Key Insights

The Asia-Pacific agricultural enzymes market is projected for substantial growth, driven by increasing demand for sustainable and efficient farming. With a current market size of 2998.2 million, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 7.7% from the base year 2024. This expansion is propelled by the necessity to boost crop yields and quality amidst a growing global population and limited arable land. Furthermore, agricultural enzymes are recognized as environmentally friendly alternatives to traditional chemical fertilizers and pesticides, aligning with governmental sustainability initiatives and consumer preferences. Technological advancements in enzyme production are also enhancing cost-effectiveness and enabling targeted formulations, accelerating market penetration. The adoption of precision agriculture techniques further supports the integration of enzymatic solutions for optimized nutrient uptake and crop disease management.

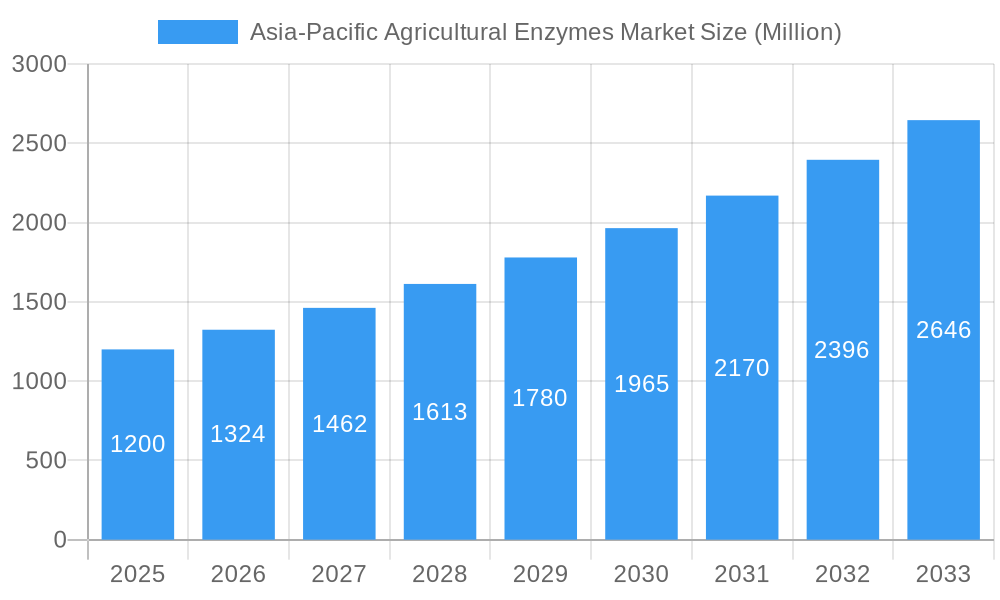

Asia-Pacific Agricultural Enzymes Market Market Size (In Billion)

Market evolution is influenced by trends such as the development of novel enzyme cocktails for specific crops and conditions, and the growing emphasis on bio-fertilizers and bio-pesticides within integrated pest management (IPM) strategies. While growth catalysts are strong, challenges include the initial cost of some enzyme-based products, the need for farmer education on their benefits and application, and regional regulatory hurdles for new enzymatic formulations. Despite these factors, the Asia-Pacific region's vast agricultural landscape presents significant opportunities. Key market segments, including production, consumption, import/export analysis, and price trends, are expected to exhibit considerable activity, reflecting expanding adoption and innovation. The presence of established global and emerging regional players indicates a competitive yet growing ecosystem focused on delivering advanced enzyme solutions to the agricultural sector.

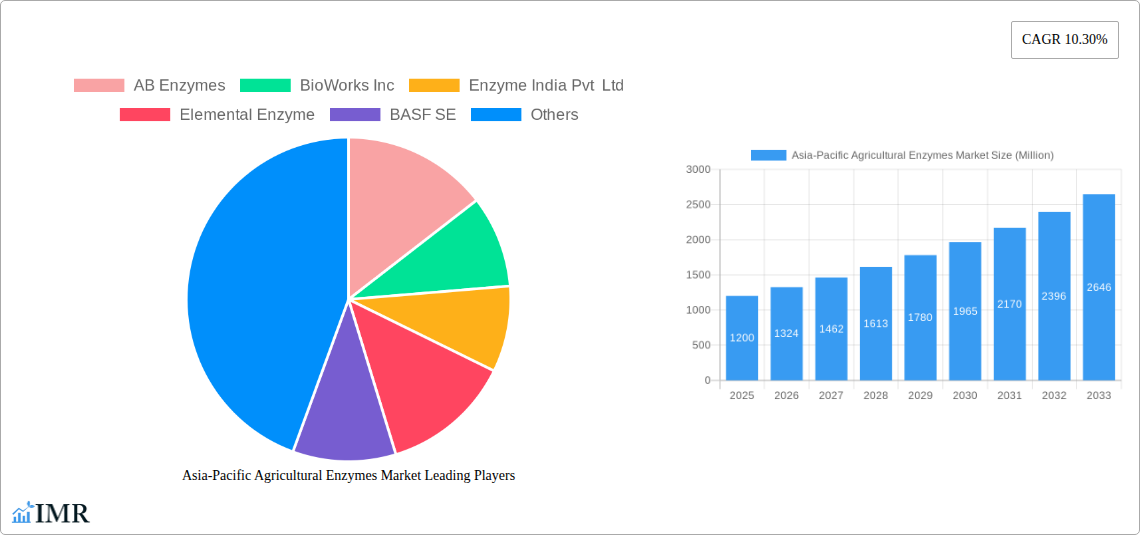

Asia-Pacific Agricultural Enzymes Market Company Market Share

This comprehensive report provides an in-depth analysis of the Asia-Pacific Agricultural Enzymes Market, exploring its dynamics, growth trajectories, and future outlook. Covering production, consumption, trade, and price trends, this research is an essential resource for stakeholders seeking to understand and capitalize on the burgeoning demand for advanced agricultural solutions in the region.

Asia-Pacific Agricultural Enzymes Market Market Dynamics & Structure

The Asia-Pacific agricultural enzymes market is characterized by a moderately concentrated landscape, with key players actively investing in research and development to introduce novel enzyme formulations. Technological innovation serves as a primary growth driver, with a focus on developing enzymes that enhance nutrient uptake, improve crop yields, and reduce reliance on synthetic fertilizers and pesticides. Regulatory frameworks, while evolving, are becoming more supportive of bio-based agricultural inputs, encouraging market expansion. Competitive product substitutes, primarily conventional agrochemicals, are gradually being displaced by the superior efficacy and environmental benefits of agricultural enzymes. End-user demographics are shifting towards a growing segment of environmentally conscious farmers and large-scale agricultural enterprises prioritizing sustainable practices and yield optimization. Mergers and acquisitions (M&A) trends, though currently moderate, are anticipated to increase as companies seek to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by a few key multinational corporations and a growing number of regional specialists.

- Technological Innovation Drivers: Development of highly specific enzymes for nutrient solubilization, plant growth promotion, and stress tolerance.

- Regulatory Frameworks: Increasing government support for bio-stimulants and eco-friendly agricultural inputs across countries like China and India.

- Competitive Product Substitutes: Conventional fertilizers and pesticides pose a challenge, but enzyme efficacy in nutrient utilization and soil health is a key differentiator.

- End-User Demographics: Growing adoption by precision agriculture practitioners and organic farming enthusiasts.

- M&A Trends: Anticipated increase in strategic alliances and acquisitions to gain market share and technological expertise.

Asia-Pacific Agricultural Enzymes Market Growth Trends & Insights

The Asia-Pacific agricultural enzymes market is poised for significant growth, driven by an increasing understanding of their benefits in enhancing crop productivity and promoting sustainable agriculture. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 9.5% between 2025 and 2033, reaching an estimated value of $1,850 million units in 2033, up from an estimated $875 million units in 2025. Adoption rates are accelerating as farmers, particularly in developing economies within the region, recognize the potential of enzymes to improve soil health, boost nutrient availability, and reduce crop stress. Technological disruptions, such as the development of enzyme cocktails tailored to specific crop types and soil conditions, are further fueling market penetration. Consumer behavior shifts towards organic and sustainably produced food are indirectly stimulating demand for agricultural enzymes. The increasing focus on food security in the densely populated Asia-Pacific region also acts as a strong impetus for adopting advanced agricultural practices that maximize yield, where enzymes play a crucial role. The market penetration for agricultural enzymes, while still relatively nascent in some sub-regions, is steadily increasing, indicating a strong future growth trajectory.

Dominant Regions, Countries, or Segments in Asia-Pacific Agricultural Enzymes Market

Within the Asia-Pacific agricultural enzymes market, China stands out as the dominant country, driven by its massive agricultural sector and increasing government initiatives promoting sustainable farming practices. Its leadership is evident across all analyzed segments:

- Production Analysis: China possesses a robust and expanding manufacturing base for agricultural enzymes, supported by strong government investment in biotechnology and agricultural research. Production capacity is estimated to reach 550 million units by 2025.

- Consumption Analysis: The sheer size of China's agricultural land and the growing adoption of advanced farming techniques make it the largest consumer of agricultural enzymes. Consumption is projected to reach 480 million units by 2025, with a significant portion attributed to the cereal crops segment.

- Import Market Analysis (Value & Volume): While a significant producer, China also imports specialized enzyme formulations to supplement its domestic production and access cutting-edge technologies. Import value is estimated at $220 million units, with a volume of 70 million units in 2025.

- Export Market Analysis (Value & Volume): China is increasingly becoming a significant exporter of agricultural enzymes, leveraging its cost-effective production capabilities. Export value is anticipated to be $180 million units, with a volume of 65 million units in 2025.

- Price Trend Analysis: Prices for agricultural enzymes in China are moderately competitive, influenced by domestic production volumes and the availability of both imported and locally manufactured products. Average prices are estimated to be around $3.14 per unit in 2025.

Beyond China, India is emerging as another significant growth engine, characterized by its large agricultural workforce and a rising focus on improving crop yields and soil fertility. Government policies supporting agricultural innovation and a growing awareness of the benefits of bio-fertilizers and bio-stimulants are contributing to India's market expansion. Other countries like Japan and South Korea are also contributing, particularly in the adoption of high-value, specialized enzyme applications in horticulture and advanced farming systems. The cereal crops segment and the plant growth regulators application segment are anticipated to be the leading segments in terms of volume and value respectively.

Asia-Pacific Agricultural Enzymes Market Product Landscape

The product landscape of the Asia-Pacific agricultural enzymes market is dynamic, characterized by continuous innovation in enzyme formulation and application. Key product categories include cellulases, amylases, proteases, lipases, and phytases, each offering distinct benefits for crop enhancement. These enzymes are increasingly being developed as customized blends, targeting specific soil deficiencies, crop types, and environmental stresses. For instance, phytase enzymes are crucial for improving phosphorus availability in soils, while cellulases aid in breaking down organic matter to release essential nutrients. Unique selling propositions often lie in the development of highly stable enzyme formulations with extended shelf lives and improved efficacy in diverse environmental conditions. Technological advancements are focused on improving enzyme production through advanced fermentation techniques and genetic engineering, leading to more potent and cost-effective solutions for the agricultural sector.

Key Drivers, Barriers & Challenges in Asia-Pacific Agricultural Enzymes Market

Key Drivers:

- Growing Demand for Sustainable Agriculture: Increasing awareness of environmental concerns and the need for eco-friendly farming practices.

- Enhancement of Crop Yield and Quality: Enzymes improve nutrient uptake, leading to better crop growth and higher yields.

- Government Support and Initiatives: Favorable policies and subsidies promoting the use of bio-based agricultural inputs.

- Technological Advancements: Development of novel enzymes and efficient production methods.

- Increasing Awareness of Soil Health: Recognition of enzymes' role in improving soil fertility and structure.

Barriers & Challenges:

- High Initial Cost of Enzymes: Compared to conventional fertilizers, enzymes can have a higher upfront investment.

- Limited Awareness and Education: Lack of knowledge among some farmers about the benefits and proper application of agricultural enzymes.

- Regulatory Hurdles: Inconsistent regulatory frameworks across different countries in the region can slow down market entry and adoption.

- Supply Chain and Distribution Challenges: Establishing efficient and widespread distribution networks for specialized bio-inputs.

- Competition from Conventional Agrochemicals: Established market presence and familiarity of traditional fertilizers and pesticides.

Emerging Opportunities in the Asia-Pacific Agricultural Enzymes Market

Emerging opportunities within the Asia-Pacific agricultural enzymes market lie in the development of enzyme-based solutions for climate change adaptation, such as enzymes that enhance drought or salinity tolerance in crops. The untapped potential in smallholder farming communities, particularly in Southeast Asia, presents a significant opportunity for developing cost-effective and easy-to-use enzyme products. Furthermore, the growing trend of vertical farming and controlled environment agriculture offers a niche for highly specialized enzyme formulations designed for precise nutrient delivery. The integration of enzymes with digital farming platforms for precision application based on real-time soil data also represents a promising avenue for market expansion.

Growth Accelerators in the Asia-Pacific Agricultural Enzymes Market Industry

Long-term growth in the Asia-Pacific agricultural enzymes market will be significantly accelerated by continued breakthroughs in enzyme discovery and engineering, leading to more potent and versatile products. Strategic partnerships between enzyme manufacturers and agrochemical companies, as well as with agricultural research institutions, will foster innovation and market penetration. Market expansion strategies targeting under-served regions and crop segments, coupled with effective farmer education and extension programs, will also be crucial catalysts. The increasing investment in R&D by major players, focused on developing sustainable and highly effective enzyme solutions, will further propel the industry forward.

Key Players Shaping the Asia-Pacific Agricultural Enzymes Market Market

- AB Enzymes

- BioWorks Inc

- Enzyme India Pvt Ltd

- Elemental Enzyme

- BASF SE

- Syngenta AG

- Novozymes A/S

- Agrilife

Notable Milestones in Asia-Pacific Agricultural Enzymes Market Sector

- 2023: Novozymes launches a new generation of microbial inoculants and enzyme blends for enhanced nutrient efficiency.

- 2023: BASF introduces an innovative enzyme-based biostimulant for improved crop resilience in challenging climates.

- 2022: Syngenta AG expands its portfolio of biological solutions, including enzyme-enhanced products, in the Southeast Asian market.

- 2022: AB Enzymes invests in expanding its production capacity for agricultural enzymes to meet rising regional demand.

- 2021: China's agricultural ministry announces new guidelines promoting the use of bio-fertilizers and bio-stimulants.

- 2021: Agrilife secures funding for further research and development of novel enzyme applications in agriculture.

In-Depth Asia-Pacific Agricultural Enzymes Market Market Outlook

The future outlook for the Asia-Pacific agricultural enzymes market is exceptionally bright, driven by a confluence of favorable factors including increasing global food demand, a strong push for sustainable agriculture, and continuous technological advancements. Growth accelerators such as the development of customized enzyme cocktails for specific soil and crop needs, coupled with strategic collaborations and market expansion initiatives into emerging economies within the region, will define the market's trajectory. The increasing adoption of precision agriculture technologies and a growing consumer preference for organic and residue-free produce will further bolster demand. Strategic investments in research and development, alongside supportive government policies, will solidify the position of agricultural enzymes as indispensable tools for modern, efficient, and environmentally responsible farming in Asia-Pacific.

Asia-Pacific Agricultural Enzymes Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Agricultural Enzymes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

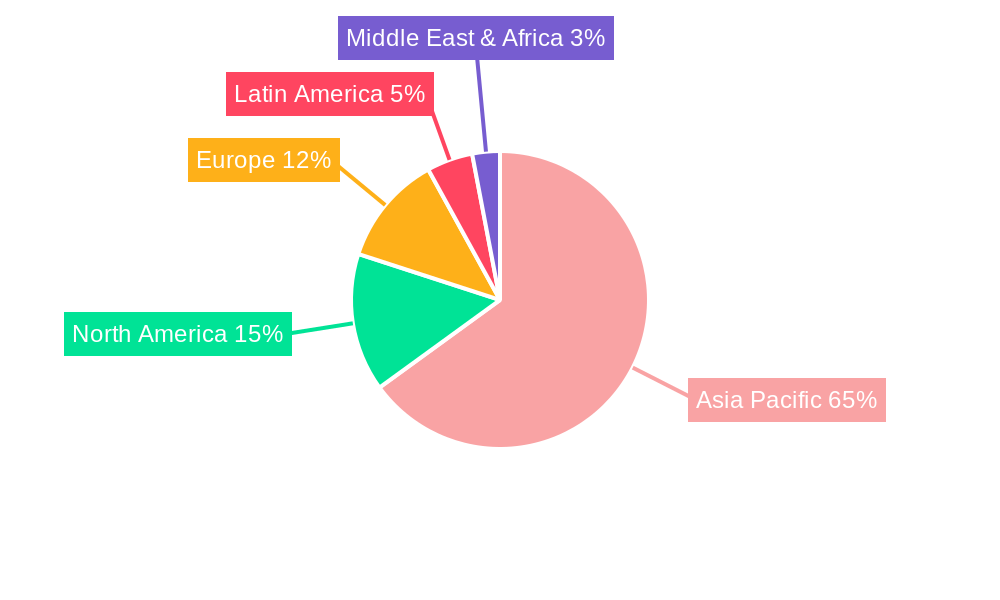

Asia-Pacific Agricultural Enzymes Market Regional Market Share

Geographic Coverage of Asia-Pacific Agricultural Enzymes Market

Asia-Pacific Agricultural Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Rising Trend of Organic Farming Practices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Agricultural Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Enzymes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BioWorks Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enzyme India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Elemental Enzyme

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novozymes A/S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agrilife

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 AB Enzymes

List of Figures

- Figure 1: Asia-Pacific Agricultural Enzymes Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Agricultural Enzymes Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Agricultural Enzymes Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Agricultural Enzymes Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Agricultural Enzymes Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia-Pacific Agricultural Enzymes Market?

Key companies in the market include AB Enzymes, BioWorks Inc, Enzyme India Pvt Ltd, Elemental Enzyme, BASF SE, Syngenta AG, Novozymes A/S, Agrilife.

3. What are the main segments of the Asia-Pacific Agricultural Enzymes Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2998.2 million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Rising Trend of Organic Farming Practices.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Agricultural Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Agricultural Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Agricultural Enzymes Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Agricultural Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence