Key Insights

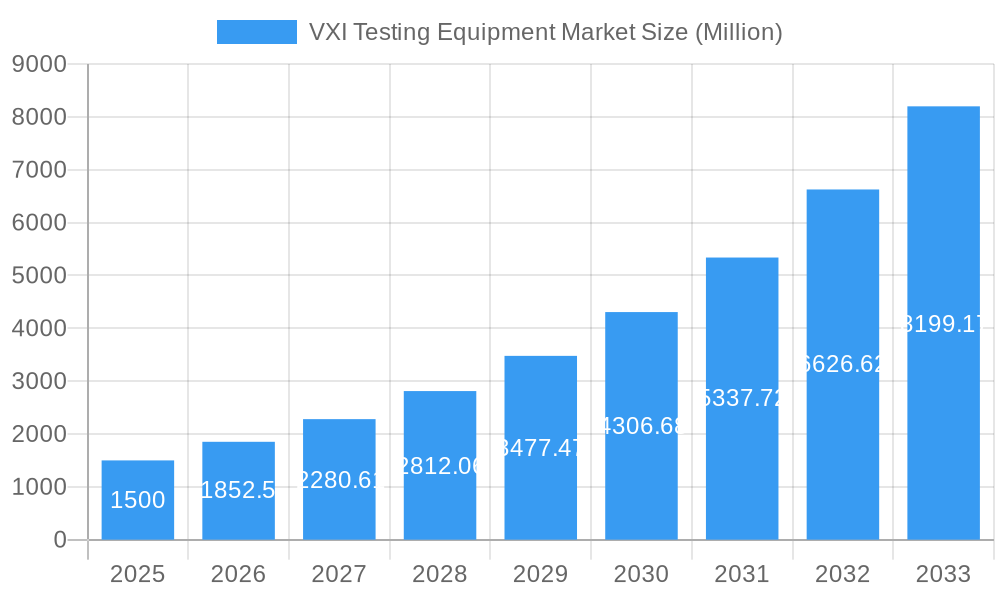

The VXI (VME eXtensions for Instrumentation) testing equipment market is projected to expand significantly, driven by the increasing demand for automated testing solutions across diverse industries. The market size is estimated at 5.77 billion, with a Compound Annual Growth Rate (CAGR) of 7.27% from the base year 2025 through 2033. Key growth catalysts include the widespread adoption of advanced electronic systems in consumer electronics, aerospace, and defense, necessitating stringent and efficient testing protocols. Technological advancements, such as enhanced processing speeds and improved measurement accuracy, further bolster market expansion. The market is segmented by product type, including oscilloscopes, function generators, power supplies, and others, and by end-user industries such as consumer electronics, communications, aerospace & defense, and industrial electronics. North America currently leads the market share, attributed to its robust technological infrastructure and high adoption rates. However, the Asia-Pacific region is anticipated to experience rapid growth due to escalating investments in electronics manufacturing and infrastructure development.

VXI Testing Equipment Market Market Size (In Billion)

Despite challenges such as the high cost of VXI equipment and the emergence of alternative testing methodologies, the long-term outlook for the VXI testing equipment market remains positive. Leading companies like National Instruments, Keysight Technologies (formerly Agilent Technologies), and Aeroflex Inc. are at the forefront of innovation, addressing evolving market requirements. Future growth will be shaped by the increasing complexity of electronic devices, the imperative for faster test cycles, and the escalating adoption of automated testing in manufacturing. The trend towards miniaturization and greater integration in electronics will also stimulate demand for more sophisticated and compact VXI testing solutions. The market is likely to witness intensified competition with the entry of new players, driving innovation and competitive pricing strategies. Successful market participants will prioritize offering comprehensive solutions and customized support to address specific industry needs.

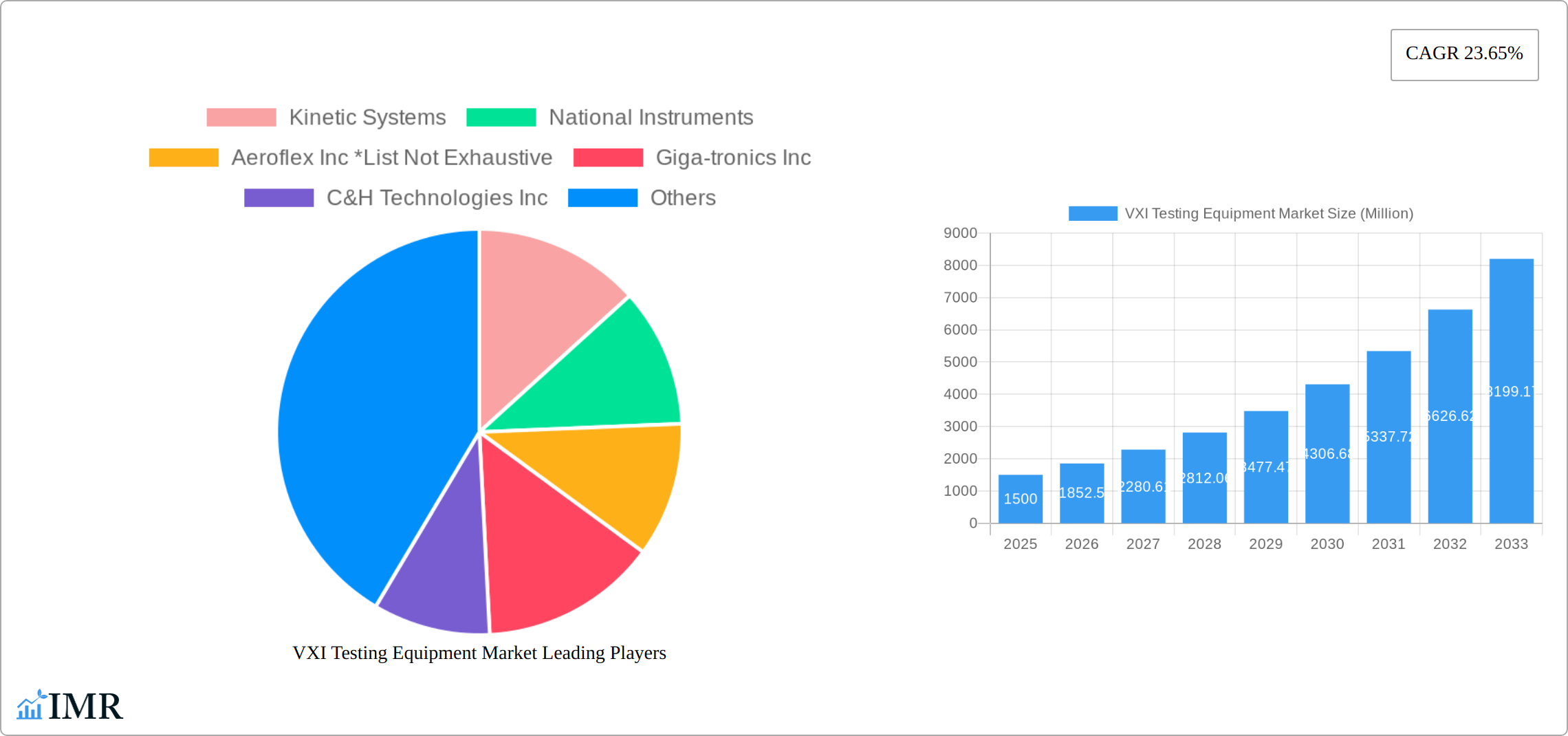

VXI Testing Equipment Market Company Market Share

VXI Testing Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the VXI Testing Equipment market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period covers 2025-2033, and the historical period is 2019-2024. This report is crucial for industry professionals, investors, and strategic decision-makers seeking a detailed understanding of this dynamic market segment. The report is valued at xx Million units.

VXI Testing Equipment Market Dynamics & Structure

This section analyzes the competitive landscape of the VXI testing equipment market, focusing on market concentration, technological advancements, regulatory influences, and market dynamics. The parent market is the broader Test and Measurement equipment market, while the child market is specifically VXI-based testing solutions. We explore the impact of mergers and acquisitions (M&A) activities on market consolidation and innovation.

- Market Concentration: The VXI testing equipment market exhibits a moderately concentrated structure, with a few major players holding significant market share. xx% of the market is controlled by the top 5 players in 2025.

- Technological Innovation: Continuous advancements in digital signal processing (DSP), high-speed data acquisition, and miniaturization are key drivers of innovation. Competition is fierce, pushing companies to develop more sophisticated and efficient VXI modules.

- Regulatory Frameworks: Compliance with international safety and electromagnetic compatibility (EMC) standards significantly impacts the design and manufacturing of VXI instruments.

- Competitive Product Substitutes: The emergence of PXI and other modular instrument platforms presents a competitive challenge to VXI, albeit with varying degrees of interchangeability. xx% of the market is estimated to be lost to alternative solutions in the next decade.

- End-User Demographics: The key end-users include aerospace & defense, telecommunications, automotive, and industrial automation sectors. Demand is significantly driven by the increasing need for high-speed testing and automated test systems.

- M&A Trends: The past five years have witnessed xx M&A deals in the VXI testing equipment market, primarily focused on consolidation and expanding product portfolios. This trend is expected to continue, leading to further market concentration. Larger companies like Agilent are estimated to complete xx acquisitions in the coming years.

VXI Testing Equipment Market Growth Trends & Insights

This section provides a detailed analysis of the market's historical and projected growth, considering factors such as adoption rates, technological disruptions, and evolving consumer behavior. We leverage both quantitative and qualitative data to offer a comprehensive understanding of market evolution. The market size was valued at xx Million units in 2019 and is projected to reach xx Million units by 2033, exhibiting a CAGR of xx%. Market penetration in key segments like Aerospace & Defense remains high, while penetration in emerging sectors like IoT is expected to significantly rise, reaching xx% by 2033. The increasing demand for higher-performance, lower-cost test solutions has accelerated the adoption of VXI-based systems, despite competitive pressure from alternative technologies. Specific technological disruptions like the rise of cloud-based test environments will significantly influence the market growth in coming years. A shift towards more automated and software-defined testing also significantly impacts the market dynamics.

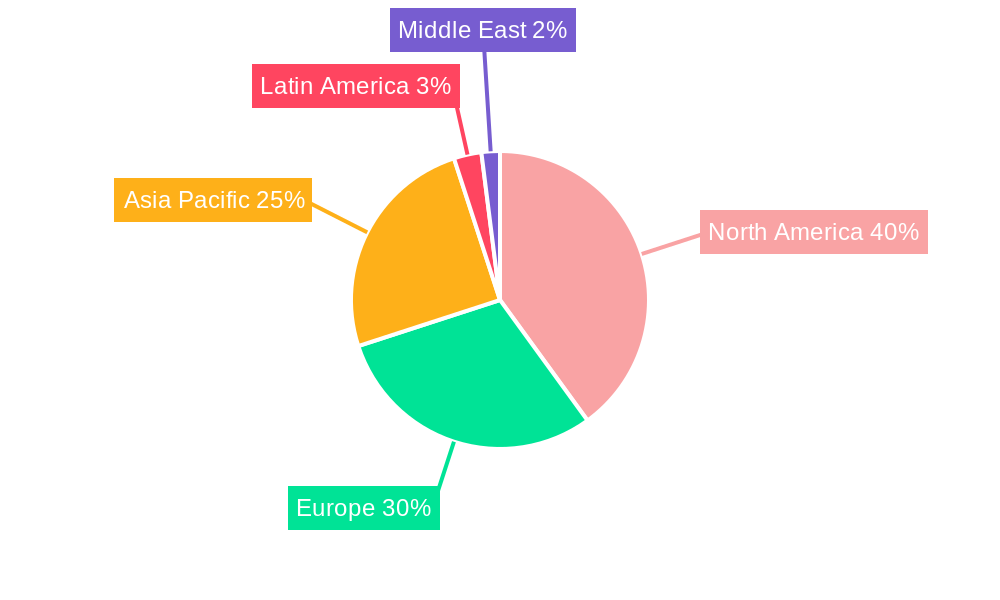

Dominant Regions, Countries, or Segments in VXI Testing Equipment Market

North America currently holds the largest market share (xx%), followed by Europe (xx%) and Asia-Pacific (xx%) in 2025. The dominance of North America is primarily driven by the strong presence of key players and a robust aerospace & defense industry. Strong governmental investment in communication infrastructure greatly fuels the market growth in the Asia-Pacific region.

By Product Type:

- Oscilloscopes: This segment holds the largest market share (xx%) due to their widespread application in various testing scenarios.

- Function Generators: This segment exhibits strong growth potential (xx% CAGR) owing to increasing demand for signal generation in high-speed communication systems.

- Power Suppliers: This segment is expected to experience steady growth (xx% CAGR) driven by continuous advancements in power electronics technology.

By End User:

- Aerospace & Military and Defense: This sector drives significant demand (xx% of market share) due to stringent testing requirements.

- Communications: The telecommunications sector is characterized by high growth (xx% CAGR) in demand.

VXI Testing Equipment Market Product Landscape

VXI testing equipment encompasses a range of instruments, including oscilloscopes, function generators, digital multimeters, and other specialized modules. Recent innovations focus on improving measurement accuracy, speed, and integration with automated test systems. Key advancements include enhanced signal processing capabilities, improved data acquisition rates, and increased miniaturization to meet the demands of increasingly complex electronic systems. The unique selling propositions of VXI modules lie in their modularity, flexibility, and compatibility within a standardized platform.

Key Drivers, Barriers & Challenges in VXI Testing Equipment Market

Key Drivers:

- Surging Demand for High-Speed and High-Bandwidth Testing: Industries such as aerospace & defense, automotive, telecommunications, and semiconductor manufacturing are continuously pushing the boundaries of performance, necessitating sophisticated testing solutions capable of handling increasingly complex signals and faster data rates. VXI's inherent architecture provides the bandwidth and speed required for these demanding applications.

- Accelerated Adoption of Automated Test Systems (ATS): The drive for increased efficiency, reduced test times, and improved accuracy is fueling the widespread adoption of automated test systems. VXI's modularity and rich ecosystem of instruments make it an ideal foundation for building highly customized and scalable ATS solutions.

- Stringent Regulatory Compliance and Quality Standards: Global regulatory bodies and industry-specific standards mandate rigorous product testing to ensure safety, reliability, and performance. VXI systems, with their precision and versatility, are well-suited to meet these exacting compliance requirements across diverse sectors.

- Legacy System Modernization and Upgrades: Many organizations maintain existing VXI test systems that are critical to their operations. The need to upgrade or expand these systems with newer, more capable instruments to accommodate evolving product designs presents a significant driver for the market.

Key Barriers & Challenges:

- Intensifying Competition from Alternative Modular Platforms: The market faces significant competition from emerging modular instrument platforms like PXI (PCI eXtensions for Instrumentation), which offer advantages in terms of cost, performance, and a broader ecosystem of vendors and software solutions for certain applications.

- High Initial Investment and Total Cost of Ownership: The upfront cost of acquiring VXI chassis, modules, and supporting software can be substantial. Furthermore, maintenance, calibration, and potential upgrades contribute to the total cost of ownership, which can be a deterrent for some organizations.

- Supply Chain Vulnerabilities and Component Availability: Like many technology sectors, the VXI testing equipment market can be susceptible to global supply chain disruptions. Shortages of critical electronic components or manufacturing delays can impact product availability and lead times.

- Skill Gap and Expertise Requirements: Developing, deploying, and maintaining complex VXI test systems often requires specialized engineering expertise. A shortage of personnel with the necessary VXI knowledge and experience can pose a challenge for some end-users.

- Migration Complexity for Existing Users: While VXI offers longevity, transitioning to entirely new test architectures can be a complex and resource-intensive undertaking for companies heavily invested in VXI infrastructure.

Emerging Opportunities in VXI Testing Equipment Market

Emerging opportunities include expansion into the rapidly growing IoT market, development of more efficient and cost-effective solutions, and increased focus on software-defined test systems. The integration of VXI instruments with cloud-based platforms also presents significant opportunities for remote testing and data analysis.

Growth Accelerators in the VXI Testing Equipment Market Industry

Technological advancements in signal processing, miniaturization, and software-defined testing are key growth accelerators. Strategic partnerships between manufacturers and end-users will also contribute to market expansion. Investments in research and development, particularly focused on high-speed and high-accuracy measurement technologies, will drive innovation and accelerate growth.

Key Players Shaping the VXI Testing Equipment Market Market

- Kinetic Systems

- National Instruments

- Aeroflex Inc

- Giga-tronics Inc

- C&H Technologies Inc

- Agilent Technologies

- Interface Technology Inc

Notable Milestones in VXI Testing Equipment Market Sector

- 2021: Keysight Technologies (formerly Agilent Technologies) continued to enhance its VXI portfolio by launching new generations of high-speed oscilloscopes and advanced signal generators designed to meet evolving performance demands in demanding applications.

- 2022: NI (National Instruments) significantly bolstered its software-defined test offerings, providing more robust integration capabilities that can complement and enhance VXI-based test strategies, facilitating more flexible and intelligent test automation.

- 2023: A major strategic alliance or acquisition was reportedly explored between prominent VXI manufacturers, aiming to consolidate market expertise, expand product portfolios, and streamline R&D efforts to better compete in the evolving landscape. (Specific details vary and are subject to ongoing market developments).

- Ongoing: Continuous advancements in VXI module technology, including increased processing power, improved accuracy, and expanded measurement capabilities, are regularly introduced by various players to maintain the relevance and competitiveness of the VXI platform.

In-Depth VXI Testing Equipment Market Market Outlook

The future of the VXI testing equipment market is promising, driven by continuous technological innovation, increasing demand for higher-performance test systems, and expansion into new applications. Strategic partnerships and investments in research and development are expected to accelerate market growth. The market is expected to maintain a robust growth trajectory, presenting significant opportunities for established players and new entrants alike. The focus on enhanced software integration and cloud-based testing platforms will continue to shape the future of this market.

VXI Testing Equipment Market Segmentation

-

1. Product Type

- 1.1. Oscilloscopes

- 1.2. Function Generators

- 1.3. Power Suppliers

- 1.4. Other Product Types

-

2. End User

- 2.1. Consumer Electronics

- 2.2. Communications

- 2.3. Aerospace, Military and Defense

- 2.4. Industrial Electronics

- 2.5. Other End Users

VXI Testing Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

VXI Testing Equipment Market Regional Market Share

Geographic Coverage of VXI Testing Equipment Market

VXI Testing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Consumer Electronics Sale; Increased Focus on Sophisticated Testing Methods

- 3.3. Market Restrains

- 3.3.1. ; High Cost Associated with Testing Equipment; Fluctuations in the Semiconductor Industry

- 3.4. Market Trends

- 3.4.1. Growth of Consumer Electronics to Drive VXI Testing Equipment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Oscilloscopes

- 5.1.2. Function Generators

- 5.1.3. Power Suppliers

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Consumer Electronics

- 5.2.2. Communications

- 5.2.3. Aerospace, Military and Defense

- 5.2.4. Industrial Electronics

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Oscilloscopes

- 6.1.2. Function Generators

- 6.1.3. Power Suppliers

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Consumer Electronics

- 6.2.2. Communications

- 6.2.3. Aerospace, Military and Defense

- 6.2.4. Industrial Electronics

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Oscilloscopes

- 7.1.2. Function Generators

- 7.1.3. Power Suppliers

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Consumer Electronics

- 7.2.2. Communications

- 7.2.3. Aerospace, Military and Defense

- 7.2.4. Industrial Electronics

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Oscilloscopes

- 8.1.2. Function Generators

- 8.1.3. Power Suppliers

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Consumer Electronics

- 8.2.2. Communications

- 8.2.3. Aerospace, Military and Defense

- 8.2.4. Industrial Electronics

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Oscilloscopes

- 9.1.2. Function Generators

- 9.1.3. Power Suppliers

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Consumer Electronics

- 9.2.2. Communications

- 9.2.3. Aerospace, Military and Defense

- 9.2.4. Industrial Electronics

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Oscilloscopes

- 10.1.2. Function Generators

- 10.1.3. Power Suppliers

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Consumer Electronics

- 10.2.2. Communications

- 10.2.3. Aerospace, Military and Defense

- 10.2.4. Industrial Electronics

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kinetic Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 National Instruments

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aeroflex Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Giga-tronics Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 C&H Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Agilent Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Interface Technology Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Kinetic Systems

List of Figures

- Figure 1: Global VXI Testing Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 5: North America VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Latin America VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Latin America VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Latin America VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global VXI Testing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the VXI Testing Equipment Market?

The projected CAGR is approximately 7.27%.

2. Which companies are prominent players in the VXI Testing Equipment Market?

Key companies in the market include Kinetic Systems, National Instruments, Aeroflex Inc *List Not Exhaustive, Giga-tronics Inc, C&H Technologies Inc, Agilent Technologies, Interface Technology Inc.

3. What are the main segments of the VXI Testing Equipment Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.77 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Consumer Electronics Sale; Increased Focus on Sophisticated Testing Methods.

6. What are the notable trends driving market growth?

Growth of Consumer Electronics to Drive VXI Testing Equipment Market.

7. Are there any restraints impacting market growth?

; High Cost Associated with Testing Equipment; Fluctuations in the Semiconductor Industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "VXI Testing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the VXI Testing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the VXI Testing Equipment Market?

To stay informed about further developments, trends, and reports in the VXI Testing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence