Key Insights

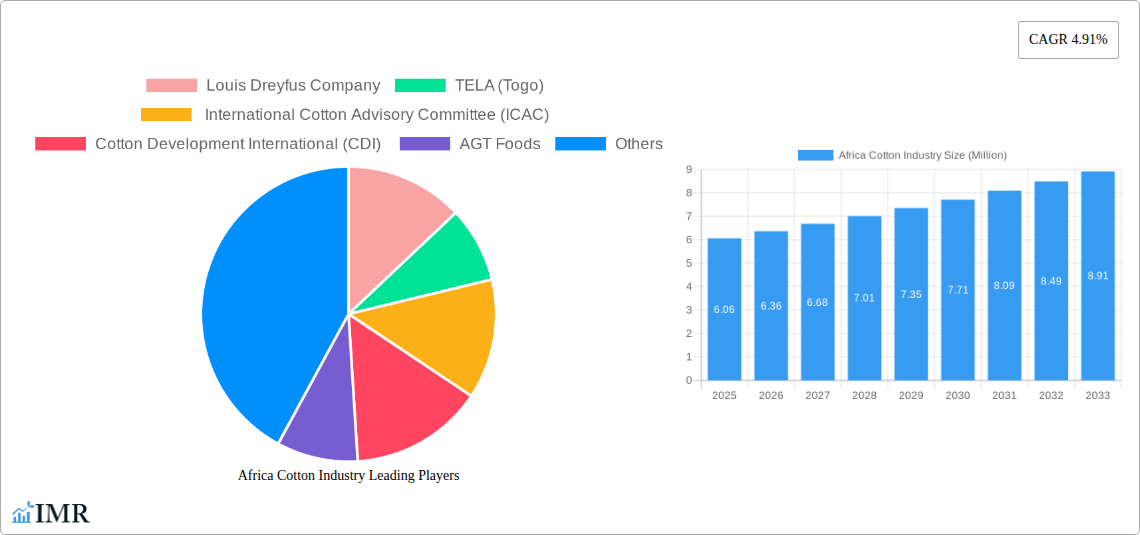

The African cotton industry is poised for significant growth, projected to reach a market size of approximately USD 6.06 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.91% anticipated over the forecast period of 2025-2033. This expansion is fueled by several key drivers, including increasing global demand for cotton in the textile and apparel sectors, favorable government policies supporting agricultural output in major producing nations, and advancements in farming techniques leading to improved yields and quality. Emerging trends such as the growing emphasis on sustainable and organic cotton production, driven by consumer awareness and regulatory pressures, are also shaping the market. Furthermore, investments in modernizing ginning facilities and improving supply chain efficiencies are contributing to a more competitive African cotton landscape.

Africa Cotton Industry Market Size (In Million)

Despite the promising outlook, the industry faces certain restraints that could temper its full potential. These include challenges related to infrastructure deficits, particularly in transportation and storage, which can lead to higher logistical costs and post-harvest losses. Price volatility in the global cotton market, influenced by factors like weather patterns, geopolitical events, and speculative trading, presents another significant hurdle for producers and exporters. Limited access to financing and advanced agricultural technologies for smallholder farmers, who form the backbone of cotton production in many African countries, also poses a constraint. Nonetheless, the collective efforts of key industry players, international organizations, and regional governments to address these challenges through strategic initiatives and capacity building are expected to mitigate these restraints and steer the market towards sustained prosperity.

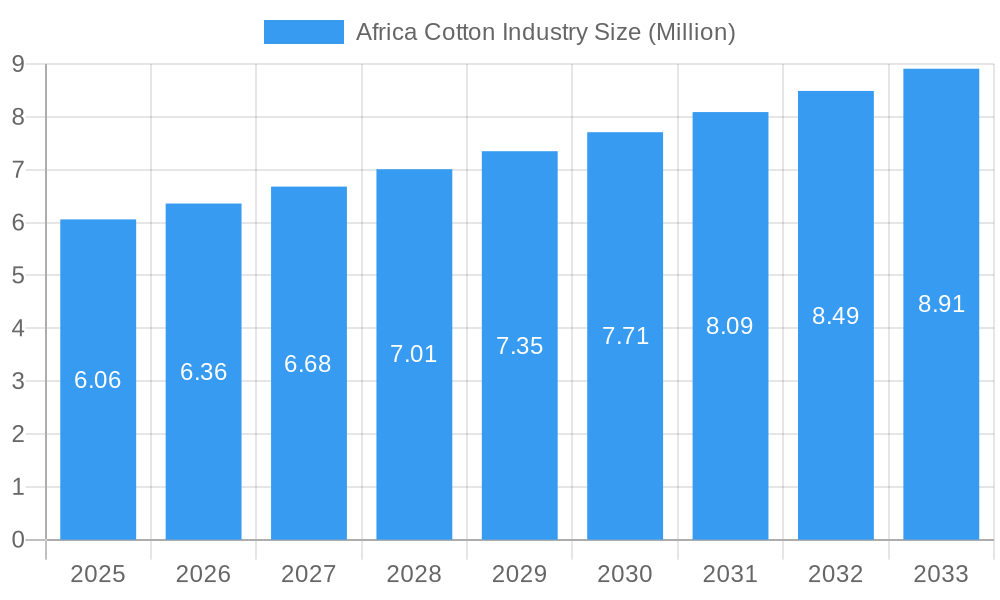

Africa Cotton Industry Company Market Share

This comprehensive report delves into the dynamic Africa Cotton Industry, providing an in-depth analysis of market size, growth drivers, regional dominance, and competitive landscapes. Covering the period from 2019 to 2033, with a base year of 2025, this report offers critical insights for industry stakeholders, investors, and policymakers. We explore key segments including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis, all presented with values in million units. Discover the impact of sustainability initiatives, strategic partnerships, and emerging opportunities that are shaping the future of African cotton.

Africa Cotton Industry Market Dynamics & Structure

The Africa Cotton Industry is characterized by a moderately concentrated market, with major global players like Louis Dreyfus Company, Cargill, and Archer Daniels Midland Company (ADM) holding significant influence in raw material sourcing and trading. Technological innovation is primarily driven by advancements in agricultural practices, improved seed varieties, and the increasing adoption of digital tools for farm management and traceability. Regulatory frameworks, particularly those promoting sustainable and ethical cotton production, are gaining prominence, influencing both production and trade. Competitive product substitutes, such as synthetic fibers, present a constant challenge, necessitating a focus on the superior quality and unique selling propositions of natural cotton. End-user demographics are shifting towards a greater demand for sustainably sourced and traceable textiles, driven by increased consumer awareness and brand initiatives. Mergers and acquisitions (M&A) trends are observed, with larger entities consolidating their market positions and expanding their reach across the African continent.

- Market Concentration: Dominated by a few large multinational corporations in trading and processing, with a fragmented farmer base.

- Technological Innovation: Focus on precision agriculture, pest-resistant seeds, and digital farming solutions.

- Regulatory Frameworks: Increasing emphasis on sustainability standards (e.g., Better Cotton Initiative, Cotton made in Africa) and fair trade practices.

- Competitive Substitutes: Synthetic fibers (polyester, nylon) and recycled materials pose ongoing competition.

- End-User Demographics: Growing demand for ethically produced, traceable, and organic cotton.

- M&A Trends: Consolidation among processing units and trading houses to achieve economies of scale.

Africa Cotton Industry Growth Trends & Insights

The Africa Cotton Industry is poised for significant growth, projected to witness a robust Compound Annual Growth Rate (CAGR) driven by increasing global demand for textiles, the growing focus on sustainable and ethical sourcing, and supportive government policies across various African nations. The market size evolution will be marked by steady expansion in production volumes and value, fueled by improved agricultural yields and increased cultivation areas. Adoption rates of new technologies and sustainable farming practices are expected to accelerate, enhancing both productivity and profitability for cotton farmers. Technological disruptions, such as advancements in ginning machinery and supply chain digitization, will streamline operations and reduce post-harvest losses. Consumer behavior shifts towards conscious purchasing, prioritizing products with traceable origins and minimal environmental impact, will further bolster the demand for African cotton, particularly varieties certified under sustainability programs. The market penetration of premium, sustainably grown cotton is anticipated to rise as apparel brands increasingly commit to responsible sourcing.

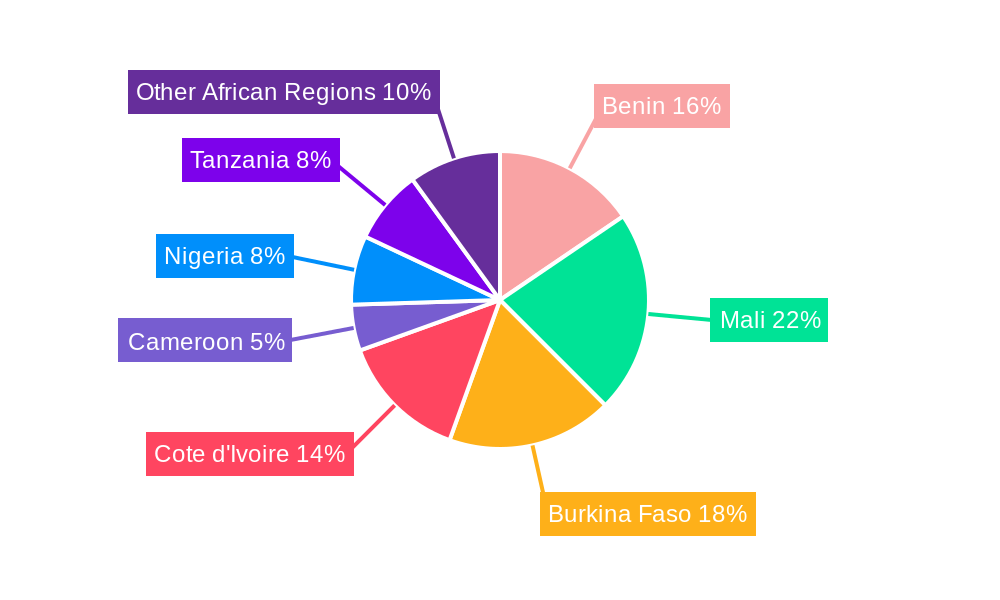

Dominant Regions, Countries, or Segments in Africa Cotton Industry

The Export Market Analysis (Value & Volume) segment is a dominant driver of growth within the Africa Cotton Industry. West African nations, particularly Cote d'Ivoire, Benin, and Burkina Faso, consistently rank as leading cotton exporters, leveraging their favorable climate, fertile land, and established agricultural infrastructure. These countries benefit from a strong presence of international trading houses and a long history of cotton cultivation, allowing them to meet global demand efficiently. The Import Market Analysis (Value & Volume) also plays a crucial role, as African cotton is vital for textile manufacturing hubs both within and outside the continent.

Leading Export Region: West Africa (specifically Cote d'Ivoire, Benin, Burkina Faso)

- Key Drivers: Favorable agro-climatic conditions, established export infrastructure, government support for cotton production, and strong presence of international buyers.

- Market Share: These countries collectively account for a significant portion of Africa's total cotton exports, demonstrating consistent performance in global markets.

- Growth Potential: Continued investment in irrigation, improved seed varieties, and value-added processing can further enhance export volumes and revenues.

Dominant Export Segment: Raw Cotton Lint

- Analysis: The primary export commodity is raw cotton lint, which is then processed into yarn and fabric in importing countries. Value-added processing within Africa remains a key area for future growth and increased revenue.

Emerging Import Demand: Growing demand from emerging textile manufacturing nations in Asia and North Africa, seeking competitively priced and sustainably sourced raw materials.

Africa Cotton Industry Product Landscape

The Africa Cotton Industry primarily deals with the production and export of raw cotton lint, serving as a crucial feedstock for the global textile industry. Product innovation is largely focused on improving the quality and sustainability of the lint produced. Advancements in seed technology contribute to higher yields, better fiber strength, and increased resistance to pests and diseases. Furthermore, there is a growing emphasis on producing certified organic and sustainably grown cotton, meeting the evolving demands of environmentally conscious apparel brands and consumers. Performance metrics revolve around staple length, micronaire, and strength, all of which are critical for spinning into high-quality yarn and fabrics.

Key Drivers, Barriers & Challenges in Africa Cotton Industry

Key Drivers: The Africa Cotton Industry is propelled by a confluence of technological advancements in agriculture, favorable global demand for natural fibers, and increasing government support for the sector. The growing consumer preference for sustainable and ethically produced textiles is a significant market pull. Initiatives like the Cotton made in Africa (CmiA) program are fostering responsible production practices and enhancing market access. Economic diversification efforts in many African nations also highlight cotton as a key agricultural export commodity.

Barriers & Challenges: Significant challenges include climate change impacts, leading to unpredictable weather patterns and reduced yields. Inadequate infrastructure, particularly in rural areas, hampers efficient transportation and increases logistical costs. Price volatility in the global commodity market poses a risk to farmer incomes. Limited access to finance, modern farming technologies, and extension services among smallholder farmers also restricts productivity. Furthermore, the presence of synthetic fiber substitutes and the need for greater investment in local value-added processing capacity present ongoing hurdles.

Emerging Opportunities in Africa Cotton Industry

Emerging opportunities lie in expanding value-added processing within Africa, transforming raw cotton into yarn, fabric, and finished textile products. This would create local employment and increase revenue streams. The growing global demand for organic and sustainably certified cotton presents a significant niche for African producers to capitalize on. Furthermore, leveraging digital technologies for supply chain traceability and transparency can attract premium pricing and build greater trust with international buyers. The development of innovative applications for cotton by-products, such as cottonseed oil and linters, also offers new avenues for market expansion.

Growth Accelerators in the Africa Cotton Industry Industry

Growth in the Africa Cotton Industry will be accelerated by strategic investments in research and development for high-yield, climate-resilient cotton varieties. Enhanced public-private partnerships to improve agricultural infrastructure, including irrigation systems and rural road networks, will be crucial. The expansion of certification schemes that guarantee sustainable and ethical production practices will open doors to new markets and attract socially responsible brands. Furthermore, fostering local textile manufacturing capabilities through skills development programs and access to modern technology will create a more integrated and robust industry ecosystem.

Key Players Shaping the Africa Cotton Industry Market

- Louis Dreyfus Company

- TELA (Togo)

- International Cotton Advisory Committee (ICAC)

- Cotton Development International (CDI)

- AGT Foods

- SIAT (Cote d'Ivoire)

- Bunge Limited

- GIZ

- Cargill

- Archer Daniels Midland Company (ADM)

Notable Milestones in Africa Cotton Industry Sector

- October 2022: The Cotton made in Africa (CmiA) program received official recognition by the German Green Button standard as a sustainable natural fiber and was accredited by Cradle to Cradle Certified. This is expected to boost CmiA uptake volumes through demand from program partners and apparel brands.

- January 2022: Polish clothing company LPP partnered with Cotton made in Africa (CmiA), contracting the purchase of CmiA-compliant cotton for the production of up to 60 million products.

- April 2021: France pledged to invest 68.5 million euros (USD 83.04 million) over five years to boost sustainable cotton production in Ivory Coast, targeting 120,000 cotton farmers and aiming to increase revenue in the sector.

In-Depth Africa Cotton Industry Market Outlook

The Africa Cotton Industry is on a strong growth trajectory, driven by increasing global demand for sustainable textiles and supportive policy environments. Key growth accelerators include the expanding adoption of CmiA certified cotton, evidenced by major brand partnerships, and significant foreign investment in enhancing sustainable production, as seen with France's commitment to Ivory Coast. The industry's outlook is positive, with opportunities for increased market penetration of premium cotton varieties and the development of local value chains. Strategic focus on technological adoption, infrastructure development, and continued commitment to ethical and sustainable practices will be pivotal in unlocking the full potential of Africa's cotton sector in the coming years.

Africa Cotton Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Cotton Industry Segmentation By Geography

- 1. Benin

- 2. Mali

- 3. Burkina Faso

- 4. C

- 5. Cameroon

- 6. Nigeria

- 7. Tanzania

Africa Cotton Industry Regional Market Share

Geographic Coverage of Africa Cotton Industry

Africa Cotton Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Climatic Conditions; Blooming Export Opportunities

- 3.3. Market Restrains

- 3.3.1. High Adoption Cost of Modern Technology; Increasing Insect Infestations

- 3.4. Market Trends

- 3.4.1. Increasing Demand for African Cotton in Textile Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Benin

- 5.6.2. Mali

- 5.6.3. Burkina Faso

- 5.6.4. C

- 5.6.5. Cameroon

- 5.6.6. Nigeria

- 5.6.7. Tanzania

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Benin Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Mali Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Burkina Faso Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. C Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Cameroon Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Nigeria Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 11.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 11.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 11.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 11.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12. Tanzania Africa Cotton Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Production Analysis

- 12.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 12.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 12.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 12.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 12.1. Market Analysis, Insights and Forecast - by Production Analysis

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Louis Dreyfus Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 TELA (Togo)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 International Cotton Advisory Committee (ICAC)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cotton Development International (CDI)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 AGT Foods

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 SIAT (Cote d'Ivoire)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bunge Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 GIZ

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cargill

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Archer Daniels Midland Company (ADM)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Louis Dreyfus Company

List of Figures

- Figure 1: Africa Cotton Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Cotton Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Africa Cotton Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Africa Cotton Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 27: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 29: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 33: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 34: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 35: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 38: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 39: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 40: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 41: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 42: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 47: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 50: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 51: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 52: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 53: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 54: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 57: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 58: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 59: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 61: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 62: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 63: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 64: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 65: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 66: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 67: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 68: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 69: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 70: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 71: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 73: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 74: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 75: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 76: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 77: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 78: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 79: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 80: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 81: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 82: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 83: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 85: Africa Cotton Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 86: Africa Cotton Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 87: Africa Cotton Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 88: Africa Cotton Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 89: Africa Cotton Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 90: Africa Cotton Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 91: Africa Cotton Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 92: Africa Cotton Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 93: Africa Cotton Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 94: Africa Cotton Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 95: Africa Cotton Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 96: Africa Cotton Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Cotton Industry?

The projected CAGR is approximately 4.91%.

2. Which companies are prominent players in the Africa Cotton Industry?

Key companies in the market include Louis Dreyfus Company, TELA (Togo) , International Cotton Advisory Committee (ICAC) , Cotton Development International (CDI) , AGT Foods, SIAT (Cote d'Ivoire) , Bunge Limited , GIZ , Cargill , Archer Daniels Midland Company (ADM) .

3. What are the main segments of the Africa Cotton Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Climatic Conditions; Blooming Export Opportunities.

6. What are the notable trends driving market growth?

Increasing Demand for African Cotton in Textile Industry.

7. Are there any restraints impacting market growth?

High Adoption Cost of Modern Technology; Increasing Insect Infestations.

8. Can you provide examples of recent developments in the market?

October 2022: The Cotton made in Africa (CmiA) program run by the Aid by Trade Foundation received official recognition by the German Green Button standard as a sustainable natural fiber,' and was confirmed as an accredited source of raw materials by Cradle to Cradle Certified. It is likely to further boost CmiA uptake volumes through demand from existing and new program partners and apparel brands and retailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Cotton Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Cotton Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Cotton Industry?

To stay informed about further developments, trends, and reports in the Africa Cotton Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence