nutritional content, and genetically modified organisms (GMOs). Stringent regulatory frameworks, enforced by bodies such as the U.S. Food and Drug Administration (FDA) and Health Canada, mandate rigorous testing protocols to ensure animal and human safety, thus fueling consistent demand. Competitive product substitutes are limited due to the specialized nature of feed testing services.

- Market Concentration: Dominated by a few large, established players, though smaller niche labs are emerging.

- Technological Innovation Drivers: Increased demand for rapid, sensitive, and comprehensive testing solutions.

- Regulatory Frameworks: FDA, Health Canada, and international standards are critical for market access and product safety.

- Competitive Product Substitutes: Limited; services are highly specialized, but novel testing methodologies can disrupt existing approaches.

- End-User Demographics: Feed manufacturers, livestock producers, pet food companies, and regulatory bodies are key consumers.

- M&A Trends: Strategic acquisitions by larger entities to expand service portfolios, geographic reach, and technological capabilities are prevalent. For instance, acquisitions often focus on specialized testing capabilities like mycotoxin analysis or allergen detection. The volume of M&A deals has seen a steady increase, reflecting consolidation and expansion strategies.

North American Feed Testing Market Growth Trends & Insights

The North American feed testing market is projected for robust growth, driven by an increasing awareness of animal welfare, food safety, and the desire for enhanced nutritional value in animal feed. The market size is estimated to have been valued at approximately $1,500 million in 2024 and is forecast to reach $2,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.0% during the forecast period of 2025–2033. This expansion is fueled by evolving consumer preferences for ethically sourced and high-quality animal products, which directly translates to a demand for superior animal feed. Adoption rates for advanced testing technologies are accelerating, with laboratories investing in sophisticated equipment to meet the growing need for rapid and precise analysis.

Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) in data analysis and predictive modeling for feed quality, are beginning to impact the industry. These technologies promise to improve efficiency, reduce turnaround times, and provide deeper insights into feed composition and potential risks. Furthermore, the increasing prevalence of feed-borne diseases and the need to detect contaminants like mycotoxins, heavy metals, and pesticides at trace levels are significant market drivers. Consumer behavior shifts towards transparency and traceability in the food supply chain are also compelling feed producers and manufacturers to invest more heavily in comprehensive testing services. The penetration of advanced testing methods, including molecular diagnostics and rapid screening techniques, is steadily increasing across both the parent market (animal feed testing) and its child markets (e.g., pet food testing, aquaculture feed testing). The estimated market penetration for comprehensive nutritional analysis has reached over 75% in the commercial livestock sector, with significant growth expected in the niche pet food segment, projected to grow at a CAGR of 8.5%.

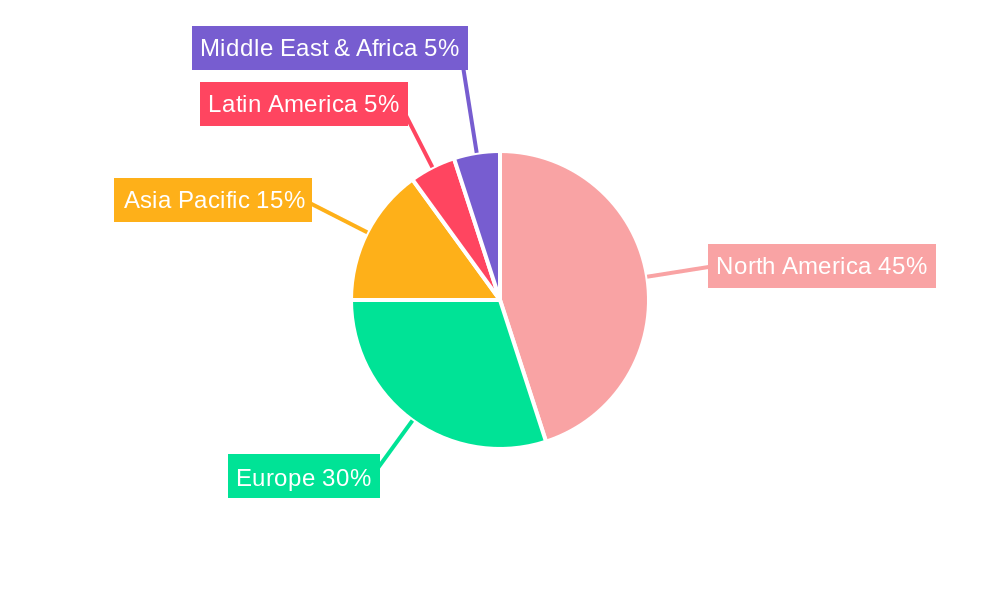

Dominant Regions, Countries, or Segments in North American Feed Testing Market

Within the North American feed testing market, the United States consistently emerges as the dominant region, driven by its substantial agricultural output, advanced food processing industry, and a highly regulated environment that mandates rigorous feed testing. The sheer volume of livestock production, encompassing poultry, cattle, swine, and aquaculture, coupled with a burgeoning pet food industry, creates an immense demand for diverse feed testing services. This dominance is further bolstered by the presence of leading global testing laboratories and a strong network of research institutions that foster innovation.

- Production Analysis: The U.S. leads in the production of animal feed, influencing the overall testing landscape. Key production hubs are concentrated in the Midwest for livestock feed and along the coasts for aquaculture and pet food.

- Consumption Analysis: High per capita meat and dairy consumption in the U.S. necessitates large-scale animal feed production, directly driving consumption of feed testing services to ensure quality and safety. The pet food segment in the U.S. represents a rapidly growing child market, with estimated consumption of testing services reaching $450 million in 2025.

- Import Market Analysis (Value & Volume): While the U.S. is a net exporter of many agricultural commodities, imports of specialized feed ingredients and additives often necessitate testing to comply with domestic regulations, contributing to import testing volumes. Import value for feed ingredients requiring testing is estimated at $800 million in 2025.

- Export Market Analysis (Value & Volume): The U.S. exports significant volumes of animal feed, particularly to countries with developing agricultural sectors. The export market for tested feed is valued at an estimated $700 million in 2025, with a volume of 1.5 million metric tons.

- Price Trend Analysis: Prices for feed testing services in the U.S. are influenced by the complexity of tests, the turnaround time required, and the volume of samples submitted. Prices for comprehensive nutritional analysis range from $150 to $500 per sample, with specialized contaminant testing reaching higher figures.

- Industry Developments: The U.S. is at the forefront of adopting new testing technologies and adapting to evolving regulatory standards, such as the Food Safety Modernization Act (FSMA) requirements for animal food. The country's robust infrastructure and investment in R&D significantly contribute to its leading position.

North American Feed Testing Market Product Landscape

The North American feed testing market offers a diverse range of services, from routine nutritional analysis to highly specialized detection of contaminants and pathogens. Innovations focus on enhancing accuracy, reducing detection limits, and improving turnaround times. Key applications include ensuring compliance with regulatory standards, verifying nutritional content for optimal animal growth, and identifying potential hazards like mycotoxins, heavy metals, pesticides, and pathogens such as Salmonella. Performance metrics are increasingly being driven by ISO 17025 accreditation, demonstrating laboratory competence. Unique selling propositions often lie in the ability to conduct rapid screening tests alongside comprehensive confirmatory analyses, providing a holistic approach to feed safety and quality assurance. Technological advancements include the adoption of liquid chromatography-mass spectrometry (LC-MS/MS) for accurate quantification of mycotoxins and pesticides, and real-time PCR for rapid pathogen detection, offering a competitive edge in this dynamic sector.

Key Drivers, Barriers & Challenges in North American Feed Testing Market

The North American feed testing market is propelled by several key drivers. Increasing consumer demand for safe and traceable animal products is paramount, directly influencing the need for stringent feed quality control. Evolving regulatory landscapes, mandating higher standards for animal feed safety and nutritional content, serve as a continuous catalyst for growth. Technological advancements in analytical techniques, enabling faster, more accurate, and comprehensive testing, are also significant drivers. Furthermore, the growing global demand for animal protein necessitates increased efficiency and safety in animal agriculture, indirectly boosting feed testing services.

- Technological: Advancements in rapid testing methods, molecular diagnostics, and data analytics.

- Economic: Rising disposable incomes leading to increased meat and pet food consumption.

- Policy-driven: Stricter government regulations on animal feed safety and traceability.

Key challenges and restraints facing the market include high operational costs associated with sophisticated laboratory equipment and qualified personnel. The availability of skilled labor can also be a bottleneck. Geopolitical instability and global supply chain disruptions can impact the availability and cost of raw materials and testing reagents, potentially leading to increased testing costs. The fragmented nature of the feed industry, with numerous small-scale producers, can pose challenges for standardized testing implementation. Competitive pressures from new entrants and the need for continuous investment in technology to remain competitive are also significant restraints.

- Supply Chain Issues: Volatility in reagent availability and cost.

- Regulatory Hurdles: Navigating complex and evolving regulatory requirements across different jurisdictions.

- Competitive Pressures: Intense competition among testing laboratories leading to price sensitivity.

Emerging Opportunities in North American Feed Testing Market

Emerging opportunities in the North American feed testing market lie in the growing demand for sustainable and organic feed testing. As consumers increasingly favor environmentally friendly and natural products, testing for organic certification compliance and the presence of sustainable ingredients will become more critical. The expansion of specialized testing for aquaculture feed presents a significant untapped market, driven by the growth of global fish farming. Furthermore, the increasing focus on animal gut health and the microbiome opens avenues for testing related to probiotics, prebiotics, and feed additives that influence gut health. The development and adoption of real-time, on-site testing solutions utilizing portable devices and AI-powered analytics offer opportunities for increased efficiency and accessibility for feed producers.

Growth Accelerators in the North American Feed Testing Market Industry

Several catalysts are accelerating long-term growth in the North American feed testing market. Technological breakthroughs in areas like genomics and metabolomics are enabling a deeper understanding of feed composition and its impact on animal health, driving demand for advanced analytical services. Strategic partnerships between feed manufacturers, technology providers, and testing laboratories are fostering innovation and creating integrated solutions. Market expansion strategies by key players, including acquisitions of smaller niche laboratories and investments in new testing capabilities, are consolidating market share and broadening service offerings. The increasing focus on preventative health measures in animal agriculture, rather than reactive treatments, is a significant growth accelerator, pushing for proactive feed testing to identify and mitigate potential risks before they impact animal health or food safety.

Key Players Shaping the North American Feed Testing Market Market

- SGS SA

- NSF International

- Intertek Group PLC

- Adpen Laboratories Inc

- Bruker Biosciences Corporation

- Genetic ID NA Inc

- Genon Laboratories Ltd

- Eurofins Scientific

- Invisible Sentinel Inc

Notable Milestones in North American Feed Testing Market Sector

- 2019: Launch of advanced LC-MS/MS methods for comprehensive mycotoxin analysis by leading laboratories, enhancing detection limits.

- 2020: Increased adoption of rapid screening technologies like ELISA for Salmonella and other pathogens in response to heightened food safety concerns.

- 2021: Significant investment in automation and robotics within feed testing laboratories to improve throughput and reduce human error.

- 2022: Growing emphasis on testing for antimicrobial resistance (AMR) markers in animal feed, driven by public health initiatives.

- 2023: Introduction of AI-powered platforms for data interpretation and trend analysis in feed quality, offering predictive insights.

- 2024: Expansion of testing services to include nutritional profiling for specialized diets, such as plant-based animal feeds and functional pet foods.

In-Depth North American Feed Testing Market Market Outlook

The outlook for the North American feed testing market is exceptionally promising, driven by an unwavering commitment to animal health, food safety, and consumer confidence. Growth accelerators such as the continued integration of cutting-edge analytical technologies, including AI and blockchain for enhanced traceability, will further solidify its trajectory. Strategic collaborations between industry stakeholders will foster innovation and create comprehensive service ecosystems. The expanding pet food sector, with its premiumization trends, and the growing aquaculture industry represent significant untapped potential. As regulatory bodies worldwide continue to elevate standards and consumers demand greater transparency, the indispensable role of robust feed testing services will only intensify, ensuring a sustained period of expansion and opportunity within this vital market segment.

North American Feed Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North American Feed Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Feed Testing Market Regional Market Share

Geographic Coverage of North American Feed Testing Market

North American Feed Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increasing Government Regulations Driving Growth of Pet Food Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Feed Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NSF Internationa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adpen Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bruker Biosciences Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetic ID NA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genon Laboratories Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurofins Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invisible Sentinel Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGS SA

List of Figures

- Figure 1: North American Feed Testing Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North American Feed Testing Market Share (%) by Company 2025

List of Tables

- Table 1: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North American Feed Testing Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North American Feed Testing Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Feed Testing Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the North American Feed Testing Market?

Key companies in the market include SGS SA, NSF Internationa, Intertek Group PLC, Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, Genon Laboratories Ltd, Eurofins Scientific, Invisible Sentinel Inc.

3. What are the main segments of the North American Feed Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 539.05 million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increasing Government Regulations Driving Growth of Pet Food Testing Market.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Feed Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Feed Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Feed Testing Market?

To stay informed about further developments, trends, and reports in the North American Feed Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence