Key Insights

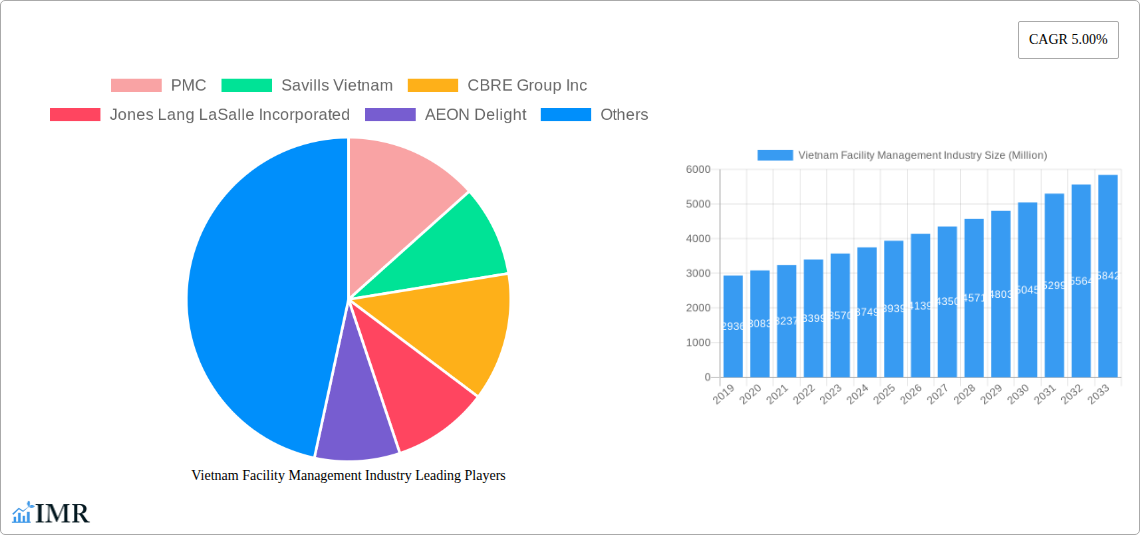

The Vietnam Facility Management (FM) industry is poised for substantial growth, projected to reach a market size of approximately USD 3,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.00% expected to continue through 2033. This expansion is primarily driven by the burgeoning real estate sector, increasing foreign direct investment (FDI) in commercial and industrial properties, and a growing awareness among businesses about the importance of efficient building operations for cost savings and employee productivity. The demand for integrated FM services, which encompass both hard and soft services, is on the rise as organizations seek a single point of contact for all their facility needs. Furthermore, the government's focus on developing smart cities and sustainable infrastructure is creating new opportunities for advanced FM solutions.

Vietnam Facility Management Industry Market Size (In Billion)

The market is witnessing a significant shift towards outsourced FM services, with businesses increasingly recognizing the benefits of specialized expertise and cost-efficiency compared to in-house management. While in-house facility management still holds a considerable share, the bundled and integrated FM segments are experiencing accelerated growth. Key offerings within the industry include Hard FM (maintenance of physical assets like HVAC, plumbing, and electrical systems) and Soft FM (services like cleaning, security, catering, and landscaping). The commercial and industrial sectors are the dominant end-users, fueled by the expansion of manufacturing hubs, office complexes, and retail spaces. The institutional and public/infrastructure segments are also showing promising growth, driven by government investments in public facilities and educational institutions. Leading players such as CBRE Group Inc., Jones Lang LaSalle Incorporated, and Sodexo Inc. are actively expanding their presence and service portfolios within Vietnam, indicating a competitive yet opportunity-rich landscape.

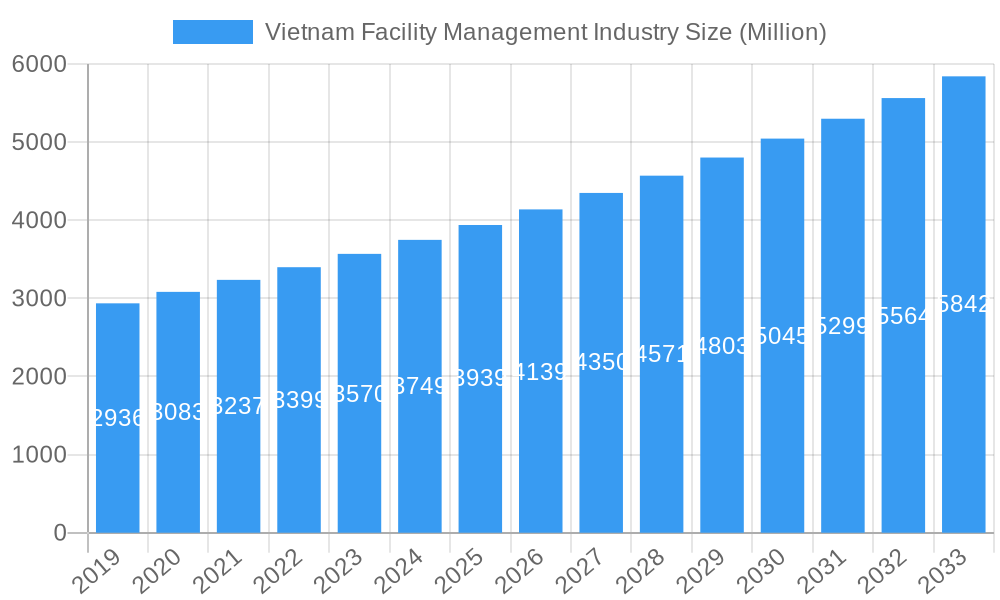

Vietnam Facility Management Industry Company Market Share

Vietnam Facility Management Industry Market Outlook 2024-2033: Unlocking Growth in a Dynamic Asian Hub

This comprehensive report provides an in-depth analysis of the Vietnam Facility Management (FM) industry, offering critical insights into market dynamics, growth trends, competitive landscapes, and future opportunities. Designed for industry professionals, investors, and strategic planners, this report leverages high-traffic keywords and detailed market segmentation to deliver actionable intelligence. Covering the period from 2019–2033, with a base year of 2025, it meticulously examines the evolution of the FM sector across Vietnam.

Vietnam Facility Management Industry Market Dynamics & Structure

The Vietnam Facility Management industry is characterized by a dynamic market structure with a growing trend towards outsourcing. While in-house FM remains a significant component, particularly within larger enterprises, the market is increasingly dominated by outsourced models, including single, bundled, and integrated FM services. Technological innovation is a key driver, with advancements in Building Information Modeling (BIM), IoT for predictive maintenance, and smart building technologies transforming service delivery. Regulatory frameworks are evolving to support professionalization and standardization within the FM sector, although some barriers to entry and innovation persist. Competitive product substitutes are emerging, particularly in specialized areas like energy management and green FM solutions. End-user demographics are diverse, with significant contributions from the commercial, industrial, and institutional sectors, each with unique FM requirements. Mergers and acquisitions (M&A) are becoming more prevalent as larger players consolidate their market presence and smaller firms seek strategic partnerships for growth and expertise.

- Market Concentration: Growing consolidation, with a few key players emerging across bundled and integrated FM.

- Technological Innovation Drivers: IoT, AI for predictive maintenance, energy management software, and smart building solutions.

- Regulatory Frameworks: Increasing focus on safety standards, environmental compliance, and professional FM certifications.

- Competitive Product Substitutes: Rise of niche service providers in specialized areas like cybersecurity for building systems and advanced waste management.

- End-User Demographics: Strong demand from commercial real estate, industrial parks, and healthcare/educational institutions.

- M&A Trends: Increasing strategic acquisitions by multinational FM providers seeking to expand their footprint in Vietnam.

Vietnam Facility Management Industry Growth Trends & Insights

The Vietnam Facility Management industry is poised for substantial growth, driven by rapid economic development, increasing foreign direct investment, and a growing demand for professional building management services. The market size is projected to expand at a significant Compound Annual Growth Rate (CAGR) throughout the forecast period, reflecting the increasing adoption of outsourced FM solutions. Technological disruptions, such as the integration of AI for data-driven insights and the widespread implementation of IoT sensors for real-time monitoring, are revolutionizing service delivery efficiency and cost-effectiveness. Consumer behavior shifts are evident, with businesses and organizations prioritizing occupant well-being, sustainability, and operational resilience, leading to a greater appreciation for comprehensive FM strategies. Market penetration of integrated FM services is expected to accelerate as clients seek single points of contact for a holistic approach to building management. The increasing complexity of modern buildings and the growing need for specialized expertise are further fueling the adoption of professional FM services.

- Market Size Evolution: Projected significant market growth, driven by infrastructure development and corporate expansion.

- Adoption Rates: Steadily increasing adoption of outsourced FM, especially among SMEs and multinational corporations.

- Technological Disruptions: Integration of digital twins, predictive analytics, and smart energy management systems.

- Consumer Behavior Shifts: Emphasis on occupant comfort, health, safety, and sustainable building operations.

- CAGR: Predicted robust CAGR of xx% over the forecast period.

- Market Penetration: Growing penetration of bundled and integrated FM services.

Dominant Regions, Countries, or Segments in Vietnam Facility Management Industry

The Commercial sector emerges as the dominant end-user segment within the Vietnam Facility Management industry, driven by the nation's burgeoning real estate market, burgeoning office spaces, and a robust retail sector. Major economic hubs like Ho Chi Minh City and Hanoi are at the forefront, attracting significant investment in commercial properties that necessitate sophisticated FM solutions. Outsourced Facility Management, particularly bundled and integrated FM, is the fastest-growing type of FM, as businesses increasingly prefer to delegate complex operational responsibilities to specialized providers. This allows them to focus on their core competencies while benefiting from expert management of their facilities. Hard FM services, encompassing technical maintenance such as HVAC, electrical systems, and plumbing, are in high demand due to the increasing complexity of modern infrastructure. However, the growth in Soft FM services, including cleaning, security, and landscaping, is also substantial, reflecting a holistic approach to building management that prioritizes occupant experience and operational efficiency. The Public/Infrastructure segment, encompassing transportation hubs, government buildings, and utilities, also presents a considerable market share, with a growing emphasis on modernizing and efficiently managing public assets.

- Dominant End-User: Commercial sector, driven by office buildings, retail spaces, and mixed-use developments.

- Leading FM Type: Outsourced Facility Management, with a strong preference for Bundled and Integrated FM.

- Key Offerings: High demand for Hard FM (technical maintenance) and growing importance of Soft FM (support services).

- Geographic Dominance: Ho Chi Minh City and Hanoi metropolitan areas, spearheading FM adoption.

- Growth Drivers: Economic growth, FDI inflows, urbanization, and demand for sustainable building practices.

- Market Share Potential: The commercial segment is estimated to hold xx% of the market share in 2025.

Vietnam Facility Management Industry Product Landscape

The Vietnam Facility Management industry product landscape is evolving rapidly, with a strong emphasis on technology-enabled solutions and integrated service platforms. Innovations in hard FM include advanced building management systems (BMS) that optimize energy consumption and predictive maintenance through IoT sensors, reducing downtime and operational costs. In soft FM, there's a growing adoption of AI-powered cleaning robots, sophisticated security systems with facial recognition, and digital platforms for streamlined request management and service delivery tracking. Unique selling propositions often revolve around enhanced operational efficiency, cost savings, and improved occupant experience. Technological advancements are enabling FM providers to offer data-driven insights into building performance, allowing for proactive problem-solving and strategic resource allocation.

Key Drivers, Barriers & Challenges in Vietnam Facility Management Industry

Key Drivers:

- Economic Growth & FDI: Vietnam's robust economic expansion and increasing foreign investment are driving demand for modern, well-maintained facilities.

- Urbanization: Rapid urbanization necessitates efficient management of growing urban infrastructure and commercial spaces.

- Technological Advancements: IoT, AI, and smart building solutions are enabling more efficient and cost-effective FM services.

- Focus on Sustainability: Growing corporate and government mandates for green building practices and energy efficiency.

Barriers & Challenges:

- Skilled Labor Shortage: A persistent challenge in finding and retaining qualified FM professionals.

- Price Sensitivity: Clients can be price-sensitive, sometimes prioritizing cost over comprehensive service quality.

- Regulatory Gaps: Inconsistent or underdeveloped regulatory frameworks in certain areas of FM.

- Fragmented Market: A highly fragmented market with numerous small players can lead to inconsistent service standards.

- Supply Chain Disruptions: Global and local supply chain issues can impact the availability of parts for maintenance and upgrades.

Emerging Opportunities in Vietnam Facility Management Industry

Emerging opportunities in the Vietnam Facility Management industry lie in the growing demand for sustainable and smart building solutions. The increasing focus on green initiatives presents a significant avenue for FM providers to offer energy efficiency audits, waste management optimization, and the integration of renewable energy sources. The industrial sector, particularly in manufacturing and logistics, is a fertile ground for specialized FM services, including the maintenance of complex machinery and supply chain support. Furthermore, the development of smart cities and advanced infrastructure projects creates a need for integrated FM solutions that encompass smart technology management, public safety, and efficient resource allocation. The rise of co-working spaces and flexible office solutions also presents unique FM challenges and opportunities in providing adaptable and occupant-centric environments.

Growth Accelerators in the Vietnam Facility Management Industry Industry

Several key growth accelerators are propelling the Vietnam Facility Management industry forward. The ongoing digital transformation within businesses necessitates sophisticated facility operations and maintenance, driving demand for technology-driven FM solutions. Strategic partnerships between international FM experts and local Vietnamese companies are crucial for knowledge transfer, capacity building, and the introduction of global best practices. Government initiatives promoting sustainable development and smart city concepts are creating a favorable ecosystem for advanced FM services. Furthermore, the increasing complexity of new construction projects, incorporating smart technologies and sustainable materials, requires specialized FM expertise, thereby expanding the market for integrated and bundled service offerings.

Key Players Shaping the Vietnam Facility Management Industry Market

- PMC

- Savills Vietnam

- CBRE Group Inc

- Jones Lang LaSalle Incorporated

- AEON Delight

- ATALIAN Global Services

- RCR Vietnam

- ADEN Vietnam

- Sodexo Inc

- Dussmann Co Ltd

Notable Milestones in Vietnam Facility Management Industry Sector

- February 2022: LOGOS Vietnam Logistics Venture and Manulife Investment Management announced the formation of a joint venture to obtain an 11-hectare build-to-suit logistics asset in the greater Ho Chi Minh City area, supporting Vietnam's expanding demand for modern, high-quality logistics facilities.

- January 2022: Aden Group joined AutoFlight at its Shanghai headquarters, where the two firms signed a Memorandum of Understanding for engagement in smart air mobility and logistics. The agreement establishes a framework for the two firms to collaborate on new zero-carbon solutions based on AutoFlight's eVTOL (electric vertical take-off and landing) technology and Aden Group's digitalization expertise worldwide network of 1,500 customers in China and the rest of the Asia-Pacific region.

In-Depth Vietnam Facility Management Industry Market Outlook

The Vietnam Facility Management industry is characterized by robust growth driven by economic dynamism and increasing adoption of professionalized services. The outlook indicates a continued surge in demand for outsourced solutions, particularly integrated FM, as businesses prioritize efficiency, cost-effectiveness, and occupant well-being. Technological innovation, including AI and IoT, will further revolutionize service delivery, enhancing predictive maintenance and energy management. Strategic partnerships and foreign investment will play a pivotal role in shaping the competitive landscape and elevating service standards. Emerging opportunities in green FM, smart building technologies, and specialized industrial sector services present significant avenues for expansion. The industry is well-positioned to capitalize on Vietnam's growth trajectory, offering a promising future for stakeholders.

Vietnam Facility Management Industry Segmentation

-

1. Type of Facility Management Type

- 1.1. In-house Facility Management

-

1.2. Outsourced Facility Mangement

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offerings

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others

Vietnam Facility Management Industry Segmentation By Geography

- 1. Vietnam

Vietnam Facility Management Industry Regional Market Share

Geographic Coverage of Vietnam Facility Management Industry

Vietnam Facility Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Vietnam policies Encouraging Foreign Direct Investment (FDI) Drives the Growth in Industrial Sector; Service Sector Drives the Growth in Vietnam

- 3.3. Market Restrains

- 3.3.1. Increased instances of Data Breaches and Security Threats

- 3.4. Market Trends

- 3.4.1. Industrial Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Facility Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management Type

- 5.1.1. In-house Facility Management

- 5.1.2. Outsourced Facility Mangement

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offerings

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PMC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Savills Vietnam

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBRE Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jones Lang LaSalle Incorporated

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AEON Delight

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATALIAN Global Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RCR Vietnam

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ADEN Vietnam

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sodexo Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 P Dussmann Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PMC

List of Figures

- Figure 1: Vietnam Facility Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Facility Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Facility Management Industry Revenue Million Forecast, by Type of Facility Management Type 2020 & 2033

- Table 2: Vietnam Facility Management Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 3: Vietnam Facility Management Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Vietnam Facility Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Vietnam Facility Management Industry Revenue Million Forecast, by Type of Facility Management Type 2020 & 2033

- Table 6: Vietnam Facility Management Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 7: Vietnam Facility Management Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Vietnam Facility Management Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Facility Management Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Vietnam Facility Management Industry?

Key companies in the market include PMC, Savills Vietnam, CBRE Group Inc, Jones Lang LaSalle Incorporated, AEON Delight, ATALIAN Global Services, RCR Vietnam, ADEN Vietnam, Sodexo Inc, P Dussmann Co Ltd.

3. What are the main segments of the Vietnam Facility Management Industry?

The market segments include Type of Facility Management Type, Offerings, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Vietnam policies Encouraging Foreign Direct Investment (FDI) Drives the Growth in Industrial Sector; Service Sector Drives the Growth in Vietnam.

6. What are the notable trends driving market growth?

Industrial Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increased instances of Data Breaches and Security Threats.

8. Can you provide examples of recent developments in the market?

February 2022 - LOGOS Vietnam Logistics Venture and Manulife Investment Management announced the formation of a joint venture to obtain an 11-hectare build-to-suit logistics asset in the greater Ho Chi Minh City area and support Vietnam's expanding demand for modern, high-quality logistics facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Facility Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Facility Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Facility Management Industry?

To stay informed about further developments, trends, and reports in the Vietnam Facility Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence